Gold: FED will take action against inflation pressure in the US

XAUUSD Gold price is moving in an Ascending channel and standing at the higher low area of ascending trendline and Retracement level of 61.8%.

XAGUSD Silver price is moving in an Ascending channel and standing at the higher low area of 38.2% retracement level.

Gold prices are kept lower after US Consumer confidence data came at higher last night.

And the inflation higher keeps automobile sectors more pressure on transports and Cargo shipments.

Due to this scenario, Supply chain Bottlenecks and makes more Production’s disruptions.

And US FED is watching all scenarios of inflation pressures and will soon decide on tapering.

China Evergrande crisis made slower consumption of Gold, and prices are in consolidation mode.

US Dollar: Wells Fargo analysed the November FOMC meeting

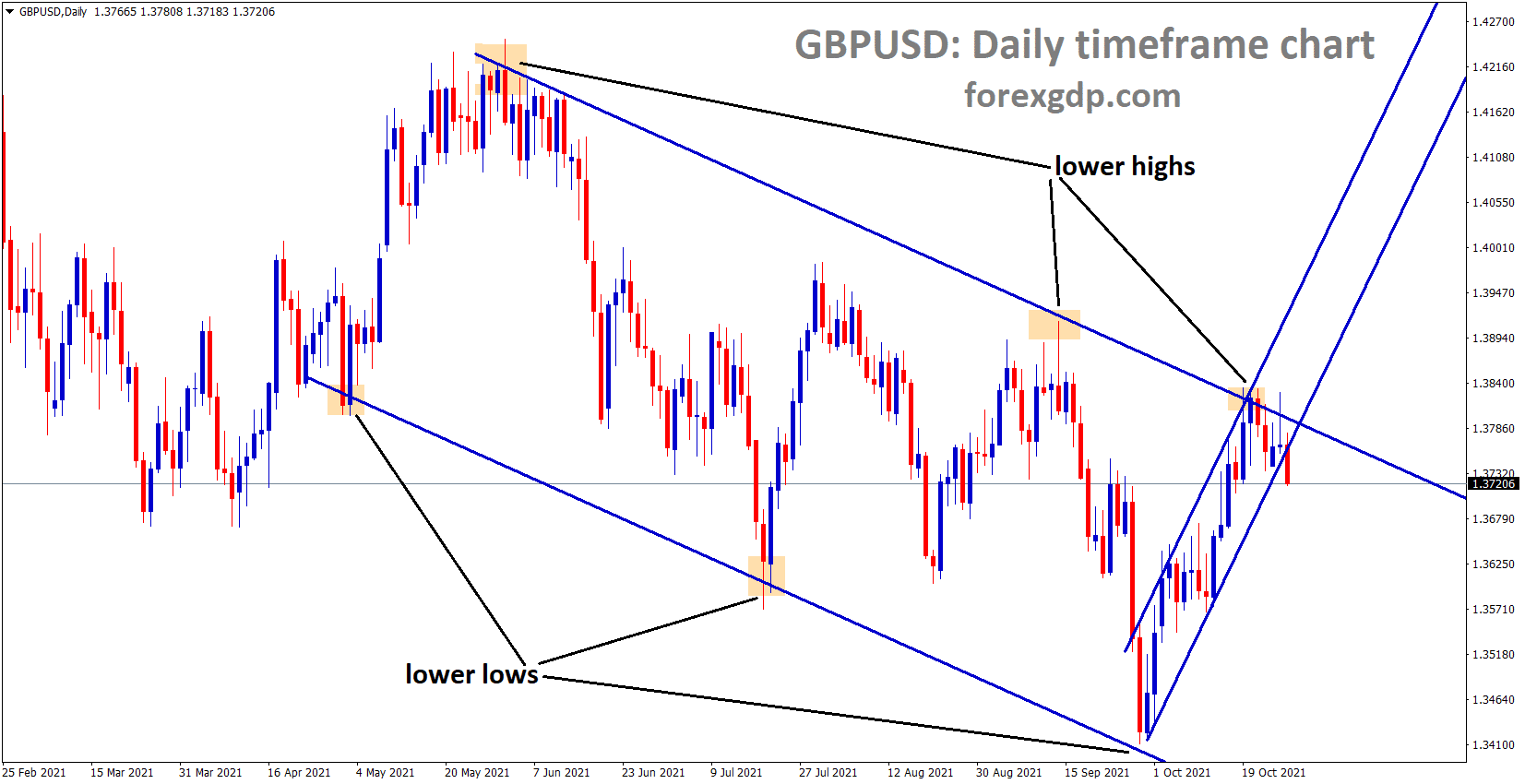

GBPUSD is moving in a Descending channel and rebounded from the lower high area, Inside Descending channel market moving in a minor ascending channel at the higher low area.

Analysts at Wells Fargo forecasted the FOMC meeting of November month as FED decided to announce the tapering plan at the November meeting, but as per Wells Fargo, tapering will start in the December meeting.

And it will happen in a step by step manner, the first reduction of $10 Billion from Treasury securities and $5 Billion from Mortgage-backed securities, to be controlled in mid of 2022.

And the employment rate will grow slowly, but it will be achieved at the end of 2022.

Due to the above scenarios, Rate hikes are visible in 2023 as inflation causes lower reading, and employment growth shows a stronger number.

FED’s Balance sheet is expanded by $8.5Trillion, and it will be increased to $9T in Mid 2022.

US Democratic senator Manchin speech

US Democratic senator Joe Manchin said the $1.5 trillion spending bill is more than fair as he commented.

He also said more than $1.5 trillion stimuli might increase if the economy wants.

And US Debt limit is set to increase by US President Joe Biden, with Congress having the right to override it.

So, at last, the Spending bill is going to pass in US Senate and waiting for approval from US President Joe Biden to sign it.

More spending leads to US Dollar weakness on one side but Spending stimulus makes use of US Growth will return as Gains to US Economy only.

EURO: German Domestic data came at higher

EURNZD is moving in a Box Pattern and the market rebounded from the Support Area..

German 2-year bunds increased to -0.65% area, and 10-year bunds rose to levels below-0.13%.

And German GFK Consumer improved to 0.9% for November month, and Import prices rose to 1.3% MoM in September and 17.7% from a year earlier.

German Data showed a mixed bag of domestic data, and this week ECB meeting is going to happen, so any tapering or rate hike by the end of 2022 is expected mainly from ECB Chairwoman Christine Lagarde.

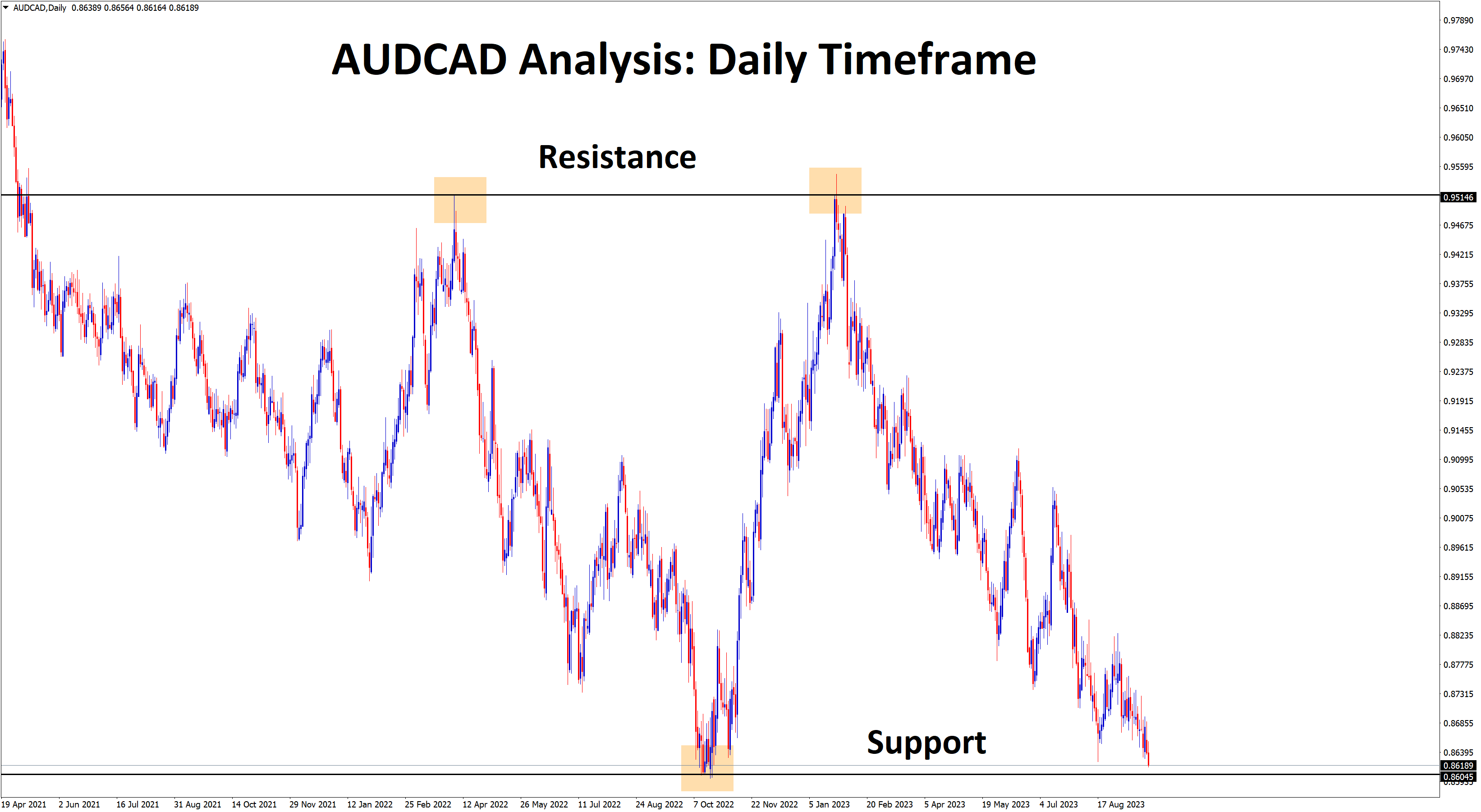

UK POUND: UK Budget forecast

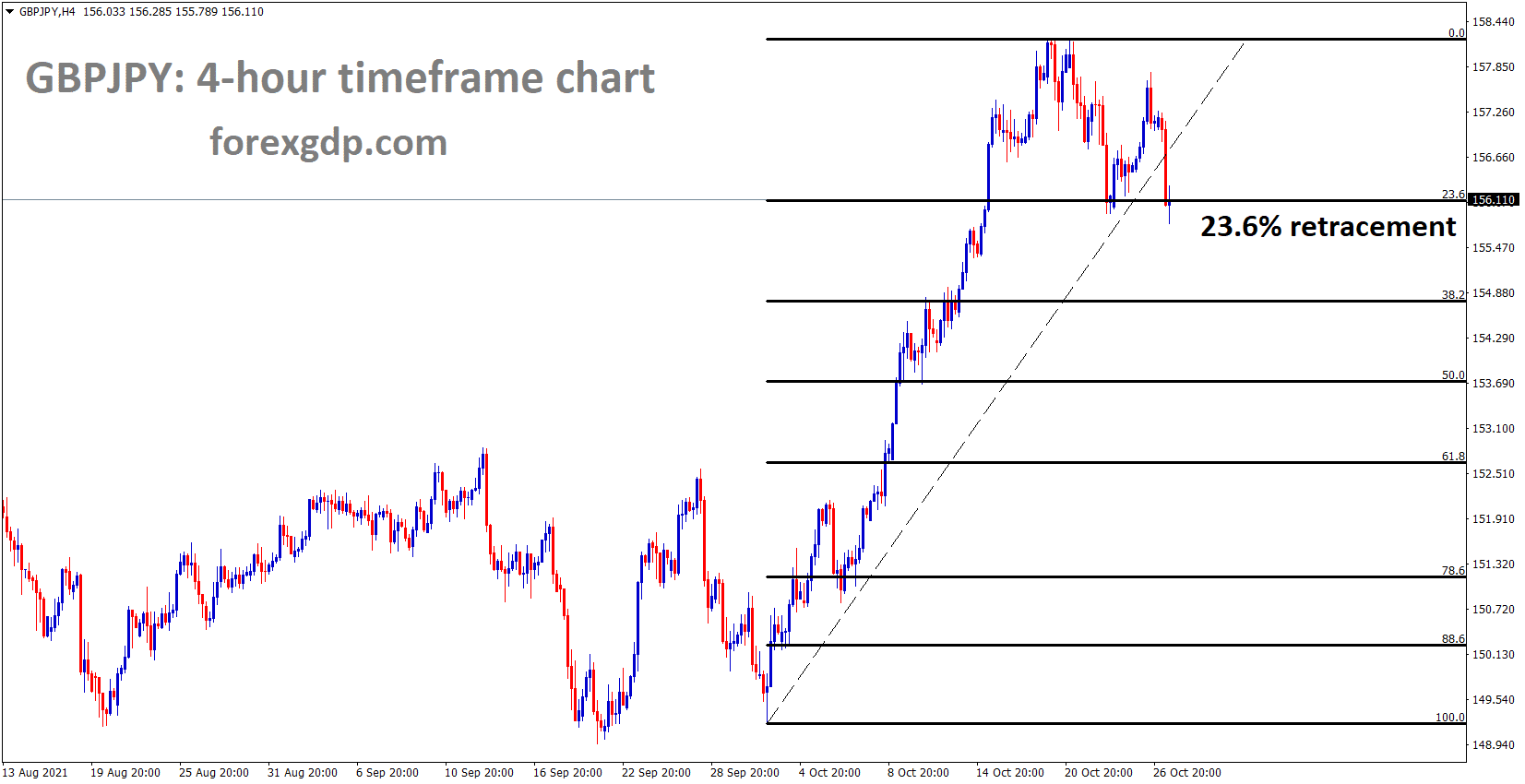

GBPJPY is now standing at the higher low area of 23.6% retracement level.

UK Budget will be present today by Chancellor Rishi Sunak, and the rising inflation causes more cost of servicing in national debt.

Inflation targets to 5%, as chief economist Pill commented last week is noted.

And UK Inflation points hits highest since 2008, So rate hikes are the only method to reduce the inflation cost.

And Australian Dollar shows lower inflation numbers than expected.

Due to this, GBPAUD rigid support going to break, waiting for the UK Budget and Bank of England monetary policy meeting.

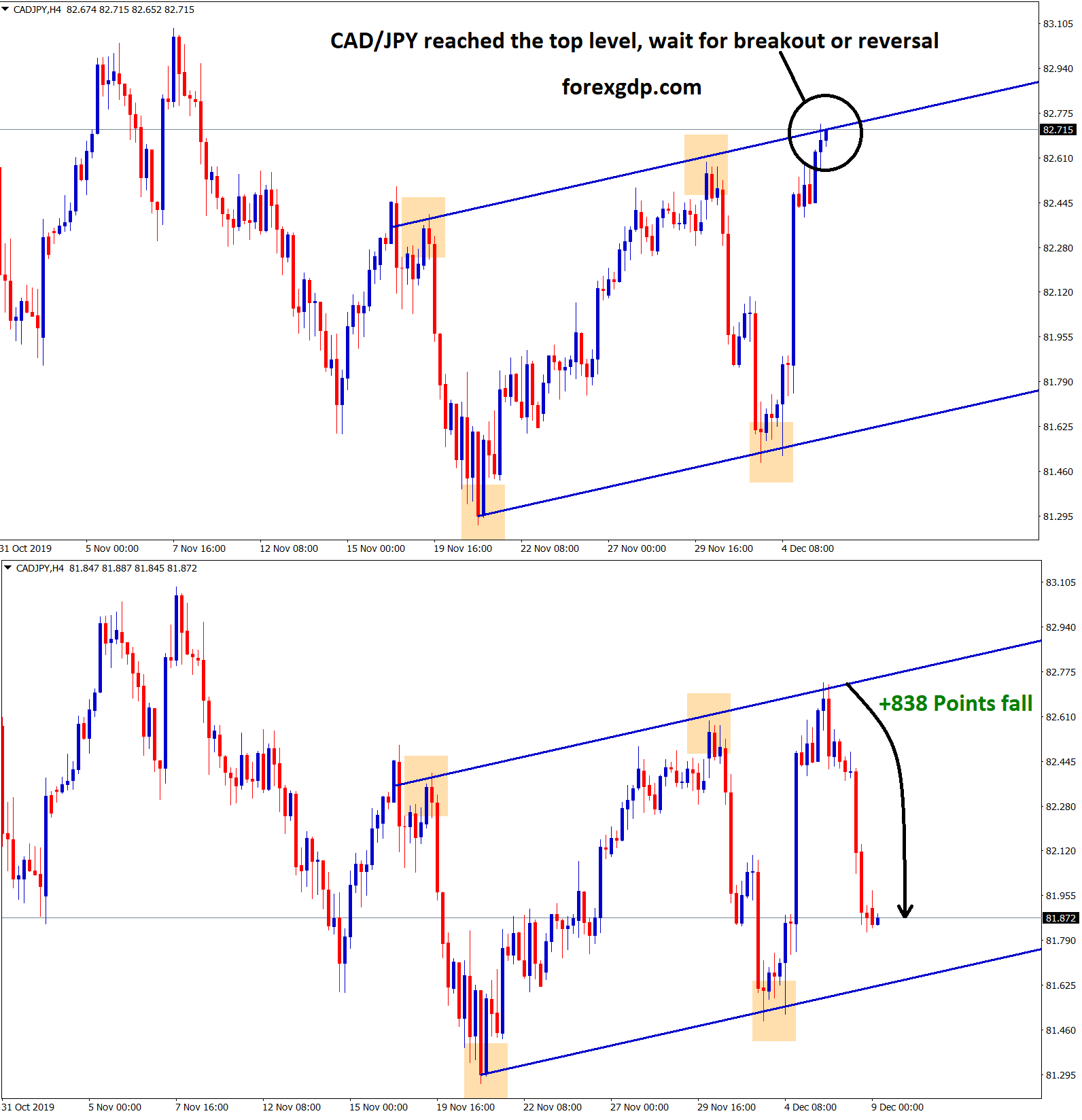

Canadian Dollar: BoC meeting today

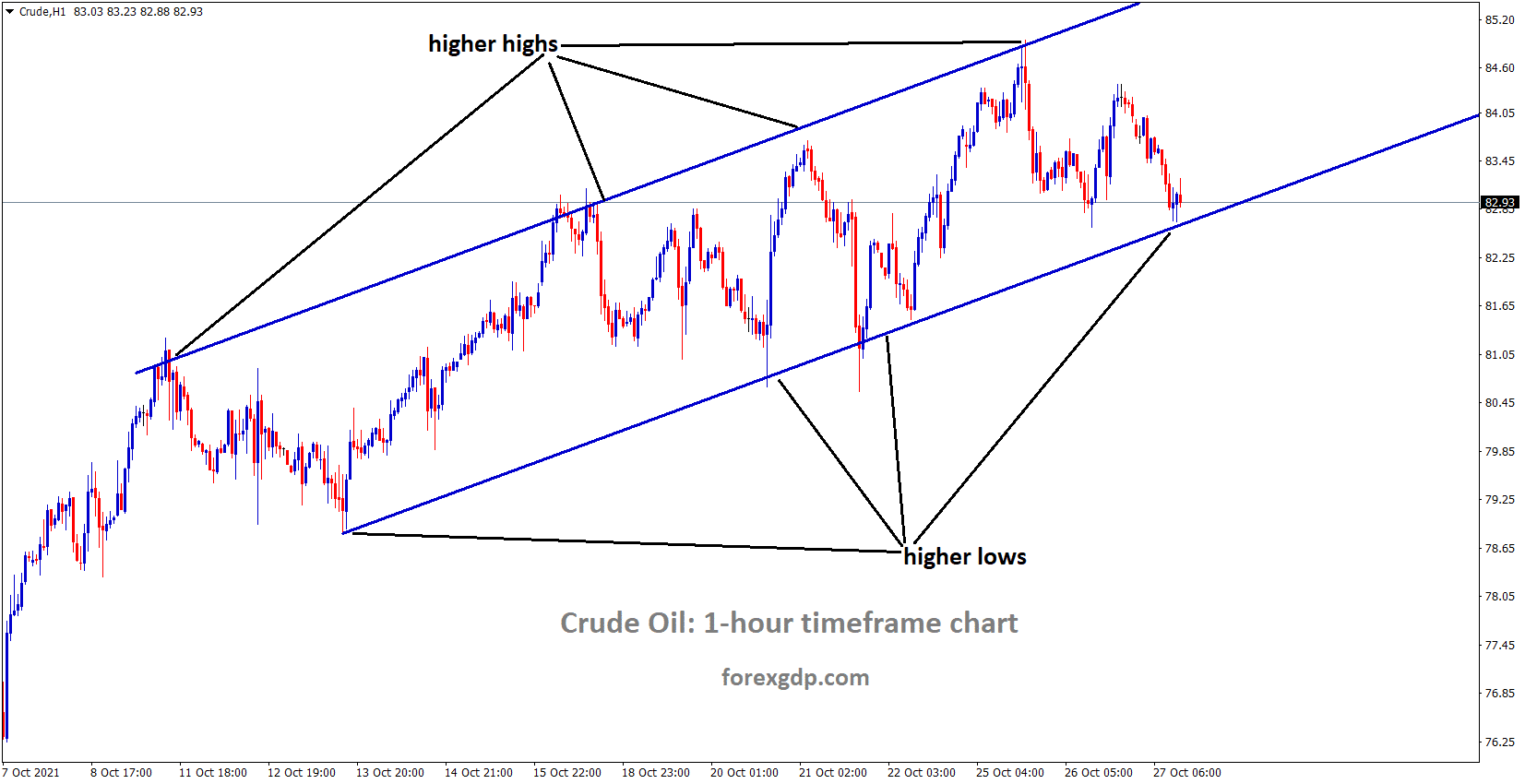

Crudeoil is moving in an ascending channel and the market is standing at the higher low area of Ascending trendline..

US Home sales increased to 14% in September, and Consumer confidence rose to 113.8 level from lower reading expected.

And Bank of Canada monetary policy meeting happening today, any rate hikes will make a bullish view for the Canadian Dollar.

Inflation readings are higher, and lower labour market conditions make the Bank of Canada taper or rate hikes sooner than other G10 nations.

Oil prices are soared to 83 mark and OPEC +Nations delaying more supply as productions are slower.

The Winter season makes hurricanes in China, and the Gulf of Mexico shut, creating more demand for Oil production.

Japanese Yen: Bank of Japan monetary policy forecast

EURJPY is moving in a Box pattern and the market is now at a retracement level of 38.2%..

Tomorrow Bank of Japan monetary policy meeting happening, more stimulus and lower inflation is the backdrop of the Japanese Yen.

US Dollar shows strong bullish trend as US Domestic data performed well in this week.

And Japanese PM Kishida said after the elections, they have planned to inject more stimulus to recover the Japanese economy inefficiently.

Now inflation keeps lower in Japan and employment rate crossed the lines of expectations, but still not enough to improve, more struggles to face by New PM Kishida after the election.

Australian Dollar: CPI inflation data came at lower than expected

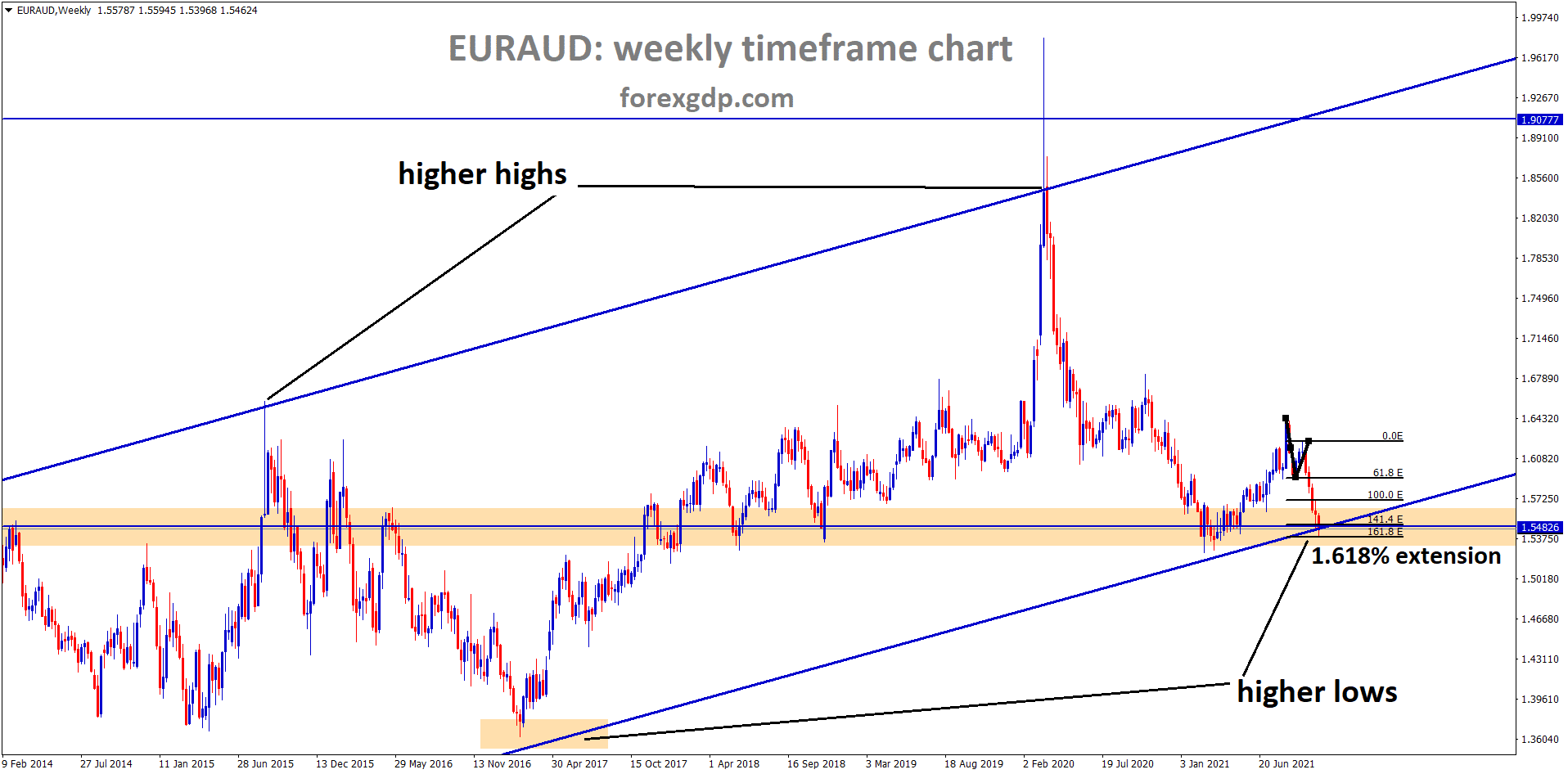

EURAUD is moving in an Ascending channel and market completed Fib extension level of 1.618% and the price is standing now at the horizontal support and higher low area of ascending channel line in the weekly time frame.

Australian CPI inflation came lower as 0.8%q/q against 0.80% expected, and the annual headline inflation rate came at 3.0% Y/Y versus 3.1% Forecasted.

The annual reading of CPI in the Third quarter stands lower because of Lockdown implementation in Australia; 50% of the population were under lockdown. So, spending and retail sales are lower when compared to the Normal period.

And RBA did taper before earlier according to inflation higher situation, so in coming months the same type of tapering the assets will be done to control inflation.

New Zealand Dollar: Exports and imports improved in New Zealand

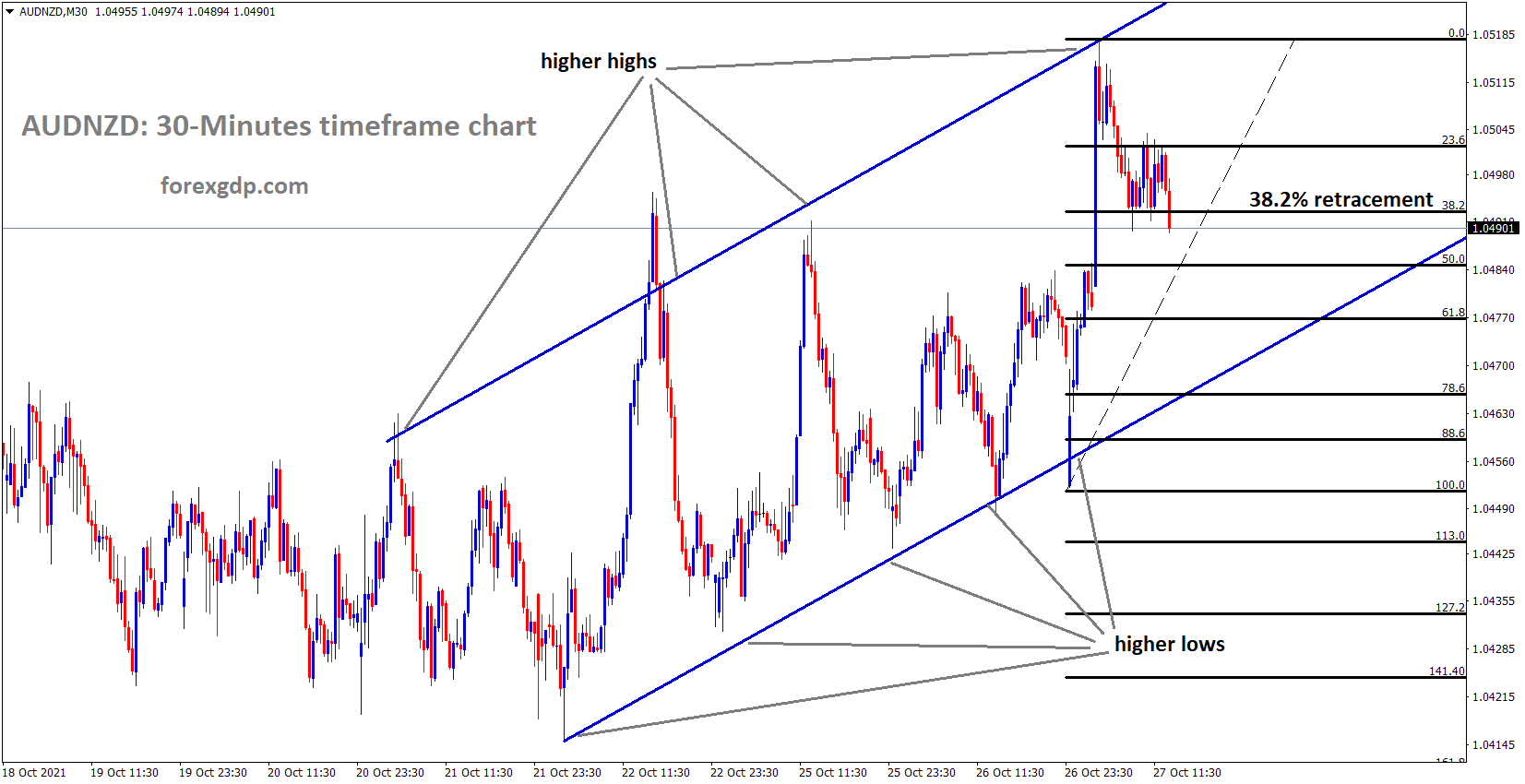

AUDNZD is Moving in an Ascending channel and market standing at the higher low area of 38.2% retracement level.

New Zealand Trade balance shrank to $-2171M from $-2139M in the previous month.

Exports and imports data marked higher than the last month.

US and China talks and now trade war getting smoothens, once deal is signed, then New Zealand Dollar got a positive move in the market.

And Yesterday, US Consumer confidence data displayed higher numbers than expected, and this help’s US Dollar to be stronger.

New Zealand Dollar in a consolidation move, Largely dependents on exports to China is revenue income for New Zealand.

This week US GDP data is also on the table and makes New Zealand Dollar consolidate, waiting for the outcome.

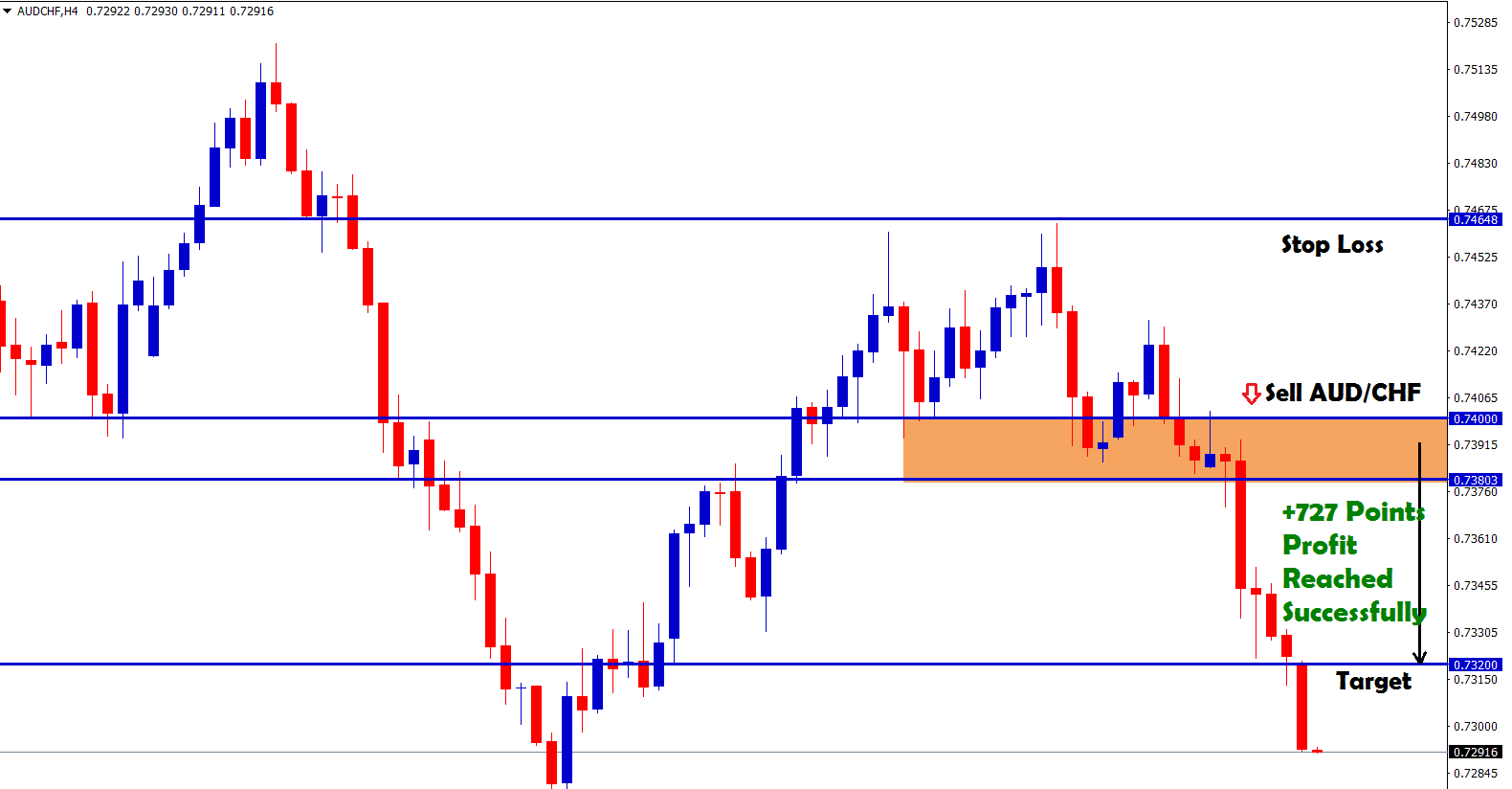

Swiss Franc: US New Home sales data improved

AUDCHF is Moving in a box pattern and rebounding from the Resistance area.

US New Home sales reached 800K units as six months high in September, and Consumer confidence data reached 113.8 from 108.3 expected.

Due to this week positive domestic data, US getting stronger and pushed US Dollar higher against the Swiss Franc.

Swiss Zone shows moderate improvements in employment data as easing lockdowns.

Proper vaccinations are progressing in the Swiss zone, and overcoming pandemic levels is a little struggle for the Swiss Government.

China crisis makes support for US Dollar and Swiss Franc.

This week US GDP data and ECB meeting make directions for the Swiss Franc in the near term.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/