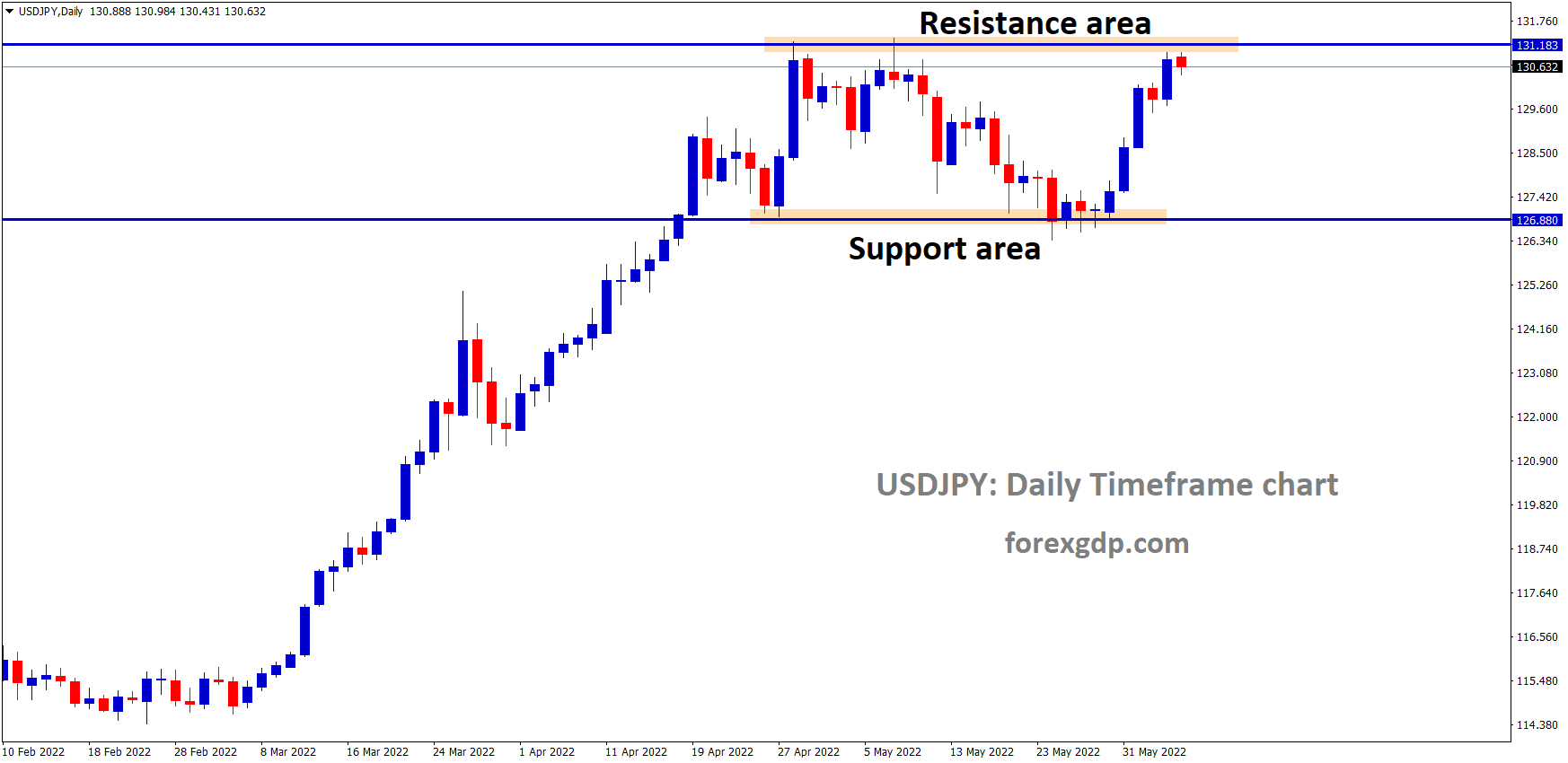

USDJPY Daily Time Frame Analysis: Market is moving in the Box Pattern and the Market has reached the Horizontal resistance area of the Pattern.

Where Is USDJPY Today

The USDJPY currency pair is struggling to grow in value following the recent speeches by the Bank of Japan and the Federal Reserve Bank. We can see that every now and then, the pair seems to gain slightly before falling back down to its regular values.

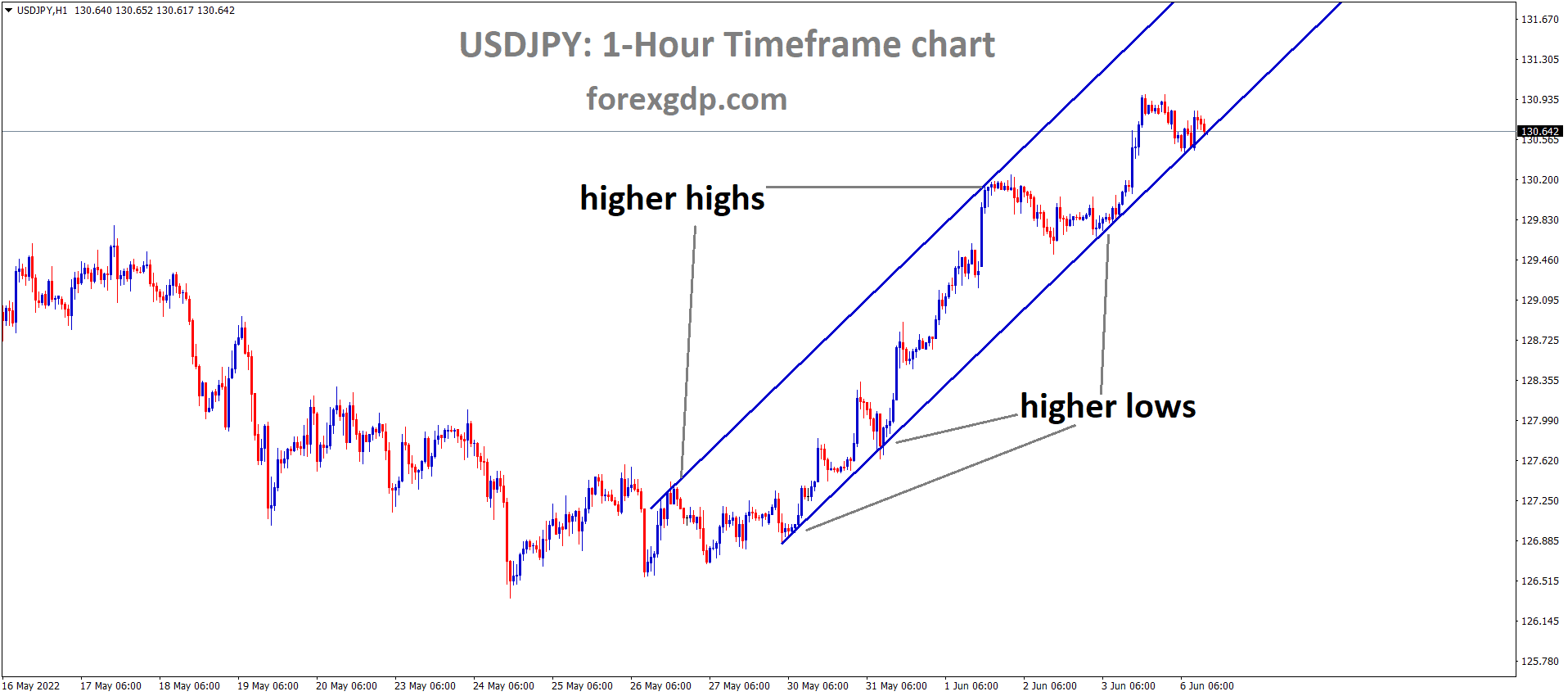

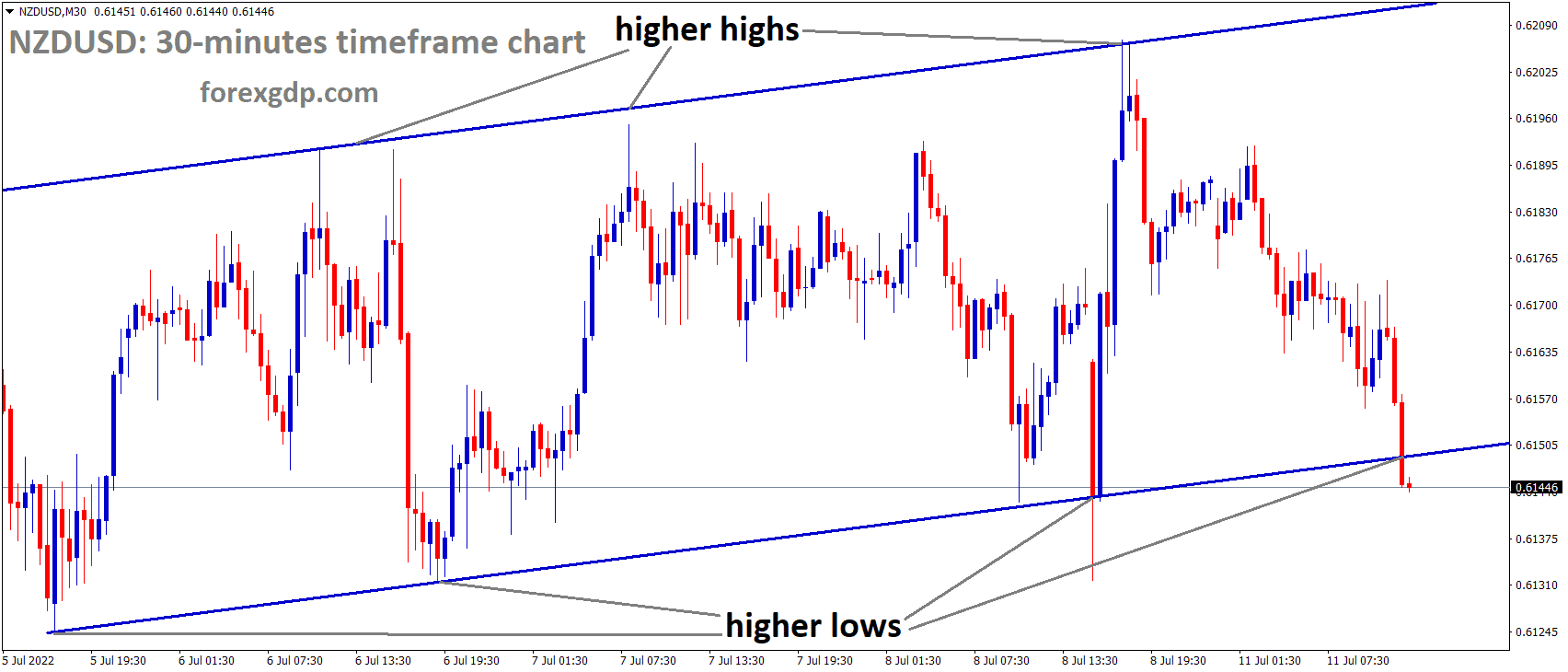

USDJPY M30 Time Frame Analysis: Market is moving in an Ascending channel and the Market has Fallen from the higher high area of the channel

Just today, we have seen the USDJPY pair fall as low as 130.4 but has since slightly recovered and is now teasing around the 130.6 region. At the moment, it seems as though this pair may continue to try and trend upwards. However, it is very unlikely that this will actually occur.

BOJ Kuroda Speech

Haruhiko Kuroda, the governor of the Bank of Japan, held a speech early on Monday where he revealed the upcoming monetary policy ideas that could potentially help bring Japan into a moment of price stability in all aspects of the country. He reveals, “Japan’s economy is still on its way to recovery from the pandemic and has been under downward pressure from the income side due to rising commodity prices. In this situation, monetary tightening is not at all a suitable measure. The top priority for the Bank is to persistently continue with the current aggressive monetary easing centered on yield curve control and thereby firmly support economic activity. Unlike other central banks, the Bank has not faced the trade-off between economic stability and price stability. For this reason, it is certainly possible for the Bank to continue stimulating aggregate demand from the financial side.”

He further reveals, “In order to provide a quantitative and easy-to-understand explanation of its projections for underlying inflation, the Bank included its forecasts for the CPI excluding fresh food and energy in the April 2022 Outlook Report. The forecasts show that the year-on-year rate of change in the CPI excluding both categories should increase in positive territory to around 1.5 percent for fiscal 2024, on the back of improvement in the output gap and a rise in inflation expectations. For prices to rise as projected and further toward 2 percent in a stable manner, it is necessary to create a virtuous cycle that generates synergy between wage increases and price rises, as I have explained today. I would like to close by noting that the Bank will take a strong stance on continuing with monetary easing, in that it will provide a macroeconomic environment where wages are likely to increase so that the rise in inflation expectations and changes in the tolerance of price rises — which have started to be seen recently — will lead to sustained inflation.”

FEDS Waller Speech

As we’re currently seeing a crash in the crypto markets, Christopher Waller, the governor of the Feds decided to hold a speech regarding the risks in the crypto markets and how to safely trade within them. He reveals, “New retail users, by definition, do not have crypto experience. They don’t know how to independently buy a crypto asset, how to obtain and protect a private key, how to conduct trades on a DeFi protocol, or how to write a smart contract. They need help, and for a price, a range of fast-growing exchanges, wallet providers, and other intermediaries are willing to provide it. But while intermediaries can potentially help monitor and manage risk, they can’t eliminate it. In such a volatile market, any user still has a meaningful chance of losing their money. From a social perspective, there is another possible outcome when losses become widespread: Those losses become practically, politically, or morally intolerable. When everyday investors start losing their life savings, for no reason except wanting to participate in a hot market, demands for collective action can mount quickly.”

He further states, “History shows that there will be demands to make individual investors “whole” by socializing their individual losses. We saw it just a few weeks ago after what can only be described as a run on the Terra ecosystem when everyday users were seeking restitution and even experienced DeFi players were discussing ways to compensate retail investors.

USDJPY H1 Time Frame Analysis: Market is moving in an Ascending channel and the Market has reached the higher low area of the channel.

Society wants to regulate new and poorly understood markets for financial products. It’s not to protect high-net-worth investors but to protect society from the often-irresistible pressure to socialize the losses of investors with limited resources and to limit the spread of financial stress.8 The desire for a backstop can emerge even in an isolated failure—to say nothing of a systemwide event—when uncertainty or private information moves stress from one asset class to others. By definition, those financial externalities—which central banks, including the Fed, monitor closely—can create losses that innocent parties never signed up for and couldn’t have controlled.”

US Oil Debt

We’ve talked about the US supplying crude oil to Europe a couple of times previously. They are only doing so in order to make Europe stop getting their supply from Russia. However, it was revealed late last week that the US is struggling to maintain its own oil reserves as most of it is being shipped off to the EU. Due to this, the US is looking for other ways to fulfill its promise to the EU of supplying them with oil. Early on Monday, it was revealed that the US is now using the help of Venezuelan oil in order to fulfill its promise to the EU. The Italian oil company Eni and Spanish oil company Repsol will be responsible for shipping this oil to the EU.

Analysts at Reuters reveal their thoughts on this new three-way, multiple-country contract. They state, “The volume of oil Eni and Repsol are expected to receive is not large any impact on global oil prices will be modest. U.S. President Joe Biden’s administration hopes the Venezuelan crude can help Europe cut dependence on Russia and re-direct some of Venezuela’s cargoes from China. Coaxing Maduro into restarting political talks with Venezuela’s opposition is another aim. The two European energy companies, which have joint ventures with Venezuelan state-run oil company PDVSA, can count the crude cargoes toward unpaid debts and late dividends.”

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade setups at Premium or Supreme plan here: https://signal.forexgdp.com/buy/