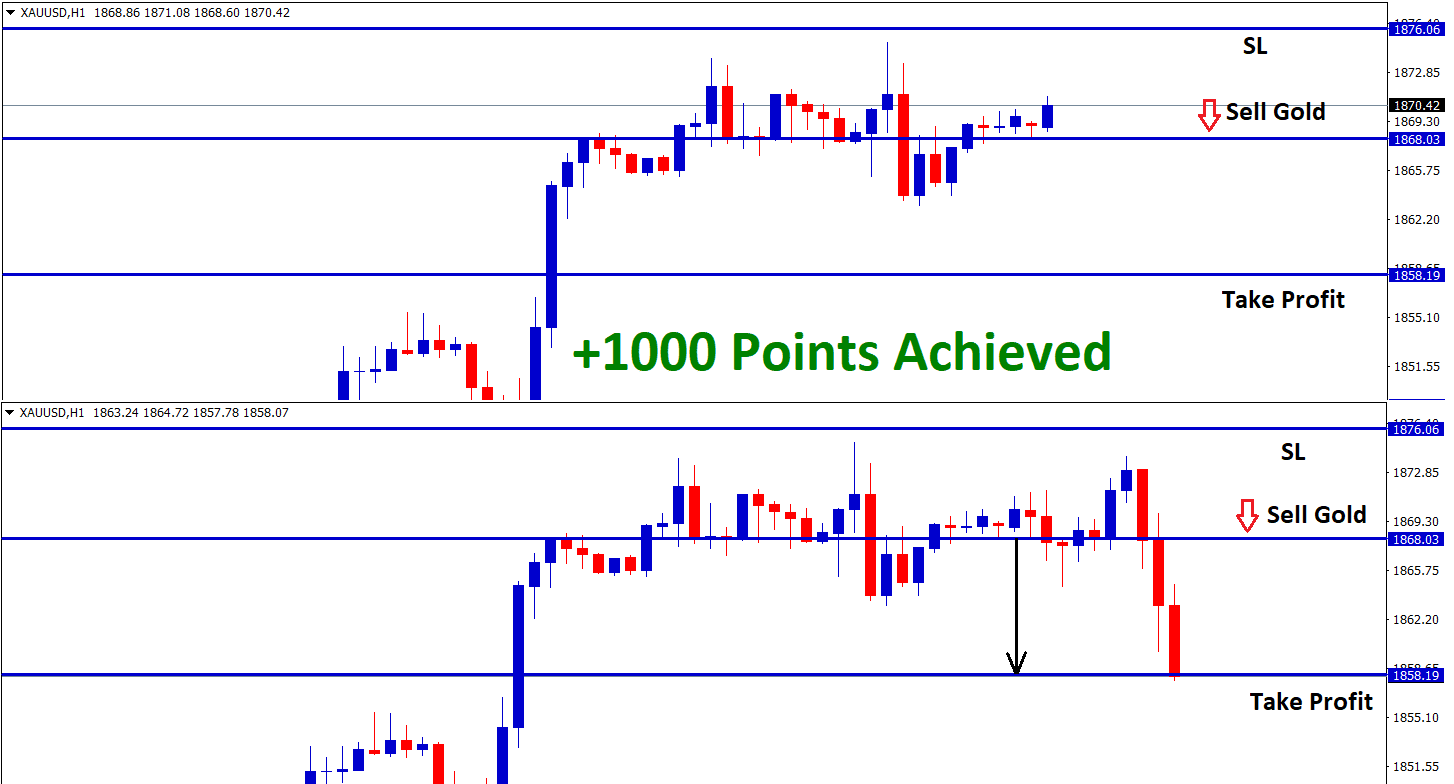

Gold: Omicron Variant is less potent and CPI expectations are higher

Gold prices consolidating at the ranging market due to Omicron Variant threat which Subsided in Global levels and Scientists believe that it will be less deadly than Delta variant.

XAUUSD Gold price is moving in an ascending channel and the market has consolidated at the higher low area of the channel.

And 10 years US Treasury yield regained to 1.4%, so US Dollar stays Bullish in momentum without fears of New Variant.

By considering the above situation, Gold ETFs are under selling pressure by the Investors as funds move towards risk yielding assets.

And US CPI inflation year on year is expected to be 6.7% this week from 6.2%. This CPI expectation will beat the 5-year expectations rate of 2.73% soon as analysts view.

But US FED Powell commented quick decision for tapering was soon implemented in the December meeting.

US Dollar: PBOC announced to cut 50 basis points for Banks reserves

AUDUSD is moving in the Descending channel and the market reached near to the lower high area of the channel.

US Dollar index makes gains as US FED Powell will do extra tapering in next week meeting.

And People bank of China announced to cut the bank reserve requirements by 50 basis points.

This news cheered for Bank lenders, and China is ready to give CNY1.2 trillion to the economy for liquidity crunch due to property developers.

This makes it happy for Chinese real estate developers to sell quickly with the help of more liquidity implementation.

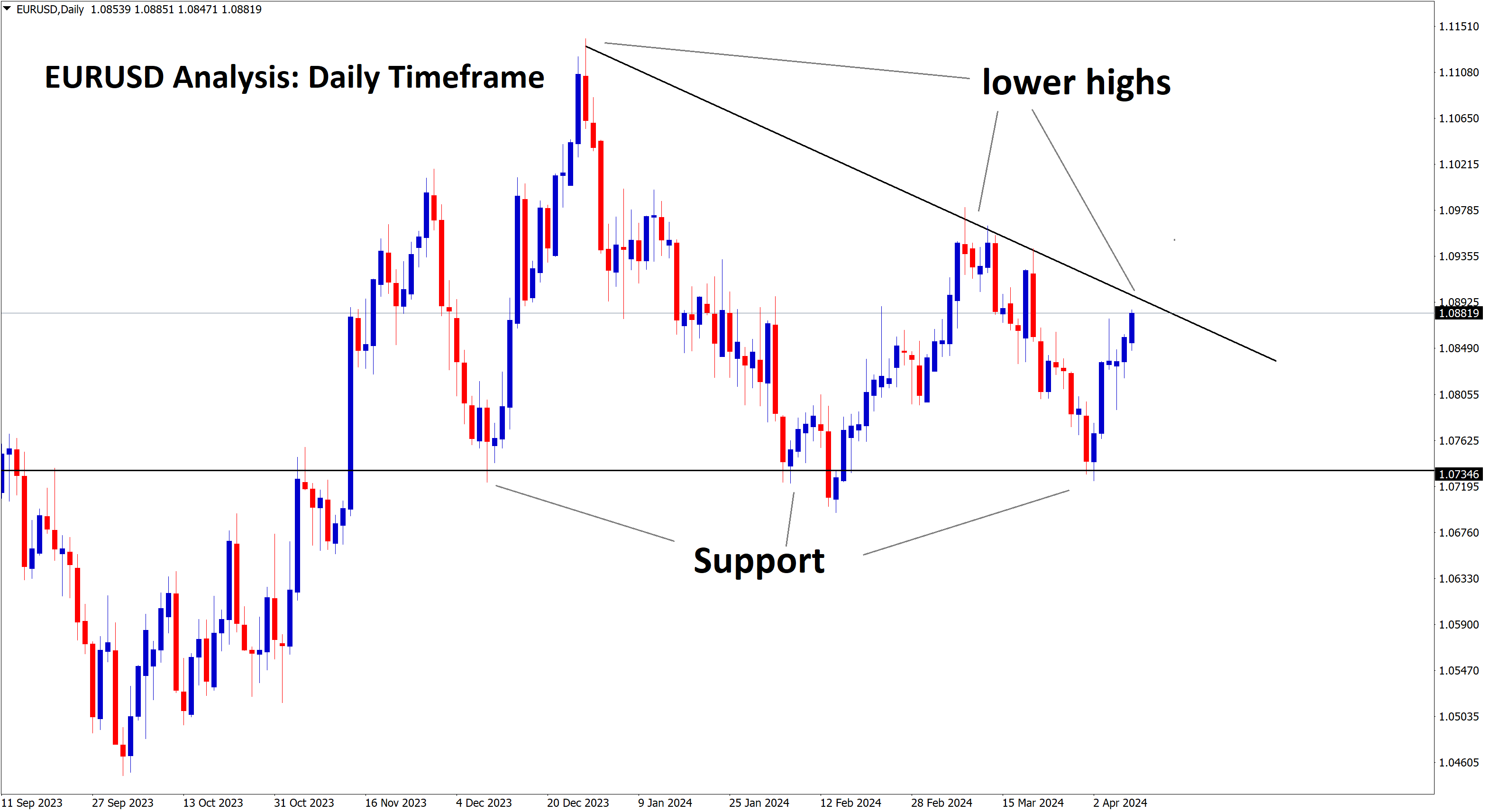

EURO: German industrial production hits higher in the market

EURUSD is moving in the Descending channel and the market reached the lower low area of the channel.

German industrial production shows 2.8% growth makes EURUSD stronger, but the market failed to impress with data.

UK and EU talks over Northern Ireland Protocol was progressing, but no negative outcome was reflected in markets.

And EURGBP makes a ranging market at the top of 0.8540 area; as Omicron variant makes more lockdowns some parts of Euro region.

And the Bank of England expected to raise rate hikes in December; if the rate hike is done, then EURGBP will fall again.

ECB Holzmann speech on Inflation and Omicron Variant

Austrian Governor and ECB Governing council member Robert Holzmann said inflation seems not to return to below 2% by 2022 end of 2022.

And We can see elevated inflation reading in 2022-2023, but we have the option to raise interest rates if PEPP Programme once completed.

And the current Omicron Variant is not more potent as previous, but ECB said more cautious now on an economy running.

In March 2022, PEPP purchases will end, and the Normal asset purchasing program will reduce according to the economy’s usage. We will see a dent in Economy recovery but not a Downturn in markets.

UK Pound: The UK agreed to France for issuing licenses

GBPJPY is moving in an Ascending channel and the market has reached the higher low area of the channel.

GBPUSD makes rallying after Britain ready to issue permits to French Fishermen to use British waters for fishing.

And Northern Ireland to receive Euro 920 million from the EU to solve the risks of Post Brexit deal.

So now the UK is compromised with France, UK with EU is on the air, whether good results will push further UK Pound to move higher.

And December Meeting of the Bank of England made hawkish comments which boosted UK Pound.

So Now all eyes waiting for the Bank of England monetary policy meeting and Retail sales data.

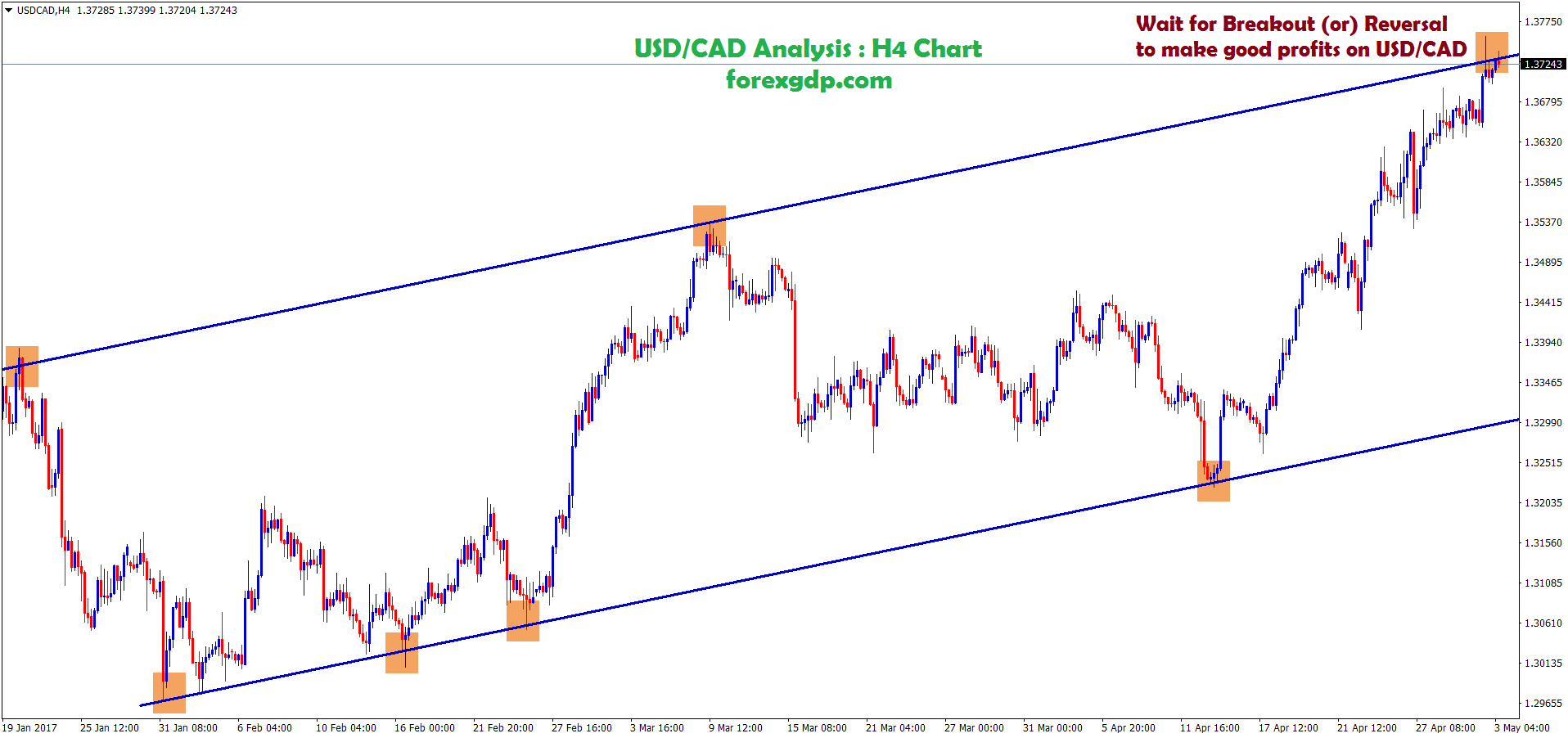

Canadian Dollar: Bank of Canada meeting forecast

USDCAD has broken the ascending channel pattern.

Canadian Dollar seems undervalued, as the Bank of Canada forecasted. USDCAD set to 1.20 area by the end of 2022 is expected, and the Bank of Canada will start the tightening measures this month.

Until March 2022, we can expect one rate hike in monetary policy settings.

So CAD remains undervalued, and it needs to pull higher according to Oil Prices level.

And tomorrow Bank of Canada monetary policy meeting will determine the Directions of the Canadian Dollar.

Japanese Yen: Omicron variant subsided with fewer risks

CHFJPY is moving in the Descending channel and market consolidation for a longer time, market price now doing corrections inside Box pattern from Horizontal support area.

Japanese Yen now shows correction in the market, and USDJPY and other counter pairs now tilting from higher low areas this week.

The main reason is that Omicron does only minor symptoms to affected people.

So, Risks are subsided, and Now riskier assets once again started to rally.

And FED Powell will do more tapering assets in terms of Billion this month; due to this, USD is more robust than its counterparts.

The Japanese Government has implemented enough stimulus, and Economy recovery is expected in 2022.

Now Omicron variant is less potent, which reflects in the market, so JPY investors shifted to riskier assets for profits.

Australian Dollar: RBA meeting keeps rates unchanged

GBPAUD is moving in an Ascending channel and the market reached the higher low area of the channel.

RBA Monetary policy meeting shows interest rates unchanged at 0.10% and Asset purchases at A$ 4 billion per week. And the next meeting in February will decide for extra assets tapering expected.

And RBA said the Recent Omicron variant shows a more negligible effect on the economy, so now recovers from pre-covid-19 levels at mid-2022.

But the inflation rate will remain at 2-3% until 2023 is forecasted, and GDP for the third quarter beats estimates and printed at 3.9% YoY versus 3.0% expected in October.

So Australian Economy recovery is on the way and will be completed in 2024 to 2025 is expected.

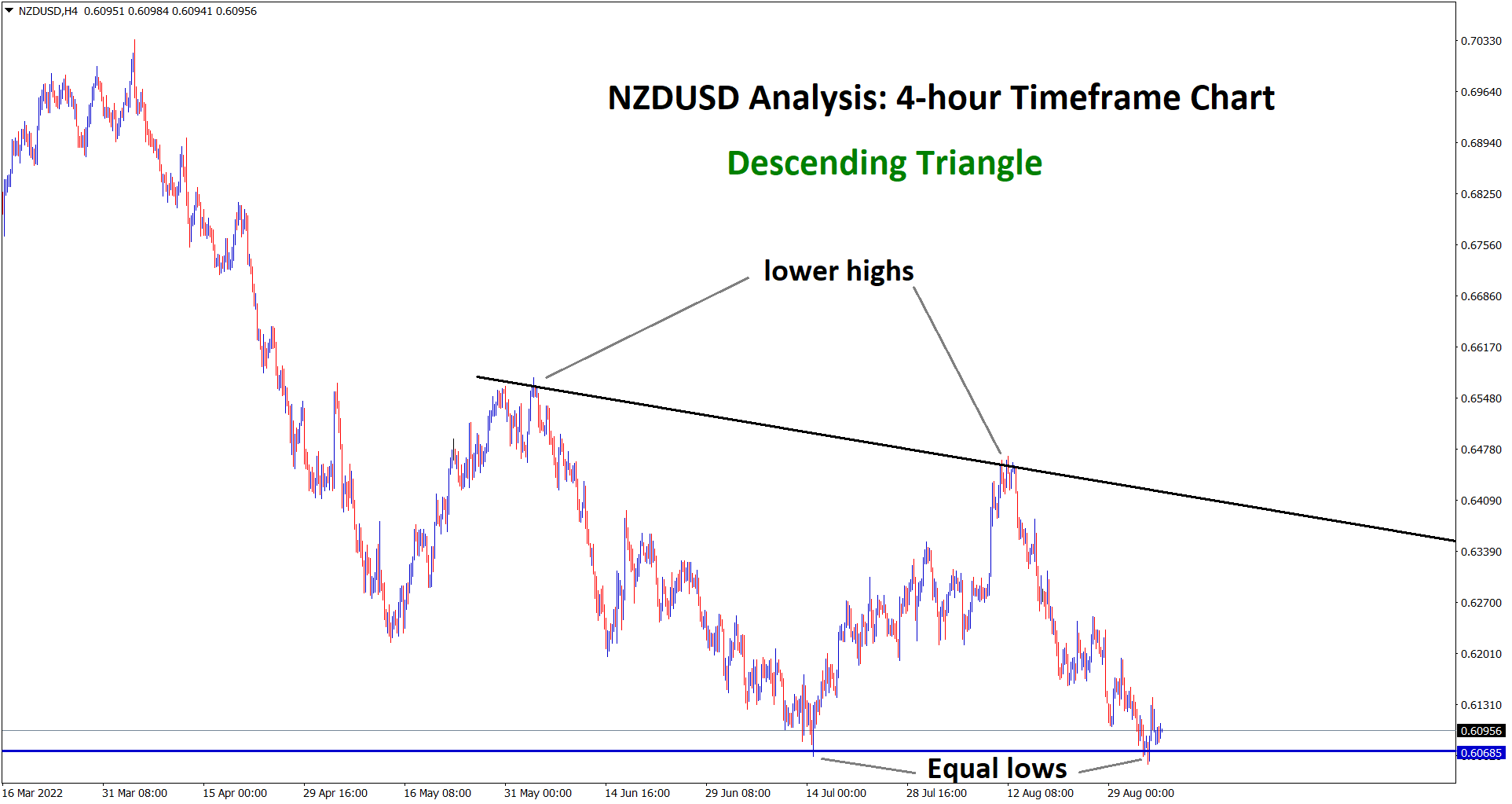

New Zealand Dollar: Housing sector elevated shows risks in NZ economy

NZDJPY is moving in an Ascending channel and the market has rebounded from the Horizontal support area and higher area of the channel.

New Zealand Dollar reached a support zone of 0.6750 area after falling from 0.7200 area in 2 months.

And RBNZ will continue to deliver five rate hikes by the end of 2022 and keep OCR to 2.00% as forecasted.

Elevated housing prices, more leveraging for Housing loans, and the China Evergrande crisis will make New Zealand Dollar weak in the coming months.

The next RBNZ meeting will be in February Until New Zealand Dollar keeps weakness against US Dollar.

The US Dollar keeps its appreciation as the Omicron variant shows less deadly against the Delta variant.

New Zealand Dollar makes cautious Domestic data stronger, and the Weaker Housing sector leverages.

Swiss Franc: SNB Vice-chairman Fritz Zurbrugg retires at 2022

EURCHF is moving in the Descending channel and market falling from the lower high area of the channel.

SNB Vice-chairman Fritz Zurbrugg was going to retire in 2022, and his achievements are more to the Swiss national bank.

He was taken charge as Vice-chairman in 2012 and implemented a Currency peg to negative interest rates, selling francs and collection of FX reserves; this action added a Balance sheet of $1.1 trillion to SNB.

The most remarkable achievement is negative interest rates and foreign currency purchases by selling Francs.

He does not name the next who will be appointed in his seat, and the bank council will do the position replacing him.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/