♦ Why you can’t earn money in real account same as demo?

♦ Entry and Exit Strategy

♦ Are you the pig?

♦ Top 8 mistakes traders do

♦ Learn these good habits now

♦ High Lot Trading – Most Important Rules to Follow

♦ How to Get Rich Overnight?

♦ How much lot size should I place on my trading account?

♦ What Money management strategy is working now?

♦ How to handle fear of loss?

♦ Overcoming Greed

♦ How Professional traders react?

♦ Practice demo trading with small money

♦ Trading Books

♦ Key Points to Successful trader

Don’t burn your hard-earned money without learning the money management properly.

If a trader loses 50% they don’t just have to make back 50% to get back to break even. They have to make back 100%! Remind this always!

If you keep losing money from your principle investment, you feel more difficult to recover the loss and come to the break-even balance.

This is the main reason, you must follow the money management from the beginning of your trading.

Bad money management is like smoking, drinking and drug addiction, it will get difficult to recover from that bad mindset.

Keep Learning these good habits from the beginning

- Trade with proper risk management – know your risk per trade.

- Know your position size depends on the account balance.

- When Stop loss orders hit, become comfortable to lose money.

- Celebrate your winning trade and Review your losing trade.

- Learn forex money management techniques before you start to earn serious money.

- Find the best trading plan that works well for you to enter and exit the trade with proper take profit target or stop loss level.

- Trade forex only at the confirmed trading opportunities. Don’t trade all the time. – NEVER feel or fear of missing market movements (FOMO)

- Protecting your trading capital is your number one priority as per money management in forex.

- Follow the investment advice of real forex markets expert.

How can I manage my money in the forex trading account?

Why do I need to learn money management?

Well, Every Trader must become a real successful trader only after learning this money management.

If you want to be successful in forex trading, you must learn the money management strategies to see the profit trading results on your account.

Most important forex management rule to follow

Trading on your account is like driving the vehicle. If you drive without following the driving rules, you will definitely get an accident. Similarly, if you don’t follow the trading rules, your trading account gets an accident.

High lot Trading

Placing a high lot in trading is like driving high speed in the traffic road. You will feel the same nervousness. Please respect the money management rules properly for trading safely without fear.

If you go in low speed, nothing can destroy you easier. Similarly, If you risk small on trading, nothing can destroy your account.

We always want to help you to improve your trading skills with great guidance in any situations.

The World’s Best Trading system could not help you unless you learn the Profitable Money Management System

When people first come to trading, they will be more excited to see fancy forex indicators, a great marketing system, auto trading robots and the profitable fake trading account statements.

How much lot size should I place on my trading account?

As a forex trader, You should be the forex money manager for your own trading account.

For 100 USD trading balance, place 0.01 lot

1000 USD, place 0.10 lot totally (i.e. 0.02 lot x 5 trades = 0.10 lot total)

10000 USD, place 1 lot total (i.e 0.01 lot x 100 trades (or) 0.10 lot x 10 trades = 1 lot total)

Depend on your forex trading account balance, your position sizing should differ. Don’t risk all your money in a single trade, calculate this simple lot size per trade formula to master the money management for forex trading account.

What Money Management Strategy is working now in Forex Trading?

I’m so stressed about trading. I want to know how much risk (per trade position size) should I take at different market conditions?

Trading successfully in the forex market means growing your trading account by wisely managing profits and loss using money management techniques.

Trading Wisdom comes from the experiences, most of the traders believe that profit should be larger than losses. i.e. Take profit should be always larger than stop loss.

There’s a Trading Rule which says

1) “Cut losses short and let profits run”

It’s one of the biggest hacks in getting big profits in the market.

In fact, most of the traders are aware of this Rule, but very very few traders are disciplined to follow this golden rule.

Advantages of cutting losses in a short time

If you cut your losses in a short time, it will prevent you from suffering a big loss. Most of the traders don’t accept the loss short, because they hope for the market to come back at least to their break-even (entry price) price.

Cut loss short = No Stress

You don’t get any stress feeling after cutting the losing trades. But you may feel guilt (or) Fear of Missing Out (FOMO) Something.

After cutting the loss, never worry about whatever happens in the market, whether the market comes back again to your closed trade entry price or market go against your closed position. Don’t make yourself worry about closing the trade in loss.

The market doesn’t care you, it doesn’t matter whether you buy or sell or earn or loss in the market. Because the currency market has a lot of big players such as International Banks, big financial institutions, Hedge funds, etc. These big players will move the market for various reasons. They are the big sharks and whales in the forex trading.

Create a trading journal for reviewing your trades. If you review your 100% lost trading account, you will mostly see “the profit trades are smaller in profits, but the losing trades are higher in loss” The main reason is “you have closed the profit trade too earlier, but held your loss trade for a long time to hope for the market to return in positive.

2) Risk of Each Trade

What is the maximum amount of risk you can take in any single trade? You can expect 1:1 or 1:3 risk-reward ratio. but it all depends on market opportunities.

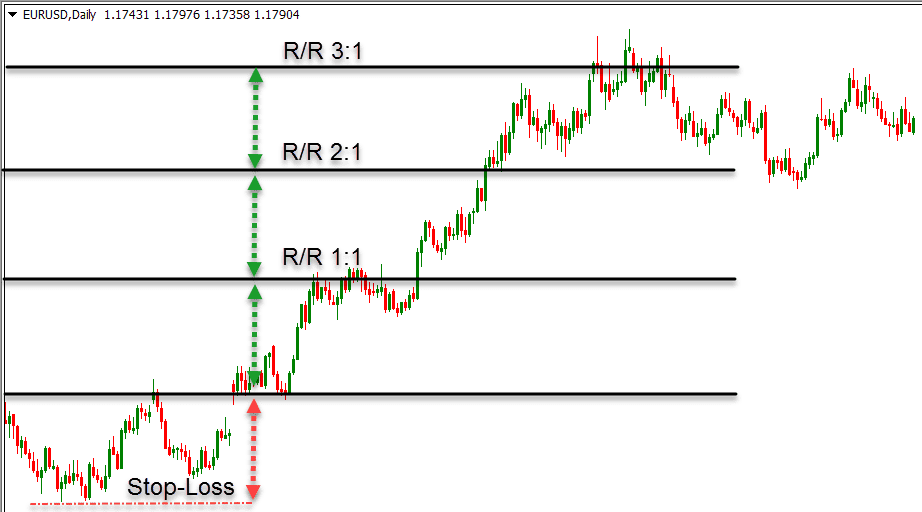

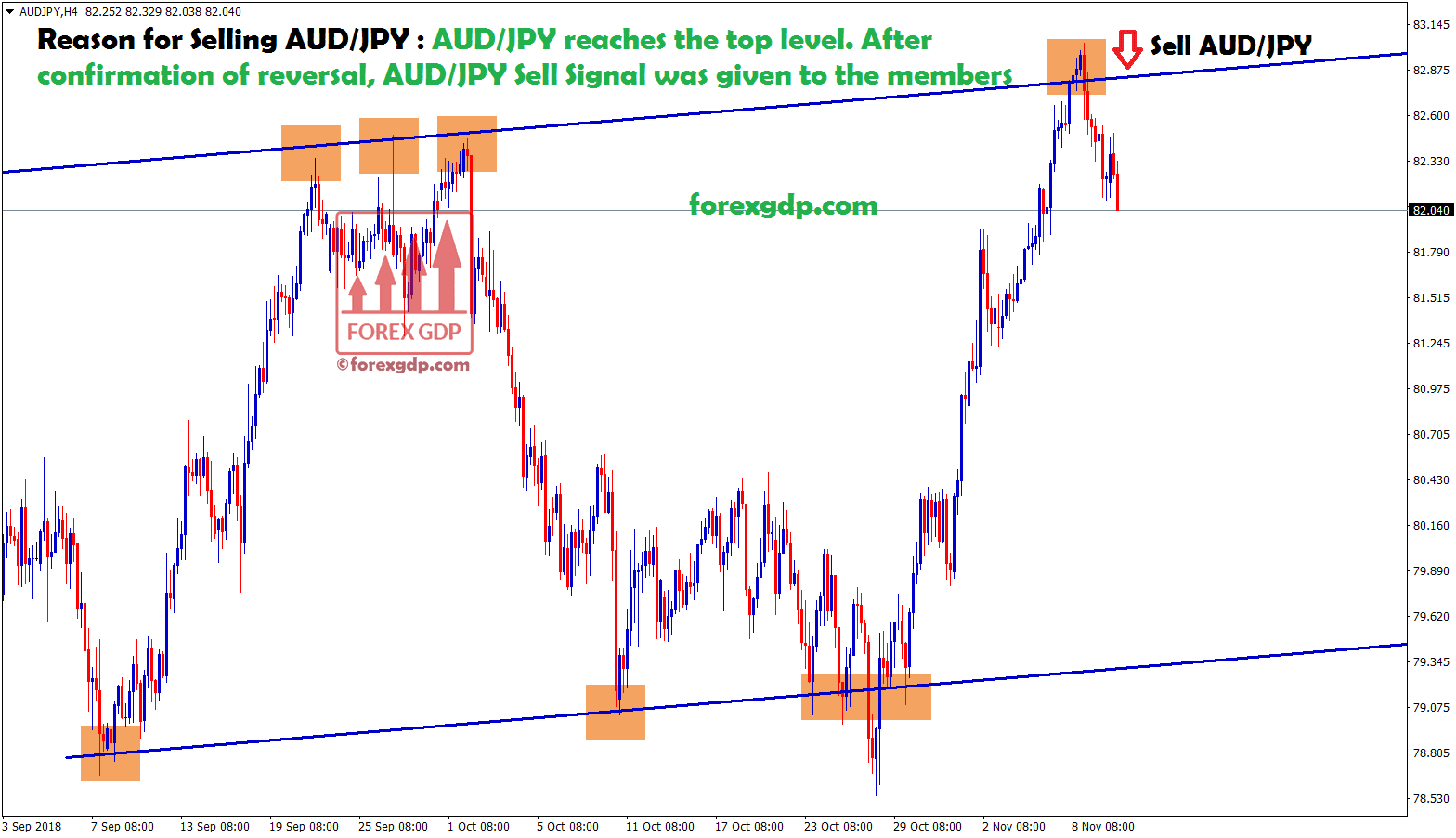

Let’s lookout this risk-reward ratio in this chart:

The stop loss and first profit target is 1:1 risk-reward (RR), 2nd profit target is 1:2, and then the third is 1:3 risk-reward ratio.

This is how forex risk management trading performance works.

You need to know the calculation of the risk before entering into your first trade.

Account Loss Probability of taking the risk

Case 1: If you lose all your money on Trading account.

Let’s say if you take a 2% risk on each trade, you need to lose 50 times continuously for losing all 100% of your Trading balance. (50 times x 2% risk each trade = 100% Loss)

5% risk on each trade = 20 times

10% risk on each trade = 10 times

20% risk on each trade = 5 times

25% risk on each trade = 4 times

50% risk on each trade = 2 times

100% risk on each trade = 1 time.

Key point: If you risk less, you lose small money.

Take an affordable risk, after you become an Expert in trading the markets.

Case 2: If you double your trading account.

Let’s say if you are going to take a 2% reward on each trade, you need 50 successful trades to get a 100% profit on your account. (50 times x 2% profit = 100% profit)

5% profit on each trade = 20 times

10% reward on each trade = 10 times

20% reward on each trade = 5 times

25% reward on each trade = 4 times

50% reward on each trade = 2 times

100% reward on each trade = 1 time.

Key point: If you increase your reward (Take Profit), you will make more money.

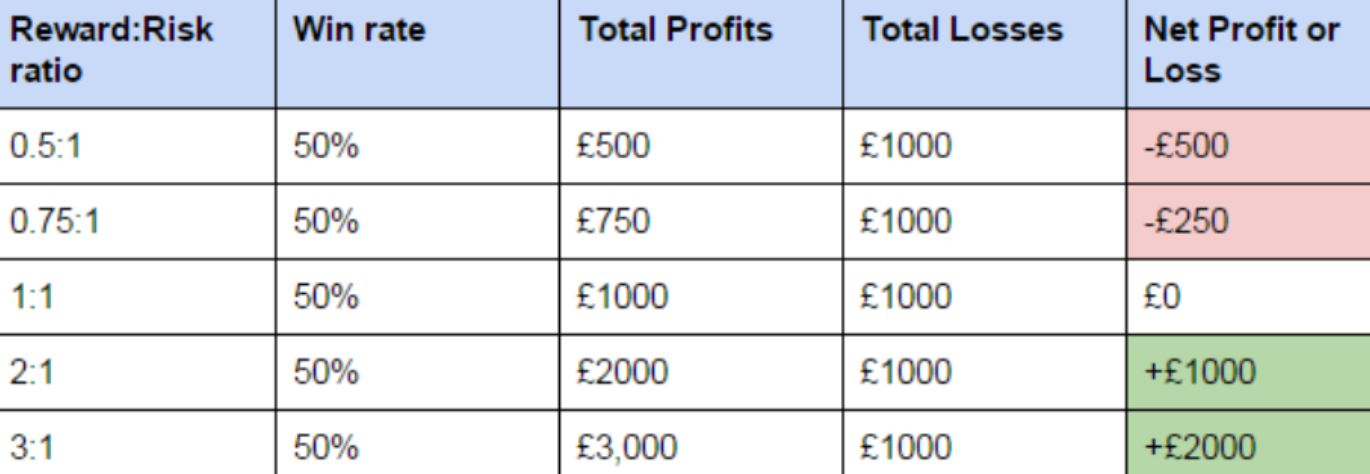

Case 3: Reward-Risk Ratio for 50% Win rate of your trades

Most traders aim to have the reward- risk ratio of less than 1:1, but their losses will be higher than the profits. This is why most of the people lose more money than making money.

Below we have included a table that highlights the different reward: risk ratios and their impact on your total profits and losses. The table below assumes 1 is equal to £100 and you have a win rate of 50% across 10 trades.

Let’s say you have a 50% winning rate totally for your trading account performance, how it will look like? check the reward risk table now.

Just for 50% Success rate, if your reward is higher and risk is lower, you still making great profits.

If you increase your success rate to 80%, You will start to make more profits. This is the reason, we always recommend our users Do Not trade forex market all the time, trade forex only at the best accurate trade setup.

“FOCUS ON QUALITY INSTEAD OF QUANTITY”

For all type of people, It doesn’t matter how many trades you do every day, At the end, you should have to be in profit.

Always trade only after getting the confirmation and when you are very sure about the trade setup on your market charts.

Check the latest confirmation forex trade setup here

3) Very Important – Handling Emotions

It is very important to handle emotions such as fear of losing money, anxiety, panic situation while trading.

How you can manage the emotions for trading profitably. Let’s see it now.

Most important mistakes traders do

- Trading with Greed.

- Praying to god that the market should move in my favourite direction.

- Expecting a quick movement and big profits after placing the trade.

- Placing a high lot and waiting for big profits.

- If there’s a losing trade running on, Waiting for that losing trade to close at zero (no profit, no loss).

- Not closing the profits at the right time. Instead, keep adding new extra trade positions.

- Dreaming of getting rich quick through trading.

- Comparing yourself with other traders. Watching other traders profit results and trying to do the same.

Trading with Greed

Greed is the worst emotion for the trader and it plays an important role in trading. New traders and greedy traders face big losses because of greed.

Don’t be a Pig in Trading

A wall street stock expert Jim Cramer says “Bulls make money, Bears make money, But Pigs get Slaughtered”

It is true that the greedy traders are pigs. A pig is an investor who puts greed on his or her investment. Whether the market moves up or down, the pigs get slaughtered anyway.

A pig thinks to become get rich quick by trading with high lots. As a result, pig deposit all his money in trading account and start to borrow loan on margin or mortgage his or her home to invest more money in the market at a higher price with the hope of making more money on the investment. The pig can get slaughtered if the market drops and all his/her investments are lost.

Don’t be a PIG, be a smart investor.

Smart investors are disciplined traders who know when to take profit and when to cut their losses. Their first priority is to focus on protecting their capital and they never risk a lot of money by selling their home, borrowing loans, etc.

Overcoming Greed

Overcoming greed is easy if you learn how to stay self-disciplined while trading. Your ego, greedy thoughts, improper planning of risk are all controlled easier through the below steps:

Are you going to Die today? or tomorrow?

Do you have any urgency to make more money right now?

You are not going to die today or tomorrow right? Then why did you hurry in making more money?

A Man Answered: Everybody wants money, I too need more money to satisfy my needs faster in this faster world.

Well, that’s right. you need to make money faster in this world, but don’t depend only on the market to give you big money faster.

If you want to become a successful trader, you must know that “Trading is not a get rich quick business, Trading is getting rich slow” business.

Rules to avoid greed and trade properly

Greed comes when one doesn’t have a proper exit and entry strategy.

Exit Strategy

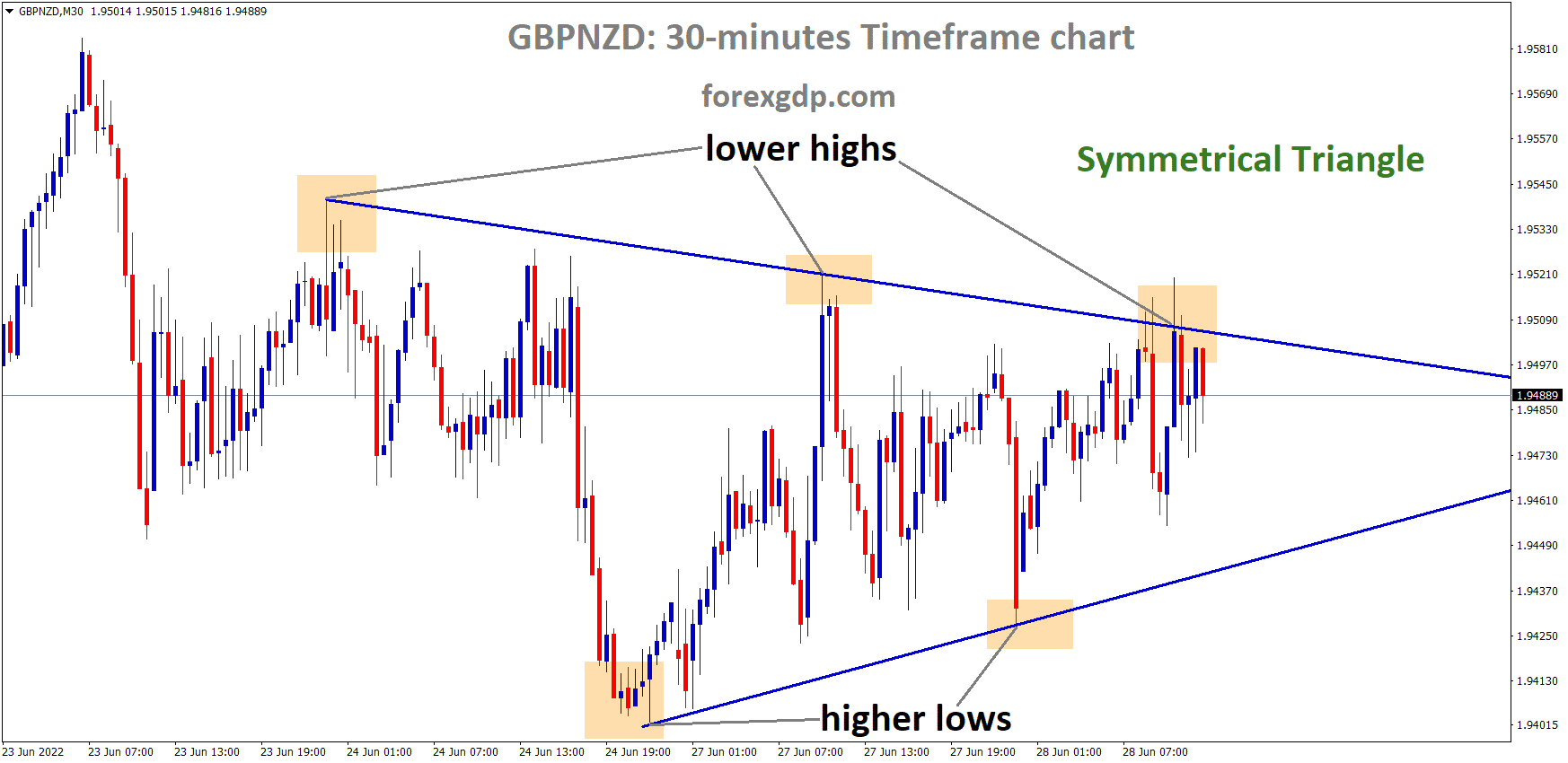

If you enter into the trade at a perfect price and the market is trending now. You make 30 pips and now what happens is market retraces back and again moves in the direction of the trend but failed to break the previous high/low. This is the early sign (alert) of caution to decrease your stop-loss price and if the market breaks the previous swing high or low then you must exit the trade no matter whatever happens.

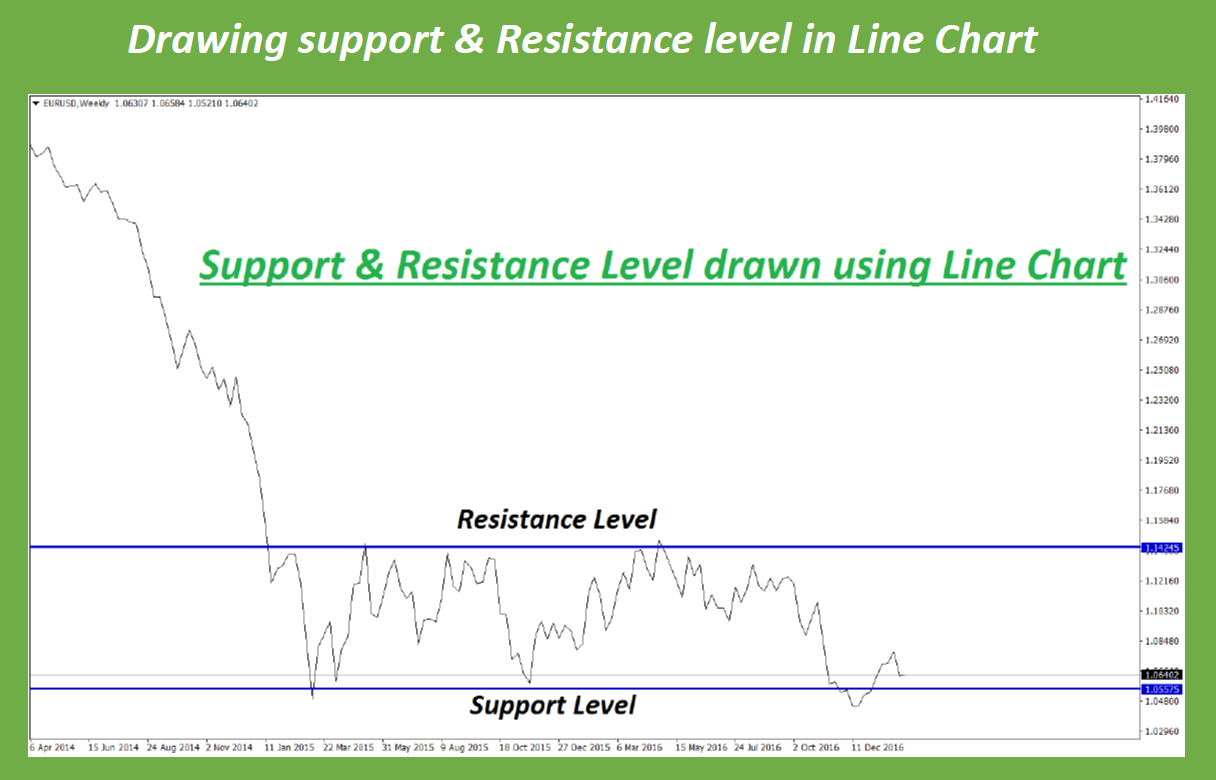

Entry Strategy

If you are trading breakouts, you need to be careful. Always use the line chart for drawing accurate strong support and resistance levels.

Reason for using line chart: Line chart always connected with the closing of the candle price.

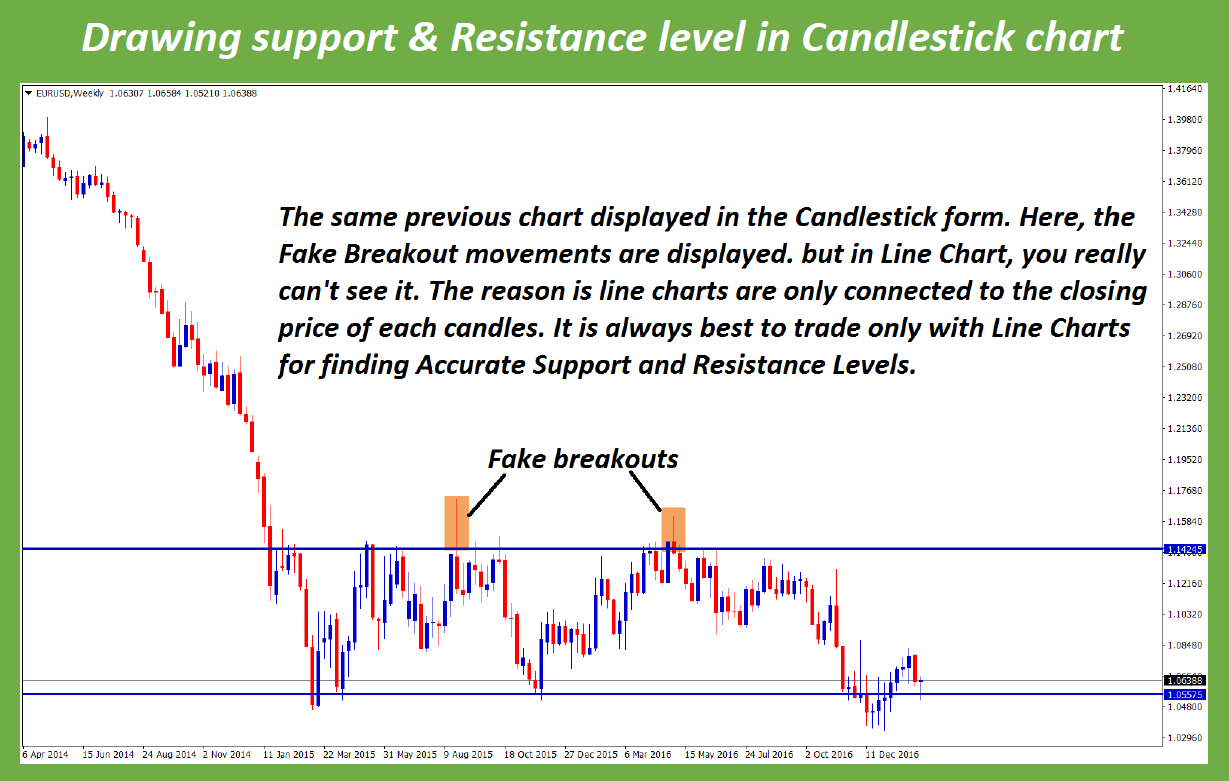

The same line chart displayed below in the candlestick chart view. now you can see more fake breakouts.

When you see the market break out the range, but the candle is not complete or not closed. It may have a chance to make a Doji or Reversal Pin bar which makes the market reversal and hit your stop loss easier. This is the result of greed as you have entered even your trade setup was not complete but you placed the trade just to make quick profits. GREED is here with you. haha.

Greed and fear, hoping and praying for the market to move in your favour direction will never help you. If you don’t follow the trading rules, entry and exit strategy, then the market will eat you alive.

If you have a proper trading strategy and don’t’ follow your trading plan, then sooner or later you will go broke.

Solution for Greed

Treat Trading as a business. learn and take care of it extremely serious, train good trading habits and build a solid base for your trading empire to stand strong. This will take time but you can do it for sure.

Come on trading warriors! You can achieve it!

Quick and Big Profits mindset

I want to make quick a profit and also a big profit right now.. right now…

This is how greedy and new traders see the market.

How Professional traders see the market?

Professional traders see the market like this…

Be patience and wait for the good trade setup for entering into the market.

This is how professional traders react to the market at all conditions. They remain Polite and calm at all the market conditions. Even if the market crashes or gain a lot of profit on the trade. They maintain patience with gratitude.

Warren Buffet says ” Stock market is a device for transferring money from the impatient to the patient”

How to get Get rich quick Overnight?

The market is for building wealth over the long term where you run a marathon race, not a 100-meter race.

Don’t run in a marathon like a 100-meter race, you will get failed.

You heard stories that “A person got rich overnight by trading the forex market”, but you must have to know how many years of experience and hard work he spent to find a way to investing that works for his way of investing in the market at the right price and at the right time to build wealth for himself.

A lot of traders got a fortune in trading overnight, but they got only after finding their own systematic wealth-building plan that made him or her that much cash.

Practice demo trading with small Money

Forex broker offers a demo account with a high trading balance, high leverage, low spread, low commission and good trade execution.

If you practice your trading on a demo account with a high balance, you will make big profits on demo trading account, you will be really excited and start to live on your dreams by this demo account profits.

Let’s say if you open a demo account with 10,000 USD and made it to 30,000 USD within a few days. You are dreaming now that, If I invest 10,000 USD real money, I can convert it into 30,000 USD within a few days same like my demo trading.

But the truth is … You can’t earn many profits in real money trading account.

Forex brokers offer you low spread, low commission and super-fast execution on demo accounts, but in real account, they don’t give such great trading experience. So, you make big profits on a demo account, but in real account, you make big losses. The real account just looks opposite to the demo account.

Forex brokers use this demo trading experience as a marketing tactic to arrest your mind mentally. So, you keep investing real money with them and hoping for big profits on a real account.

Why you can’t earn money in real account same as demo?

There are many reasons why you can’t earn the easy profits on real account when comparing to demo trading accounts.

Demo Vs Real Account Trading

| Demo Account Trading | Real Account Trading |

| No emotions | Emotions |

| Low spread | High spread |

| Low commissions | High Commissions |

| High Leverage | Low Leverage |

| No Seriousness | Very Serious |

| Watching the demo account a few times | Watching the real account very often |

| Accept the loss easier | Mind not willing to accept the loss |

| No Fear | Fear of Loss |

| Making big profits by greed and dreams | Struggling to hold your trade to reach big profits – arrested by full of emotions. |

Follow Only One Strategy

There are multiple trading strategies in the market. If you found anyone of the strategy is working well, just learn and backtest that strategy completely and follow that only one strategy with confidence.

Never doubt your well-working strategy, Don’t compare yourself with other traders.

Whatever strategy you learn, you must know how to use that strategy in different market conditions.

You should have to be patience and wait for a good opportunity to enter the market.

You should have to stay disciplined and exit the trade as per your strategy, don’t try to exit the trade depending on your need for cash or greed dreams.

Invest in Trading Education

If you keep thinking and watching the charts often, you still have a lot of things to learn in trading.

Education is the best tool to change your life entirely.

Increase your trading skills by reading more trading books.

Market Wizards by Jack D. Schwager

This book contains interviews with successful traders and it’s one of the most recommended books in the trading business.

The Disciplined Trader by Mark Douglas

One of the first books to address the psychological nature of how successful traders think – The Disciplined Trader is now an industry classic.

If you depend on others in trading, you may not follow them properly or if their strategy works well, the greed comes in and you will break the forex money management rules and lose money anyway. Educate yourself in trading financial markets.

It is always better to do your own research analysis on the forex market and confirm it with experts or forex mentors.

Some of the forex providers like Forexgdp, Tradingview mentors share their own trading ideas, analysis at an accurate price point with the reason for buying or selling the trade in the forex market. This really helps you to trade the forex market with confidence and support of the trade idea.

The best forex signals provider always gives you proper guidance for money management strategy forex and risk management depend on your position size and account size.

Every forex traders should follow the Forex Money Management Strategies to determine their risk per trade and reward of winning trade.

Forex money managers who manage the client accounts should always aware of maximum risk per trade, maximum risk per account, and the proper risk management strategies and money management plan to improve the account size gradually with a good return on investment.

Novice traders are trading forex without any forex trading plan or money management technique. they blankly believe the forex broker is giving them money.

Key Points – Conclusion

As a forex trader, make sure you must have entry and exit strategy pre-planned before entering into the trade.

Don’t overthink after you entered into the trade.

When you are trading or investing in the market you need to make a trading decision based on your strategy rules.

Follow proper risk management (risk per trade) for trading forex with small stop losses and bigger take profits.

Learn Price Action trading strategies, chart patterns, low-risk high reward trading techniques, A best forex money management system to trade forex at all market conditions in your trading career.

Choose the best forex broker which supports you in various aspects such as your trading style (some brokers don’t accept Arbitrage trading strategy, Scalping, Hedging), deposit withdrawal time and list of assets available for trading. Always use the small leverage for trading in control at all kind of situations. Check the forex brokers stop out level, spread, swap commissions to know your maximum potential risk to lose money doing nothing.

Losing money with a broker is unnoticeable.

Successful retail traders always keep learning continuously to improve their trading skills.

You too need to follow the successful good habits of traders.

I hope, you enjoyed reading this!

Thank you for reading and upgrading your trading skills!

Everybody can read. but only the great successful traders take action.

Become a Successful trader by taking Action from today!

Good Habits and discipline need to be followed by the traders. If you have bad habits and bad discipline about Money management, please change your habits immediately. Using high lots for small balance is a risky one and it’s a very bad habit for most of the beginners in forex. Most of the traders don’t grow up to the next level due to these bad habits. Once you leave the bad money management habits, you can see a positive result and growth on your trading soon.

We believe, all our members are growing well in Forex with us by learning a lot of useful guidance. You always keep improving your Trading skills faster with our Experts Support.

If you have any questions or need any help, please click here to contact now or write us your message to [email protected]

We are ready to help you always.

Thank you.

Regards,

Forexgdp Team.

Excellent work you guys put out for us..God bless

This is commendable and most valuable info on forex trading money management.

Great article!!!!

Can you recommend a good broker…& what timeframe can we choose?

This is wonderful! It has a lot of trading wisdom.

I will do my best to apply it.

Congratulations to your article.

I have been a trader for 1 month and I find myself in all the mistakes you have listed.

The reason for any loss or little profit I am having is listed in your article.

Surely this article will give me a big hand to unlock mentally and improve myself in trading.

Thank you very much

Yessssi have been trading with poor informed decisions.Thankss Forexgdp for this article..I Have learnt many things here today and I think this article was surely telling the truth of myself

It’s now time to change..am proud as a newbie I had been breaking rules.

GOD bless you guys ..you are strong