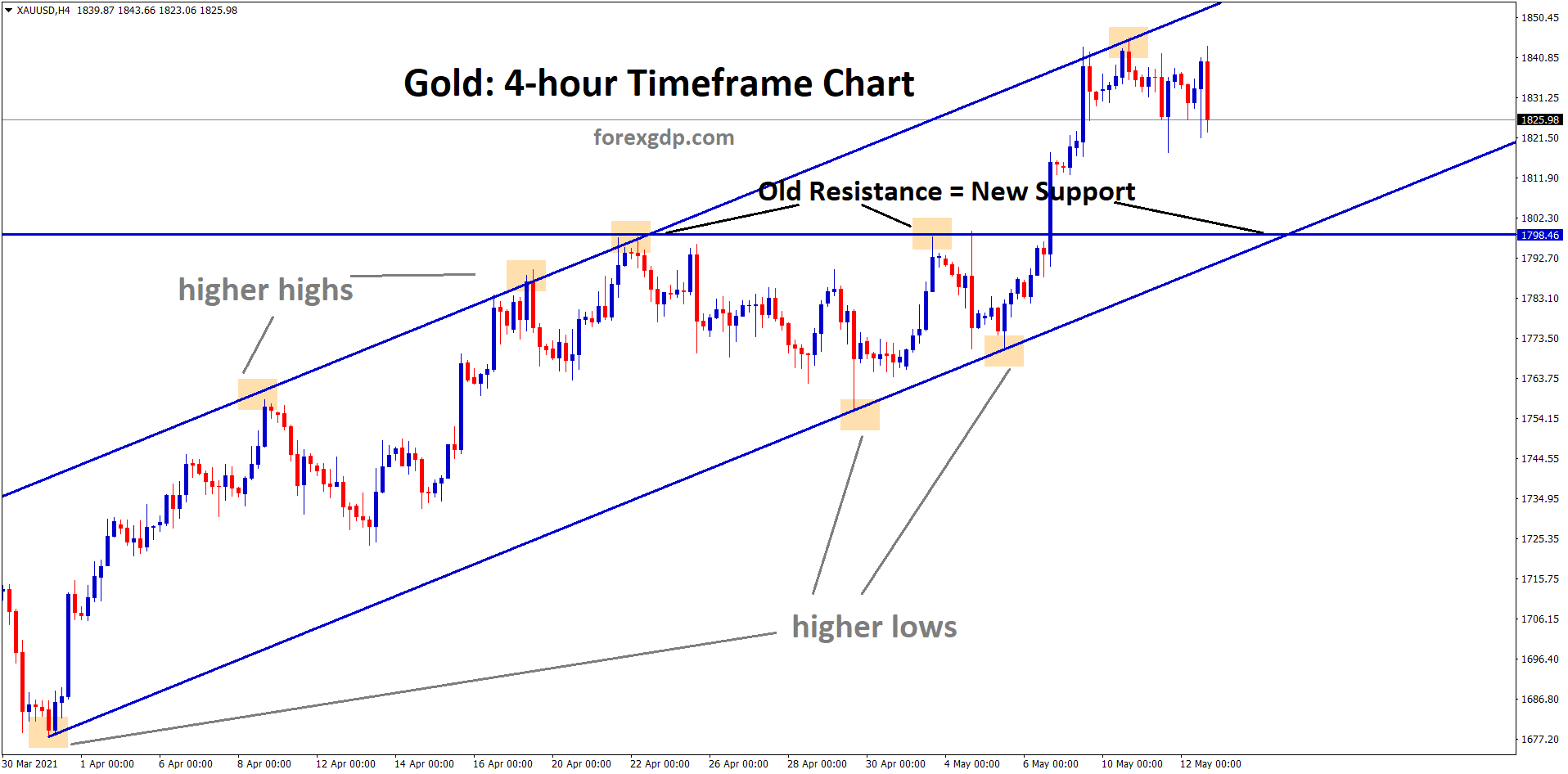

Gold

Gold is moving in an uptrend, now trying to fall from the higher high zone, if it falls, it can fall to the old resistance which will act as a new support.

Gold is moving in an Uptrend, now trying to fall from the higher high zone, if it falls, it can fall to the old broken resistance which will act as a new support.

How to trade support and Resistance properly with confirmation? learn more: https://signal.forexgdp.com/support-and-resistance/

Gold prices stepped lower from 1844$ to 1824$ as 2% down after a 2-month rally from a Lower Low of 1681$.

This correction came after US Dollar jumped 0.10% Yesterday as the Correction progress.

Agricultural prices are higher, made inflation rate makes higher and creates a FED to Pressure Tapering bets and Hike Interest rates.

And FED Official clearly stated that Lower rates and no tapering bets if the economy doing well.

Gold demand likely to be higher as the SPDR Gold trust reported, the Selling of Gold shares reduces compared to Buying of Gold Shares.

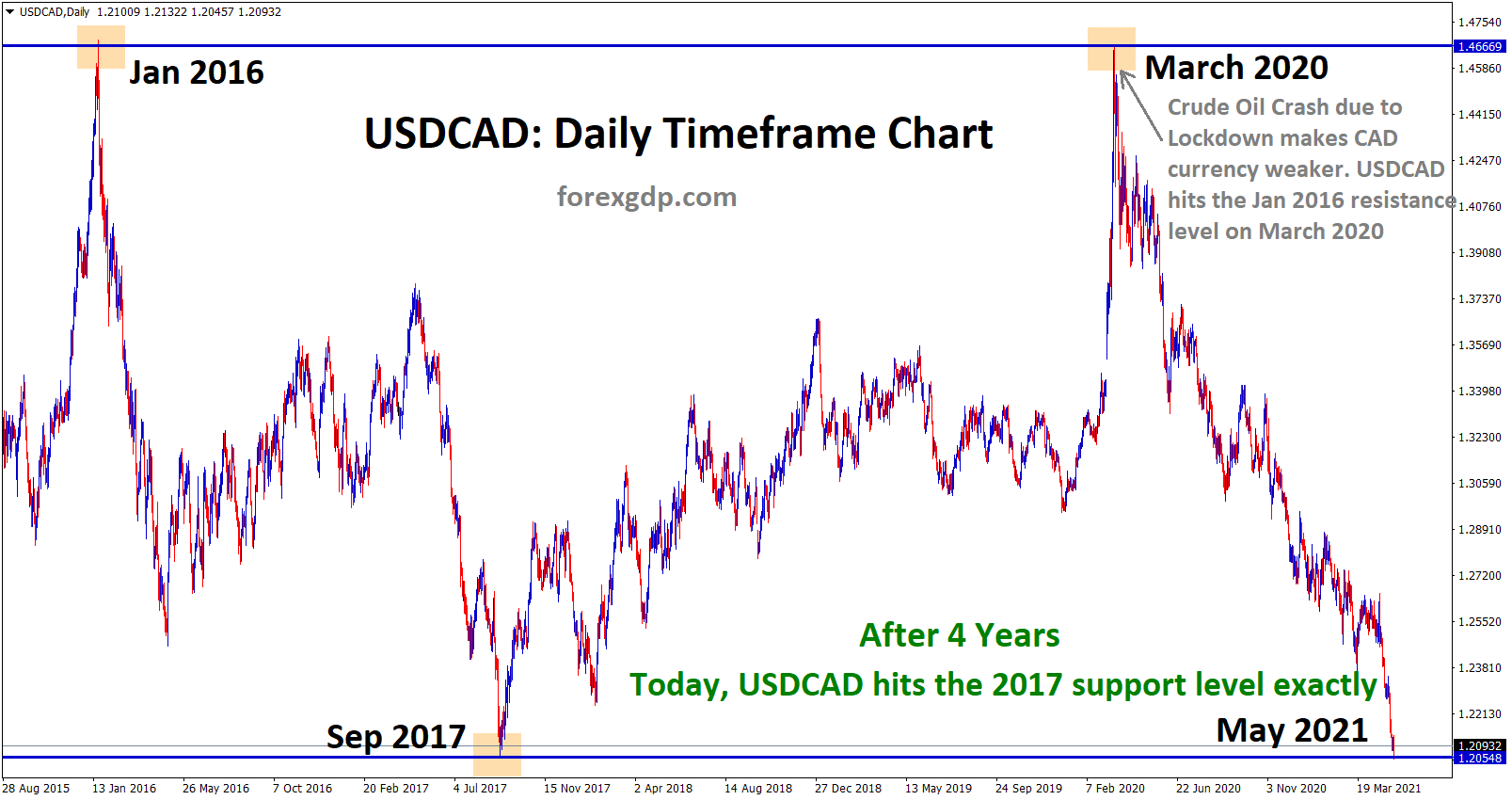

USDCAD Historical Analysis

USDCAD fall straight from the March 2020 resistance level to the Support without many retracements.

After 4 years, Today USDCAD hits the 2017 support level exactly.

In March 2020, USDCAD hits the top 2016 resistance level due to worldwide lockdown in COVID-19, We recommend our users to sell at the top on you can check our march 2020 analysis here: USDCAD Double Top Analysis

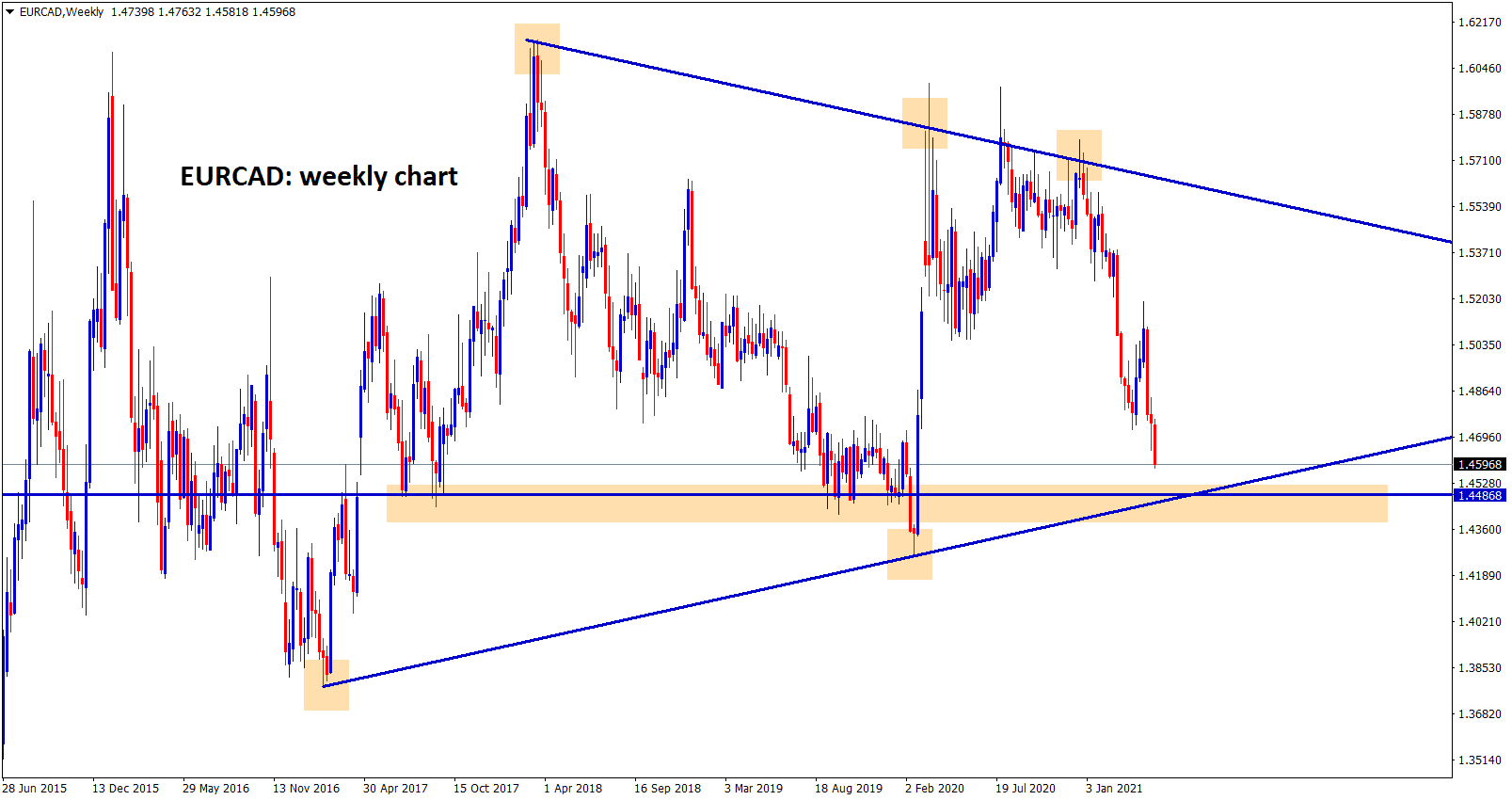

EURCAD going to reach the support zone in the weekly chart.

Canadian Dollar strengthens more after 5weeks straight declines from US Dollar.

USDCAD fell about 6% in 5 weeks; declines came after Bank of Canada approaches for Tapering assets purchases as the Canadian economy performed well.

And USDCAD’s critical support zone came at 1.19100-1.20700; if the market breaks this level, then see a huge downtrend in USDCAD.

CADJPY went higher highs after breaking 89 levels to reach 90.0.

The Canadian economy performed well in the pandemic crisis and Vaccination smooth progress made support for the Bank of Canada to take a stronger decision on the economy.

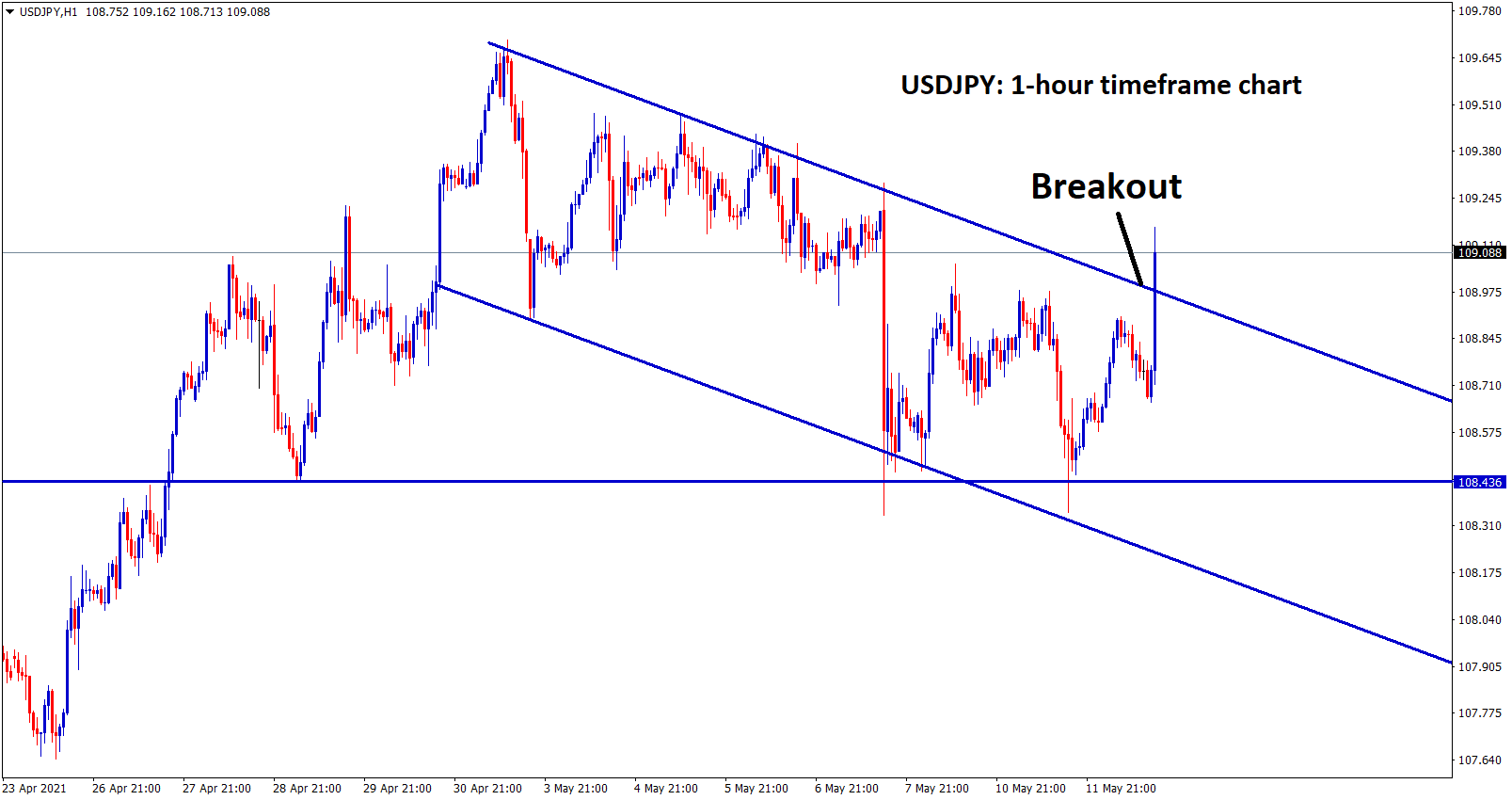

USD

USDJPY breakout the top level of the descending channel in the h1 chart

US Dollar remains higher after ahead of US CPI data to publish this week.

And FED patient for any time from Crisis and whatever Economy done good progress made no changes in Asset purchases.

These Dovish interest rates and easing asset purchasing makes stronger for Commodity currencies like CAD, AUD and NZD.

US Population gets 70% of Vaccinated and gets ready for second doses for those who had finished the first doses.

Reopening of major regions made stronger US Economy seen at the end of 2021. Forecast of GDP made higher than Previous forecasted by WTO.

And the Domestic data of last month performed more than expected, and this month may not see repeated numbers; we expected some declines compared to the previous month data.

EUR

Eurozone Industrial production in Germany makes less than expected reading of 0.1% MoM releases versus 0.7%.

And this weaker reading came after More lockdown restrictions in March month and Vaccination slower progress in the Eurozone.

Now the situation is different from March; Vaccination is in faster move in Germany, many regions removing lockdowns and businesses started to pick up.

Domestic data Performance:

European Commission raises the Eurozone GDP from 3.8% to 4.3% in 2021 and raised to 4.4% in 2022 from 3.8% Previous.

Inflation expectations raised to 1.7% in 2021 and 1.3% in 2022.

In Euro Area, all Domestic data came to the previous Crisis level soon in Q4 by the end of 2022.

So they have Revised all GDP forecasts, and inflation forecasts came from well vaccination progress in all areas of the Eurozone.

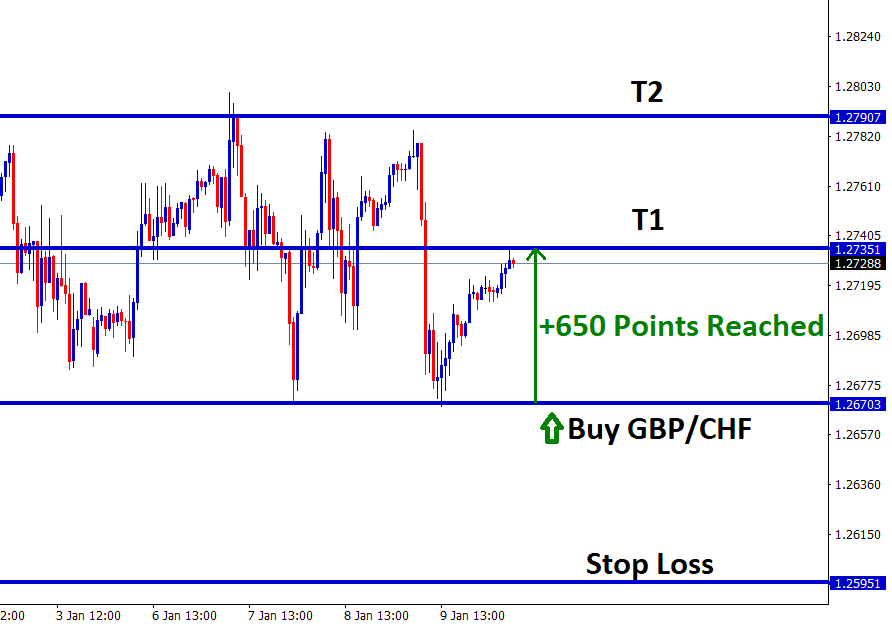

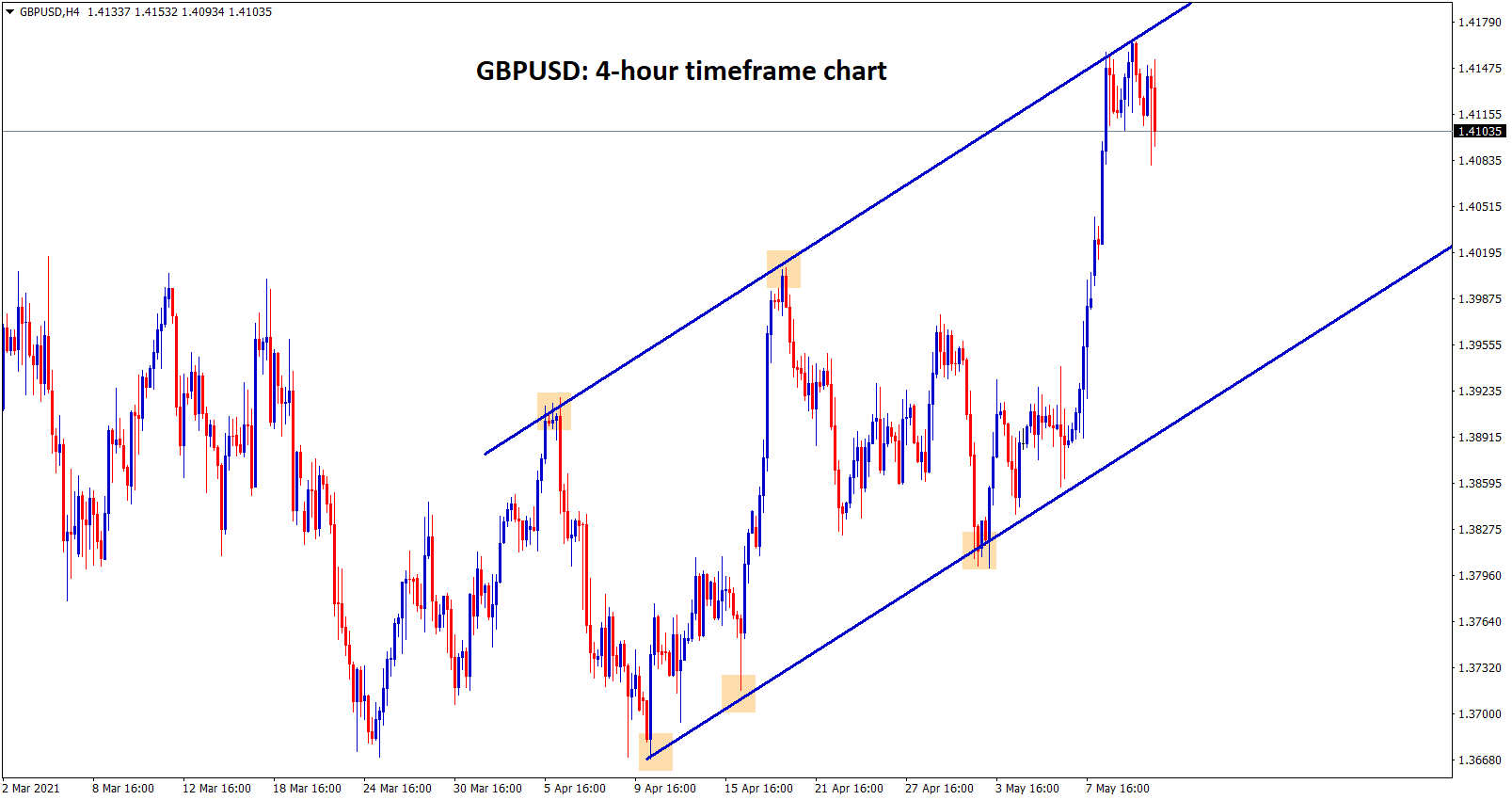

GBP

GBPUSD is moving in an uptrend forming higher highs and higher lows

UK GDP data came in slightly better than expected; shows GDP-3-month average of -1.5% versus -1.7% forecasted, YoY came at 1.4% versus 1% expected.

This data came out the result of Imports plunged out of exports.

Expenditure more in Pandemic time than in usual times.

Jobless claims were declined as a reopening of economies after Vaccination done well.

And Scotland elections result in no majority proven by Either party; due to this Scottish referendum will be postponed.

And also, the UK Vaccination campaign doing now in good progress and helped more to recover from the crisis.

UK GDP will recover by 2022 as reopening economies and reach the Pre-Crisis level in Investor’s view.

JPY

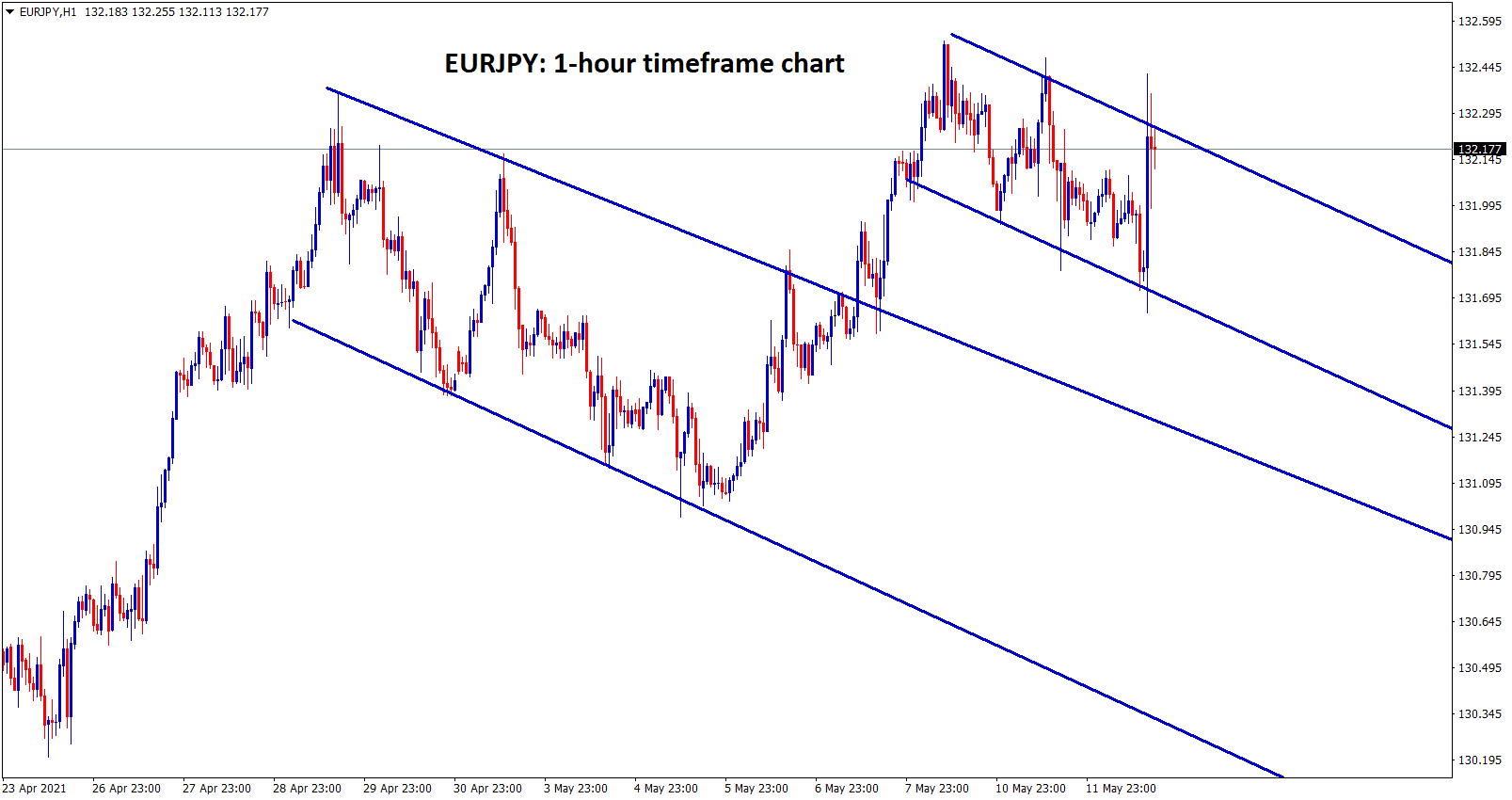

EURJPY formed a flag patterns in the h1 chart.

Bank of Japan purchased ETFs that were tumbling after the Third wave of Covid-19 attacked in Japan.

Due to this, Additional purchase will be stopped by the Japanese Government; once the situation gets well settled, then once again, purchasing will start.

And Stimulus aid of JPY500 billion issued last month for the Covid-19 pandemic, and more regions pushed for lockdown measures.

USDJPY continue to higher till the Japanese Yen gets recovered.

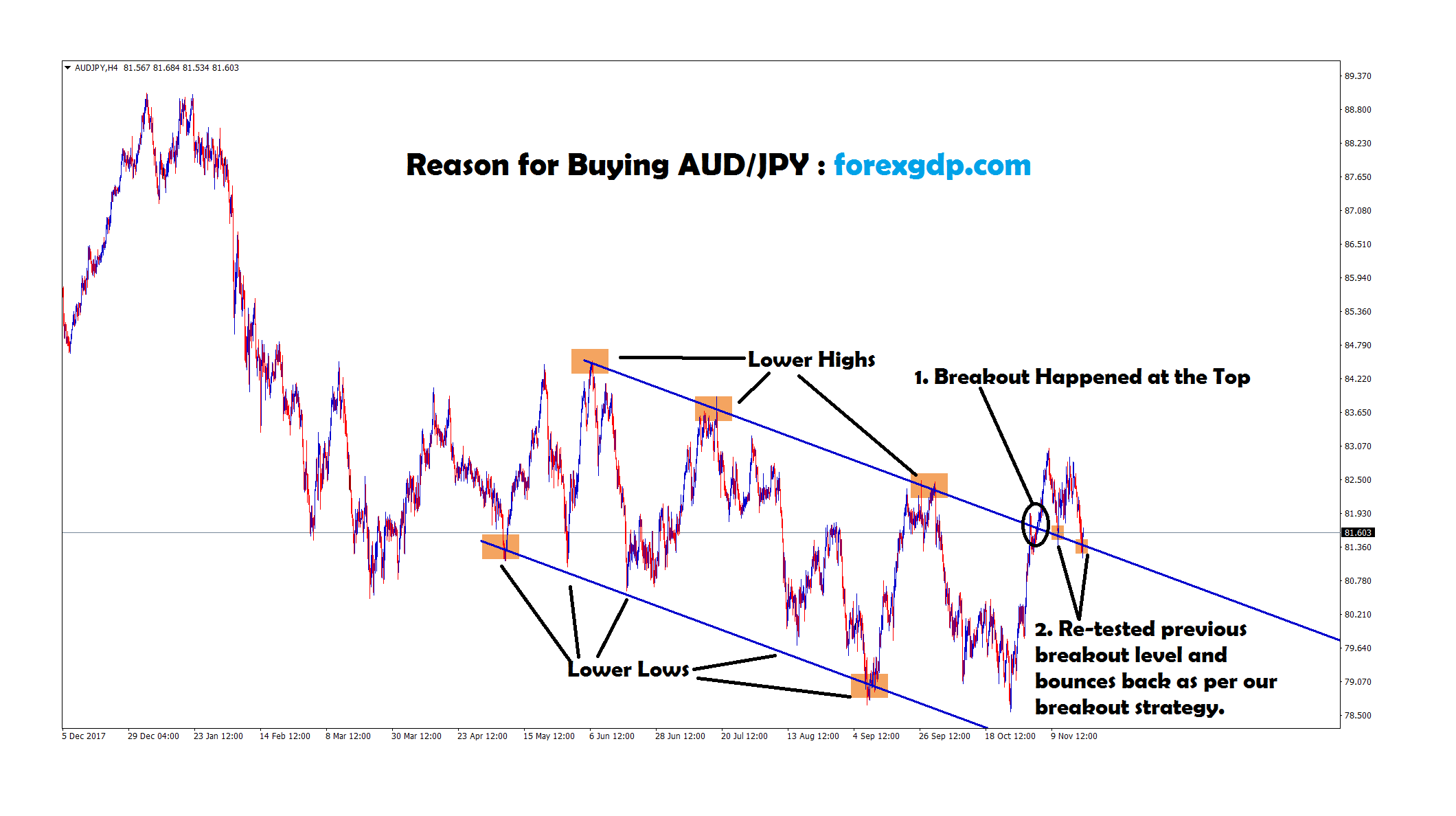

AUD

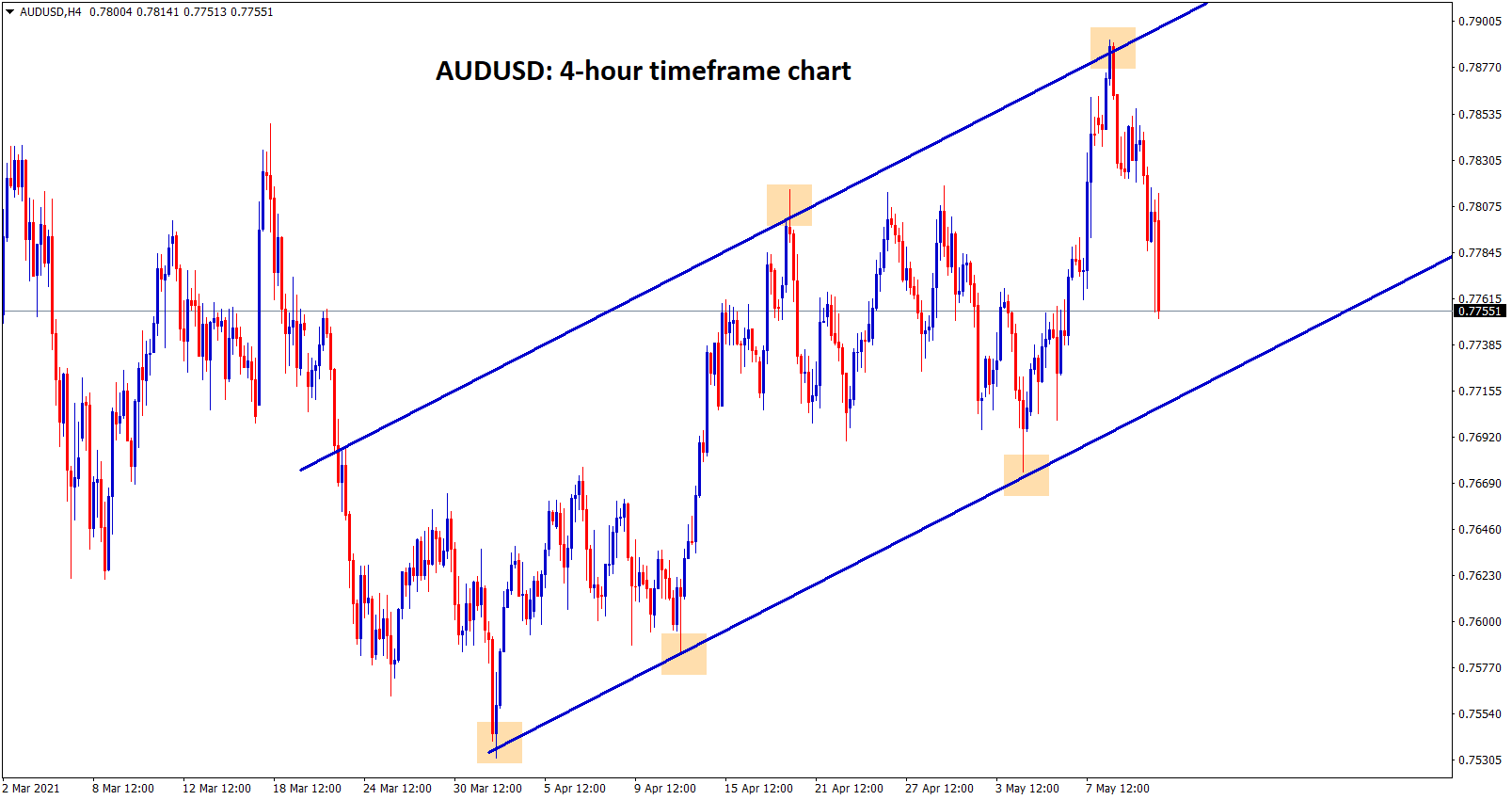

AUDUSD is moving in an ascending channel by forming higher highs and higher lows in the 4-hour timeframe chart.

US CPI published this week expected to 3.6% versus 2.6% in the previous month.

If it came in Positive data, US Dollar gets stronger and makes down for the Australian Dollar.

Iron ore prices and Copper prices are surging higher made support For Australian Dollar in Exports revenues.

And also, the Domestic data of Australia performed well, and Vaccination is in smooth progress, reopening of the economy started.

And Travel restrictions are cleared and vaccinated people allowed for New Zealand travel.

NZD

New Zealand Dollar rising in higher as US Dollar 5 weeks decline.

And also, the FED’s Dovish stance by left out tapering bets make the US Dollar weaker tone.

New Zealand Economy shows recovered manner from all domestic data; housing prices came under control and controlled bubbles before creation in the housing market.

Exports were driven to China smoother as free trade deal agreement between China and the New Zealand Government sanctioned.

Reserve bank of New Zealand may hike rates any time, and tapering bets in the upcoming meeting are expected as Domestic data performed well.

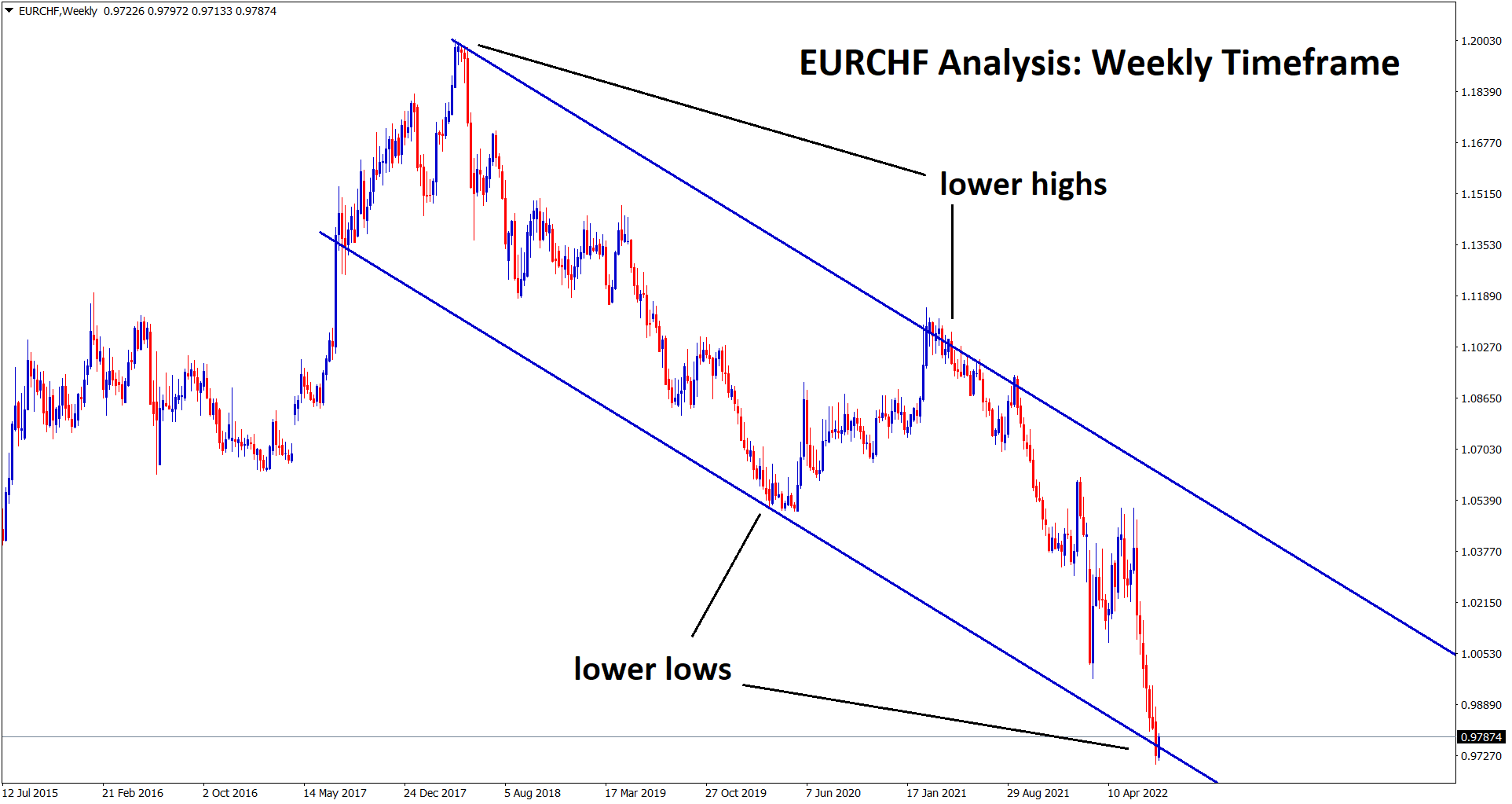

CHF

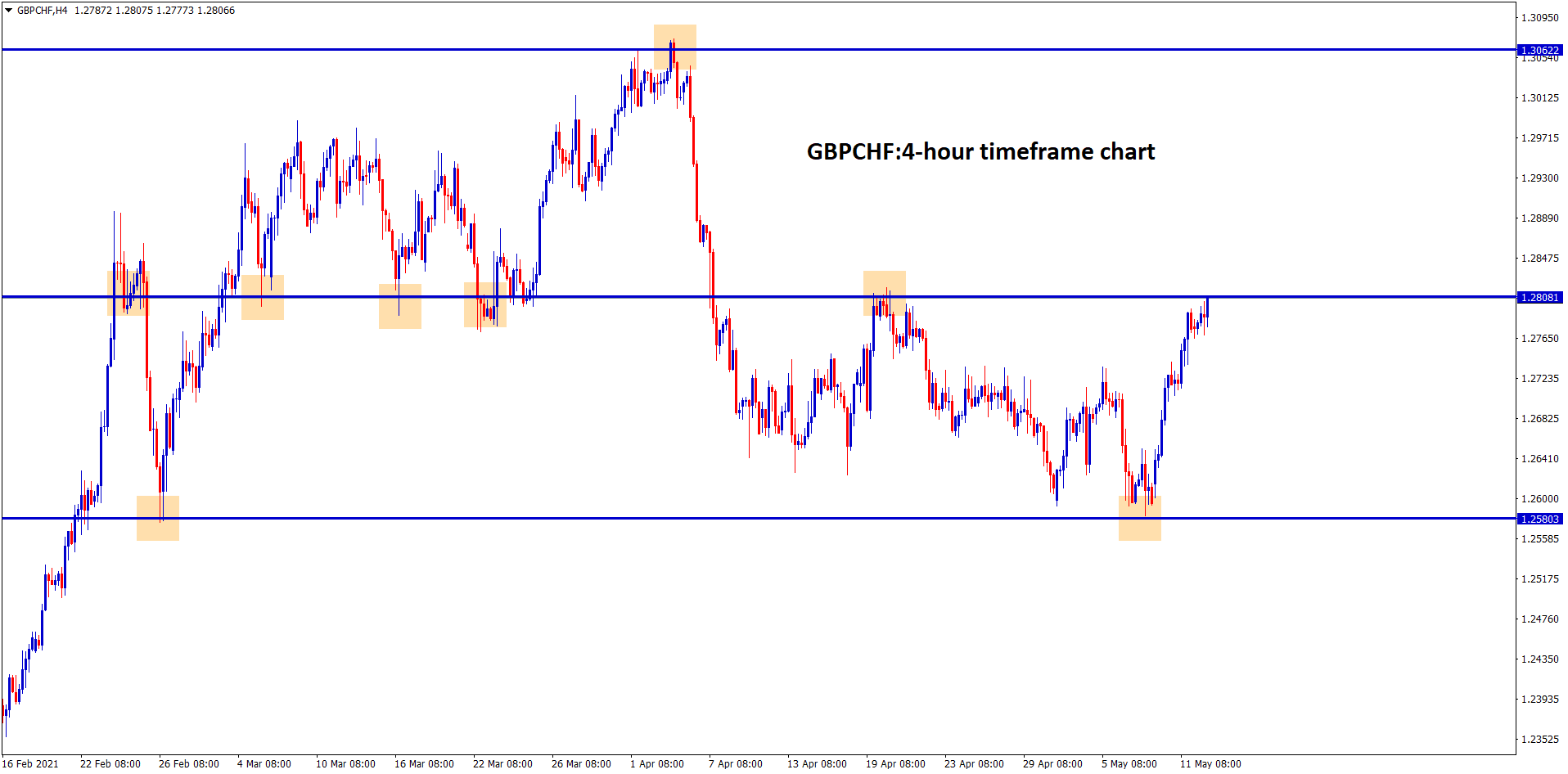

GBPCHF reached the resistance level which is the old support level.

EURCHF stands at the downside of the channel; any time will take off soon for a Lower high.

Eurozone posted weaker Industrial Production than expected.

Swiss Franc made higher after Swiss national bank committed there is no further Forex intervention by SNB.

And this creates a positive for the Swiss Franc to move higher and declines Euro against the Swiss Franc.

Now Eurozone now picking up from the Pandemic crisis soon from Vaccination doing very fast than expected.

EURCHF may see reach the level of 1.13 by the end of 2021.