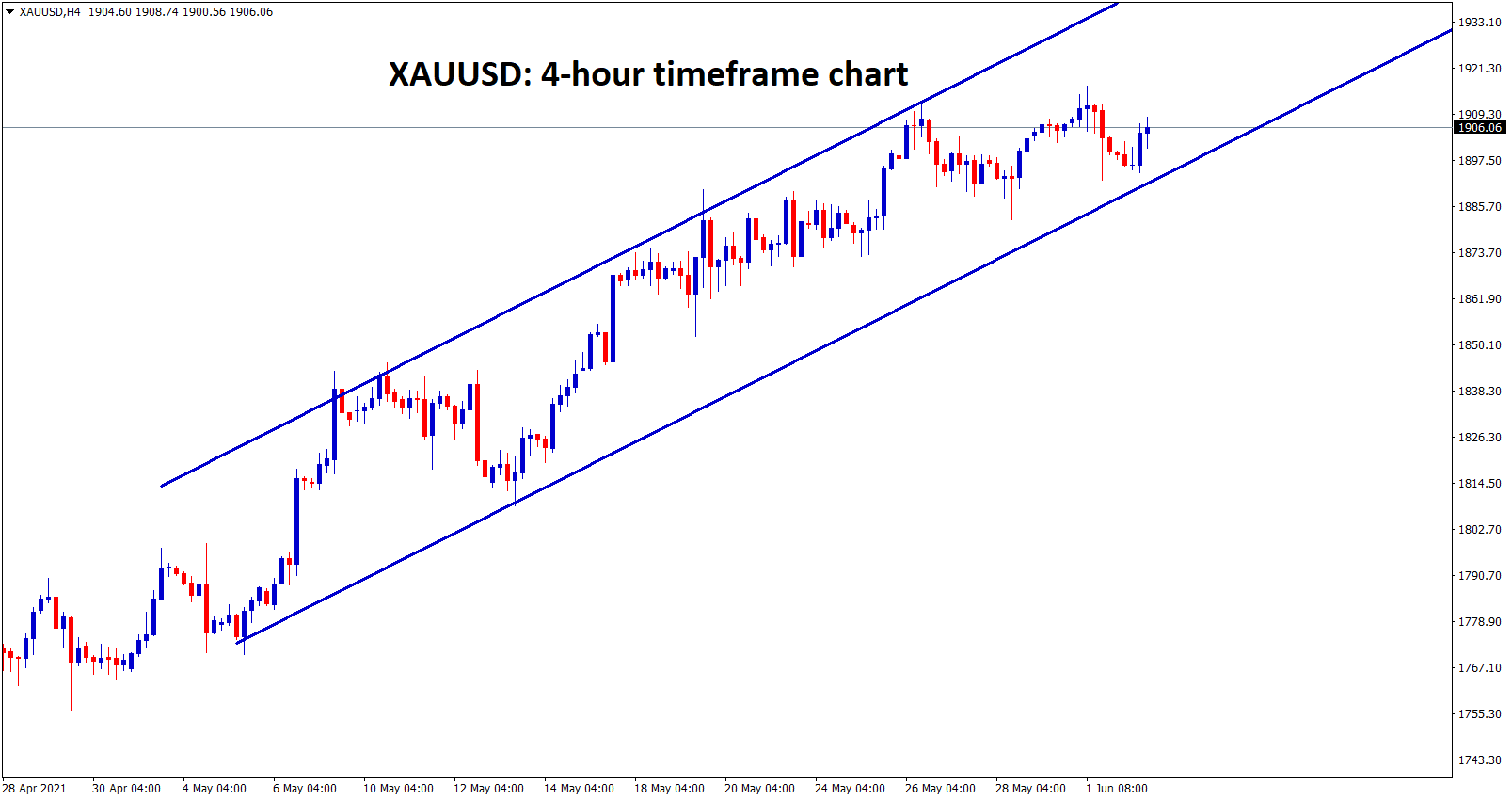

Gold

Gold is still moving in an uptrend range channel, wait for a breakout from this channel.

Gold prices remain well above 1900$. Still, corrections are made yesterday after US ISM manufacturing data released at 61.2 versus 60.7. These readings prove positive for Treasury bonds yields higher to 2% in this week.

This result in gold prices plunged 20$ from 1917$ to 1897$ as a correction view.

And China is buying 150tons so far to the safe country economy, and the US and UK continue to sell gold and buy bonds to reprint Money.

Gold demand weighted higher as US Dollar long spending to rebuilt infrastructure and long budget by US Biden. The Covid-19 crisis creates the whole pandemic, and developed countries more injured by the crisis and spending more by selling Gold to China.

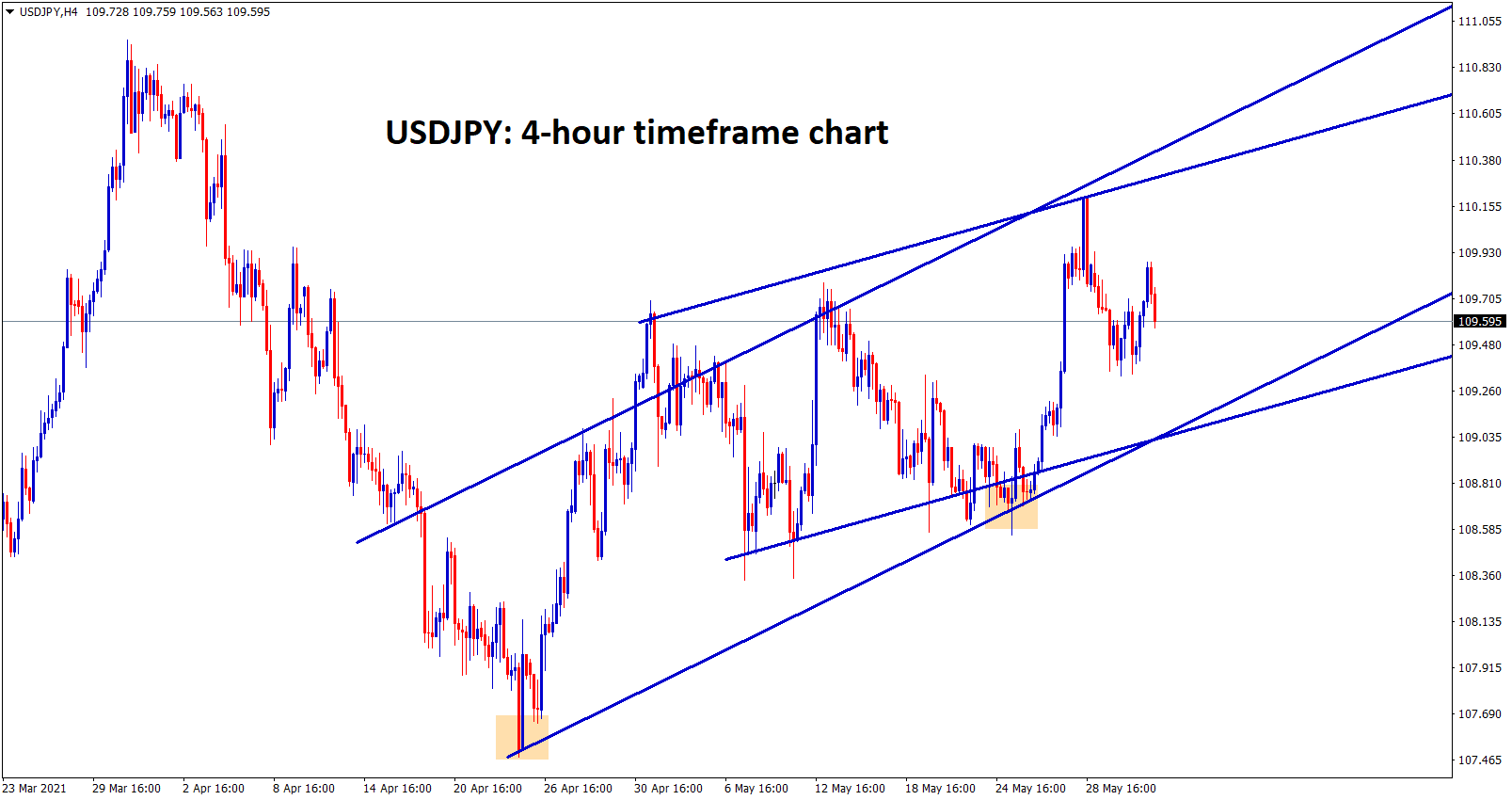

USD

USDJPY moving between the uptrend range channels.

AUDUSD is moving in a descending channel forming lower highs and lower lows.

US Dollar slightly higher from 89.500-90.200 range after US ISM manufacturing data came at 61.2 reading versus 60.7 in April.

This month FED meeting will decide the Breakout or make the consolidation level again from 88.500-92.500.

And FED tapering is not an appropriate tool for now in the US because a New Variant of Covid-19 surrounds the UK and Asian Countries. Once All variant of Covid-19 spread solved, then only the nation will recover from the Full pandemic.

ISM manufacturing data shows robust manufacturing growth of US and Orders plenty were in Que and Demand created heavily.

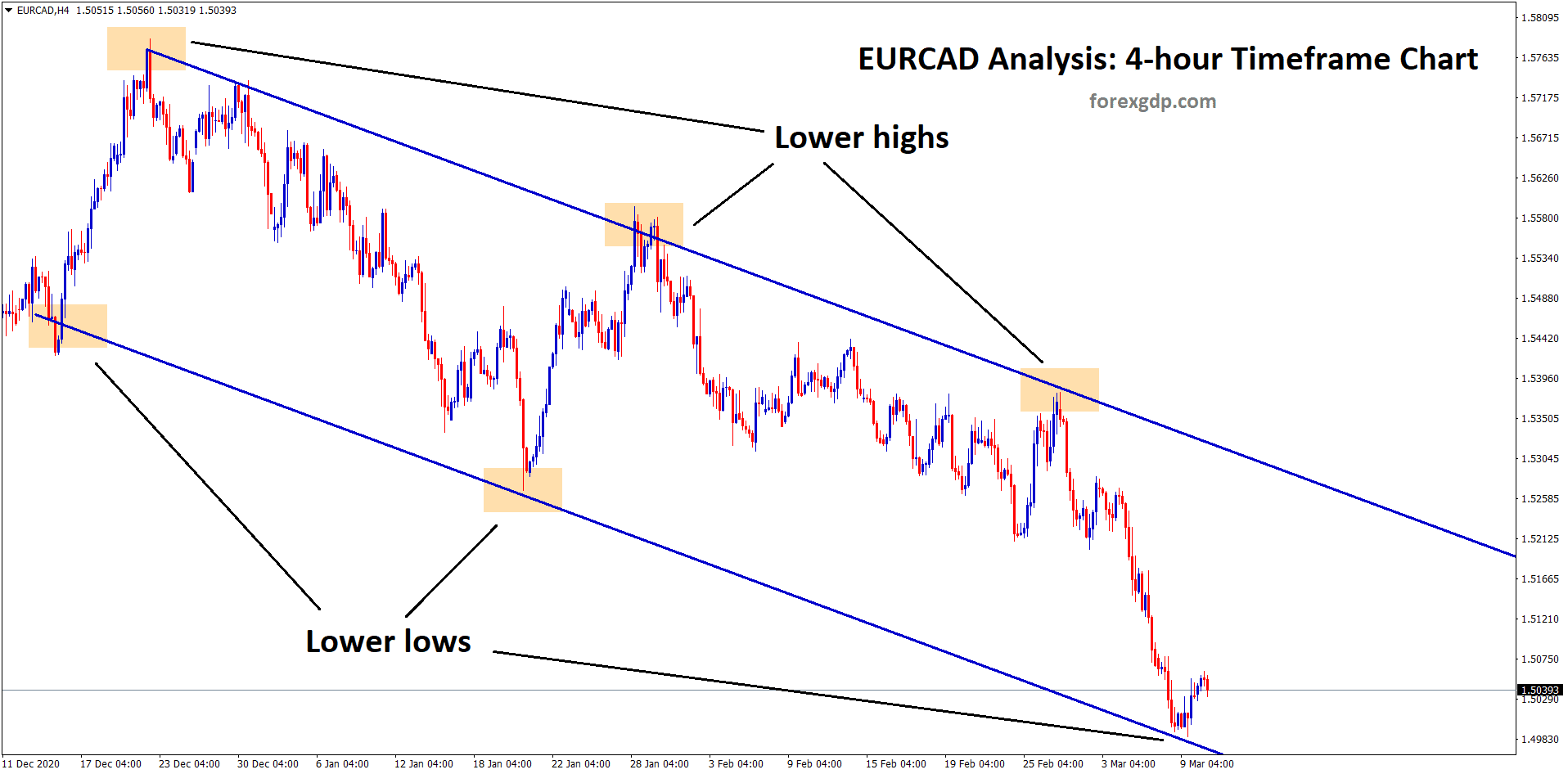

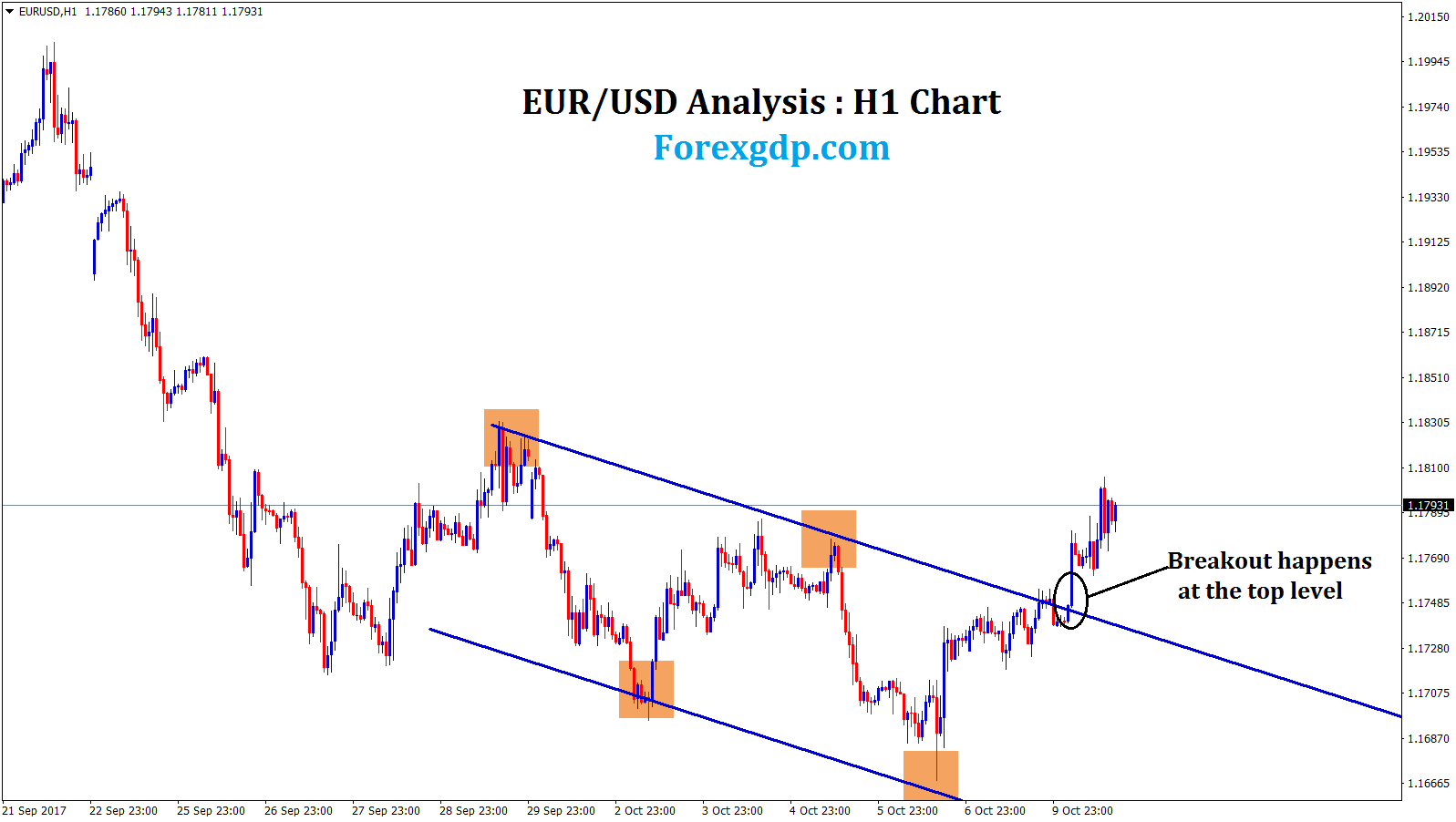

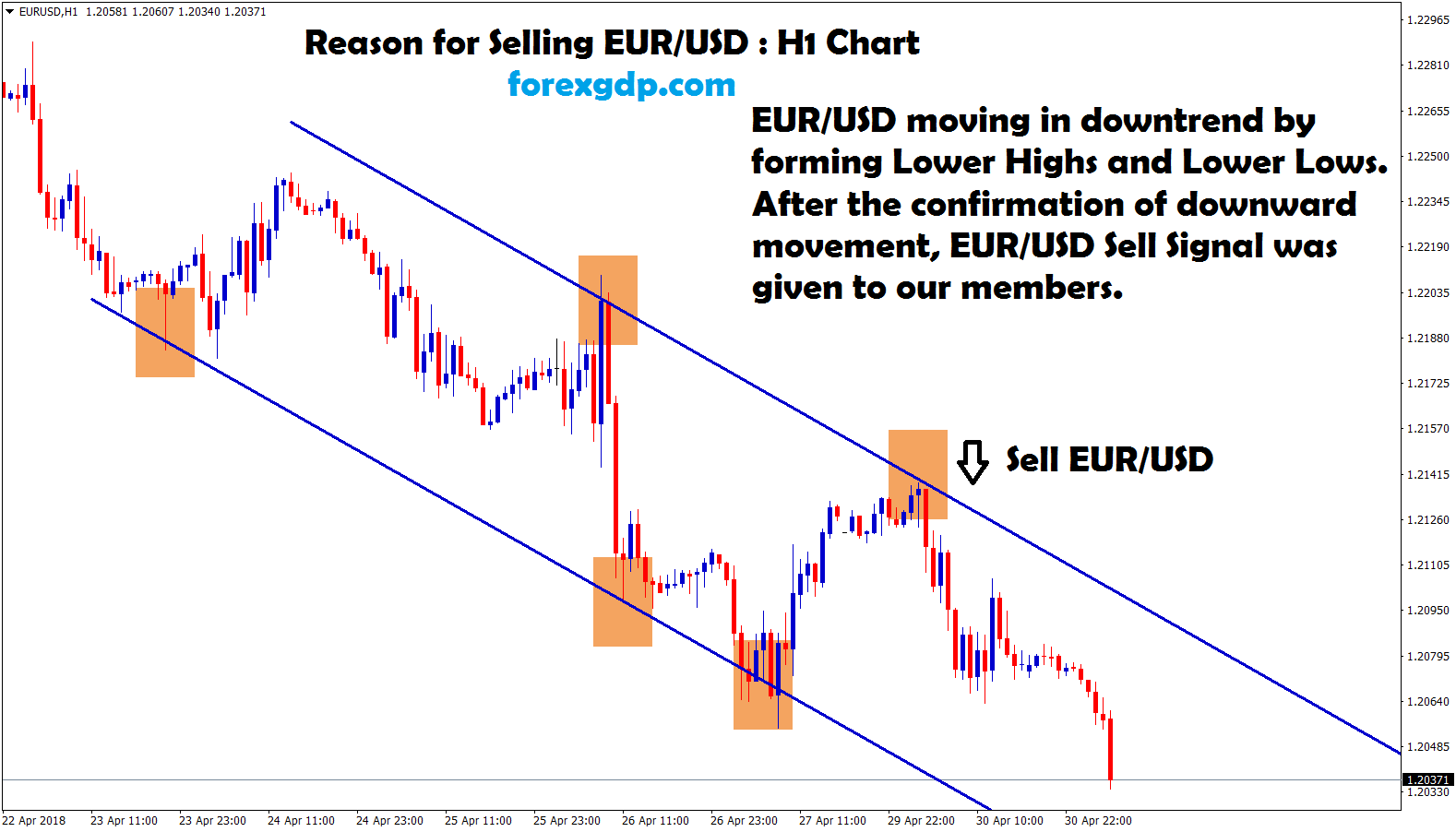

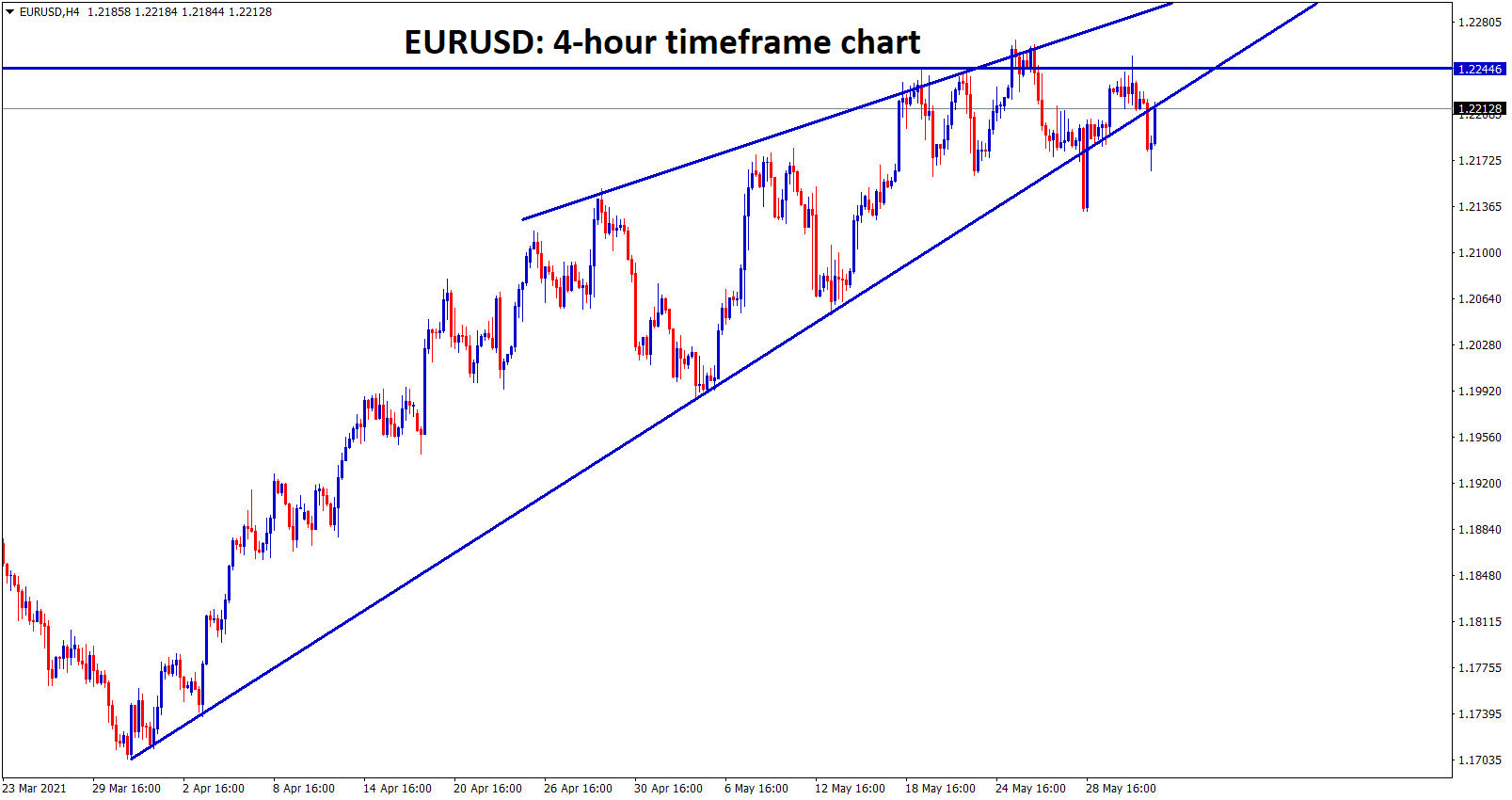

EUR

EURUSD is moving between the channel ranges, wait for a breakout from this channel.

Eurozone business confidence data came in Positive numbers, and Inflation ranges are expected to 2% this month versus 1.9% expected and 1.6% in the previous reading.

And ECB may soon turn to hawkish mode if inflation and economy grow gradually in 1 year period.

US ISM manufacturing PMI reading came at 61.2 versus expected 60.7 level and Personal income exceeding expectations.

US Domestic data performing well and higher inflation rates make investors expect more from FED tapering bets.

GBP

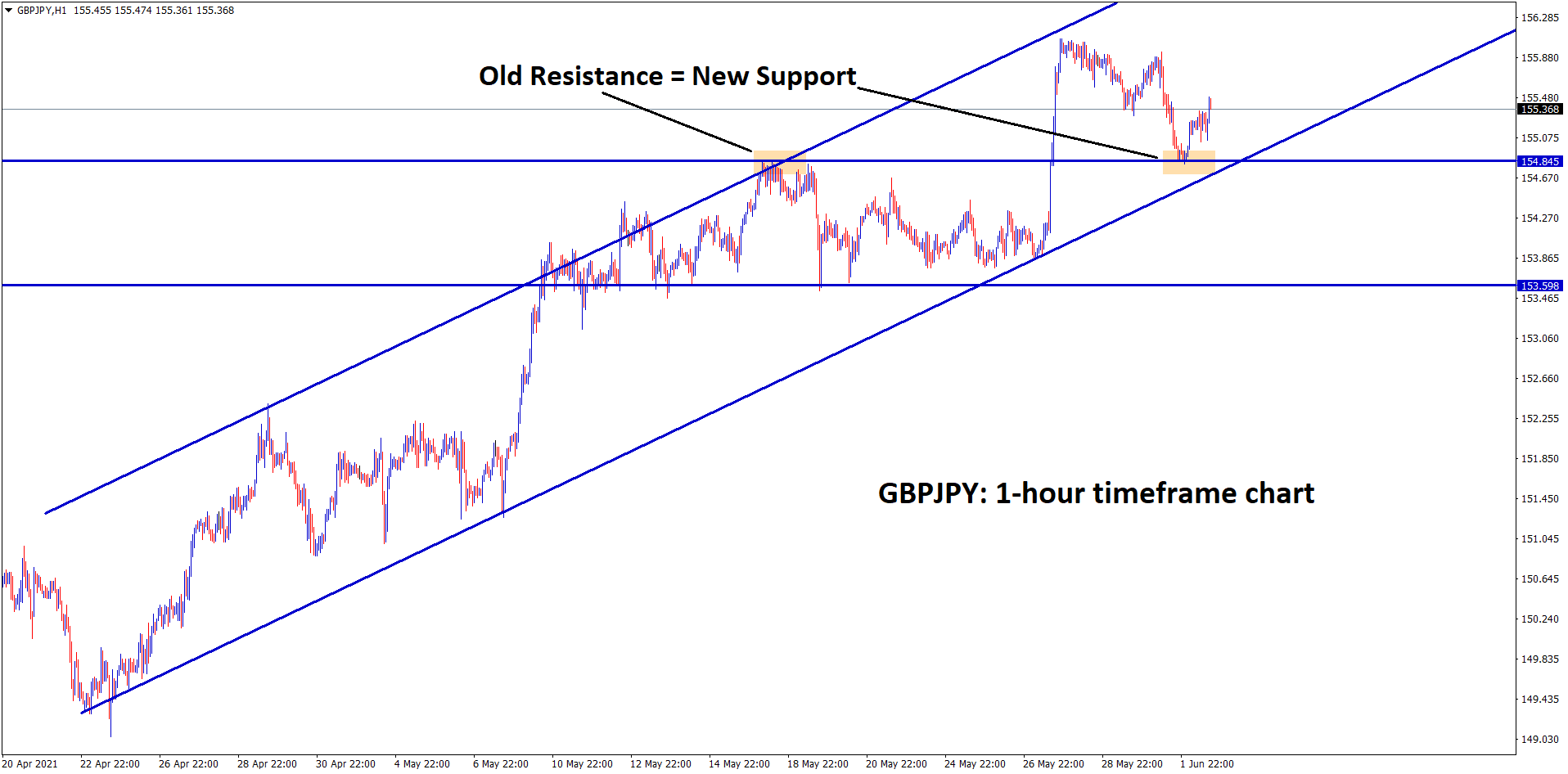

GBPJPY moving in an uptrend, recently the market has retested the broken previous resistance which acts as new support now.

UK Pound moved in the ranging market between 1.41-1.42 level as the full reopening of UK economy planned in June 21st itself.

Domestic data of UK Performed well, and New Indian Variant Covid-19 spread across the UK in little places makes Worry for upcoming releasing lockdown.

Due to this scenario, UK Pound makes hesitate to breakout strong resistance level.

And Brexit deal matters were hot now as EU-UK Deal over Northern Ireland Protocol remains concerns for the UK.

Transportations of Good from the EU to Northern Ireland were checked and Process. This process of checking took time and delayed sent of goods to Customers and complaint raised by many Customers.

And now, because of this Northern Ireland issue more cautious to watch in EU-UK Brexit deal matters.

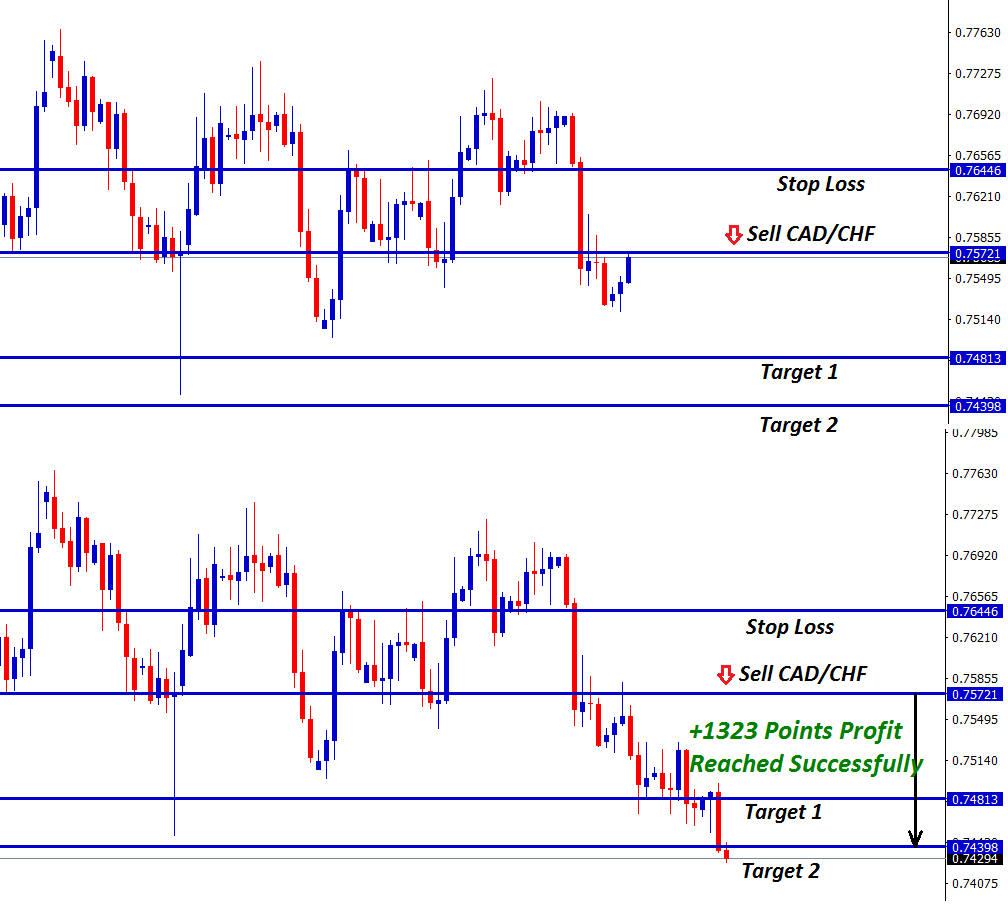

CAD

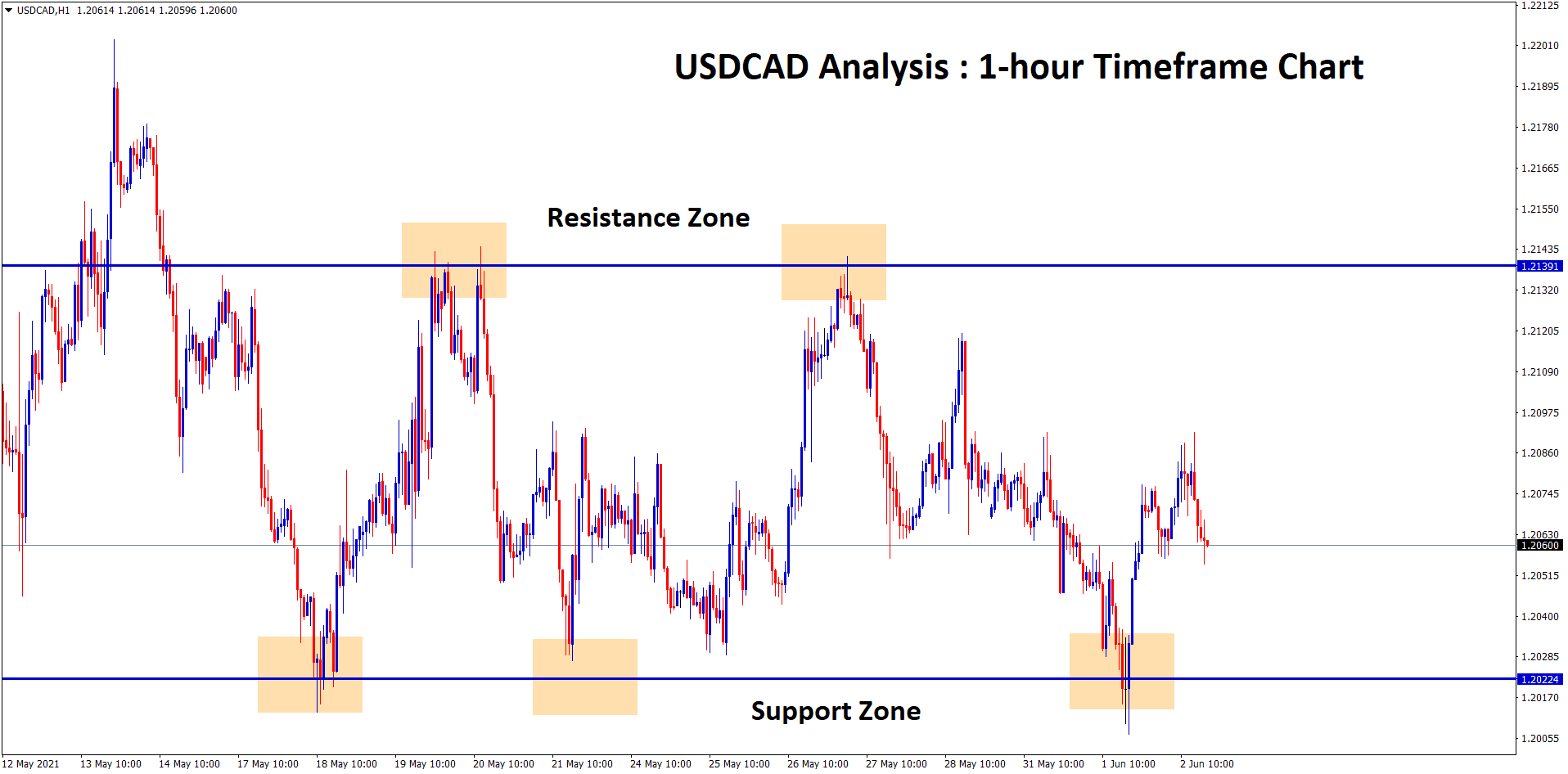

USDCAD is moving between the support and resistance levels, recently bounced back from the support

Canadian Dollar rose to 91 marks against Japanese Yen soon will reach to 92-92.500 level.

Oil prices climbed to 68$ the first time in the last 3 months, and Demand from developed countries like the EU, US and UK more will trigger the prices of Oil.

And Bank of Canada policy meeting will be held this month also trigger the Canadian Dollar to up movement.

USDCAD will breakout 1.20 level this month as Hopes of the bank of Canada tapering in upcoming meetings.

And US Dollar proves stronger against other currencies, but the Canadian Dollar stood stronger than US Dollar after the pandemic.

JPY

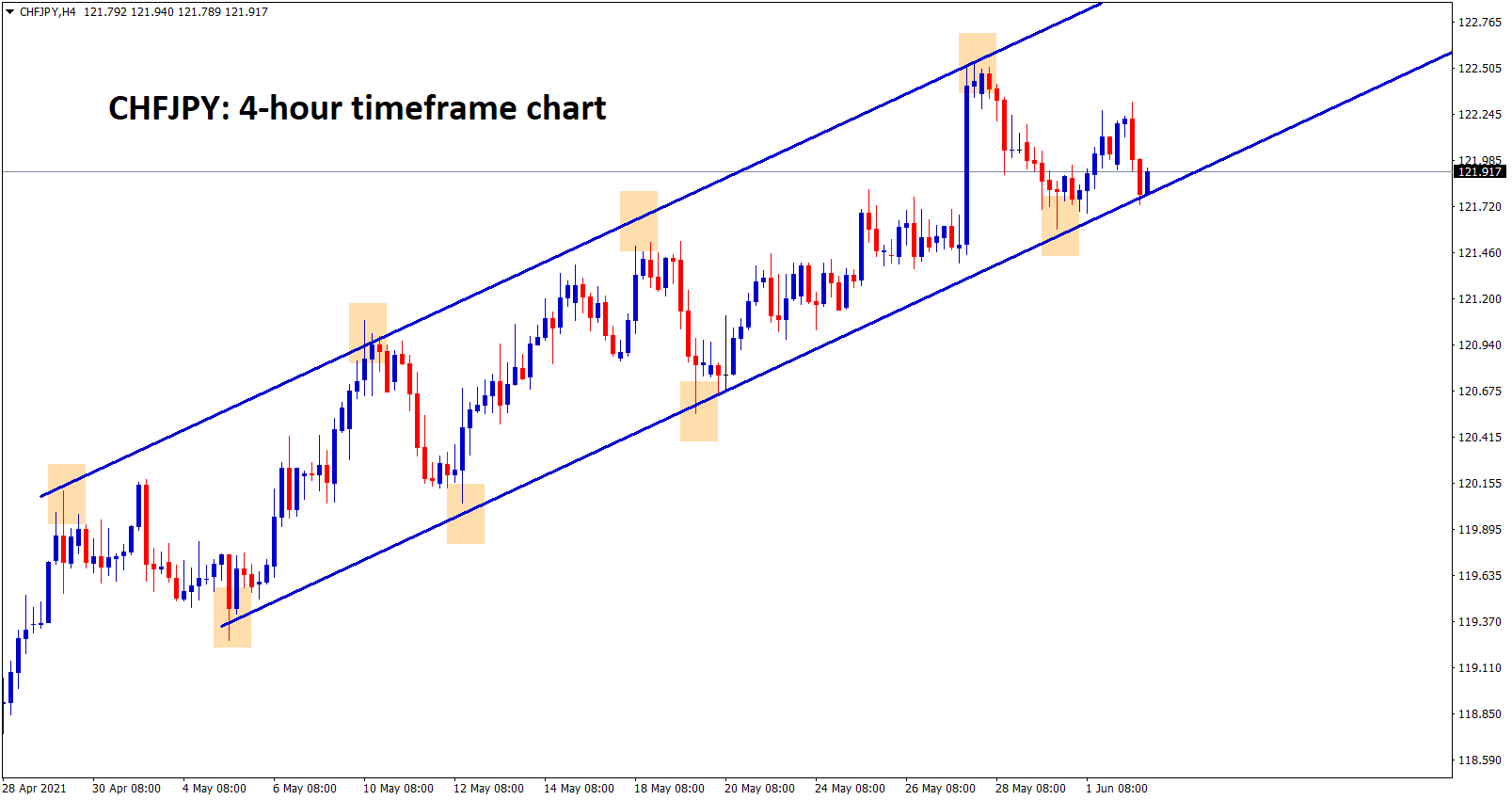

CHFJPY is still moving clearly in an Ascending channel forming higher highs and higher lows.

Japanese Currency gets weaker among G10 Peers. It is also named as worst performance peer in G10 countries.UK, EU and US Dollar most performed currencies against Japanese Yen.

And now the Pandemic solved in Developed countries and turned to emerging countries like Japan and India.

The emergency of lockdown increases in Japan weighted the economy to more lagging from improving the structure.

Vaccination rollout is progressing slowly, and Recovering from the Pandemic is the only relief for Japan.

Yen will be weaker than other currencies since lockdown in the last 1 month is not released, and extended data is announcing more.

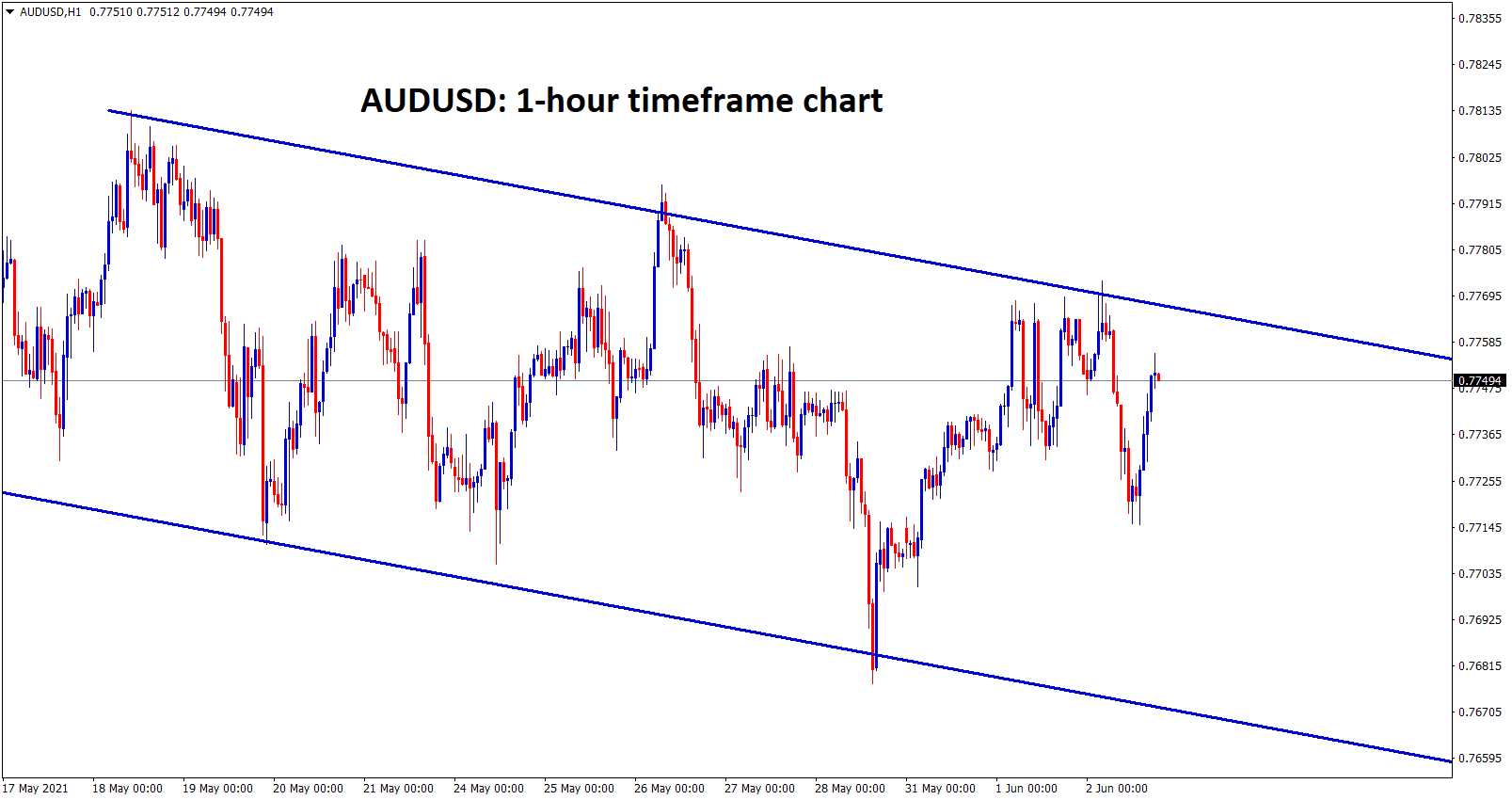

AUD

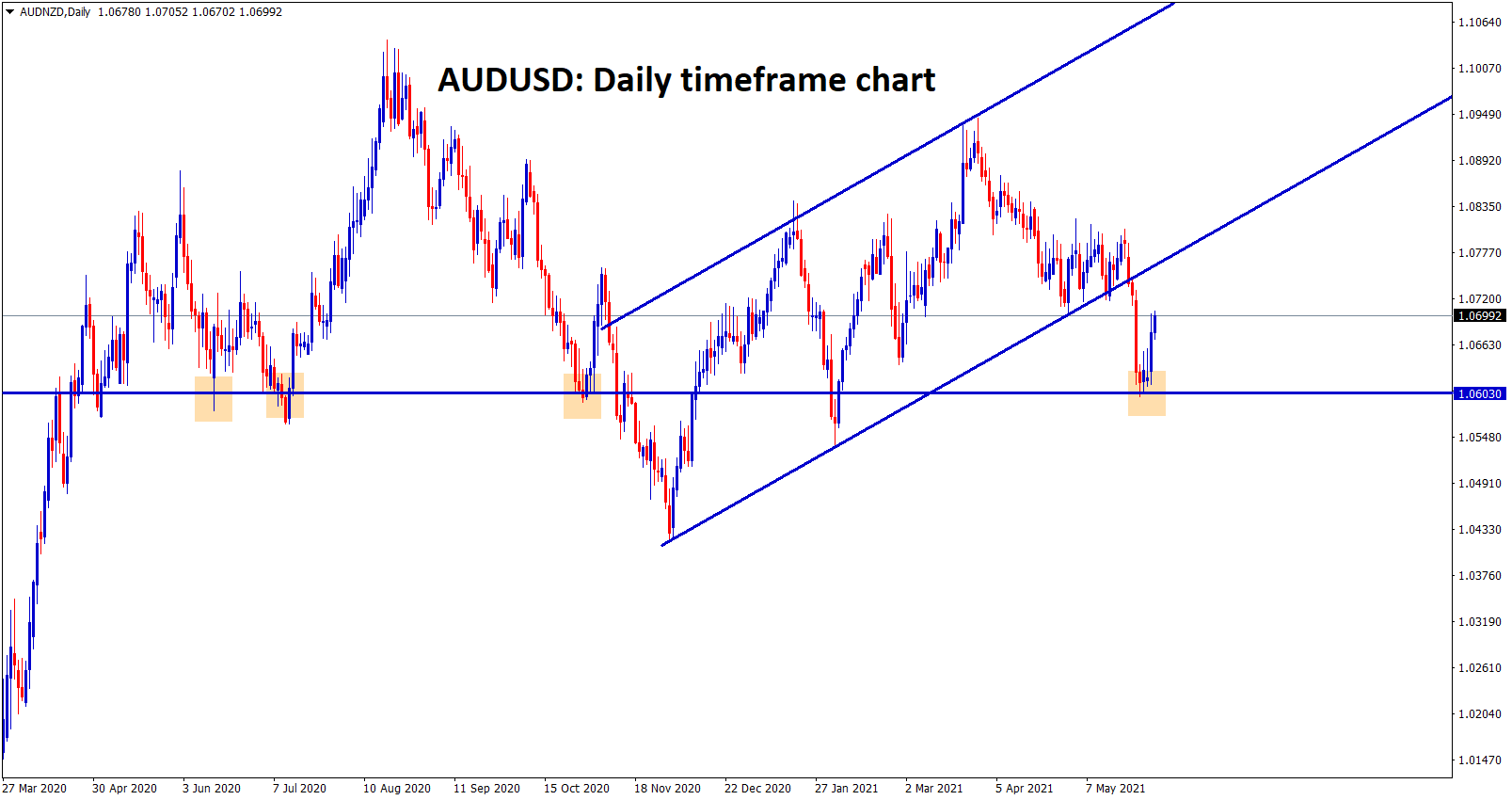

AUDNZD is bouncing back from the important support zone.

Australian Q1 GDP grows at 1.1% YoY versus 0.6% expectations and Previous reading of -1.1%.

And Reserve Bank of Australia Maintains the Cash rate the same at 0.10% last day, and AUDUSD surrounds the same ranging market.

But now, all eyes waiting for the FED meeting this month, and After the FED meeting, Markets will turn to a trending market from the Consolidation level.

RBA Governor Philip Lowe said until inflation and employment numbers came at the Central bank’s goals, only we maintain the hike rates and Tapering asset purchases.

NZD

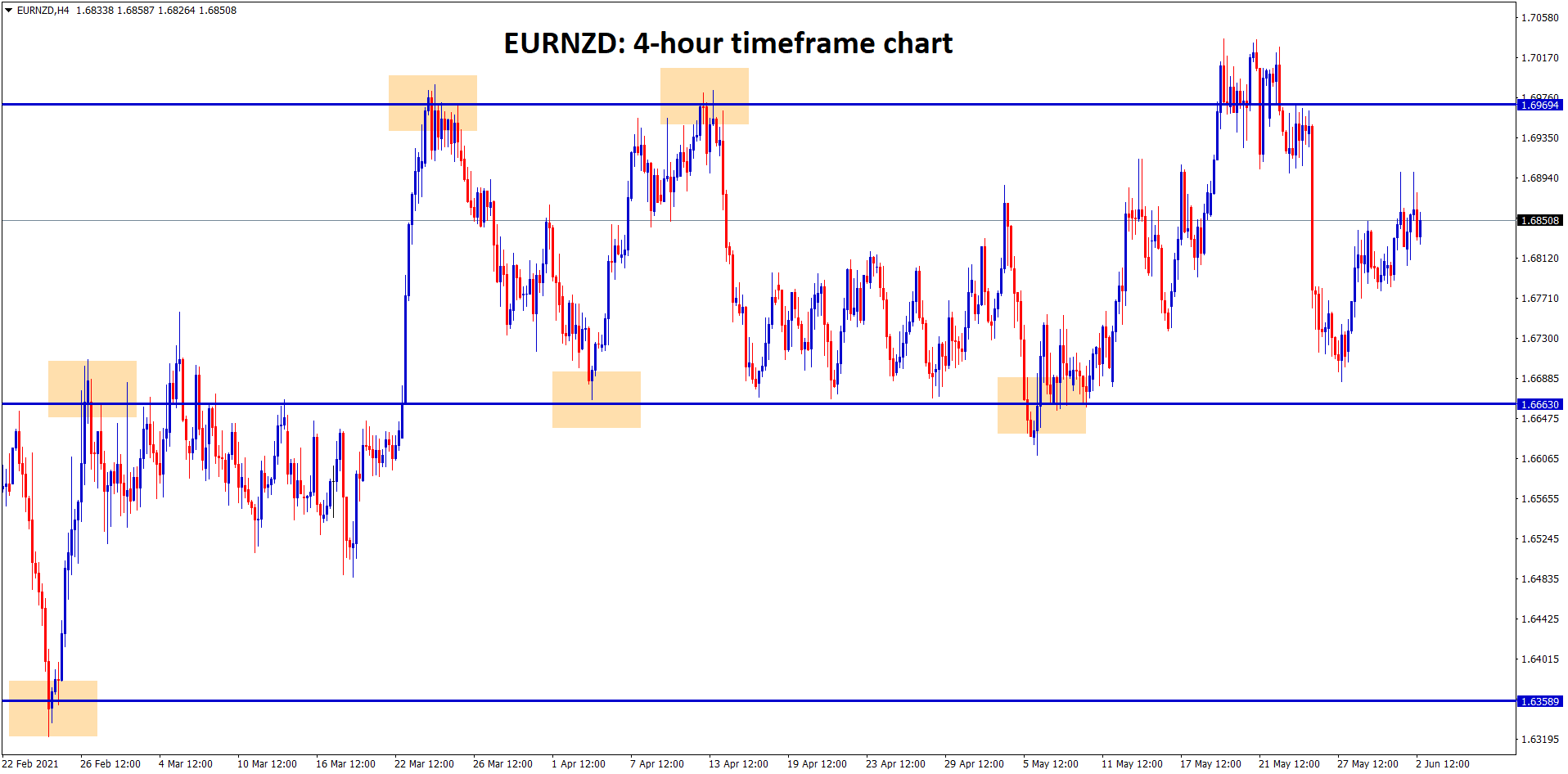

EURNZD is moving up and down between the resistance and support level ranges, previous broken resistance turned into new support.

US Fitch rating agency raised the New Zealand Dollar target of 0.74 for the rest of 2021.

New Zealand Government healthy maintenance of Covid-19 issue and reopening of economies and businesses well reached to open.

The employment rate fell at better levels, and Growth will be raised to 3.6% in 2021.

And now China has strong relationships with New Zealand and the Free trade deal signed for Four years is notable.

The monetary policy of RBNZ will tighten soon as the second half of 2022 came.

Exports of Milk

Reserve Bank of New Zealand Governor Adrian Orr said that the economy had recovered more.

And during the pandemic time, Exports of Milk were contributed more, and it will compensate Tourism losses of lockdown matters.

The Strong demand for Primary products from New Zealand makes the economy grow resilient during covid-19.

Fonterra announced the record opening milk prices for its 10k Farmer Suppliers and contributed $12 billion to the economy.