“Pain free income” is the appeal that enthralls numerous starting FOREX dealers. FOREX sites offer “danger free” trading, “exceptional yields”, “low venture.” These cases have a grain of truth in them, yet the truth of FOREX is more perplexing.

Missteps Of The Beginning Trader

There are 2 basic missteps that numerous amateur merchants make:

- trading without a procedure

- letting feelings manage their choices

Subsequent to opening a FOREX account it might entice you to take the plunge and begin trading. Viewing the developments of EUR/USD for instance, you may feel that you are letting an open door pass you by on the off chance that you don’t enter the business sector instantly. You purchase and watch the business sector move against you. You frenzy and offer, just to see the business sector recoup.

This sort of undisciplined way to deal with FOREX is ensured to lose cash. FOREX brokers must have a levelheaded trading methodology and not settle on trading choices seemingly out of the blue.

Comprehension Market Movements

To settle on normal trading choices, the FOREX broker must be knowledgeable in business sector developments. He must have the capacity to apply specialized studies to graphs and plot section and leave focuses. He must exploit the different sorts of requests to minimize his danger and augment his benefit.

The initial phase in turning into an effective FOREX broker is to comprehend the business sector and the strengths behind it. Who exchanges FOREX and why? This will permit you to recognize fruitful trading techniques and use them.

Responsibility

There are 5 noteworthy gatherings of speculators who take part in FOREX: governments, banks, organizations, venture assets, and dealers. Every gathering has its own goals, however 1 thing all gatherings with the exception of dealers have in like manner is outside control. Each association has principles and rules for trading monetary standards and can be considered responsible for their trading choices. Singular merchants, then again, are responsible just to themselves.

Expansive associations and instructed dealers approach the FOREX with systems, and in the event that you plan to succeed as a FOREX merchant you must take action accordingly.

Cash Management

Money management is a necessary piece of any forex trading methodology. Other than knowing which monetary forms to exchange and how to perceive passage and way out signs, the fruitful broker needs to deal with his assets and incorporate cash administration into his trading arrangement.

There are different systems for cash administration. Numerous depend on the computation of center value – you’re beginning equalization short the cash utilized as a part of open positions.

Center Equity And Limited Risk

At the point when entering a position attempt to constrain your danger to 1% to 3% of every exchange. This implies in the event that you are trading a standard FOREX part of $100,000 you ought to constrain your danger to $1,000 to $3,000. You do this with a stop misfortune request 100 pips (1 pip = $10) above or beneath your entrance position.

As your center value rises or falls, change the dollar measure of your danger. With a beginning parity of $10,000 and 1 vacant position, your center value is $9000. On the off chance that you wish to include a second vacant position, your center value would tumble to $8000 and you ought to constrain your danger to $900. Hazard in a third position ought to be constrained to $800.

More noteworthy Profit, Greater Risk

You ought to likewise raise your danger level as your center value rises. After $5,000 benefit, your center value is presently $15,000. You could raise your danger to $1,500 per exchange.

On the other hand, you could hazard more from the benefit than from the first beginning parity. A few merchants may hazard up to 5% against their acknowledged benefits ($5,000 on a $100,000 part) for more noteworthy benefit potential.

These are the sorts of key strategies that permit a fledgling to get an a dependable balance on productive forex trading.

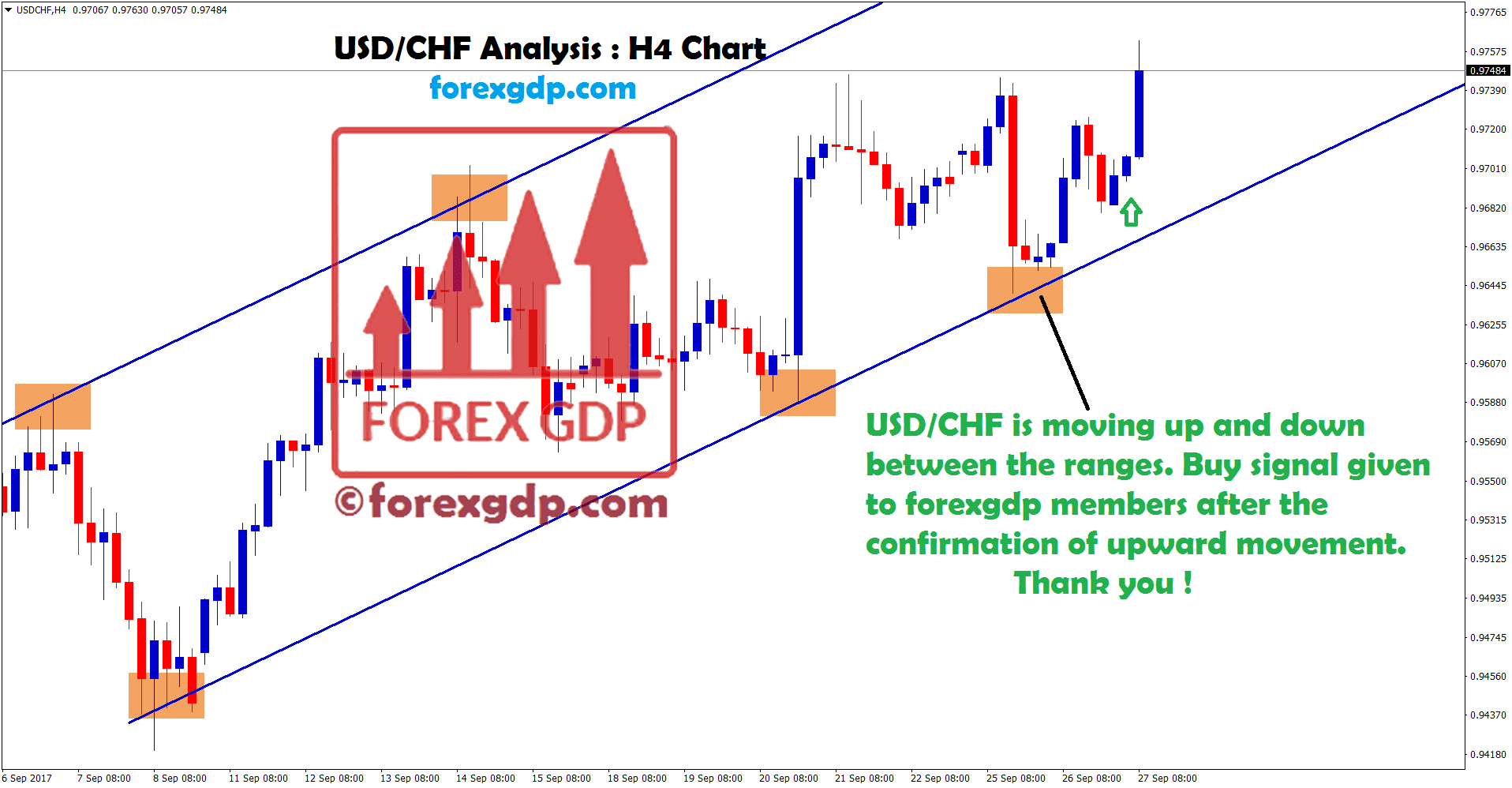

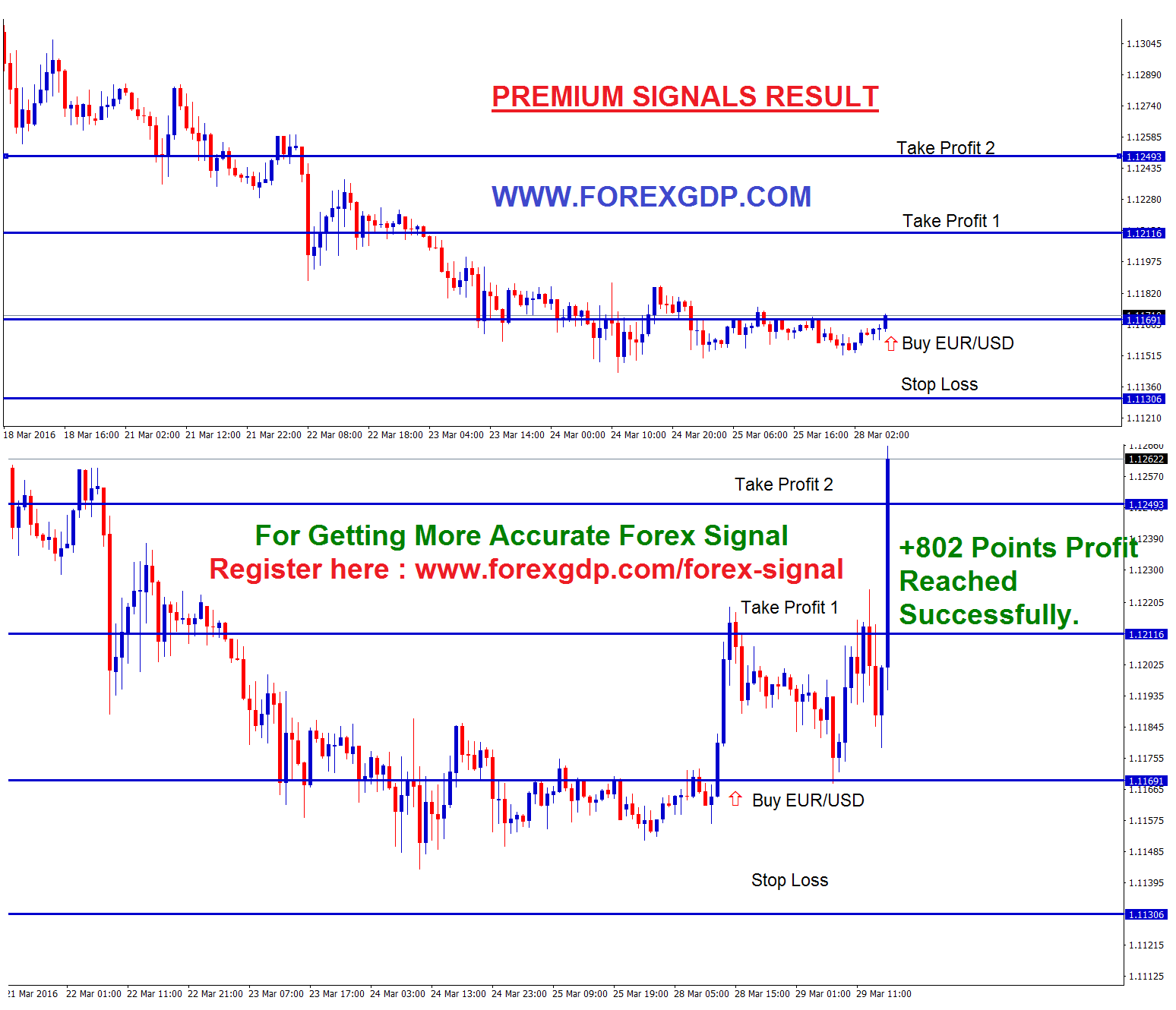

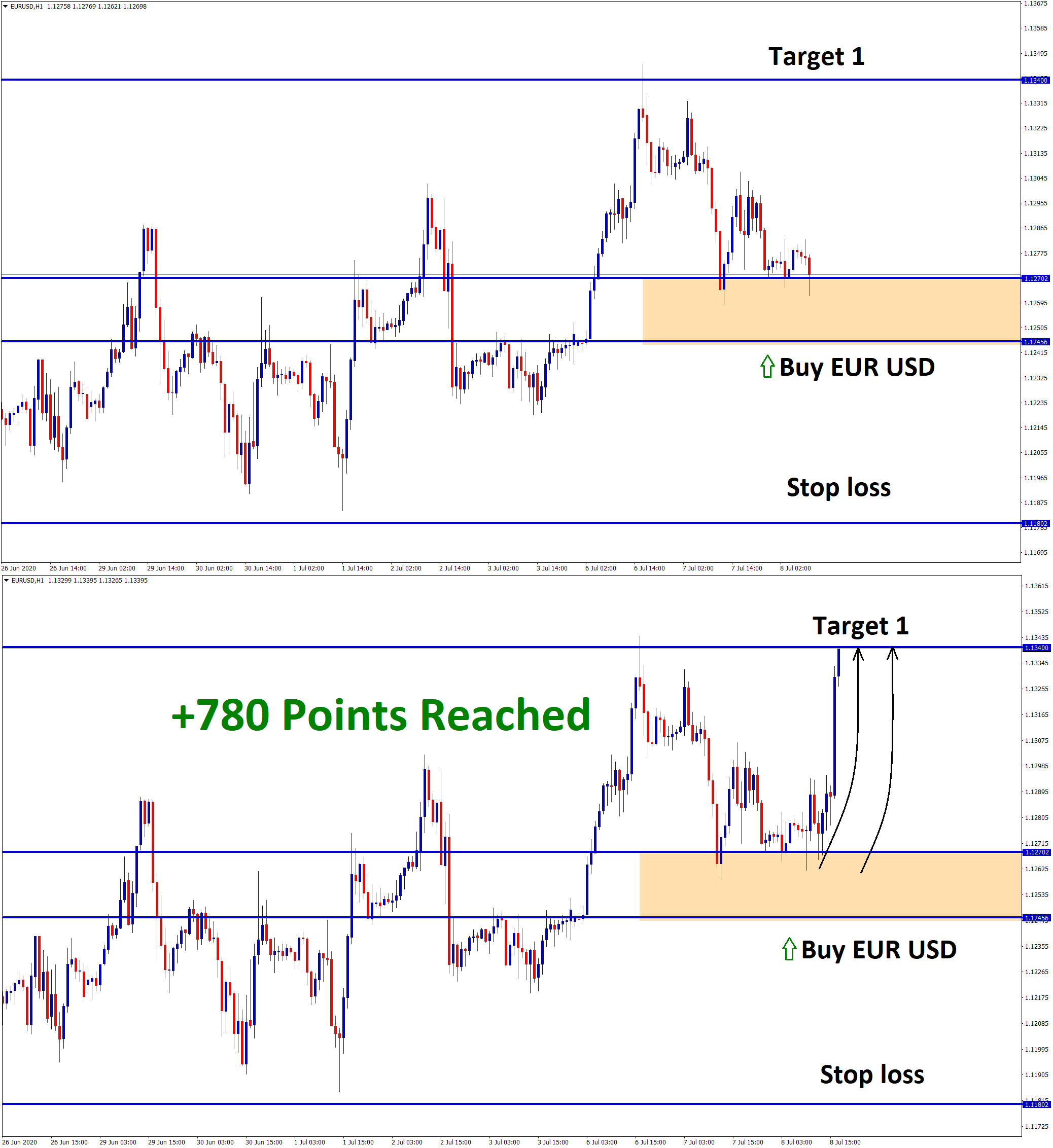

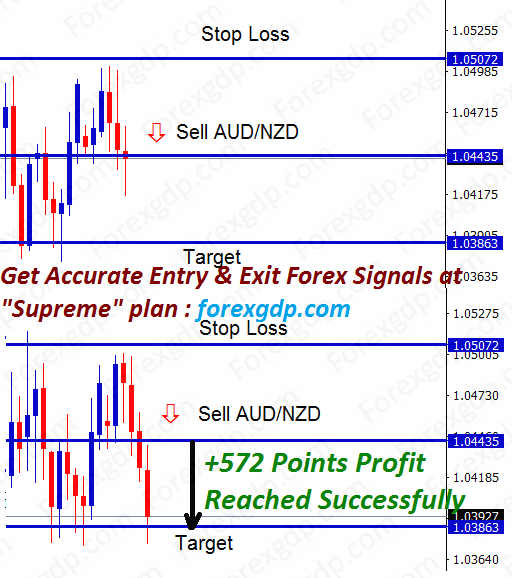

Save your time on analyzing the market and take your trades only at good opportunities available in the market.

If you want to receive forex trading signals at best trade setup with chart analysis, subscribe now to our forex signals.

The paragon of unrtdseanding these issues is right here!