Key Highlights

- The EUR continues to feel the pressure of the strong USD

- GBP still putting more pressure on the EUR

- Sterling Pound pulls a surprise as USD gains take a Pause

- Vigorous vaccination campaign and upgrade of GDP are key drivers of a strong Pound

- USD continues all major currencies apart from the Canadian Dollar

- The USD gets the highest consumer confidence since the emergence of Covid-19

EURUSD is moving in a downtrend range between the Support and Resistance zones.

EUR

Euro has not spared by USD yields rise. It has continued with a downtrend falling to 1.17. Many would have thought that Germany’s 0.5% CPI rise would have brought gains to the EUR but that has not been the case. With the market, expecting some USD longs of upside trends the pressure on the EUR could be more serious. As the yields continue to rise, the EUR will continue to bear the brunt, with long downtrends. The US economy looks bright with the latest indication by Consumer Confidence surpassing the predicted forecasts of 96.9 to a high of 109.7. What this means is more pressure on the already suppressed EUR.

The same case has happened when EUR is paired with GBP. The downtrend that seemed to hold for a while has once again lost the resistance grip by going below the 0.8531-37 zone. There is a possibility of the currency slipping to as low as 0.8277-82 if the current trend is anything to go by.

GBP

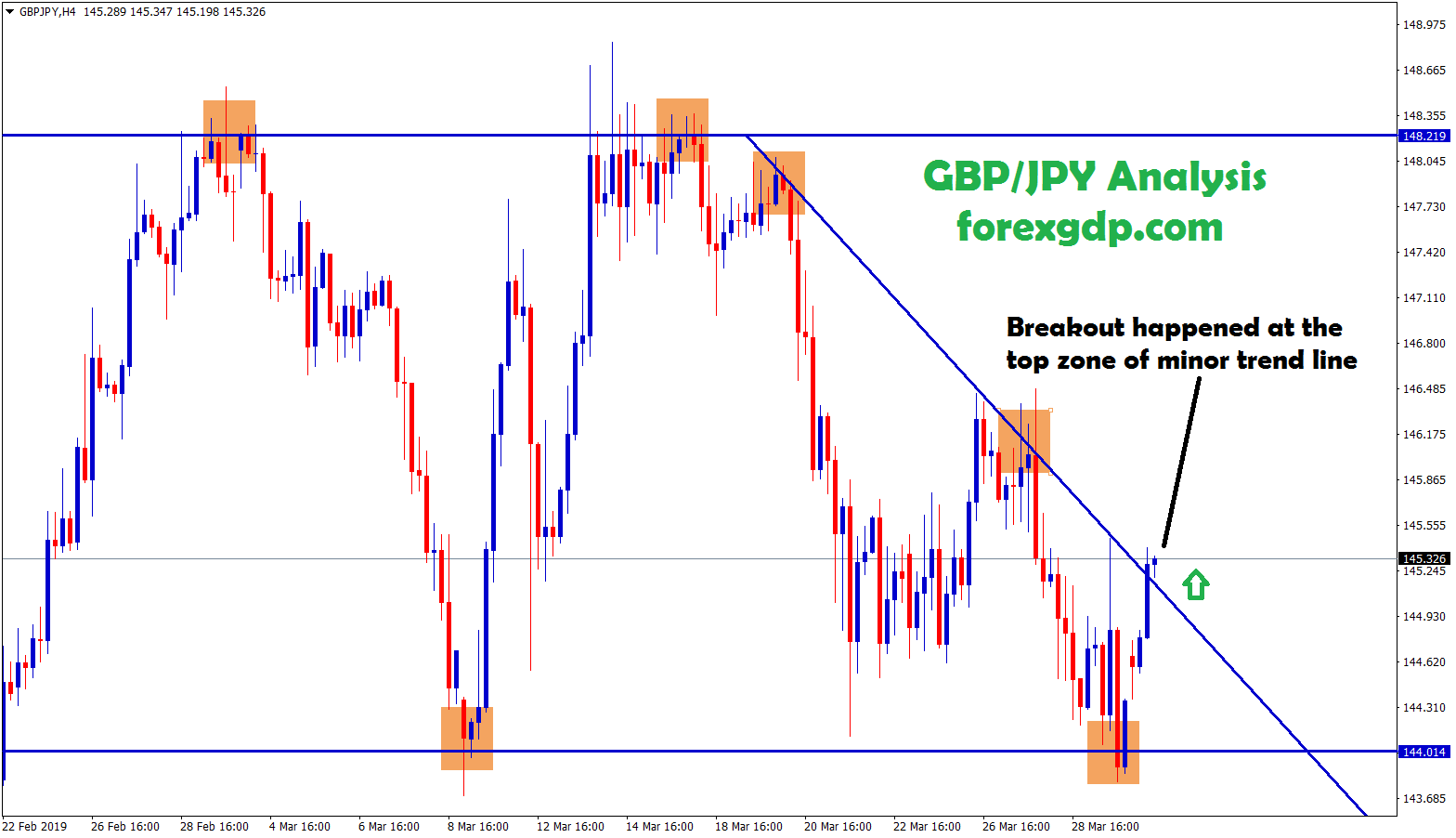

GBPUSD is moving in a downtrend range.

The Pound has put a spirited resistance to the USD and has started experiencing a rebound. The key drivers are the UK’s vigorous vaccination campaign strategy that has started yielding fruits. The campaign has seen many people vaccinated lowering the anxiety, and fear posed by the Pandemic. Another driver is the upgrading of GDP statistics late last year, from 1% to 1.3%.

The Covid-19 infection and death rate has slowed down in the UK. What this means is, easing of restrictions, lockdowns, and reopening of the economy. It will be a big boost to the Sterling Pound with an expected push uptrend.

Another critical aspect is the slowing down of USD gains after the details of the infrastructure plan by the US President emerged. The raising of taxes to cater to the budget means low debts, and high bonds value leading to low yields. Remember, the dollar has been riding high on high yields therefore if yields go down the dollar gains stagnate or go down.

It is good news to the Sterling pound that has been putting some resistance. It is showing some upward movement.

USD

Most of the Major USD currency pairs are moving in an uptrend.

USDCHF is moving in an ascending channel.

The Dollar will likely be closing the Month of March with a DXY Index of 3%. If that happens, then it will be the next biggest leap since 2016 November. If the views of the MUFG Bank Experts are anything to go by, then, Dollar support is likely to persist for a longer period.

The USD has continued dominating all major currencies apart from the Canadian Dollar.

Investors in the US are betting on the ambitious vaccination program and infrastructure stimulus for a stronger Dollar.

The USD 1.9 Trillion packages that were passed in March boosted consumer confidence in a big way. According to the latest data, the confidence rose from 90.4 to 109.7. It is the highest leap up in a single month since 2003 April, and the highest in the post-COVID-19 era.

What this means, a growth in the Us Economy that would propel the Dollar upwards. Therefore, with that in mind, the USD could remain positive for a while. The announcement of the big Numbers by Biden the US president any time from now is likely to trigger a positive trend on the Dollar. However, Congress could review the numbers otherwise to enable its passage.

CHF

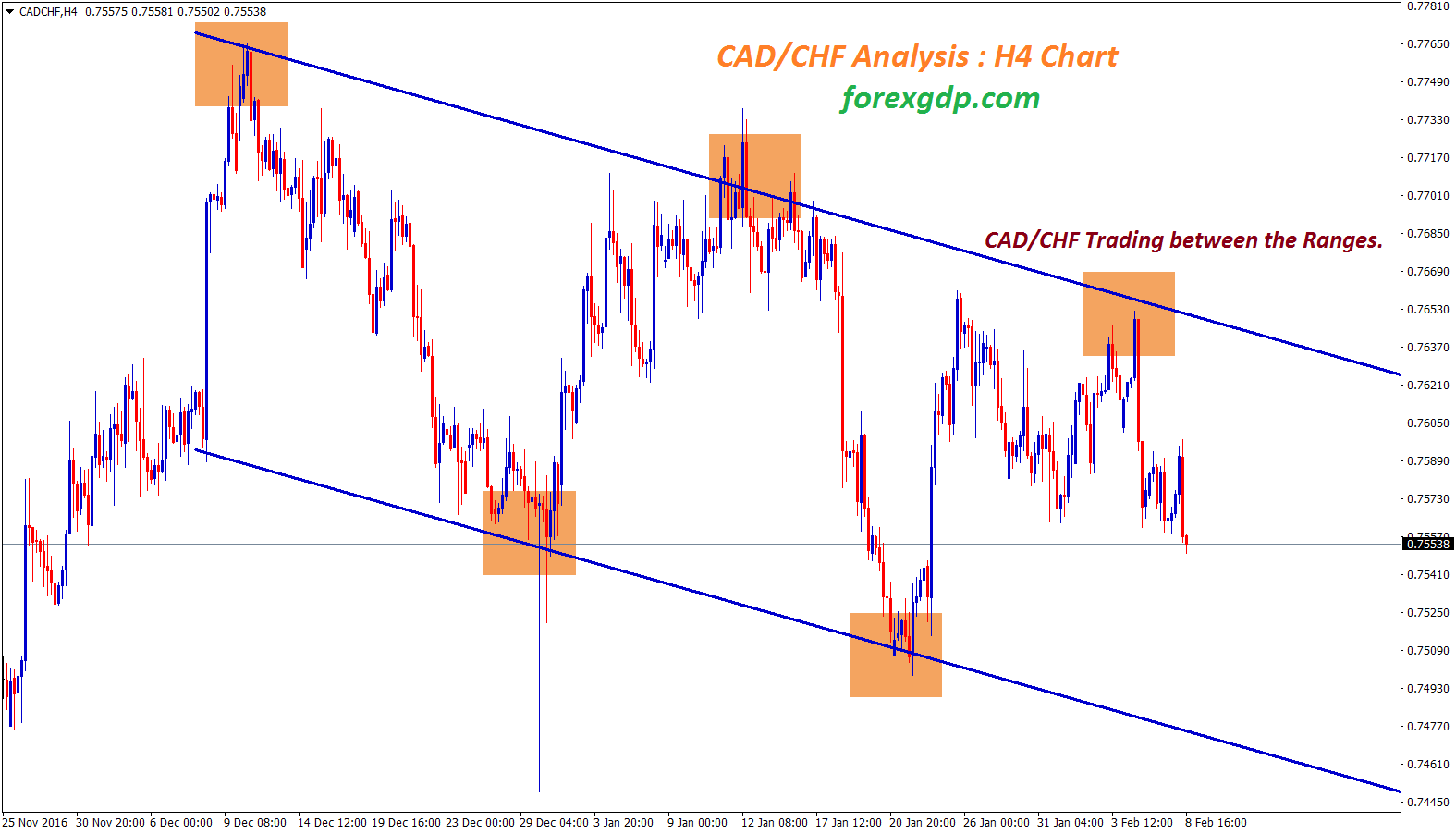

CADCHF is at the top zone of the ascending channel. wait for the reversal or breakout.

CHFJPY is moving between the descending Triangle pattern in the 4-hour timeframe chart.

In the past few weeks, the CHF has been on the lows especially against the USD, and other major currencies. Since the USD took advantage of the Covid-19 related weaknesses of Switzerland’s vaccination policies, it has dominated the Swiss Franc all through.

Only a short-lived acceleration that was broken once more by the strong US Dollar. The USD higher yields are a key driver to a strong USD over the CHF. The US dollar is generally high than most EU, Currencies. Coupled with the high rate of consumer confidence, we expect the USD to continue bullying the Swiss Franc.

It also continues to experience a Bullish push from the EUR. A recent high break of 1.1120 shows a bullish continuity, past the pennant highest peak. A serious resistance is expected at around 1.1190.

AUDNZD is moving in an Uptrend by forming higher highs and higher lows in the 4-hour timeframe chart.

NZD

For the past year or so, the New Zealand economy has been on the rocks. The covid-19 invasion has had diverse effects on the economy.

The trend has had a serious economic impact on the NZD. It has been experiencing lows for several weeks now. However, it has shown some resilience and bounces back though shaky. Due to the slowed gains on the US Dollar, the currency has received some support. However, the support or uptick is weak and can fizzle out at any moment. With the expected big announcement by the US president and the faced pace of vaccination, it is expected that the dollar will keep on being strong against the NZD.

AUD

The Australian dollar has shown resilience against the EUR. The AUD has benefited from the global confidence in the vaccination drive especially in the US. Another factor being the fiscal support by the Biden-led US government. As the EU, continues to shelve and push on the way forward regarding vaccination, the AUD continues to gain. Countries like Germany, Italy, and France have imposed more restrictions further severing the EUR strength against AUD. Even when the EU Comes out of slumber, and takes charge of the whole situation, AUD will still rate strongly against the EUR because of the Australian industrial growth network.

After suffering against the USD on Tuesday, AUD today bounced back with some gains. With the USD having gone on a flat phase, the AUD has held on strongly without serious downticks. However, how the AUD will fare depends on how the market will react to Joe Biden’s big economic agenda. It could as well mean some gain to the AUD. USD is just trying to make some correction before it’s bullish move.

Now, The AUDUSD has broken the bottom level of the Descending Triangle in the 4-hour timeframe chart.

CAD

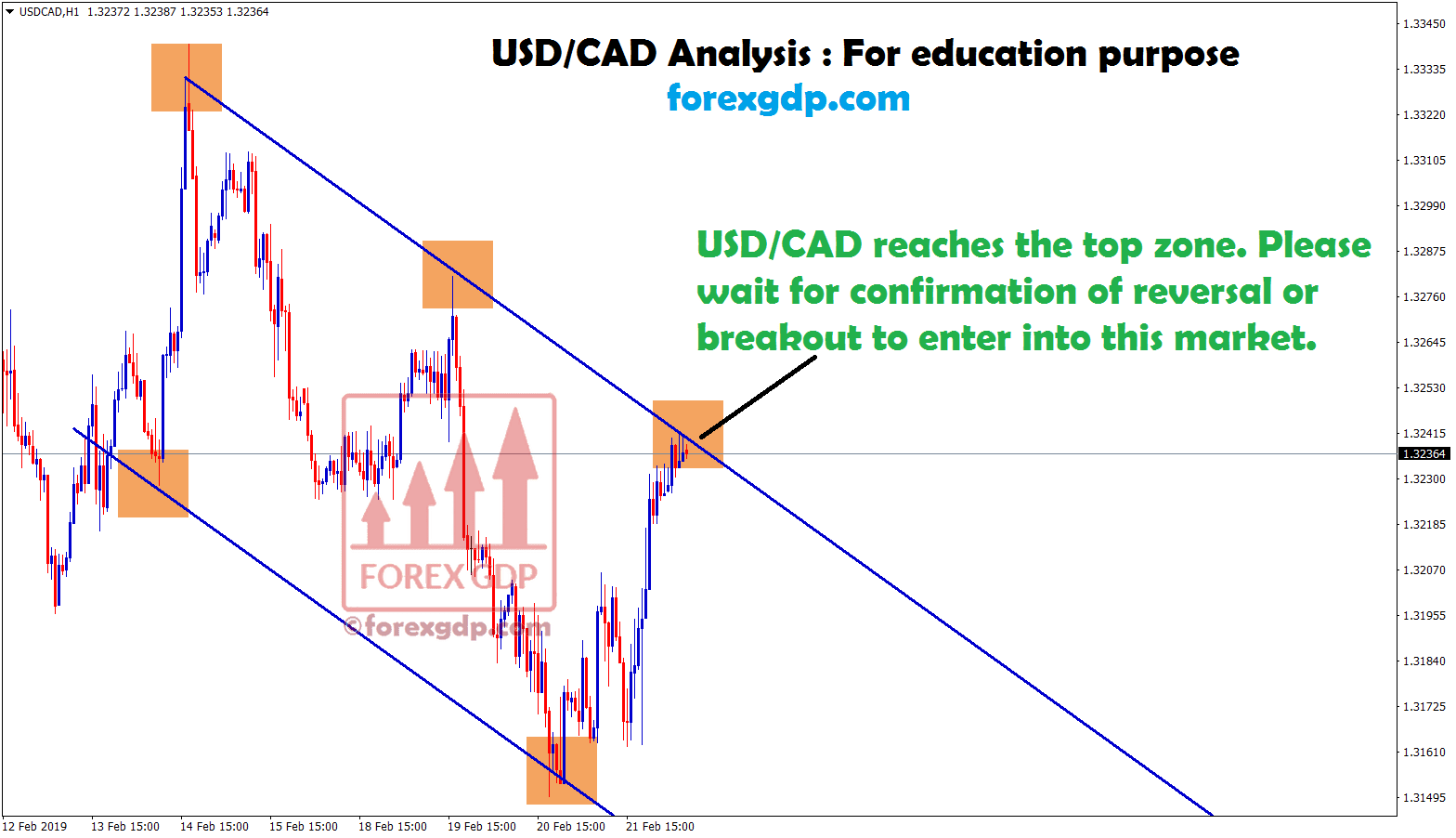

USDCAD is ranging at the top level of the descending channel in the 4-hour timeframe chart.

The CAD is enjoying a massive gain against some major currencies. The oil market prices have boosted the Canadian dollar gains. The currency has had a 5.6% gain against the EUR, and 8.4% against JPY.

It follows a stern announcement by the Bank of Canada withdrawing many emergency liquidity programs. It also warned of more monetary policies in the coming months to boost its economic growth. The announcement has seen a positive economic recovery trend in the country.

Another aspect was the blockage of the Suez Canal that sparked fears of the crude oil shortage. As nations struggled to get the crucial commodity, the prices soared. The prices went to above USD 60 for one barrel. The Canadian Dollar benefited immensely from this debacle propelling it to higher heights. There is every likelihood that the oil prices might continue gaining ground as OPEC continues to maintain its strict rules. The AUD being a commodity-linked currency will continue enjoying high tides.

The recent slow vaccination drives in EU nations will continue to weaken EUR and strengthen the AUD. Because in Canada there is a vigorous vaccination drive that has seen, many people vaccinated. Over 12% of the Canadian population have been given the first dose of the Covid-19 vaccine. In the EU, only a paltry 11% have been vaccinated for the whole block.