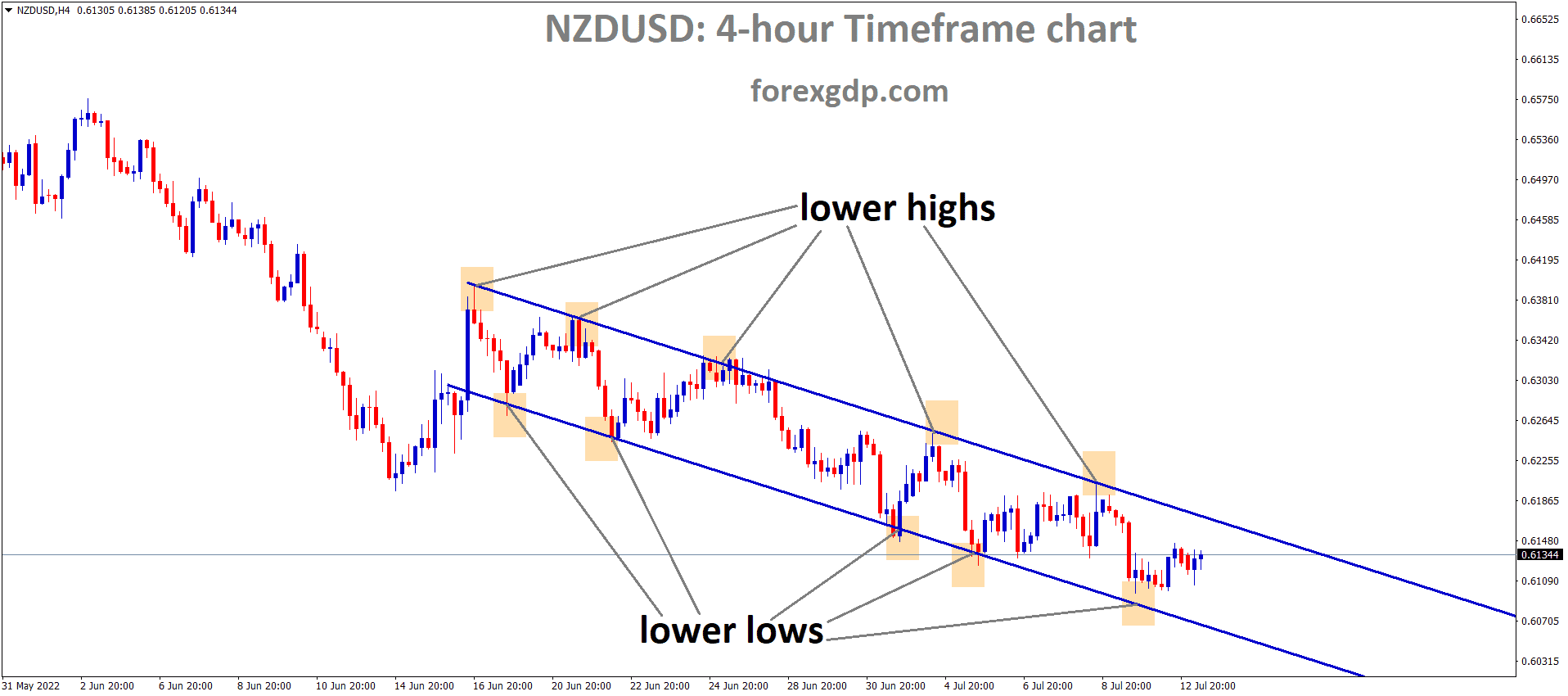

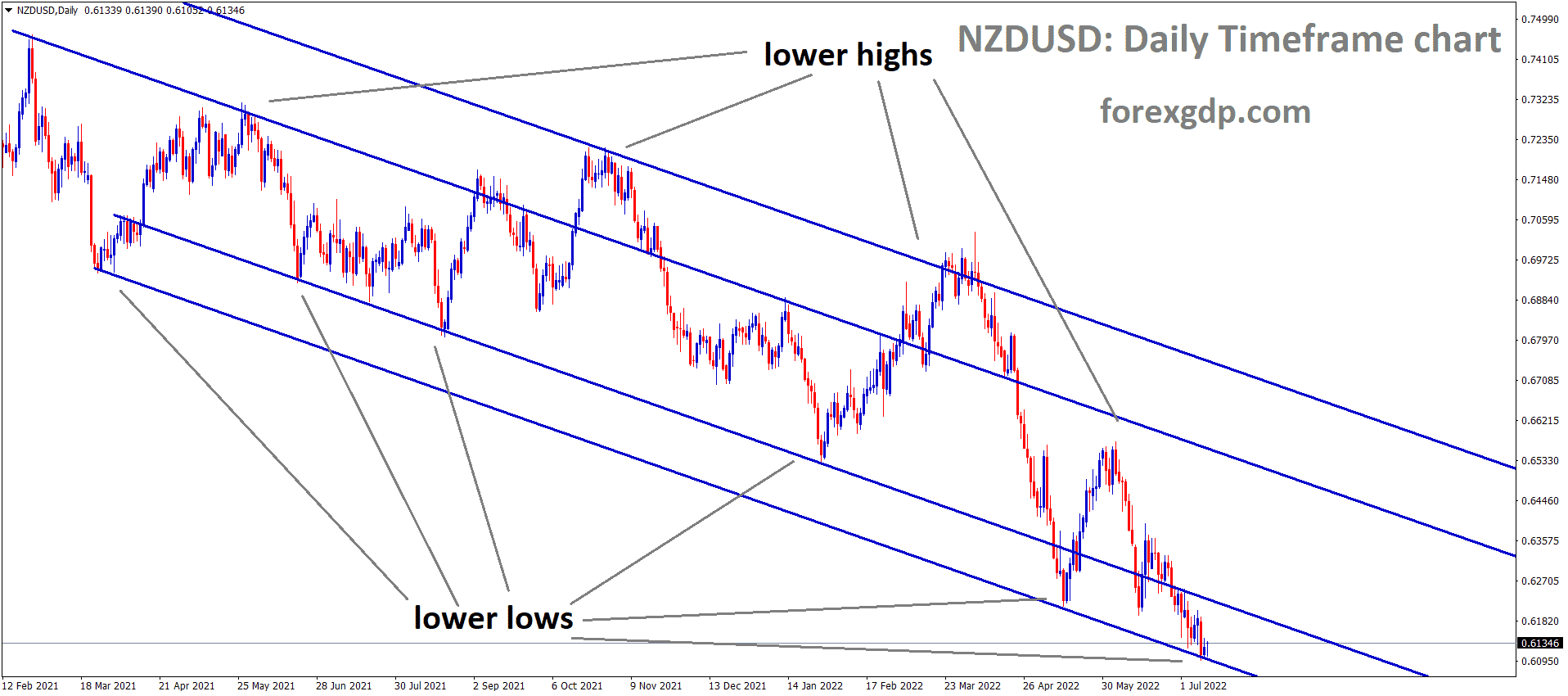

NZDUSD is moving in the Descending channel and the Market has rebounded from the Lower Low area of the channel.

Where Is NZDUSD Today

The NZDUSD charts are quite unstable today as a result of the release of the rate hike by the RBNZ and the Meeting Minutes by the Feds. We also found out that New Zealand has an active volcano threat that is a cause for concern. As a result of these releases, the NZDUSD pair faced instability in its value and is now teasing around the 0.613 region. We may continue to see this pair be unstable throughout the day.

RBNZ Rate Hike

Early on Wednesday, it was revealed that the Reserve Bank of New Zealand had updated its monetary policies and increased its interest rates from 2.00% to 2.50% which is a 50 basis points increase. This comes exactly as expected as New Zealand is facing the impact of inflation as well. In their statement, the RBNZ reveals, “The Monetary Policy Committee today increased the Official Cash Rate (OCR) to 2.50 percent.

NZDUSD is moving in the Descending channel and the Market has reached the Lower low area of the channel

The Committee agreed it remains appropriate to continue to tighten monetary conditions at a pace to maintain price stability and support maximum sustainable employment. The Committee is resolute in its commitment to ensuring consumer price inflation returns to within the 1 to 3 percent target range. The level of global economic activity, combined with the ongoing supply disruptions largely driven by both COVID-19 persistence and the Russian invasion of Ukraine, continues to generate global inflation pressures.”

They further reveal, “Food and energy prices are especially affected by geopolitical tension. However, the pace of global economic growth is slowing. The broad-based tightening in global monetary and financial conditions is acting to reduce spending growth. Asset prices have also declined due to higher interest rates and a weaker earnings outlook. The reduction in COVID-19 health-related restrictions is also enabling increased demand. Labor and resource scarcity are also contributing to upward price pressures which are currently exacerbated by seasonal illness, a resurgence in COVID-19 cases, and a net outflow of labor abroad. In these circumstances, spending and investment demand continue to outstrip supply capacity, with a broad range of indicators highlighting pervasive inflation pressures. Employment remains above its maximum sustainable level and the Reserve Bank’s core inflation measures are around 4 percent. The Committee acknowledged there is a near-term upside risk to consumer price inflation and emerging medium-term downside risks to economic activity.”

New Zealand Volcano Threat

In other news, New Zealand is known for being an island country. And being an island country comes with its fair share of unique problems. New Zealand has quite a few volcanos on its territory. One of these volcanos has been very active in the past many years and is now a cause of concern once again. This volcano is causing the ground around it to shift due to its movement. This is causing concern to the people in the region as they fear this ground shift may be a warning that the volcano is planning on erupting very soon. New Zealand will be taking measures to ensure the safety of the people in the surrounding region.

Economists at the Guardian reveal, “The lake bed of one of the world’s most hazardous super volcanoes – New Zealand’s Lake Taupō – is constantly rising and falling, proving the volcano is still very much active, nearly half a century of data has revealed. Taupō, a caldera volcano and the site of New Zealand’s largest lake, has been active 25 times in the past 12,000 years. It is responsible for one of the most significant explosive eruptions in recent human history: the AD232 eruption that sent a whopping 120 cubic km of pumice and ash into the atmosphere.”

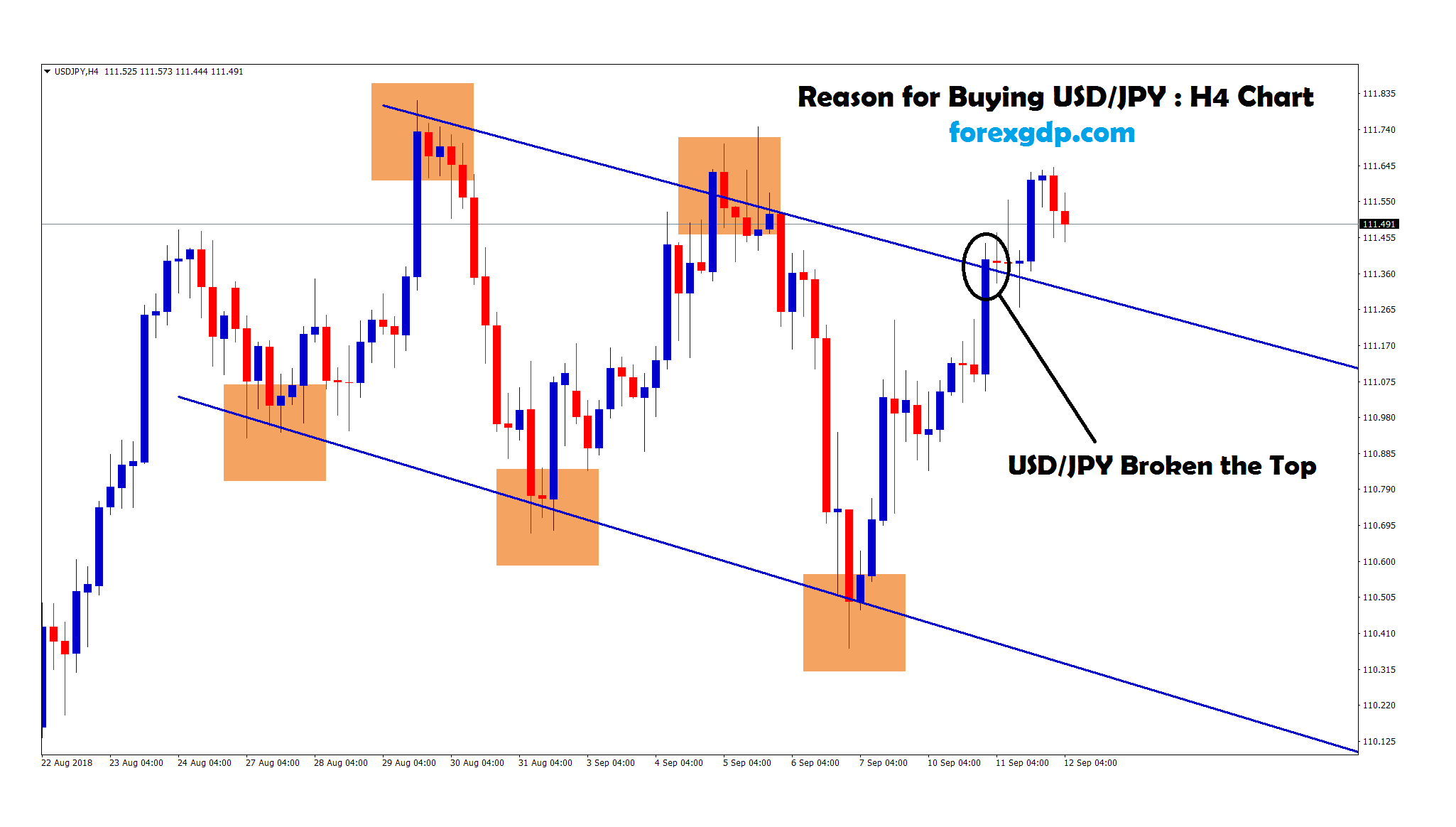

NZDUSD is moving in an Ascending triangle pattern and the Market has reached the higher low area of the triangle pattern

Feds Meeting Minutes

Early on Wednesday, the Feds finally released their Meeting Minutes from the previous session which goes into depth about their monetary policy decision and the reasoning behind it. The Minutes reveal, “Overall, Federal Reserve Bank directors continued to report strong demand and elevated inflation. In most Districts, consumer spending, particularly on services, was solid, but several directors noted that increases in food, energy, and other prices were starting to constrain spending by lower-income households. Some directors commented that the effect of increasing prices falls disproportionately on those at the lower end of the income distribution. Many directors cited supply chain disruptions and the availability and cost of labor as ongoing concerns, though hiring challenges had eased recently in some Districts. Several Directors noted persistent inflationary pressures across sectors, and some directors expressed uncertainty about the outlook.”

It further reveals, “The directors of two Federal Reserve Banks favored maintaining the current primary credit rate at the existing level (1 percent). The directors of ten Federal Existing rates and formulas approved. Requests by two Reserve Banks to maintain the existing primary credit rate and requests by ten Reserve Banks to increase the rate; requests to renew secondary and seasonal credit formulas. Office of the Secretary memorandum, June 3, 2022. Reserve Banks favored increasing the primary credit rate by 50 basis points, to 1.5 percent, in light of strong aggregate demand, tight labor markets, and elevated inflation. No sentiment was expressed by the Board at today’s meeting for changing the primary credit rate at this time, and the Board approved the establishment of the primary credit rate at the existing level of 1 percent. The Board’s action today on the primary credit rate also included renewal of the existing formulas for calculating the rates applicable to discounts and advances under the secondary and seasonal credit programs. As specified by the formula for the secondary credit rate, this rate would be set 50 basis points above the primary credit rate. As specified by the formula for the seasonal credit rate, this rate would be reset every two weeks as the average of the daily effective federal funds rate and the rate on three-month CDs over the previous 14 days, rounded to the nearest 5 basis points.”