Gold: the US Has sent Troops to Ukraine Border

Gold Prices remained in the range Bound market of 1832 to 1780$ ahead of Non-Farm Payrolls data and is expected as 150K numbers that are lesser than 199k in December and OPEC+ ready to increase output next month.

XAUUSD Gold price is moving in an Expanding channel and the market has reached the higher low area of the channel.

In Us, Wage and Labor market conditions are doing well, and the FED Powell rate hike is more impact than any other news.

In Us, Wage and Labor market conditions are doing well, and the FED Powell rate hike is more impact than any other news.

And US Joe Biden has Approved the Troops to send Eastern Europe Zone to Protect Ukraine from Russian invading.

US Dollar: US Treasury secretary Yellen Speech

USDCHF is moving in the Symmetrical triangle pattern and the market has rebounded from the Support area of the pattern.

US Treasury secretary Janet Yellen said inflation is transitory was chosen as mistaken because People think transitory words are a couple of months.

Inflation is a big problem in the economy, and it cannot be solved as a bigger stimulus as soon as possible and the unemployment rate to change to normal again.

It takes more time to come down from a higher level to a lower one and not hope that can happen in just a couple of months.

And Joe Biden quoted the size of Heft stimulus due to higher inflation compensation and economy to improve back to Normal level as we have in Pre- pandemic time

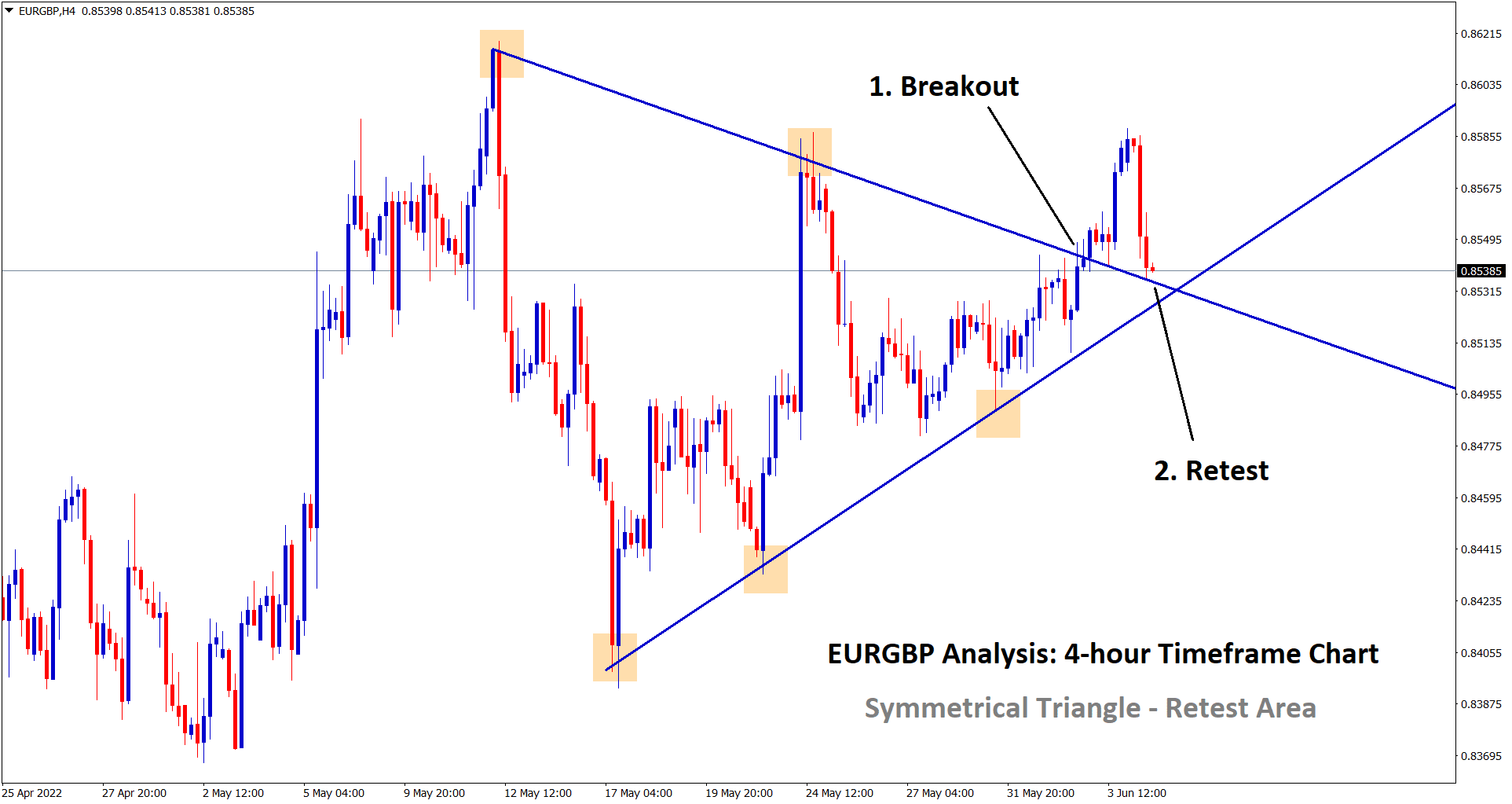

EURO: Euro CPI came higher than expected

EURCAD has broken the Descending channel and the market has reached the resistance area of the pattern..

Eurozone CPI rate printed at 5.1%YoY and Shows higher in the Decade.

And ECB might do 10Bps rate hikes in July 2022, as Analysts expected.

And Bank of England is going to rate hike today as MPC Vote 9:0 shows, and this is back-to-Back rate hikes in the last 2004 year.

Bank of England and ECB have more Divergence in Policy settings, more climate change between UK and EU makes more Covid-19 affected than the UK.

UK Pound: Bank of England Monetary policy forecast

GBPCHF is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

Bank of England will hike a 25Bps rate today with a Vote of 9:0 Polls; this is the second time the Previous meeting hiked; the same stance happened in 2004.

The UK Inflation data printed at 5.4% Y/Y Versus 5.2% expected and inflation target of 6% will be achieved in April Month target.

And the unemployment rate in the UK is Falling to 4.1%, and rising concerns of Wage Price Spiral.

This Year Bank of England will do five more rate hikes, as Analysts expected.

Due to Omicron lower impact on the UK, Rate hikes are more considerations for controlling UK’s Inflation rate.

Canadian Dollar: BOC Governor Speech & OPEC+ increasing output

USDCAD is moving in an ascending channel and the market has rebounded from the higher low area of the channel.

USDCAD faces a downturn after ADP Employment numbers reported -301K printed.

And OPEC+ Nations ready to increase their outputs of 400k per day in Next month will be compensated Demand and Supply mismatch Oil in Global levels.

Bank of Canada Governor Tiff Macklem said Inflation numbers would come down soon and All we expected.

The Robust Canadian Q4 GDP data showed this week makes the Canadian economy confident about the recovery.

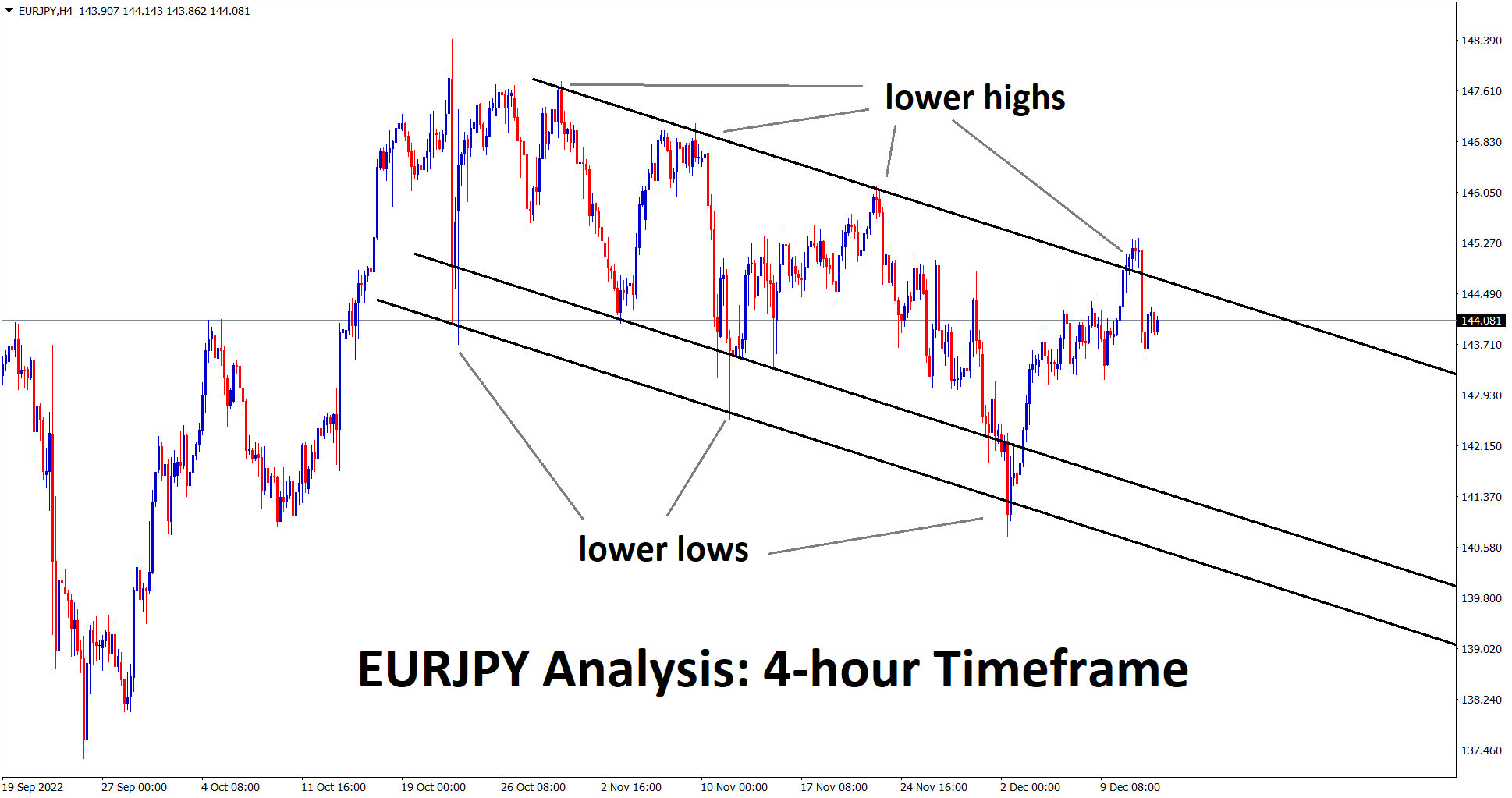

Japanese Yen: Bank of Japan member Wakata be Speech

EURJPY is moving in an Ascending Triangle pattern and the market has fallen from the Top area of the Pattern.

Bank of Japan member Masazumi Wakata said there is no room for changes in monetary policy settings.

And Easing monetary policy will be increased if downside risks are heightened.

And the 10 Year JGB bonds yields moved higher but within the range of 50bps and BoJ’s target of 0%.

More easing of monetary policy is not now debated, and the economy is much more important.

Current inflation is not improved by Cost-push factors and also reflects in Solid demand.

We are trying hard to achieve BoJ’s 2% price Goal with Cost-push inflation alone.

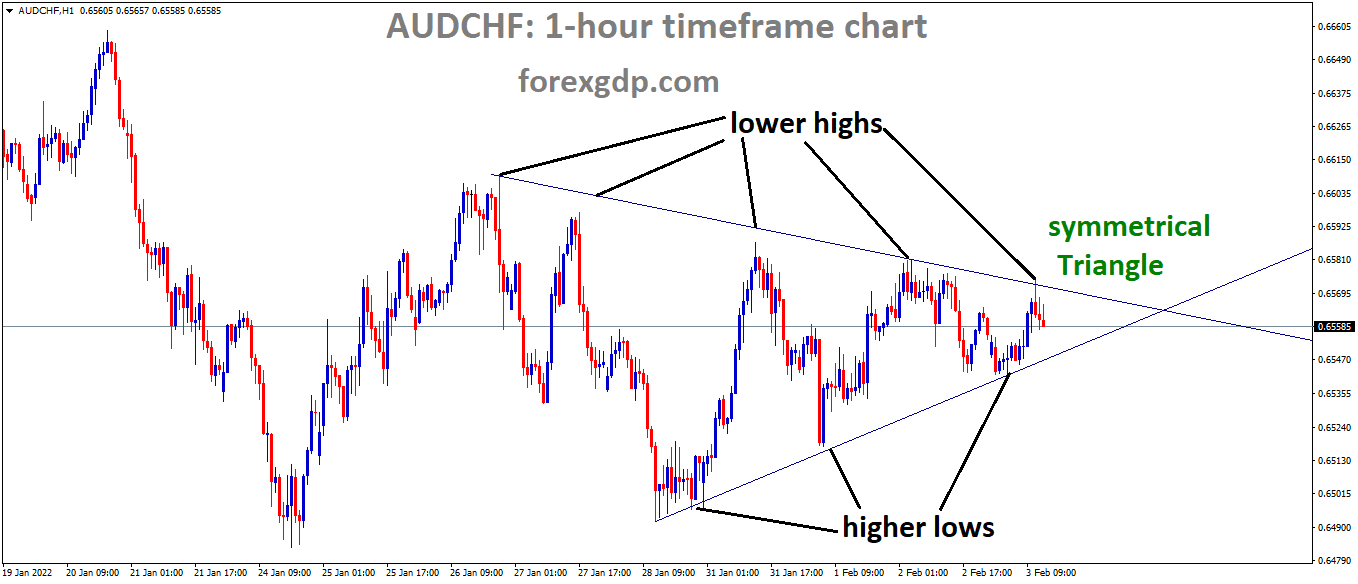

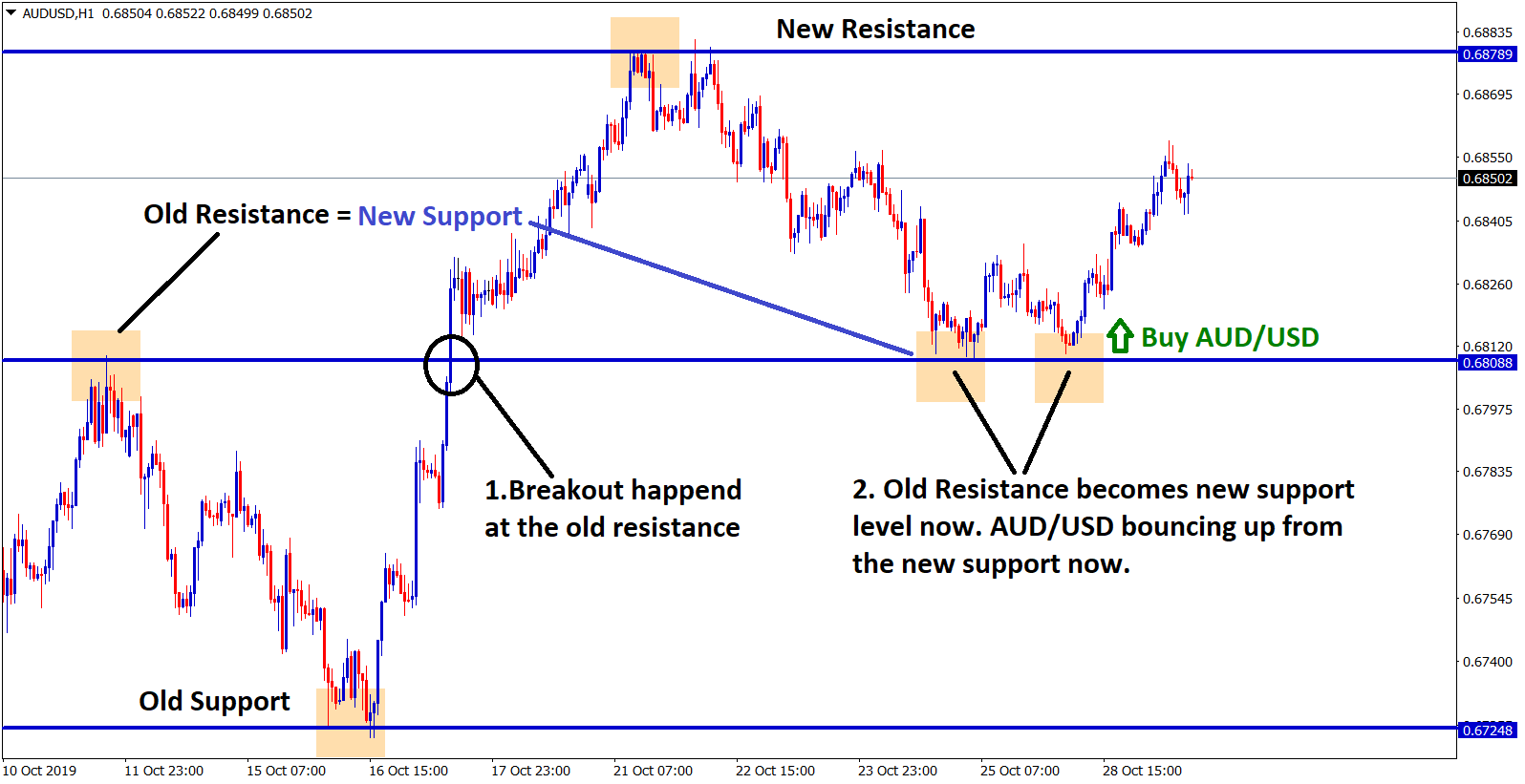

Australian Dollar: RBA rate hikes will be started in the Second Half of 2022

AUDCHF is moving in the Symmetrical triangle pattern and the market has fallen from the top of the triangle pattern.

RBA Dovish Policy meeting shows nothing support for the Australian Dollar.

Nomura and Bank of America predicted First rate hike would be in June, and nine other economists expressed a rate hike in August month as the First-rate hike of 0.15Bps to 0.25%

And Most Economists predicted RBA will raise rates to 1-1.5% by December 2023, with a current low rate of 0.10%.

RBA Governor Lowe will think and decide the rate hike in June 2022 and take the cash rate to 2.0% at the end of 2023.

Australian imports are higher than Exports data

Australian Trade surplus data is primary for the Australian Dollar to be driven in Forex markets against Counter pairs.

And in December month Balance Goods came at A$+8356 millions and December month Exports shows +1pct MoM and Imports data shows +5pct MoM.

Overall Data shows Imports are higher in December than Exports, which makes a slight weakness for the Australian Dollar.

And Trade balance surplus will be more favorable for the Australian Dollar, and fewer numbers show weaker scenarios for the Australian Dollar.

New Zealand Dollar: 25 Bps rate hikes expected in New Zealand Policy meeting in February Month

EURNZD is moving in the Descending channel and the market reached the lower high area of the channel.

New Zealand Dollar will be again retested to 0.6700 mark once February meeting is conducted on Feb 23 doing rate hikes of 25Bps.

And National lockdown is easing further, and Omicron Variant decreased much more in Kiwi, So Business promotion activities are led by New Zealand Government by hiking rates.

New Zealand Domestic data is doing well, and China recovery is on the path; if recovered in Full swing, the Kiwi gets more substantial export orders to China.

Swiss Franc: Swiss Franc benefitted by Negative US ADP numbers

CHFJPY is moving in an Ascending channel and the Market has rebounded from the higher low area of the channel.

Swiss Franc gets more benefitted by US and Russia war Fears from Ukraine issue.

And Euro Zone is only more affected by Oil and Gas problems due to 80% of Supply from the Russian side.

US ADP shows disappointment numbers and -301K printed versus 207K expected. This shows pullback from highs in Employment data.

However, US FED strong thinking of rate hikes will be placed in March Month as All expected.

And Swiss Franc is the only currency that benefitted from Oil and War fears.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/