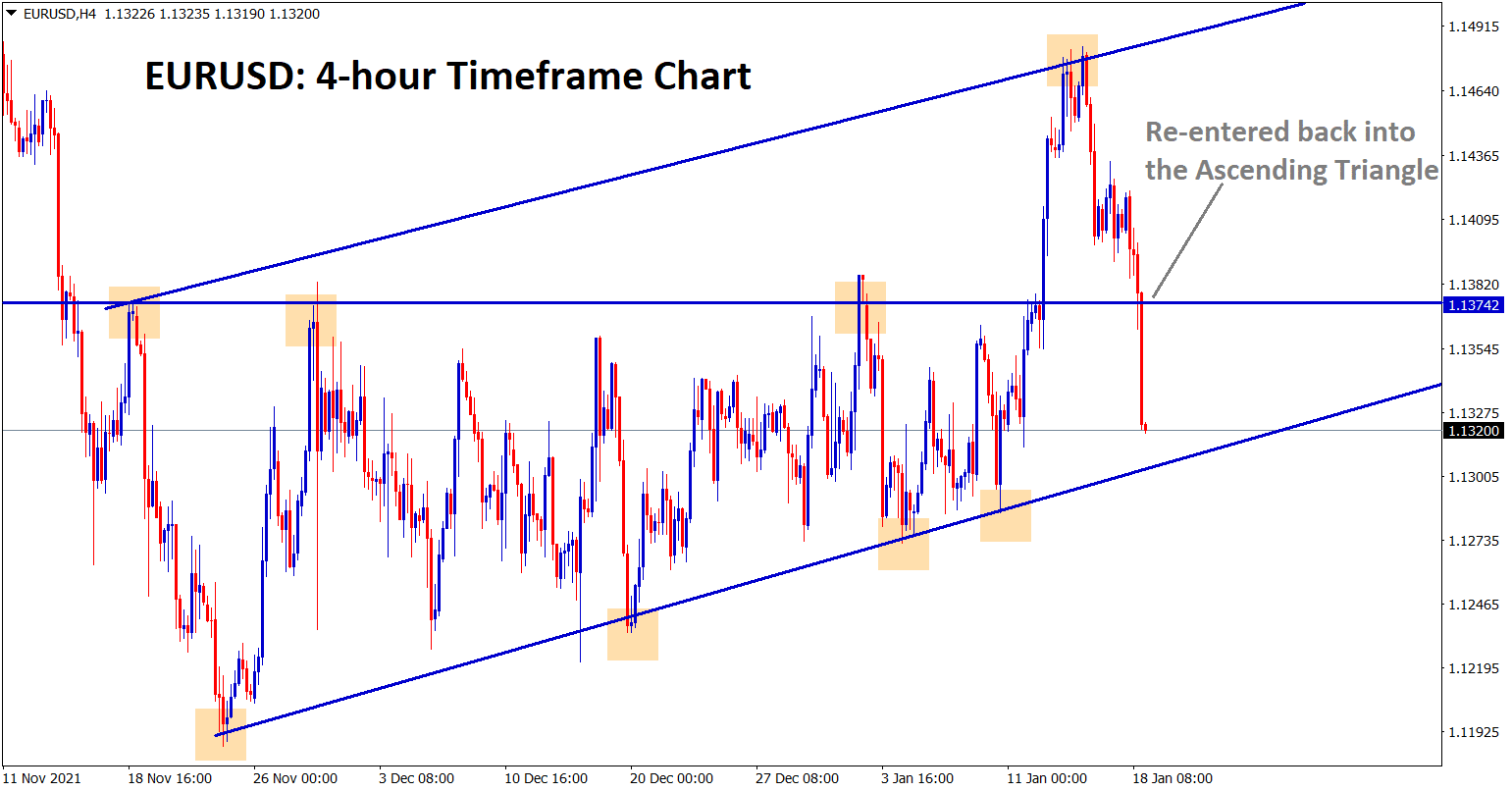

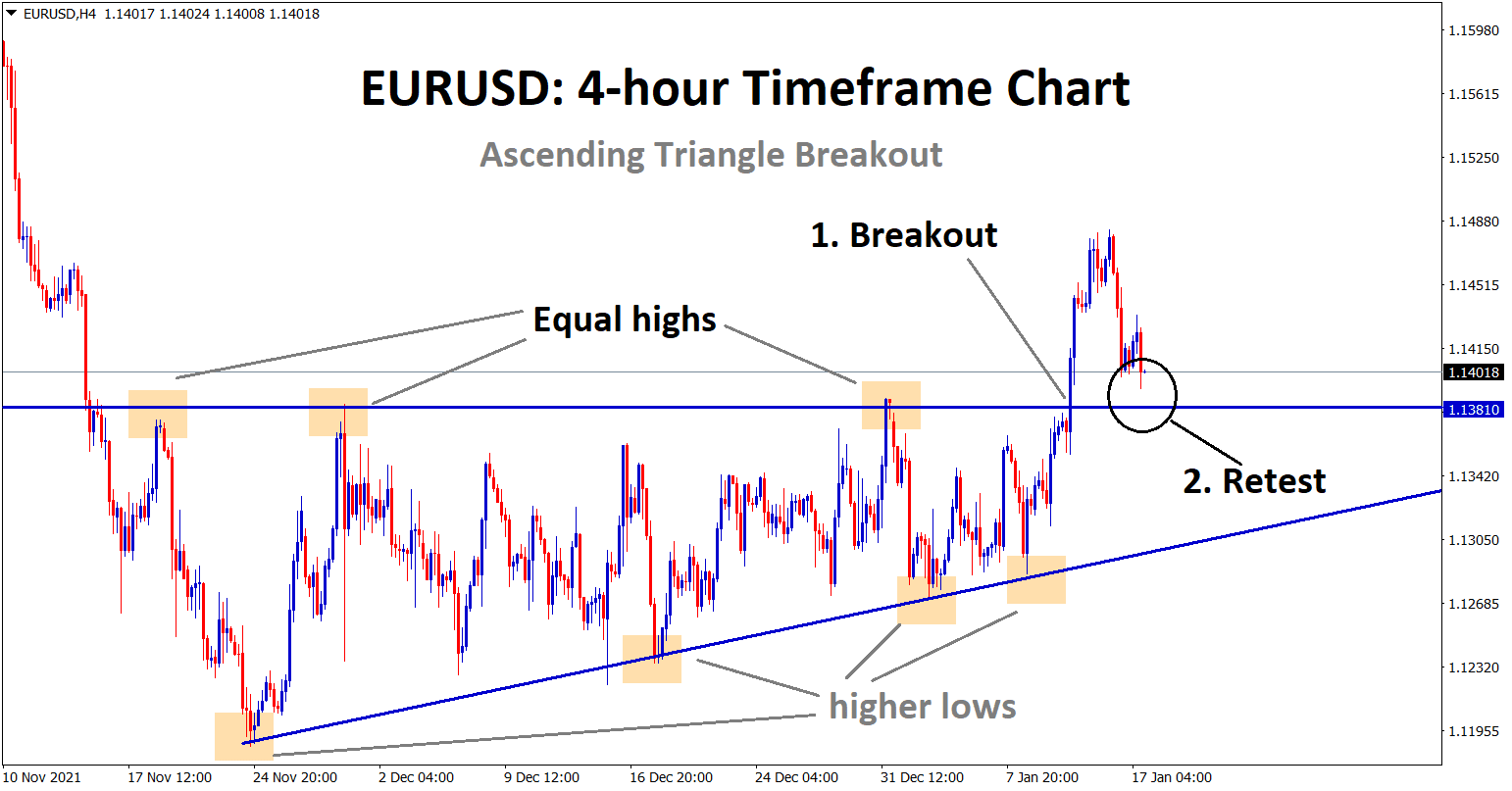

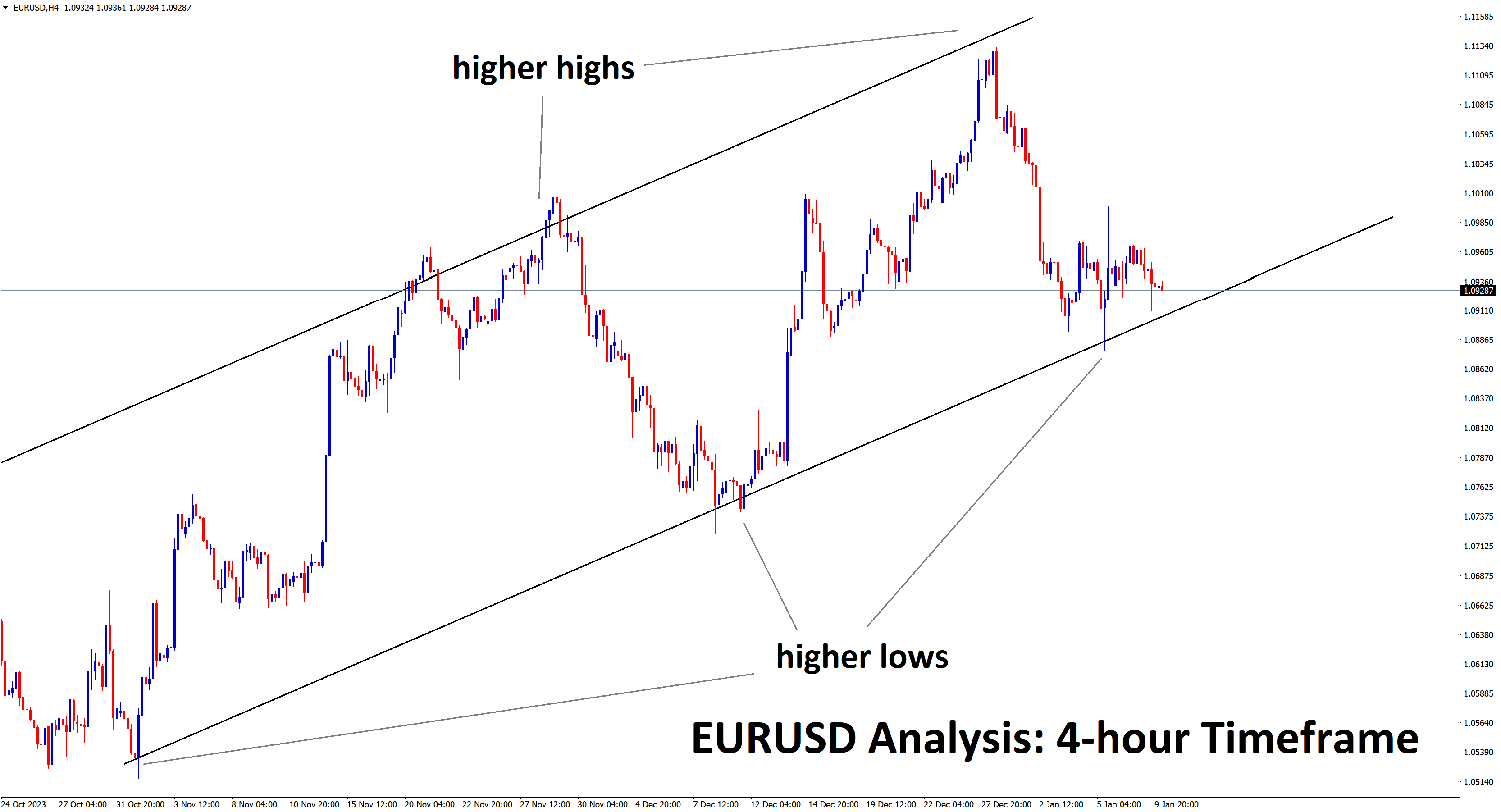

EURUSD Analysis

EURUSD has broken the top of the Ascending Triangle pattern, Now the market is near to the Retest area in the 4-hour timeframe chart.

After the confirmation of break at the op of the Ascending Triangle pattern, EURUSD buy signal given, but EURUSD has Re-entered back into the Ascending Triangle and reached the SL price. However, the market is still in an Ascending channel range – wait for the breakout from this channel range.

EURO: ECB Forecast of inflation rates in 2022

Euro makes lower after ECB President Lagarde speech looks less hawkish than counterpart FED signals of More hawkish tone.

And Inflation keeps temporary higher and does not look for a permanent, and It will be higher in 2022 end and down in 2023 as per ECB Forecasted.

Today Eurozone German ZEW reading is going to publish; Positive reading may strengthen the Euro against US Dollar.

And US San Francisco & Newyork FED Presidents Support for Rates to hike in March 2022 for FED Powell approach for rate hikes.

US Dollar: US 10Yr yield rates rose to higher

US Dollar index shows gains from the corrections that happened last week.

And Last Day US Market holiday makes little gains in 2-year note and 10-year note.

And Yields rates are also increasing due to Bonds sellers broad happened in the market as FED will tighten the interest rates in March 2022.

FED planned for three more rate hikes in 2022, So Bond yields are rising further as Bonds Sellers sell Bonds and return their funds quickly.

This week US initial Jobless claims data scheduled, better than expected data will make stronger US Dollar.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/