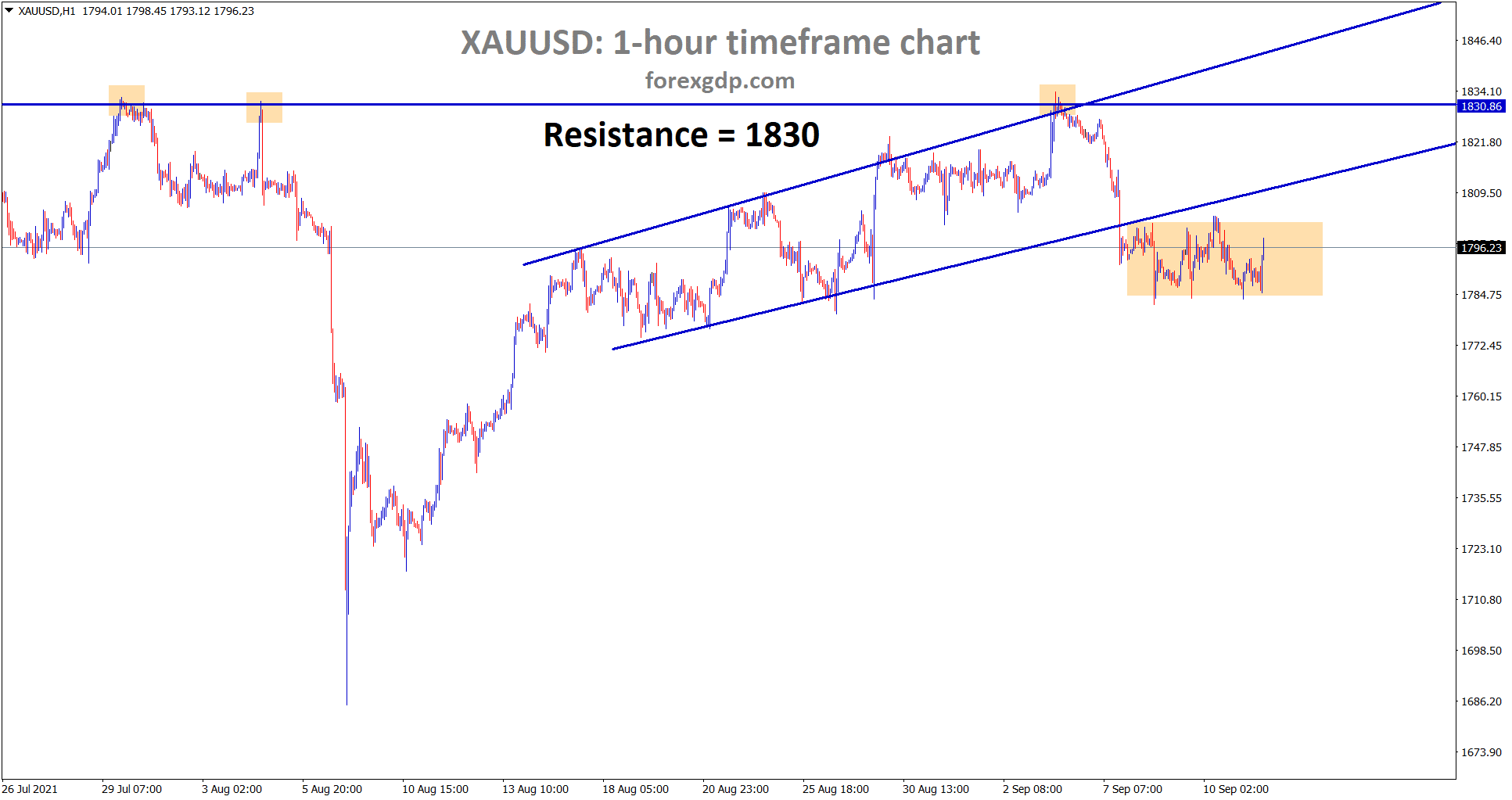

Gold: US Domestic data

Gold is consolidating between the small range after falling from the major resistance 1830.

Gold prices are moved lower as US CPI inflation data is scheduled for tomorrow.

And US Dollar performed well as US Joe Biden did more stimulus to the nation for recovery and infrastructure plans.

US Dollar continues to higher give a blow for gold prices to higher mood.

And Every meeting of FED analysts expected hikes and tapering in vain only, so don’t expect more on tapering soon from FED.

Once the Economy come to normal condition, no one has to say; FED will Do automatically tapering.

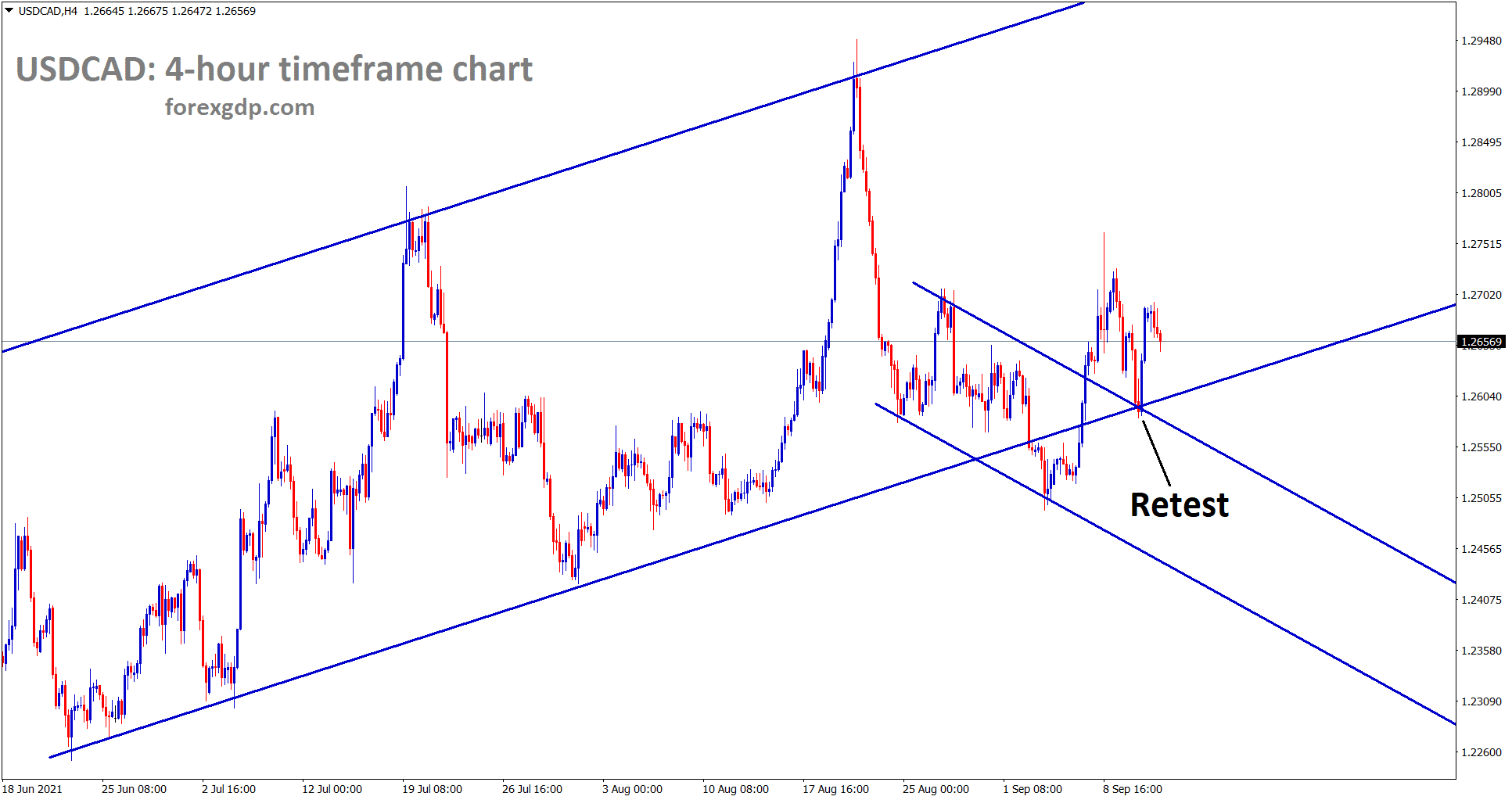

US Dollar: Philadelphia FED President Speech

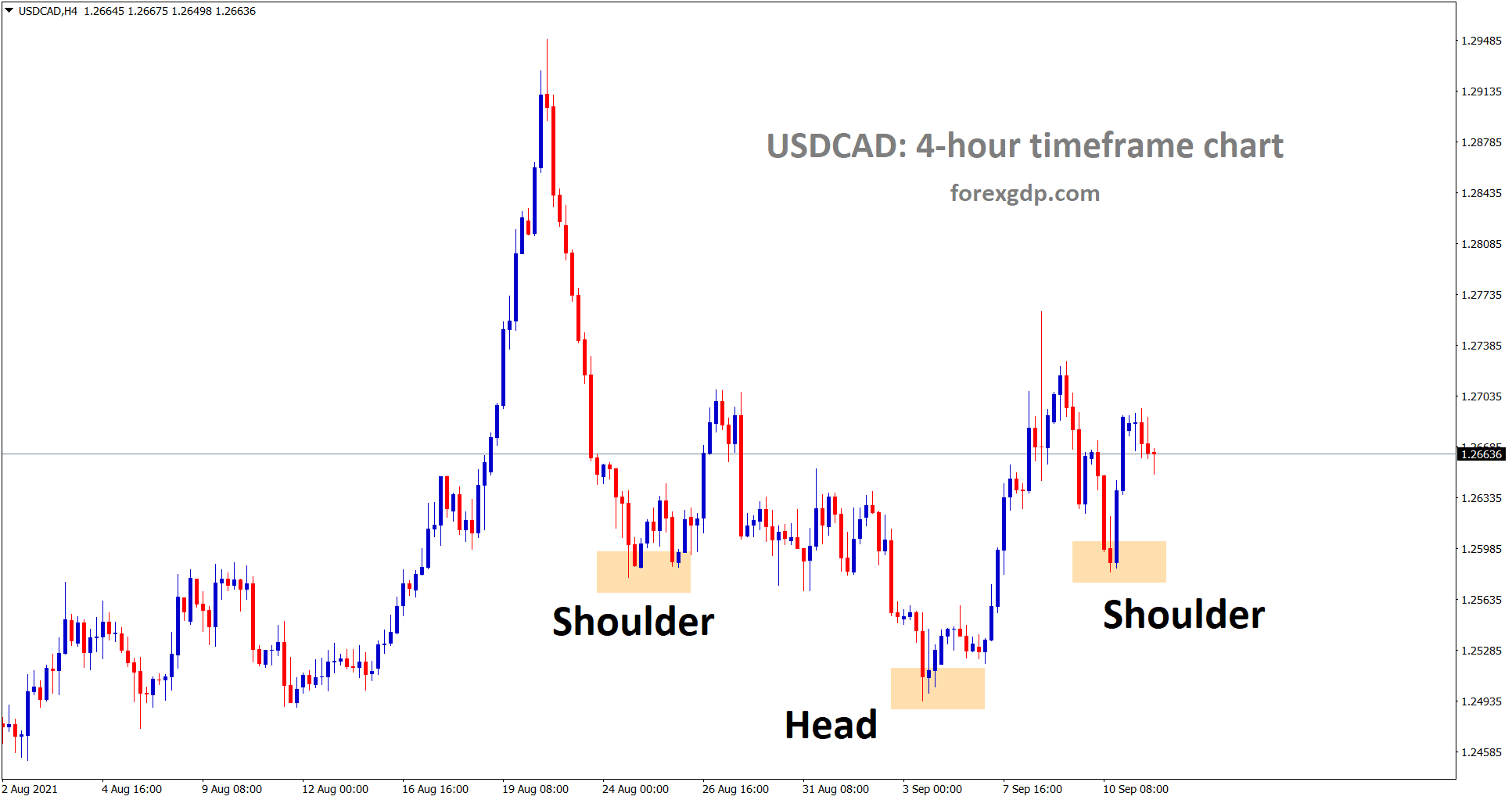

USDCAD has retested the minor descending channel line and bounces back.

In another view, USDCAD is trying to create a Inverse Head and Shoulder pattern.

US Dollar shows stronger recovery in the market as US FED tapering soon this year hopes.

And Philadelphia FED President Patrick Harker said FED would do tapering this year as confident hopes from Domestic data.

This week consumer prices data is scheduled in the table; this will say the Direction of tapering by FED.

Delta variant increases in the US, and More cautious steps are taken by US Government.

And US President Joe Biden said last week we will recover from pandemic soon, and Vaccination is progressing at a faster pace.

Tax hikes for All high-net-worth individuals

Joe Biden plan of $3.5 Trillion Stimulus is tough to pass, as Democrats said, increasing Higher wealth individuals’ taxes and Corporates and investors.

Americans who earned over $435k increased taxed to 39.6% from 37%, and new corporate tax hiked to 26.5% from 21% current rate. Additionally, capital gains tax increased to 25% from 20% for small investors.

And now Democrats planned for tax revenues estimated to be $2.9 trillion packages.

This data shows $3.5 trillion packages fully utilized for regrowth of the US economy is hoped by Analysts view.

Euro: Inflation data forecast

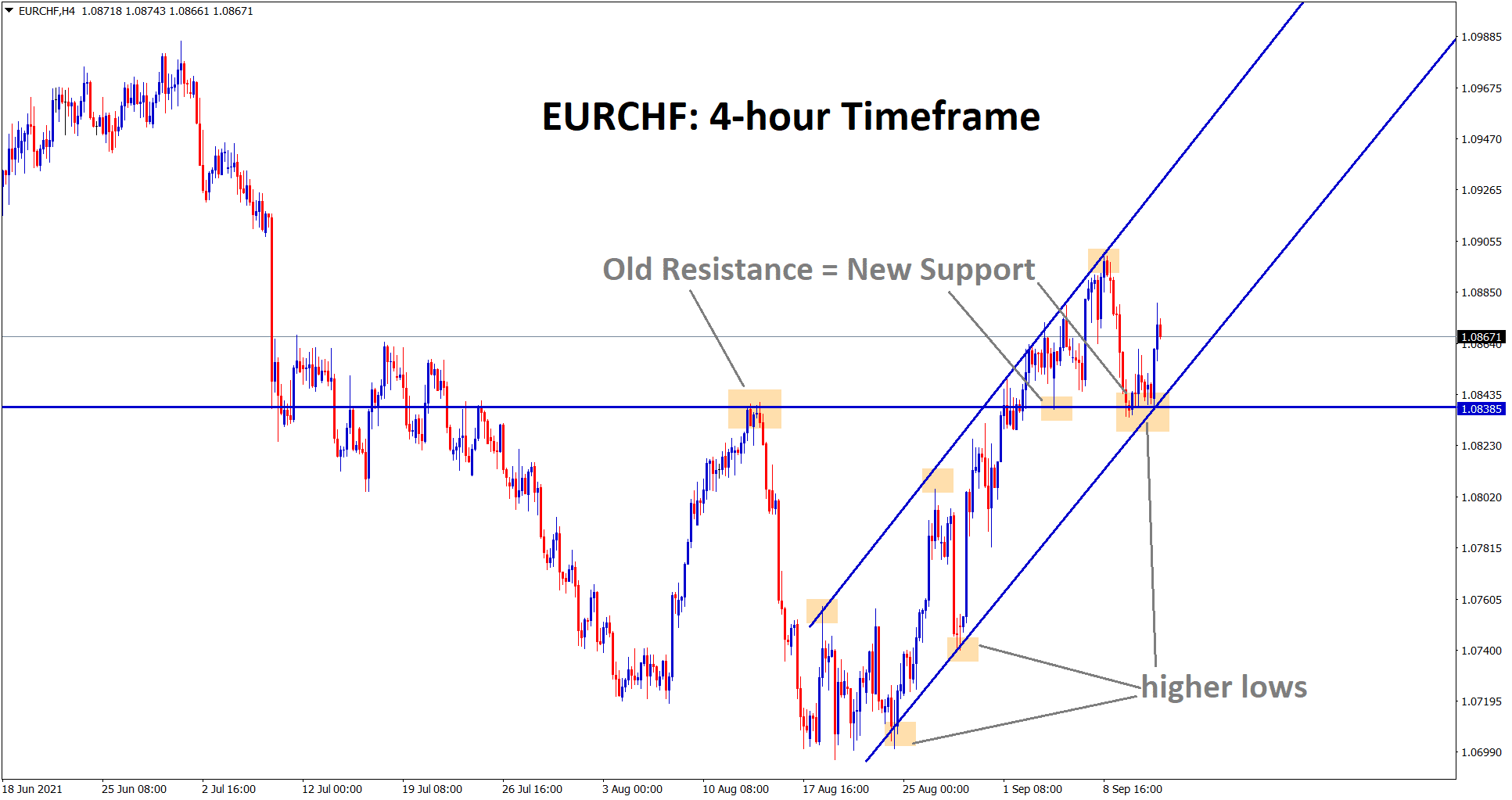

EURCHF is rebounding from the support area and the higher low of the uptrend line.

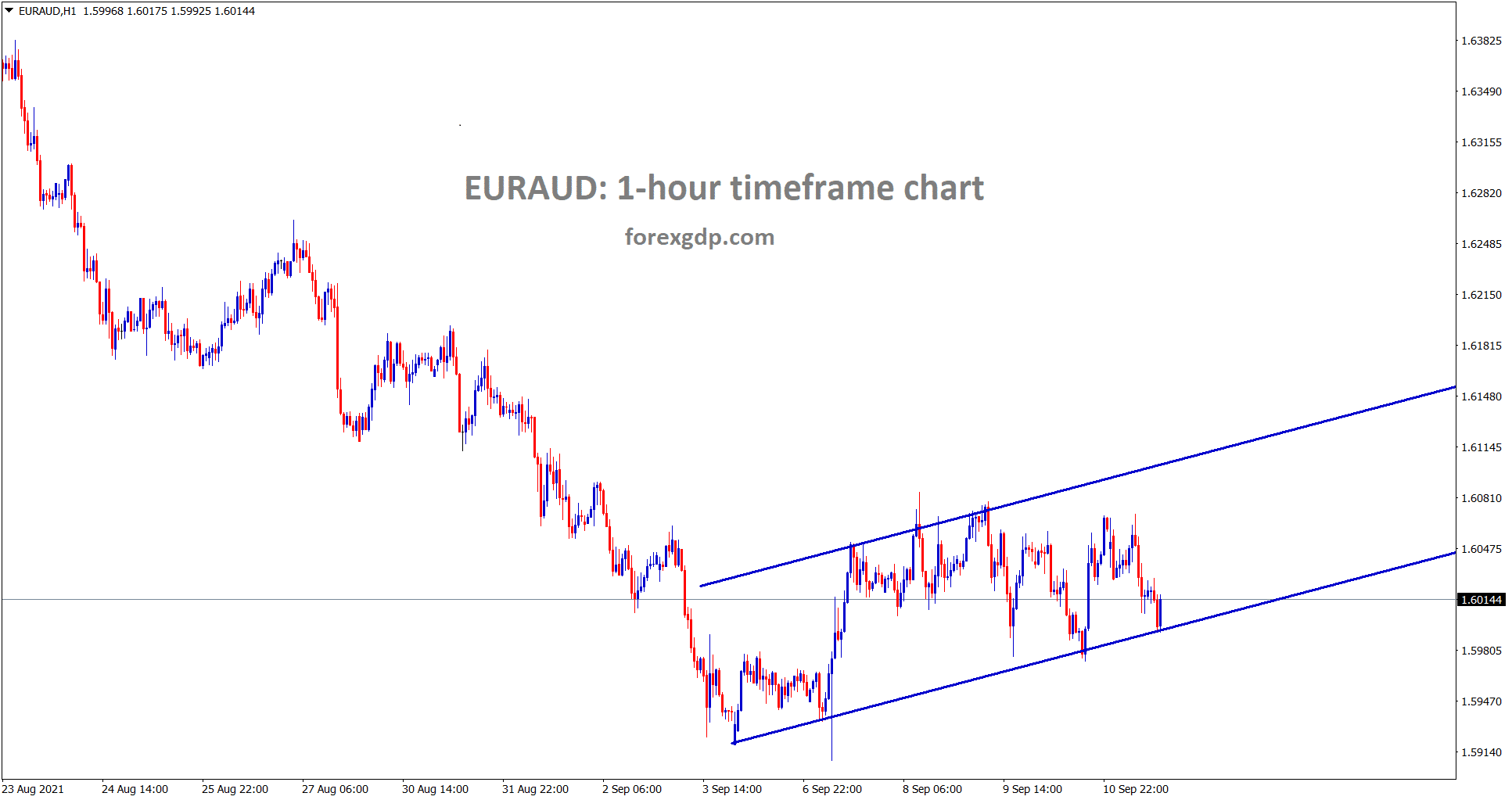

EURAUD is moving in a minor ascending channel.

EURUSD moved lower as Last week ECB meeting failed to impress the Euro currency as ECB President Lagarde thumbs-down for tapering.

EURUSD moved lower as Last week ECB meeting failed to impress the Euro currency as ECB President Lagarde thumbs-down for tapering.

And this week Inflation, industrial production data will help for breathing correction in Downtrend; if reveres the data, then pushed lower as Trend continuation.

UK and EU have problems in Post Brexit deal on Northern Ireland protocol.

And EU domestic data shows less expected numbers than other developed nations.

Vaccinations are in Moderate progress, and the Delta variant keeps increasing without controlling by a Single Dosage.

Anyhow By December End, ECB will make adjustments in Purchasing program.

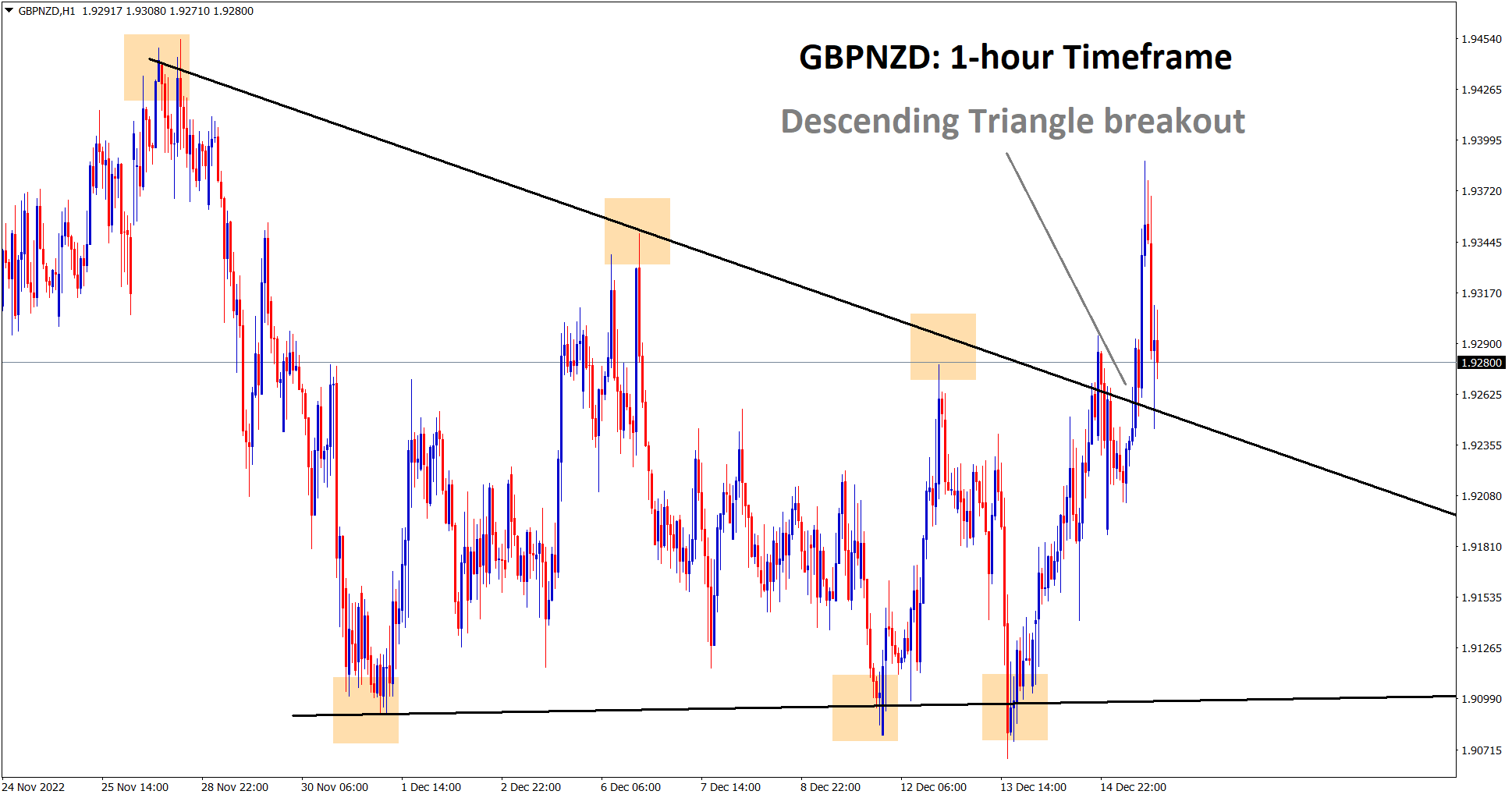

UK POUND: BoE Director Hauser Speech

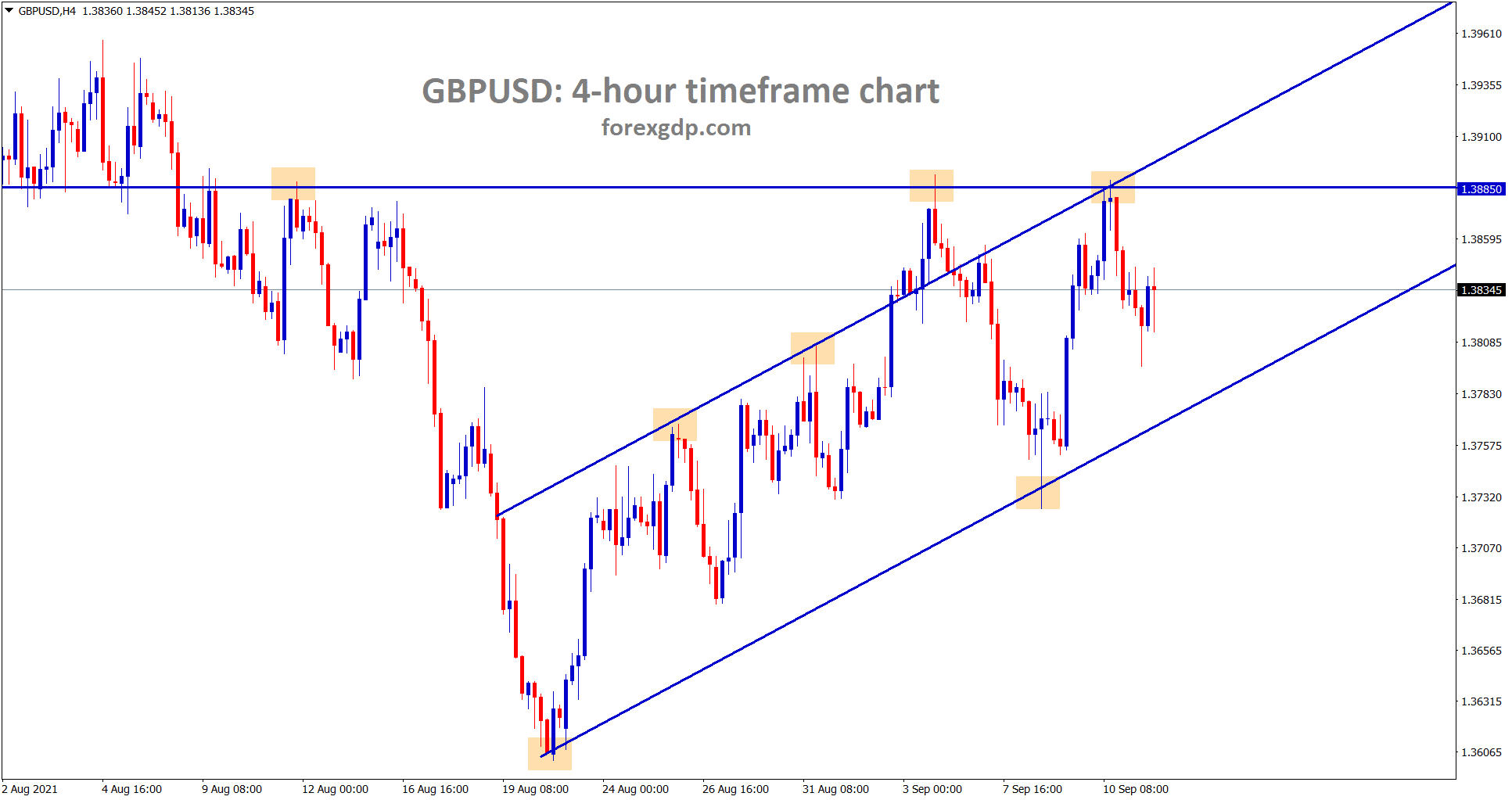

GBPUSD is moving in an Ascending channel line.

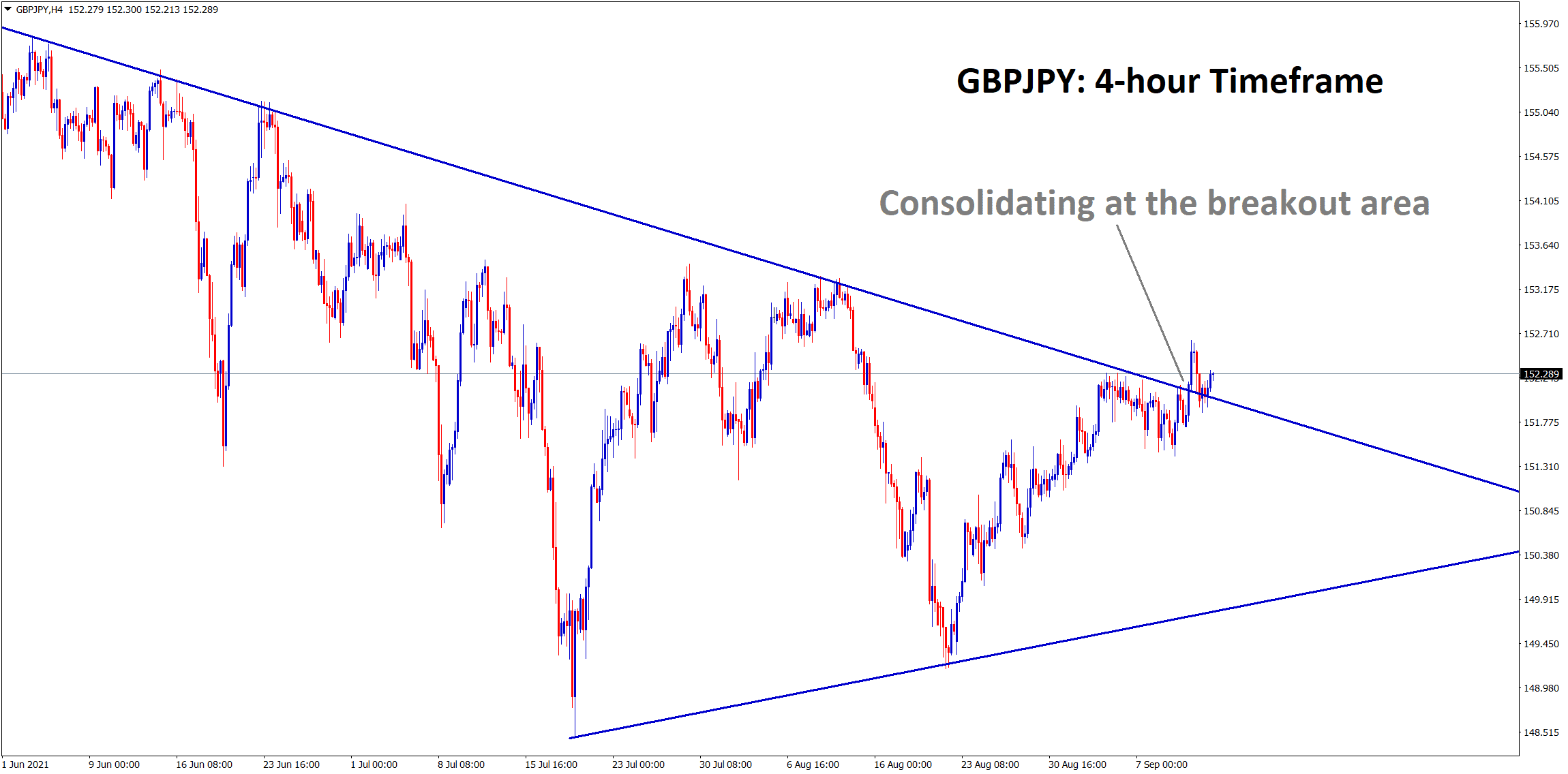

GBPJPY is consolidating now at the breakout area.

Bank of England Executive Director for markets Andrew Hauser said Unwinding QE is the tool for Future tightening policies in Bank of England.

Central Bank Balance sheet shows larger if QE Program unwinder. The central bank will need higher liquidity and will use digital currencies instead.

Central banks will be needed more strategies to compensate for pandemic backlogs.

UK POUND: BoE Director Hauser Speech

Bank of England Executive Director for markets Andrew Hauser said Unwinding QE is the tool for Future tightening policies in Bank of England.

And Central Bank Balance sheet shows larger if QE Program unwinders. The central bank will need higher liquidity & compensation and will use digital currencies instead.

Central banks will be needed more strategies to compensate for pandemic backlogs.

Canadian Dollar: Gulf of Mexico slowly recovers

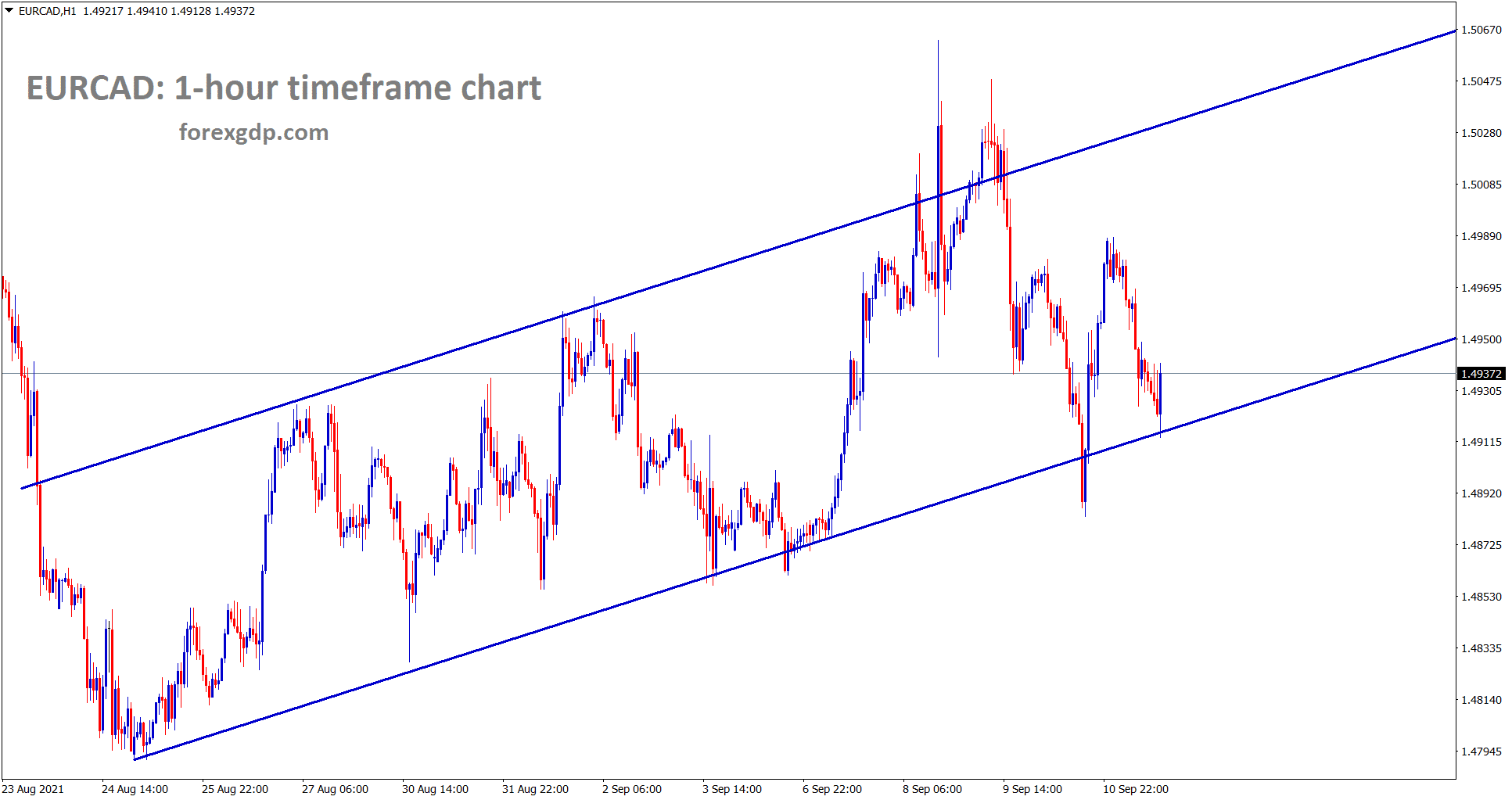

EURCAD is moving in a minor ascending channel for a long time.

Last week Canadian Dollar posted a Lower low as Disappointment numbers from the Bank of Canada Statement.

And the Gulf of Mexico slowly recovered from Hurricane which hits last week, Now again expected the Supply from the Gulf of Mexico this week.

More Supply of Oil leads to Oil prices moving down, and once Demand creates in the market, only Prices get to shoot up.

US PPI index shows robust numbers on Friday, and USDCAD pushed higher as 1% last Friday.

And Joe Biden plan of $3.5 trillion proposals likes to pass as $1.95 trillion by Senate in Progress.

More stimulus and More Vaccination are the only solutions to come back for the economy from pandemics.

Japanese Yen: Fumio Kishida speech

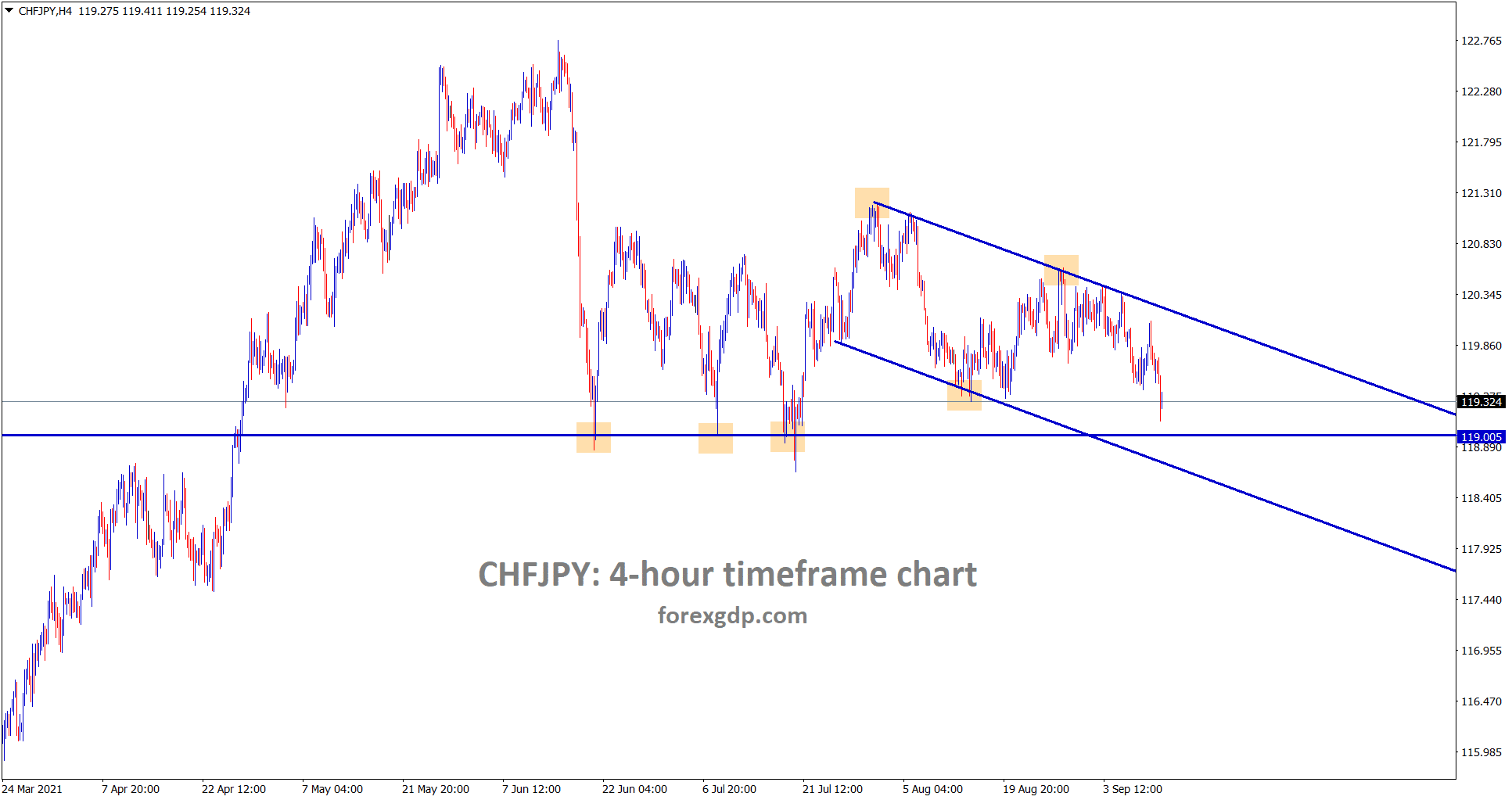

CHFJPY is moving towards the support area through the channel line.

Japan’s PM Contender Fumio Kishida said raise in Wages and incomes would support the Japanese economy further.

And Past policies will bring the shape for the Japanese Pandemic tone to the normal one.

Vaccination progress slower in Japan made lower economy in Japan.

US Consumer prices data scheduled this week and drive the further direction of USDJPY.

Australian Dollar: CPI data outcome

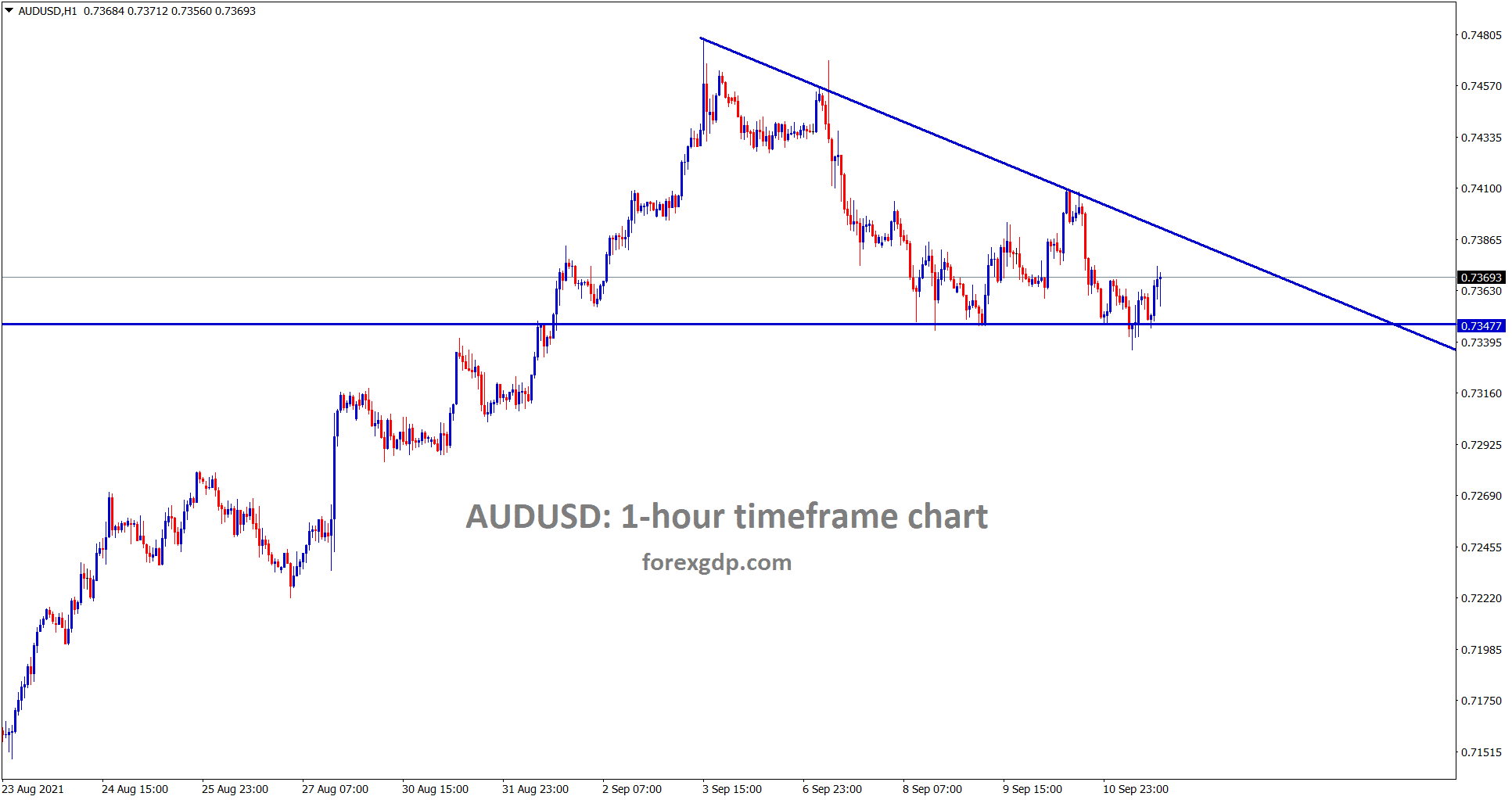

AUDUSD has formed a descending Triangle pattern in the 1-hour timeframe.

Australian Dollar makes lower as Today CPI inflation data came lower at 3.3% in August versus 3.7% in July.

And this week, Thursday, Australian Job numbers are expected to publish, and Analysts expected 70k jobs lost this week, Due to more lockdowns that happened last month.

New South Wales reported 1262 cases, and Victoria saw 392 new cases as the latest update on Sunday.

Australian Dollar further drives lower or higher based on domestic data this week.

New Zealand Dollar: Q2 GDP Forecast

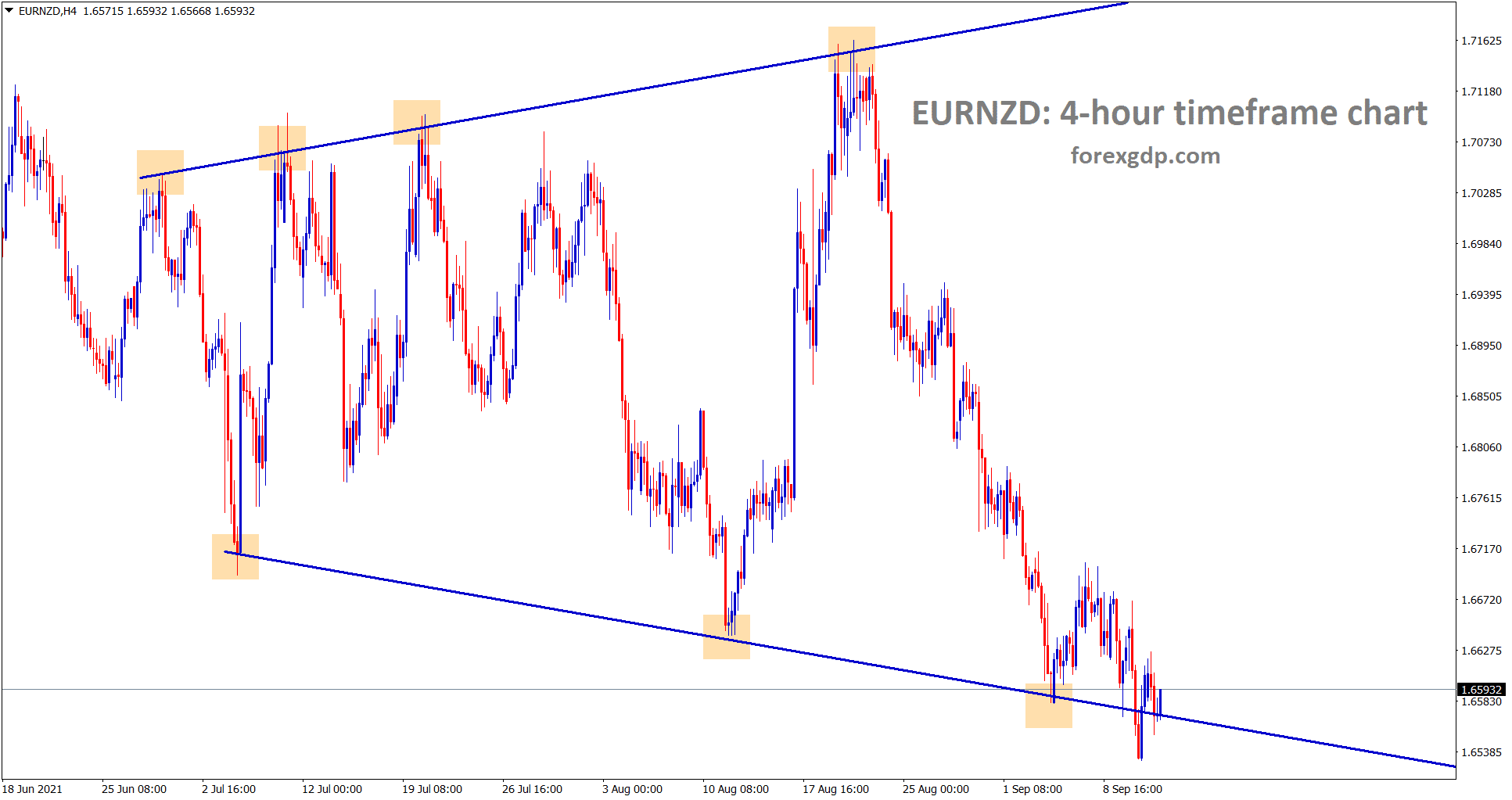

EURNZD has formed a Expanding Triangle pattern in the 4-hour timeframe chart.

New Zealand Dollar keen to watch ahead of Next October meeting, in we, can expect for rate hikes.

And Nationwide Full lockdown released by New Zealand PM, and Now Full focused on Q2 GDP of New Zealand, it came in lower numbers then wait for rate hikes in October month, it came in higher numbers, or inline numbers hikes will see in October month.

China slowdown growth hit the exports of New Zealand, New Zealand behind Australia largest milk exporter to China.

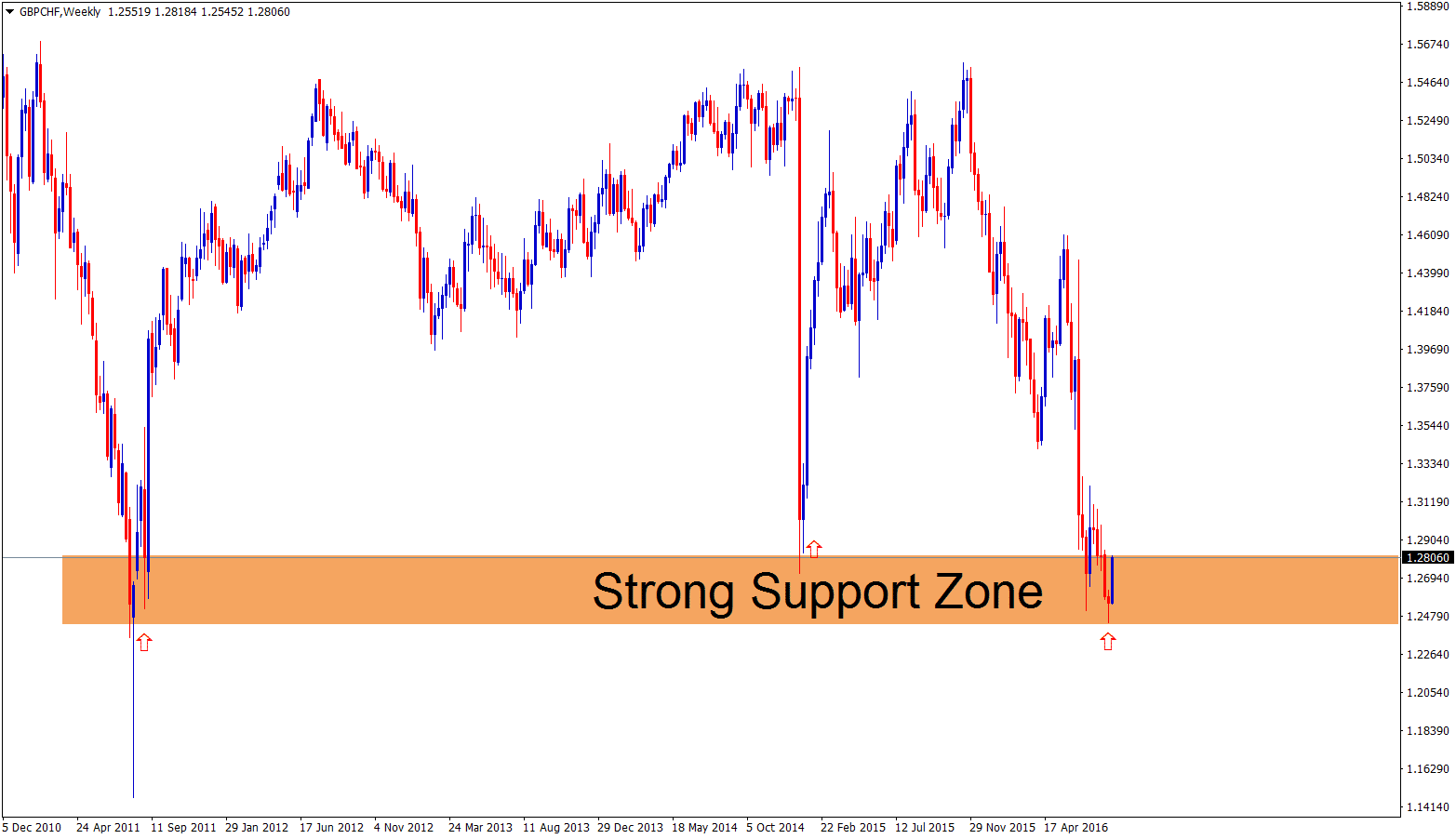

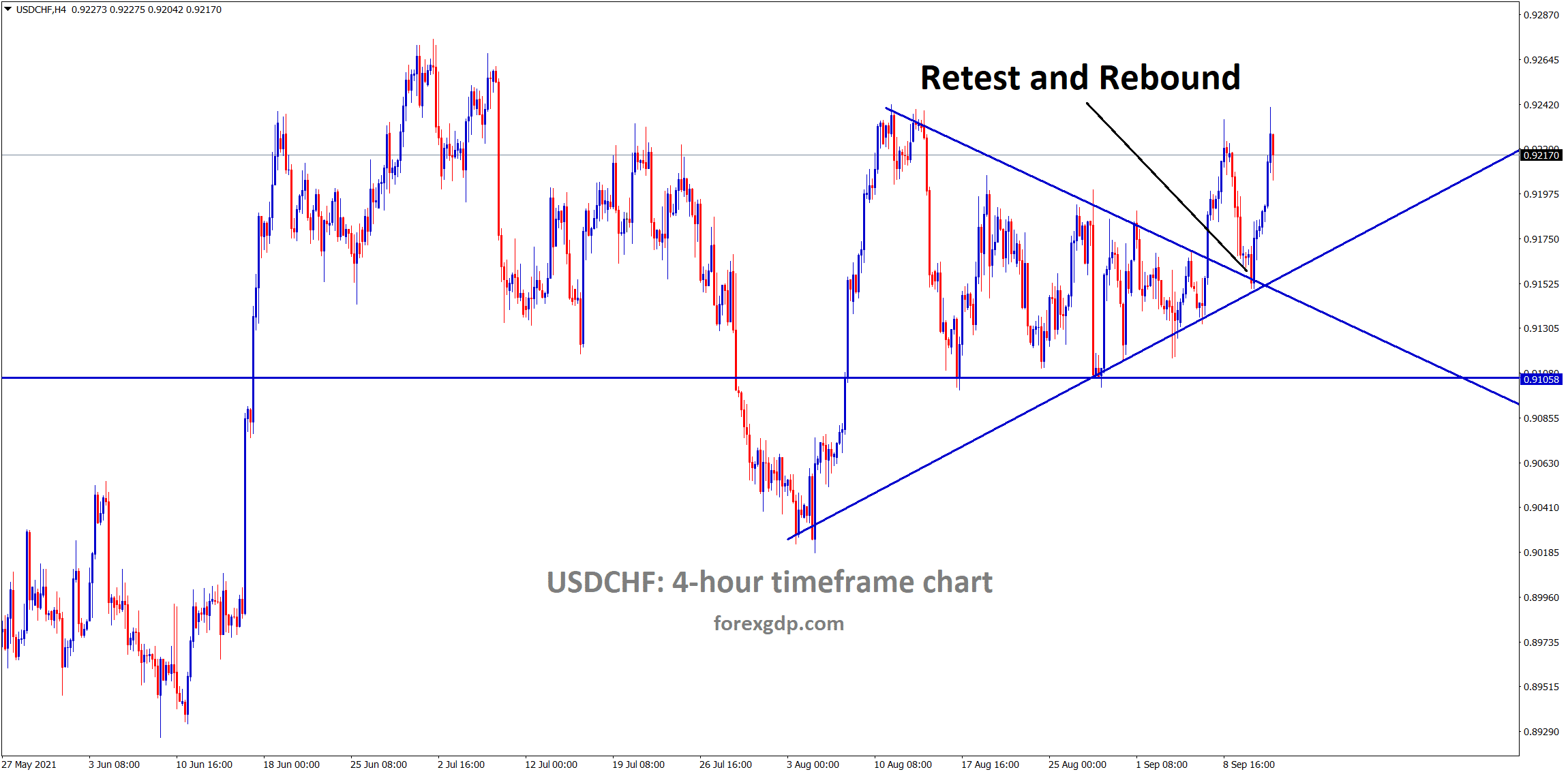

Swiss Franc: US PPI data shows largest numbers since 2010

USDCHF has retested and rebounded from the broken triangle pattern.

Swiss Franc made lower as Weaker Domestic data and Weaker vaccination rate progress in Swiss Zone.

And SNB FX intervention is quiet now and compensated for the adjustments done after the 2020 pandemic crisis.

US PPI data shows positive and largest numbers since 2010, And waiting on this week CPI inflation data look for Further move and Friday Retail sales data waiting in the table.

US 10-year yield rose to 1.35% on Friday.

USDCHF pair moved in the range-bound market as 0.91-0.92, if breaks 0.92 level, then the next target is 0.93 level this week.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/