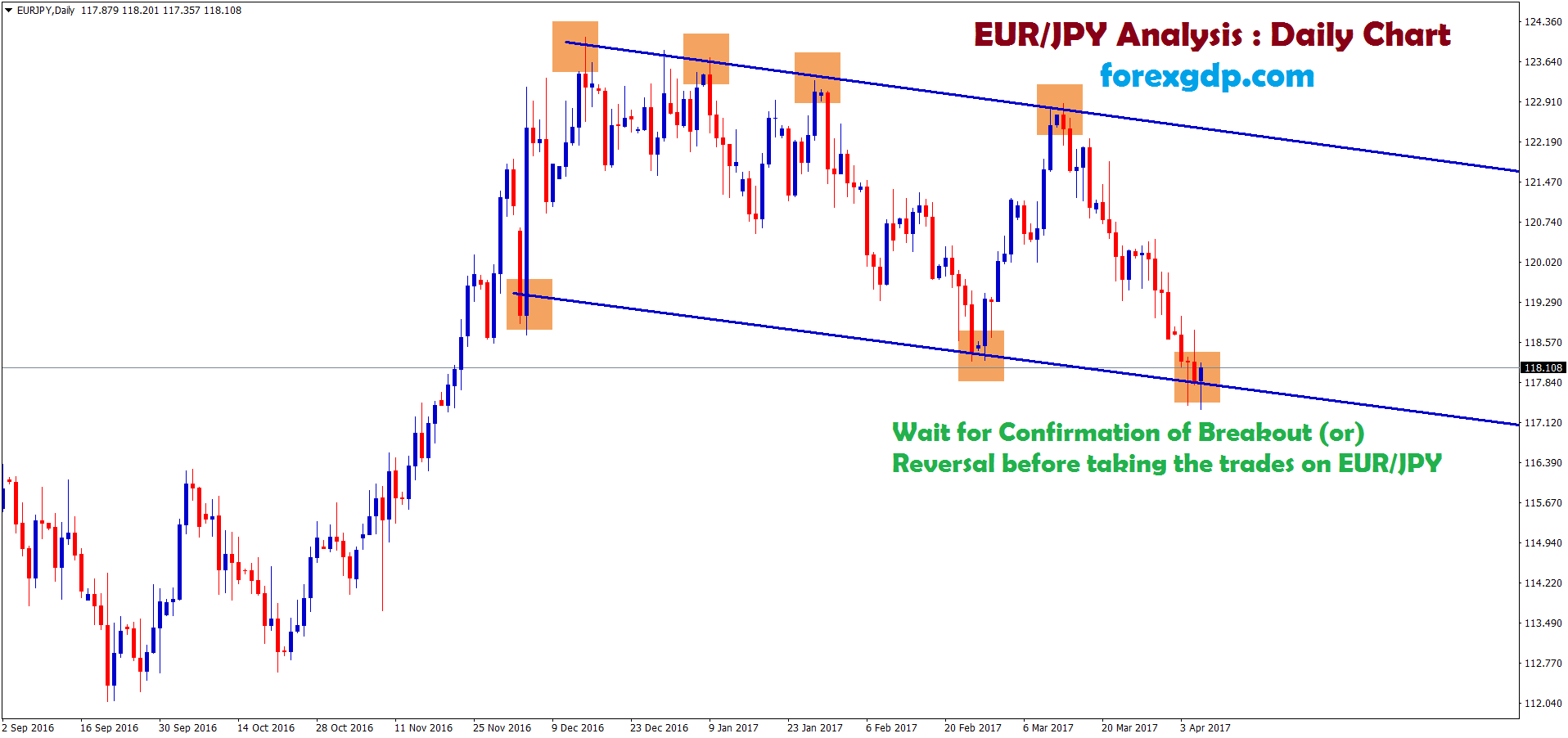

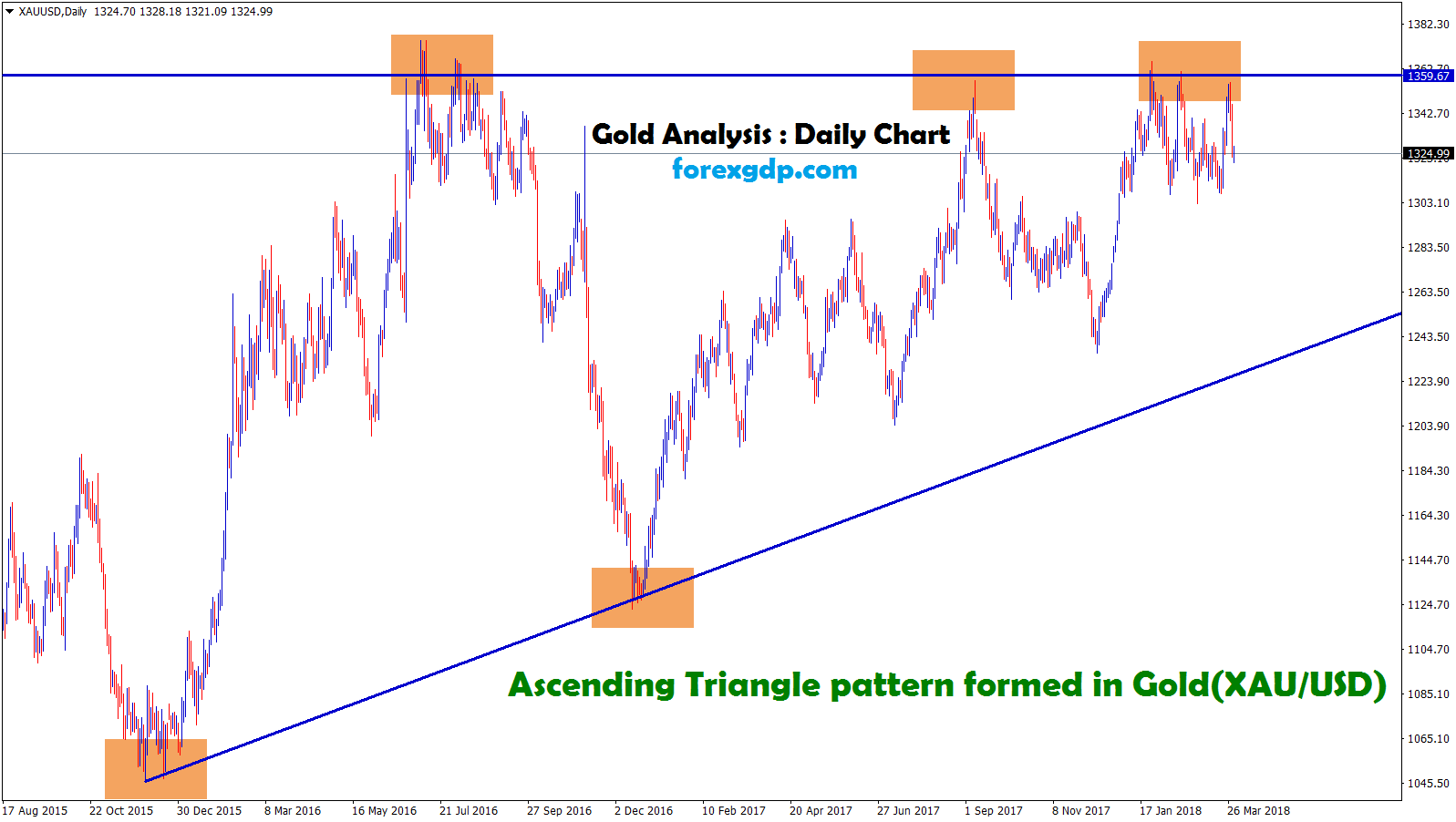

Gold: US Treasury yields higher

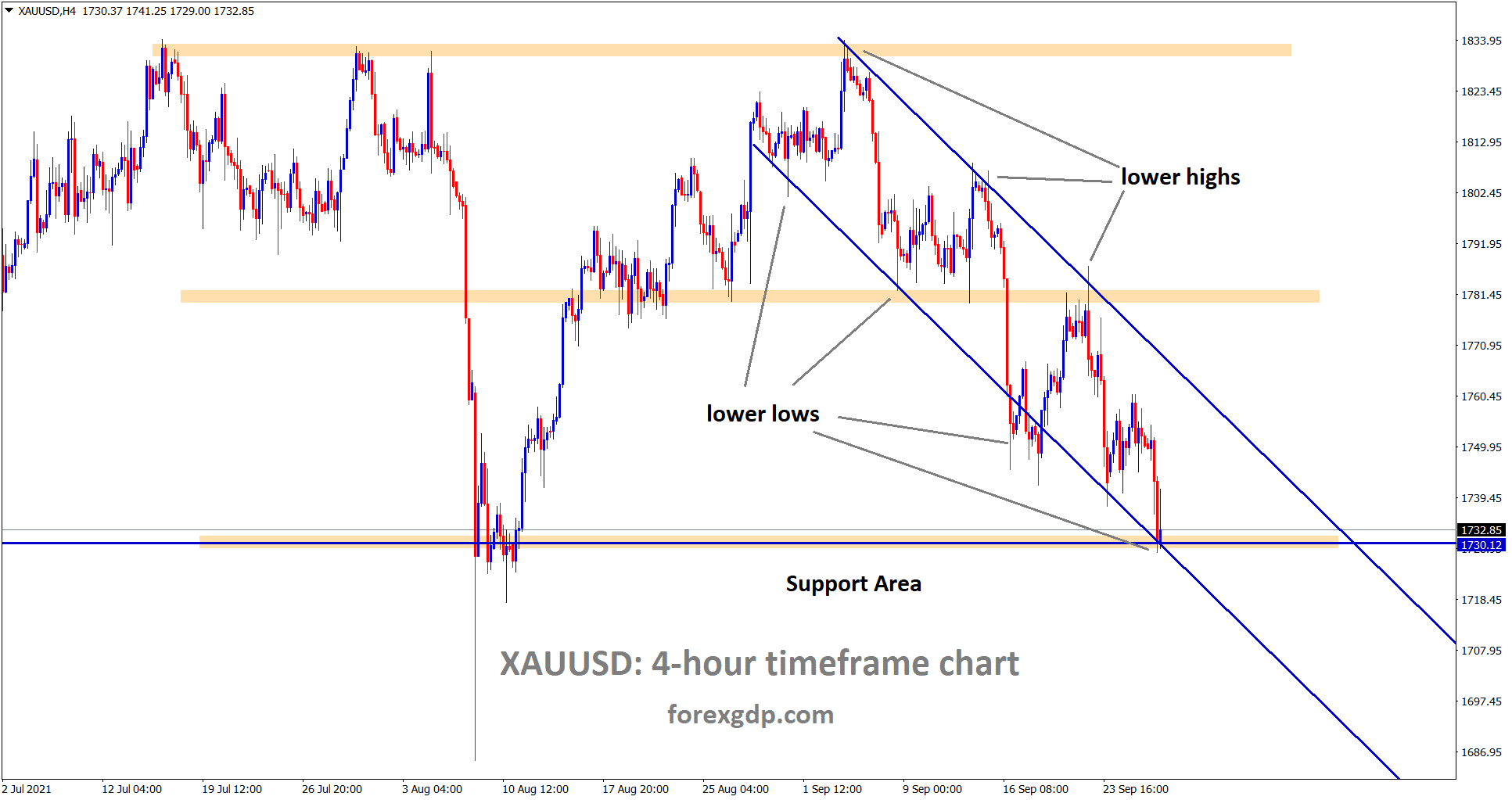

Gold has reached the horizontal support area and the lower low level of the descending channel.

Gold prices remain low as below support level of 1740$ as US Dollar Dominant performance in the market.

And China‘s crisis in the Finance system which caused by the Evergrande property Defaults payment. So Gold prices remain lower.

10 year and 5 years yield made higher as US FED delaying tapering and rate hikes.

But demand for Gold slowed in the market as Funds Flows to Equity and bonds market flowing as Rate hikes hopes.

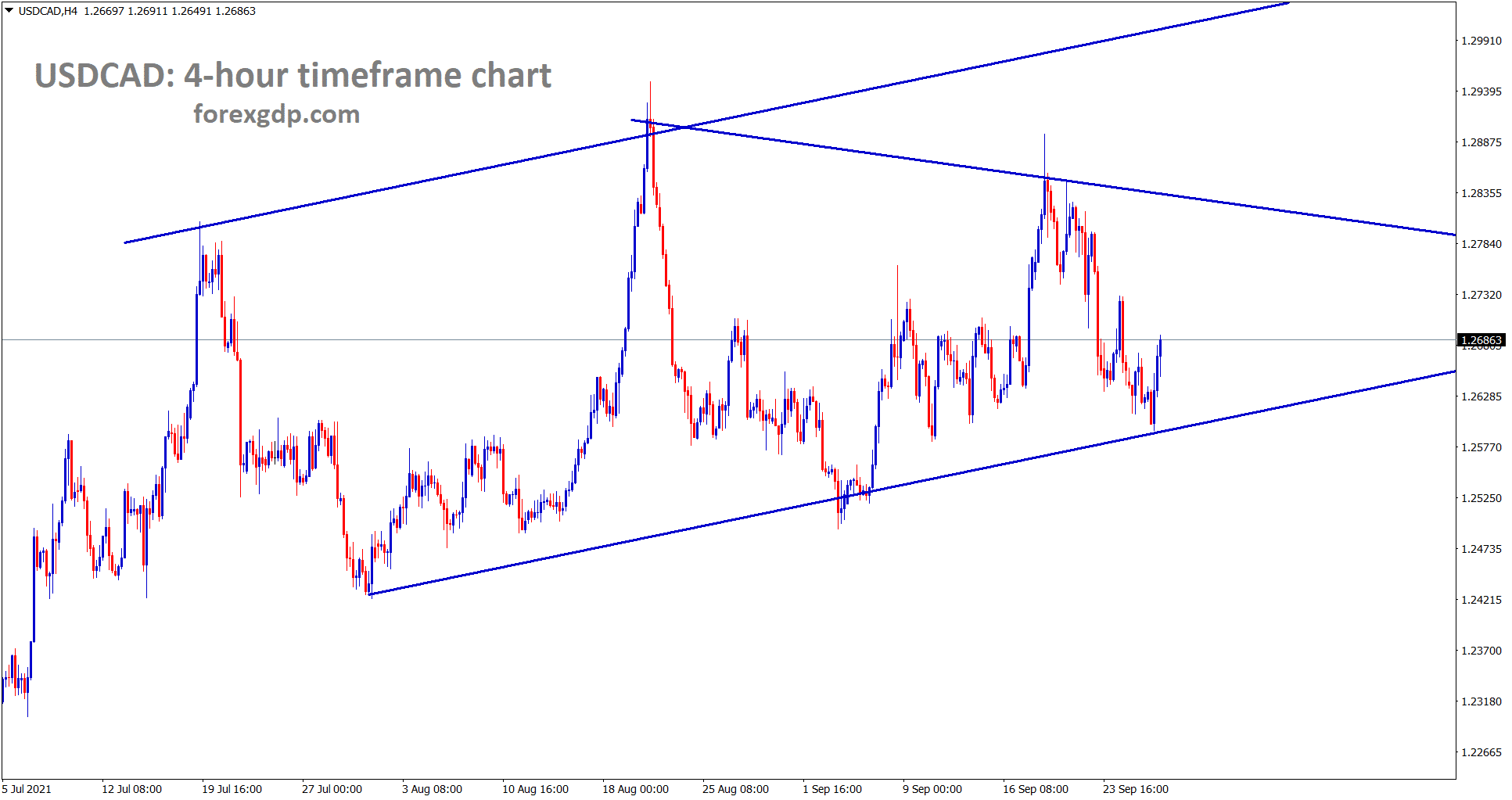

US DOLLAR: FED Powell testimony forecast

USDCAD is rebounding from the higher low area of the uptrend line and the symmetrical triangle.

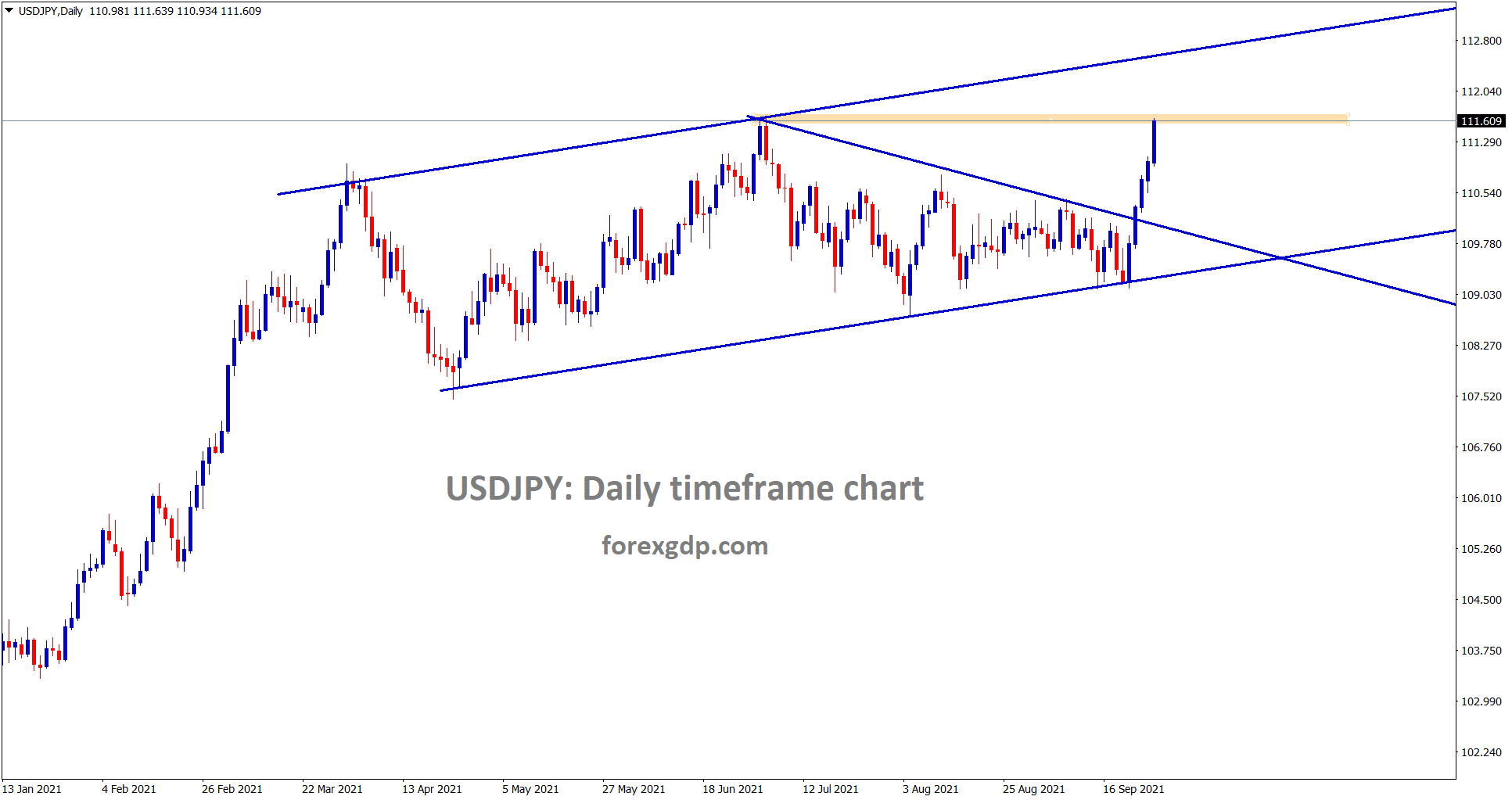

USDJPY has reached the horizontal resistance area 111.60 – USDJPY is in strong bullish mode..

US Dollar places higher in the market as US Bond yields move higher in the bond market.

And Rising US yields make stronger for US Dollar, Inflation and Job numbers are pretty good higher and Favorable for US Dollar.

FED clear path for Rate hikes and Tapering measures, which will help the US dollar as much as possible.

And China injected more stimulus into the economy for recovering the Debt crisis by Evergrande Real-estate.

This week US Dollar remains stronger, as shown in the market, FED Powell and Treasury Janet Yellen Testify meeting scheduled this week.

Senate failed to advance a measure to suspend the Debt ceiling and avoid a partial Government Shutdown.

EURO: ECB member speech

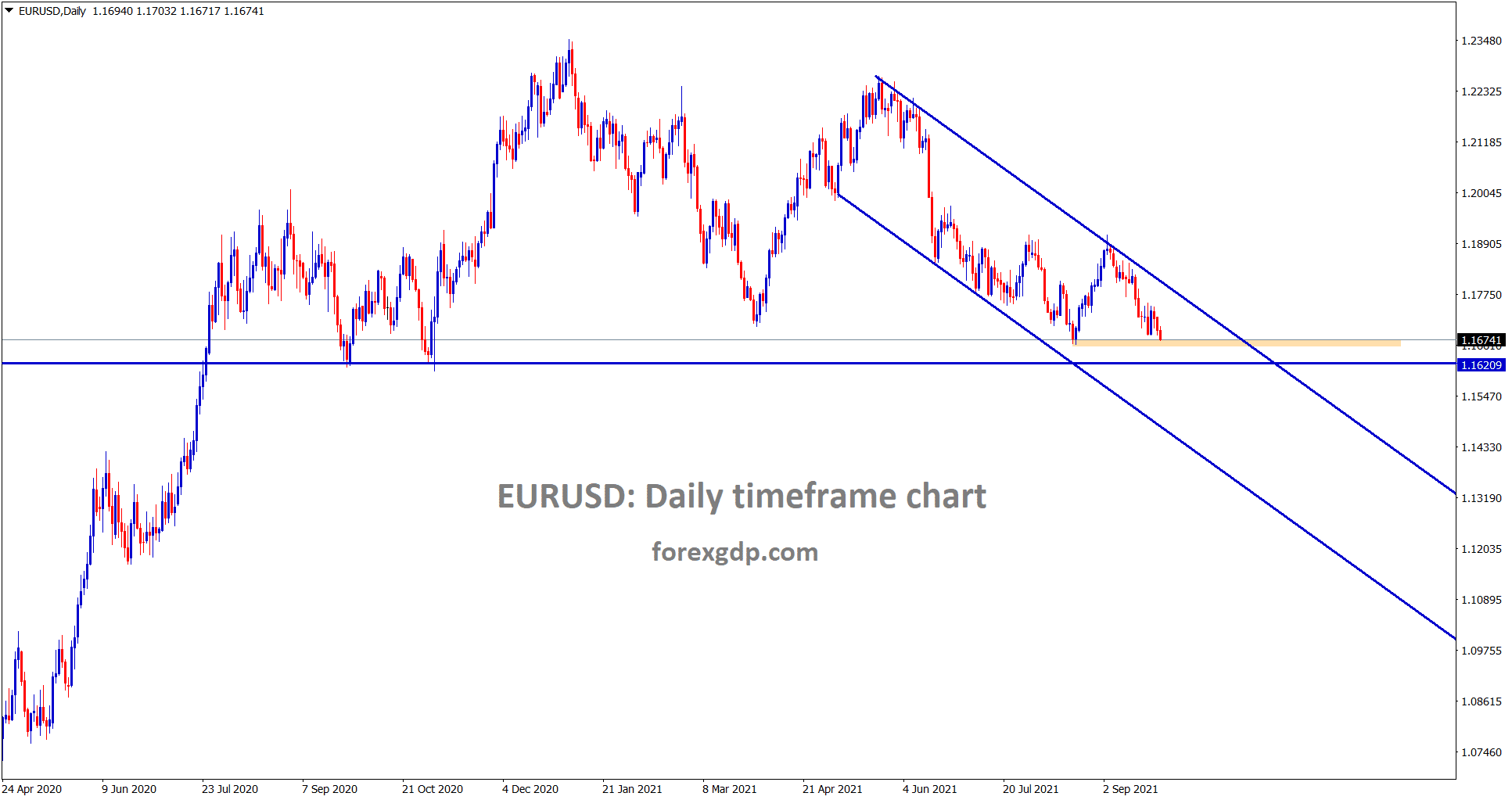

EURUSD is moving in a clear downtrend line and now it’s heading towards the next support area.

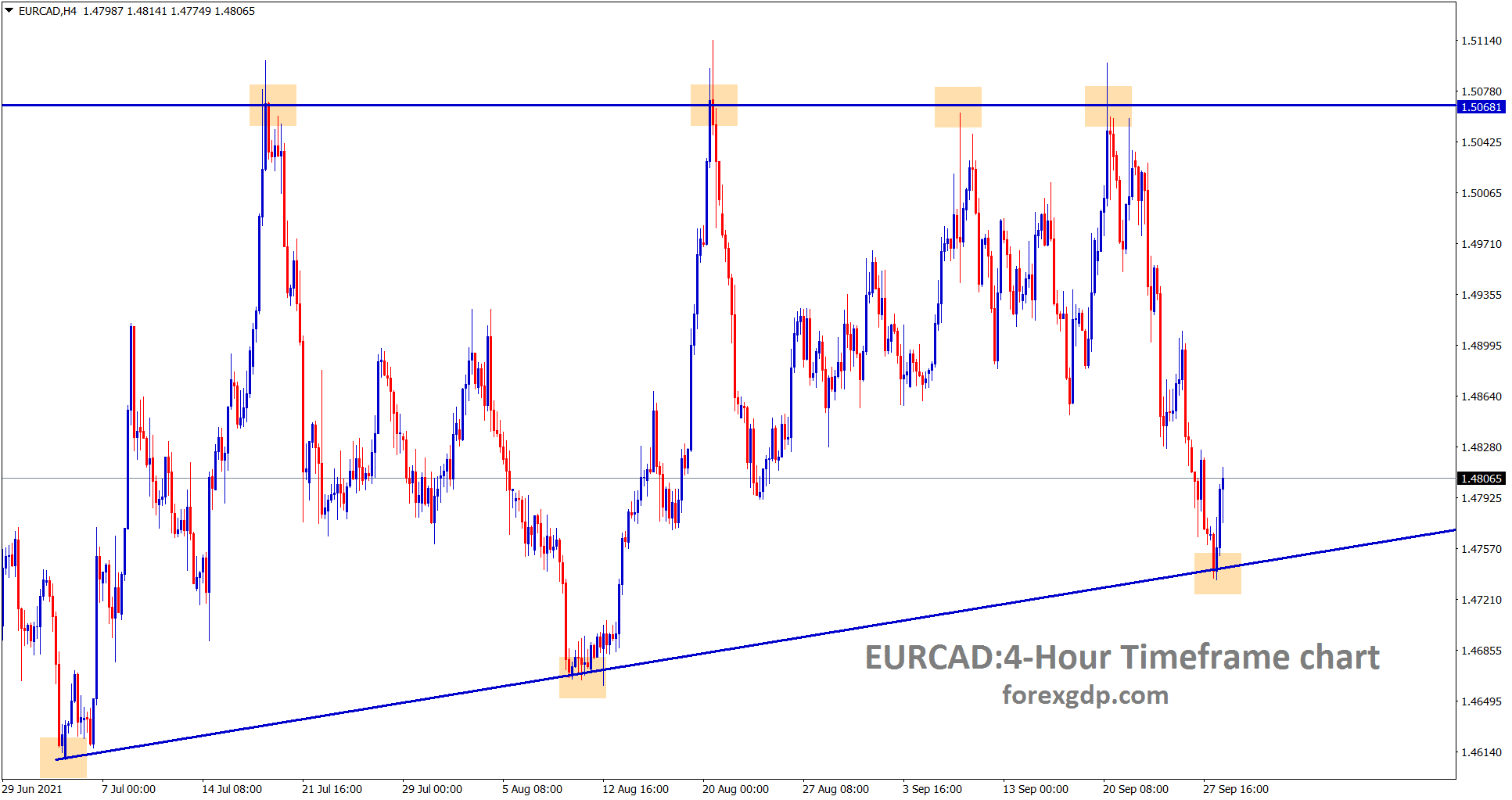

EURCAD is rebounding from the higher low area of the Ascending Triangle.

European Central Bank Governing council member and Bank of France Head Francois Villeroy De Galhau said Inflation would dictate loose monetary policy settings.

Until 2023 inflation remains under the 2% target in Eurozone. Due to energy prices increasing and Supply chain bottlenecks make inflation is lower.

ECB President Lagarde’s speech is scheduled this week, and more monetary policy settings adjustments will occur as expected.

German Domestic data

German GfK consumer confidence numbers came positive as 0.3 in October from -1.1, and France consumer confidence data rose to 102 in September.

EURUSD is not affected by positive numbers. The annual ECB Forum will be conducted this week in Portugal, and Many expectations in ECB monetary policy in future by investors mind.

And ECB won’t be tapering until 2022 end, and no rate hikes until 2024 is confident by members side.

UK POUND: Lorry Drivers shortage makes higher Fuel demand

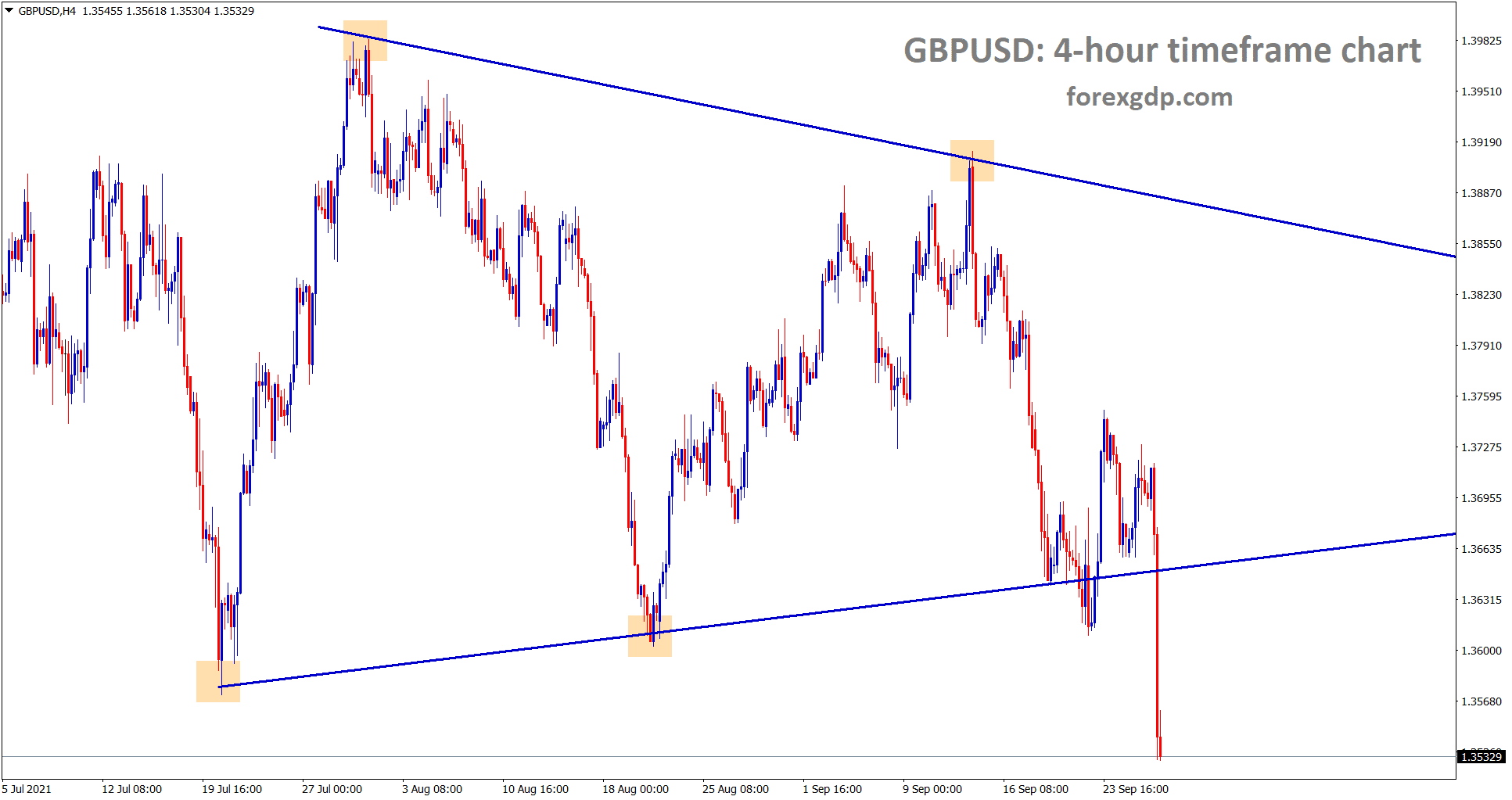

GBPUSD has made a strong breakout today from the symmetrical triangle pattern and also broken all the recent support levels.

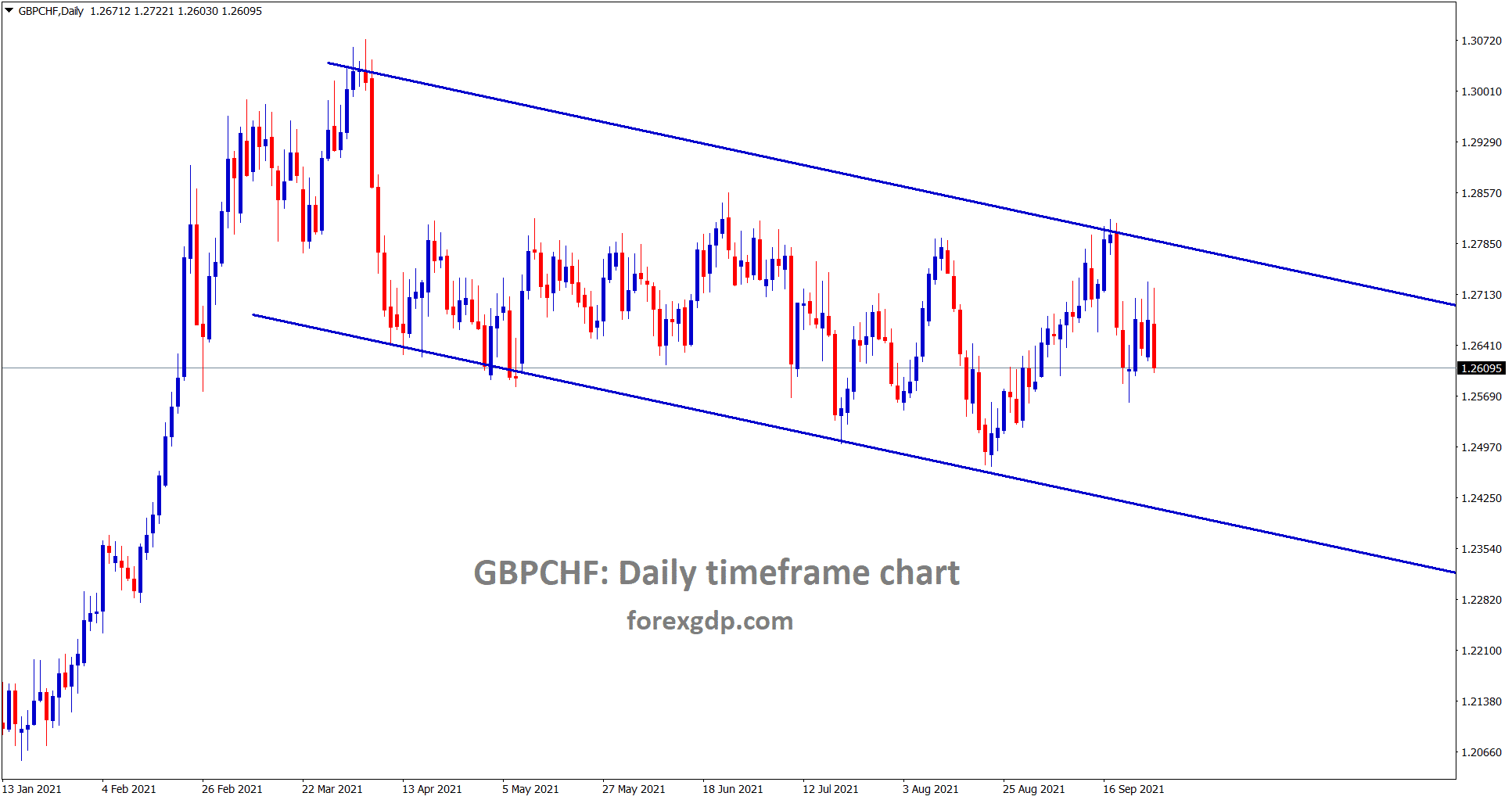

GBPCHF is moving in a downtrend line.

UK PM Boris Johnson instructed Army to deliver Gasoline to petrol stations as a shortage of Lorry Drivers was Caused by Dryups in several stations.

The Brexit deal resulted in Low EU people serve gas to stations and Temporary workers set to temporary visas issued by UK Government.

Lack of Petrol in many stations makes UK Demand for Fuel increase at this time.

And Oil Prices yesterday touched to 79-80$ and Demand for Oil growing more as Supply chain worries.

Factories failed to deliver Goods, and the Shortage of Coal resulted in Power shortages in the Highly industrialised Northeast. This boosts US Dollar, and GBP makes it weaker.

Canadian Dollar: Energy crisis makes stronger for CAD

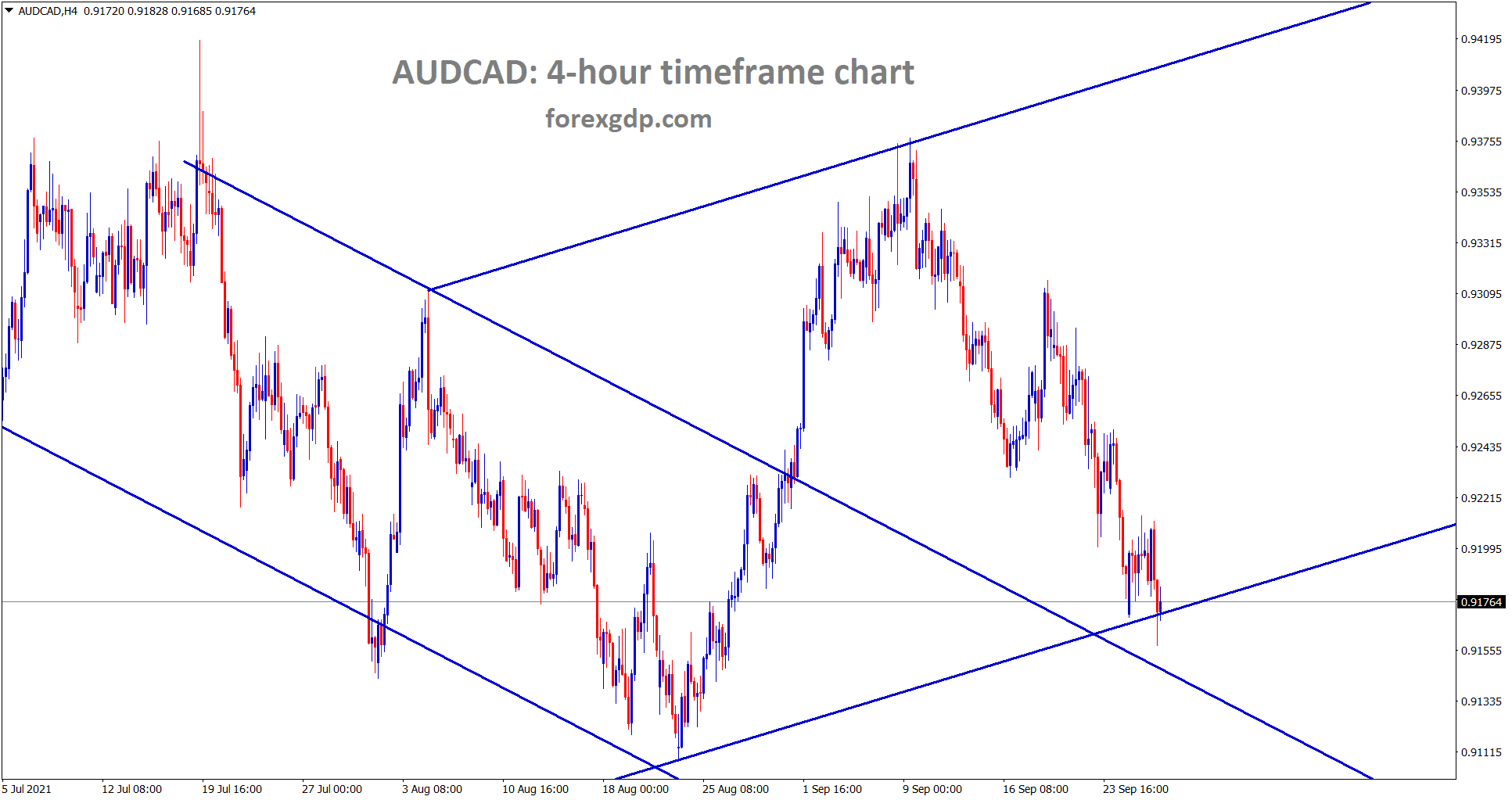

AUDCAD is standing at the higher low and retest area of the previous broken descending channel.

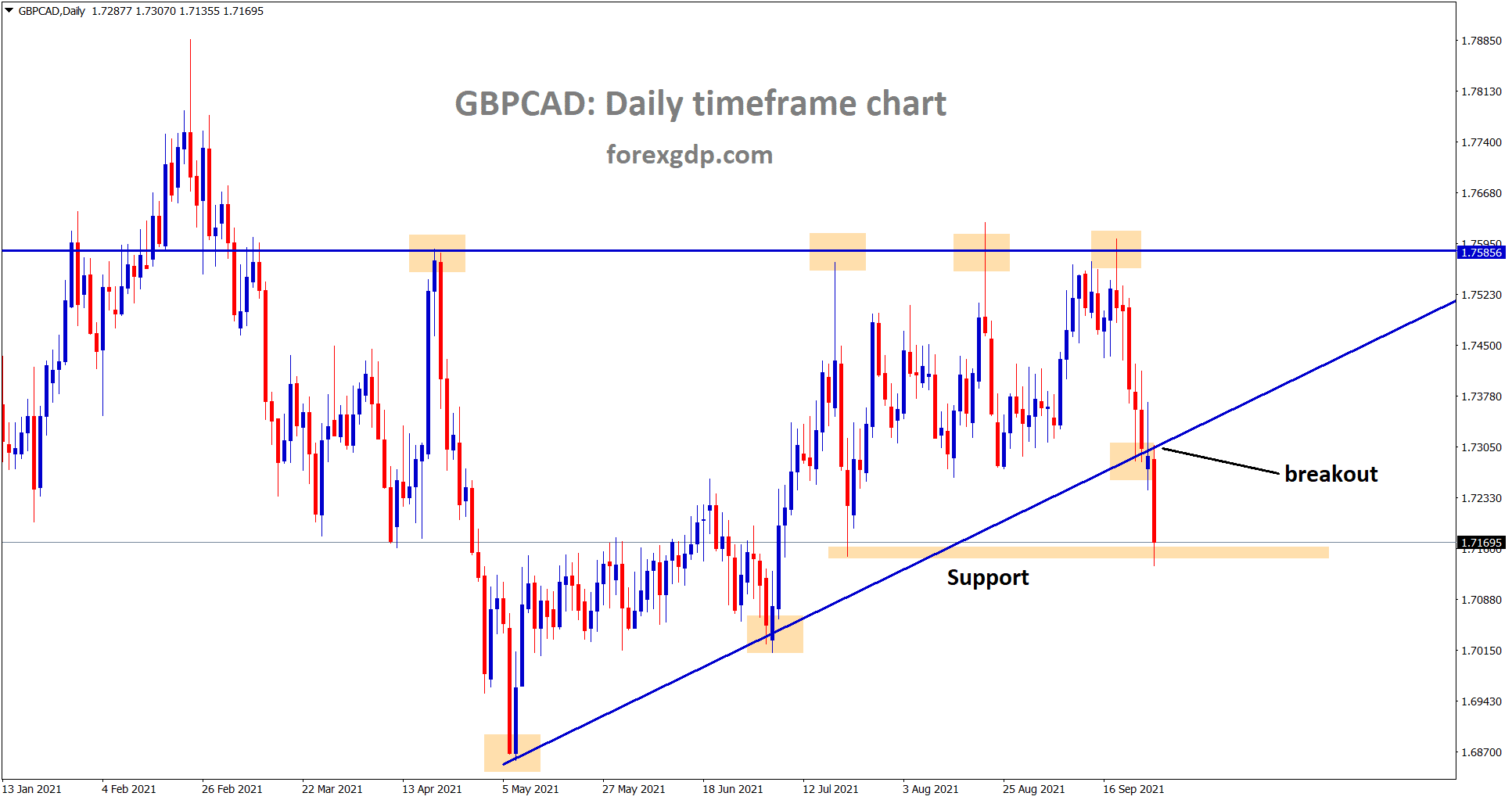

GBPCAD has broken the ascending triangle low and reached the horizontal support area.

Canadian Dollar jumps to the resistance level of Previous highs as Oil prices soar to the 80$ mark.

And the energy crisis that happened in Eurozone and UK Side caused demand for Oil to rise to a higher level.

China now tightening with the Real estate crisis and Steel production are slower as Real estate materials consumption is slower.

FED Powell commented tapering bonds purchases soon, and planning for tapering discussions are progressing in FED.

US Dollar continuous more robust makes weak for other currencies except for CAD.

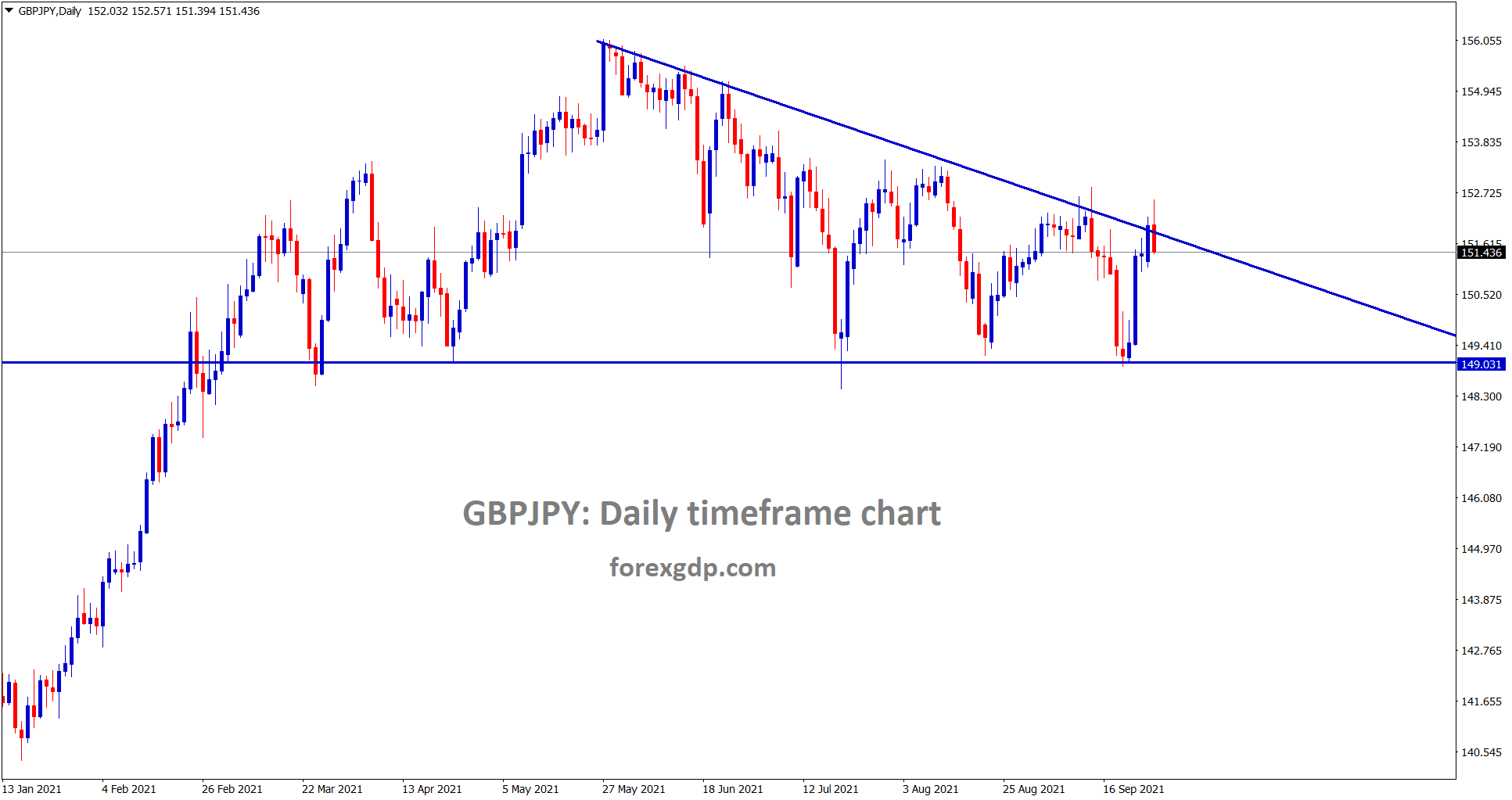

Japanese Yen: Japanese PM Suga Speech

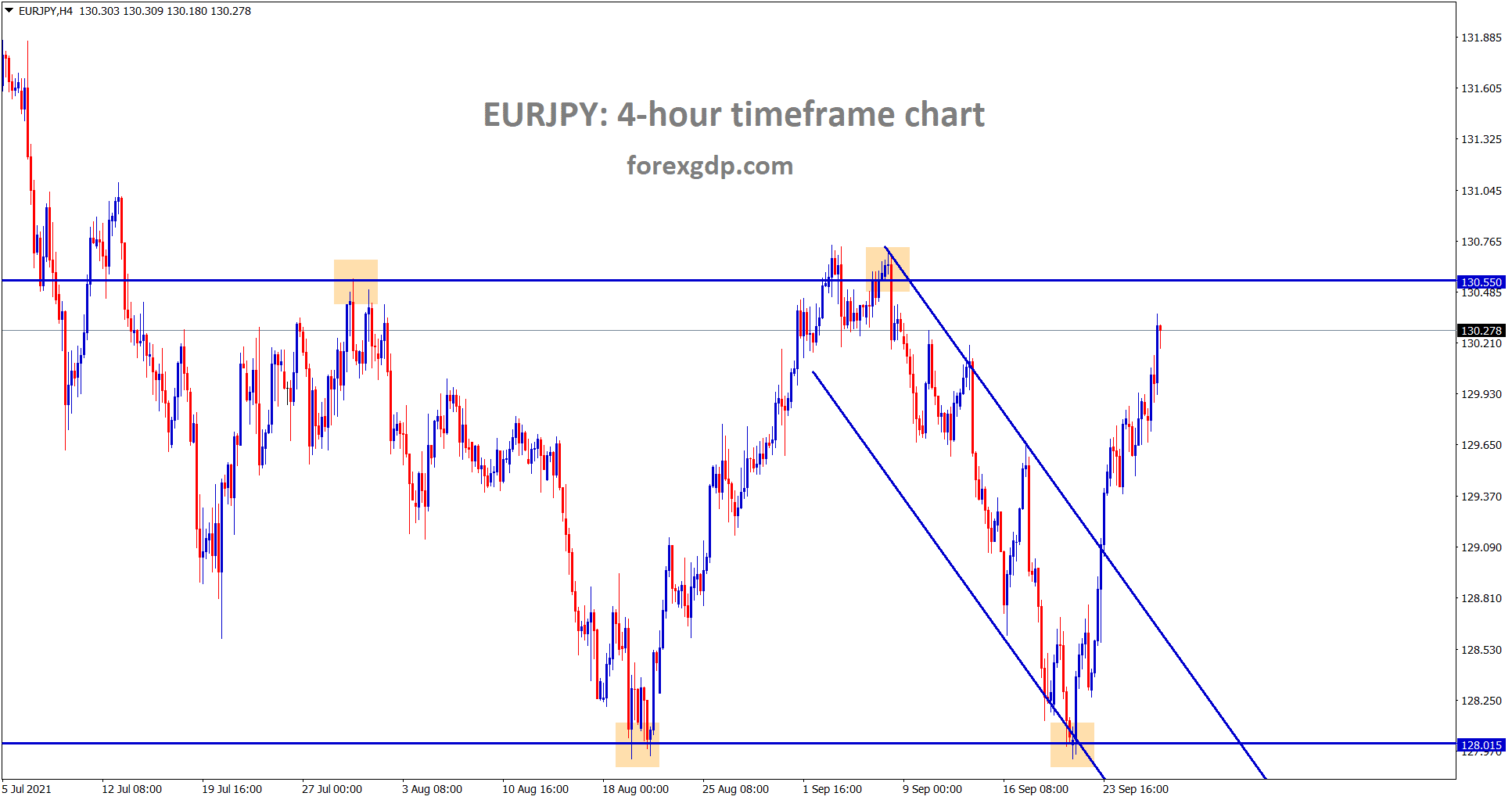

EURJPY is moving up continuously after breaking the descending channel.

GBPJPY is making a correction from the lower high area of the Descending Triangle pattern.

Japanese PM Suga will like to announce the end of the lockdown on September 30.

Japanese Yen makes weaker Tone as Stimulus requirement much lower in Japanese Economy. Vaccinations are slower than expected makes the Economy recovery is questionable in Japan.

And the energy crisis that happened in the Eurozone makes factories shut in many regions.

USDJPY hits to the resistance level of 111.200 level as Japanese Yen weaker as lower stimulus and extended lockdown worries.

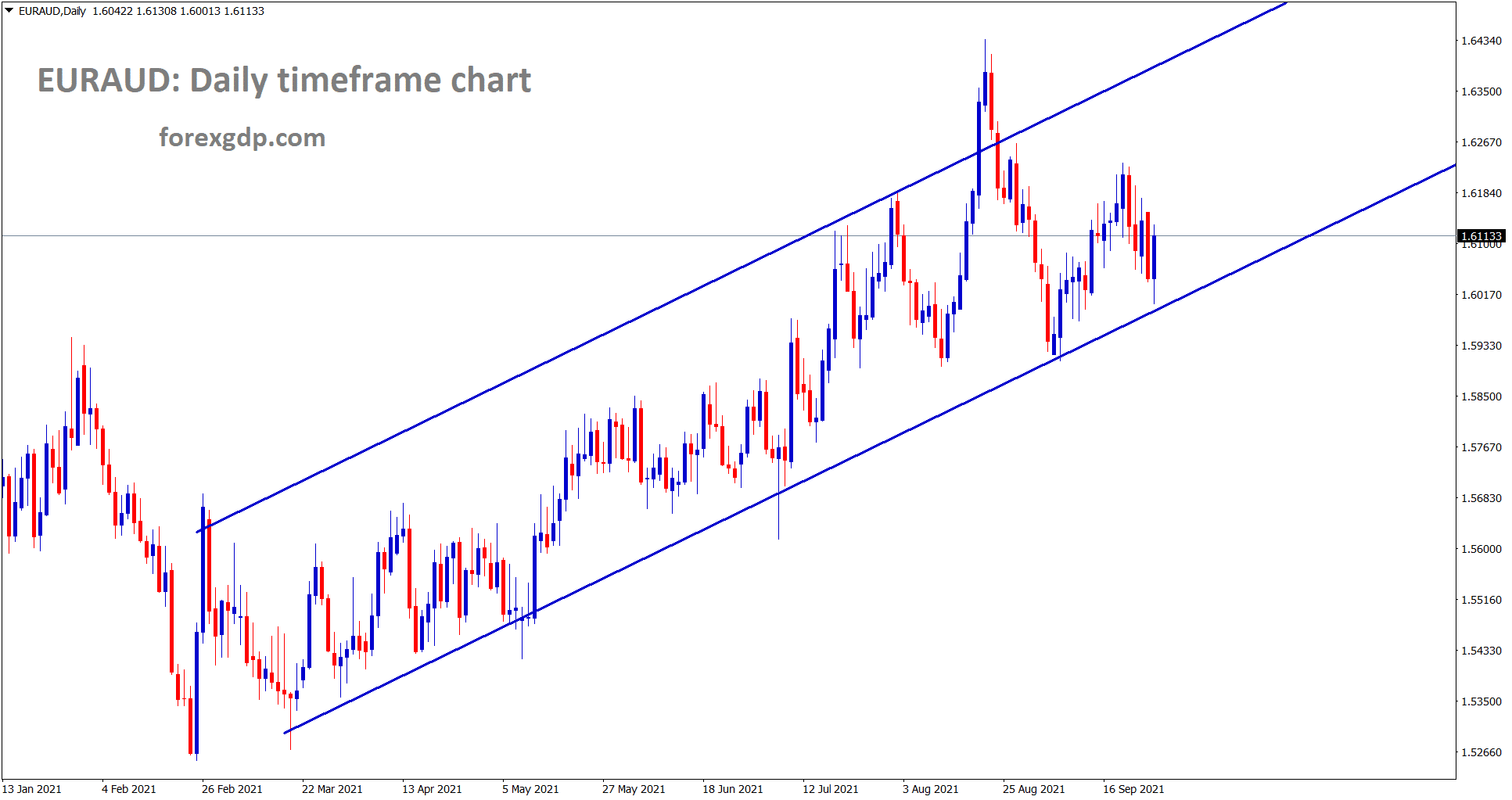

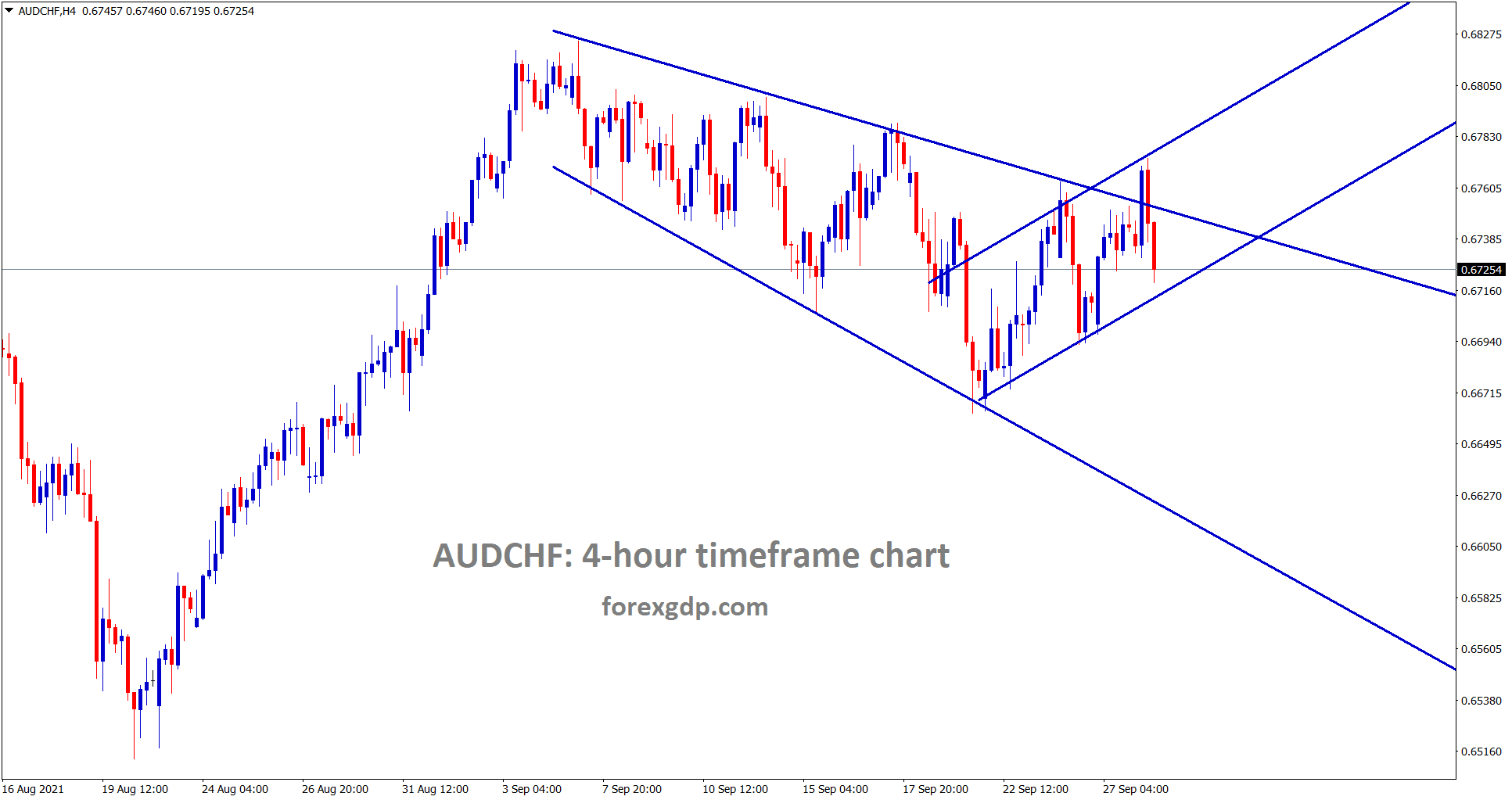

Australian Dollar: Retail sales data

EURAUD is moving in an Uptrend line.

AUDCHF is moving in an Expanding channel pattern and also moving in a minor ascending channel.

Australian Dollar stays range-bound market as today no cheers for Retail sales data shows some breath-taking numbers as -1.7%m/m versus -2.5% expected.

The tight lockdown was released, and Tier 2 lockdown was implemented in more cities except New South Wales and Victoria.

Boston Fed President Eric Rosengren and Dallas Fed President Robert Kaplan resigned due to concerns about securities trading.

This resignation indicates there is no alter the path of tapering in the US$120 billion per month bond-buying program.

People Bank of China added liquidity on the 8th straight day.

UK Government announced Army to settle petrol stations which running out of gas.

Fed Powell and Treasury secretary Janet Yellen Testimony are scheduled this week.

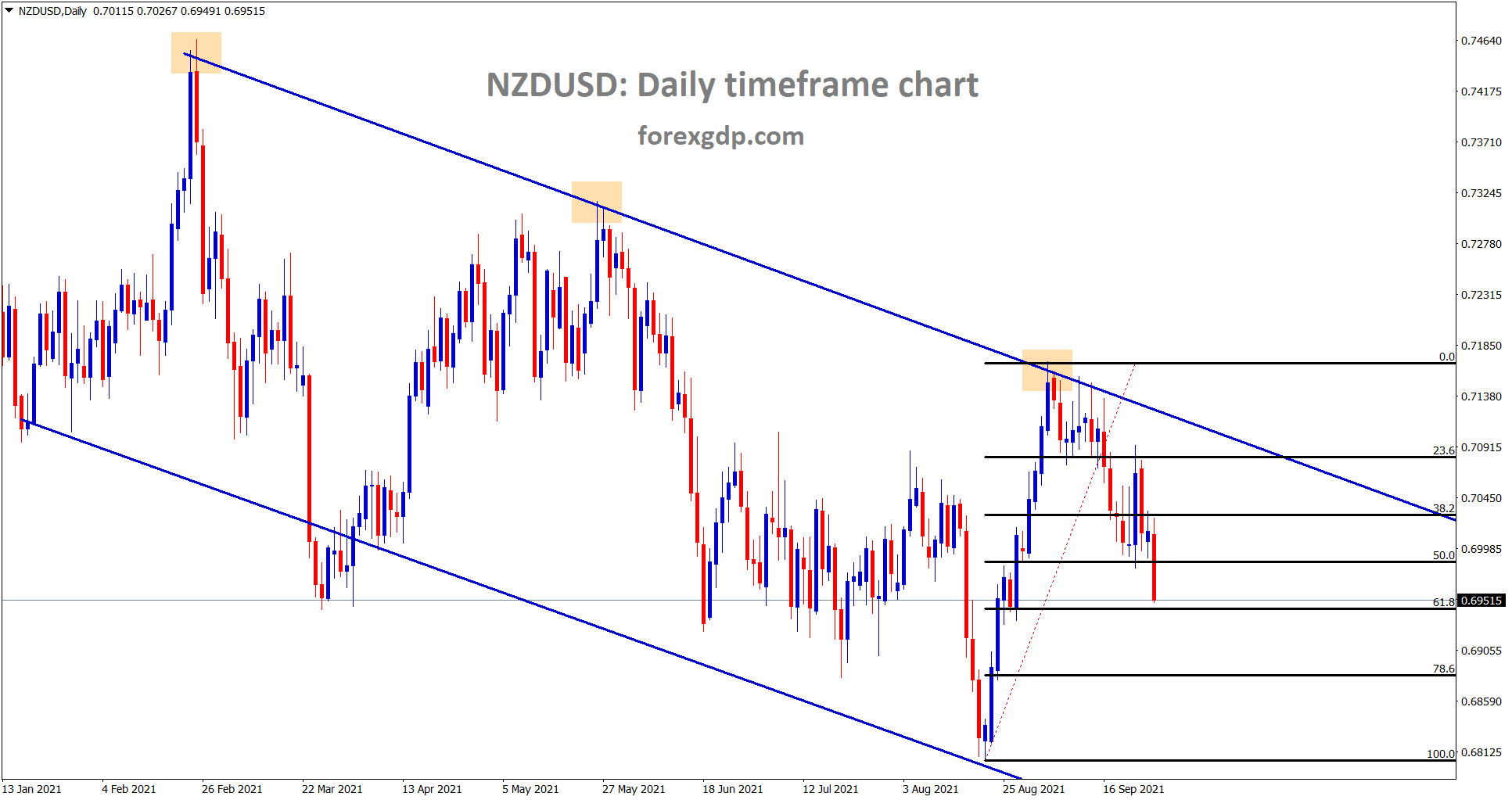

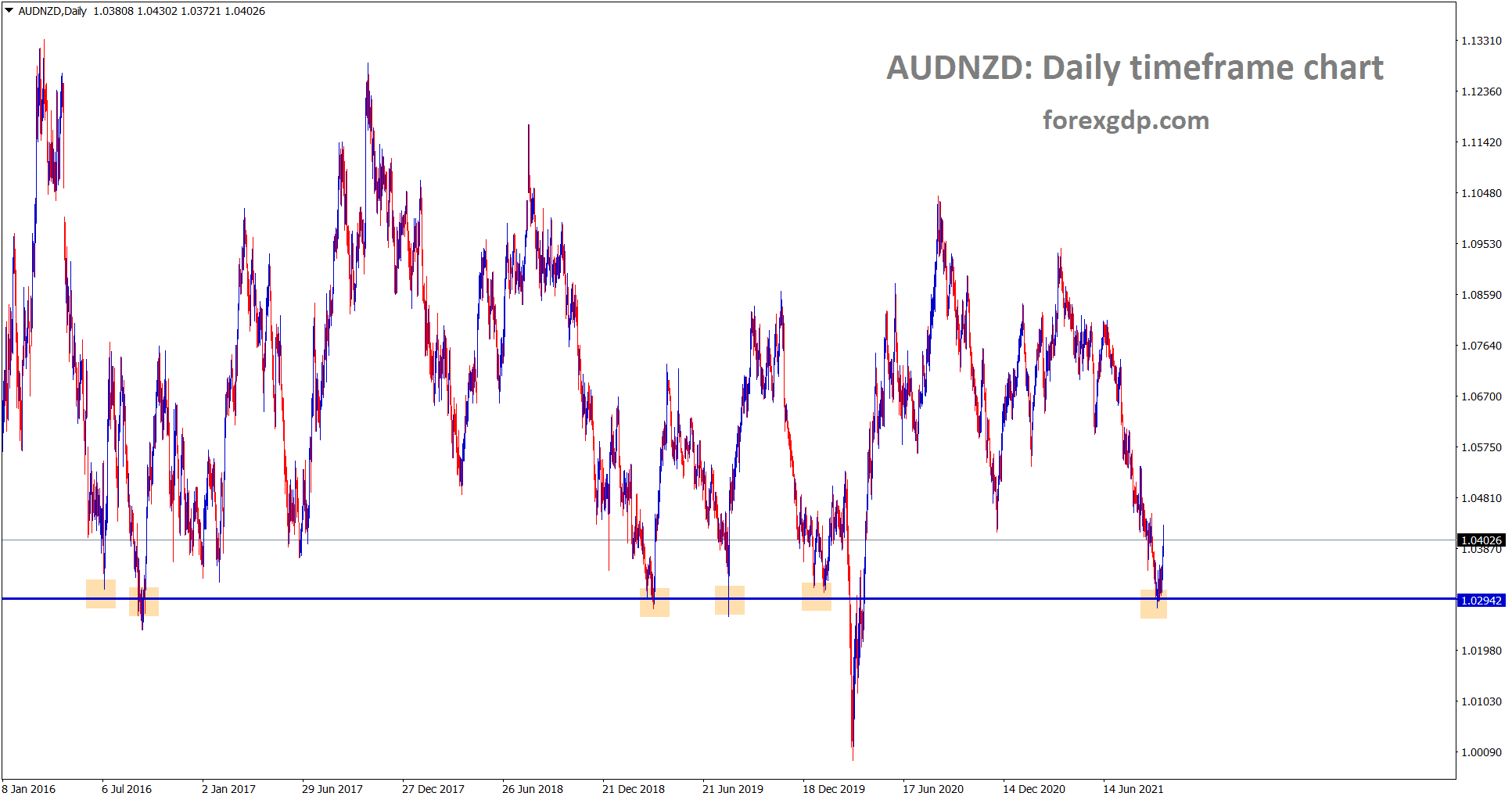

New Zealand Dollar: RBNZ Assistant Governor Speech

NZDUSD is moving in a descending channel falling towards the 61% retracement area.

AUDNZD is rebounding from the support area.

‘New Zealand Dollar posted declines as the Reserve bank of New Zealand will make 25Bps rate hikes in an upcoming meeting instead of a 50Bps rate hike.

And RBNZ Assistant Governor Christian Hawkesby said increments of 25Bps is possible in coming meetings, not to single shot as 50bps hikes are expected.

New Zealand Government finished 90% of 1st Dose covered and Second Dose covers 25% of People, soon 90% of Second Dose will be covered by December month.

Once 2nd Dose is covered in all people, strict lockdowns will be cooled.

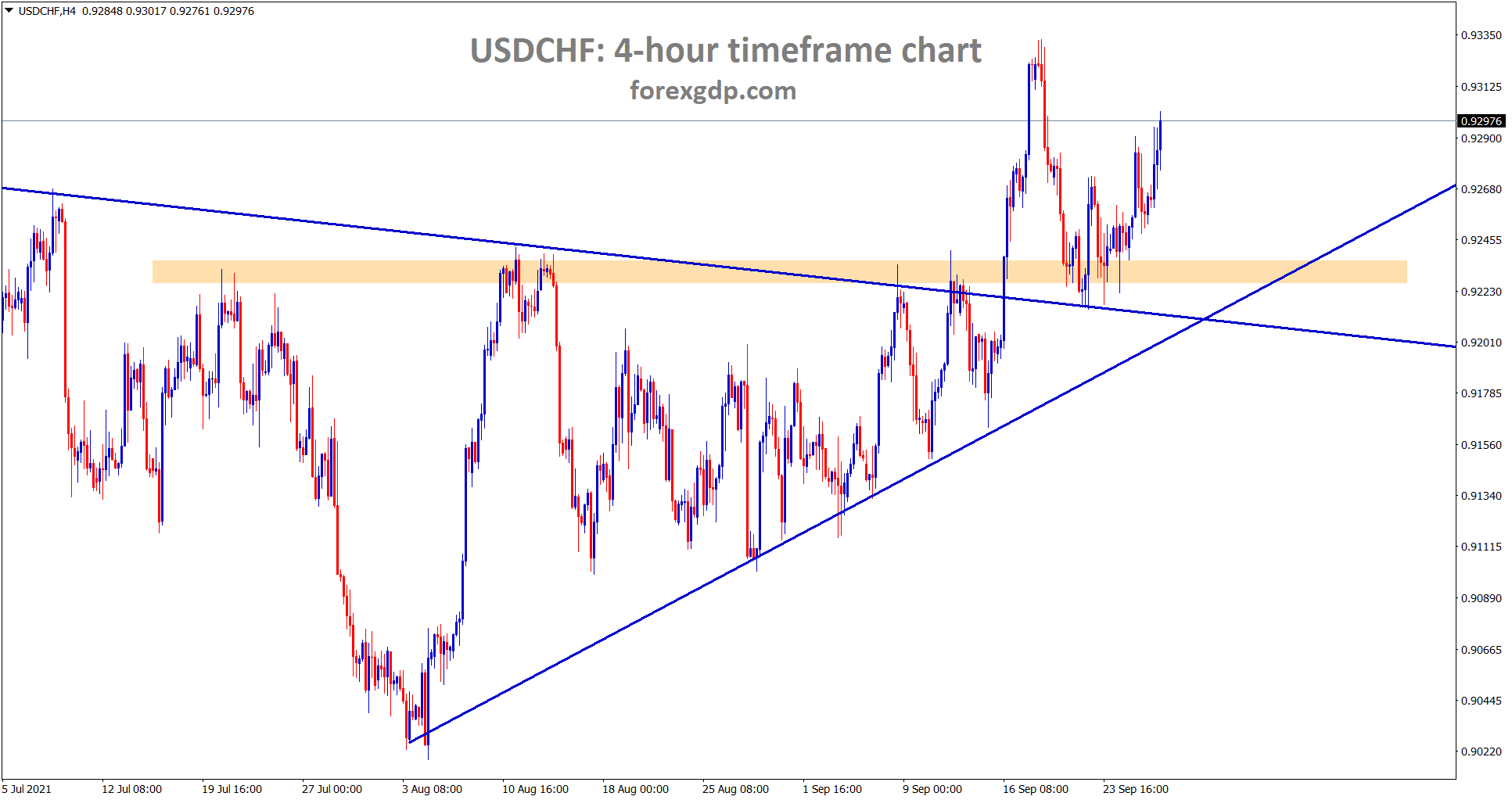

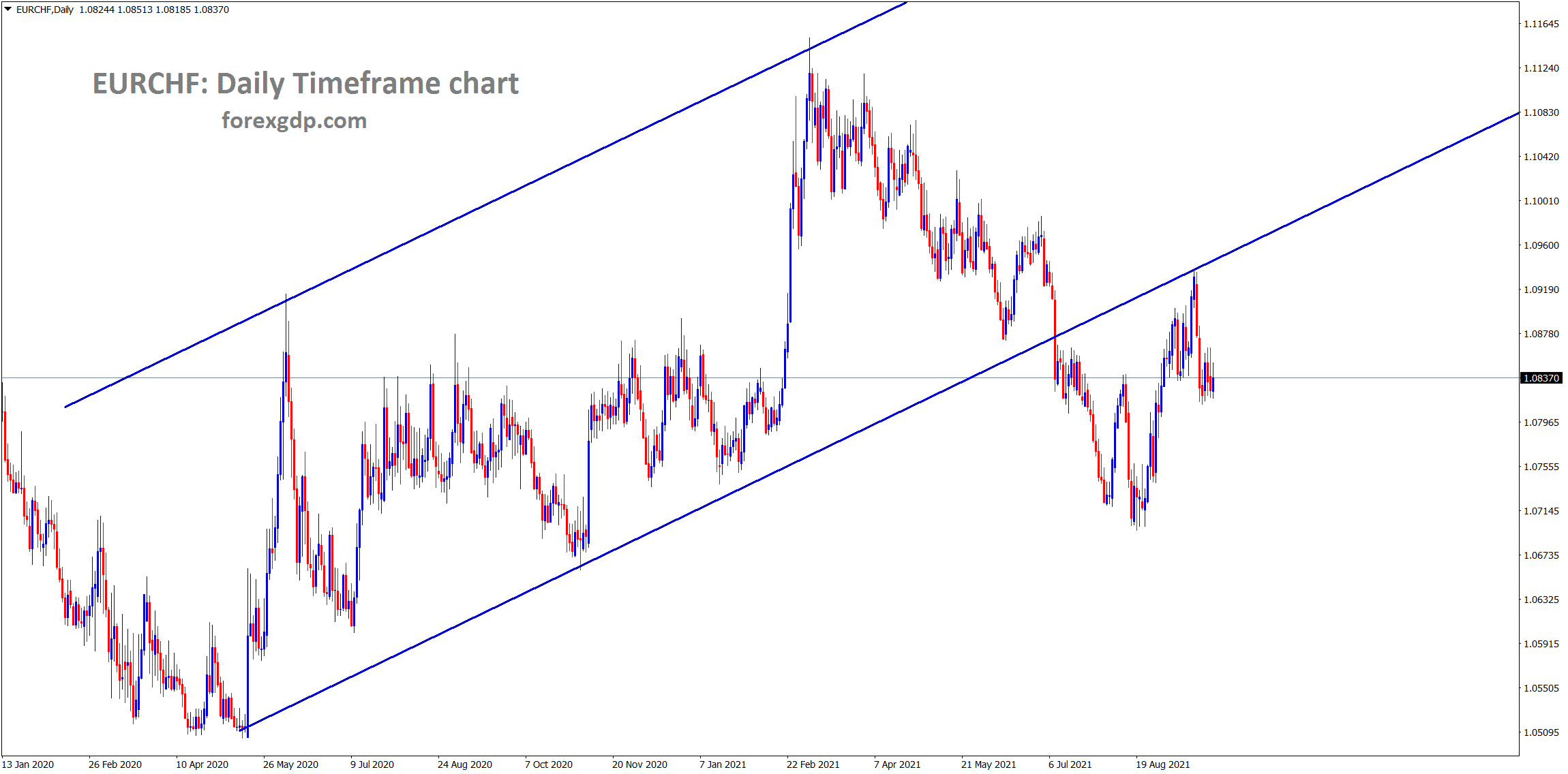

Swiss Franc: China Evergrande crisis triggered Swiss Franc

USDCHF is rebounding from the retest zone of the symmetrical triangle and bounced back from the horizontal support area where old resistance becomes new support.

EURCHF has retested the broken ascending channel and consolidating now at the retest area.

Swiss Franc was made higher as the China Debt crisis by Evergrande, and investors shifted their funds to Swiss Francs and US Dollar for safety purpose.

Newyork FED Williams said there would be a negative impact on the US economy if Parties did not solve the US Debt ceiling issue before September 30.

FED Powell testimony and US Treasury Janet Yellen speech are scheduled this week.

Investors are hoping that the Debt ceiling and the tapering issue will be solved.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/