The forex market is hard to predict? Yes, Of course.

Forex market movements are harder to predict because of more volume and high volatility in the market. However, some of the most easily predictable currency pairs are listed with examples below. Anyone can learn to predict the forex market easier with these currency pair strategies.

The main factors to consider when choosing the best currency to trade include volatility, spread, trading strategy and the level of difficulty of forecasting the forex market.

There is a huge list of currency pairs available for trading in the forex market. If you look out your forex broker market watch window. you can see a list of currency pairs.

If you look out each currency pair, you can see the difference in prices, trend, movement, spread and chart patterns.

Each currency pair is unique. But the most predictable forex pairs are easily identified by their market structure and repeated chart pattern movements.

Top Predictable Currency Pairs

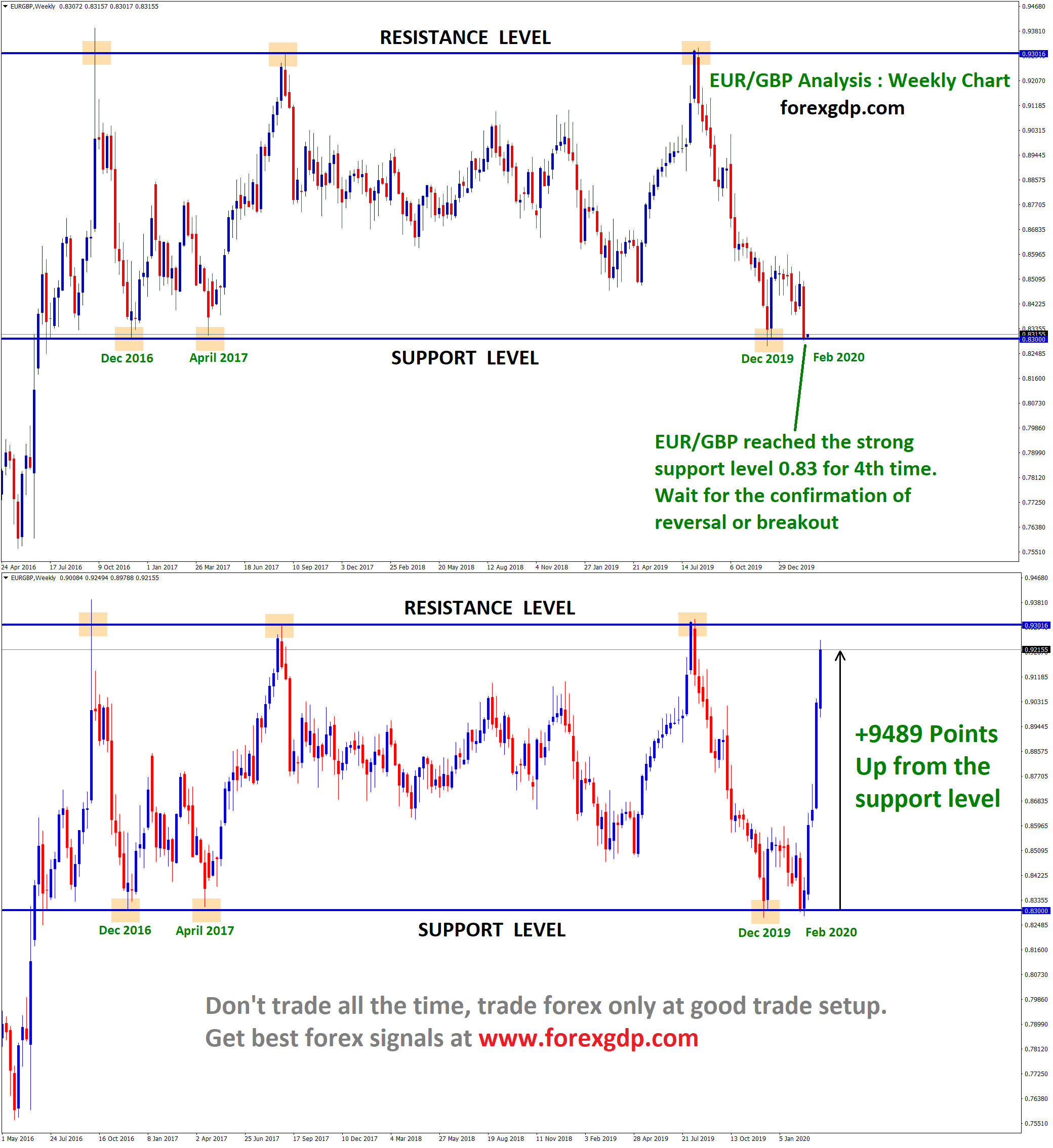

EUR/GBP

The European Economy is closely tied to the UK economy. Due to this, EURGBP mostly keeps moving up and down between specific price ranges.

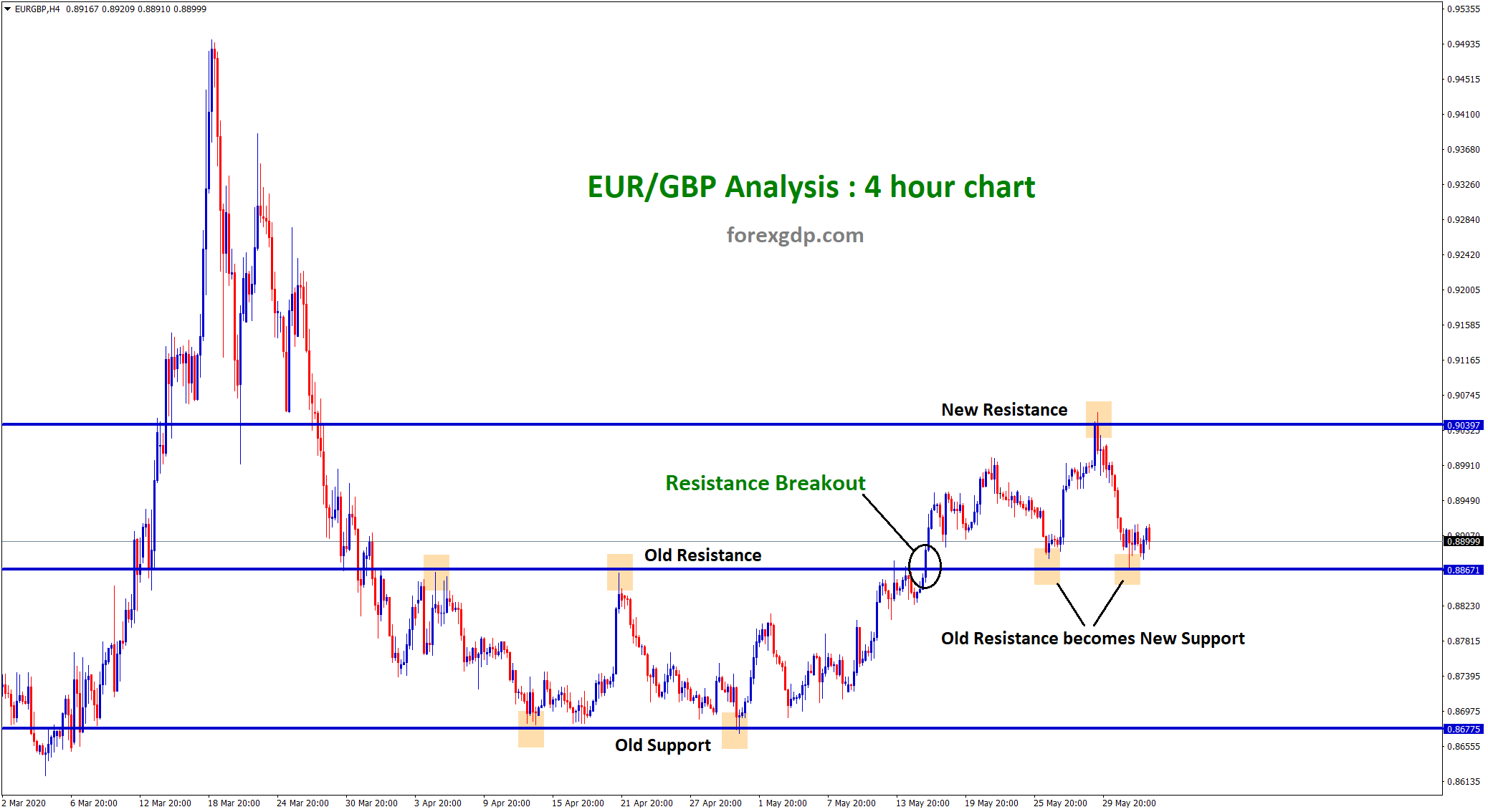

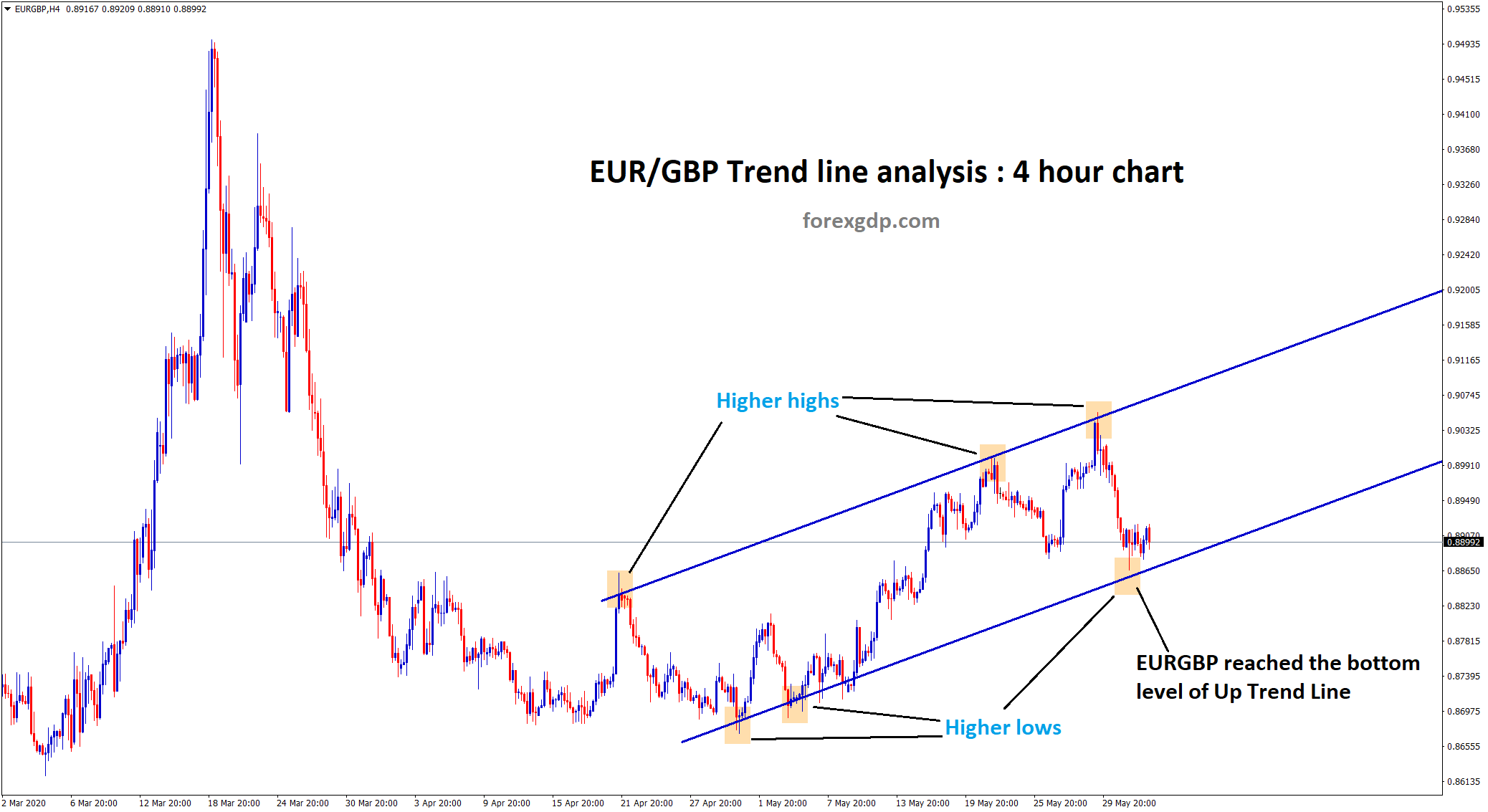

In this currency pair, You can see more support and resistance opportunities, trend line, Continuous Channel trading opportunities.

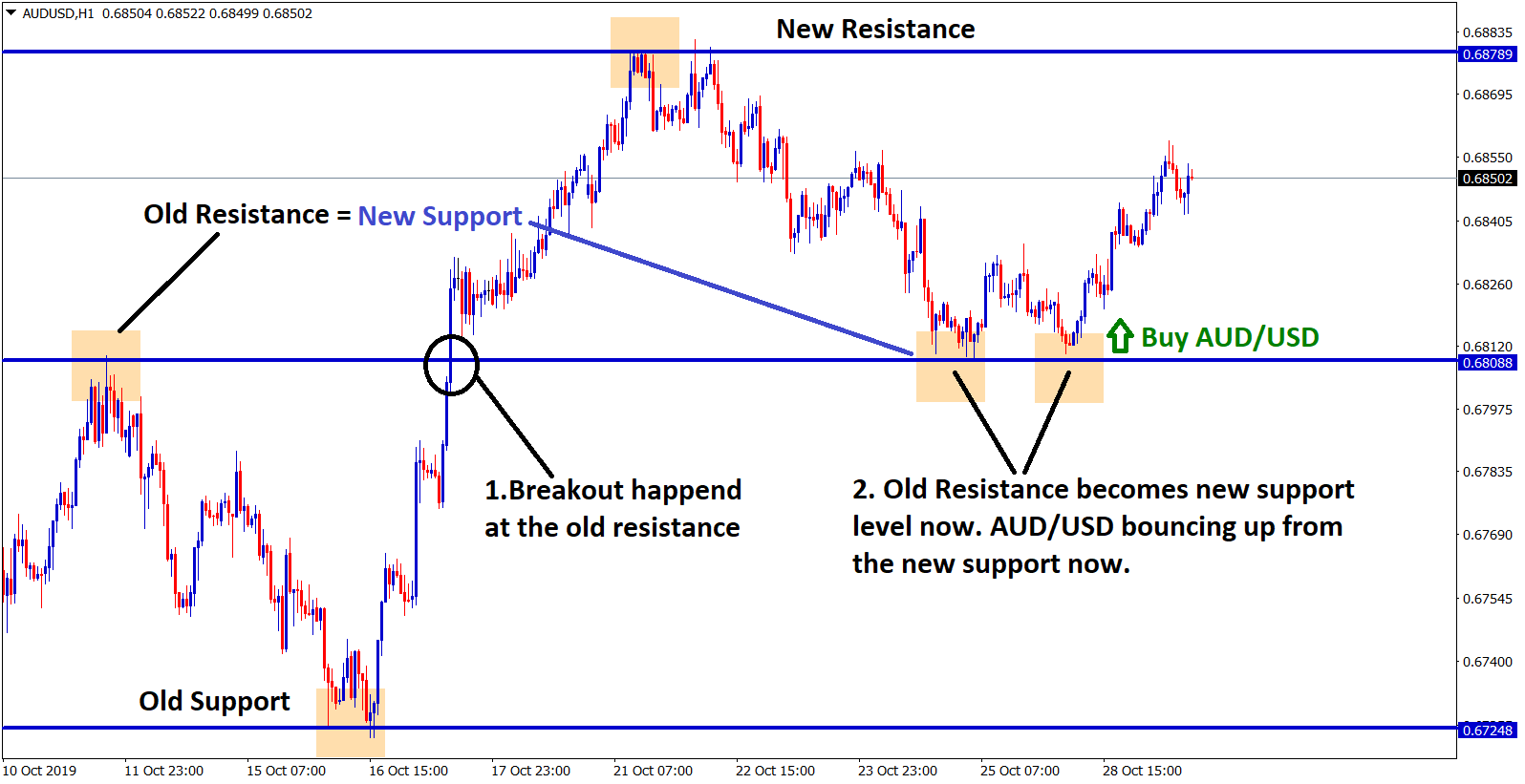

old resistance becomes new support in EURGBP h4

The EURGBP price movement may not give more pips, however, the EURGBP future movement is easily predictable using simple technical analysis. As a cross currency pair, The value of a pip is higher in EUR/GBP. The combination of the price movement of EUR USD + GBP USD = EURGBP. If Eurozone faces any issues, the EURO currency gets affected, GBP gets strong automatically. Similarly, If Britain economy faces any issues, GBP gets weak automatically.

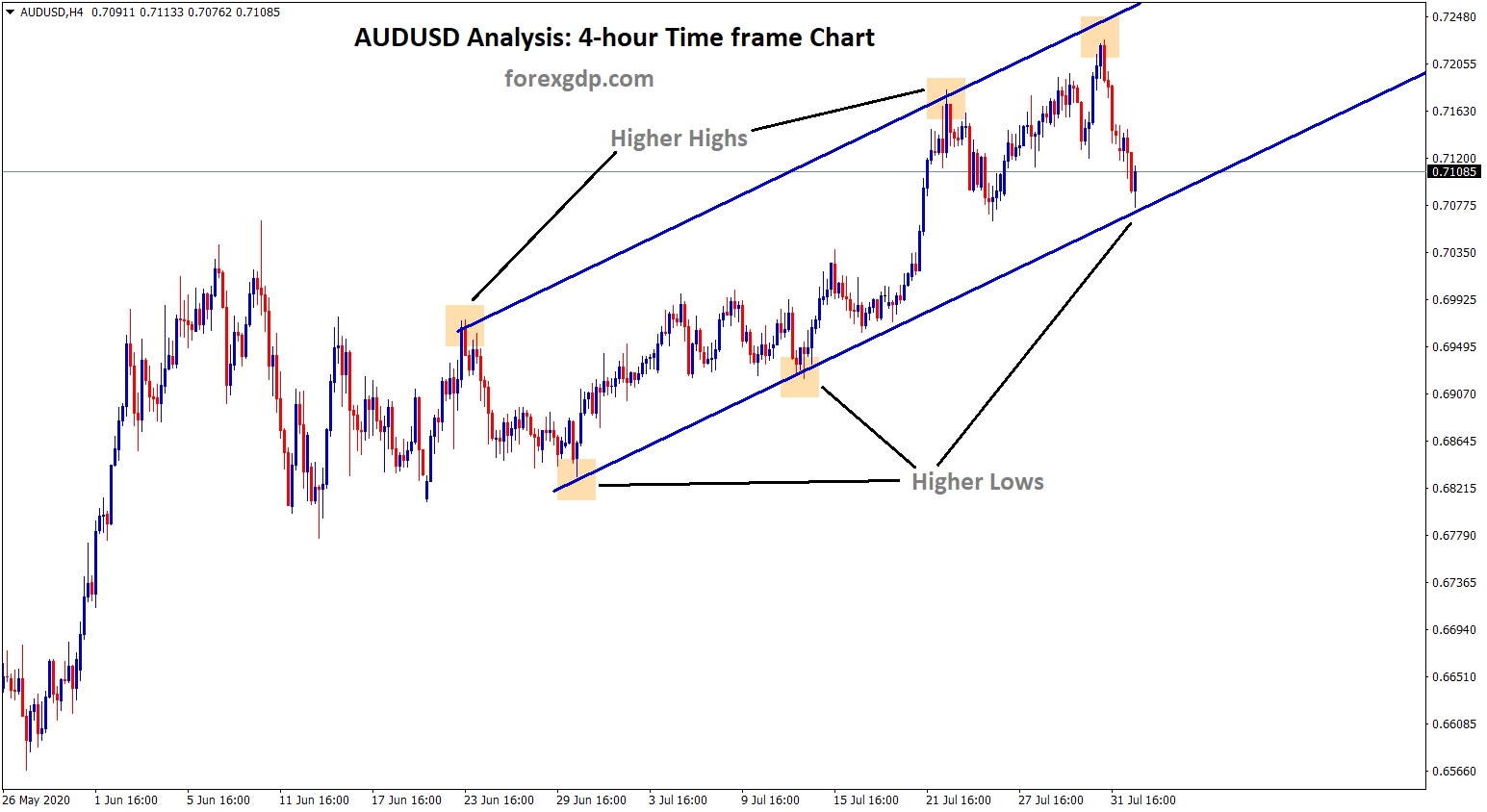

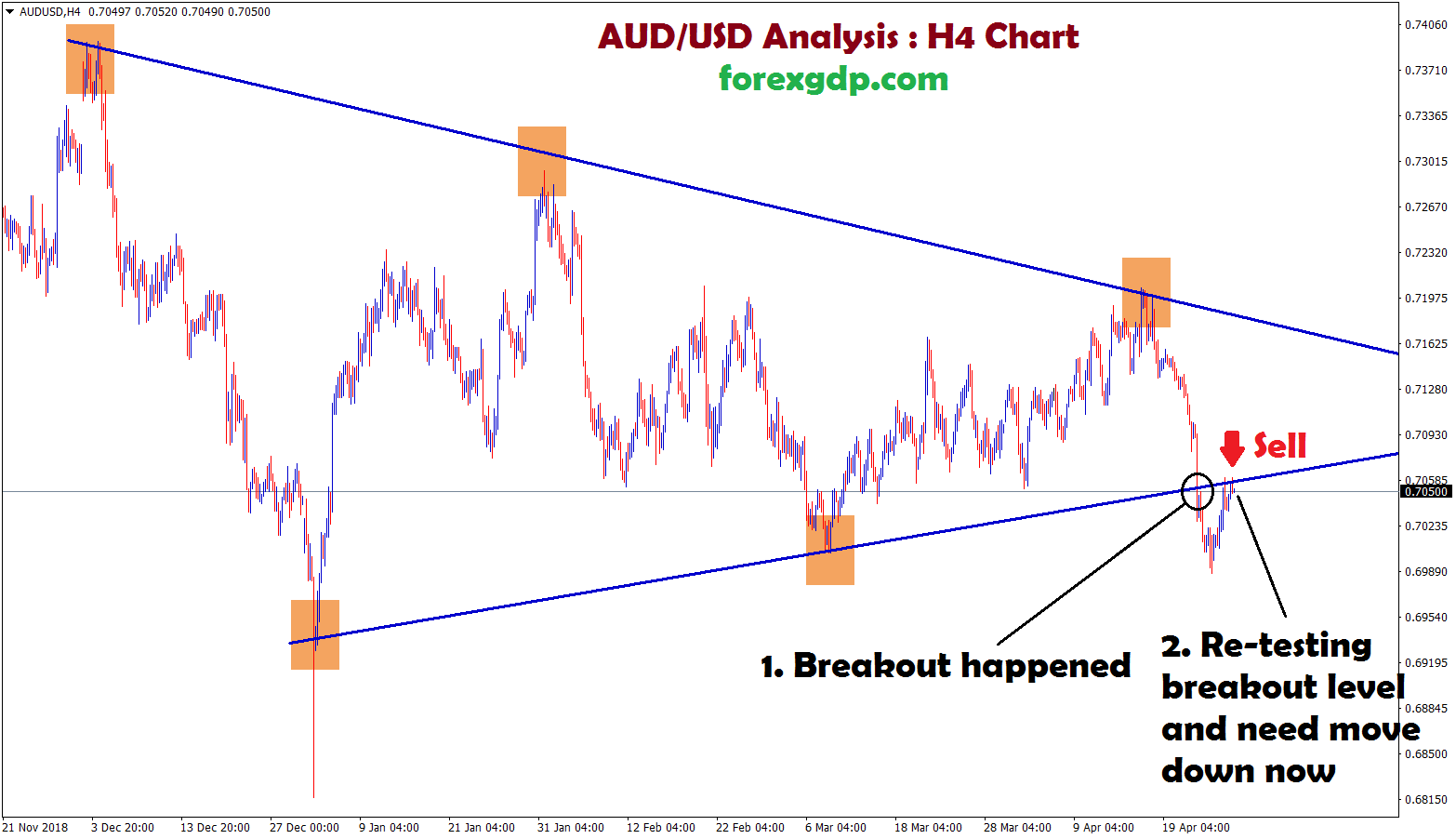

AUD/USD

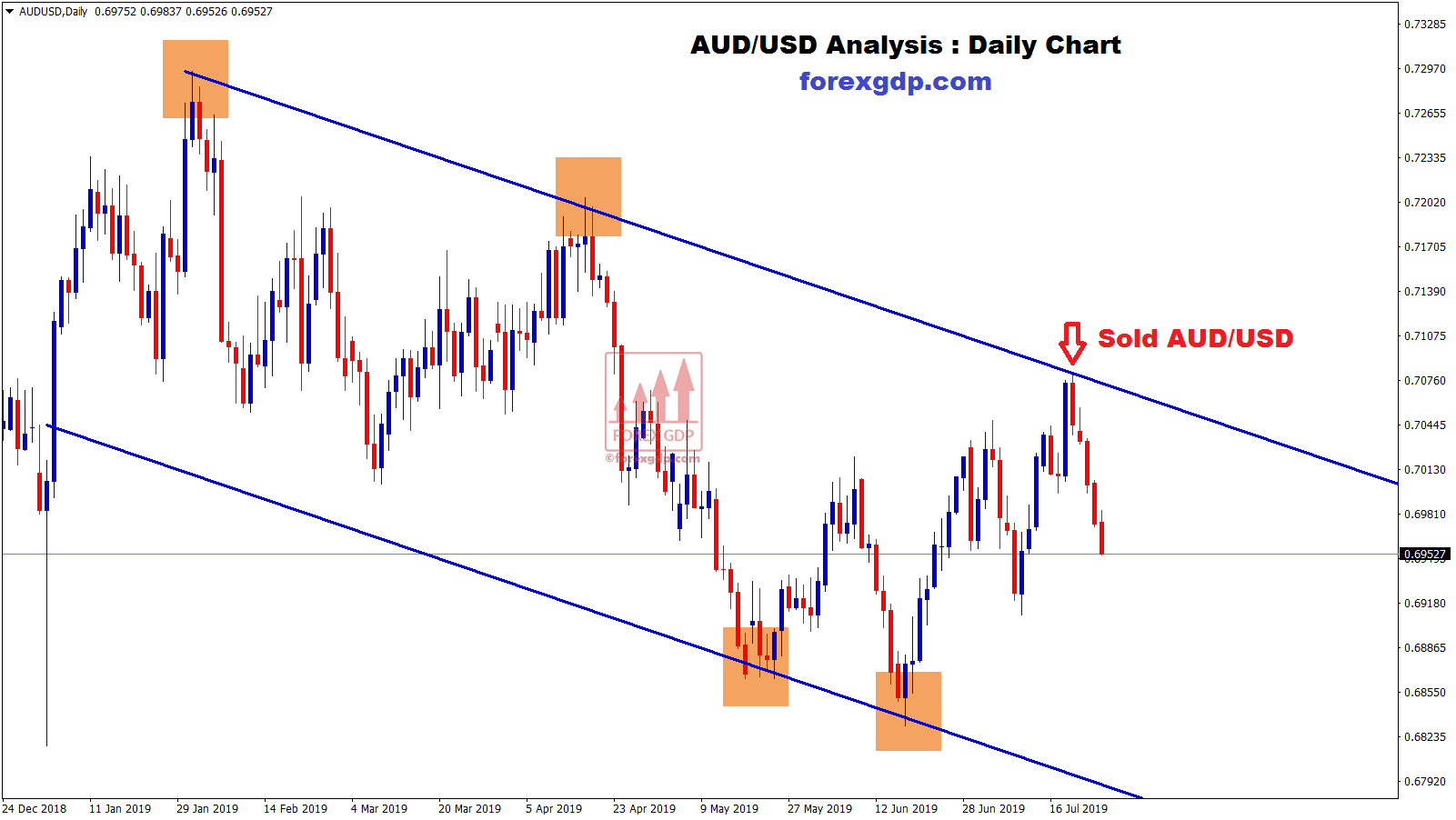

AUD/USD is one of the major currency pairs in forex trading. Look at the bigger picture with regard to this pair and you’ll see wide range trading at play. Take a closer look, and you’ll notice that the AUD/USD pair generally respects both Ascending and Descending channels as well as rising and falling wedges.

AUDUSD moving in an Ascending Channel

It generally takes something quite extreme to mess up this pairing, making it one of the most traditionally predictable currency pairs out there. The Australian Economy mostly depends on closer Asian countries such as China, Japan, India. Australia exports and imports to China contributes 30% of GDP.

Other than China, the US also contributes Australia to 20% of GDP

If China does not import raw materials from Australia then Australian GDP fell more and reflects the Australian dollar to decline.

The strength of the Aussie dollar is closely tied to its exposure to Asia and the commodity cycle, as well as a somewhat counter-cyclical position relative to the currencies of other major currencies.

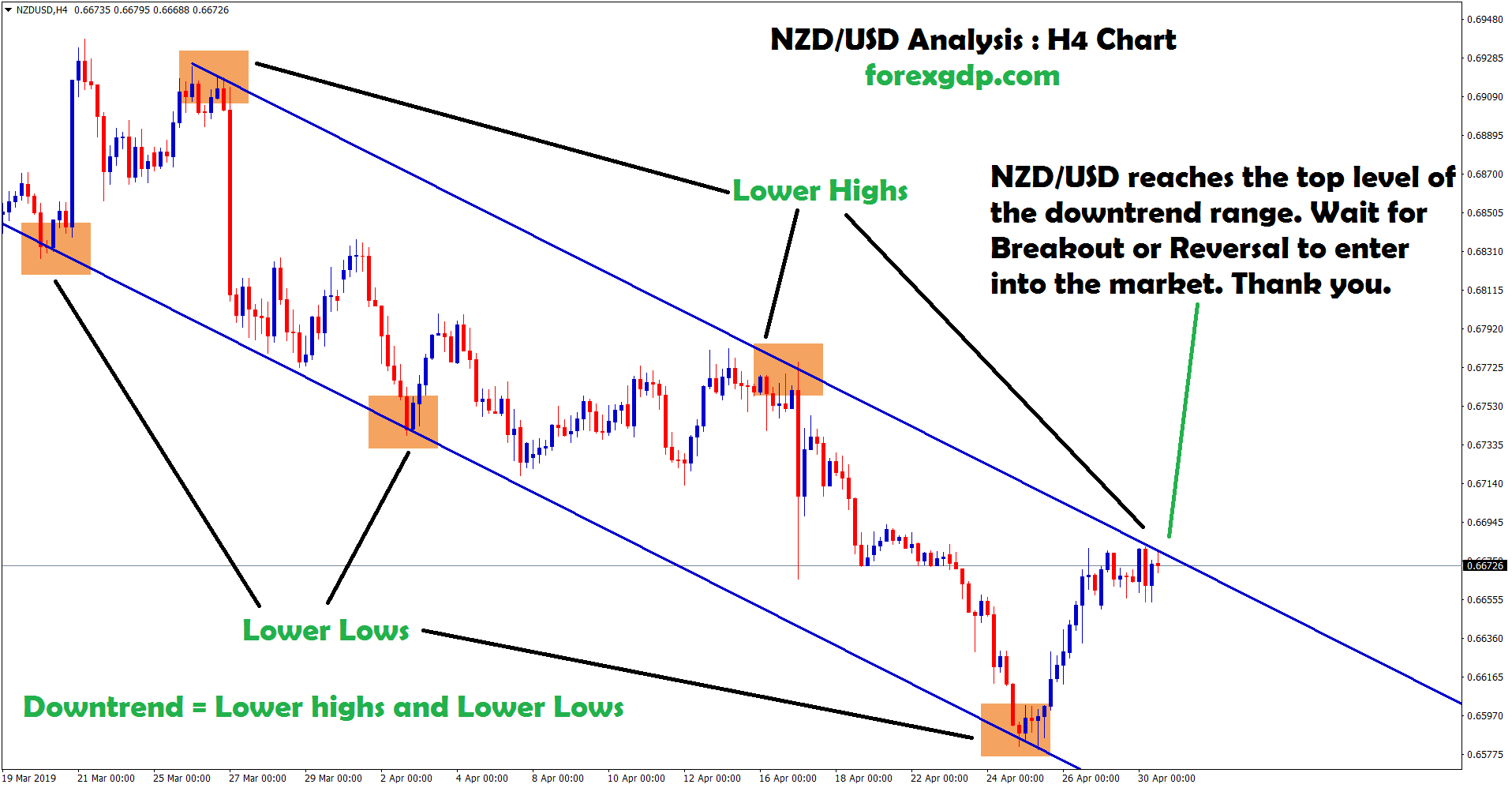

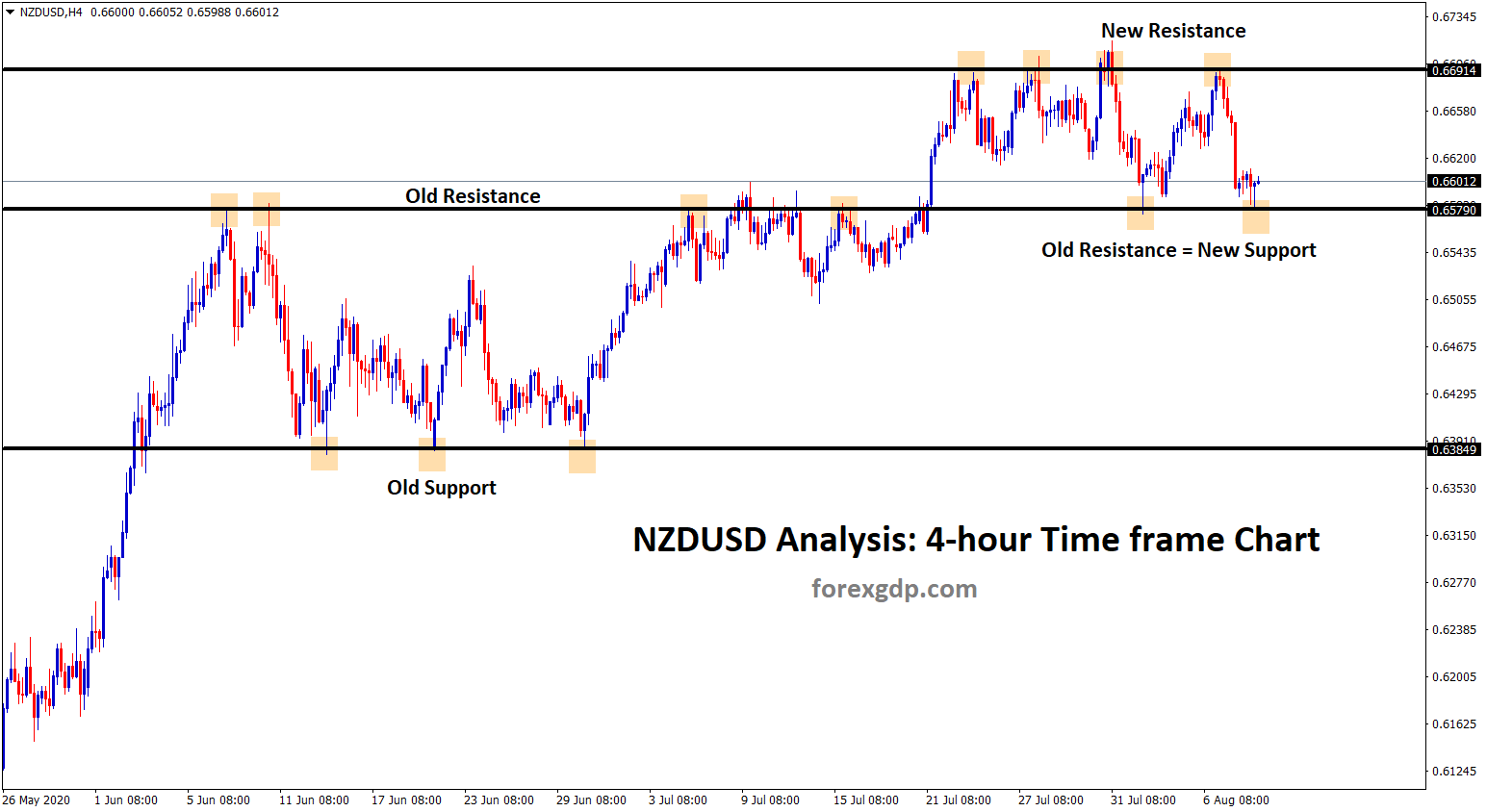

NZD/USD

NZDUSD pair mostly trades depend on the Support and Resistance Levels, Range markets, Channel lines, Fibonacci Retracement levels, etc.

Newzealand is also the same as Australia, depends on China. Newzealand dairy products, meat is contributed 10% of GDP.

China is the largest importer of meat, dairy products from Newzealand. New Zealand looks like an independent country, as you see during the Covid-19 times, Newzealand is the first country to get recovered from Coronavirus. This shows that they are not dependent completely on other countries.

Both AUD/USD and NZD/USD is considered as commodity currency pairs in forex trading because the commodities, foods, raw materials exports and imports are happening

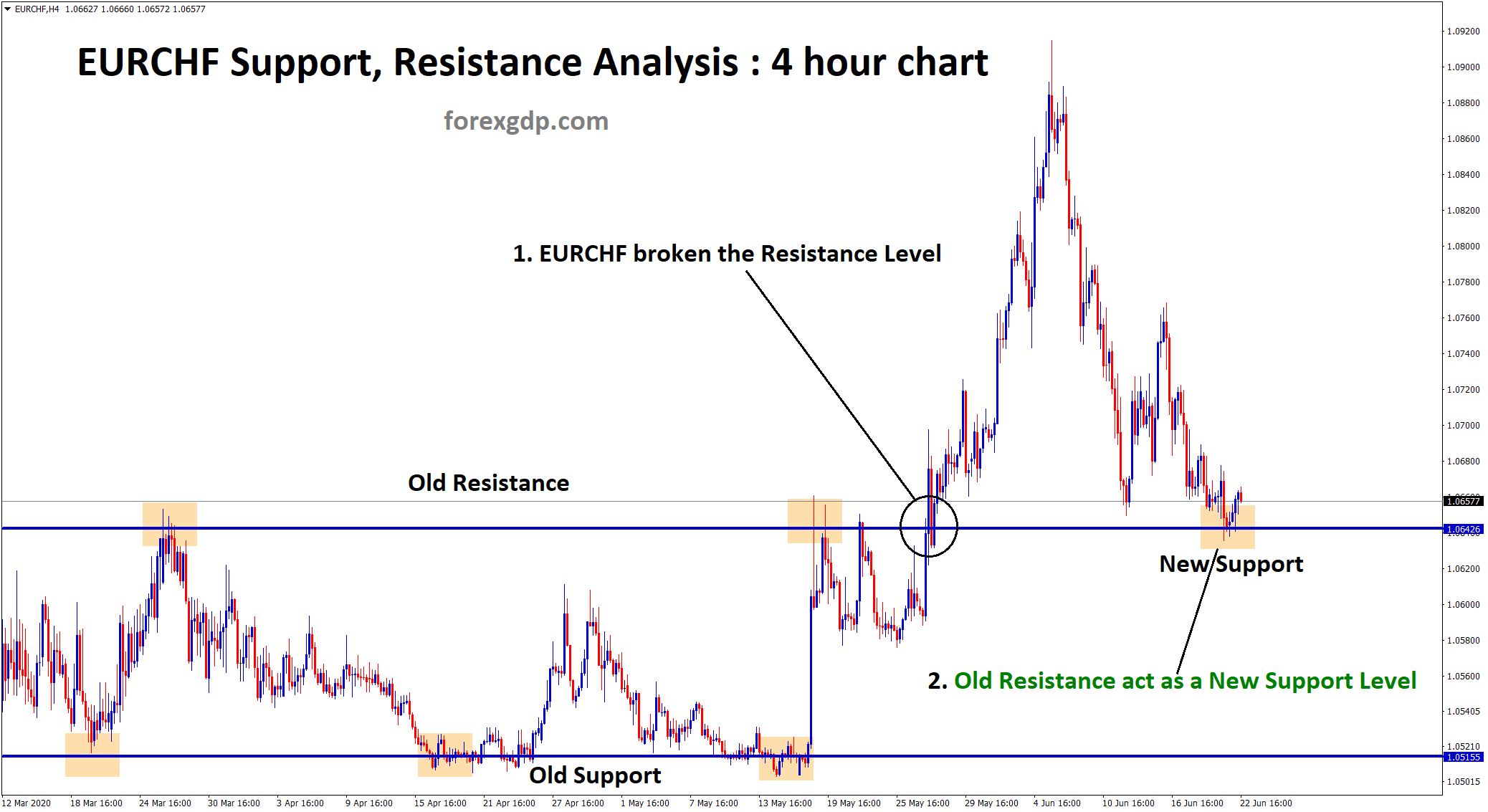

EUR/CHF

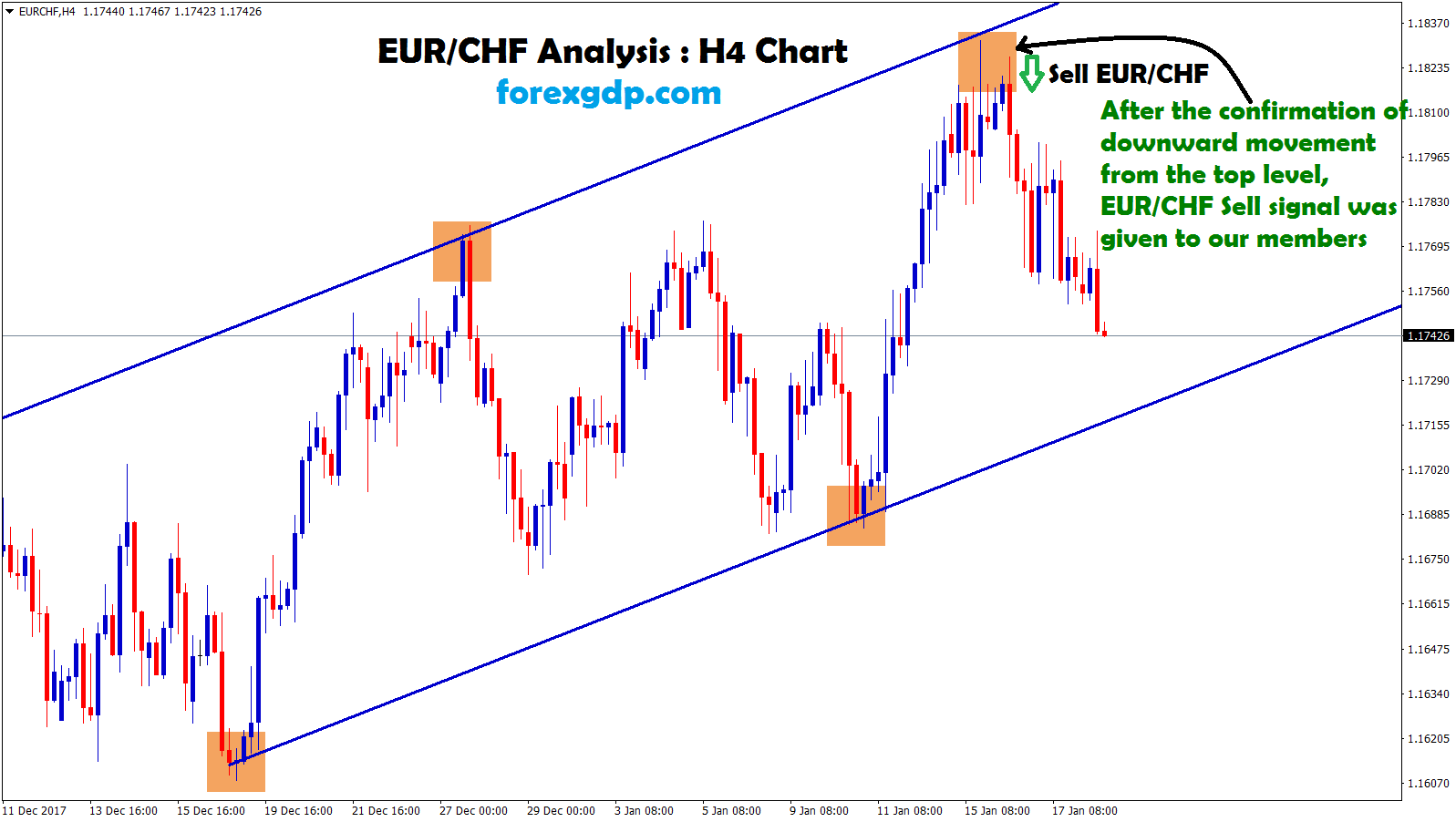

EUR/CHF is the most predictable pair in forex trading among the technical traders because the market always keeps moving depend on some technical analysis or forex trading chart patterns. This is one of the very slow-moving currency pair out there with low volatile and liquidity.

In this currency pair, You can see more support and resistance opportunities, trend line, Continuous Channel trading opportunities.

The combination of the price movement of EUR USD + USD CHF = EURCHF. The Europe and Switzerland Economy is mostly tied closer. however, Swiss Frac Currency (CHF) is more stable than other currencies due to their high holdings of Gold and Black money in the Swiss banks. Switzerland is one of the most expensive countries in the world.

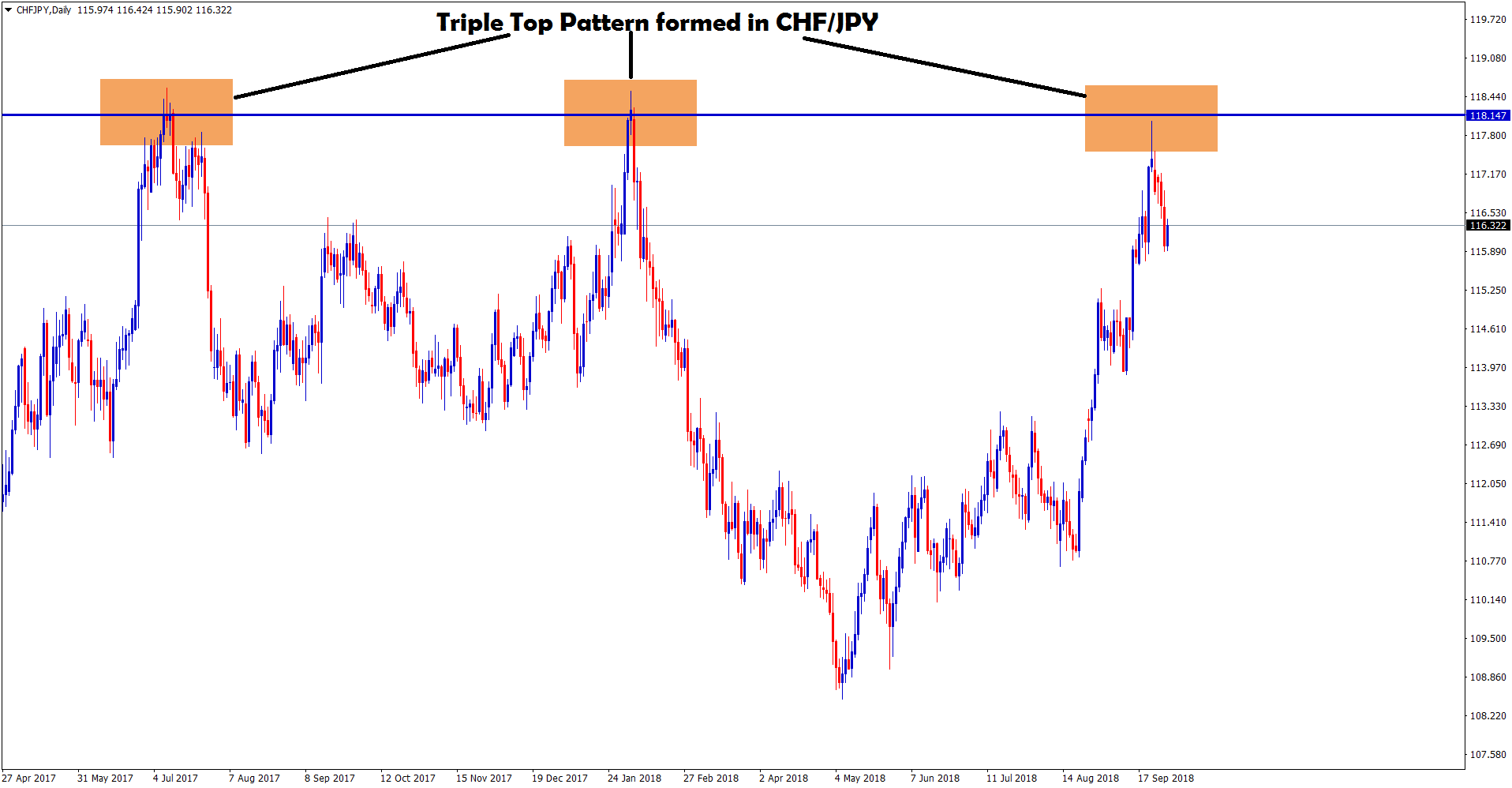

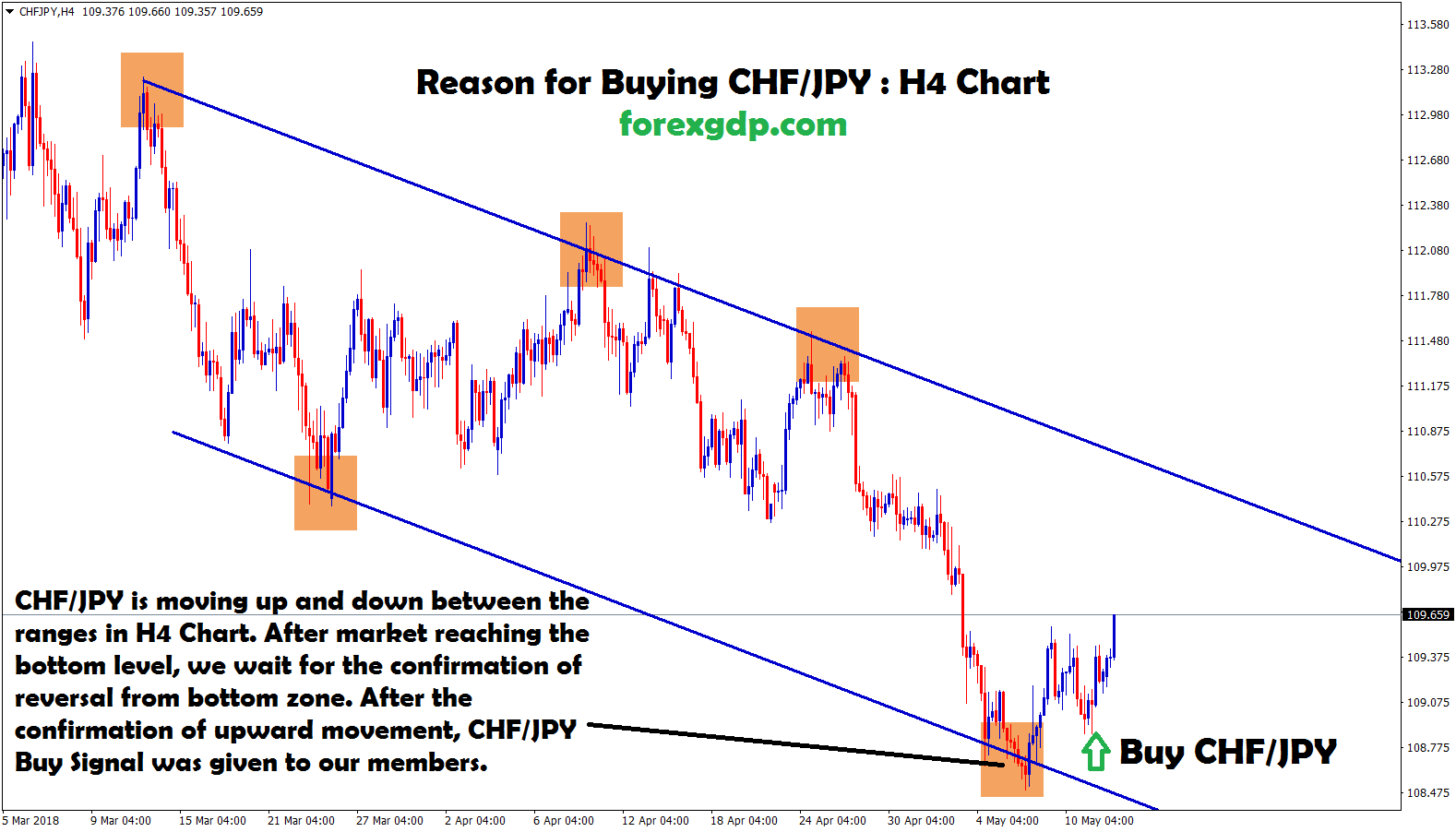

CHF/JPY

CHFJPY pair creates more technical chart patterns like Triple Top, Double top, Double bottoms, Head and Shoulder, Triangles, Ascending and Descending Channels, etc.

CHFJPY has many ups and downs with false breakouts if you look out in candlestick chart. However, if you look out in the line chart, you will see a clear market structure and patterns. The CHF remains stronger most often, however Japanese yen plays the main role in this CHFJPY.

If you take the trade depend on the Economic news of Japan yen, that gives a great opportunity for CHF/JPY because whenever the market falls or rises due to Japan economy, we can see a deep correction on this pair.

The combination of the price movement of USD CHF + USD JPY = CHF JPY.

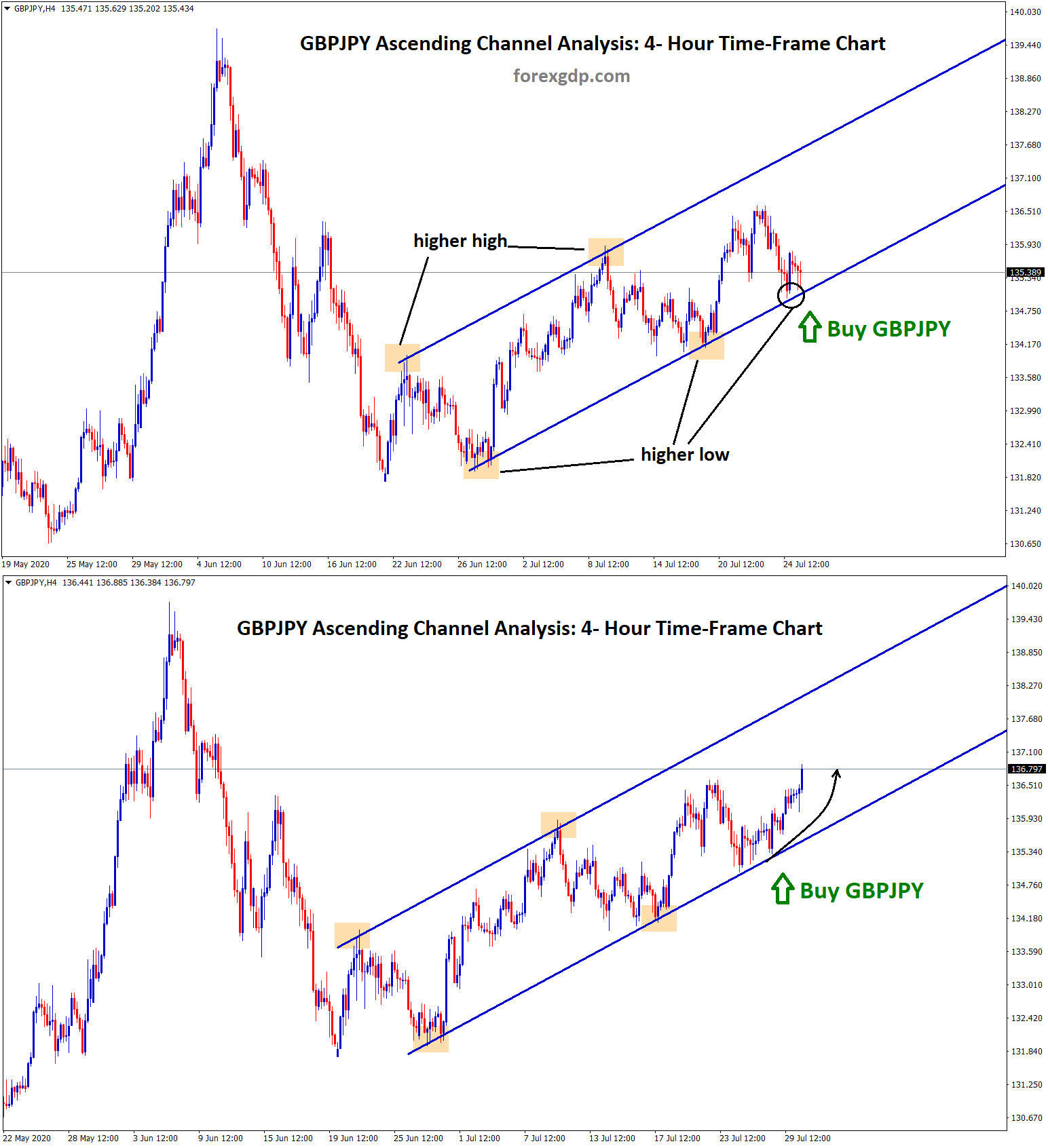

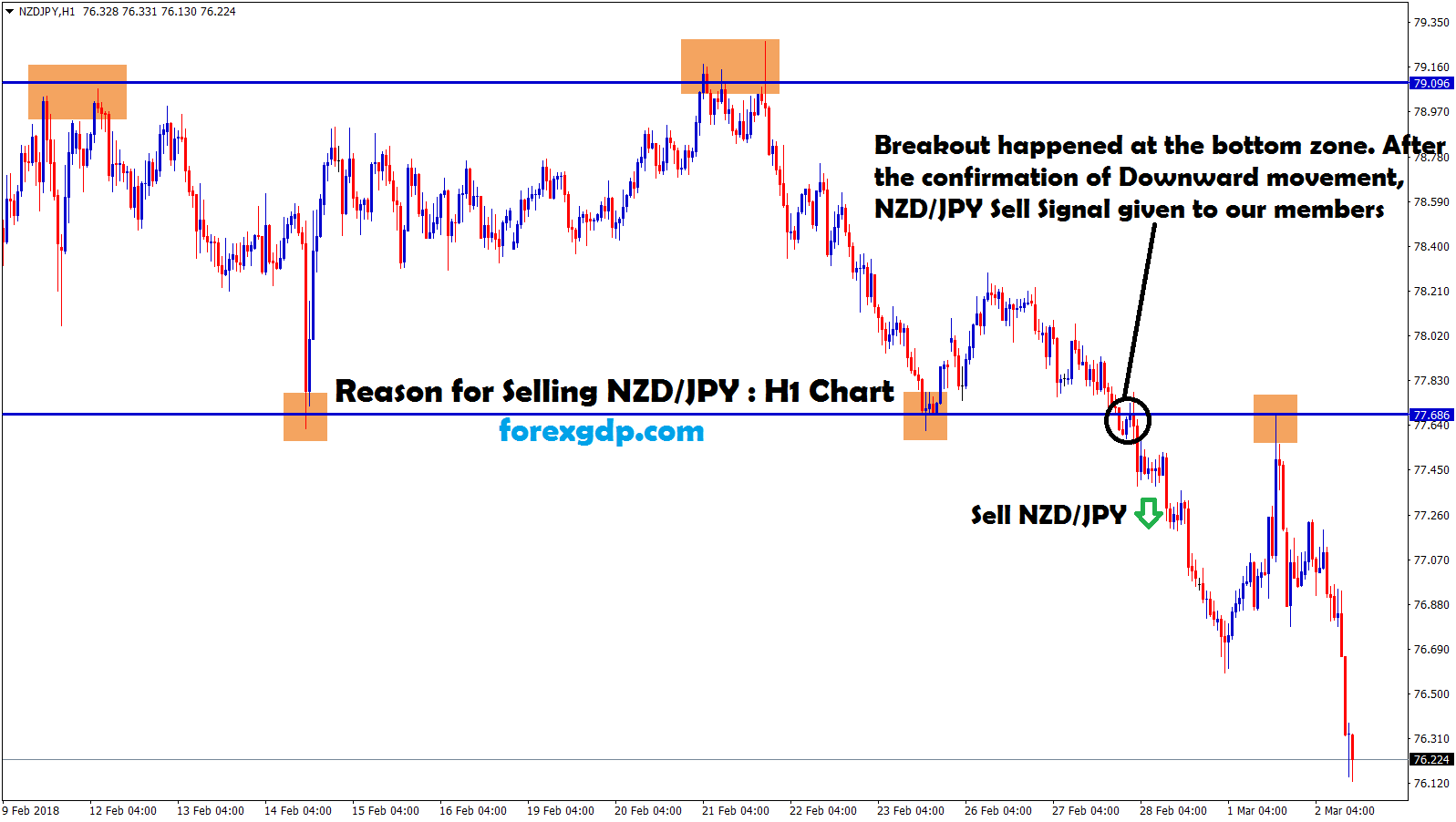

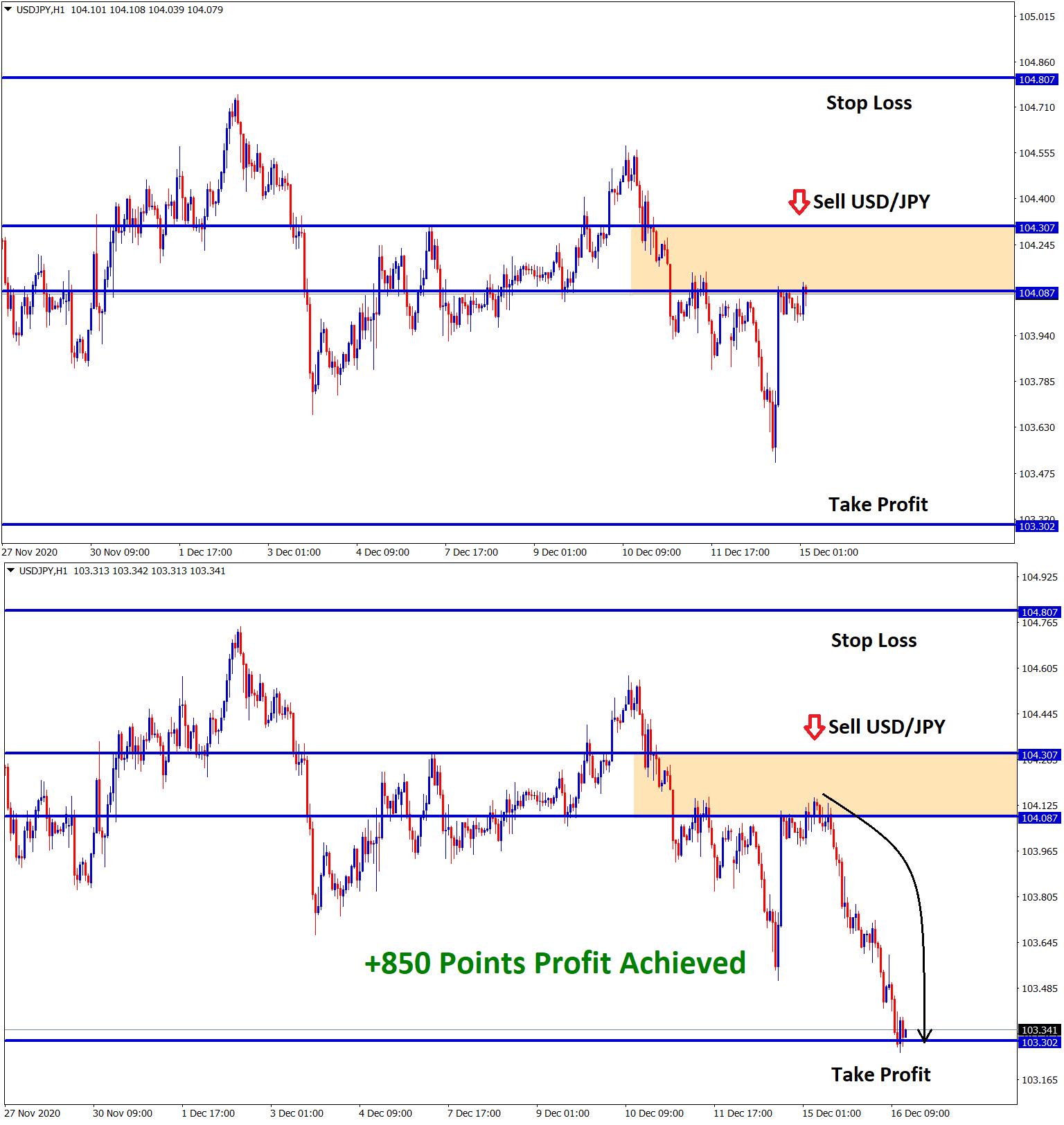

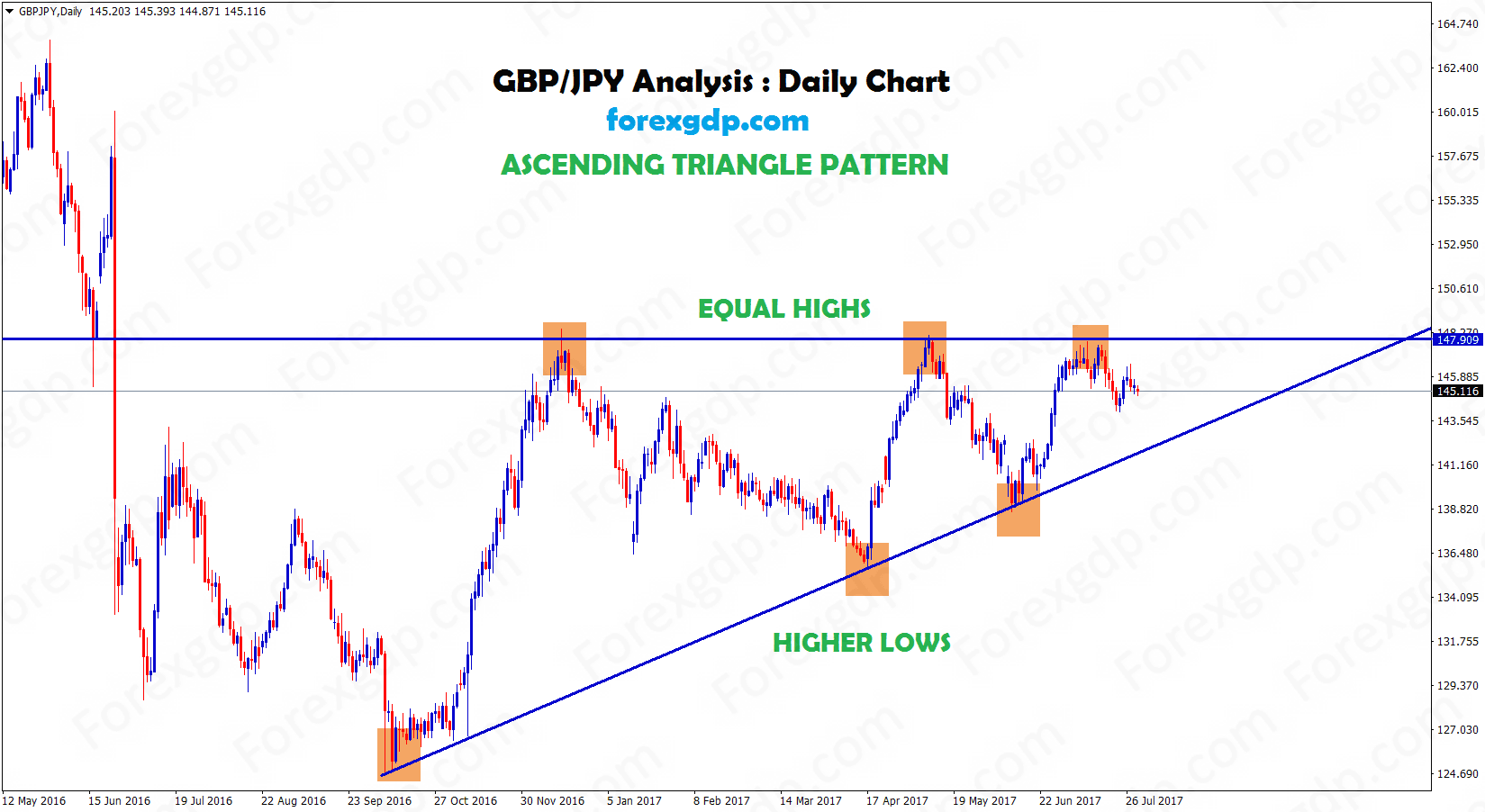

GBP/JPY

GBP/JPY is one of the highly volatile and popular currency trading pair. It’s a Gaint famous for big movement currency pair next to Gold(XAUUSD). You can see 100 to 200 pips move easier in a day on GBPJPY due to high transaction turn over of Great Britain and Japan yen.

Trend line breakout, Support Resistance breakout, Parallel Channel trading, Triangle patterns are the best predictable trading opportunities in this forex pair.

Either if you want to trade short term, scalping, swing trading or long term, this Currency pair gives the best opportunities. Note: Since many traders make big gains/losses on this pair depend on the risk-reward trading strategy. Always use stop loss while trading this pair because it may create big spikes and big movements in very short time.

Due to high liquidity, this Pound-Yen need more investment and margin requirement.

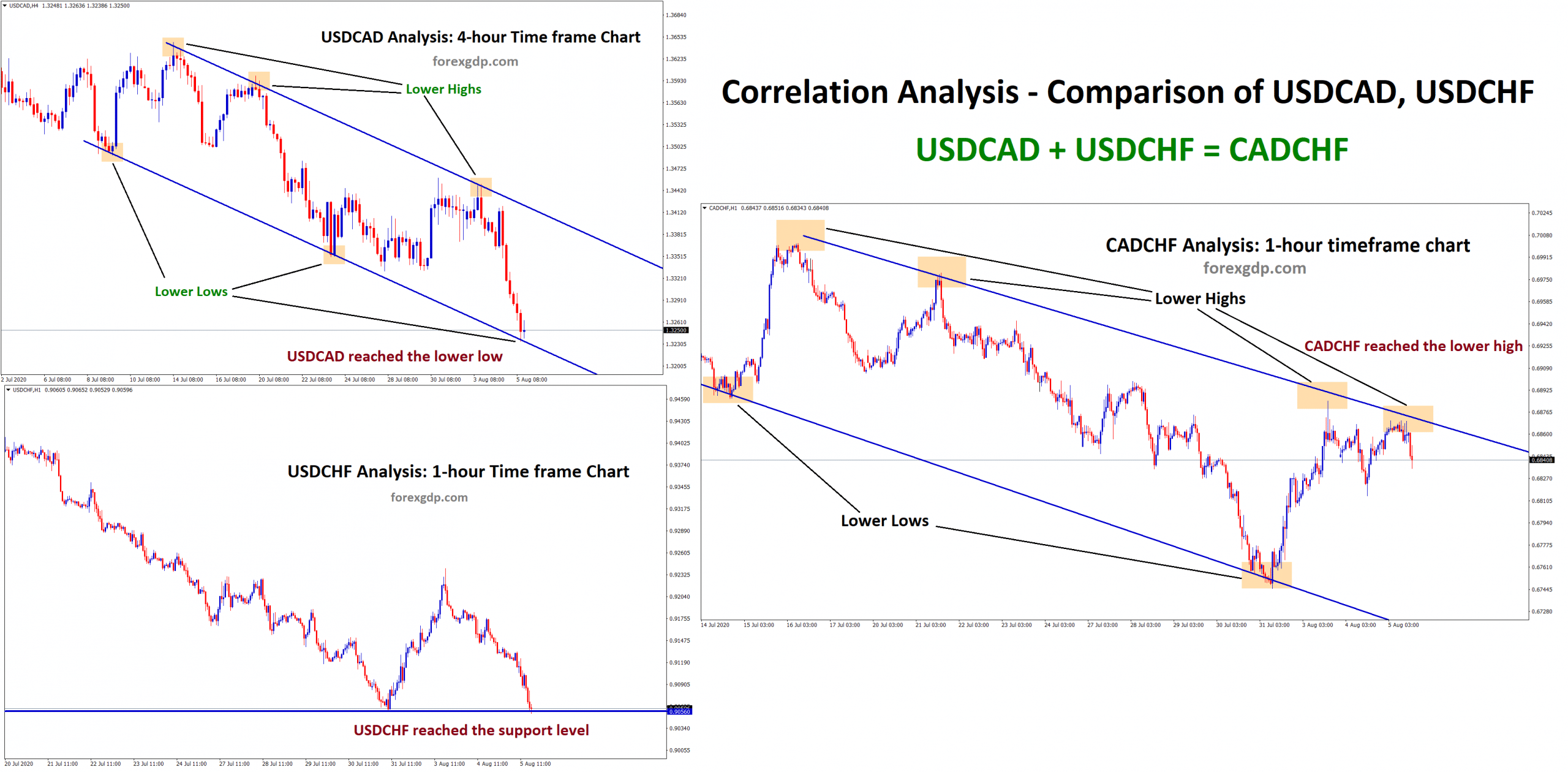

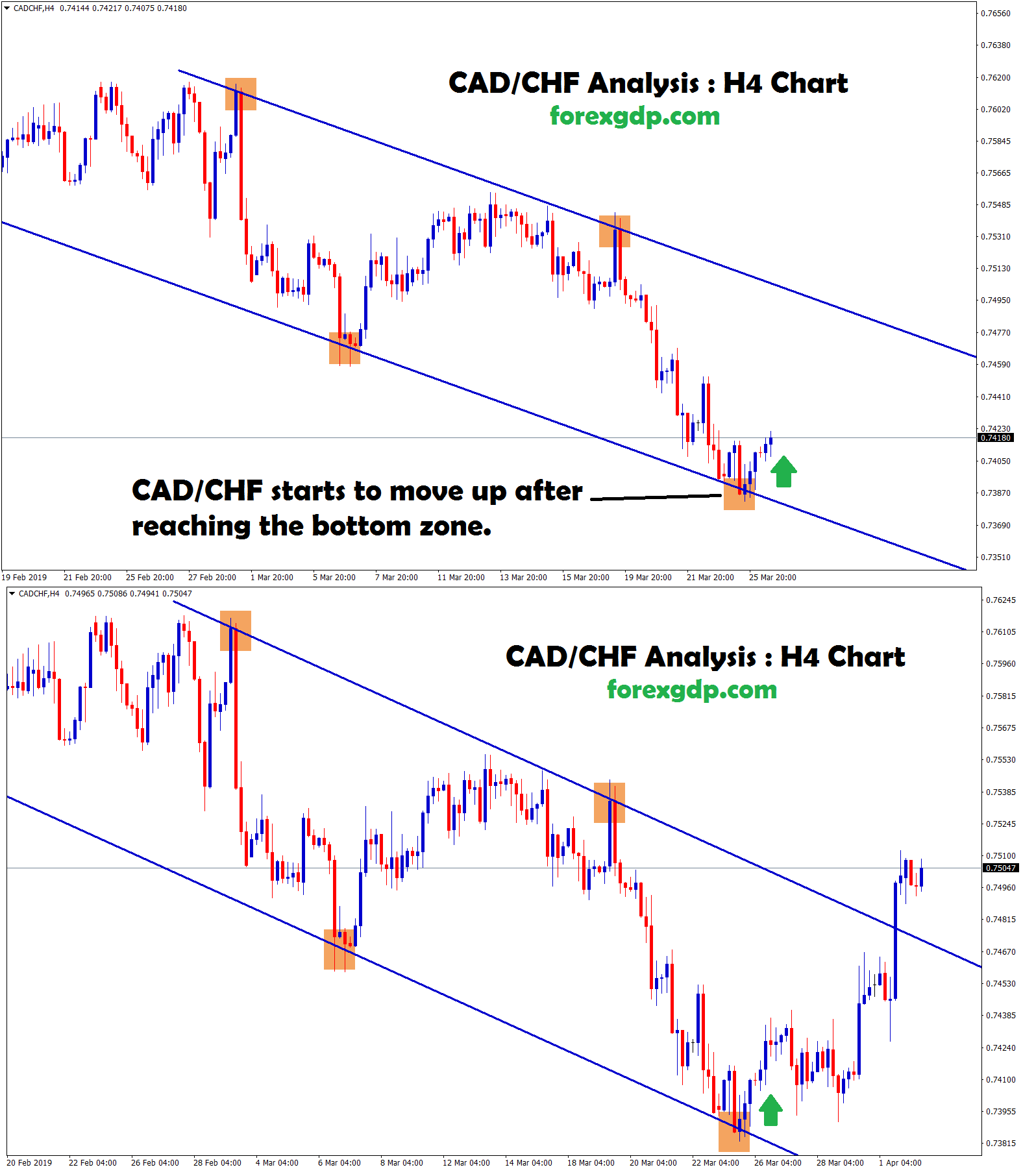

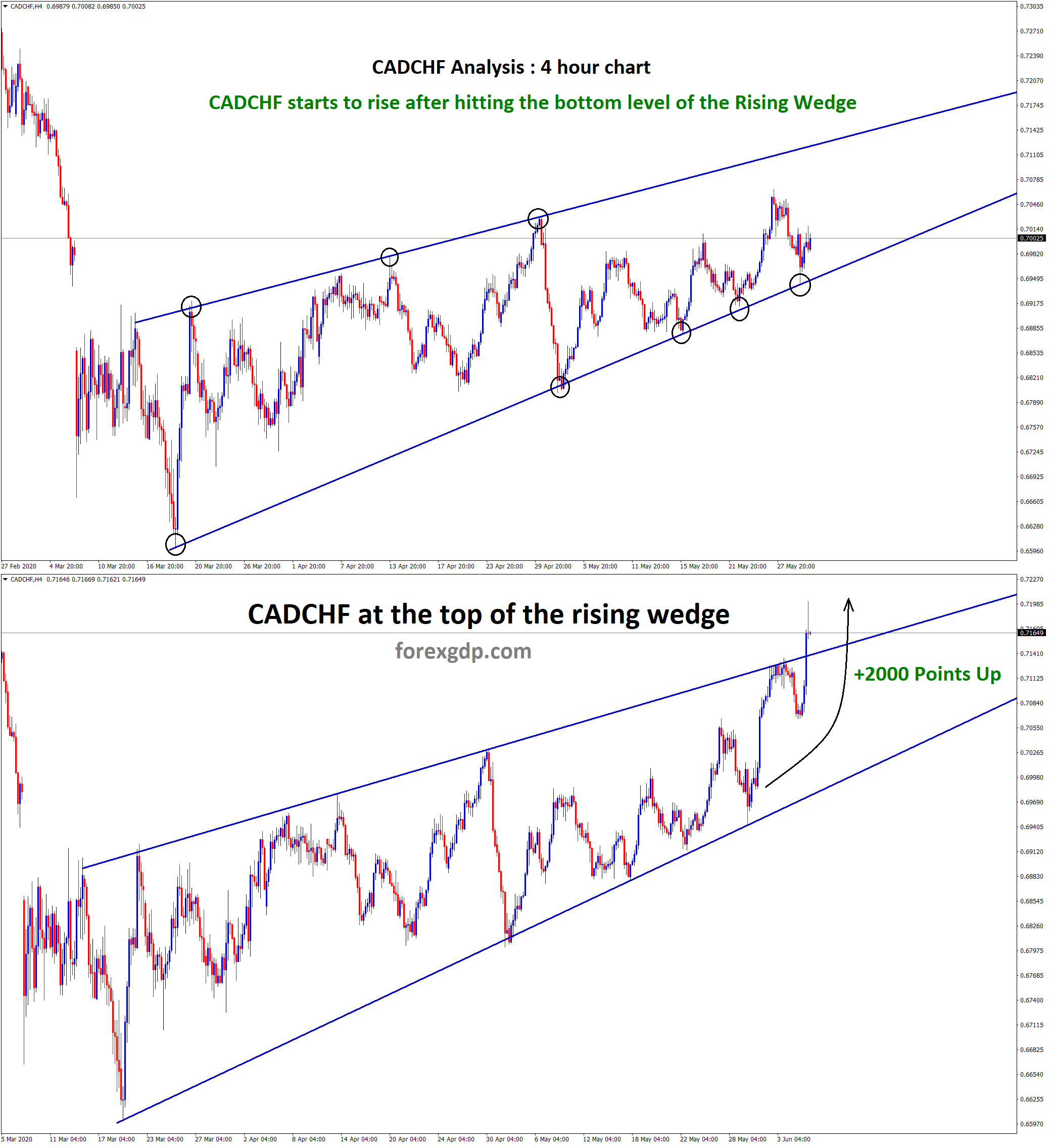

CAD/CHF

CAD/CHF is also similar to EURCHF however the liquidity tends to be higher due to Canadian Dollar (CAD) volume of transactions.

The Rising Wedge, Falling Wedge, Support and Resistance Levels, Trend line Fibonacci ranges are easily predictable on these currency pairs.

The Canadian Economy completely depends on the Crude Oil market. If Crude oil falls, CAD currency becomes weak.

CAD is a commodity currency whereas CHF depends on the Switzerland Currency Reserves and Gold Investment.

Trading on CADCHF carries low financial risk because it is good and better to predict the future movement using simple technical analysis tools. The combination of the price movement of USD CAD + USD CHF = CADCHF.

Conclusion

The above list of currency markets is the most predictable currency pairs in forex trading.

These fx pairs can be easily predicted by the popular technical strategies used by the basic and professional traders.

Most of the trade transactions worldwide are carried out by the US Dollar. it is always better to keep an eye on most traded currency pairs such as EUR USD, USD JPY, GBP USD. Monitor US Dollar Index chart for predicting the strength and weakness of the US dollar in general. If USDIndex is falling, all USD related pairs start to fall in the foreign exchange market.

Each currency pair has its uniqueness depend on volatility, foreign buyer and seller traders volume, interest rate decisions, GDP data, import-export transactions, World bank debt, financial stability of the government, foreign exchange financial traded goods and services, average daily currency rates change and stock instruments conditions, etc.

EUR USD and USD JPY pairs are the top 2 traded major pairs in forex trading. These pairs are not easily predictable due to a more competitive number of buyers and sellers tend to make more noises in lower time-frame charts.

The Top popular markets have more forex traders who bring high volatility and quite big trade volumes in an unexpected time which would kill the small retail traders with big traders volume.

If you want to predict more accurate, you should not have competitions (more traders) in that deal. It is always better to avoid the most traded instruments because the following volume transactions may be higher, but the same high volume will give you big loss in a short time if market behavior likely to go against the opposite direction.

Please Don’t trade all the time, trade forex only at best trade setup.

It is better to do nothing, instead of taking wrong trades.

We are here to help you for taking the trades only at best trade setup.

Start to receive the forex signals now: forexgdp.com/forex-signals/