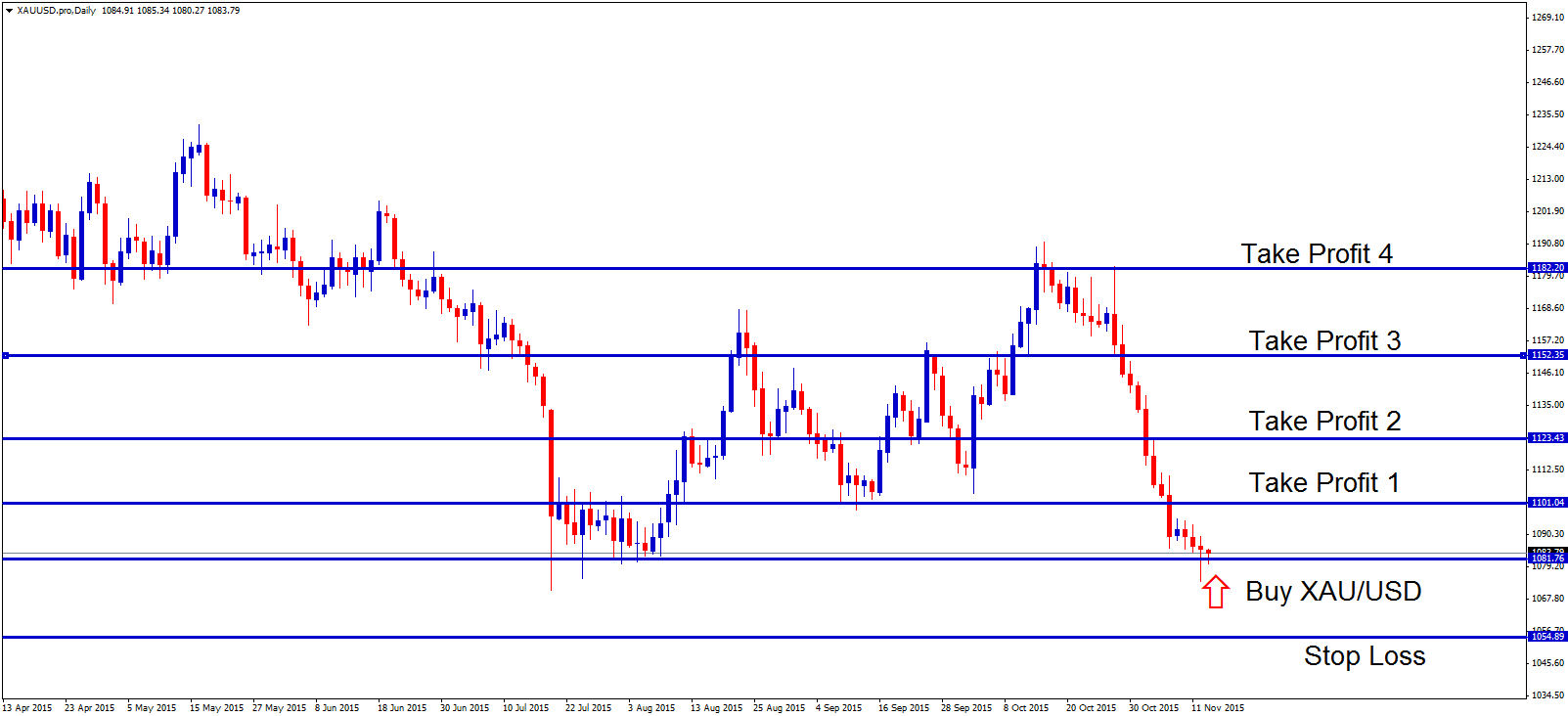

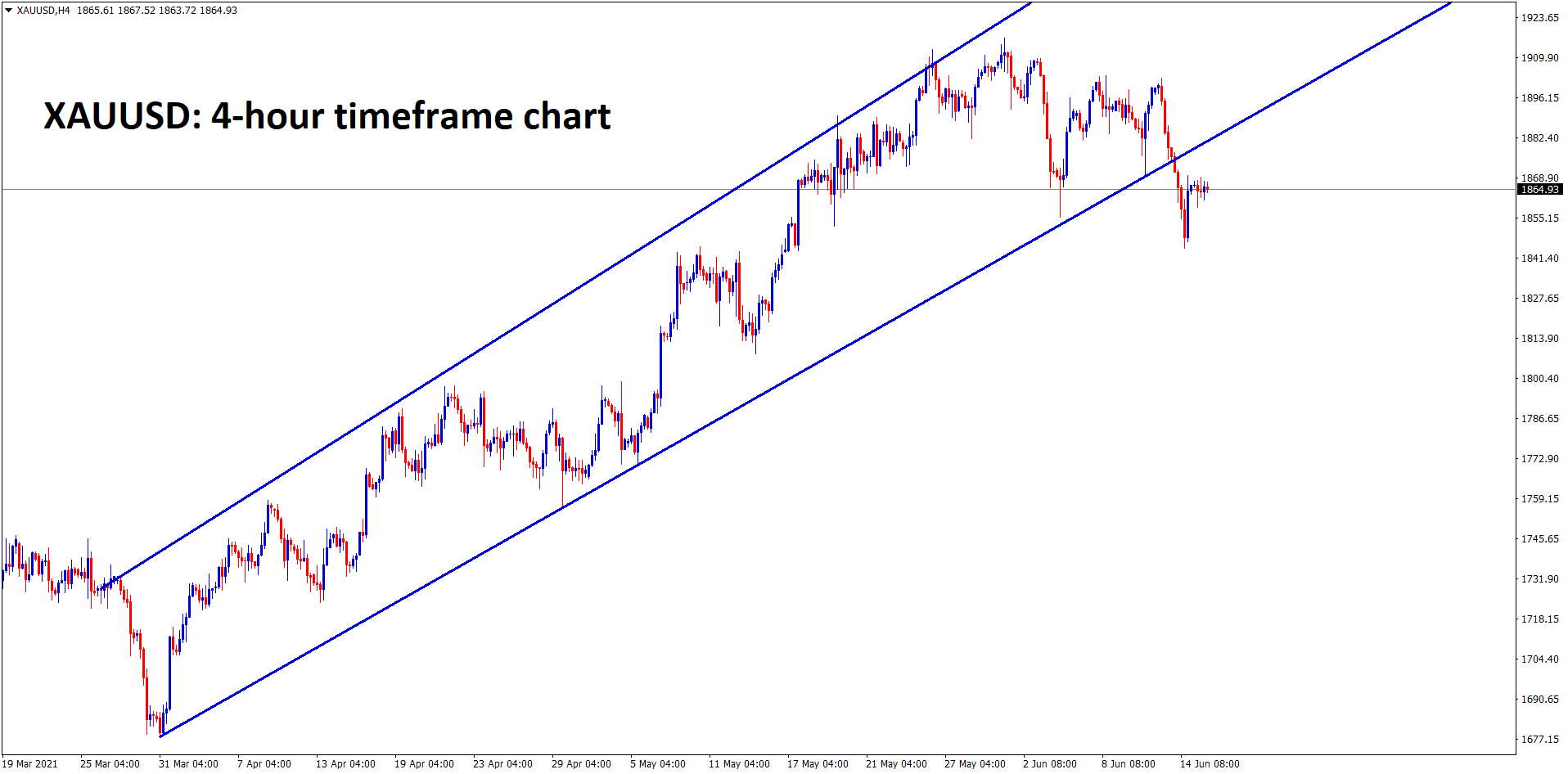

GOLD

Gold is consolidating after breaking the bottom level of the uptrend line.

Gold prices remain downside more after US Dollar stronger in the market, and the Gold prices fell by more than 5-6% in 2 weeks from 1920$ to 1850$.

FOMC meeting is a favoured stream for US Dollar this week because of rising inflation and Decreasing employment rates, and both readings will be positive for Fed policy decision this week.

And Demand for Gold went for Profit correction from last 2 months higher and its slightly in bearish tone after bulk purchases from last 2 months in Global level.

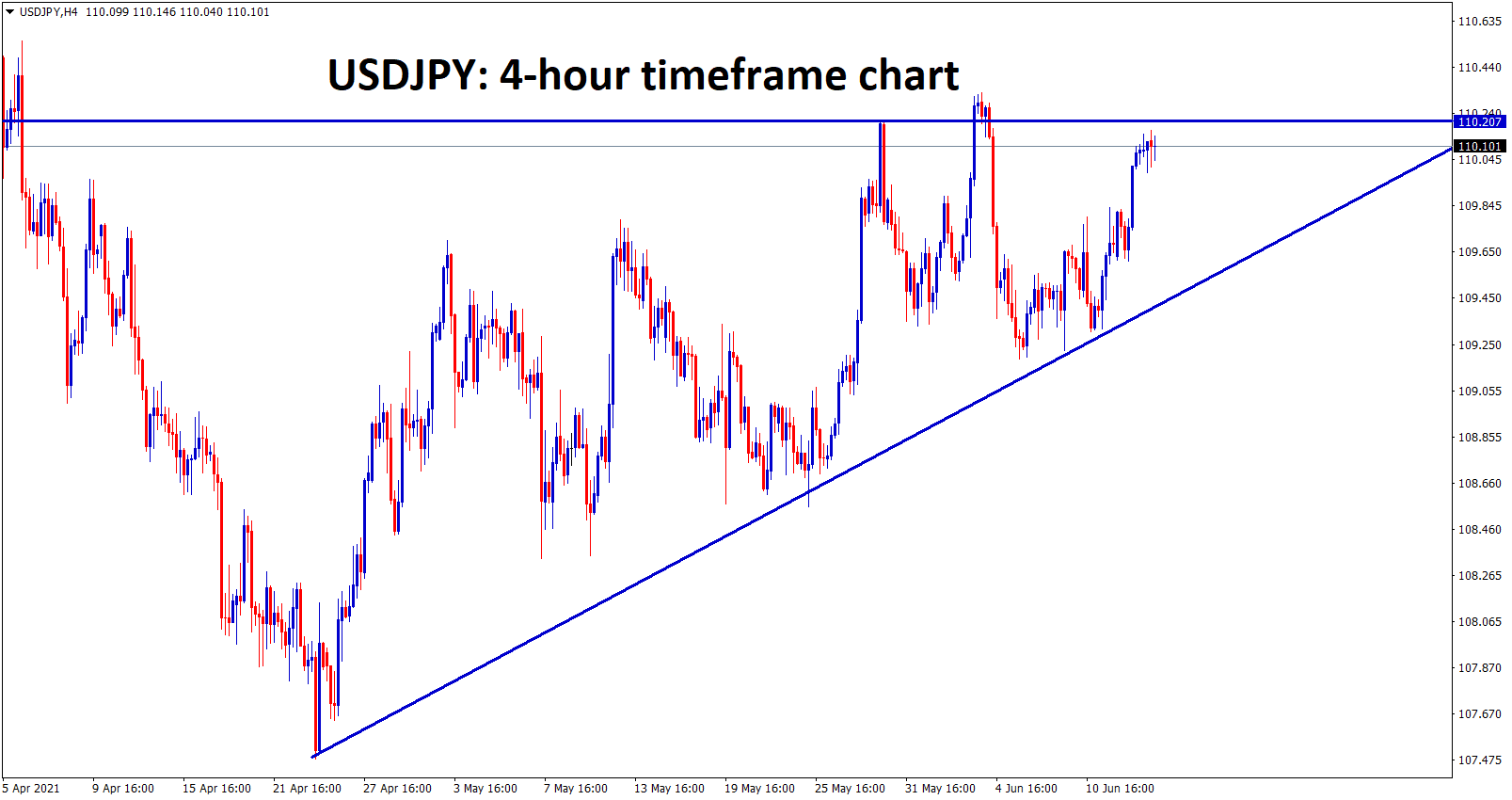

USD

USDJPY has reached the top level of the Ascending Triangle, wait for a breakout from this triangle pattern.

US Dollar shows stronger gains as the FOMC meeting will give a clear picture of Adjusting asset purchases this week.

And the Domestic data, like the Employment rate, fell to 5.8%, and the Manufacturing sector shows rising numbers and Consumer sentiment hits higher since 2008.

The Overall scenarios show the US economy is rebounding from the Crisis level and looking good.

But this flow is Transitory because the compounding effect of economic developments only taken into consideration by FED.

And the average number of readings taken into consideration index is still moved inside the sideways market.

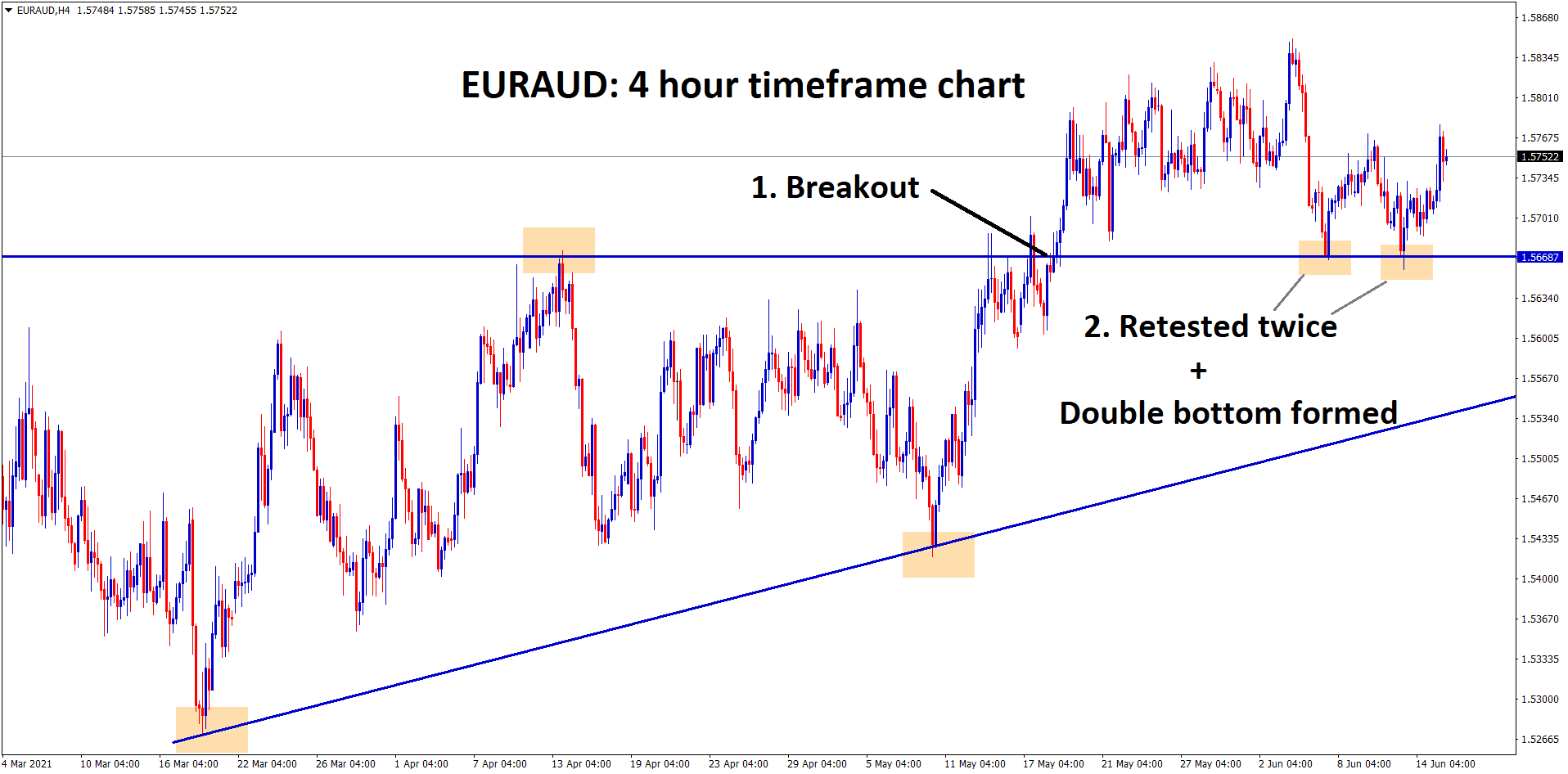

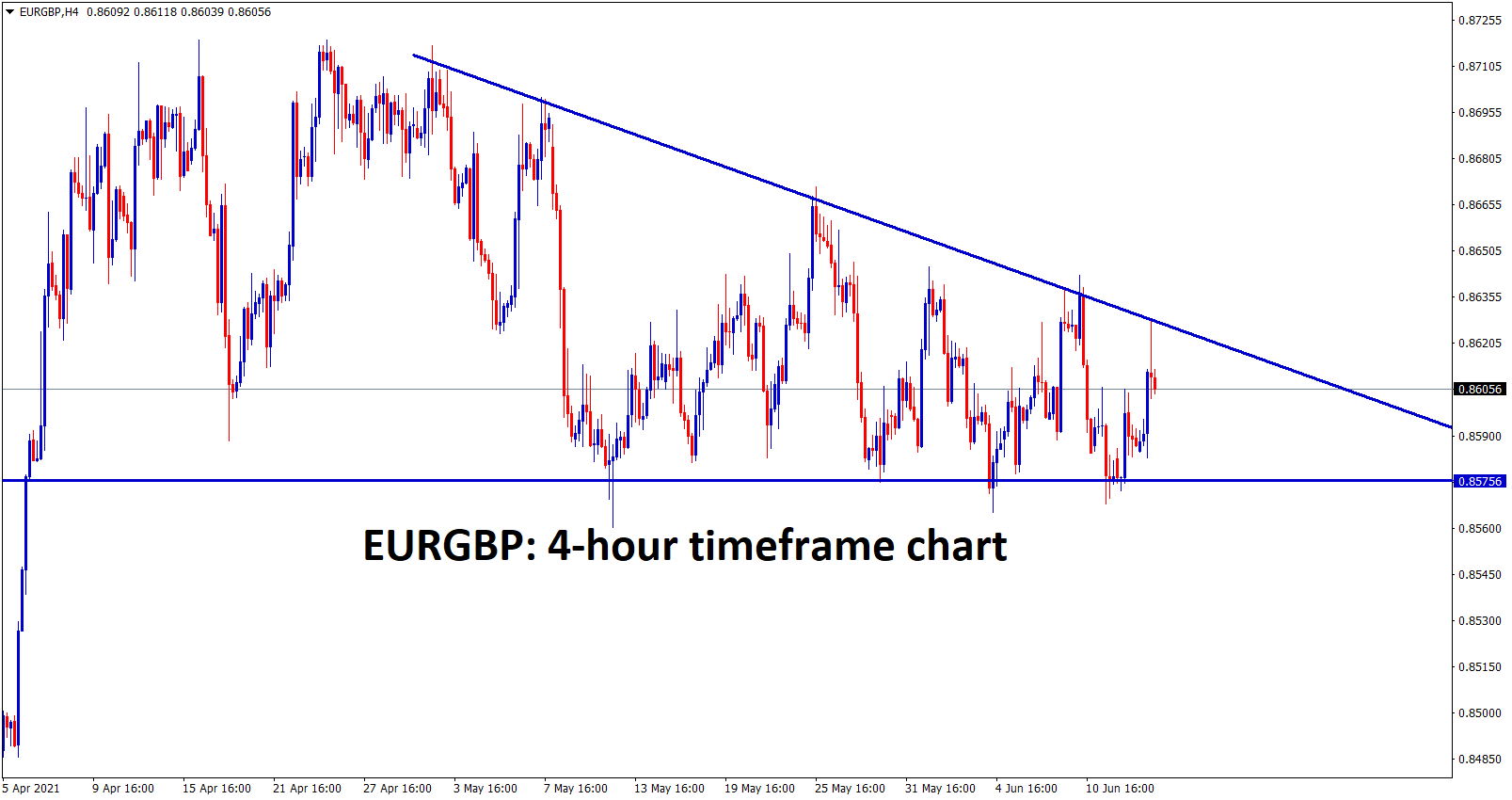

EUR

EURAUD has formed a double bottom after retesting the broken level of Ascending Triangle.

EURGBP is going to end it’s Descending Triangle pattern soon. Reason – triangle getting narrower.

EURUSD moved higher after industrial output data increased to 0.8% from 0.4% in April month.

The Higher industrial output came from Many lockdowns reopening in the economy, and consumer made free to consume more products. This, in turn, the employment rate increased, and the EUR currency turned stronger.

And German inflation CPI data scheduled this week, FOMC meeting which will happen this week will support US Dollar more than EUR is expected.

In Eurozone, the Vaccinations are progressing well, and Factory is orders rising more as consumer side demand increases.

US and EU deal on Airbus Boeing tariffs

European President Ursula Von der Leyen sounded Confident that the US and EU may cut the tariffs issue on Airbus Boeing tariffs extended to another 5 years.

And this plan will increase the tariff-free Airbus contract will support the Eurozone economy in the next 5 years.

EU and Canada discussed a way to Global carbon pricing and How to make Greenway environment Globally.

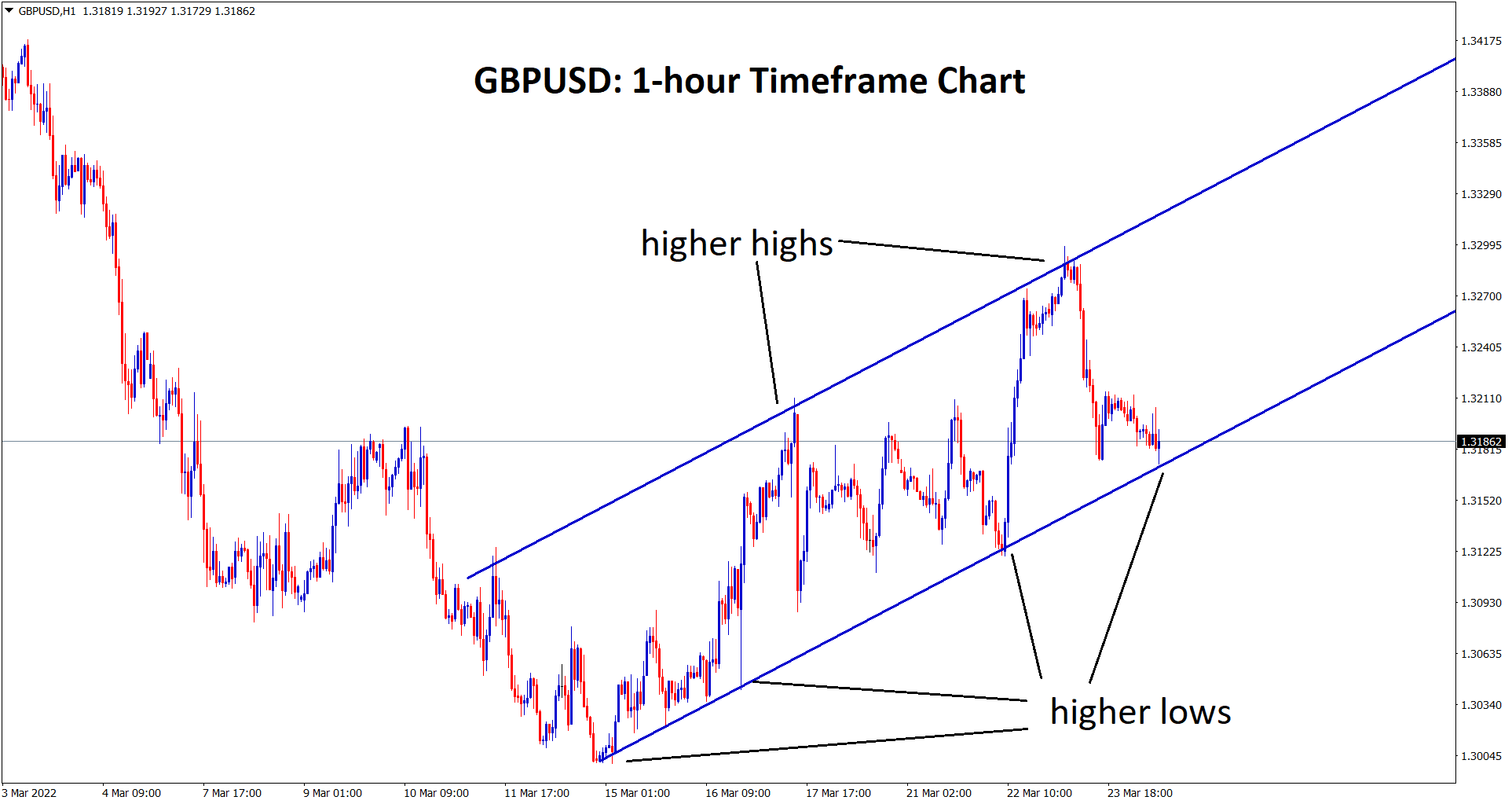

GBP

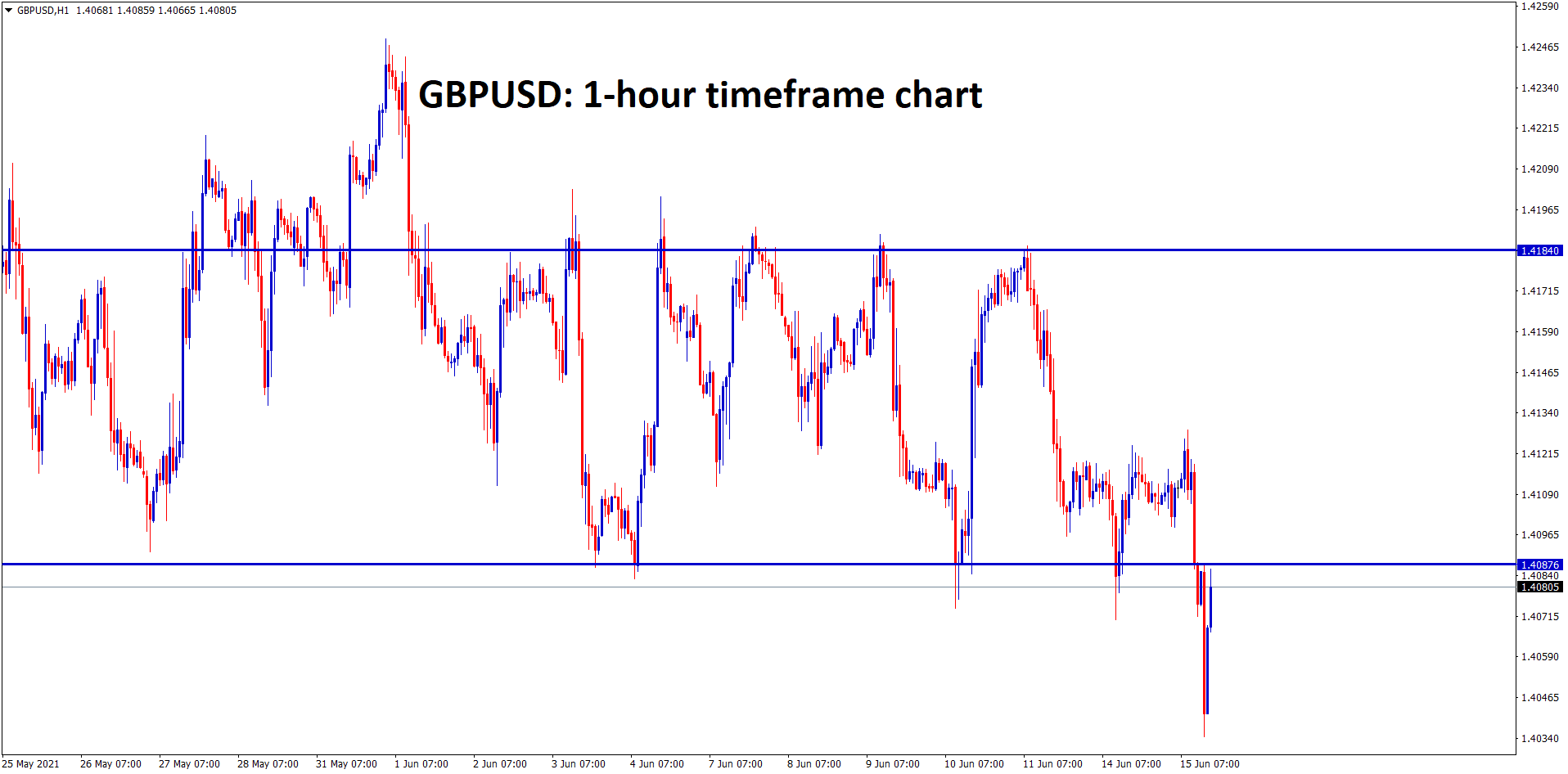

GBPUSD broke the bottom level of the range, however the market has bounced back harder to the retest zone.

UK Pound struggles inside consolidation range even UK unemployment data came in Positive report on Tuesday.

And now waiting for the UK CPI inflation report to publish, UK chief economist Haldane said there should be some changes in the upcoming monetary policy meeting after Domestic data of the UK outperformed well.

US Dollar strengthens made EUR, GBP all pairs went Downside, FOMC meeting this week Helps to stronger US Dollar as Outlook view.

Delaying of lockdown released to Next month postponed made Bearish outlook for UK Pound in the near term.

CAD

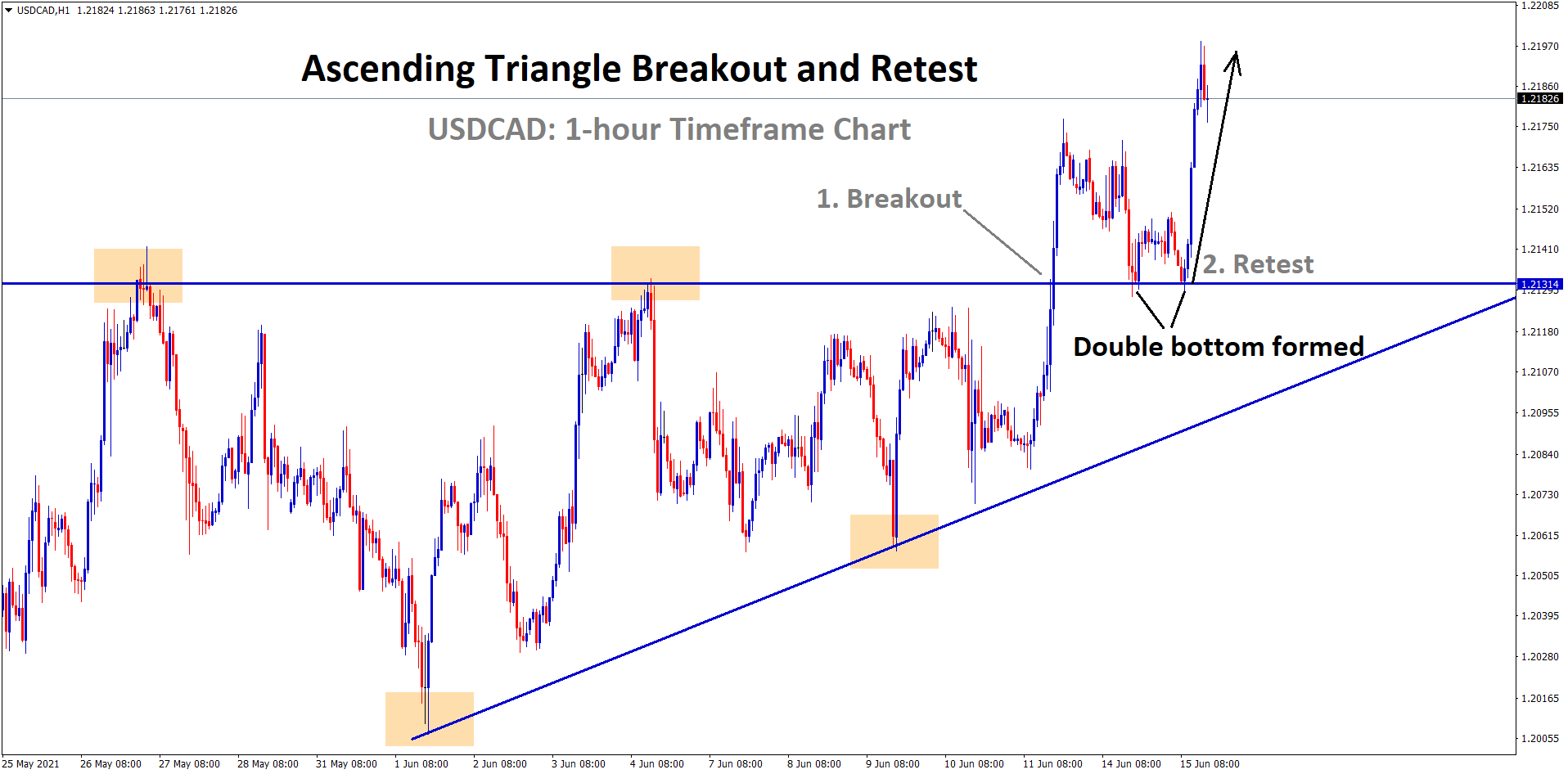

USDCAD bounced back after retesting the broken level of an Ascending Triangle.

Canadian Dollar underperformed in last 1 month as Canadian Dollar hits higher to the monthly resistance level of last 4 year’s level. Now waiting for a Decent correction to 89-88 level as a good jump up in the next 2 to 3 months.

USDCAD will see a good correction in the lower high side to the level of 1.25 level in the next 2 months.

And FOMC meeting made no outlook for Tapering assets but started to discuss tapering asset purchases in the upcoming meeting.

Oil prices climbed higher to 71$ and may increase to a further 72-73$ this month.

The only solution to drag down oil price is Iran supply; which will come to market then All OPEC+ countries will decide to supply increasing. As a result, oil prices are shooting up every month higher, and Oil producers profited from Surging levels to offset the crisis loss in March 2020.

Due to these scenarios, the Canadian Dollar will get stronger in the next 2-3 years as Oil prices will increase to 100$.

JPY

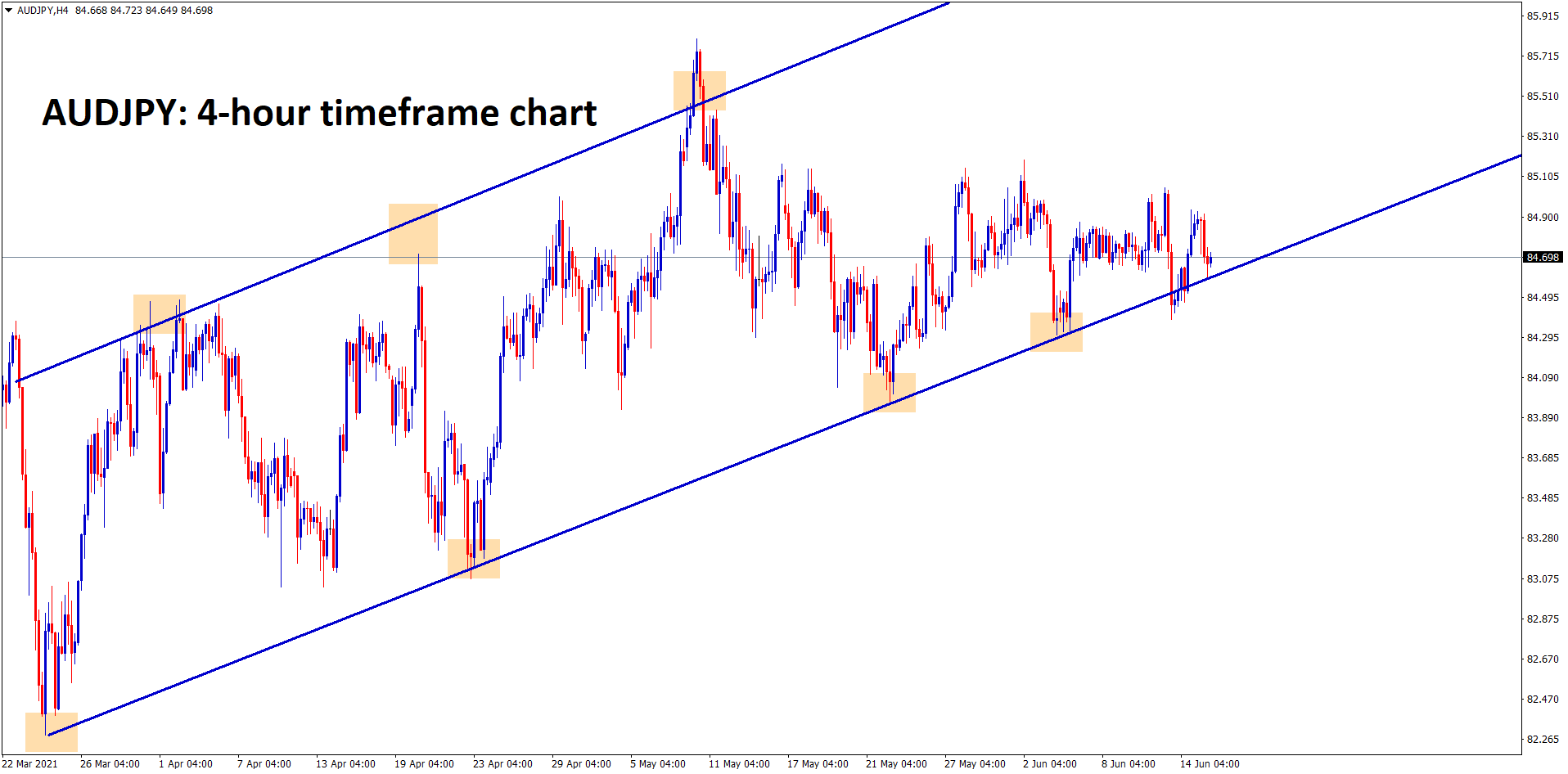

AUDJPY hits the higher low zone and it’s consolidating.

Bank of Japan decided to extend the September month-end Pandemic purchases to December end as Former central board member Makoto Sakurai said on Tuesday.

Bank of Japan maintaining Yield curve control until the governor term ending April 2023, and Too early to curb the purchases will harm the Japanese Government bond market.

Bank of Japan must proper planning to disburse the holdings from ETF’s profits.

AUD

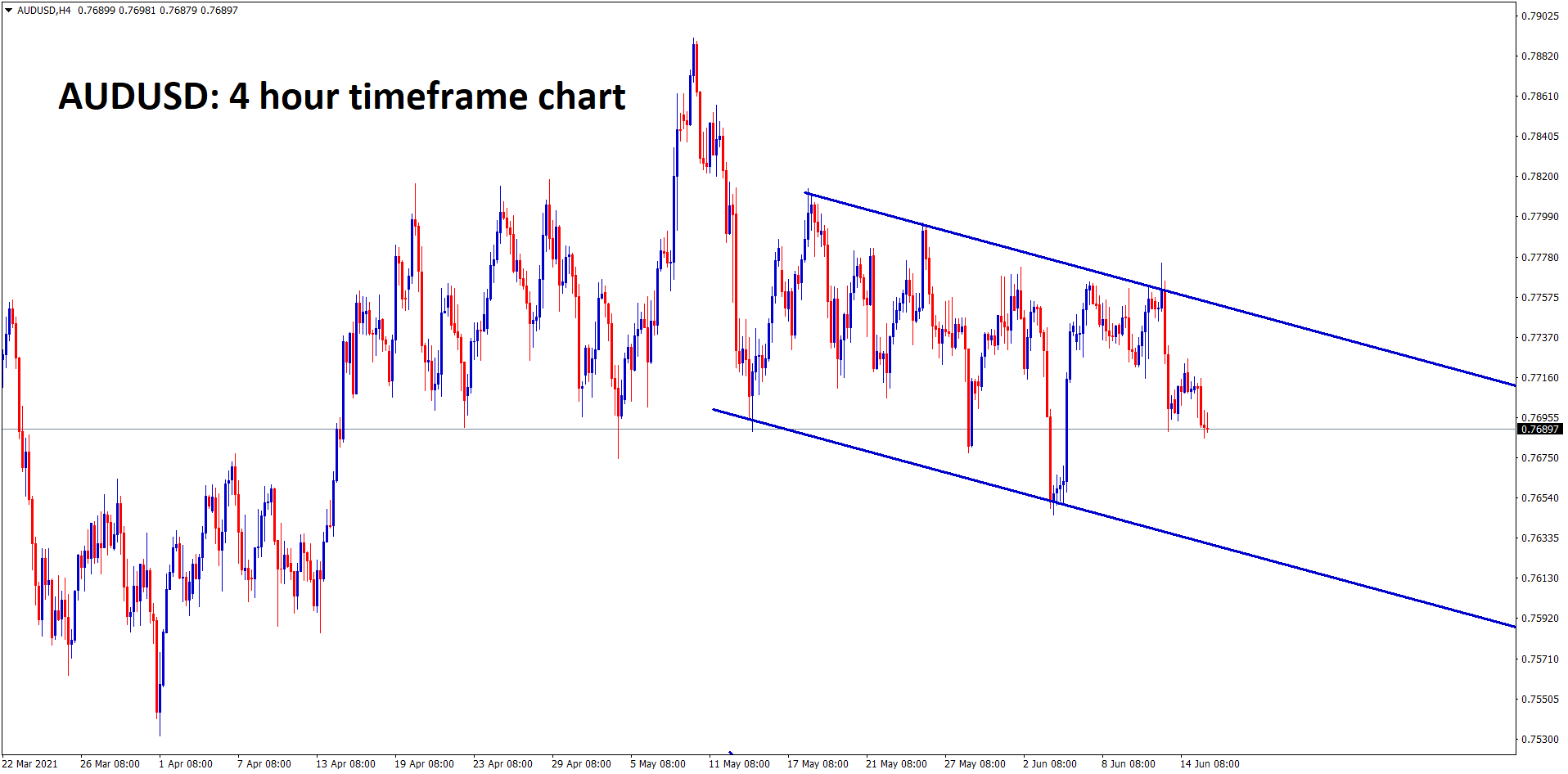

AUDUSD is moving in descending channel ranges for a long time.

Iron ore prices surge back rally after Chinese manufacturing hub of Iron ore attacked by natural Floods.

Due to these scenario’s demand for Iron ore remains robust growth for Australian exports to China.

AUDUSD moved in the ranging market as no more Domestic stronger data will happen in the near term, RBA meeting minutes no healthy outcome is revealed.

FOMC meeting tomorrow will give the direction of Trending or Consolidation market in AUDUSD.

NZD

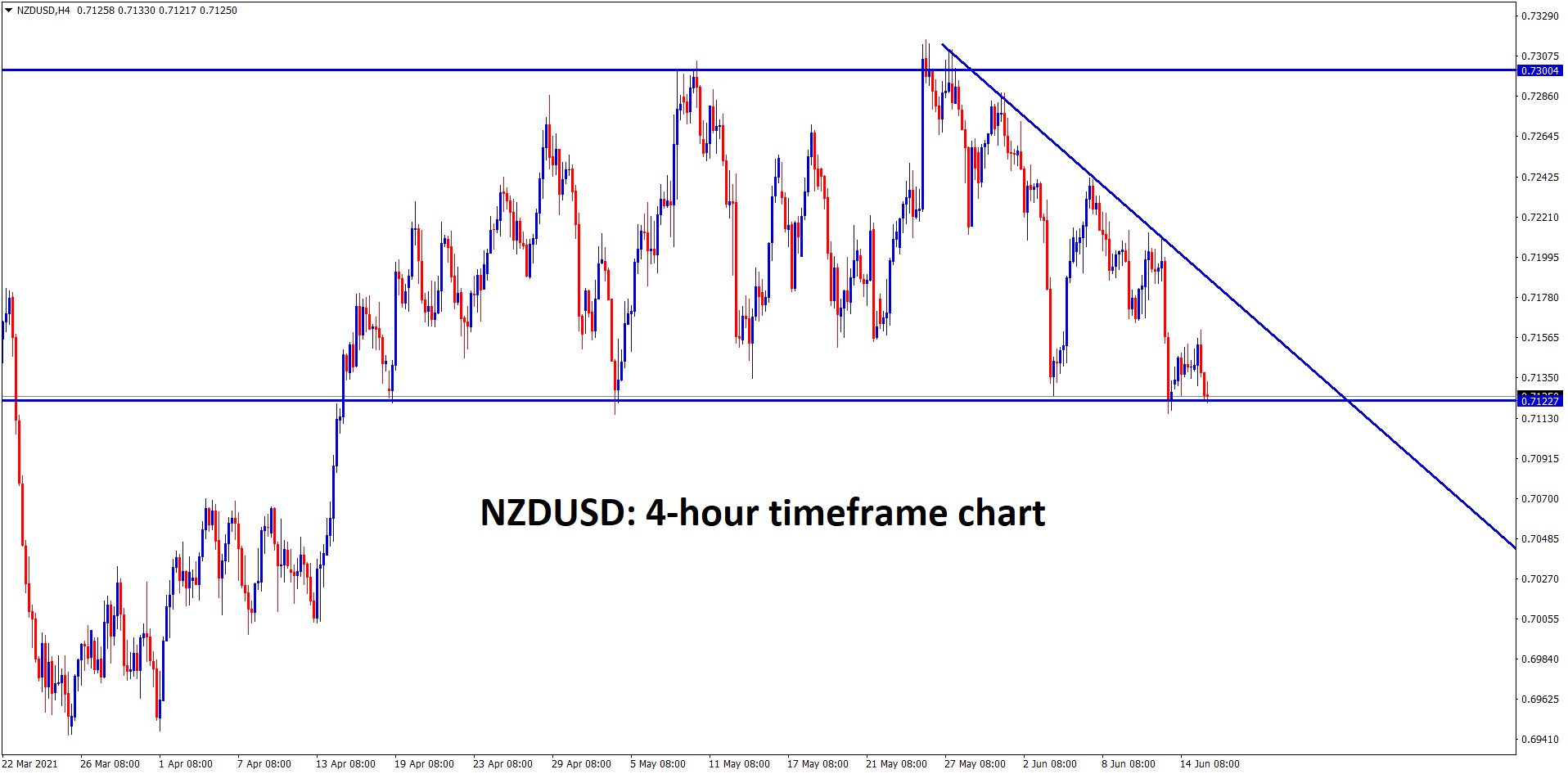

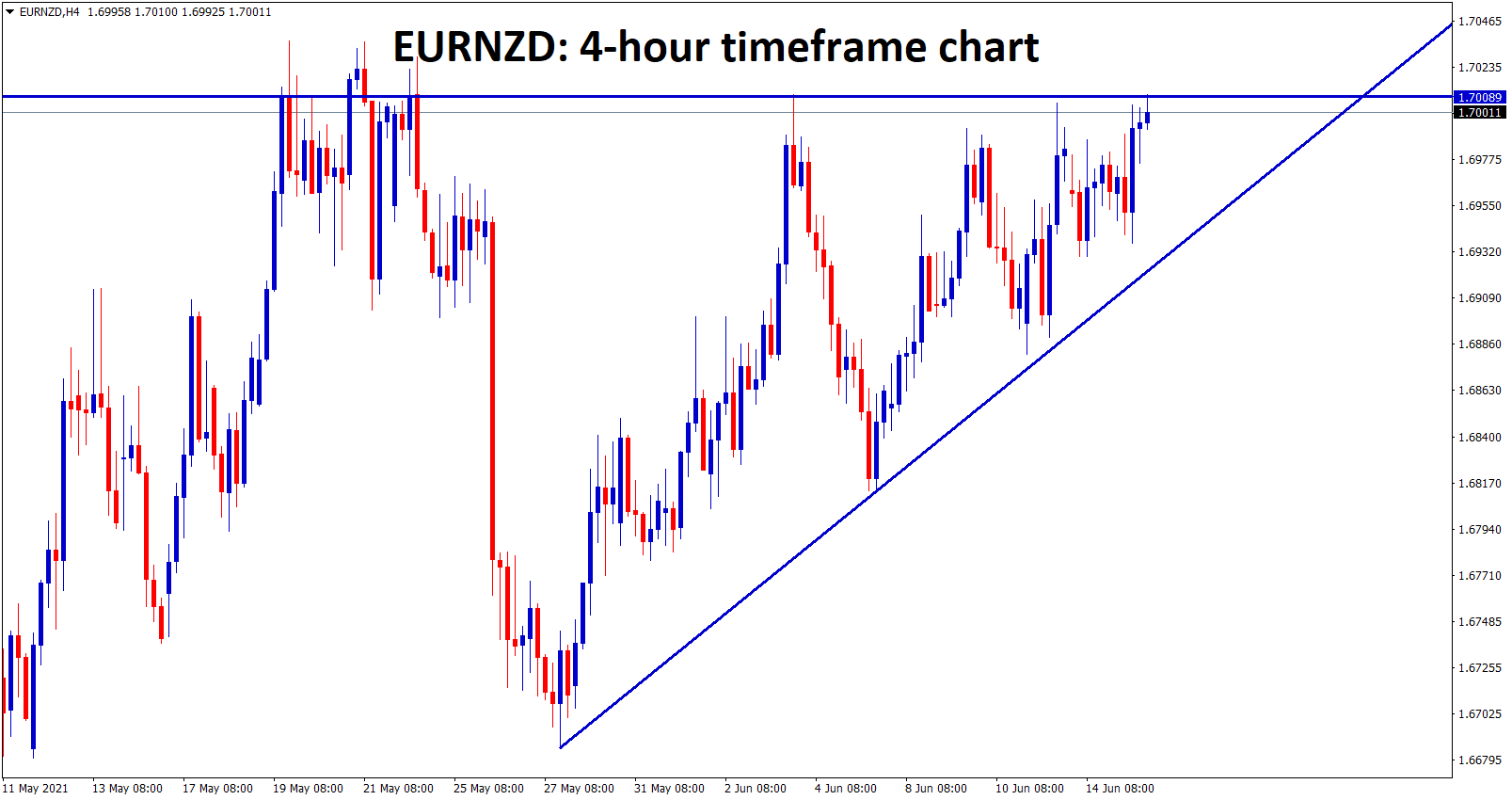

NZDUSD is at the strong support zone, wait for a breakout of this descending triangle..

EURNZD hits the top level of the Ascending Triangle, wait for the breakout either at the top or bottom.

New Zealand Dollar is stood on kicking prices to jump on the Clear trendline point in the Daily Time frame chart.

And Any news from US Domestic data or FOMC outcome is favourable for New Zealand Dollar this June month.

Fundamental news is good or bad, nothing will impact the Downside for New Zealand Dollar, but a Strong Upside move is possible for NZDUSD. Domestic data and RBNZ performed well for Island Country.

Due to this scenario USD Dollar stronger appearance will dominate other currency pairs like EUR, GBP and AUD. But not New Zealand Dollar.

CHF

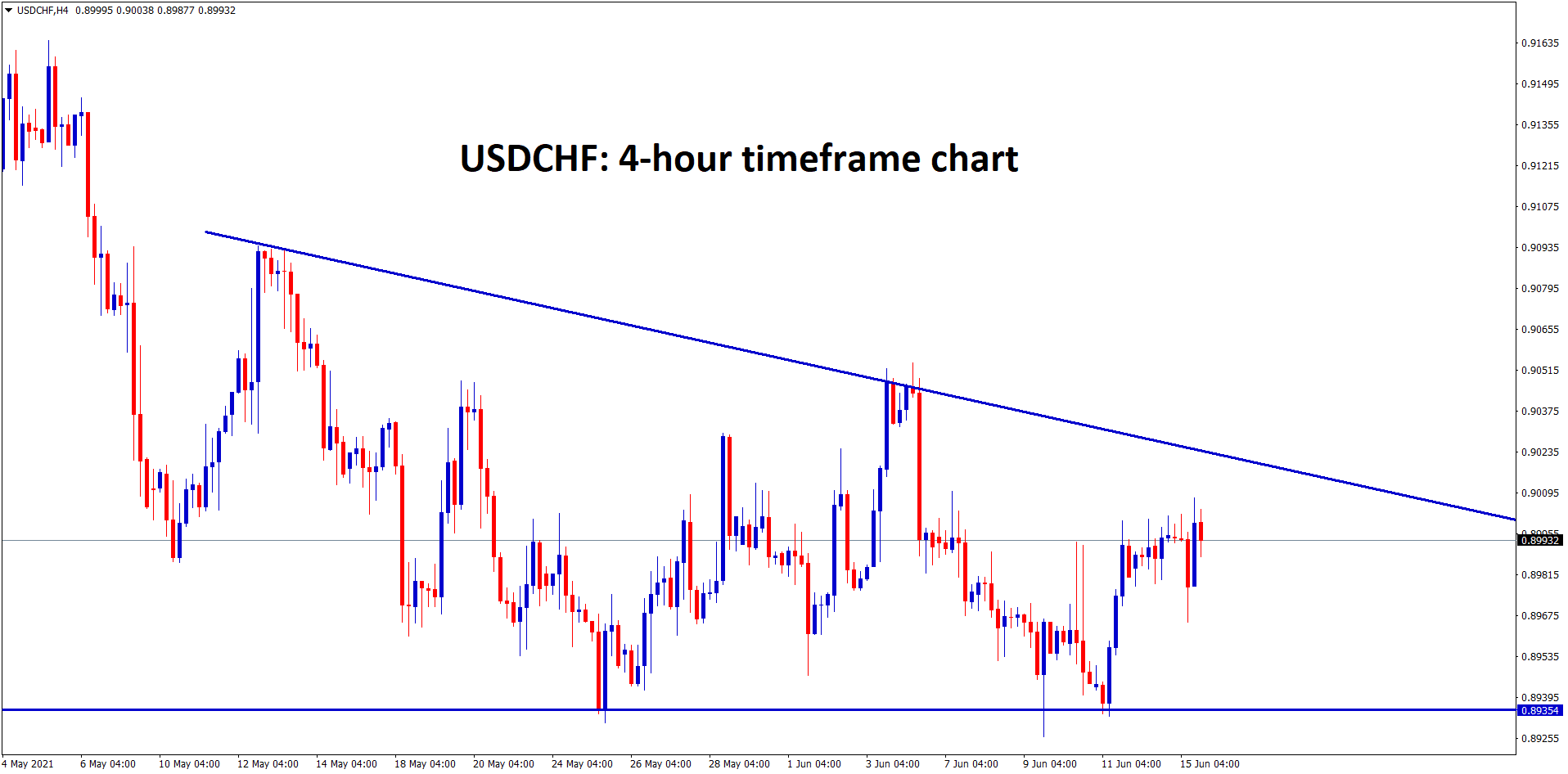

USDCHF is moving in a descending triangle, wait for a breakout from this triangle.

Switzerland’s state secretariat for economic affairs has raised the Country’s Growth forecast in 2021-2022 after easing lockdown in Swiss expected a huge recovery in the economy.

As reports Prepared by SECO towards Forecast of GDP growth of 2021 are 3.6% from the previous forecast of 3.0%, 2022 +3.3% forecasted from the previous same reading.

- 2021 CPI forecasted to 0.4% versus 0.4% previous reading.

- 2022 CPI forecasted to 0.5% versus 0.4% previous reading.

The Strong recovery in the second quarter will be reflected in the GDP growth of Switzerland.

And Easing lockdown will help the economy to recover robust growth in 2 years.