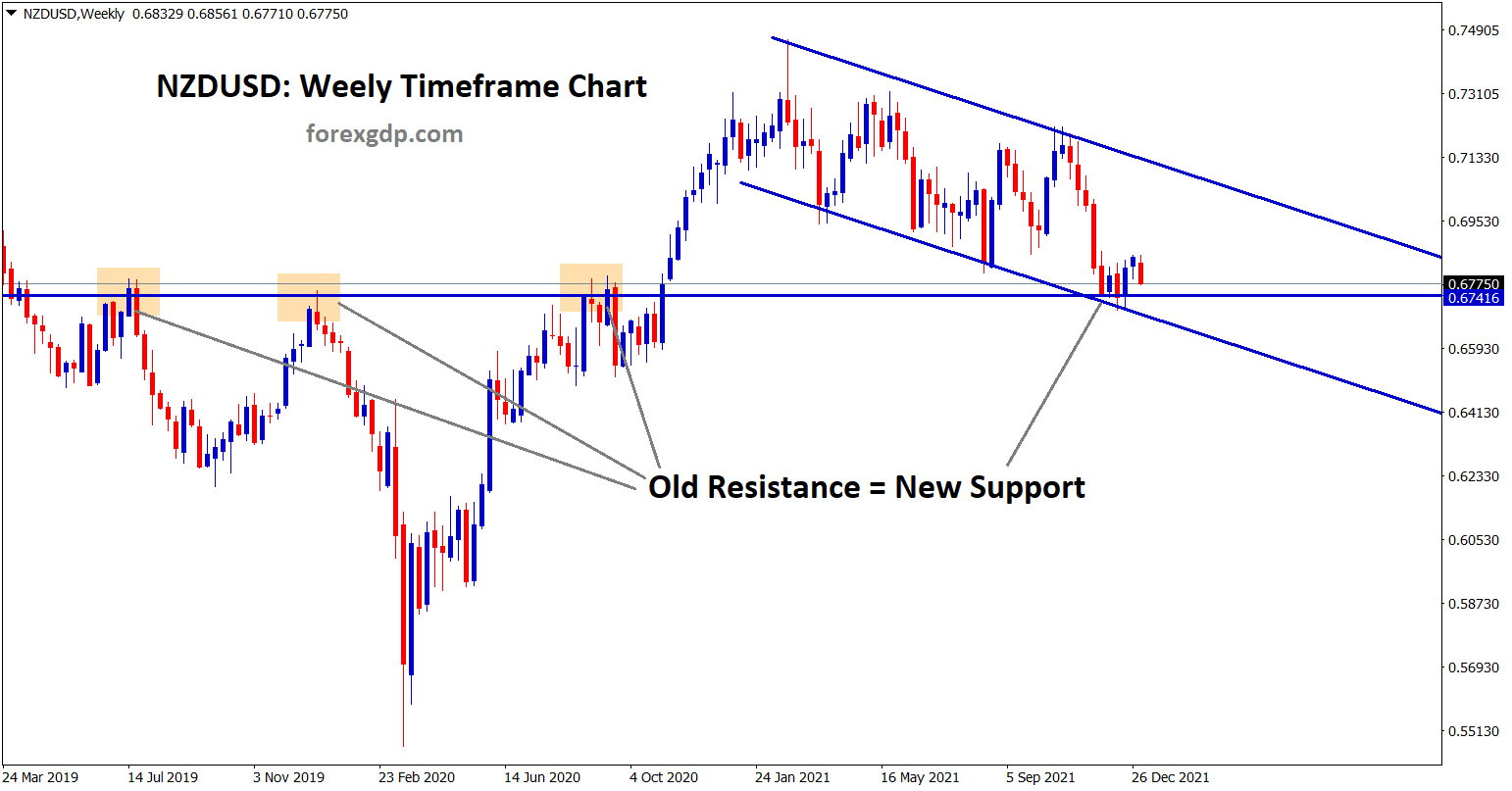

NZDUSD old resistance acting now as a New support in the Weekly timeframe chart. NZD/USD GAINS SOME TRACTION AFTER U.S. BOND YIELDS HINDER THE DOLLAR. This made NZDUSD to fall down to the nearest support and the channel retest area in the 4-hour timeframe chart.

WHAT YOU MAY HAVE MISSED

NZD/USD started last week off pretty strong as they managed to reach their one month high of 0.6855. However the next day, the rise in the Federal Reserve’s interest rates had caused a massive upward movement for the dollar. This in turn caused NZD/USD to drop rapidly. Following this day, NZD/USD is struggling to pick themselves back up but are on the mends slowly but surely. They ended the week off at just below the 0.6800 point as they lacked bullish movement. Dollar is expected to continue to rise but traders remain optimistic regarding the future of NZD/USD.

Markets have decided to finalize the increase of interest rates for May instead of June. They have also decided to have two more occur by the end of 2022. Analysts are predicting that the Feds are going to become more vigilant with their policies very soon and this therefore caused the U.S. Treasury bonds to see new heights. The 10-year U.S. government bond have reached a high point of 1.6420%. This is the highest point they’ve seen in about two months.

OMICRON AND THE FOREX MARKET

The new Omicron variant of the COVID-19 variant is continuing to cause uproar internationally as precautionary measures are being put back in place. Countries are closing their trade borders once again and administering booster shots more than ever. Despite the rise in this new variant, traders are remaining optimistic about the future of the forex market. Analysts have reported that they don’t see the variant having much of an impact due to countries being prepared enough to handle the influx of new patients globally. The record highs and lows demonstrated by the market these days is evidence to suggest that the variant is a background player on the main performance stage.

HOW TO MOVE FORWARD

These next few weeks are going to be pretty busy therefore traders are reluctant to place any new positions until they understand which direction the market is planning on shifting in the next few weeks. Some important events to add to your calendar for the upcoming weeks include:

- ISM Manufacturing PMI report

- JOLTS Job Openings report

- Feds Minutes Meeting

- ADP report

- ISM Services PMI report

- S. Monthly Jobs report

It is still unclear which side NZD/USD is planning on shifting in the long-term. It is recommended to hold positions and wait to hear further from the important events scheduled to take place this week before placing any new positions or changing any existing ones. If the market continues at the rate it’s currently going, NZD/USD might hit the next support level at 0.6700.