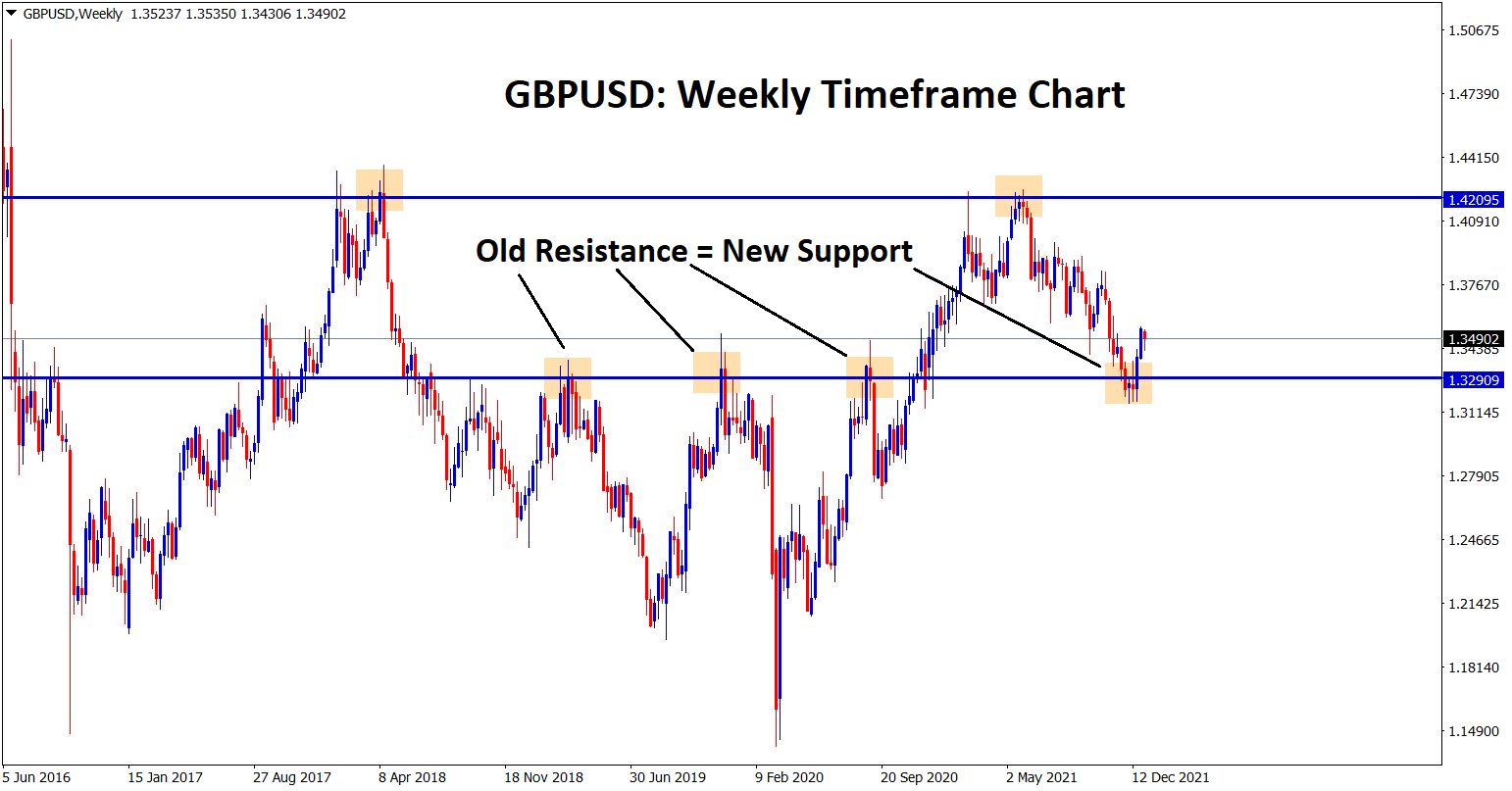

There are a number of factors that are influencing two of the world’s largest economies, Europe and the U.S. Without current world events such as the U.S. election fast approaching us, it seems to be grabbing all the headlines and affecting the EUR/USD currency.

A Trump win could spell disaster

One of the main factors at play here that is causing the euro to seem stronger against the dollar is speculation that the Federal Reserve might adopt negative interest rates, or curve control if Donald Trump wins another term.

Market speculation for a Trump win could be pricing itself into the market because a Trump win would be deeply dollar negative on both the fundamental and institutional basis, all while driving the risk-averse into a dollar-buying panic. Such an environment is likely to cause whipsaws. All in all, not everything is as it seems at the moment, with dollar weakness coming causing the euro to strengthen.

Stimulus news makes EUR/USD weak at the knees

The EUR/USD pair accelerated south in relation to President Trump’s proposal for a stimulus package, which would support the U.S. economy. Undeterred by the news, House Speaker Nancy Pelosi demonstrated confidence that a deal would eventually be reached, despite the negative reaction this received.

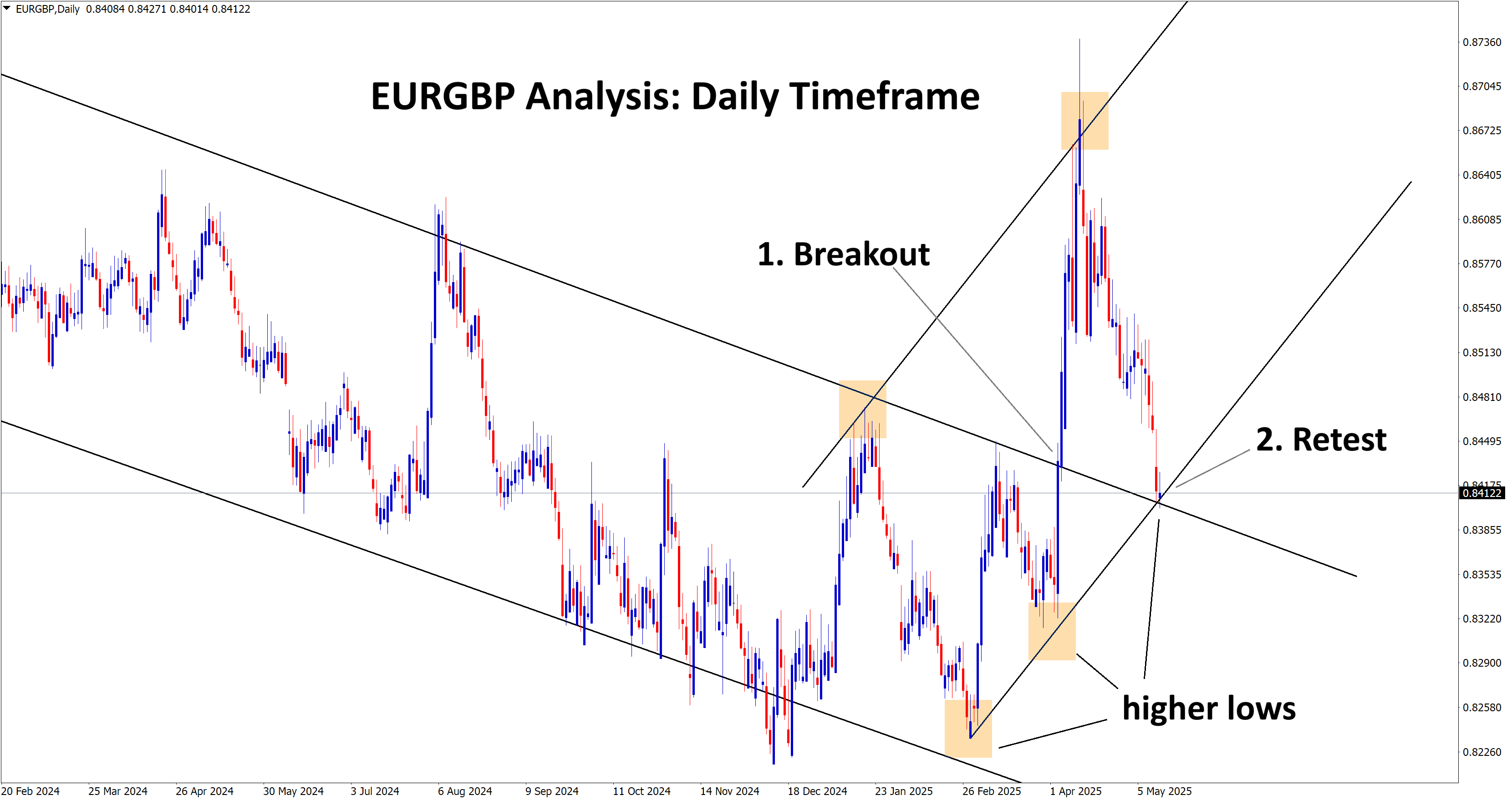

EURUSD has broken the bottom level of the minor uptrend line and starts to fall down.

Now Market try to bounce back. It will Re-test the breakout level and fall down again or it will break the top zone.

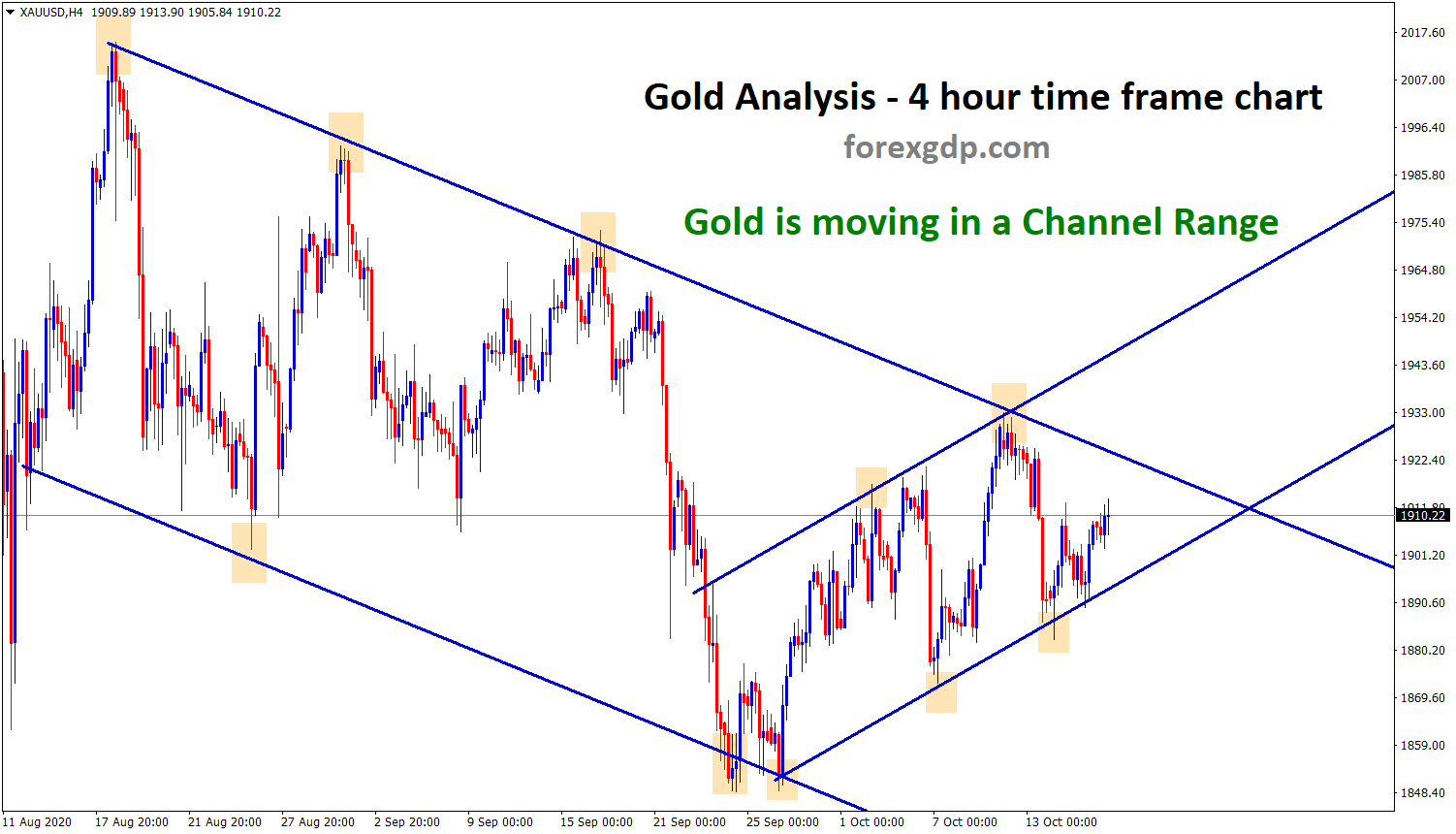

Gold Prices

The U.S. economy is a global powerhouse when it comes to affecting other nations and commodities. If we take gold prices for instance, we can see a direct correlation between the U.S. economy and the price of gold.

Gold price is moving between the Channel Ranges now.

Be Patience and wait for the breakout from this channel ranges to pick up the long term trade on Gold.

The price of the precious metal actually reveals the true state of the U.S. economic health. As some of you may know, that when the price of gold is high, that generally means that the economy is becoming or has become stagnant and is turning sour. As a result, investors tend to buy and hold gold as protection from things such as economic disasters or inflation becoming too high.

On the flip side, when gold prices are relatively low, we tend to see the U.S. economy in good health, with stocks, bonds or real estate seen as attractive buying opportunities.

With the current outlook for the U.S. economy looking rather uncertain due to who will end up in the White House, it is no wonder gold prices are as high as they are. At the moment the current driving force behind the rise in gold is the U.S. election between Trump and Biden.

As it stands, Trump’s years in office have indirectly been relatively good for the price of gold. The catalyst behind this is the never ending trade way going on with China, and Trump’s unique approach to diplomacy has created the perfect environment for safe havens like gold.

However, in the event of a Biden victory, could we see a drop in gold prices, since a possible victory by Biden is currently seen as a bullish move and an acceptable one seen by investors. Or, after an initial short-term spike, the underlying uptrend could actually resume after everything has quieted down.

In reality, no matter who ends up in the White House, the current macroeconomic conditions should stay favourable for the precious metal.

Whoever wins, Gold Price is going to rise anyway.

Get Each forex signal with Chart Analysis and Reason for buying or selling the trade which helps you to Trade with confidence on your trading account.

We always want you to trade forex market safe with care.

Please Don’t trade all the time, trade forex only at best trade setup.

It is better to do nothing, instead of taking wrong trades.

We are here to help you for taking the trades only at best trade setup.

If you like to receive more analysis at accurate time, subscribe to premium or supreme signal plan here : forexgdp.com/forex-signals/

If you want to learn forex trading using best trading strategies, you can purchase our forex trading video course here.

Thank you.

Good morning FX-GDP I recommend work that the team doing its improving our lives and our trading skill as young ones in forex market I even wish to take a course because every time when we receive signals they get in profits I don’t gamble anymore I just wait for good trading opportunities #i salute the team