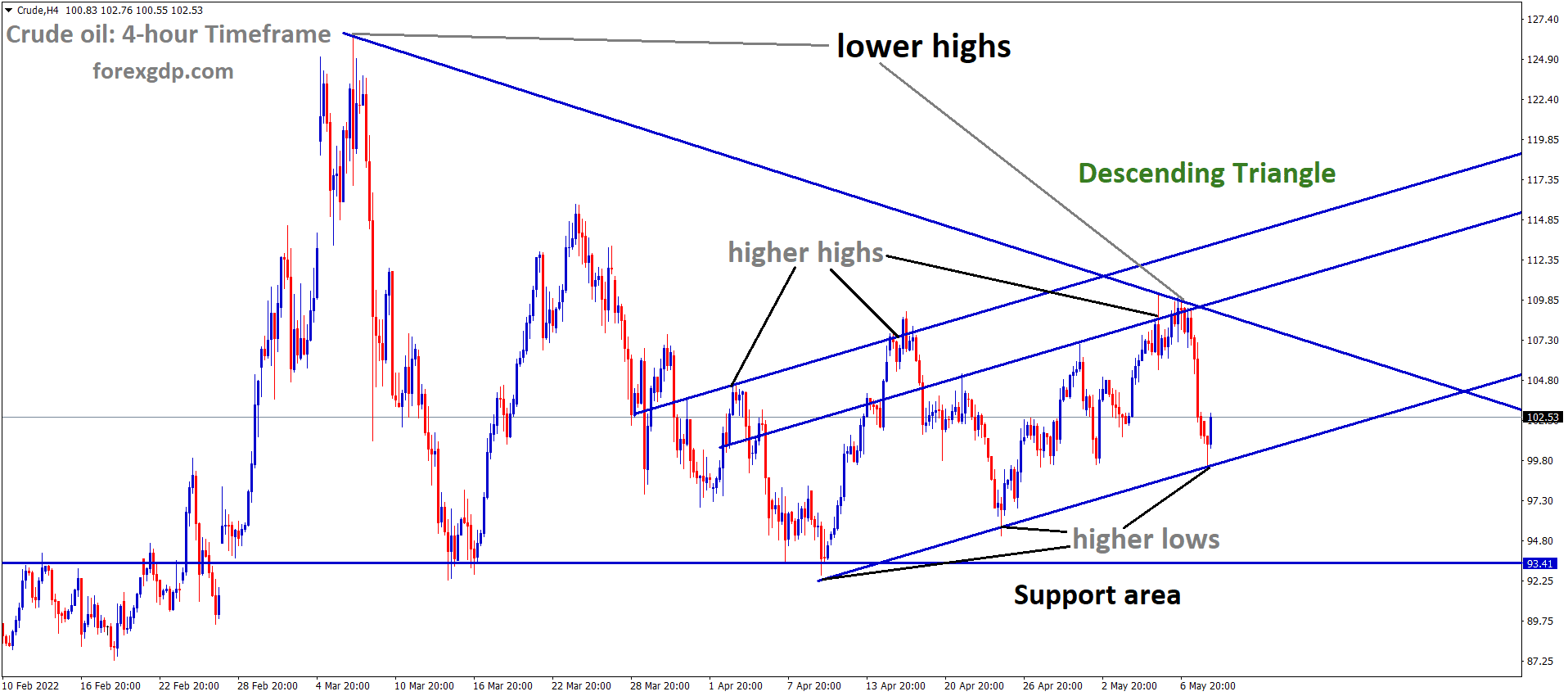

Crude Oil H4 Time Frame Analysis Market is moving in the Descending triangle pattern and the Market has rebounded from the higher low area of the minor Ascending Channel under Triangle pattern.

Where Is Crude Oil Today

This past week, we’ve seen crude oil levels in the highs of the 111.25 region. So imagine to our surprise when just this past day, the crude oil prices faced a sharp decline and is now enjoying around the 103 region. This is still quite good compared to the levels we witnessed earlier today when crude oil had even reached lows of about 100.65.

Crude M15 Time Frame Analysis Market is moving in the Descending channel and the Market has reached the Lower high area of the Channel

There are several factors impacting the oil prices in the market. We’ve previously discussed how the COVID crisis in Beijing was a top contributing factor. We now have quite a few more factors including the terrorist attacks in Saudi and UAE as well as the Indonesian oil ban.

Saudi Oil Crisis

As the world faces a shortage in oil supply, top oil producers are being eyed at very carefully to see if they would sell the oil they produce to the rest of the world. Saudi is among one of the top oil producers in the world. For the longest time, they were a major supplier in the world’s oil supply. However, they have recently faced terrorist attacks from neighboring countries on their oil fields. The attacks are suspected to be carried out by Yemeni extremists who have also accepted responsibility for the attacks. This Houthi militia has been behind attacks in both Saudi as well as UAE oil fields. They are using drones and missiles to carry out these attacks. Due to this imminent threat, Saudi is very hesitant to produce and supply the world with as much oil as it used to previously.

Energy Minister, Prince Abdulaziz bin Salman, has recently released a statement where he explains this energy crisis in the country. He states, “Cross-border attacks have put to question our ability to supply the world with the necessary energy requirements. The attacks have been carried out by Yemen’s Iran-backed Houthi militia. In the old days, we, along with our friends here in the UAE, worked on a collective effort to assure and ensure energy security. These pillars are no longer there. We have developed and delivered our side of the story. People, and others, need to deliver their own side of the commitment. Otherwise, the very pillar of energy security will be disturbed, to say the least.” Economists have come out to explain the issue with the Yemeni militia. They reveal, “The war in Yemen where an Arab military coalition, which includes the UAE, has been battling the Houthis since 2015 has rattled these two Gulf Arab states, revealing the vulnerability of their oil facilities. The largest attack claimed by the Houthis took place in late 2019 against a sprawling Saudi Aramco site in the Kingdom’s eastern region.”

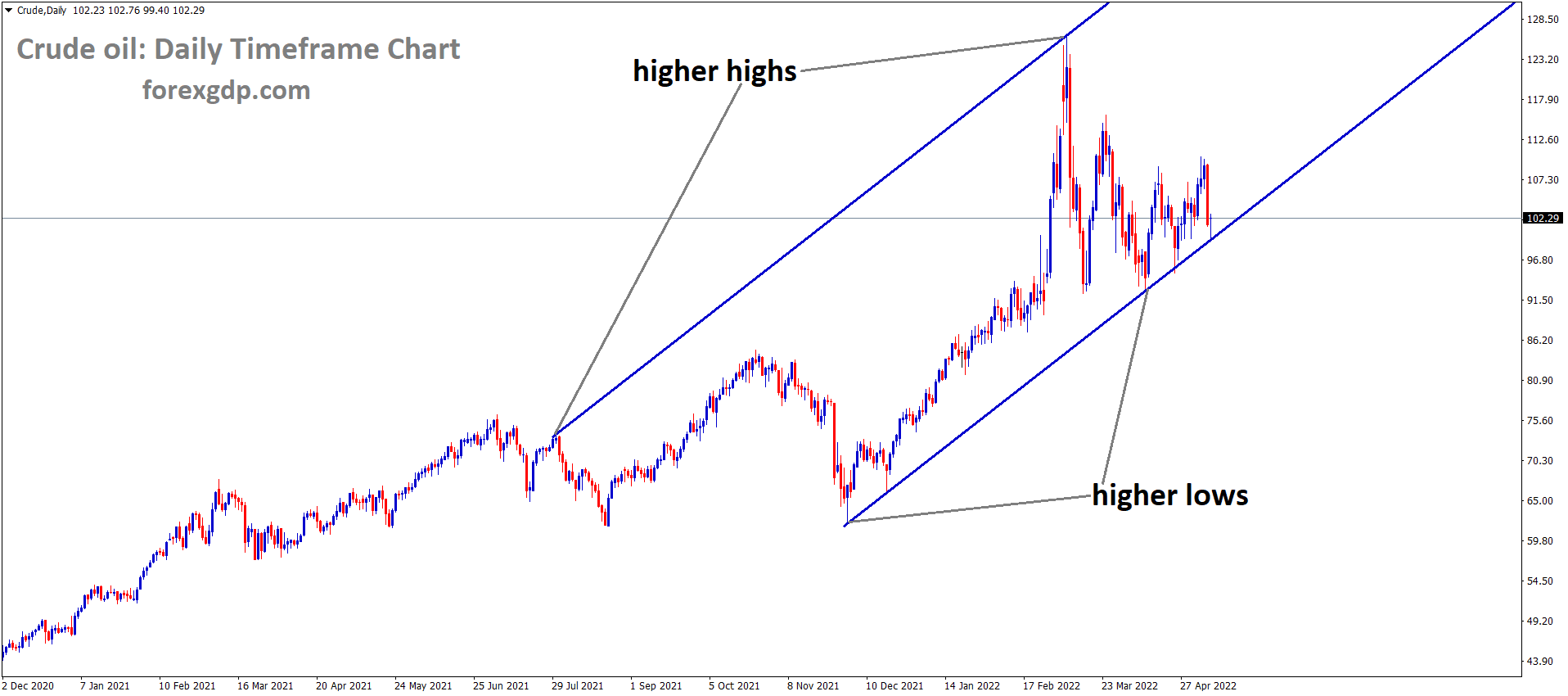

Crude oil Daily Time Frame Analysis Market is moving in an Ascending channel and the Market has rebounded from the higher low area of the Channel.

Indonesia Oil Ban

There are two types of countries during this oil crisis. The first type is the one that shares their energy supply with the world when they realize that the energy is in short supply. The second type is the one that bans any exportation of their oil when they realize it is in short supply. Indonesia belongs to the latter. Early on Monday, it was revealed that Indonesia has banned the exportation of its palm oil amid the oil shortage around the world. Although they may not admit it, it is quite evident that they have done this out of greed and they don’t wish to share some of the most sought-after commodities in the world. Due to this oil ban, the world is now looking to Malaysia for its supply of palm oil.

James Guild, a fellow at RSIS Singapore had publicly spoken about this oil ban. He reveals, “I have no doubt official complaints will be coming in, especially as Indonesia is hosting the G20 in Bali later this year and this is not exactly model behavior from a reliable trade partner or a country holding the presidency of the G20. But there’s not much anyone can do. Indonesia is the largest producer of palm oil in the world so it holds all the cards and the government seems willing to accept the diplomatic heat in the interest of achieving its domestic goals.” Ega Kurnia Yazid, an Economic Analyst at CSIS Jakarta has also come out revealing her thoughts on the matter. She states, “So far, no country has officially complained, including from the major importers of Indonesian palm oil such as China, India, and Pakistan. However, signs of an increase in food prices are starting to appear in these countries.”

Germany-Qatar LNG Deal

These past couple of weeks we have seen how the EU is desperate to find a new energy supplier so they can stop feeding off of Russia for their energy supply. Germany faced the most pressure since it was previously almost completely reliant on Russia for its oil supply. Now, it has to look to other countries to meet its demand. Germany and Qatar have been in talks for an LNG deal for quite some time now but it doesn’t seem to be going anywhere as Qatar is putting forward some pretty strict terms which Germany is quite reluctant to agree upon. Qatar wants this LNG deal to last about 20 years whereas Germany was only looking to get it for a short term as they want to be completely independent of any energy needs by 2040. Qatar also stated that it doesn’t want Germany to be getting another supplier during their contract either.

Sources from Germany have revealed their side of this entire ordeal. They state, “The issue of LNG contract length potentially putting Germany’s decarbonization targets at risk is part of the ongoing discussions with Qatar. LNG supplies from Qatar are not expected to happen soon.” Felix Booth, Head of an LNG firm has revealed, “Qatar is in the driving seat in these discussions, with a new project underway, strong interest in their volumes, and a long history as a reliable supplier. To secure this supply, it is expected that the German team will need to accept a traditional oil-linked pricing structure. Leaving the European buyer with significant financial exposure compared to the European hub prices.”