Gold: US CPI data forecasted and Geopolitical tension

Gold prices are remains consolidated at 1770-1820$ in the last two weeks, due to Geopolitical tensions and the US making a solid comeback from the economy, makes a bearish tone for the yellow metal.

XAUUSD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

XAGUSD Silver price has reached the horizontal support area of the Box Pattern.

The US asks the German Government to take action against Russia if Russia invades Ukraine.So, Gold remains lower as Demand gets slower in markets.

The US asks the German Government to take action against Russia if Russia invades Ukraine.So, Gold remains lower as Demand gets slower in markets.

And US CPI data scheduled this week, higher CPI data refers to FED Pressures on tapering assets soon than later.

Precious metal is non-yielding assets, and US Treasury yields show a higher reading on the hopes of FED rate hikes soon in 2022.

US Dollar: US Domestic data and Geopolitical tension will impact US Dollar

GBPUSD is moving in the Descending triangle pattern and the market has reached the horizontal support area.

US Dollar index shows consolidation range in the past month between 97-95.50.

And the US will do sanctions on economic measures on Russia if it invades Ukraine by Russian military forces.

And the US has told German troops to make ready if Russia starts to attack Ukraine.

This, in turn, fears surrounding the market and US Dollar like to stronger if Global tensions packed up.

This week US CPI data is set to release, and higher numbers make US Dollar stronger in the hopes of FED tapering.

EURO: ECB central bank member speech

EURUSD is moving in the Descending channel and the market reached the lower high area of the channel.

ECB Central bank Policymakers and Governing council member Madis Muller said that it is not Clear for the Bank to add the Asset purchase program after March month PEPP program ended due to higher inflation and instability of Economy recovery.

And Slovak Central bank Governor Peter Kazimir said we are more aware of premature tightening.

And EURUSD found lower to 1.1230 area once again after ECB shows inflation is transitory and not too tapering asset purchases and to increase the rate of interest.

US domestic data shows improvement in Economy recovery and just opposite to Eurozone economy.

UK POUND: UK and EU made closer to solving Northern Ireland Protocol

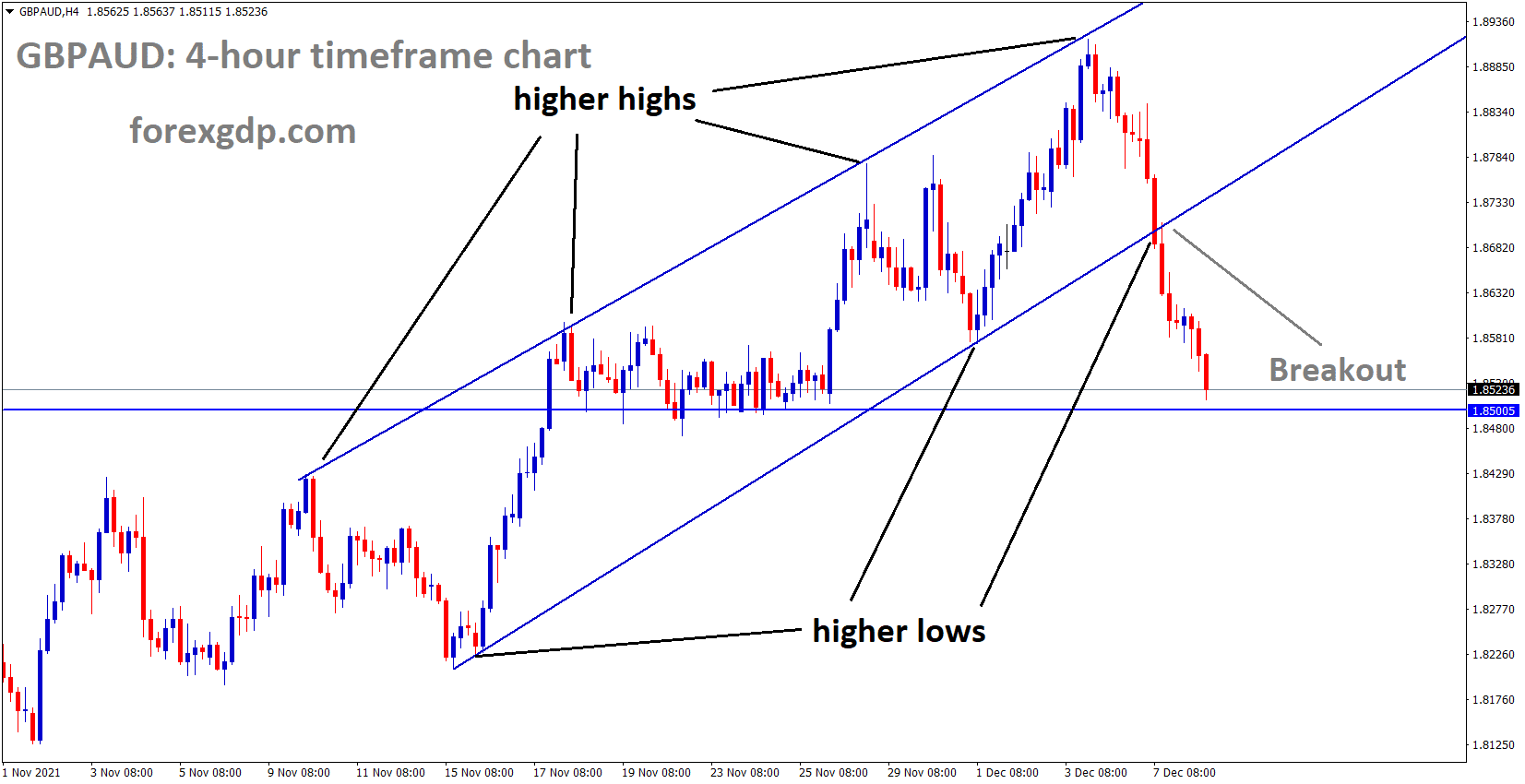

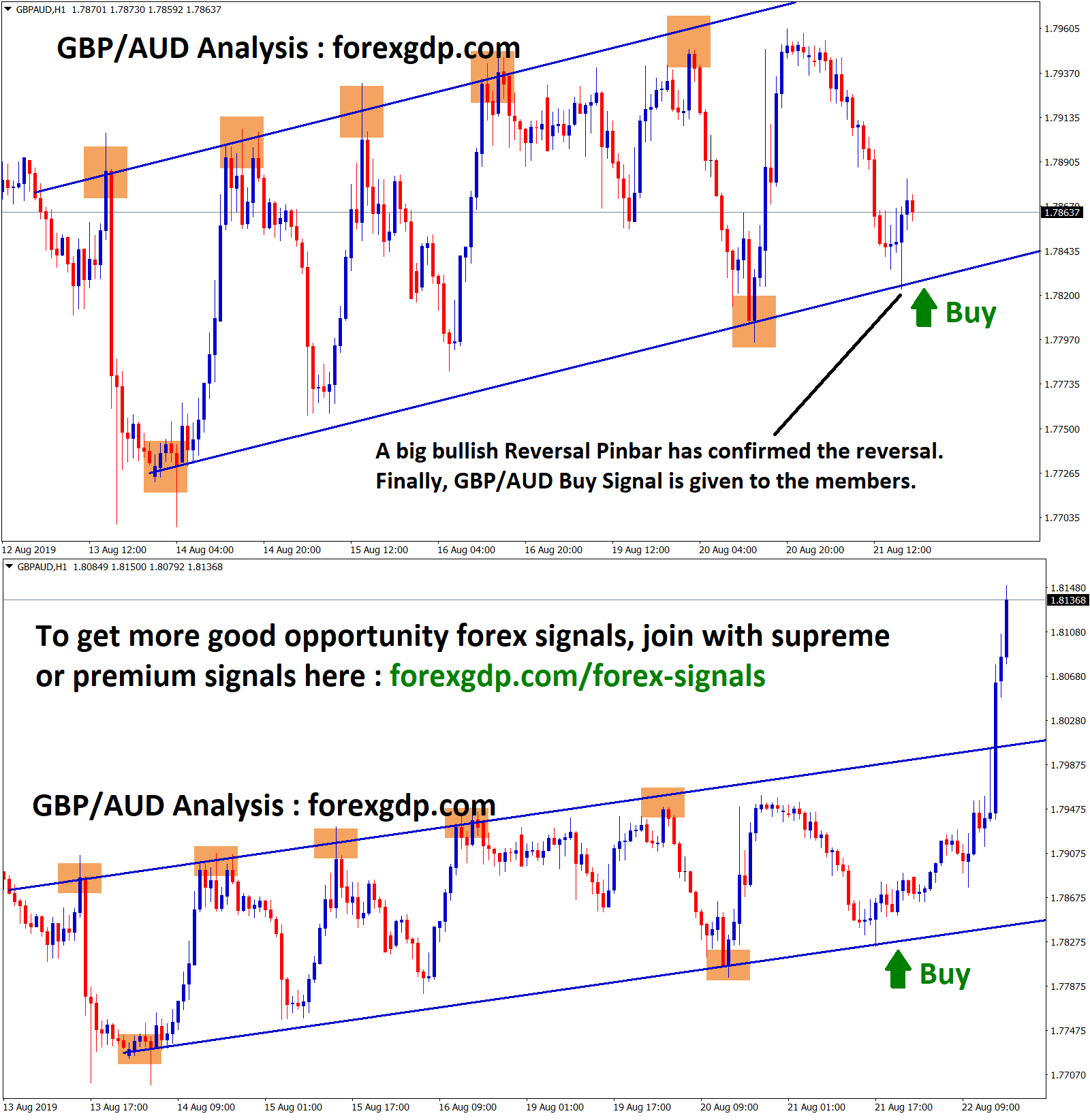

GBPAUD has broken the ascending channel and the market has reached near the horizontal support area.

UK Pound like to benefit from UK and EU over Northern Ireland protocol to solve soon.

And Britain now granted licenses to French Fishermen last day, and this news subsided to UK and France talks.

Now UK and EU over Post Brexit deal talks on Northern Ireland Protocol are remaining.

US treasury yields made higher after FED hopes on tapering bets higher in the December meeting.

Due to this scenario, GBPUSD has been in consolidation for the last three weeks around the 1.3190-1.3350 range.

And the Geopolitical tensions between US and Russia takes charge this week; the US impose sanctions if Russia invades Ukraine anytime.

The Omicron variant crossed the 100 marks in the UK, but no one has died from the Omicron variant, so cases seem less deadly than the Delta variant.

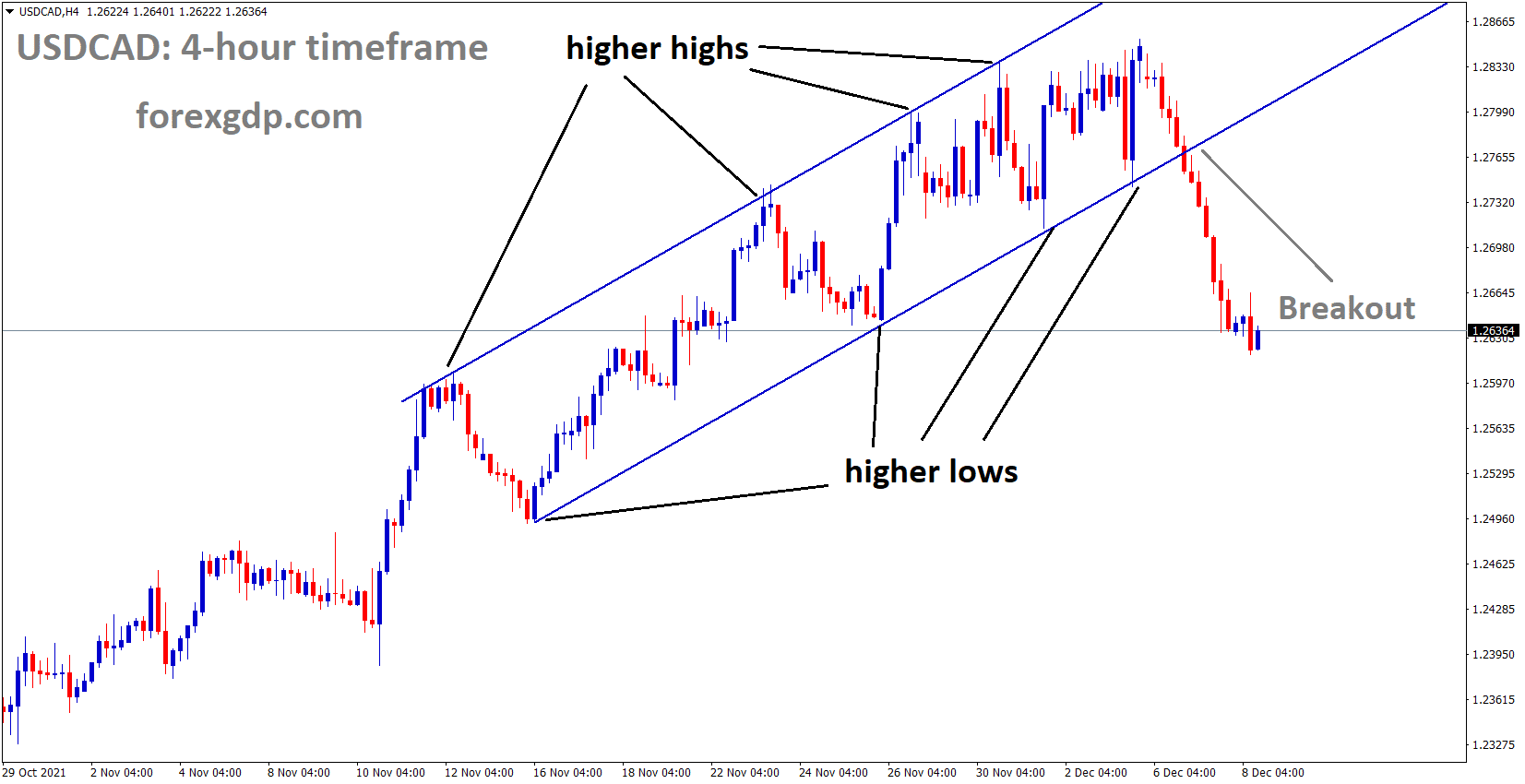

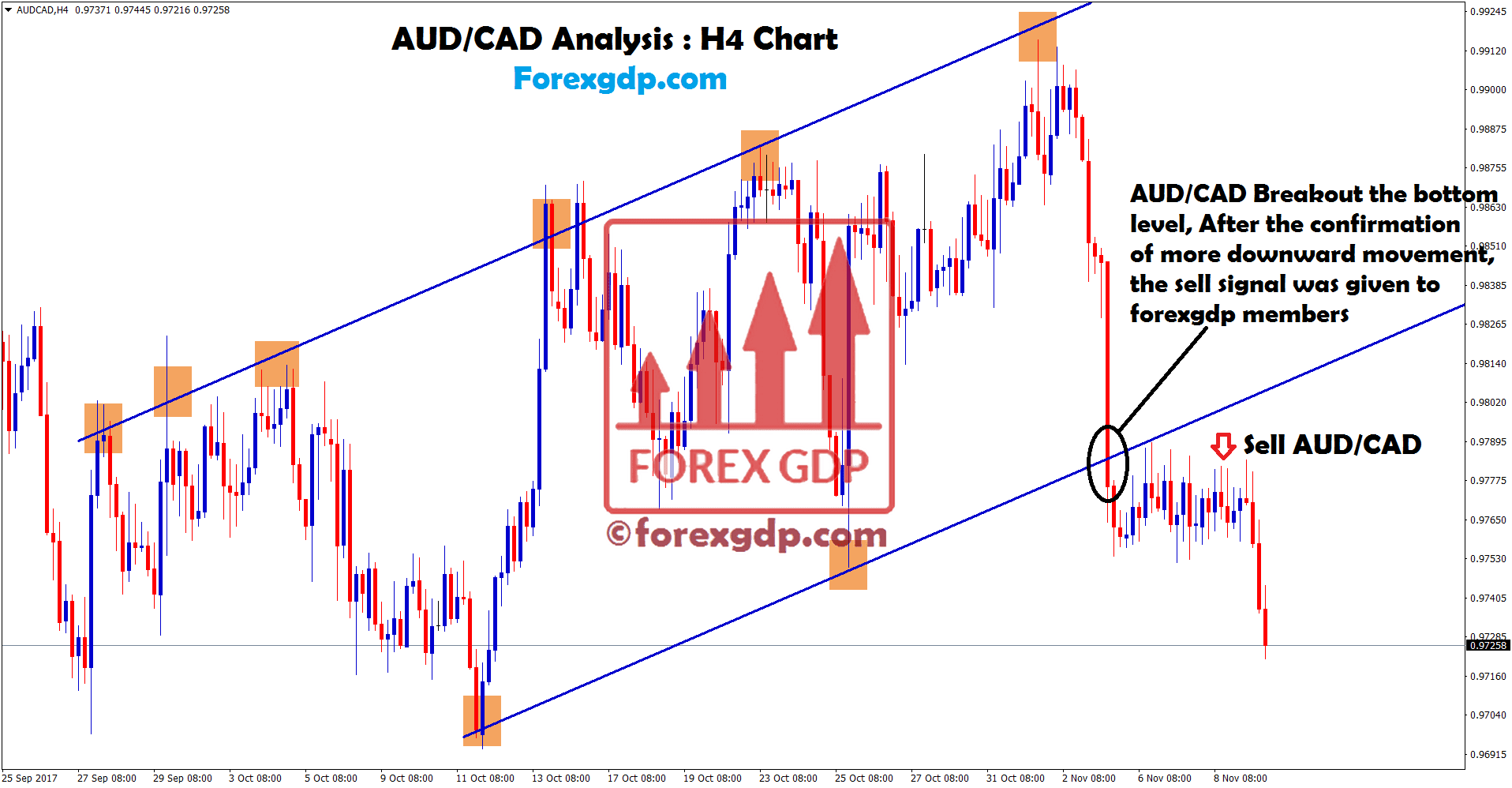

Canadian Dollar: Canadian Ivey data came higher than expected

USDCAD has broken the Ascending channel and reached the horizontal support area.

Canadian Dollar, Ivey PMI data came higher as 61.2 versus 59.3 expected. Due to this data, USDCAD fell 2% from highs this week.

And Today Bank of Canada monetary policy decision going to happen; if the same repeated statement of significant inflation is transitory, the CAD boom once again.

US and Russia conflict with Ukraine will boost oil prices if war enters.

If war comes between Russia and Ukraine, more Gasoline and Fuel will be required.

So Canadian Dollar after long fell to 8% against JPY, now started to breathing again in correction path.

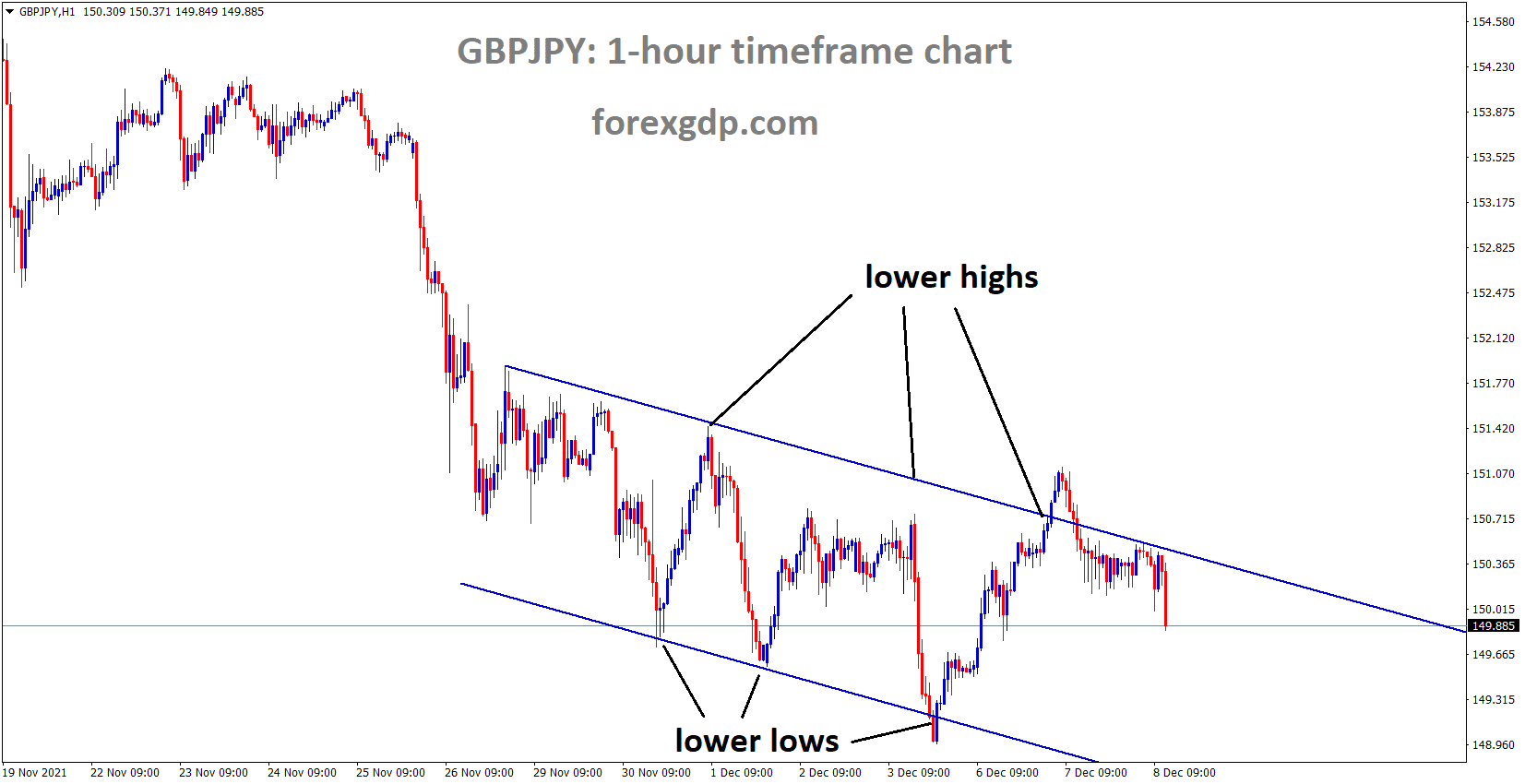

Japanese Yen: The US Has boycotted Olympics in Beijing

GBPJPY is moving in the Descending channel and the market falls from the lower high area of the channel.

Japanese Yen has benefitted as tensions rise between the US and Russia, imposing economic measures if Russia takes on Ukraine.

And the US has boycotted the Winter Olympics in Beijing due to China alleged human Violations against Muslims in the Uyghur region.

Due to these issues, the Japanese Yen keeps higher ahead of US and Russia concerns, other side US and China on Human violations issue.

And Japanese Government announced a Trillions of Japanese-Yen stimulus to invest in economic recovery; hopes are available as soon as the Japanese economy takes recovery.

Bank of Japan member speech

Bank of Japan’s Masayoshi Amamiya said Japan’s economy is stagnating, and economic recovery will be seen next year-end.

And this comment after Japanese GDP Quarter-on Quarter basis fell by 0.90% worse than forecast of 0.80% Drop.

In the third quarter, the Japanese economy shrank 3.6%, worse than the 3.0% estimated. This is mainly due to the impact of Private spending, which is less due to the resurgence of Covid-19.

And the Wholesale inflation increased to 40-year highs, and the corporate goods price index gained 8.5% in November than 8.0% in October.

Australian Dollar: The US and Russia tension fears Geopolitical concerns

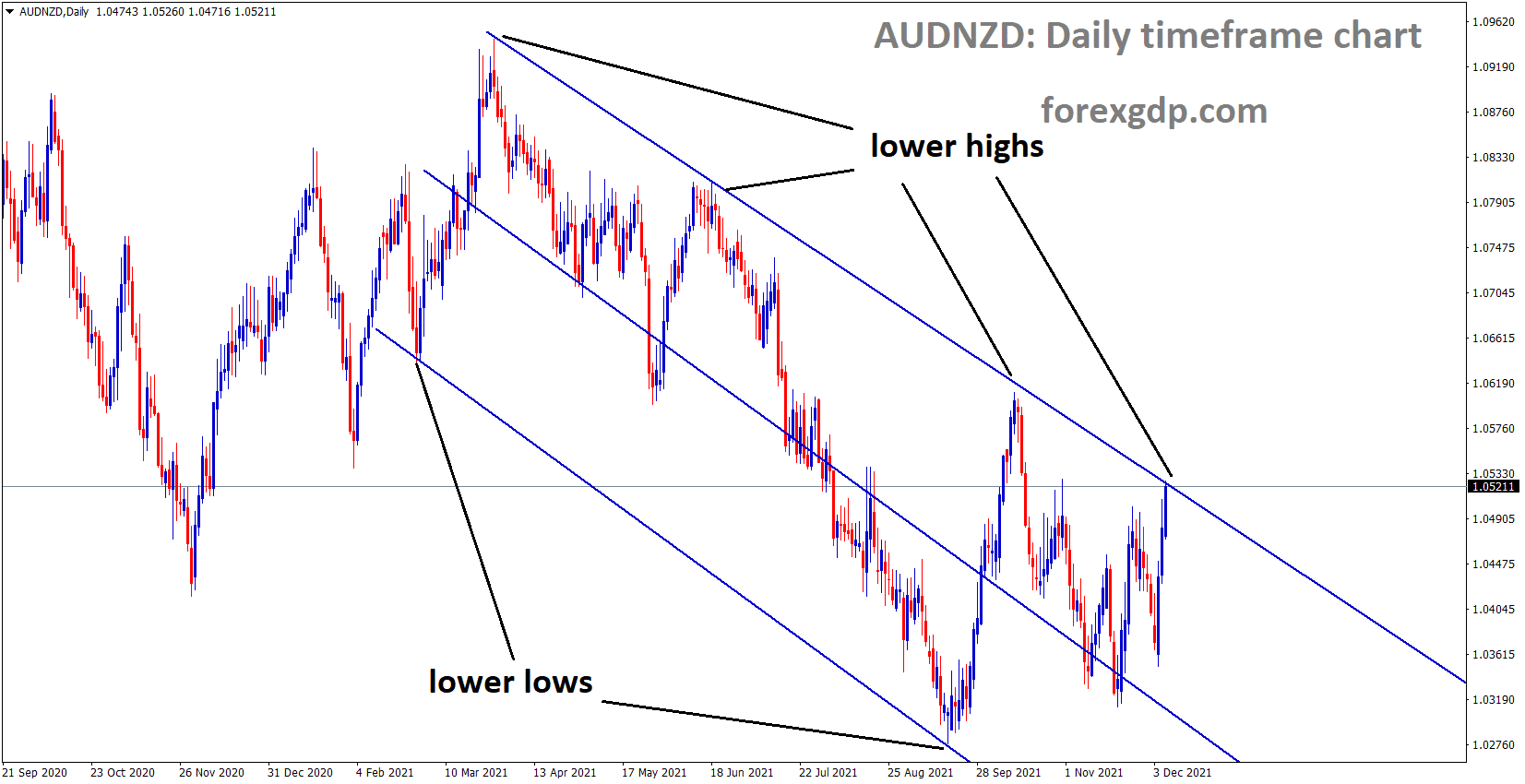

AUDNZD is moving in the Descending channel and the market reached the lower high area of the Descending channel.

US and Russia made some fears on Geopolitical tensions due to Russia planning on Invading Ukraine; if it happened, the US would take Economic imposition and some tariffs on Russia.

This scenario creates concern among the Riskier currencies.

And yesterday, RBA Monetary Policy settings were unchanged, and no reflections in the Australian Dollar.

Now Corrections progressing in AUDUSD after 5.5% down from highs.

This week US CPI data will release; Omicron Virus variant fears declines as the death impact is slower than Delta variant.

China economy is recovering after injecting more liquidity into markets.

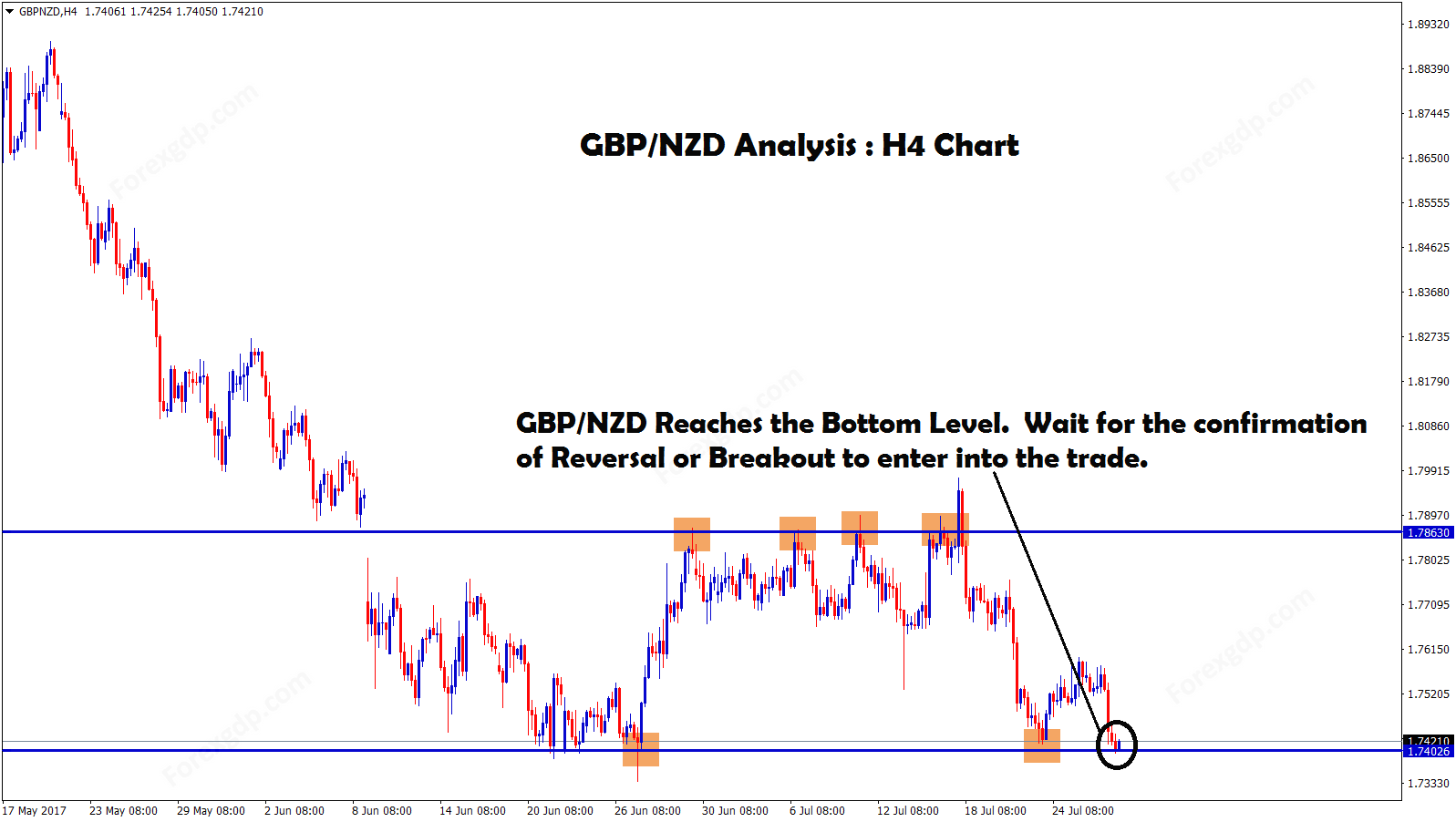

New Zealand Dollar: US Domestic data and Geopolitical tension

drives NZD Dollar this week

GBPNZD is moving in an ascending channel and the market has reached the higher low area of the channel.

New Zealand Dollar shows correction from lows after hefty fell from highs as 5.0% correction.

The next RBNZ meeting will happen in February, and hopes of hawkish matters have subsided. So now, US Domestic data drives the NZDUSD market.

And Geopolitical tensions between US and Russia make it a Down tone for Riskier currencies like NZD.

New Zealand Dollar shows healthy correction after broad one year from 2020.

And China has overcome from liquidity crunch due to the real estate crisis and has made some relief for NZD and AUD Dollars.

Swiss Franc: SNB Governing member Andrea Machler speech

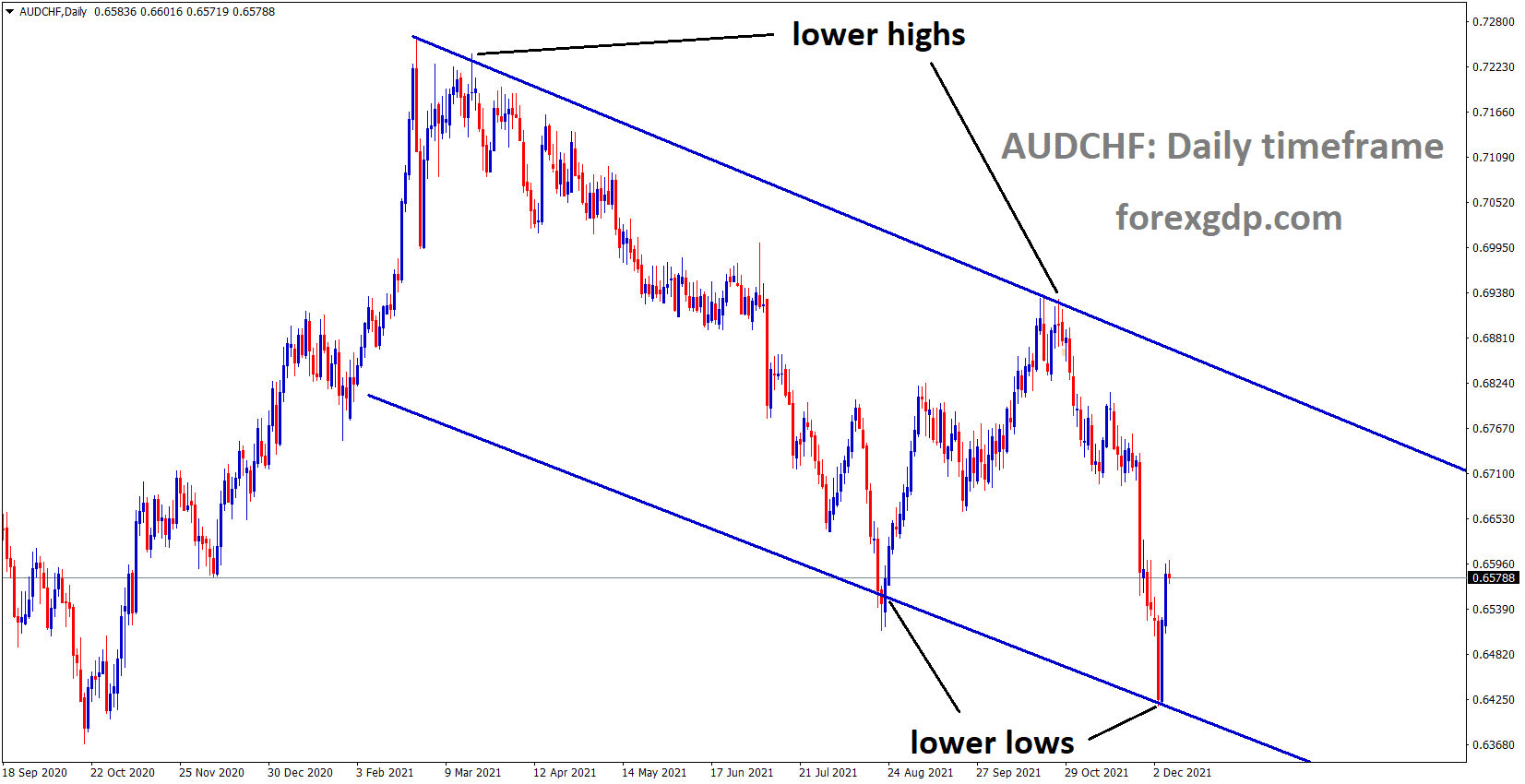

AUDCHF is moving in the Descending channel and the market has rebounded from the lower low area.

SNB Governing Board member Andrea Machler said SNB anytime intervene in foreign exchange markets to stabilize the Swiss franc in regular momentum.

As the Swiss Franc sees higher against EURO to six years high, it is time to intervene to add foreign currencies and sell Francs to stabilize the Swiss franc.

SNB intervention in foreign currencies accumulation is only for Swiss Franc stabilization and not for trading purposes. We will not watch every time shock in currency markets.

And Our aim for inflation target is 0-2% for the next three years, and the Swiss Economic is on the way to recovery, We believe the 2% target soon we achieved in 3 years.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/