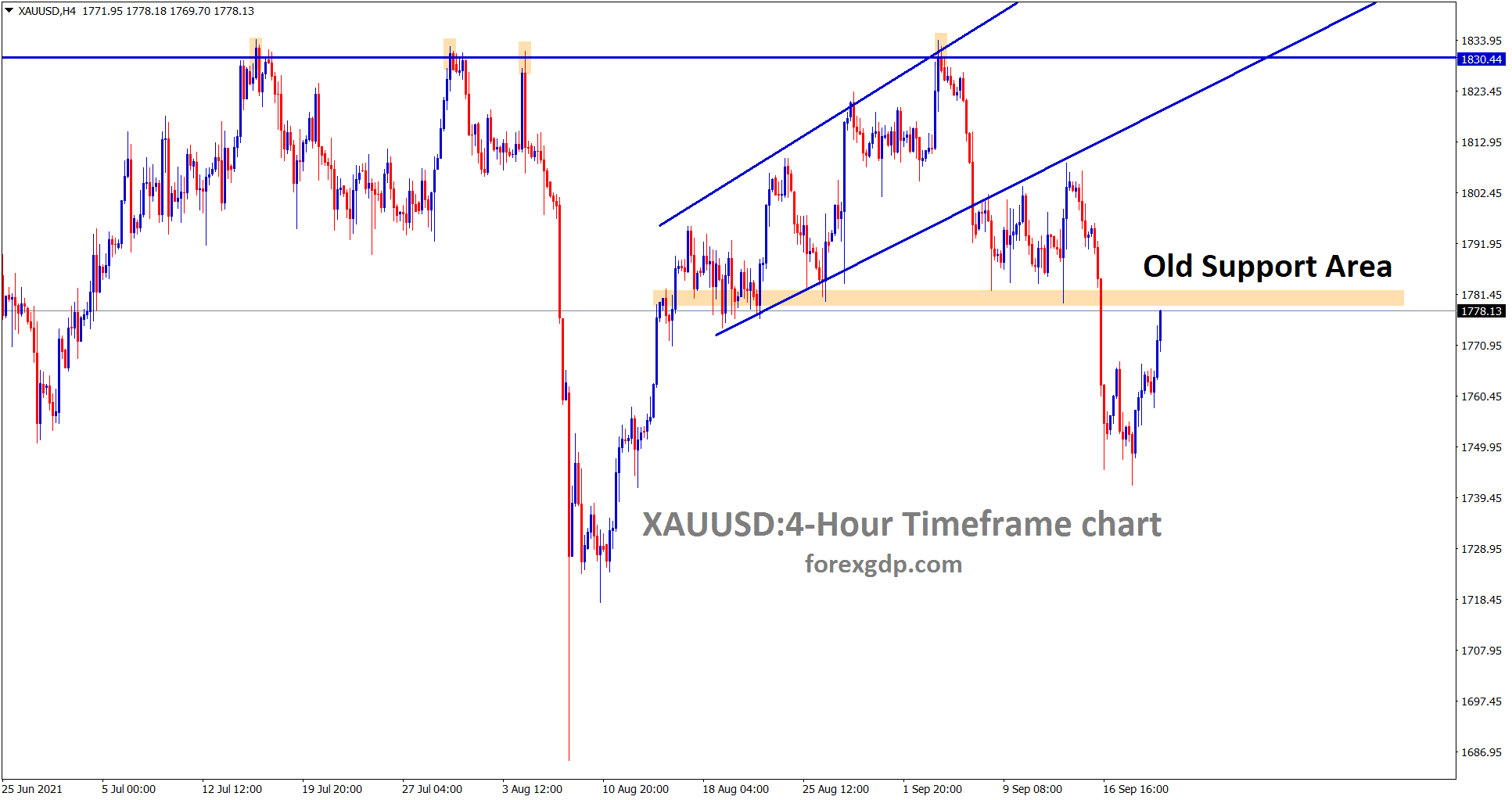

Gold: China crisis in Real estate made slower demand in Gold

Gold is going to reach the old support area which may have chances to turn into new resistance – however, wait for the confirmation of reversal..

Gold prices are down from a higher point of 1833$ as last week fell to 1741$.

But China Concern over the real estate crisis of Evergrande made a Default of $300 Billion is more affecting Gold prices sell-off in the market.

China is the largest steelmaker; once Real-estate got a crisis, steel demand got worsened, and Iron ore import from Australia is down as much more in the market.

And now Metals show more declines as the housing market collapse.

Due to these scenarios, Gold prices further weakness in the coming weeks as China recovers from the Real estate Crisis.

US Dollar stubborn higher point in the market shows more blow for Gold prices in the market.

US DOLLAR: FOMC meeting outlook

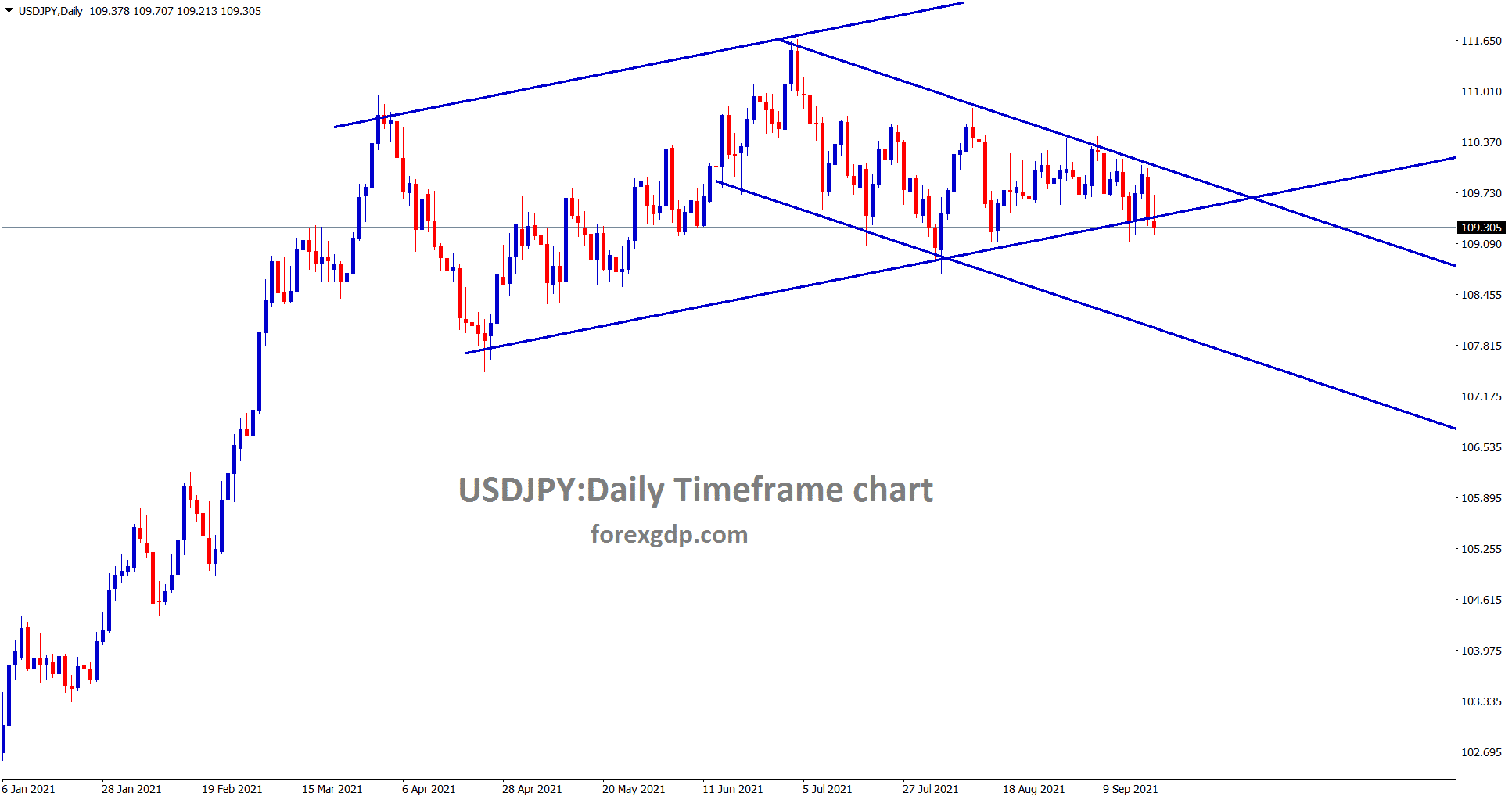

USDJPY is still moving between the channels.

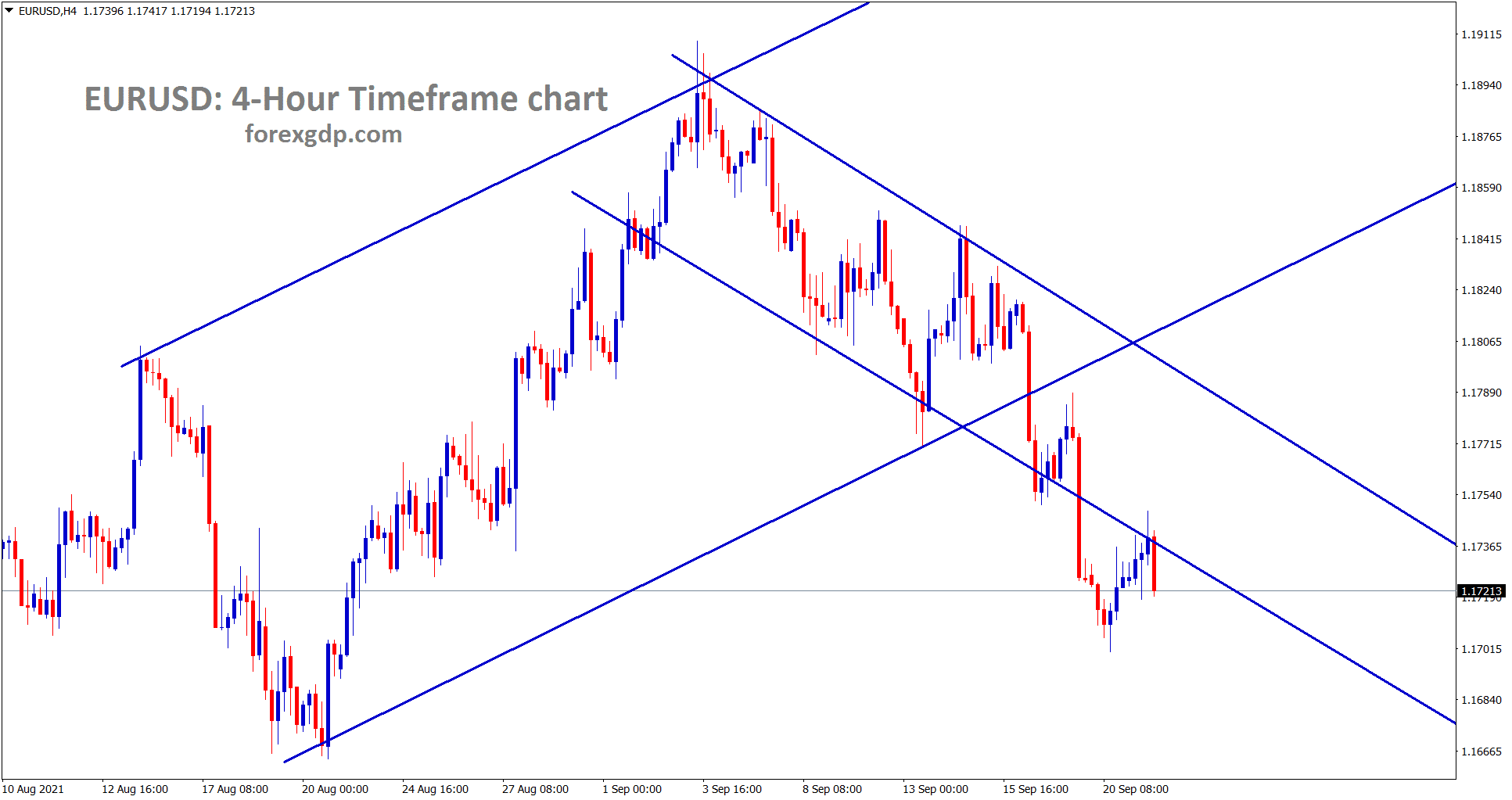

EURUSD is falling after retesting the broken descending channel.

US Dollar index falling from the neckline of the Previous resistance level last day, and this week Building permits and Housing sector data is yet to publish, and also FOMC meeting is scheduled this week.

Now US Dollar going to stronger or weaker based on Speech from FED Powell & CO.

And US Senator Mnuchin delays the Joe Biden Votes to January 2022 as the Spending package remains delayed.

China crisis is once again favouring For US economy, and the US affected with covid-19 recovered by Vaccination.

But Now China affected by the Real estate crisis is more concerned about the Covid-19 issue. $300 billion Worth is not a cheaper value for China like a Developed country.

Due to this US Dollar becomes more robust as Demand creating high by China.

EURO: ECB Vice President Speech

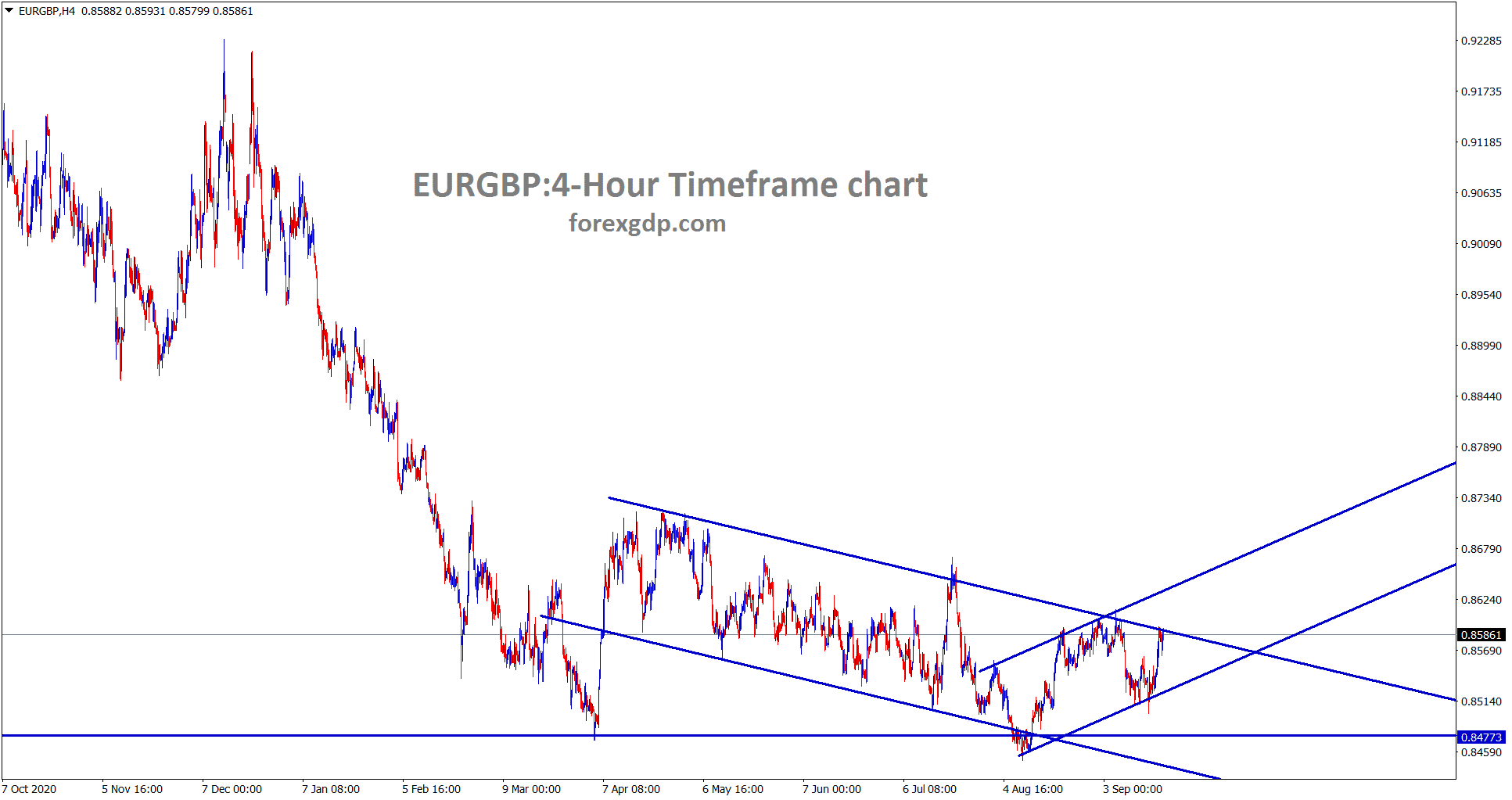

EUGBP is moving in an minor ascending channel now – however wait for major descending channel breakout to buy EURGBP.

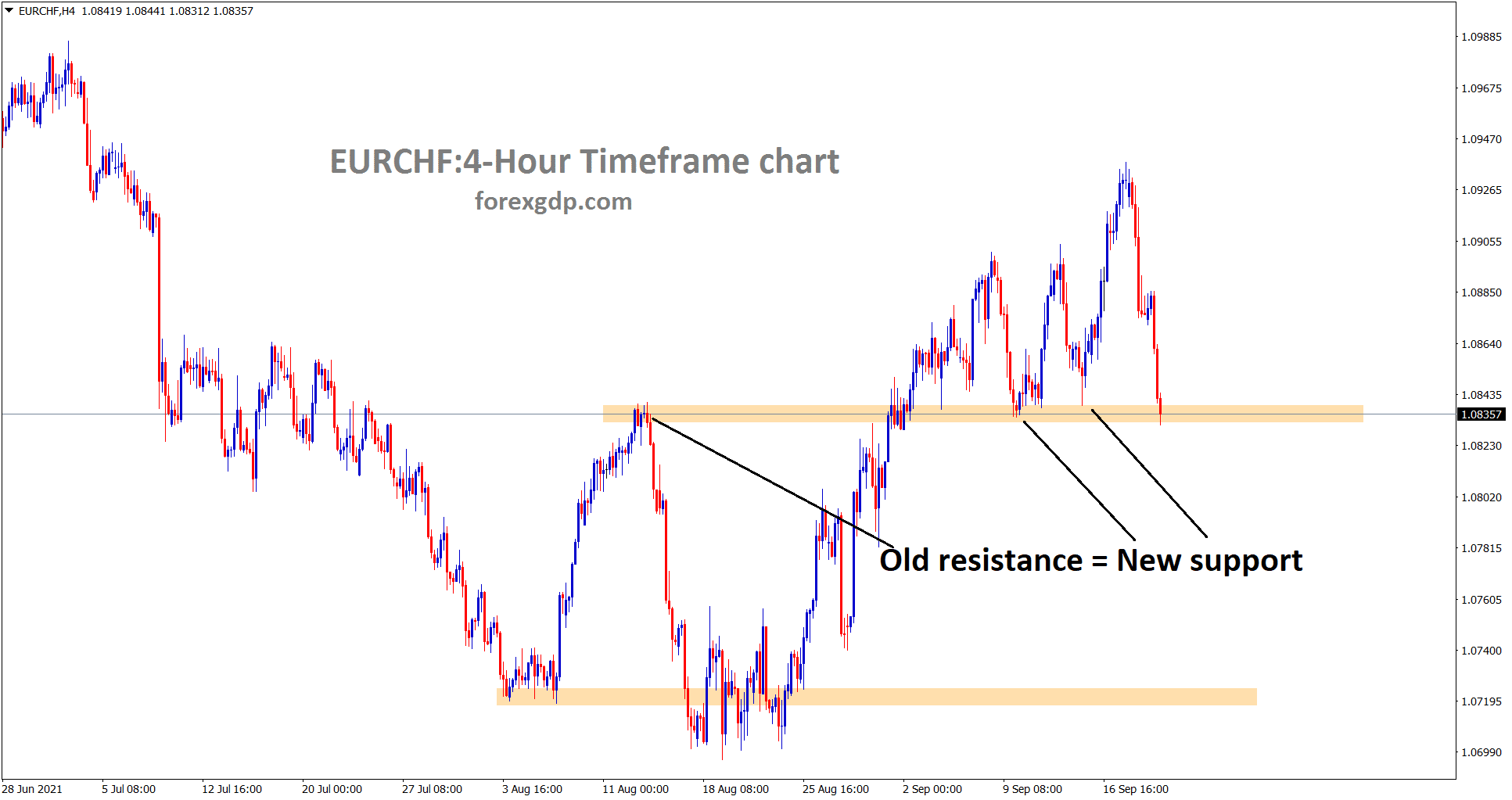

EURCHF has reached the old resistance area again which acted before as a support – let’s wait for reversal or breakout.

ECB Vice president Luis De Guindos said Inflation would hit 3.4-3.5% in November, but this is a temporary outlook.

And Q3 of Eurozone growth will be stronger. Wages rise is not up to mark in Q3. We need to be cautious about inflation rising in the coming months.

The majority of Inflation higher is not long-lived and short term high only; once the economy recovered, Inflation will be lowered.

German elections Forecast

German elections are scheduled this week, and we do not take severe actions on Euro to get positive after Winning the current President of Germany.

And Germany posted weaker economic growth in recent months, and Vaccinations are at a Faster rate.

ECB will not soon taper or rate hikes after the outcome of the German elections.

So be positive on Euro whether the outcome of the election is positive or negative.

UK POUND: UK Domestic data Forecast

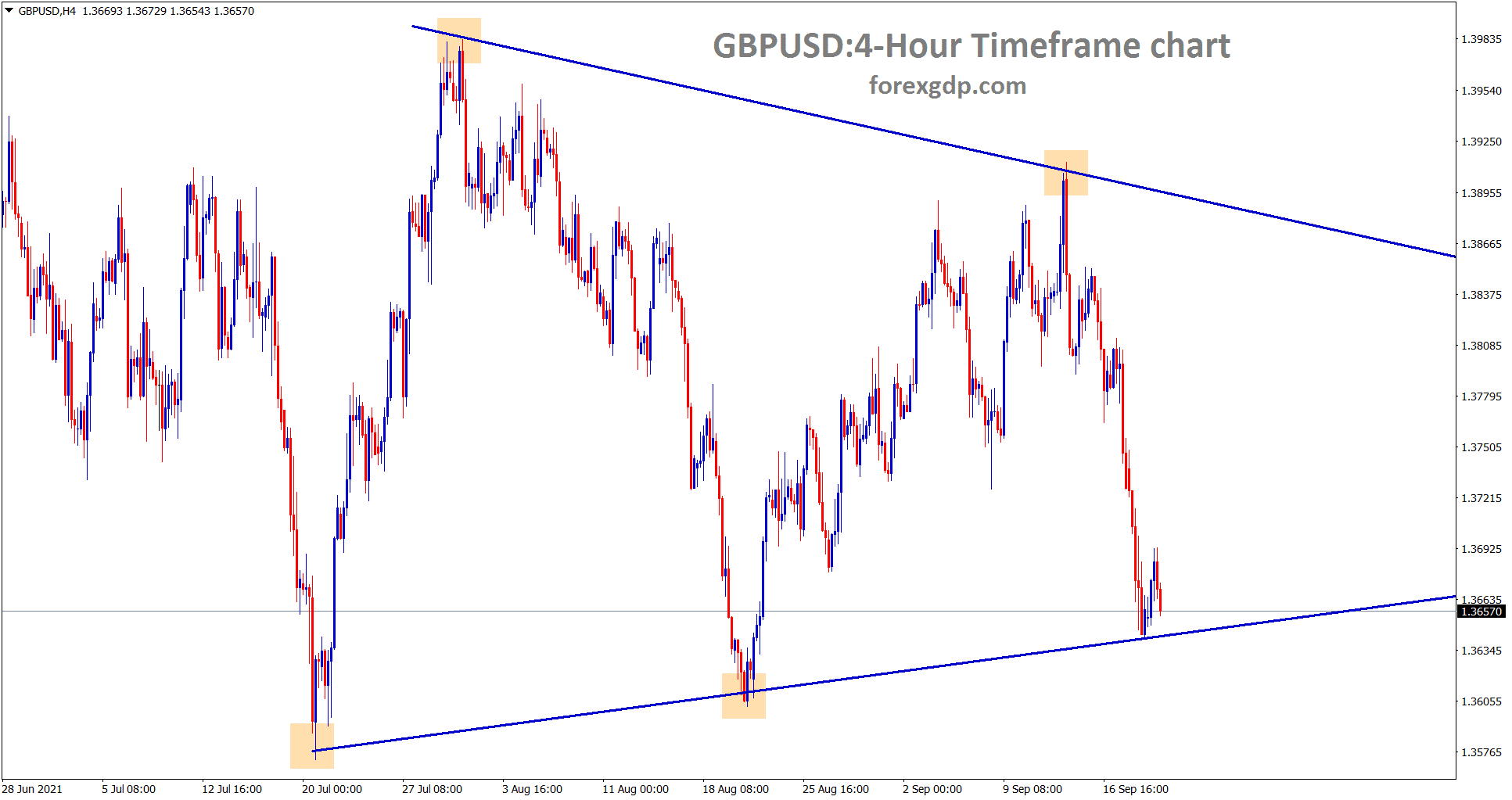

GBPUSD has formed a symmetrical triangle pattern – wait for breakout from this pattern.

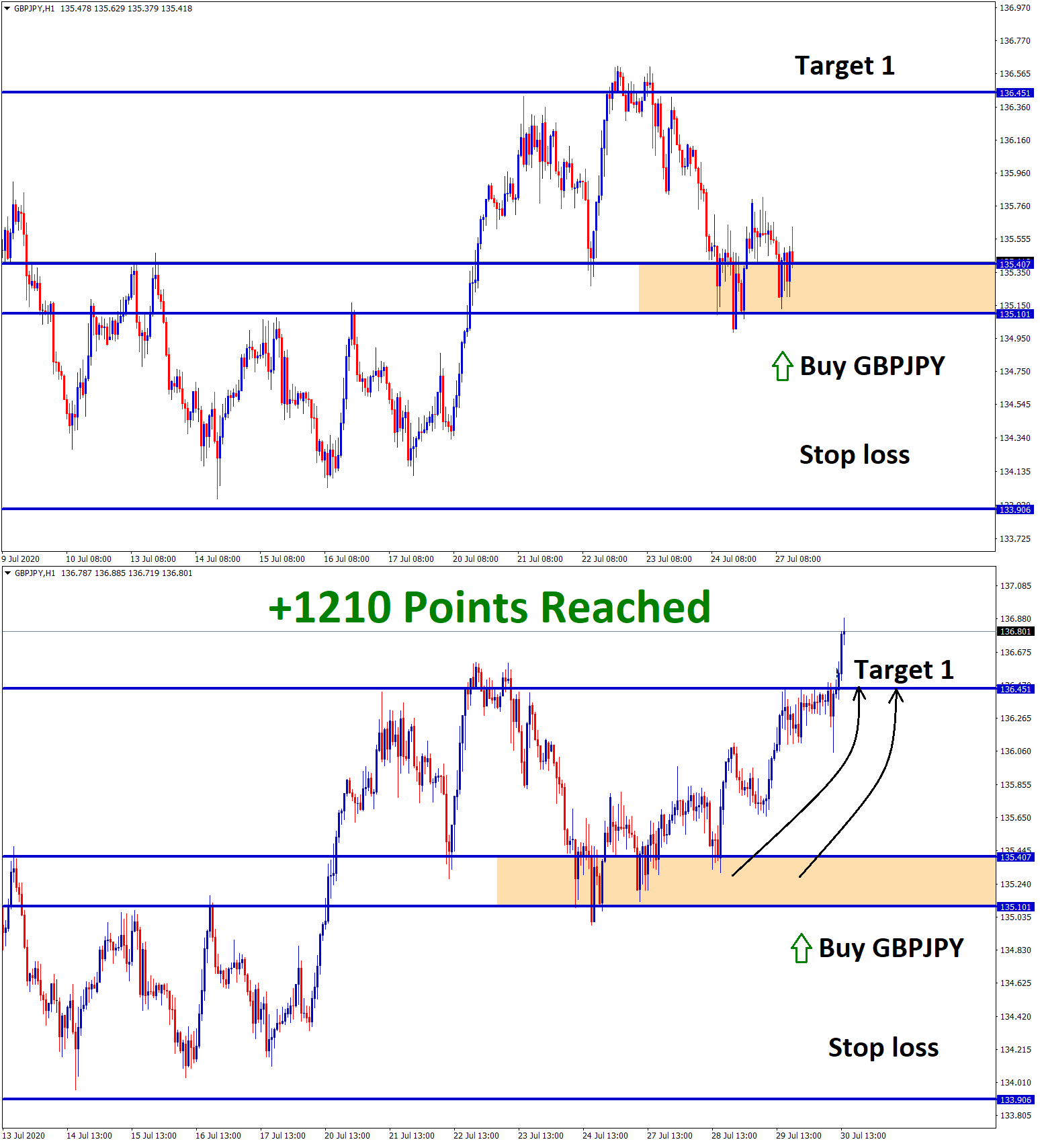

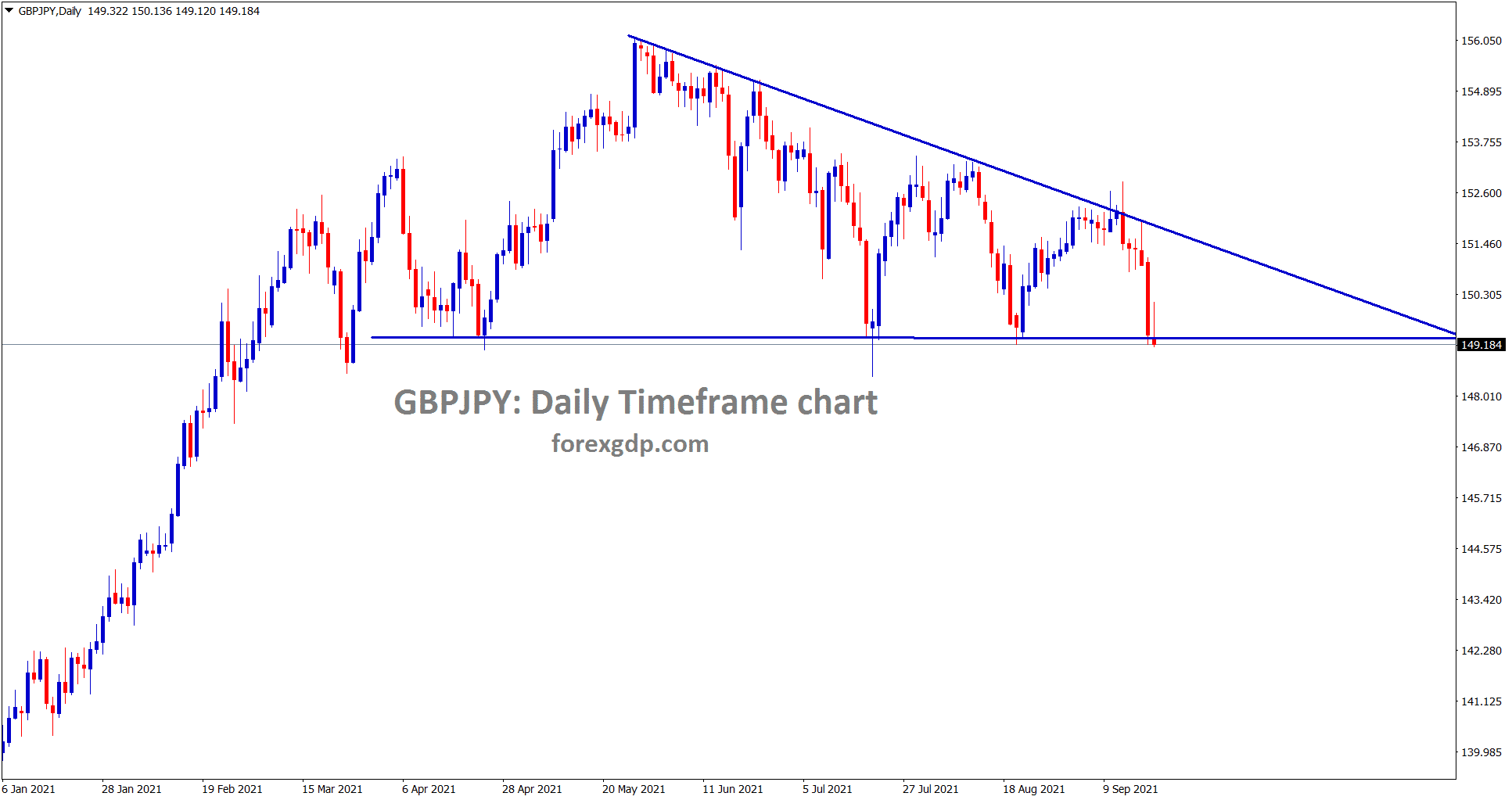

GBPJPY is standing exactly at the support area of descending triangle pattern.

UK Pound made lower about 2.5% from higher highs as US Dollar continuous in more robust pace.

China’s Real estate Giant Evergrande in Defaults of $300 billion is a big concern for the economy of China, and it is the second-largest GDP next to the US, who is facing a severe crisis in Real estate.

UK Public borrowings results came weak as expected this week, last August UK Pound Dropped to 20.5 billion, and this week we can expect latest numbers to 15.6 billion.

And also, Domestic data came in declined numbers in the UK and made UK Pound weaker in recent days.

Canadian Dollar: Canadian PM Third time Won in election

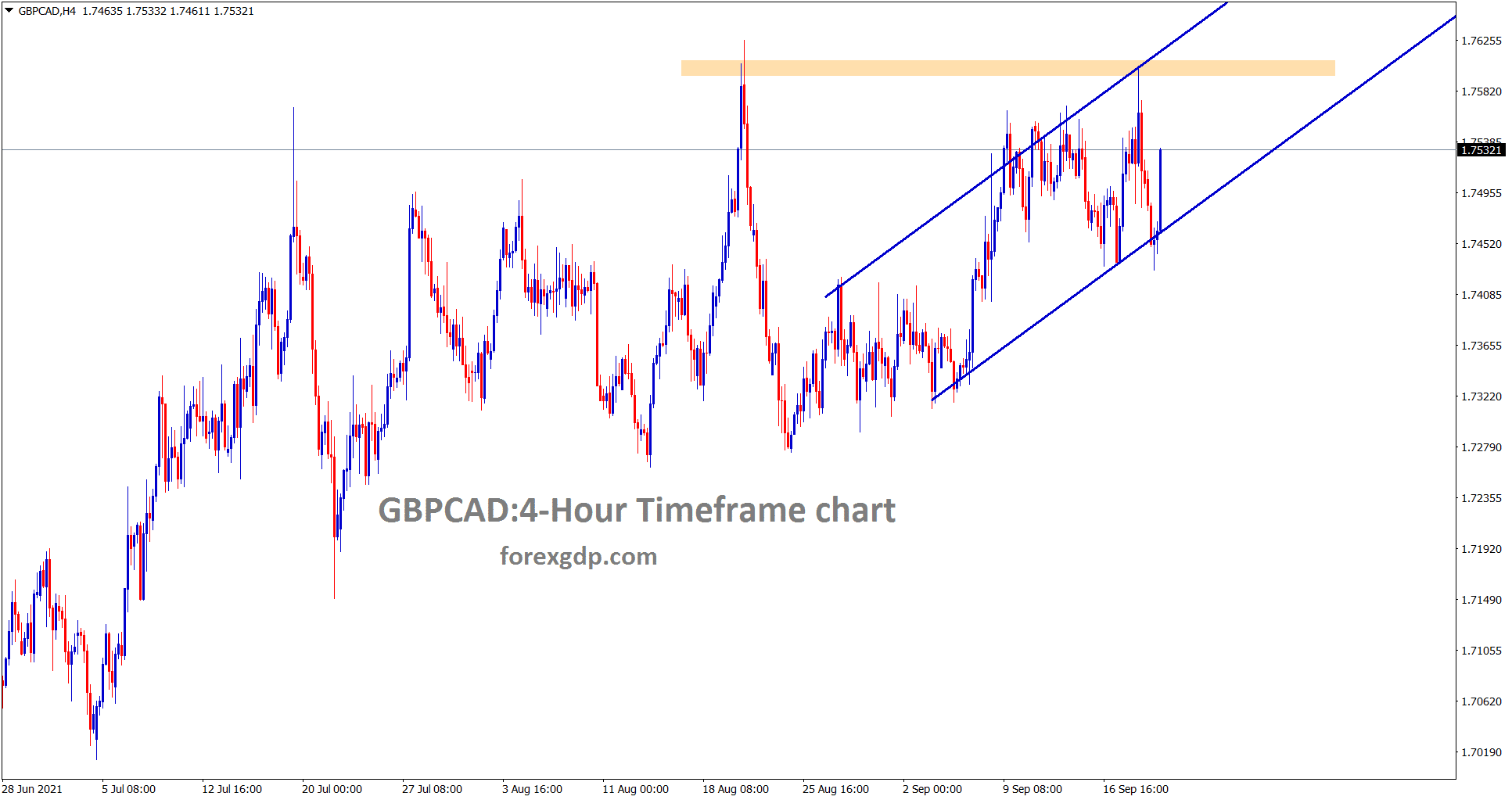

GBPCAD is still moving in an Uptrend within the channel ranges.

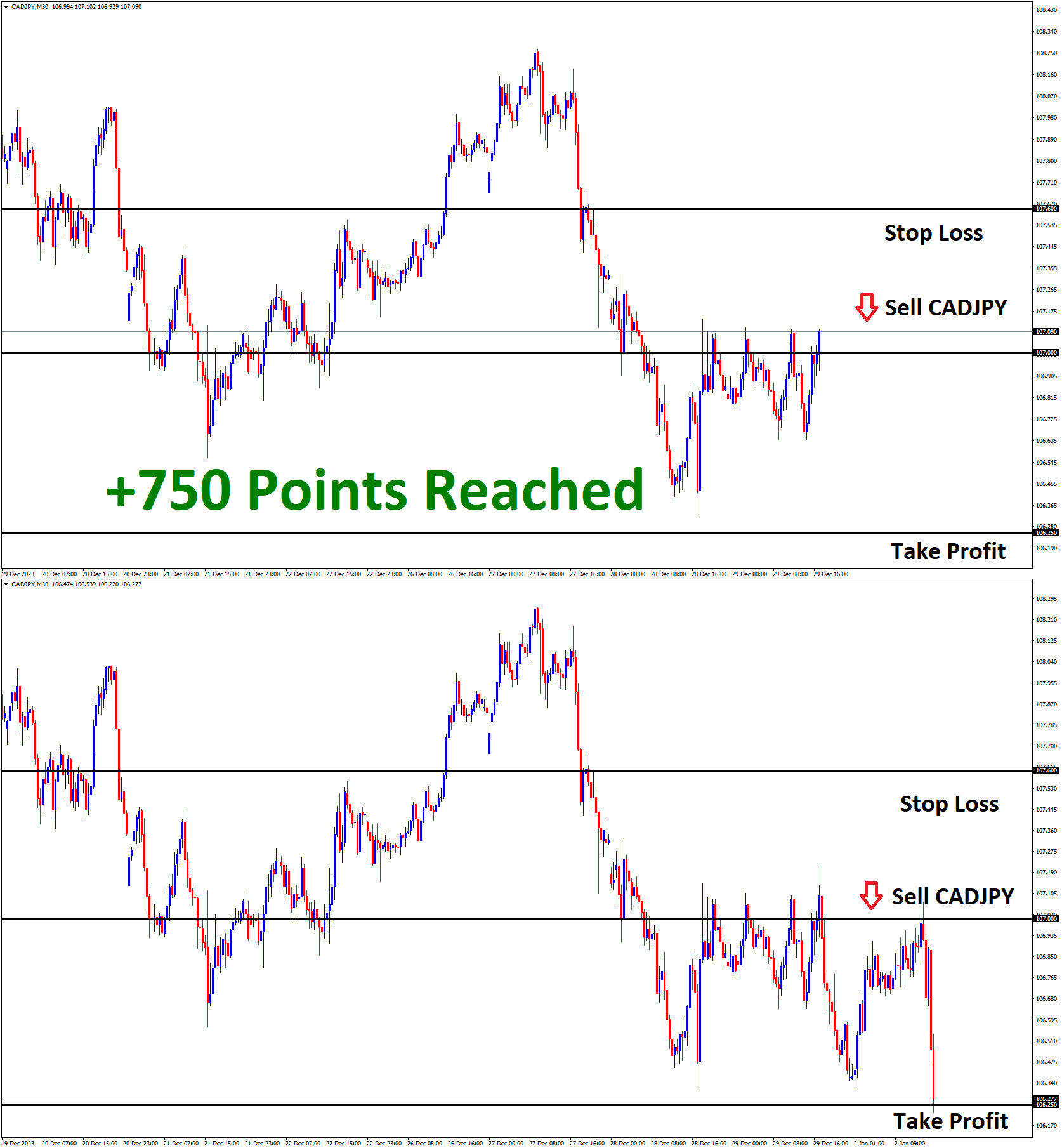

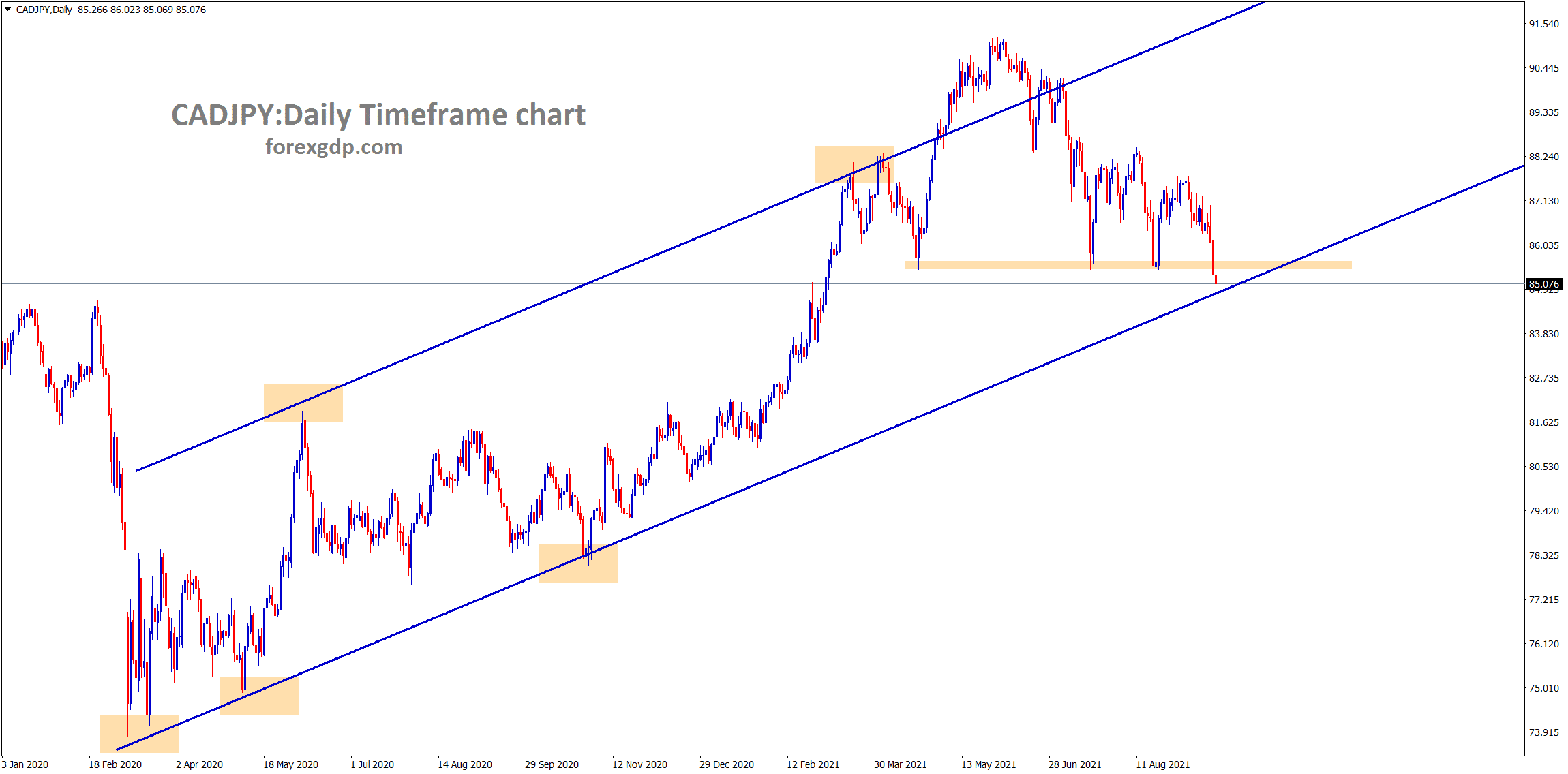

CADJPY hits the higher low area of the Uptrend line and the horizontal support area.

Canadian Dollar recover from lower low to Lower high as 1% jump after Current Incumbent Canadian PM Justin Trudeau wins for Third time with a lower majority.

Once again Canadian economy will recover in good shape as the Current PM is elected for the third time.

More tapering and rate hikes are possible under the Current PM are expected.

And also, Crude Oil prices are ticked higher as Demand recovers on the Global side; this will be helpful for revenues in the Canadian Economy.

So, Like New Zealand Dollar, the Canadian Dollar also reverted to Bullish momentum as expected.

And RBA meeting minutes happened today; no surprising news from the Meeting, the Same purchase of A$ 4 billion per week will be followed until February 2022.

Japanese Yen: Bank of Japan meeting Forecast

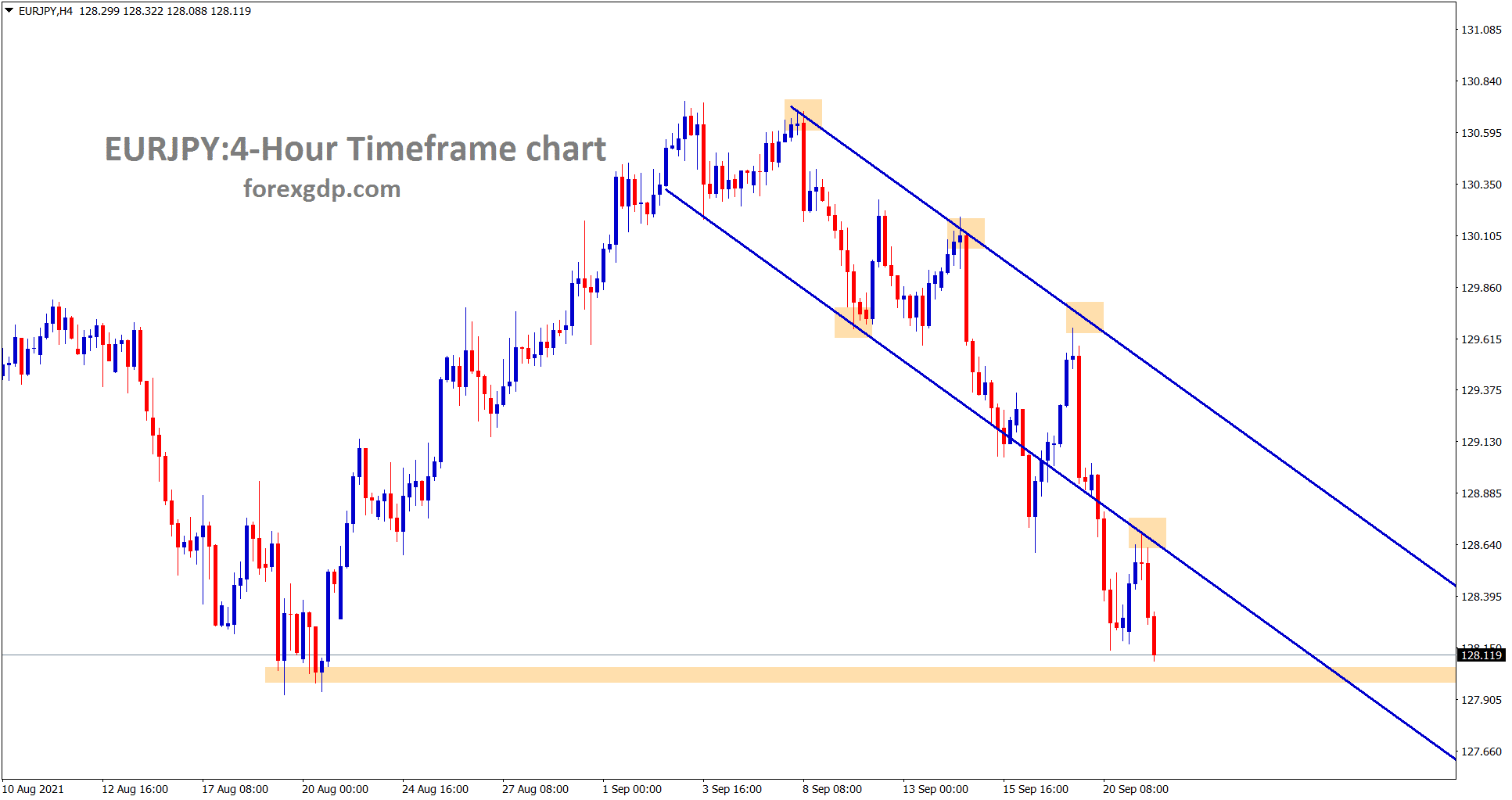

EURJPY is going to reach the horizontal support area – wait for reversal or breakout.

Bank of Japan Monetary policy meeting will happen tomorrow, and the expected outcome is -0.10% and Keep asset purchases at no changes.

Due to covid-19 Japanese economy faces more problems in Industrial production and Services sector side.

Inflation numbers are at 0.20% as against the Goal of 2% in the Bank of Japan.

Yet Japanese Yen plays stronger in the market as Chinese Giant Evergrande defaults of $300 billion; Now peoples are buying haven currency Yen as a stable asset.

Australian Dollar: Global cues made Aussie Dip more.

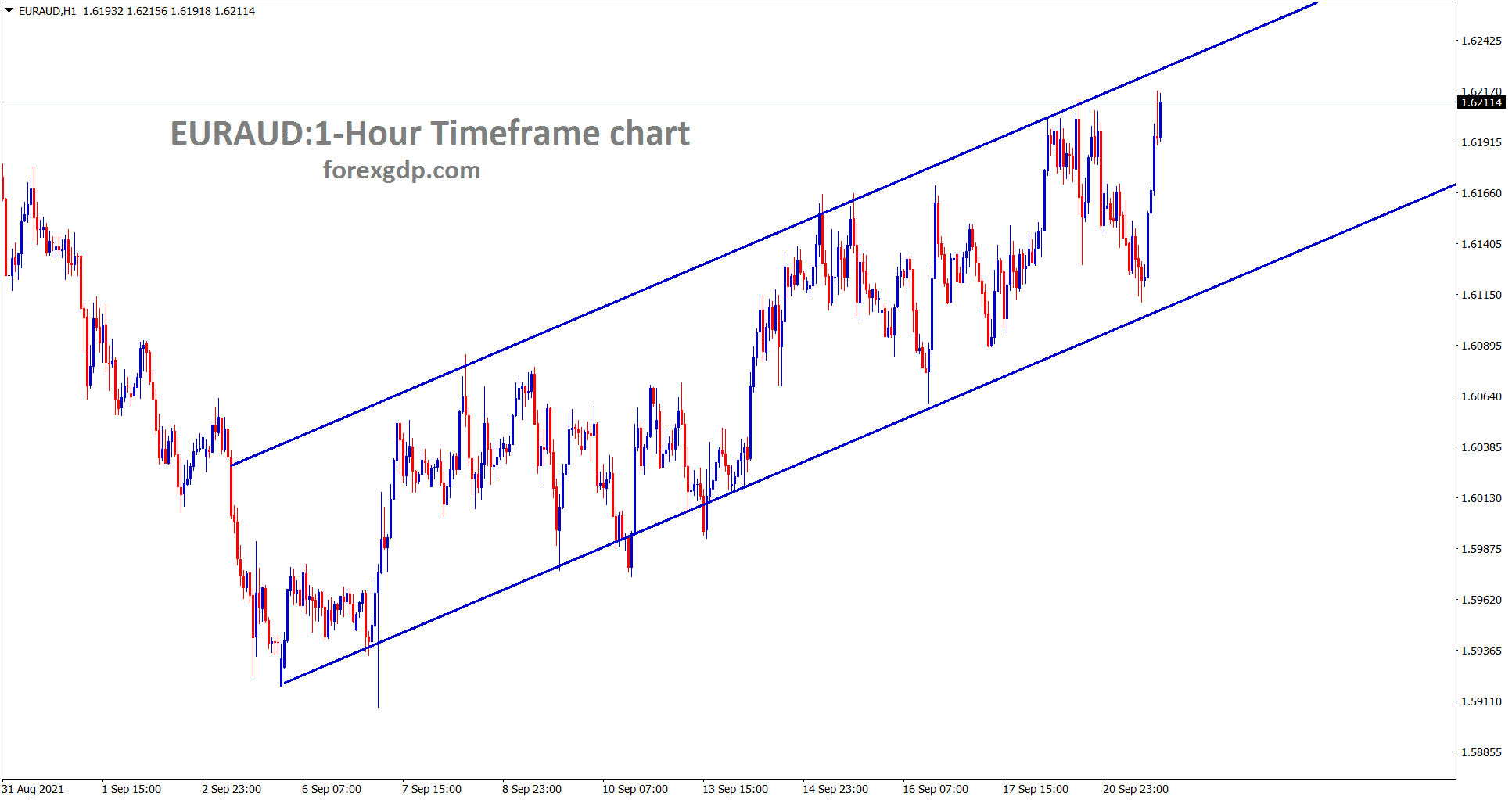

EURAUD is moving in an Ascending channel for a long time.

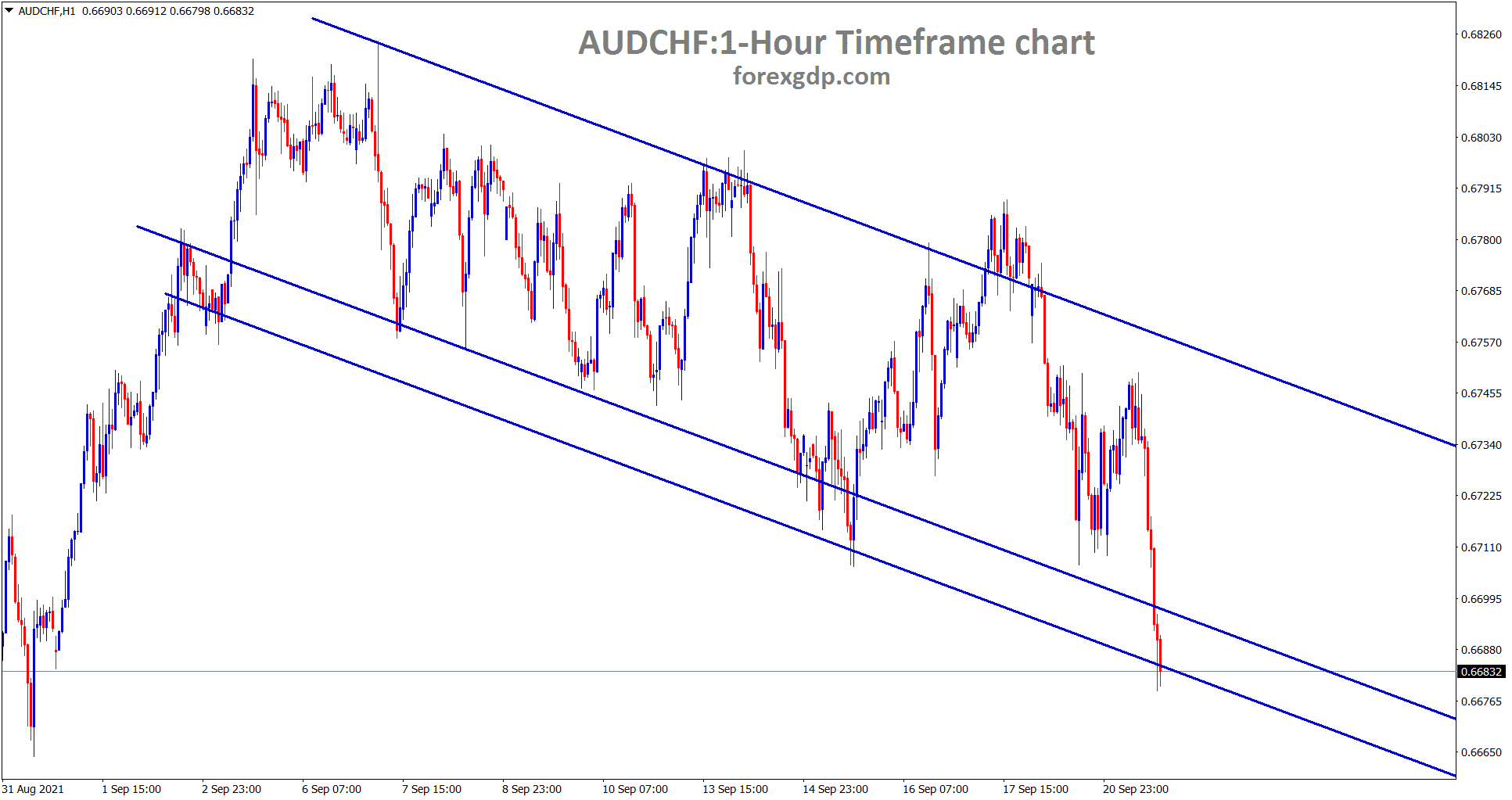

AUDCHF is moving in a clear descending channel.

Last week US Domestic data was softer than the CPI report released, and robust Retail sales data printed makes Aussie step down 2% from highs.

And Covid-19 cases were controlling in many cities step by step, New South Wales and Victoria shows moderate cases compared to last week Higher.

And also, Age under 16 vaccination progressing in Australia; once completed fully, lockdown release will be announced in the coming weeks.

Bank of Australia Governor Phillip Lowe said the economic contraction in Q3 as Covid-19 lockdown occurs in significant regions. But more expansion shows in Q4 is our Forecast view.

China is facing a default from the second-largest real estate company in China – Evergrande, which will form a concern for imports from Australia and New Zealand.

Bank of England monetary policy meeting happening this week, and no rate hikes until May 2022 is expected by analysts.

New Zealand Dollar: Lockdown releasing in major cities

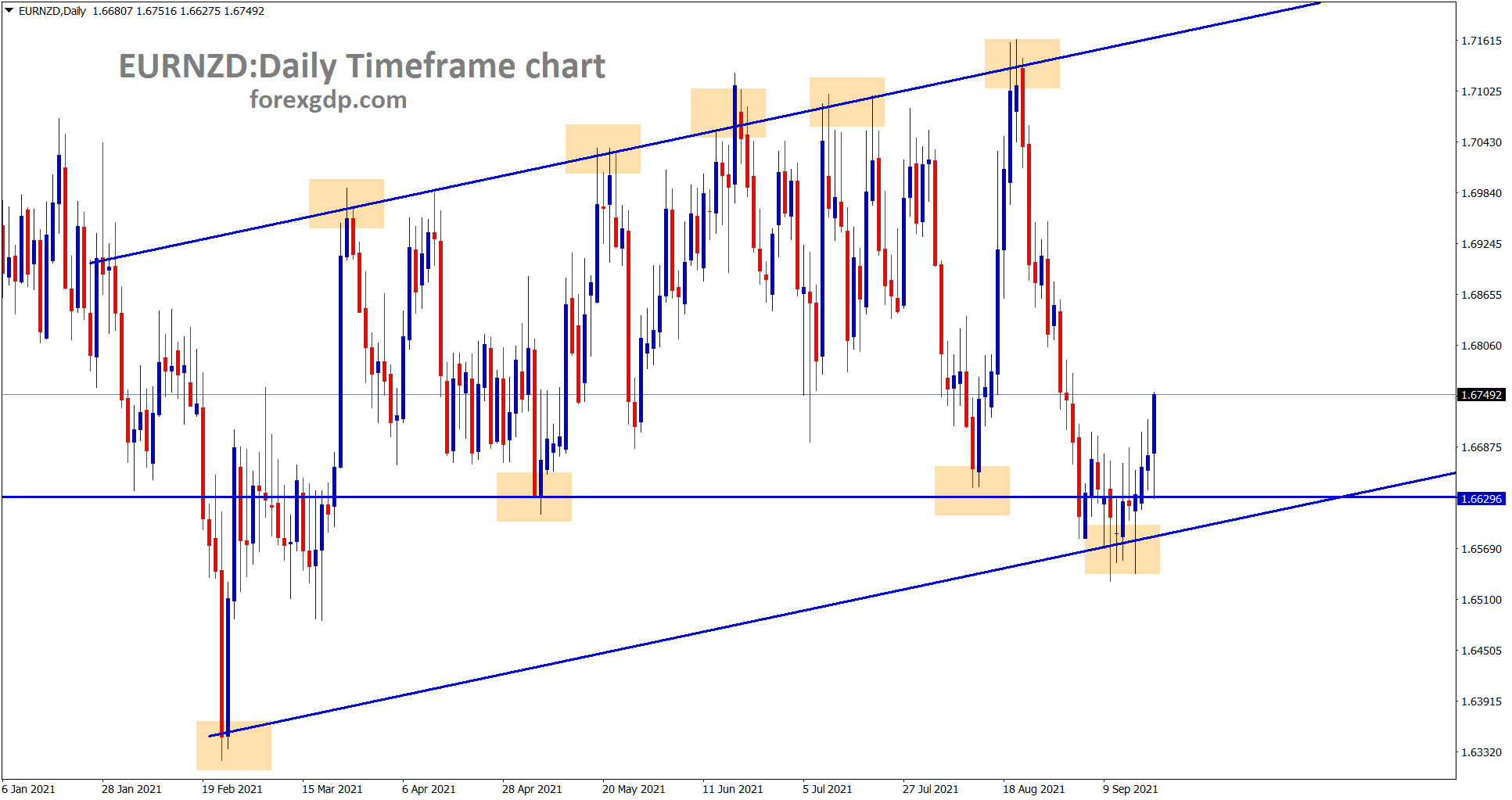

EURNZD is moving between the higher low ranges in the daily timeframe.

New Zealand Dollar shows declines of 1.5% from higher highs.

And New Zealand PM Ardern announced level 2 lockdown releasing in more cities, and Auckland is waiting for Scaling back from level 4 to Level 2 Lockdowns.

US Dollar shows dominant performance in Market as US Domestic data performed well.

China faced a real estate crisis and will impact imports from New Zealand, and it affected New Zealand Dollar in the short term.

Swiss Franc: Swiss Government Downgraded economy this year

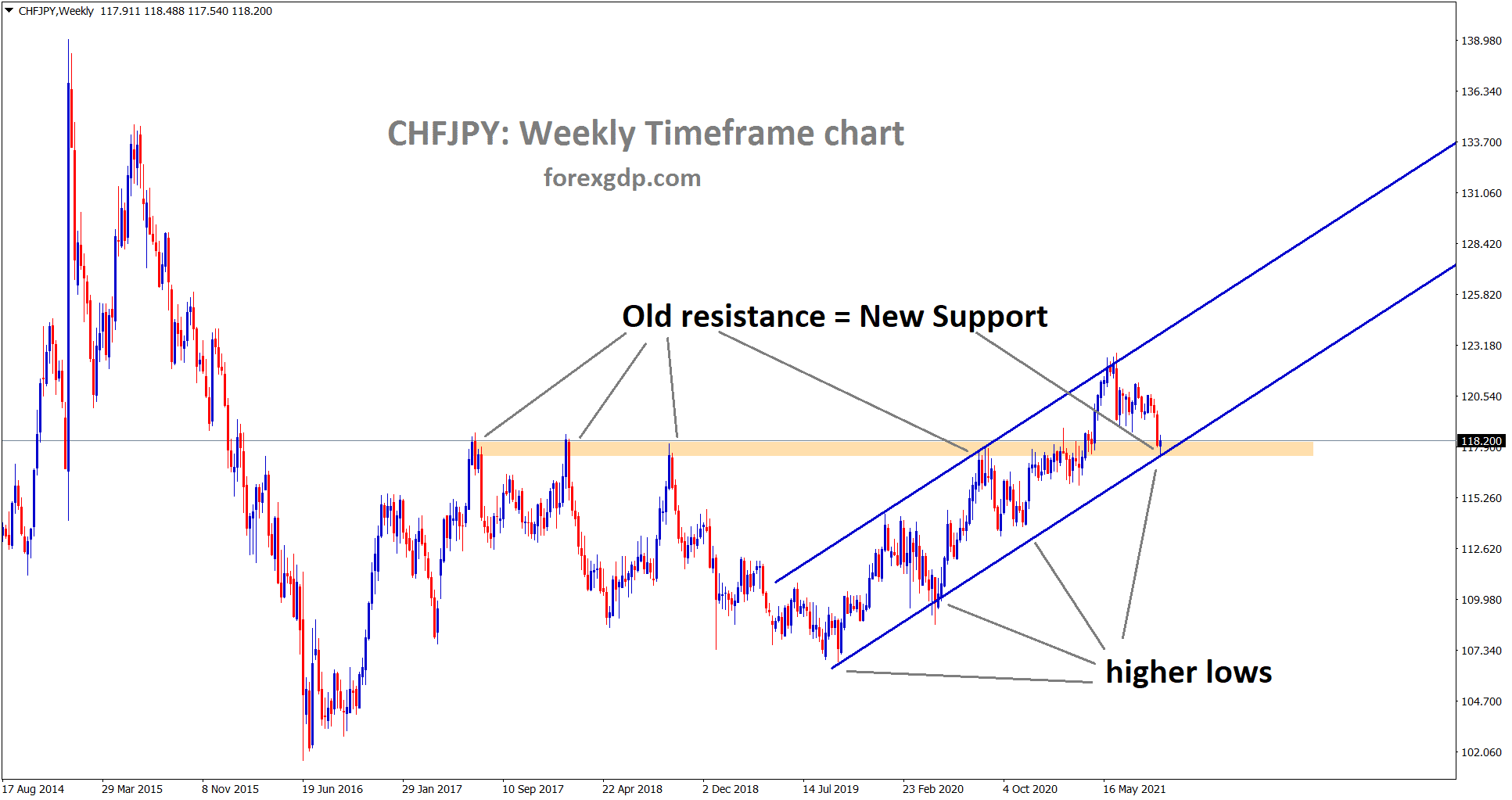

CHFJPY is standing now at the Old resistance which may have.

The Swiss Franc remains a haven currency as investors want to reduce risks from external factors.

And Recently, Foreign investments are flows in Swiss Stocks and kept Swiss currency to the higher side.

But Swiss Government downgraded its economic growth to 3.2% this year.

According to the Secretariat of Economic affairs shows less quick economic recovery in the market, Supply chain bottlenecks and Tightened Covid-19 measures; these are significant reasons behind the pull-down of the financial projections.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/