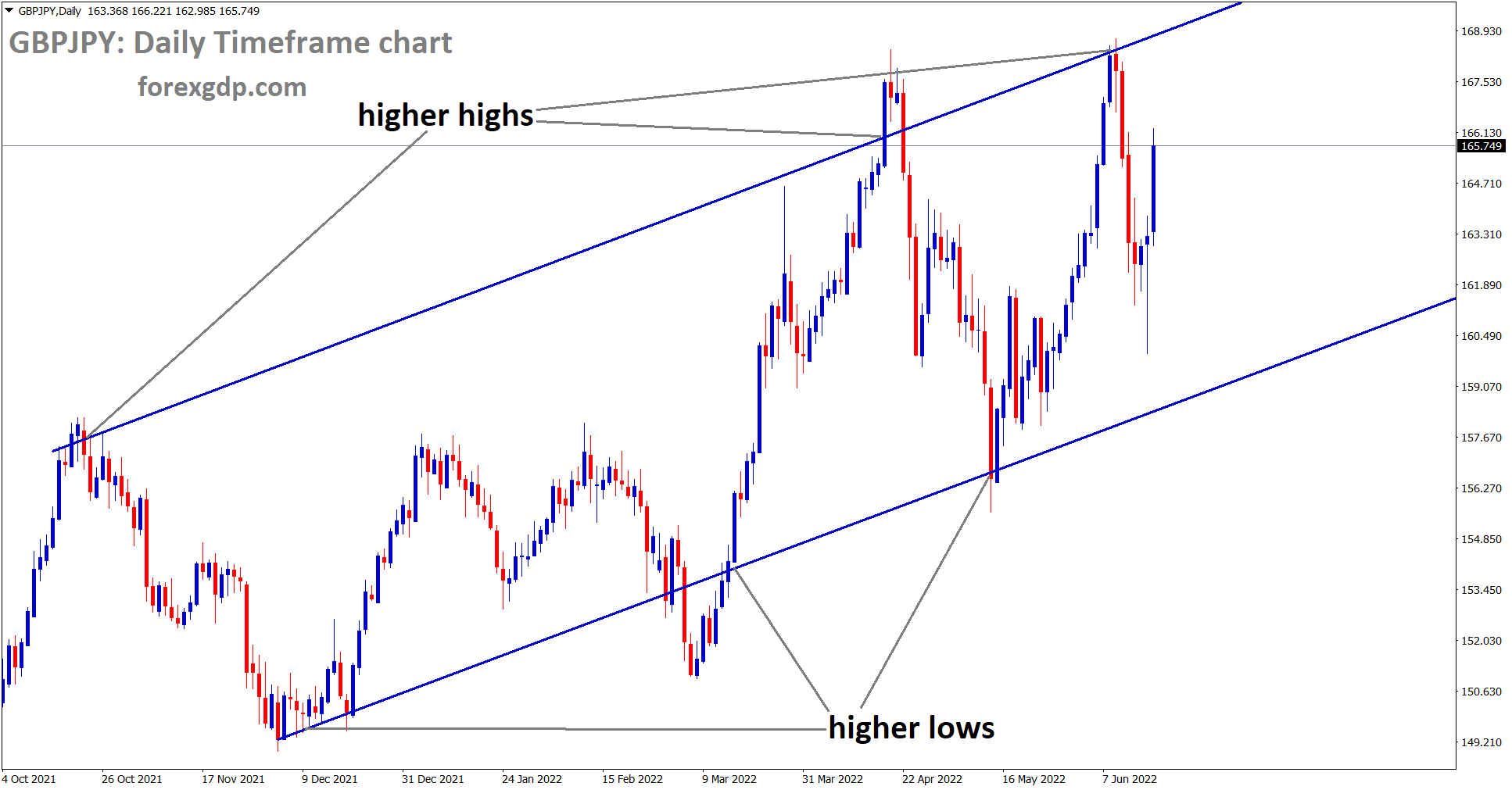

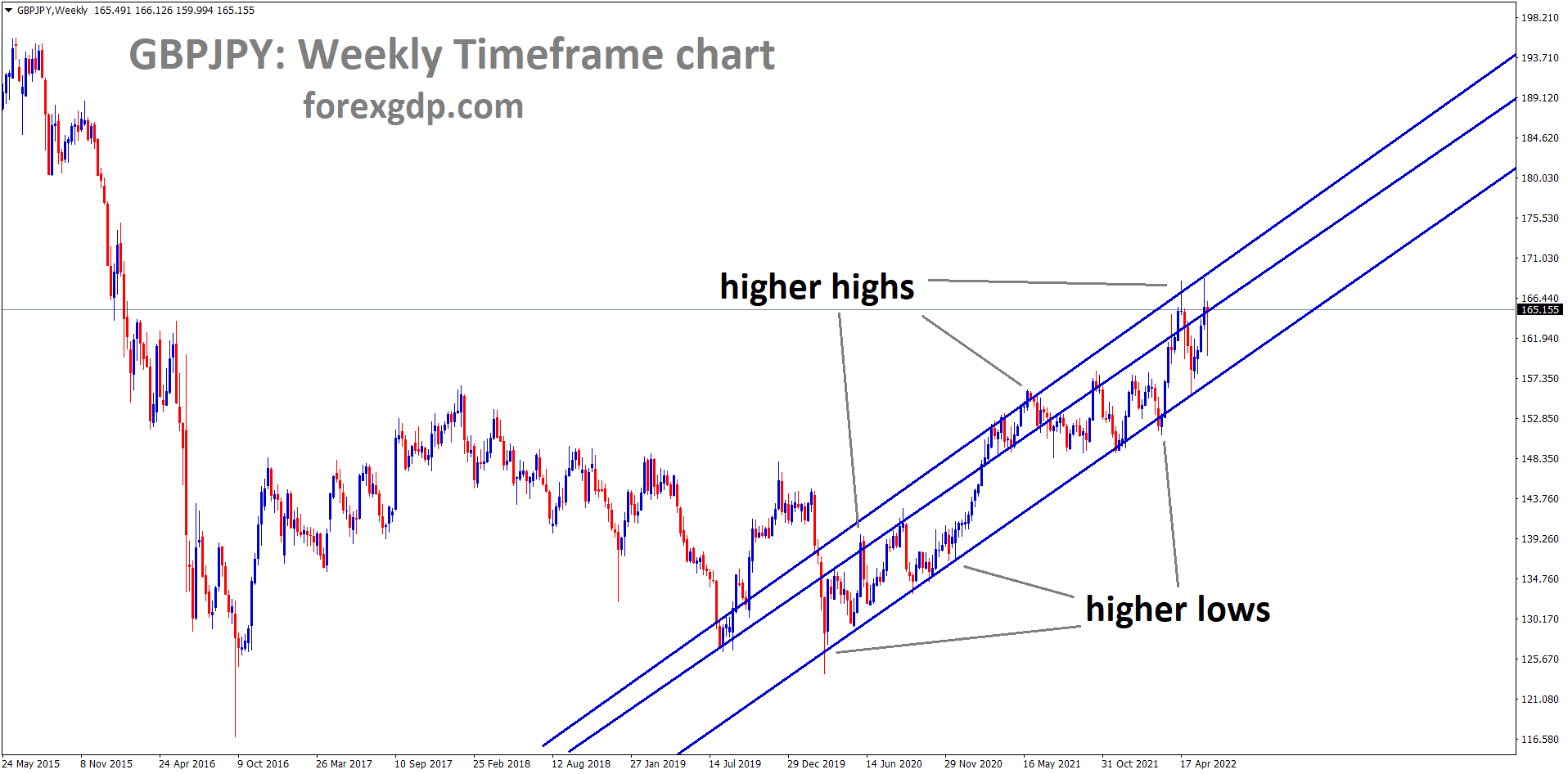

Where Is GBPJPY Today

The GBPJPY charts are on a rise today as a result of the interest rate decisions by both the Bank of England and the Bank of Japan. As a result of these releases the GBPJPY pair had faced an increase in its value and is now teasing at around the 165.1 region. The GBPJPY chart is showing some bullish market conditions. We may continue to see this pair increase in value throughout the day.

BOE Interest Rate Decision

Early on Thursday, the Bank of England released its interest rate decision for the term. It was revealed that it increased its interest rates by 25 basis points, therefore taking it from 1% to 1.25%. This comes as a surprise as most economists and analysts were hoping for an increase by 50 basis points to properly get a hold of the inflation problem. The monetary policy statement reveals, “The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. At its meeting ending on 15 June 2022, the MPC voted by a majority of 6-3 to increase Bank Rate by 0.25 percentage points, to 1.25%. Those members in the minority preferred to increase Bank Rate by 0.5 percentage points, to 1.5%.”

It further reveals, “In the MPC’s central projections in the May Monetary Policy Report, UK GDP growth was expected to slow sharply over the first half of the forecast period and, although the labor market was expected to tighten slightly further in the near term, the unemployment rate was projected to rise to 5½% in three years’ time. CPI inflation was expected to average slightly over 10% at its peak in 2022 Q4. Conditioned on the rising market-implied path for Bank rates at that time and the MPC’s forecasting convention for future energy prices, CPI inflation was projected to fall to a little above the 2% target in two years’ time, largely reflecting the waning influence of external factors, and to be well below the target in three years, mainly reflecting weaker domestic pressures. The risks to the inflation projection were judged to be skewed to the upside at these points.”

BOJ Interest Rate Decision

The Bank of Japan also released its interest rate decision early on Friday. It was revealed that they decided to keep their interest rates at the same level at 1%. This comes as no surprise as the BOJ has been following this same strategy for a very long time as they hope to maintain the top spots in trade markets by keeping their rates super low. The monetary policy statement reveals, “Japan’s economy has picked up as a trend, although some weakness has been seen in part, mainly due to the impact of COVID-19 and a rise in commodity prices. Overseas economies have recovered on the whole, albeit with some weakness seen in part. Exports and industrial production have continued to increase as a trend, but the effects of supply-side constraints have intensified lately. Business sentiment has seen a pause in its improvement recently, mainly due to the impact of supply-side constraints and the rise in commodity prices. Corporate profits have been at high levels on the whole. Business fixed investment has picked up, although weakness has been seen in some industries.”

It further reveals, “Japan’s economy is likely to recover, with the impact of COVID-19 and supply-side constraints waning and with support from an increase in external demand, accommodative financial conditions, and the government’s economic measures, although it is expected to be under downward pressure stemming from the rise in commodity prices due to factors such as the situation surrounding Ukraine. Thereafter, as the negative impact of high commodity prices wanes and a virtuous cycle from income to spending intensifies gradually, Japan’s economy is projected to continue growing, albeit more slowly, at a pace above its potential growth rate. The year-on-year rate of increase in the CPI (all items less fresh food) is likely to be at around 2 percent for the time being due to the impact of rises in energy and food prices, but it is expected to decelerate thereafter because the positive contribution of the rise in energy prices to the CPI is likely to wane.”

BOE Gerken Speech

Bank of England Executive Director, Charlotte Gerken, recently held a speech at the JP Morgan European Insurance Conference where she talks about the goals of competitiveness and productive investment. She reveals, “On internal models, we are seeking ways to improve and streamline the application process as well as achieving a more flexible approach to the modeling of complex and emerging risks. This may allow models that are adequate but suffer from some non-fatal shortcomings to nonetheless be used whilst those shortcomings are addressed over a realistic timetable. Potentially, this approach could also make use of safeguards where appropriate. We will not allow the best, in modeling, to become the enemy of good enough. These reforms are also intended to help address the tension between innovation in investments and underwriting, and the strong reliance on historic data in internal models.”

She further adds, “The reforms to investment flexibility, reporting, and approval processes are not without risks. In the case of annuity firms, the reforms are reliant on our confidence in the level of MA benefit taken – and hence on the fundamental spread being appropriately calculated. More broadly, in addition to the use of safeguards where appropriate, the reforms are contingent on the continued effectiveness of a central pillar of the Solvency II regime, the quality of firms’ own risk management. That will remain at the core of firm-to-supervisor dialogue and engagement. Our overall work on potential Solvency II reform has already benefited from the effective engagement as part of the pre-consultation phase of the review. Following the publication of our DP at the end of April, we are requesting more information from firms and I am looking forward to our next series of meetings in order to hear the views of firms, their investors, and other stakeholders.”