Gold: Core PCE data

XAUUSD has breakout and retest at the Ascending Triangle pattern

US Core durable goods printed at 2.8% up from -1.3%. No changes happened in US GDP 6.4%.

But Core PCE index for May month expected reading is 3.4% from a 3.1% rise in April month.

And US Baseline inflation target is 2% and the above range is feared for the economy.

But we Don’t need to worry for inflation reading came higher because FED told in an earlier meeting that Inflation rising is transitory, wait for patience until 2022 end.

Gold prices headed to another plunge to 1674$ in July month as US Dollar continues to rally for 95$.

US DOLLAR: Core PCE inflation data

EURUSD is moving in an Uptrend forming higher highs and higher lows

US economy makes upturn from covid-19 pandemic crisis now as inflation and employment numbers reported in Higher numbers. This week Friday Core PCE personal consumption expenditure measures the gauge of inflation point.

If comes higher US turns positive and the counter pairs remain negative.

Rising interest rates may start in December 2022 and gradual grow up in March 2023.

As Inflation numbers heat the economy from Growing up and more valuable currencies should maintain inflation numbers in a controlled phase.

And Economy expansion showing by industrial outputs and employment rate readings.

Personal consumption spending more means economy is growing up as lockdown released. On one side personal consumption is higher other side Manufacturing cost of products fixing higher.

Due to this is scenario Inflation is made higher from Demand and supply mismatches.

US President Bipartisan deal on infrastructure plan

US President goes for a Bipartisan deal for Infrastructure spending of $1.2 trillion in the senate.

And Senators from Republican parties give more objections to spending and if they don’t finalize an agreement, Democrats will do alone without the republican vote in the senate.

Here there is no guarantee of success and new policy legislation will not be accepted by the Republican parties.

But the news from both parties Democratic and Republican parties from the senate said they are close to an infrastructure deal.

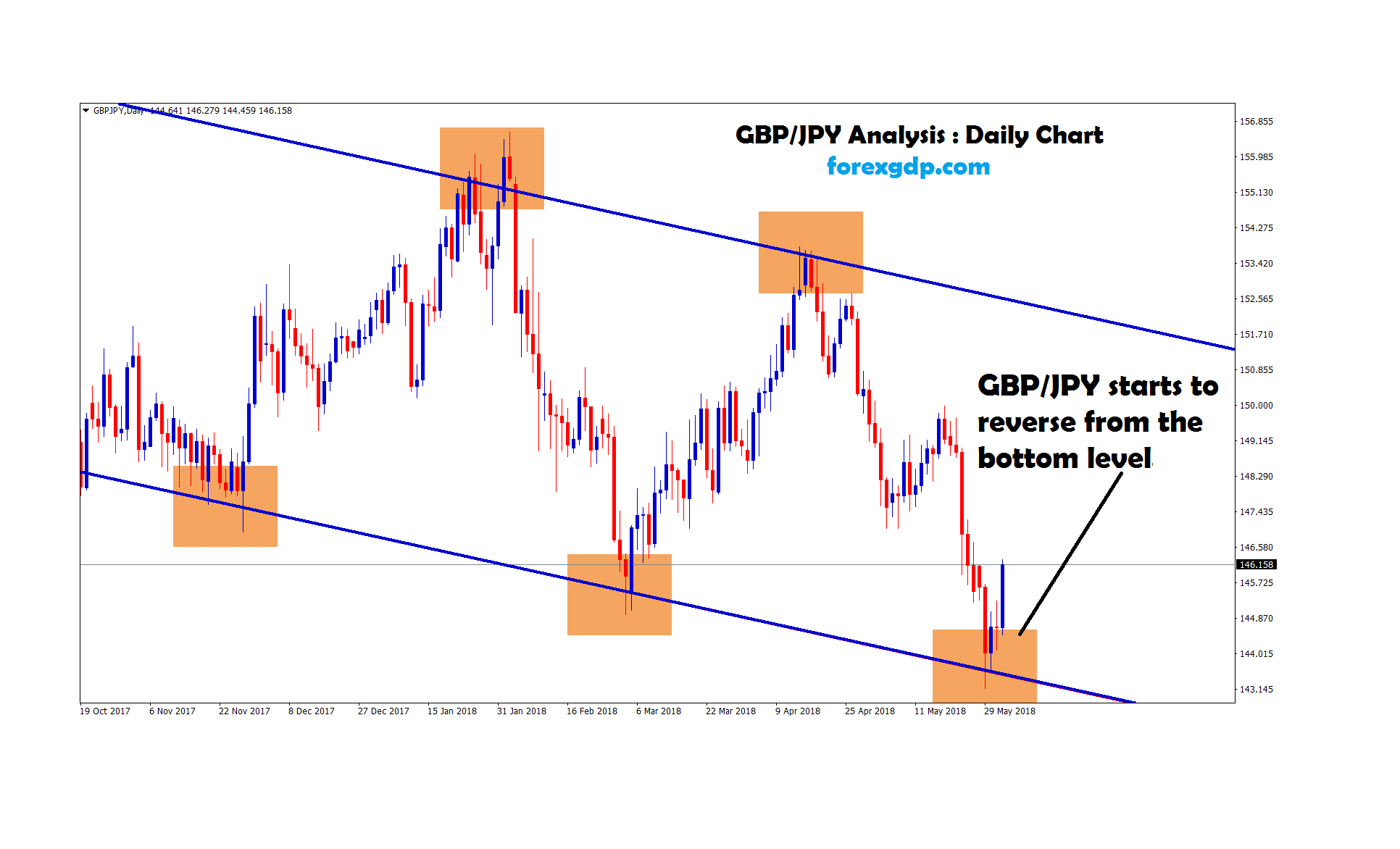

UK Pound: Bank of England meeting

GBPCHF is moving in an Ascending channel range forming higher highs and higher lows

Bank of England policy expectations are left interest rates unchanged at 0.1% and Asset purchases at GBP 895Billion.

In asset purchases BoE’s chief economist Andy Haldane voting in Favour of tapering GBP50 billion from QE; Moreover, this proposal will be dismissed by other members as expected.

UK employment rate down to 4.7% from 4.9% as good growth showing,

GDP Figures beat expectations since last summer at 2.3%.

More Hawkish tone from Haldane and other Voting members remains Neutral and Dovish tone. Tapering of GBP50 billion is doubt as Economy is now only turning to grow mode from crisis after lockdown eased.

EURO: German IFO index

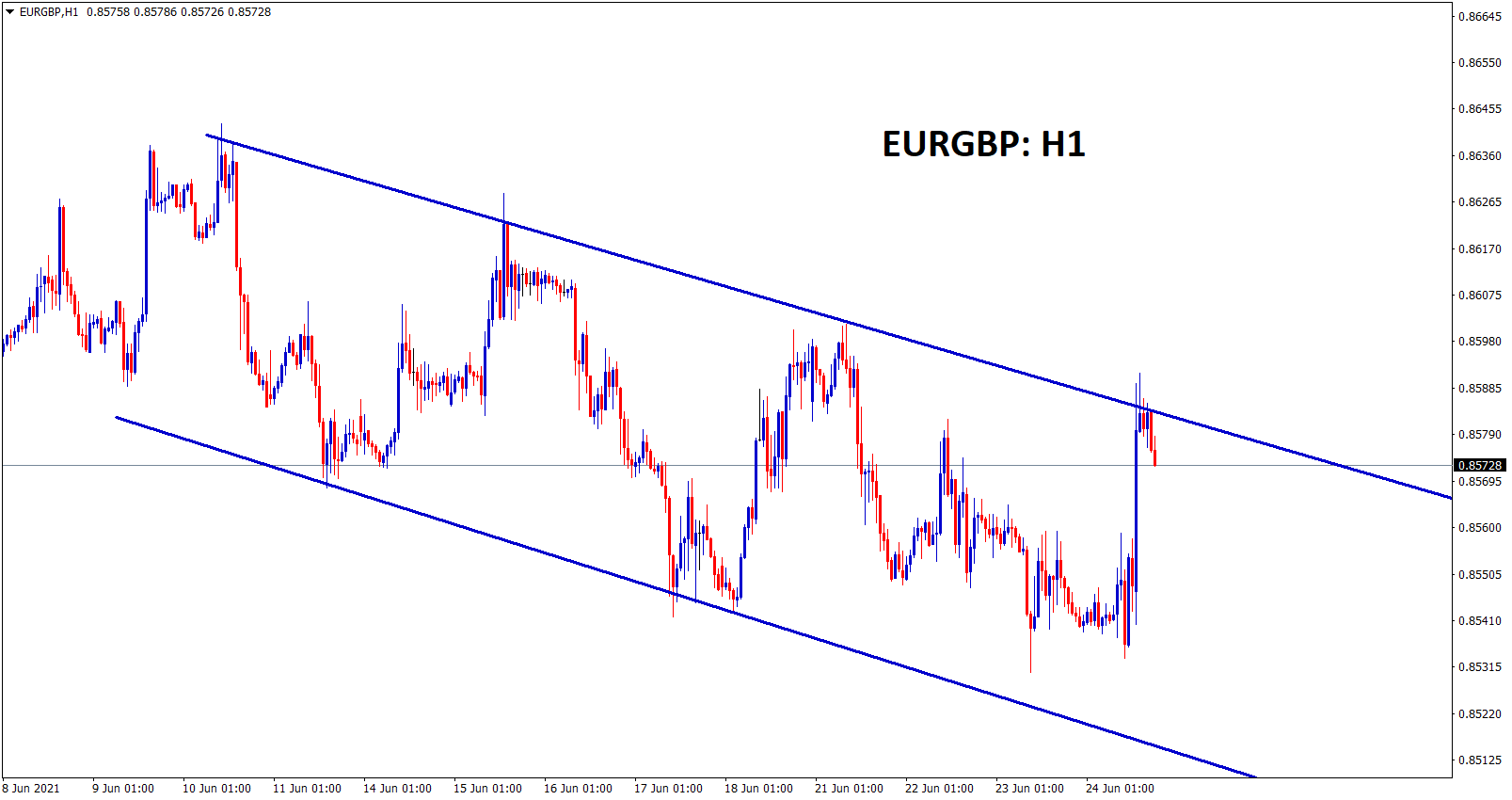

EURGBP moving in a descending channel price ranges

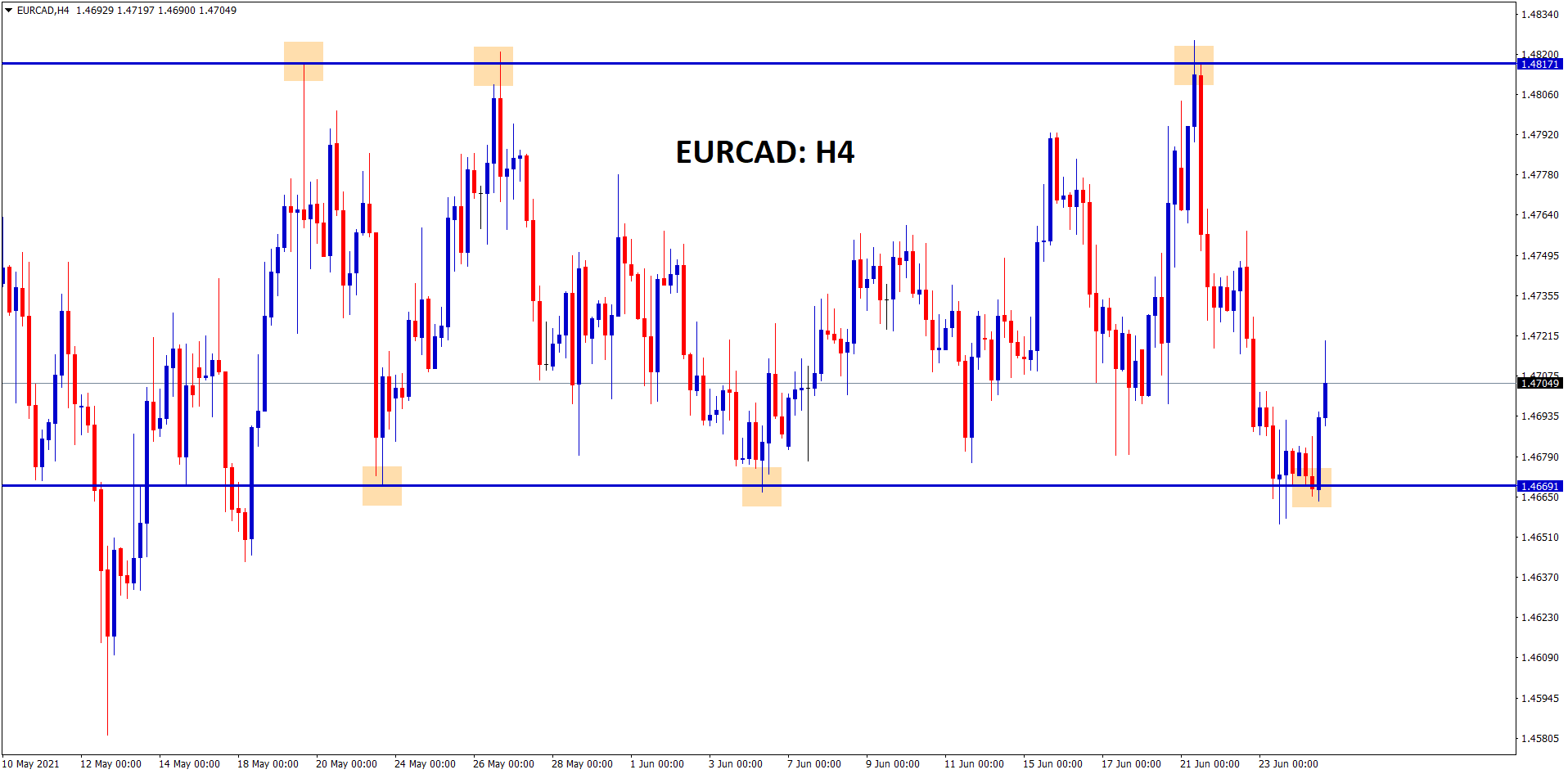

EURCAD is moving up and down between the resistance and support level range

In Eurozone, the German IFO business climate index came at 101.8 in June month versus 99.2 last month and beating the estimated reading of 100.6.

The current economic assessment came at 99.6 higher than 95.7 in the previous month.

And IFO expectations index shows coming in the next 6 months and it’s improved to 104 in June than the previous month expectations of 102.9.

IFO business climate takes the survey of 9000 monthly responses from Firms in manufacturing, services and constriction.

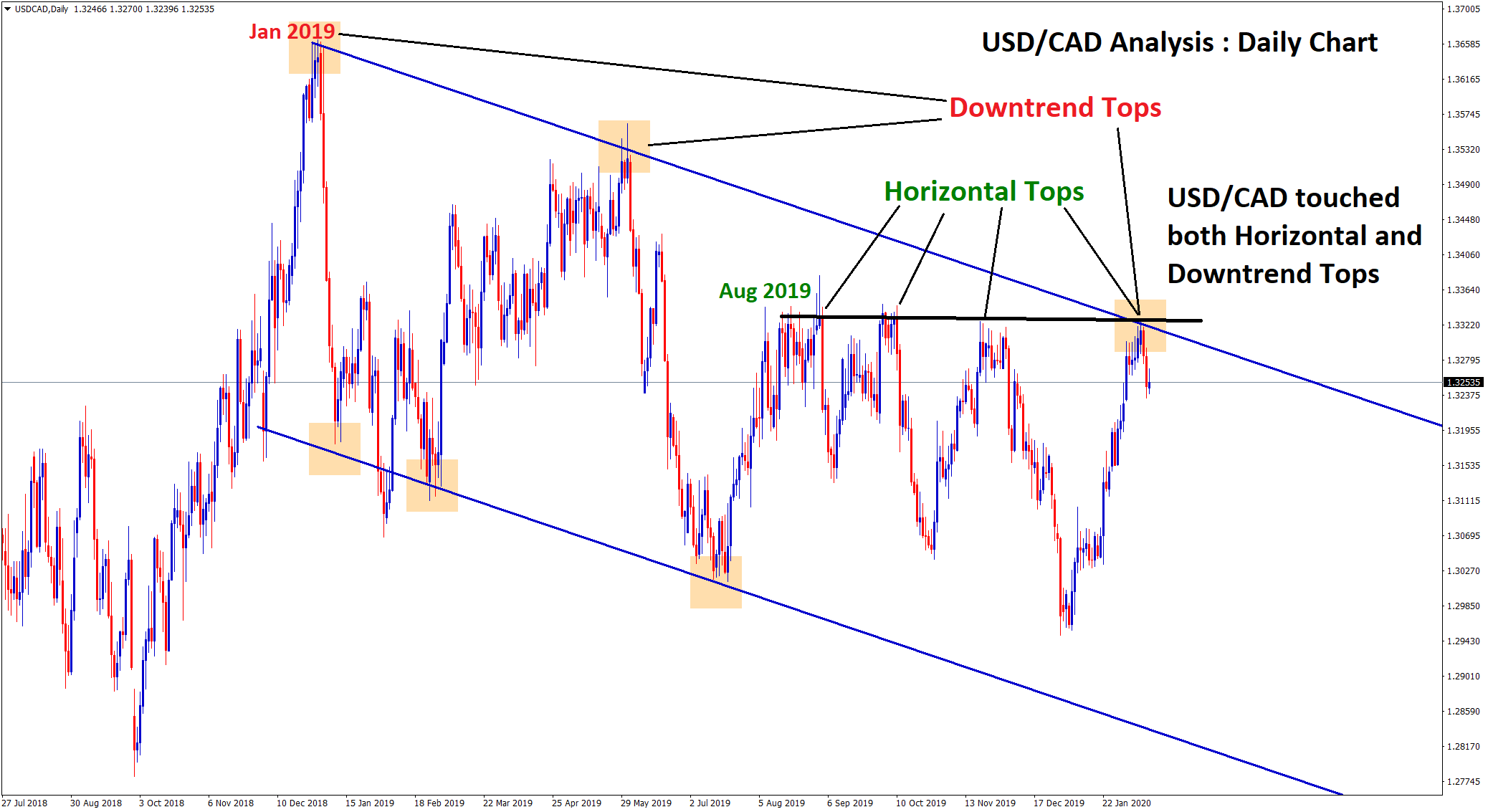

Canadian Dollar: Retail sales data

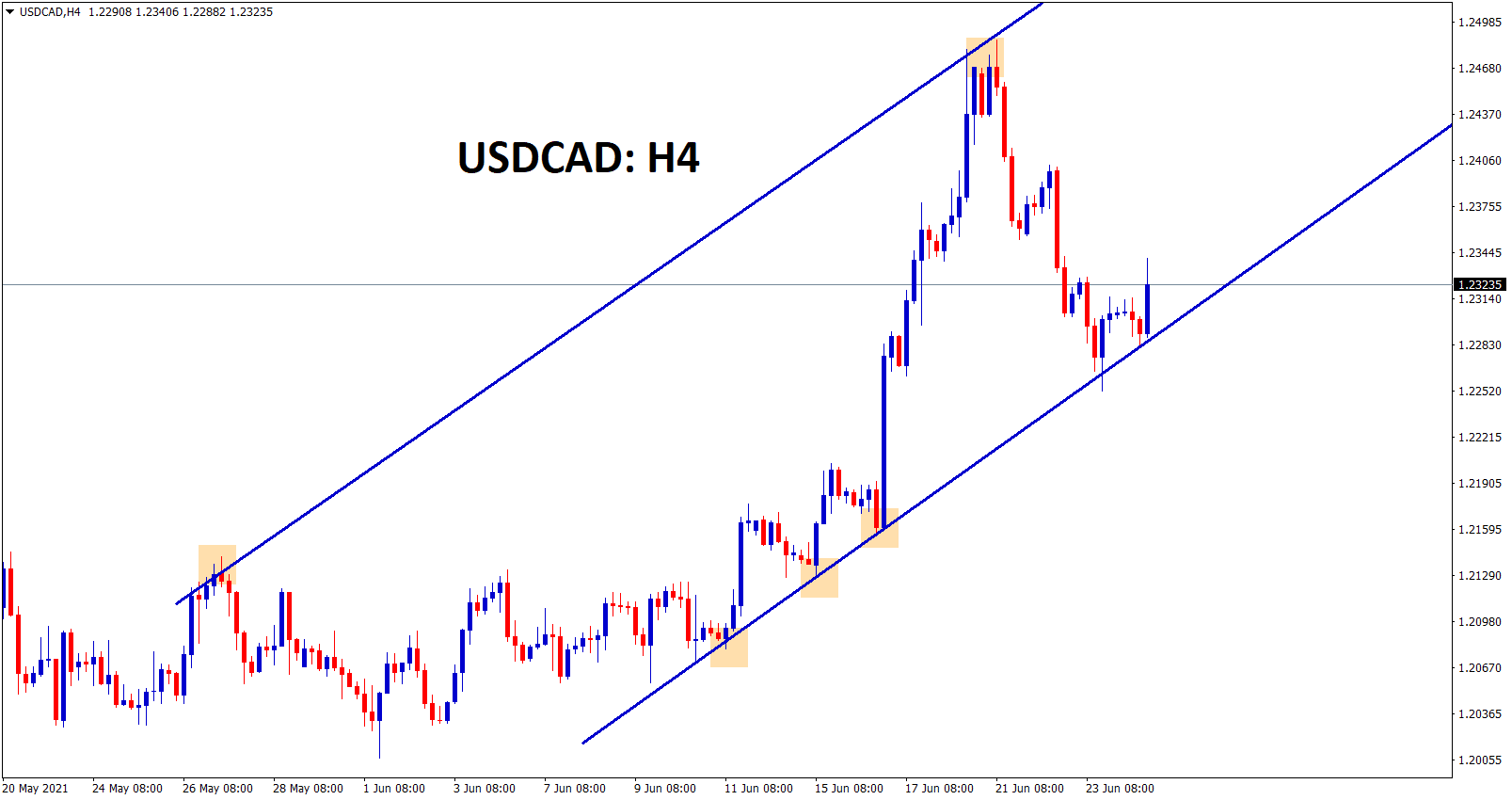

USDCAD is moving in an uptrend range, after hitting the higher low went up.

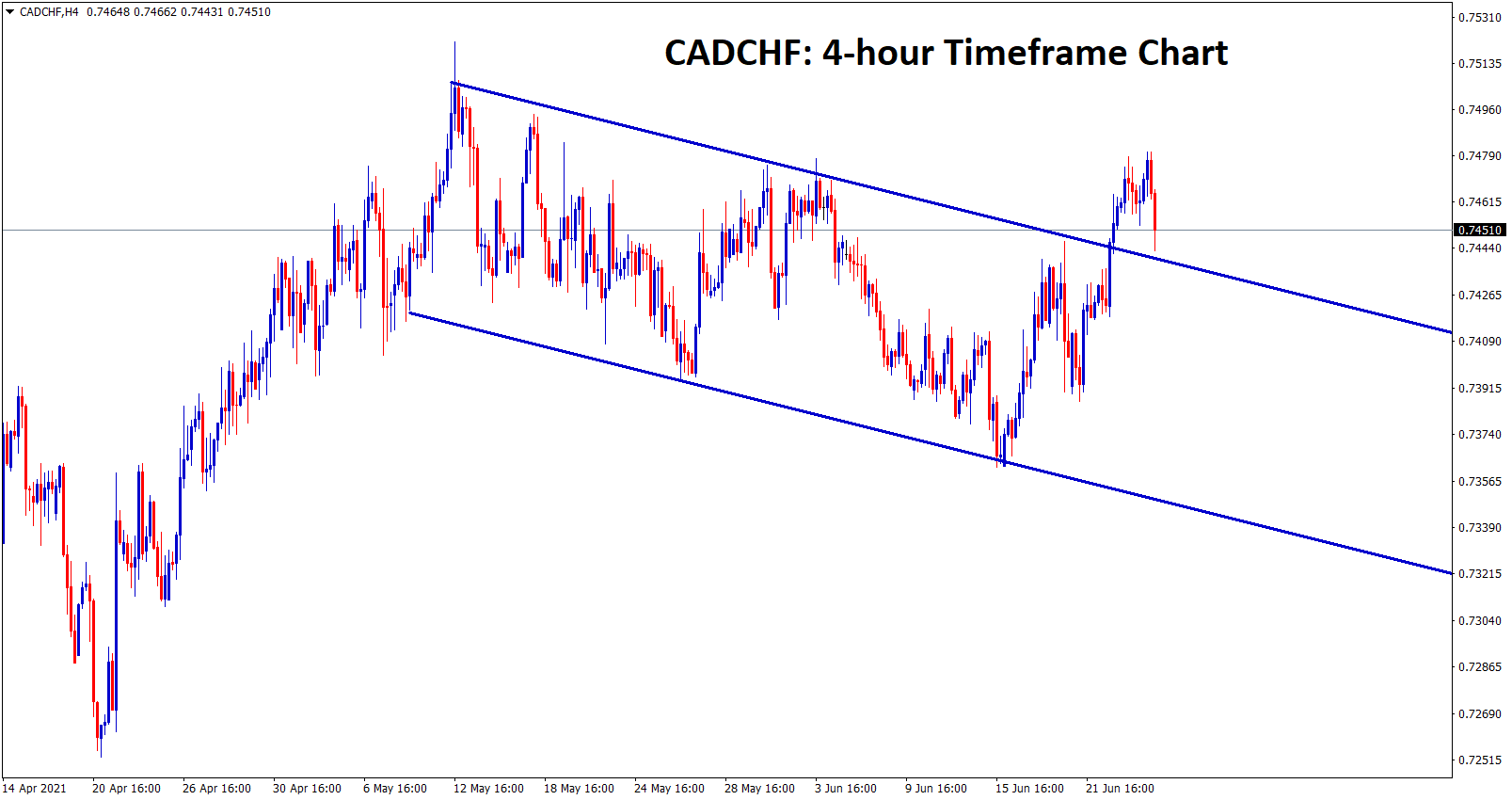

Descending channel market breakout in CADCHF h4 chart

Canadian Retail Sales data shows a larger than expected decline in April month and this retail number will get rebounded in June month as expected.

Retail sales show the largest contraction in April declined from an all-time high of C$54.8 billion. But still retail sales above pre-pandemic crisis level.

And Some provinces like Ontario and Manitoba have tightened the lockdowns as the spread increased in those areas.

Only 5% of shops were closed during the lockdown and coming third quarter will rebound all retail sales from consecutive fall in First and second quarters.

Japanese Yen: Reforms on corporate funding

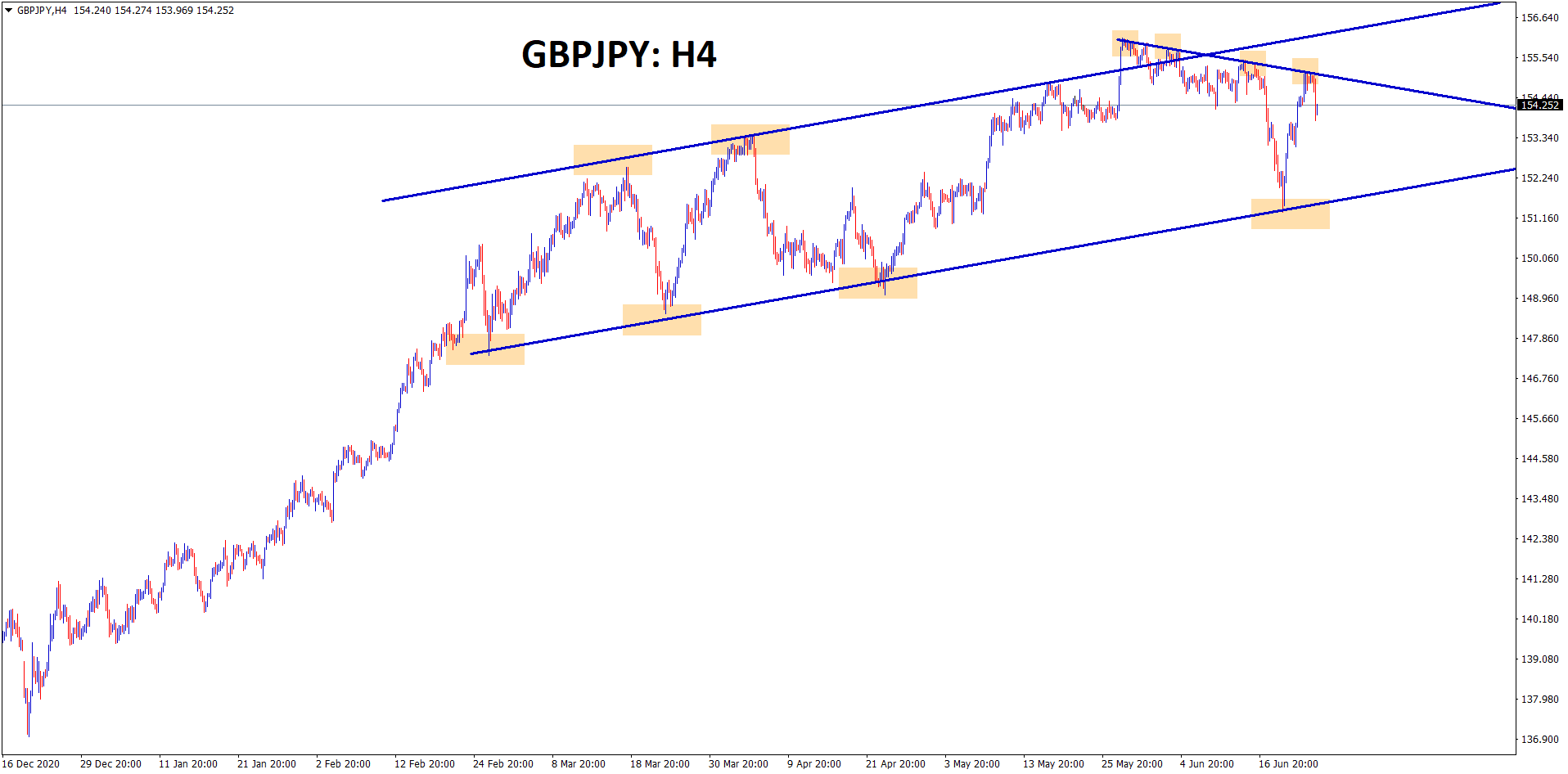

GBPJPY is moving in an Ascending channel range but still forming minor lower high levels.

CHFJPY moving in a strong uptrend, even after hitting the previously broken resistance, it bounces back harder.

Bank of Japan governor Kuroda said it is time for support for corporate funding remains under stress by the Central bank.

Consumptions are lesser and Manufacturing outputs become higher. Japan’s Financial system becomes stable.

And Private sectors will stabilize according to climate changes and the financial system strengthens in long term.

Financial institutions shift their focus from liquidity to Borrowers to support business and efforts towards reforming the economy.

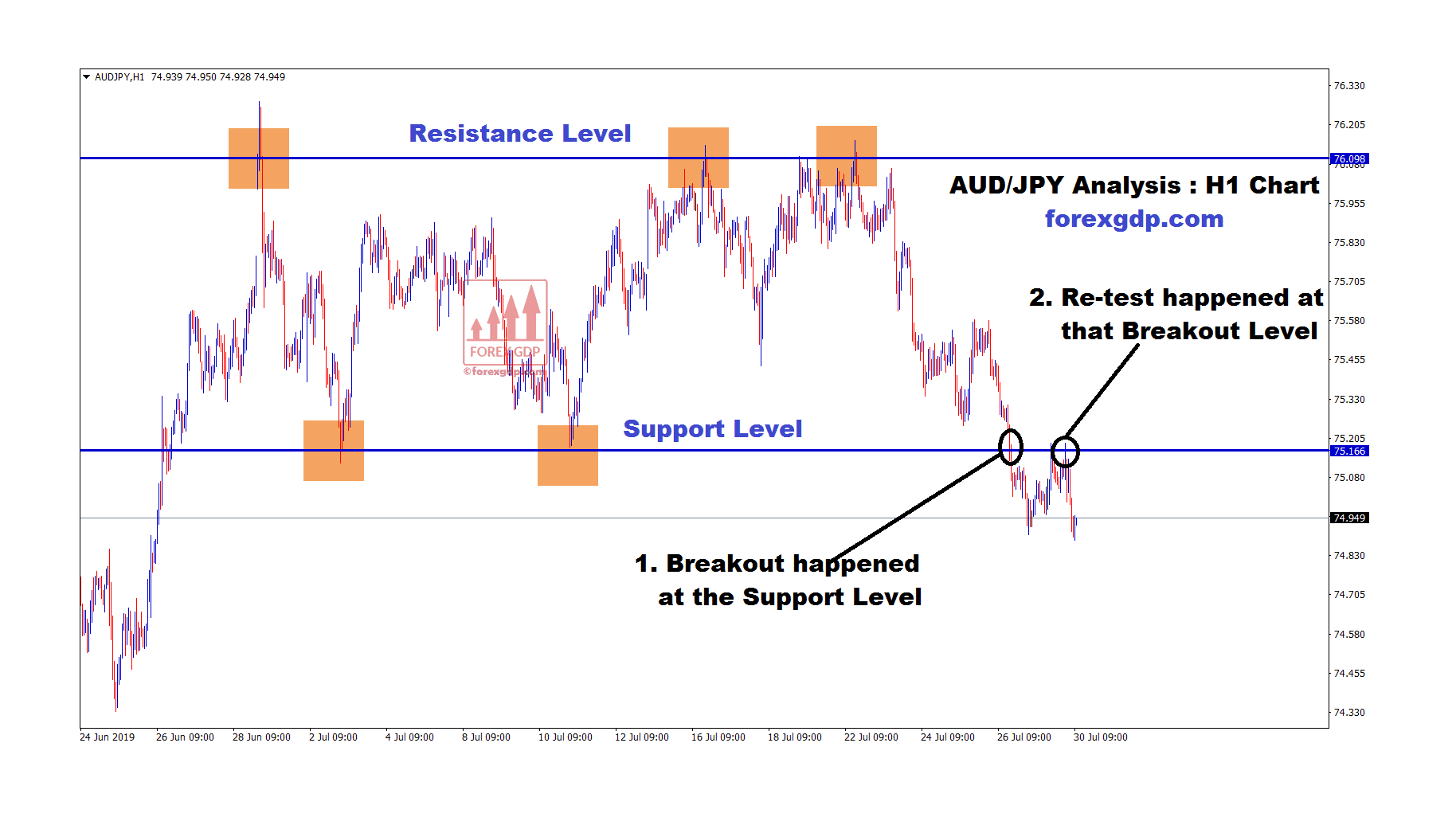

Australian Dollar: Moody’s View on China GDP

EURAUD moving in an Uptrend range

Moody’s eye on China GDP will boost the company’s earnings.

And Chinese GDP growth will help the rise for the demand for goods and services and revenue will boost in 12-18 months.

The rising demand for Goods and Services will help the boosting earnings for most rate companies this year 2021 and 2022.

Sectors like Autos and services, Food and Beverage will use more debts for improving Chinese companies leverage.

High spending needs will grow up the construction and engineering companies’ growth higher.

New Zealand Dollar: EXIM Report

New Zealand Dollar rises as Lower high flows after last week fall of 2-3% after the FOMC meeting. Now commodity prices like copper up by 4% this, in turn, reflects in New Zealand Dollar.

Last week Export and Import data posted as N$5.37 billion and N$ 4.98 billion as respectively. Economists say Cross border relations open up after Vaccination done in proper progress.

US Dollar index flows in the correction phase and New Zealand Dollar may flows further higher until wait for Tomorrow PCE data.