Can any anyone explain why not very many brokers succeed in the Forex trading environment while the stupendous lion’s share of dealers neglect to make progress?

In spite of the fact that there is no hard response to this inquiry, there are a couple of things that will put you one stage ahead and will put the chances to support you.

Mistakes are part of any profession. It can happen at any time, in any situation. As an industry like Forex involves a lot of money, a single mistake can ruin the overall process. All traders should try to avoid mistakes and take the right steps during operating the trade setups.

Newbies always try to get success within a very short time and sometimes they can succeed. But a lot of them face some tremendous difficulties while going through this platform.

The fundamental reason for this article is to guide you through some essential parts of Forex trading. In any case, differently, rather than letting you know what to do or the most ideal approach to do it, it will let you know what to keep away from. Some of the time it is ideal to recognize the principle disadvantages on control and after that disconnect them so we have the best results at a sure level of advancement.

1. The quest for the Holy Grail

Numerous brokers put in forever and a day attempting to locate the Holy Grail of exchanging. That enchantment marker or set of pointers, just known by a couple of merchants, that will make them rich in a brief timeframe.

Reality: Well, there is no enchantment marker, nor an arrangement of pointers that will make anybody rich in a brief timeframe. The fundamental reason of this is on the grounds that market changes, each and every minute is exceptional. Each Forex exchanging framework will come up short now and again. Our work here is to discover a Forex exchanging framework that fits our identity as merchants, generally the dealer will think that its difficult to tail it.

2. Searching for Easy Money

Tragically most merchants are pulled in to the Forex market therefore. For the most part due to the reputation appearing or somewhat attempting to demonstrate how simple is to exchange and profit in the Forex market.

Actuality: Yes, it is anything but difficult to exchange, anybody can do it. It is as hard as a single tick. Yet, the second a portion of it isn’t that simple. Profiting or accomplishing predictable beneficial results is hard. It requires loads of instruction, tolerance, control, duty, and this rundown could go to unbounded. In a couple words, it is conceivable to have predictable gainful results, yet unquestionably it is difficult.

3. Searching for Excitement

Some different dealers are pulled in to the Forex market or whatever other money related business sector in light of the fact that they think it is energizing to be a merchant.

Actuality: Yes, it is extremely energizing to exchange the Forex market. Be that as it may, if this is the fundamental reason you are as yet exchanging the Forex business sector, at some point or another you will find the most costly enterprise you have ever known. Do some reasoning on it.

4. Not Using Money Management.

Most brokers disregard this imperative part of exchanging. They think they shouldn’t be utilizing cash administration until they accomplish steady productive results. They absolutely disregard the danger side of exchanging.

Truth: money management in Forex permits your benefits to increment geometrically, additionally restrains your danger on each and every exchange. Cash administration lets you know the amount to chance on every exchange. Utilizing cash administration is an absolute necessity on the off chance that you need to accomplish you’re exchanging objectives. By utilizing cash administration you ensure you will be ready to exchange tomorrow, the following week, month and the next years.

5. Not Being Psychology Tuned

This is a standout amongst the most thought little of subjects with regards to exchanging. One of the primary standards of money related markets is that the cost of every instrument depends on the impression of every individual member “the group.” at the end of the day the cost of every instrument is dictated by the apprehension, insatiability, sense of self and any desire for all brokers.

Truth: Being mindful of every mental issue that influence the choices made by merchants will put the chances to support you.

6. Absence of Education

Instruction is the base of learning on each order. As legal counselors and specialists require quite a long while of school until they get their degree, Forex dealers additionally require long years of study. It is ideal to have somebody encountered to guide you through your exchanging, following some data could take you in the wrong way.

Actuality: The business sector shows us important lessons on each and every exchange made. The procedure of instruction for a Forex dealer could take for ever. Truth is stranger than fiction, we never quit learning. We ought to be unassuming about the business sectors and our insight; generally the business sector will demonstrate us off-base.

7. Fail to set the accurate plan

In every aspect of life, success will be denied if the right pan is not followed. In this sector of online earning, it is more difficult to achieve success without an accurate plan. So, the first and foremost duty of the traders is to make a plan for the upcoming activities. A proper plan will include the management process and effective forex trading strategies. It will also help the investors to select the suitable trade and exit the wrong one. Always try to get the target and minimize the loss. It will be possible if you can make a good and effective plan for operating the activities regularly. But be careful while selecting the broker. Try to open the trading account with the best Forex broker like Rakuten to avoid any technical problems.

8. Not using the stop losses correctly

Even the success rate is almost a hundred percent, the traders should use the stop losses. As the market is highly volatile, the condition can change at any time. The national bank of Switzerland was once informed about the decreasing value of their currency. The event shocked everyone who was involved in Forex trading. In that case, the traders who did not use the stop losses were in great loss. If you are unwilling to use the losses, then this incident can be a great example. Try to use the stop loss correctly and regularly then the desired profit will come

9. Add the unprofitable trade setups

It is another wrong step that is taken by the investors. They are not interested in analyzing the deals which are profitable, and which are not. As a result, the outcome is negative sometimes. The position size is an important thing that should be known by the traders before involving in trade deals. Sometimes the unbiased judgment can lead the traders to the ultimate loss. The same loss can happen if the investors increase the stop losses during unprofitable traded deals.

Most of the time this thing can end up with a loss. Try to stick to the initial decision and that will be more effective for making a good profit. Be aware of the closed trades and make some decisions by using interpersonal skills and pieces of knowledge.

10. Lack of training about risk management

The traders who do not use the rules for managing the risks are risking their whole careers. You can have a lack of basic rules and pieces of knowledge but a single wrong step about money and risk management can create a lot of hamper for the career. Try to train yourself for managing risk and uncertainty and make a profitable career.

As the financial industry is very complicated due to the chance of earning money, the traders should be aware of the wrong steps. After taking suitable action against the wrong steps, they will get a good and profitable career.

11. 17 reasons from top traders on why you keep losing money

- You are greedy.

- You fear and panic while trading.

- If you think about Rewards(profits), your greediness may increase, If you think about Risk(losses), your fear may increase.

- You don’t want to accept any losses in your trade.

- You think yourself that you are a smart trader. Because, you made some big profits before in some trades.

- You always think about the profit and don’t think about risk and stop loss.

- You close your profits faster, but you are sitting in losses for a long time.

- You are very selfish while trading. (You think only about your trade order, and you never think about market situation)

- You looking to earn money in forex without learning the market in correct way.

- You are dreaming to earn Big Profits in Forex, But you are not ready to learn forex market in correct way.

- You start to dream for spending on your needs, without getting your forex profits in your hand.

- You never accept your mistakes, you simply blame the market for your own mistakes.

- You comparing yourself with Other Forex Traders.

- You still don’t understand the “loss is the part of the Trading Business”. To be a Successful trader, You need to make More Profits and Small Losses.

- You believe on Indicators (or) EA’s without knowing about their working process Completely.

- You still getting more excitement everyday while trading. Note : The Excitement really comes from, not knowing what is going to happen next.

- You are ready to earn money from forex, but you are not ready to learn forex completely.

Conclusion

These are the absolute most vital obstructions each dealer confronts when attempting to exchange effectively.

Exchanging effectively the Forex markets is no simple errand, it requires a considerable measure of diligent work to do it right, yet with the right training, you will put yourself closer to your exchanging objectives.

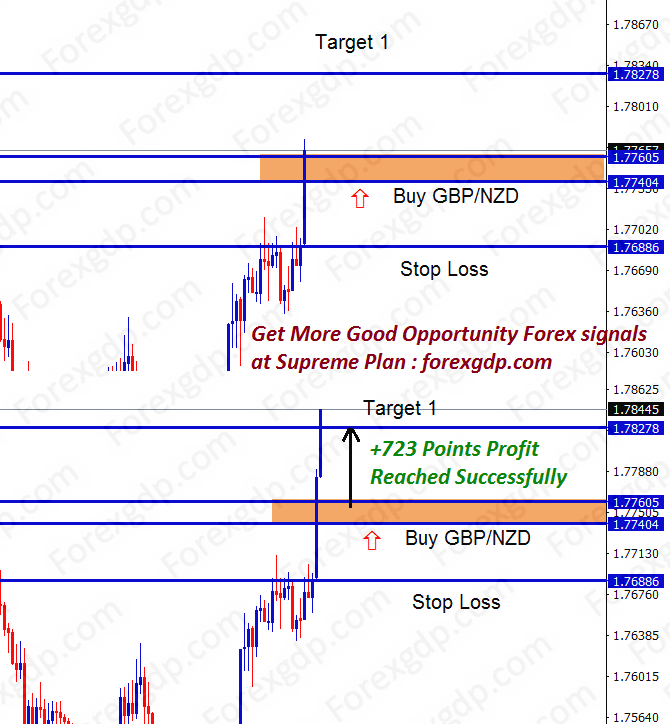

If you like to receive the best forex signals at good trade setup, you can Try free forex signals. (or) if you need additional important trade signals with high accuracy, Join now in Supreme or Premium forex signals plan.

If you want to learn trading from 20+ years expert traders, Join forex trading course online now.

Thank you.