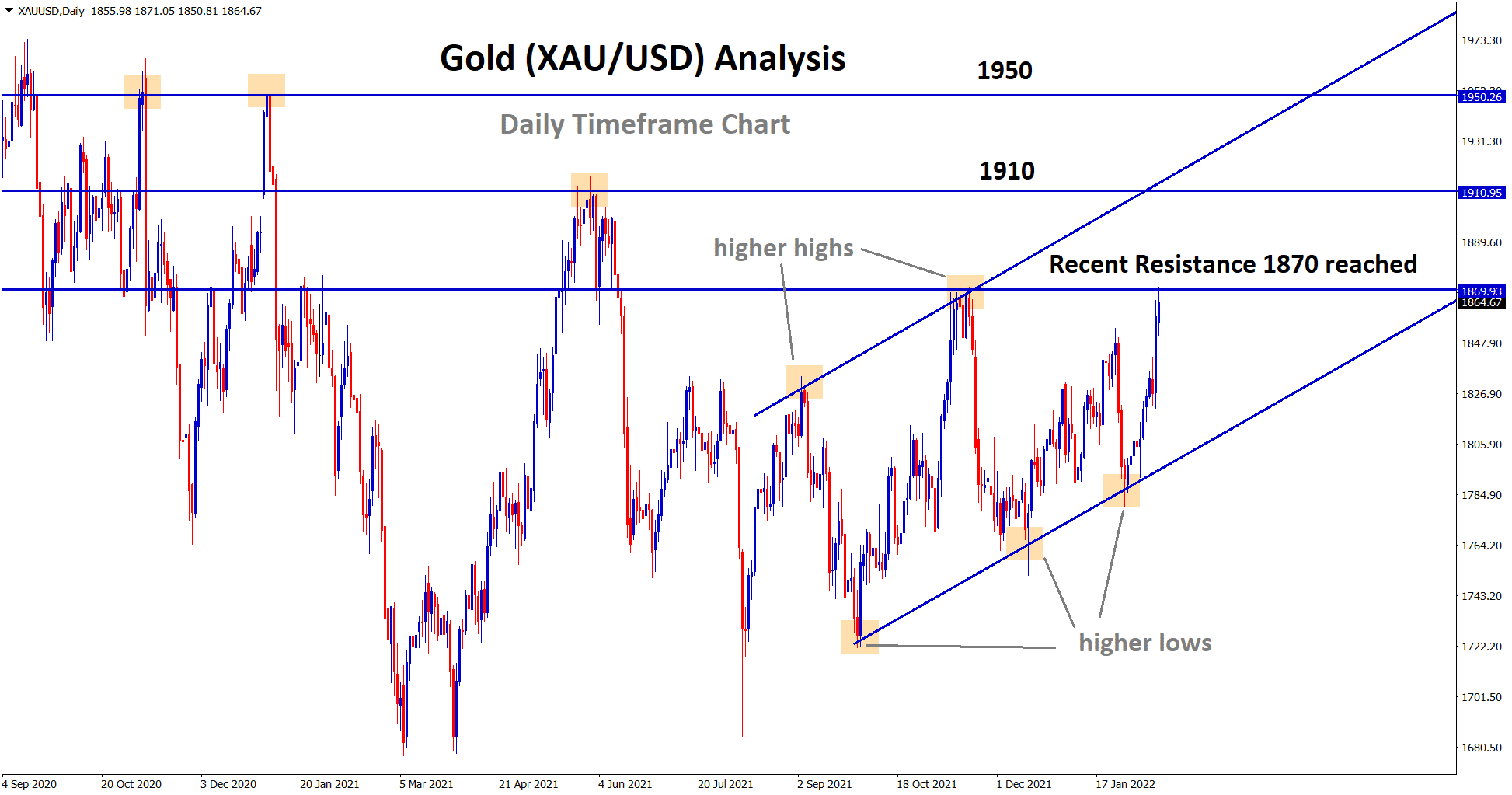

XAU/USD AIMING AT 3 MONTH HIGH AMID POLITICAL TENSIONS. Gold price is moving in an uptrend line by forming higher highs and higher lows. Now the gold hits the 1870 resistance area, the next resistance zones are 1910 and 1950.

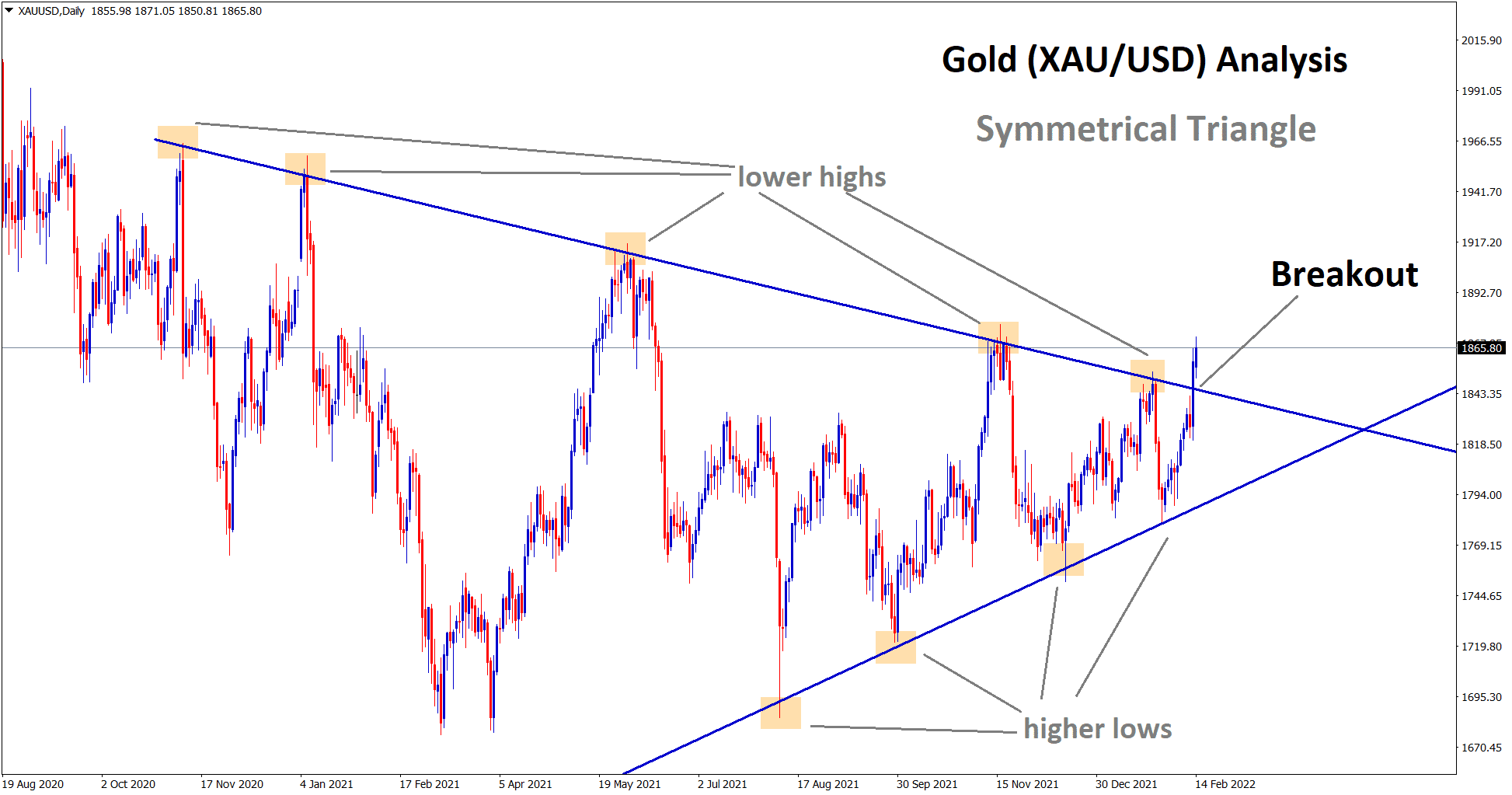

Gold price has broken the top (lower high) level of the symmetrical triangle after a long time in the daily timeframe chart.

GOLD THIS PAST WEEK

For the majority of this past week, Gold has been averaging in the 1830s with no specific reason for any drops or jumps in trend. However as of last Friday, we witnessed XAU/USD jump from the $1830s to the $1860s in a single day. This was a massive move for gold and had most traders shook as it was, for the most part, completely unexpected. Gold started an upward trend on Friday and not once had it shown signs of dropping ever since. Traders who opened BUY positions before the volatility began on Friday have witnessed massive profits. However, if you were on the SELL team, you probably witnessed a margin call if you didn’t close your positions in time. With this commodity, you just never know what to expect.

GEOPOLITICAL CRISIS

Although for most people the current Russia-Ukraine tensions seem like a newly formed issue, contrary to popular belief, they have been in tensions which each other for several years. Ever since Russia supposedly snatched Crimea from Ukraine illegally in 2014, things between the two countries haven’t been too good. For several years they’ve been working to resolve issues through diplomatic means but it seems as though diplomacy is too far out of reach. Russia has been seen placing over 100,000 troops at the Russia-Ukraine borders in an attempt to prepare for a potential war. They even flew fighter jets between the borders to show their dominance against the opposing state.

Russian President, Vladmir Putin, has come out in a statement saying that he is going to try to stay diplomatic as soon as possible. He claims that he does not wish for things to escalate where a war would begin. NATO has been in talks with both parties to defuse the situation and potentially prepare the citizens for an uprising that could begin at any moment. As long as Putin wishes things to remain diplomatic, XAU/USD has a great potential to return back to normal price levels. However, if things start to heat up, we may witness XAU/USD even cross the $1870s and even the $1880s if things get too serious.

THE FUTURE OF GOLD

The ongoing geopolitical tensions between Russia and Ukraine need to be on top of every XAU/USD trader’s watchlist. Analyst predict that things will still stay diplomatic for at least some time now but that we shouldn’t get our hopes up as anything is possible with this volatile commodity. Traders need to be prepared for any updates on the geopolitical tensions in order to properly adjust their positions accordingly. Coming up on Wednesday, we’re expecting a U.S. Sales Data Report which would reveal information that would potentially decide the future of Gold in the economy.

We’re also keeping an eye on the Feds Minutes for any updates including the ongoing inflation crisis taking over the States today. Trading indicators indicate a potential high reaching $1878 or it could go the opposite way to $1851. The next few days will be really important in predicting the future of this valuable commodity.

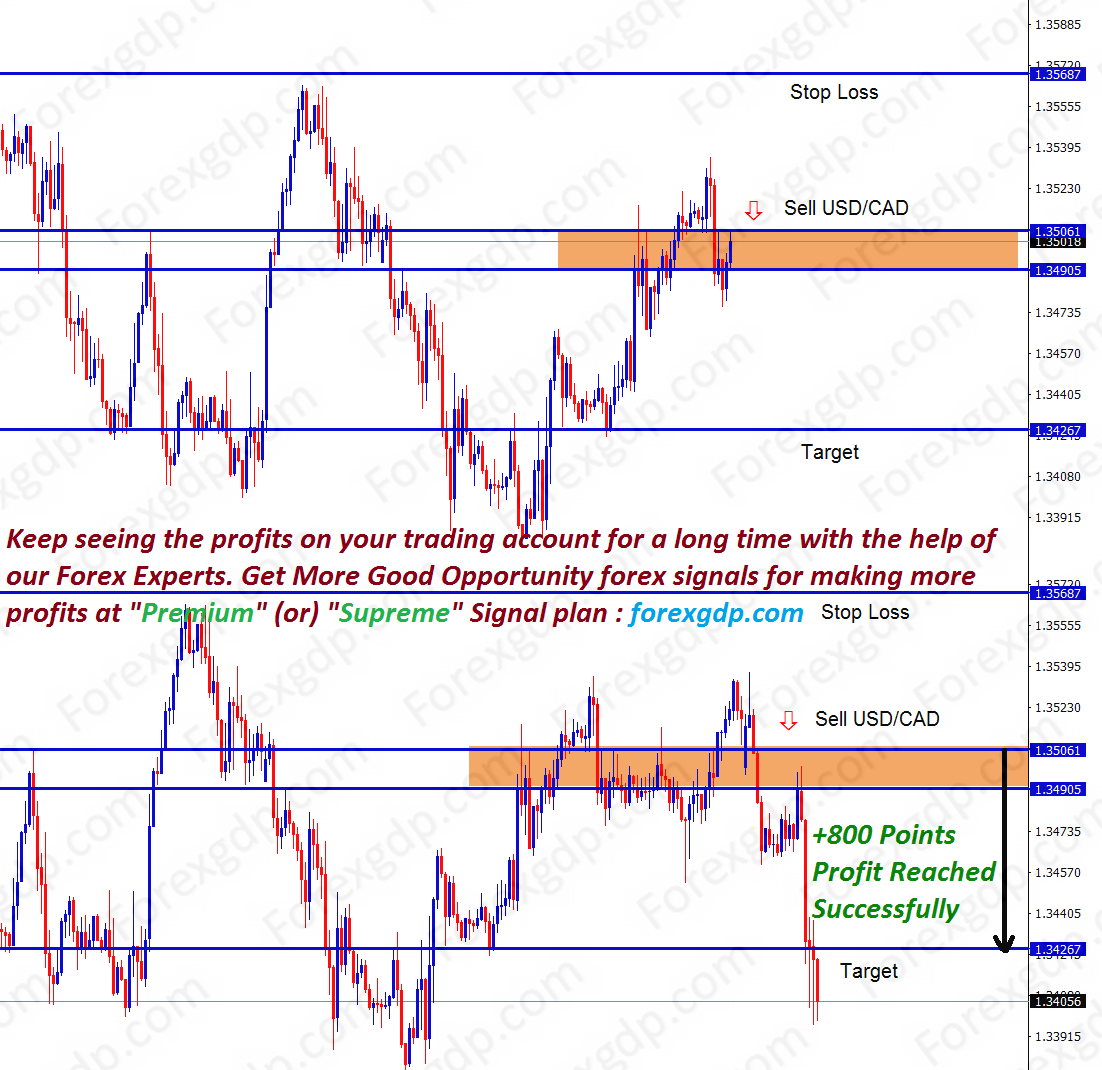

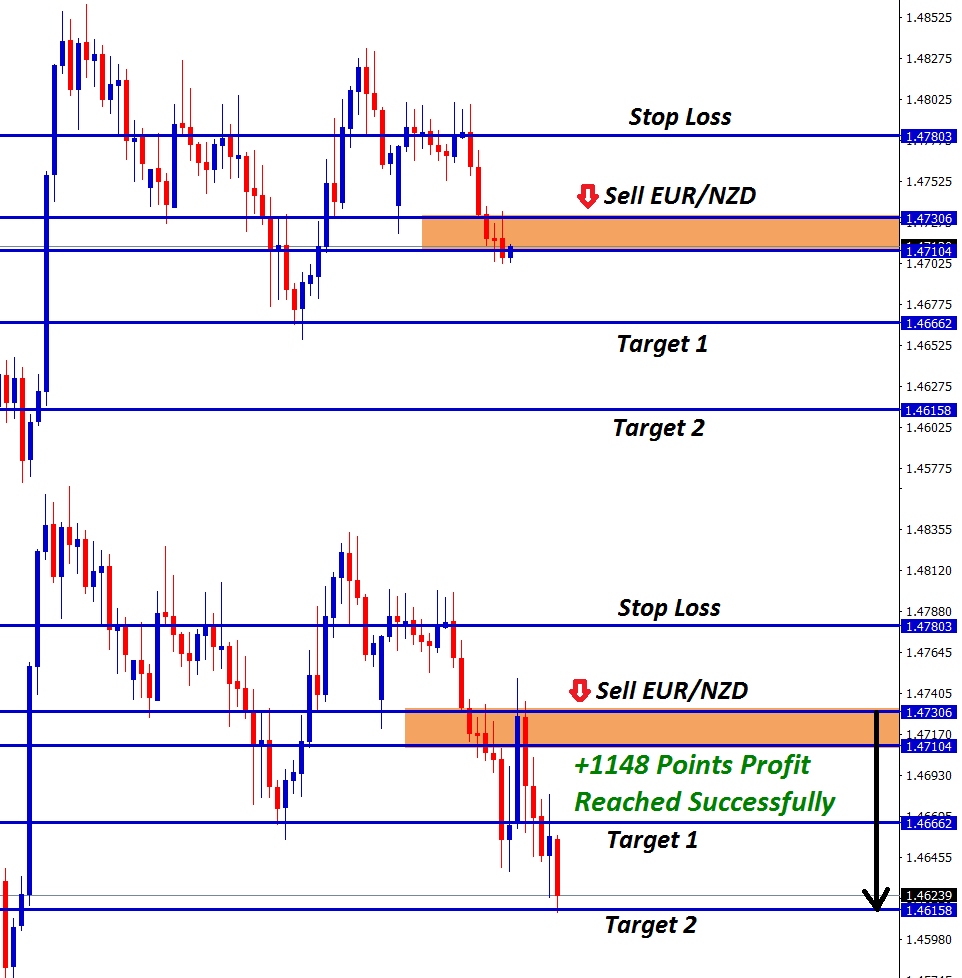

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade setups at premium or supreme plan here: https://signal.forexgdp.com/buy/