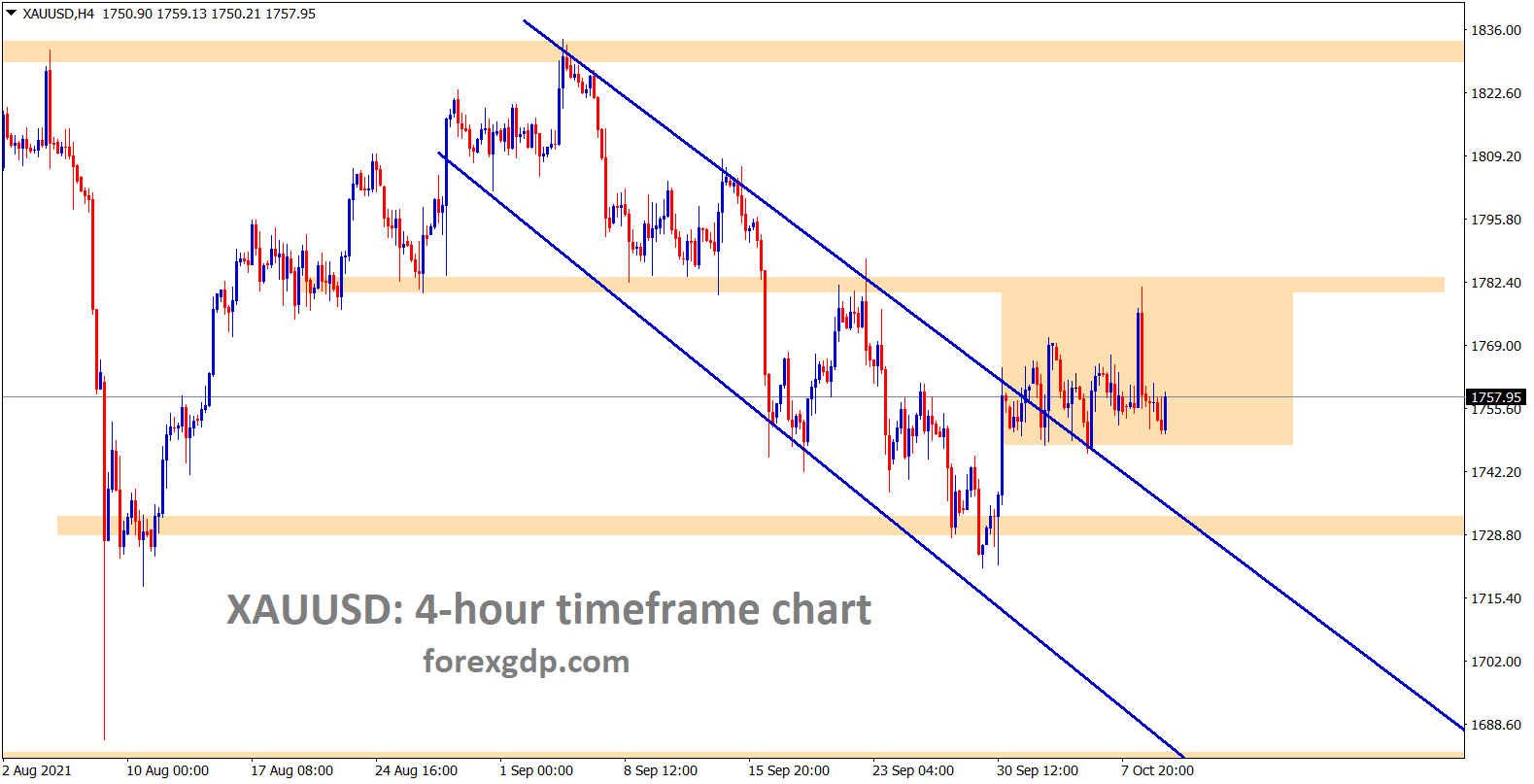

Gold: China Power difficulties makes gold demand lower

Gold is consolidating between the support and resistance area after breaking the descending channel.

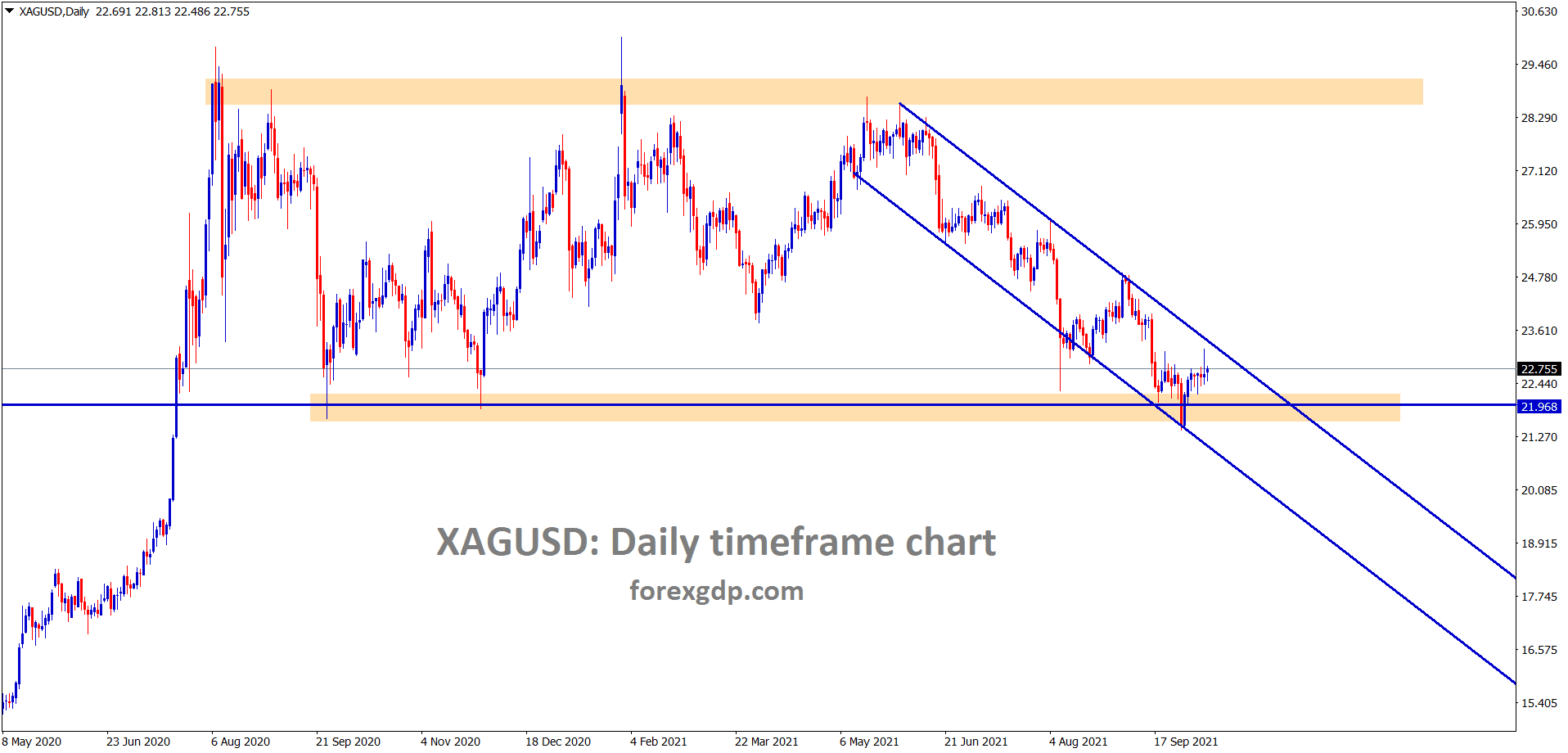

Silver is rebounding from the support area and it’s still moving between the channel ranges, wait for the breakout form this channel range.

Gold prices remain lower as US Dollar faces more support from Domestic data.

And China nation facing Power difficulties, and GDP is likely to lower if it extends further.

And Gold buyers are dimmed, and sellers were dominant in the market due to rising Bond Yields from Global markets.

Once Rate hikes have been done by All over the world step by step, gold holders keep selling in the market.

As Pandemic crisis time Funds switched over Gold from Markets, once crisis solved, Gold becomes selling and Funds switched to Bond buying programs.

US Dollar: NFP and Unemployment rate gets mixed bag data

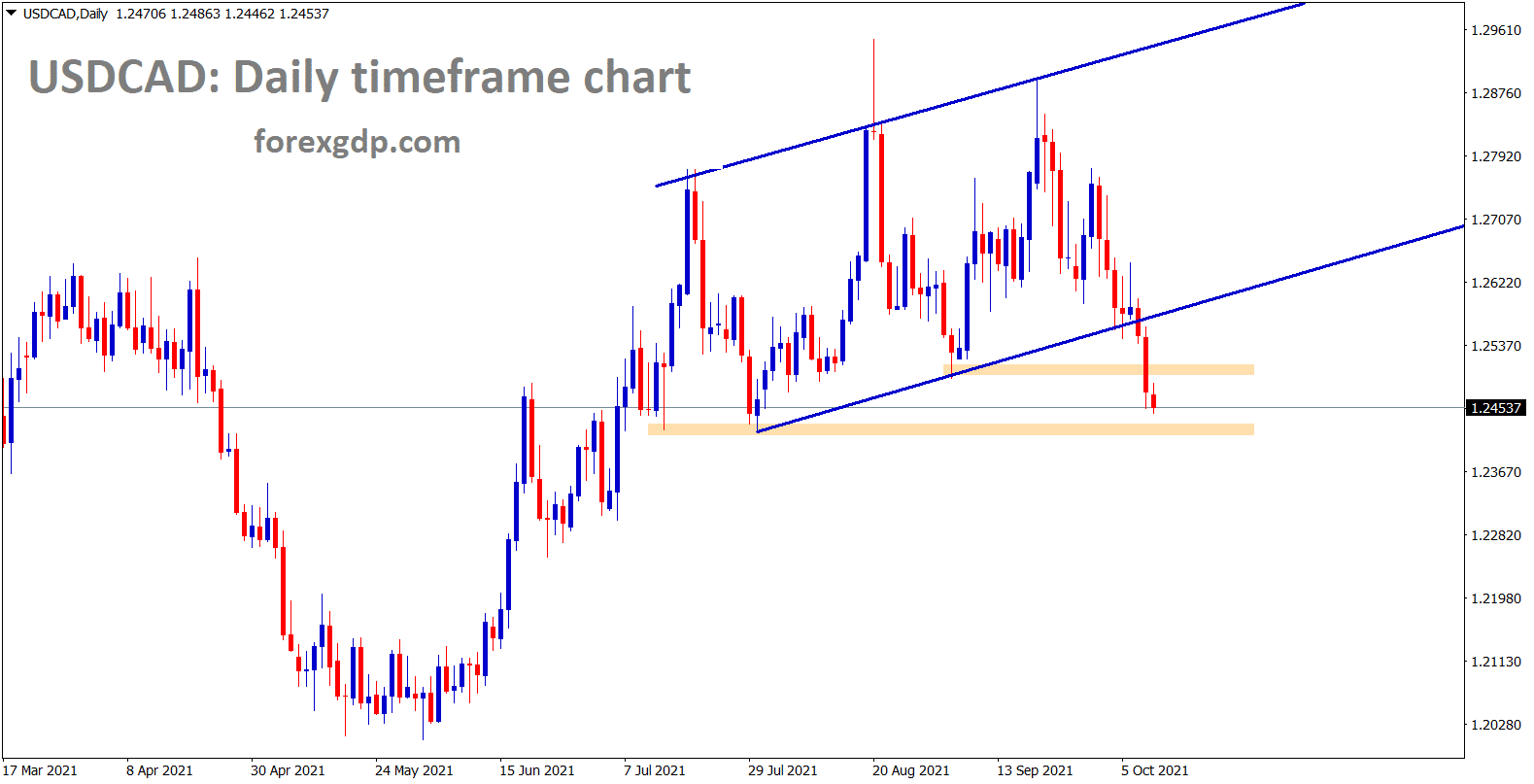

USDCAD is moving towards the next major support area.

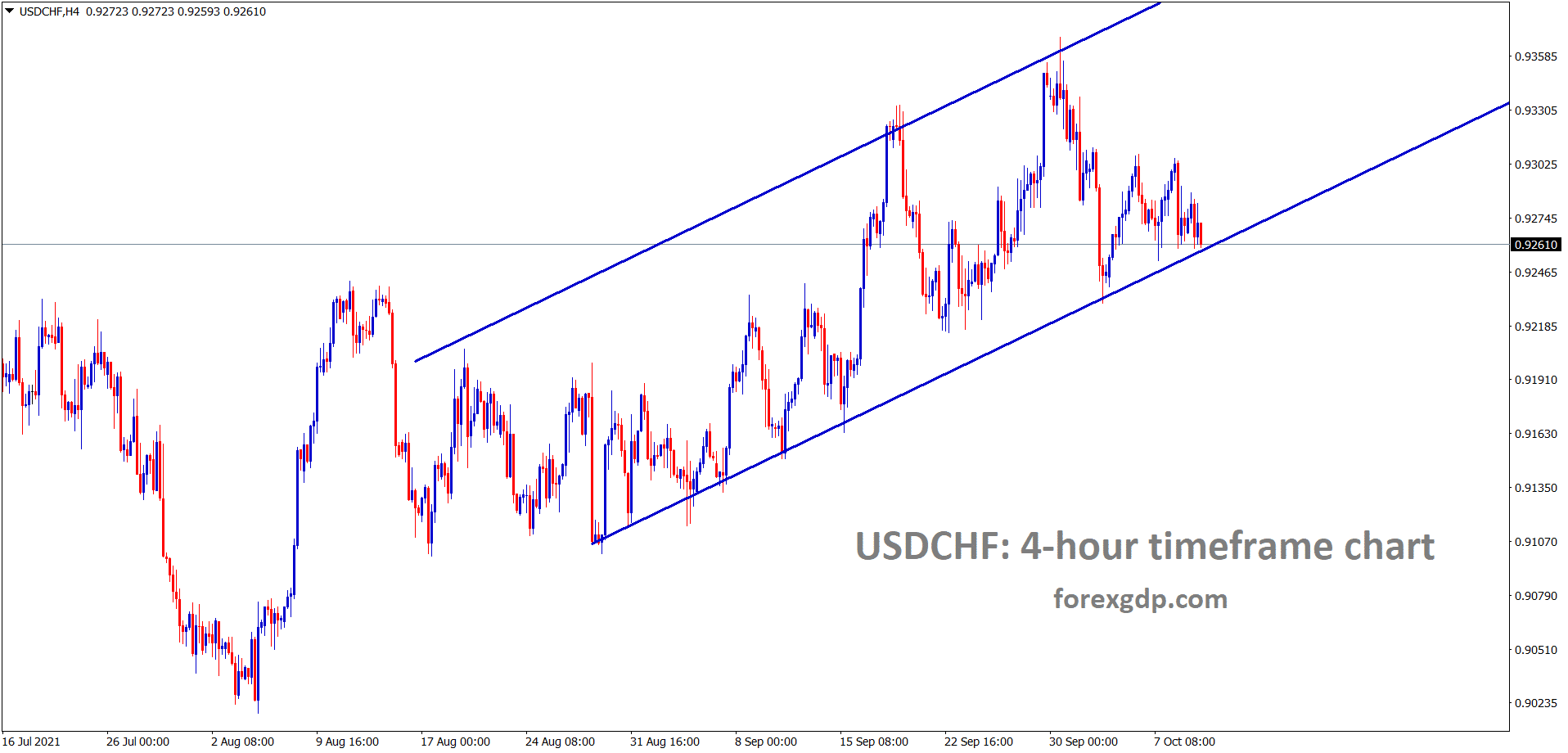

USDCHF is moving in an Ascending channel range.

US Dollar keeps higher against Japanese Yen as three years high now plays in the market.

And on Friday, NFP data shows more disappointing numbers as below 200k printed against expected 500k, But the Unemployment rate came in better numbers like 4.8% from 5.1% expected.

So, US Dollar moving in Bullish momentum and other counter pairs are bearish path as a correction.

Japanese Yen faced two issues mainly, 1. Covid-19, 2. Energy crisis.

And inflation remains lower, but manufacturing and production are running with electricity.

So, more power is required in Japan, and Now Government faces a more tough lockdown as the Covid-19 crisis is not solved.

US FED will give tapering bonds purchases in November Month because Unemployment rate came lower as FED Goal expected.

Republican Senate leader speech

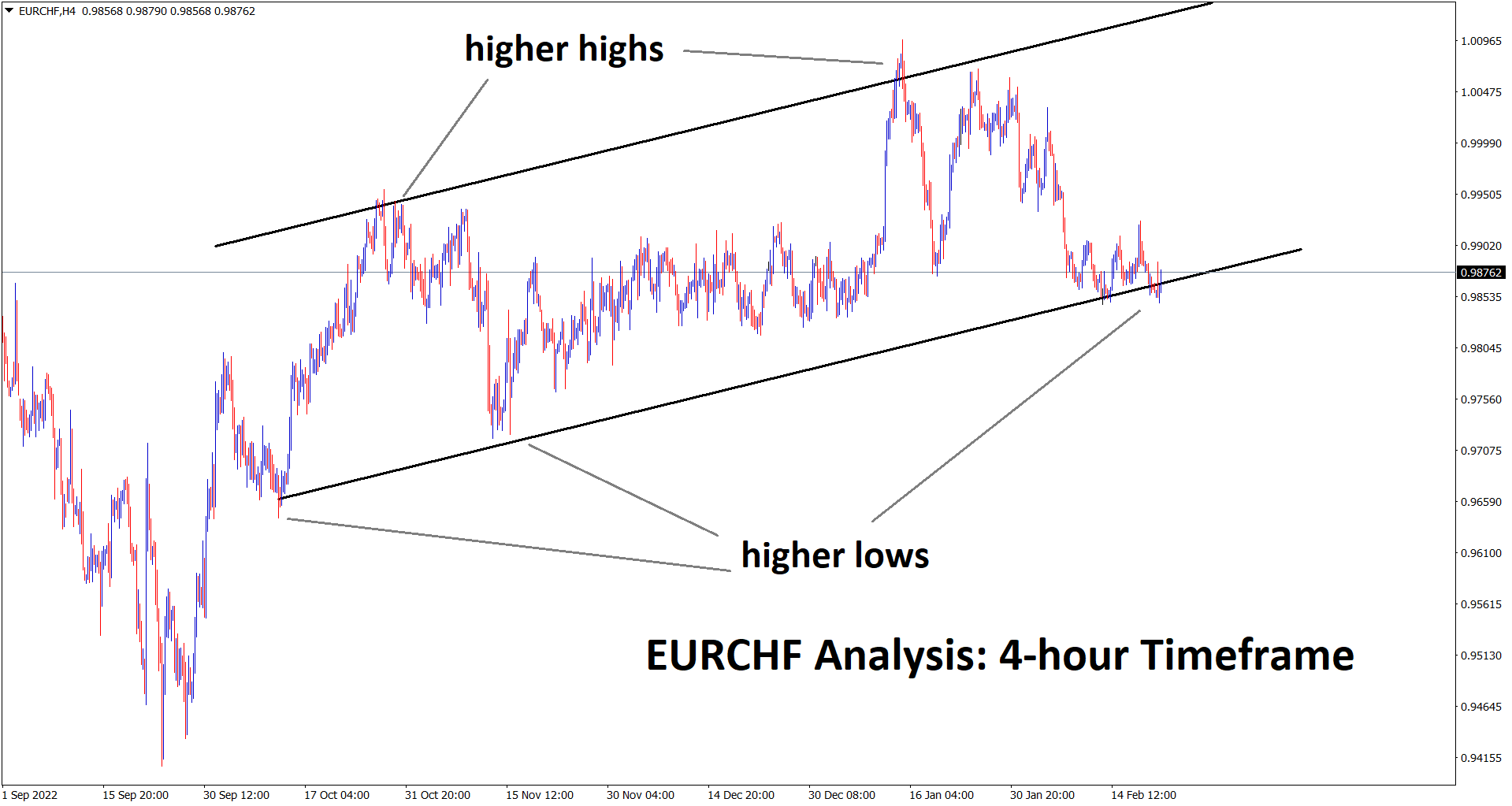

US Dollar keeps higher, and Swiss Franc also kept higher.

And on Friday, US NFP data kept lower, and the Unemployment rate kept higher.

US and China trade relationships over tariffs sanctions removing ideas are more concentrated from China Side.

Ans Republican Senate leader Mitchell McConnel said to Joe Biden in the letter that he is not again supporting US Democrats for rising Debt limits.

EURO: Eurozone facing NI Protocol and Energy crisis

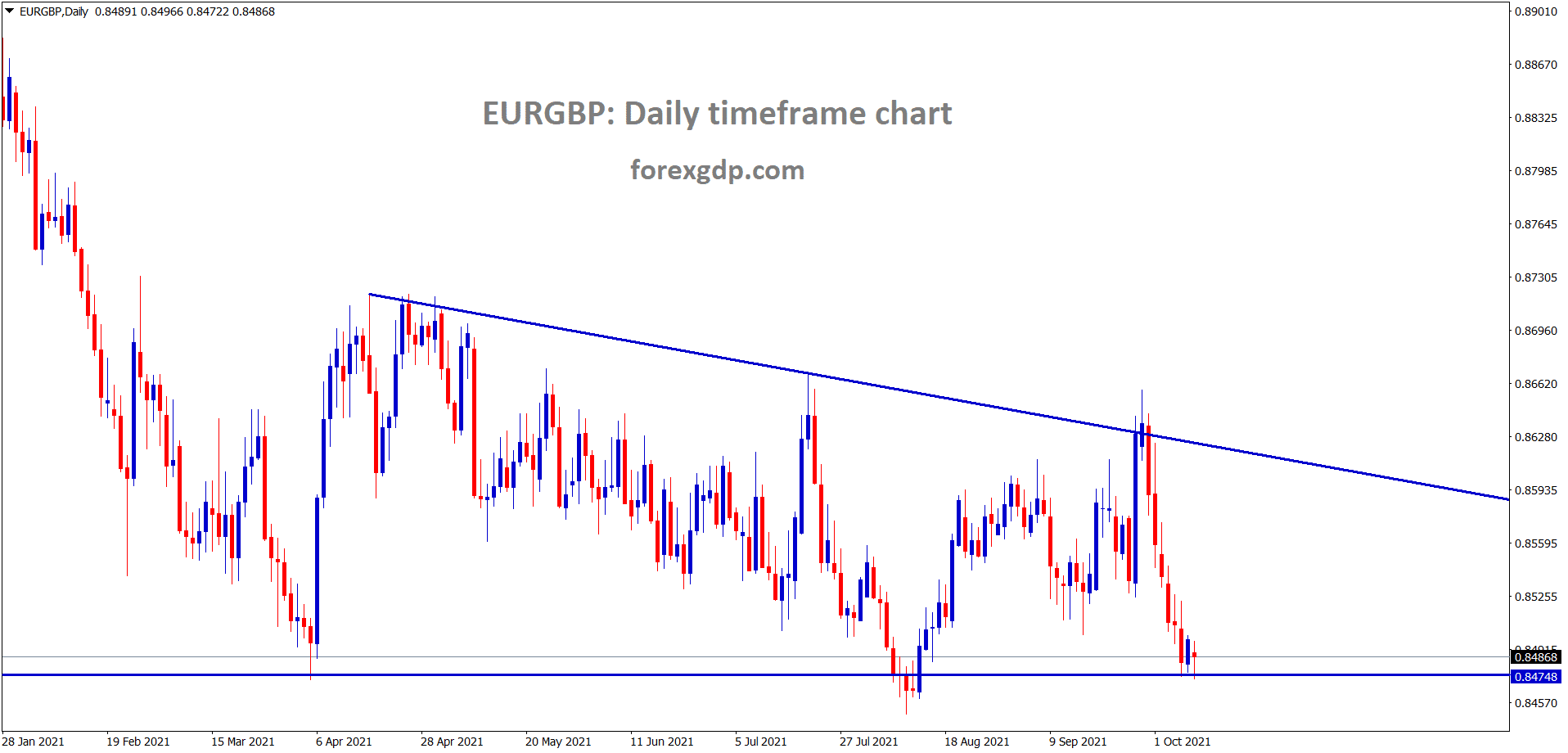

EURGBP is still standing at the low level of the descending triangle pattern.

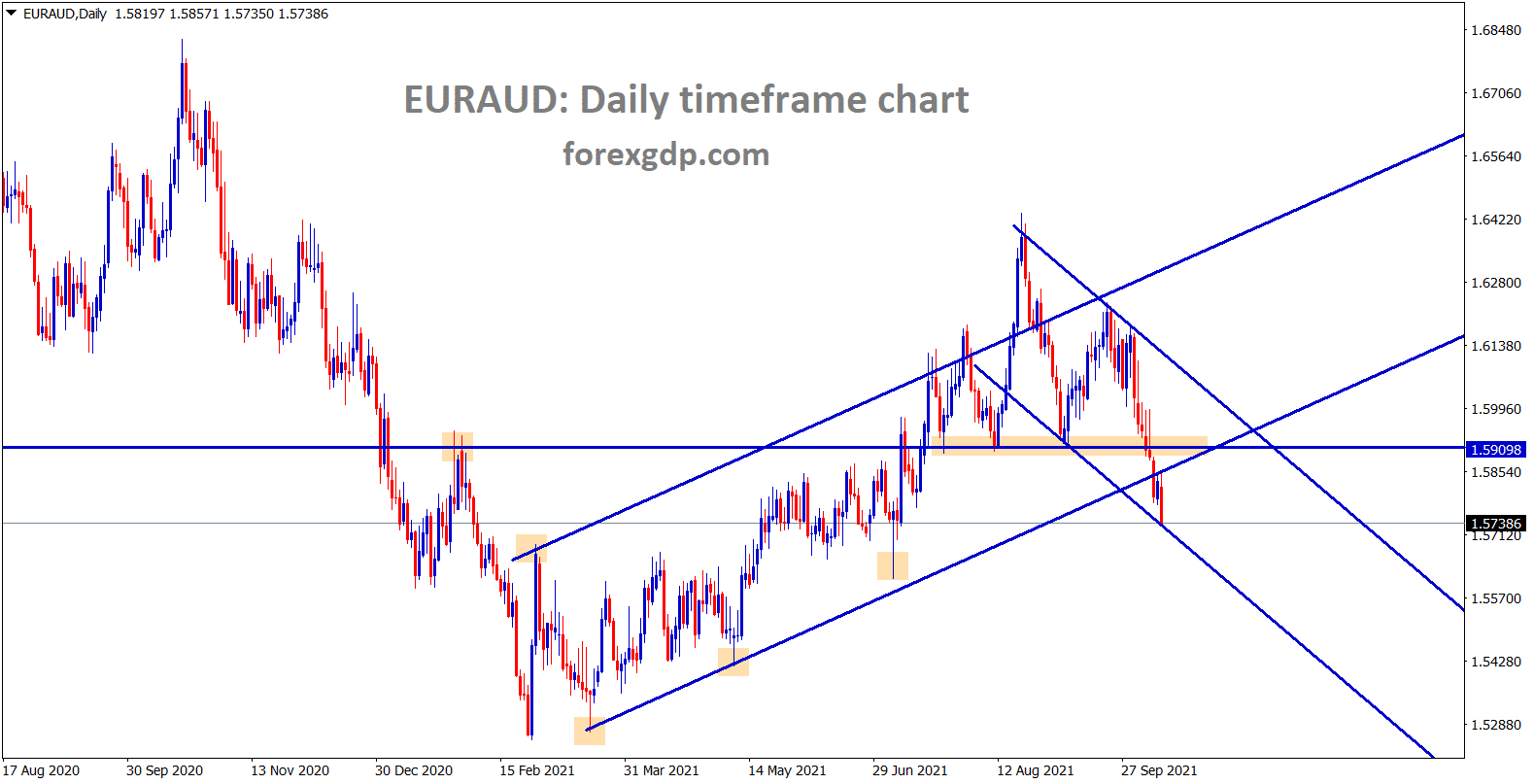

EURAUD has broken all the lows and reached the lower low level of minor descending channel.

EURUSD is set to higher as a correction from the 1.15500 level. US Domestic data on Friday shows more disappointment numbers to Investors, so pressures on US Dollar and Support for EUR currency had happened.

And also, Domestic data of Germany and France becomes lower than expected data drags down Euro to further weakness.

The Brexit deal between the UK and the EU on Northern Ireland Protocol is still not solved, EU is ready to solve the Deal, but the UK demand risks and Makes rules breaking issues from the UK.

As the EU is facing an energy crisis, Russia opens helping hands to the EU as More Gases to supplies for Europe.

UK POUND: Bank of England members rate hikes chances

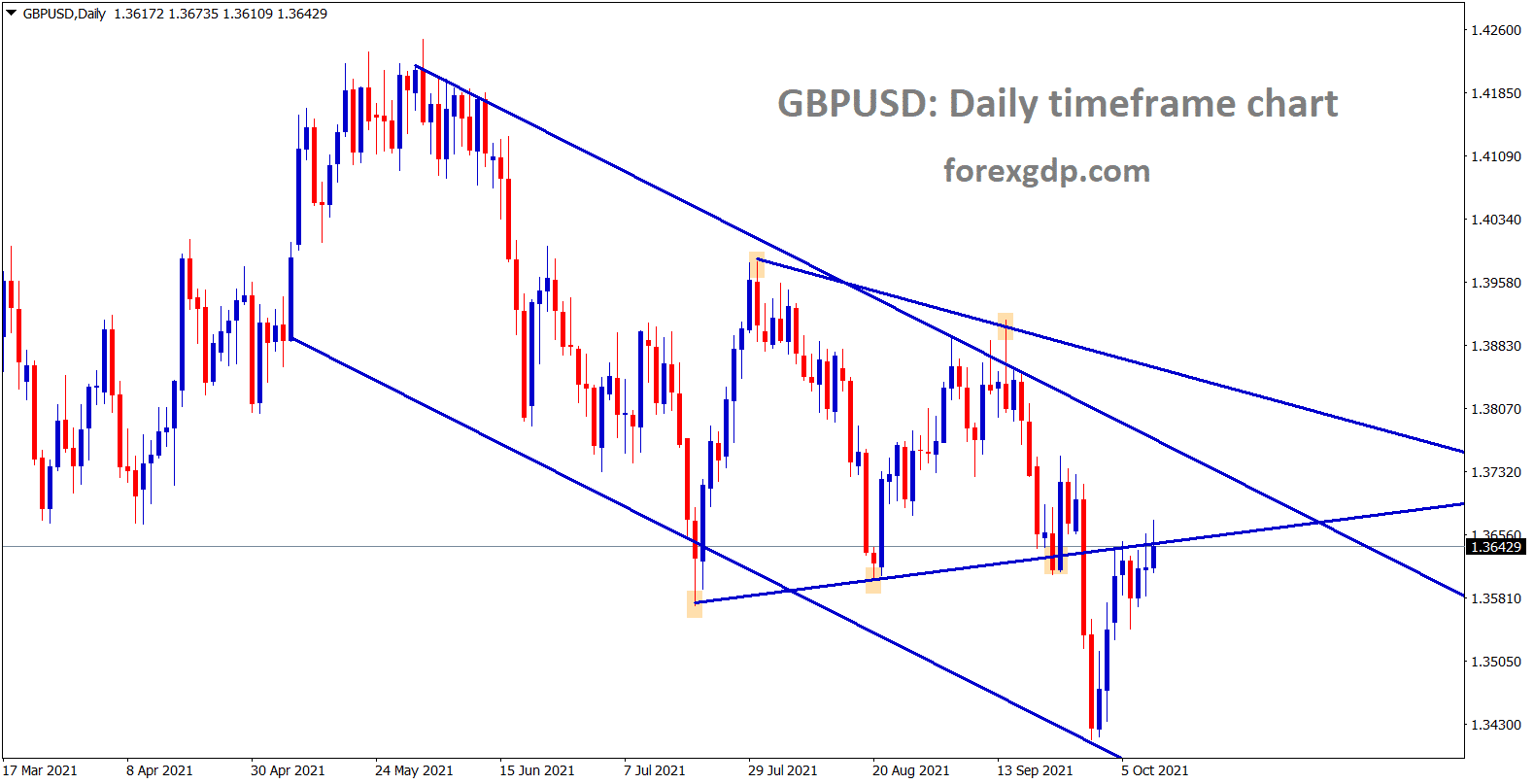

GBPUSD is consolidating at the retest area of the symmetrical triangle and it’s trying to move higher to the lower low of the descending channel line.

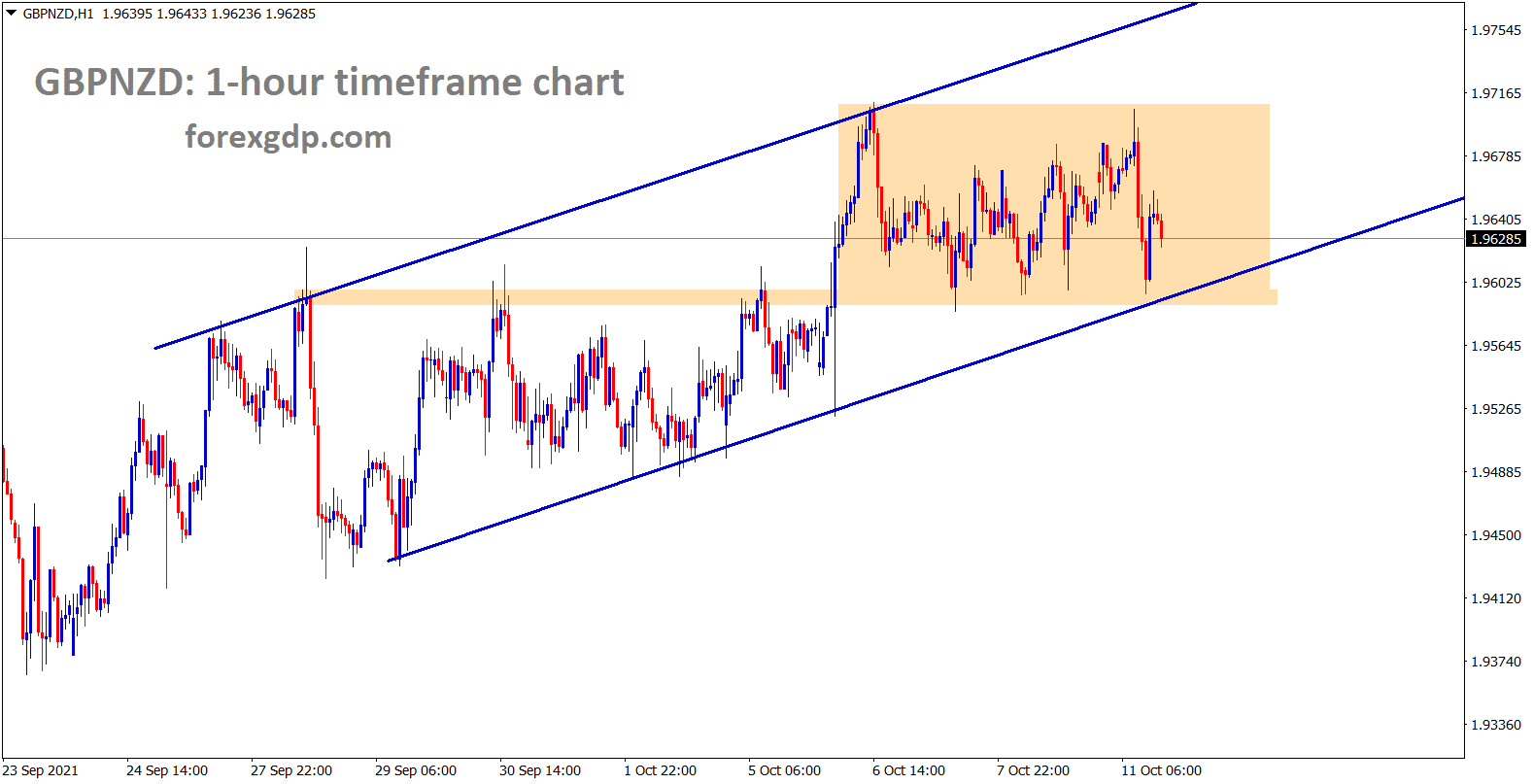

GBPNZD is consolidating in the ascending channel – wait for ascending channel breakout to catch the big movement on GBPNZD.

Bank of England expected to do rate hikes earlier than expected, as News reported.

And Bank of England Governor Andrew Bailey suggested that Running inflation in the UK is much hotter than expected. We must cool by hike interest rates in the near term as possible.

Hawk Michael sanders joined with Bailey supported for Voting to hike rates in the near term.

So GBPUSD and GBPJPY rose in the market after the Hawkish bias rate expected at the end of 2021.

Japanese Yen: Japanese PM Speech

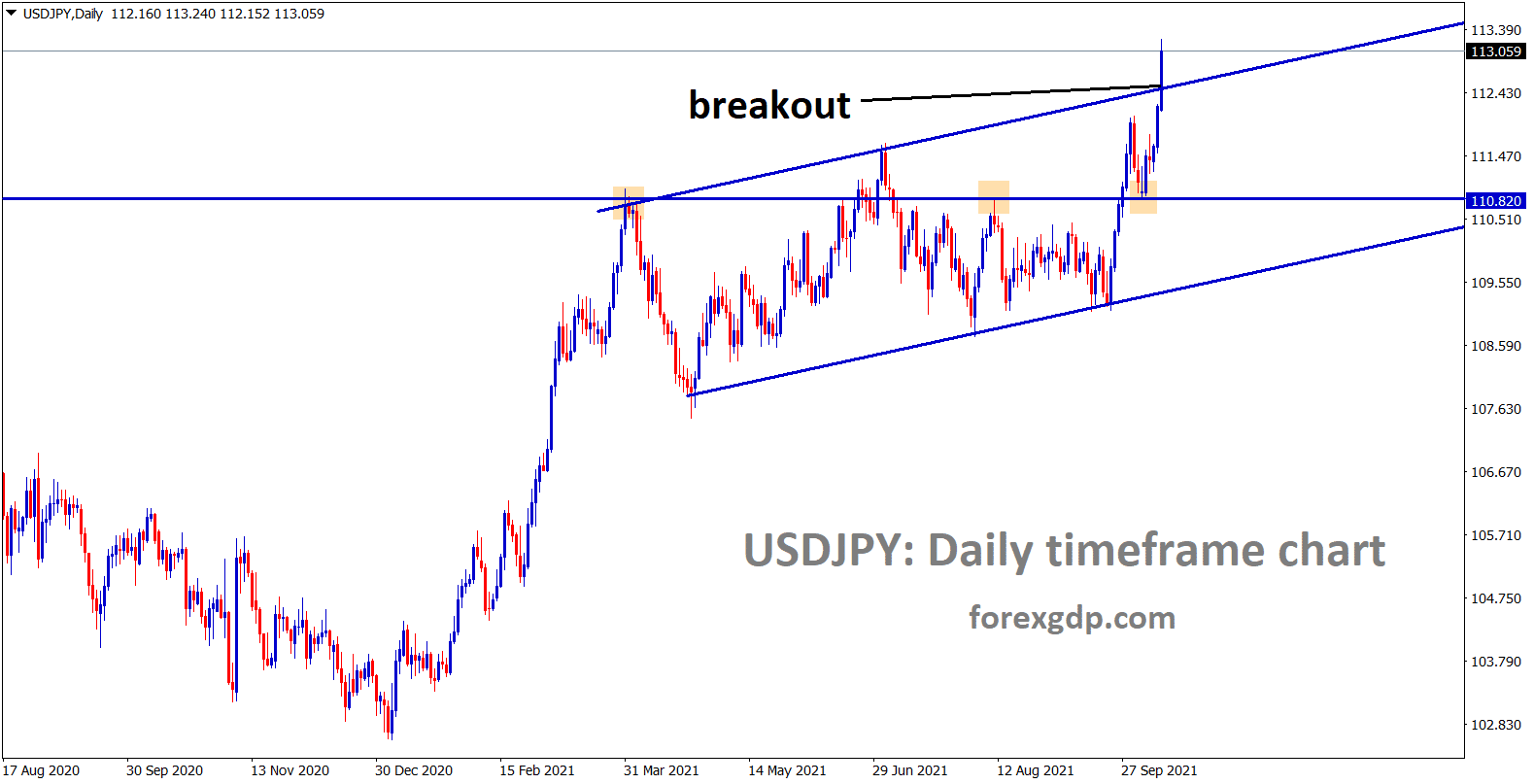

USDJPY has broken the higher high (top) area of the ascending channel range.

Japan Prime minister Fumio Kishida said a More Economic package discussion meeting would be scheduled next month.

After Election, only more Budget stimulus will be dispatched, So in this pandemic time, we need to solve issues within our budget stimulus before the arrival of a new stimulus policy.

Also added, Increasing of Tax incentives will boost wages than adding capital gains Tax.

We improve our Economy soon as level as Global economy, Taiwan is our friendly nation So we must solve our issues within the political party itself.

And we compile more extra budget after the Election.

Canadian Dollar: Oil Prices and Canadian Employment data in Good numbers

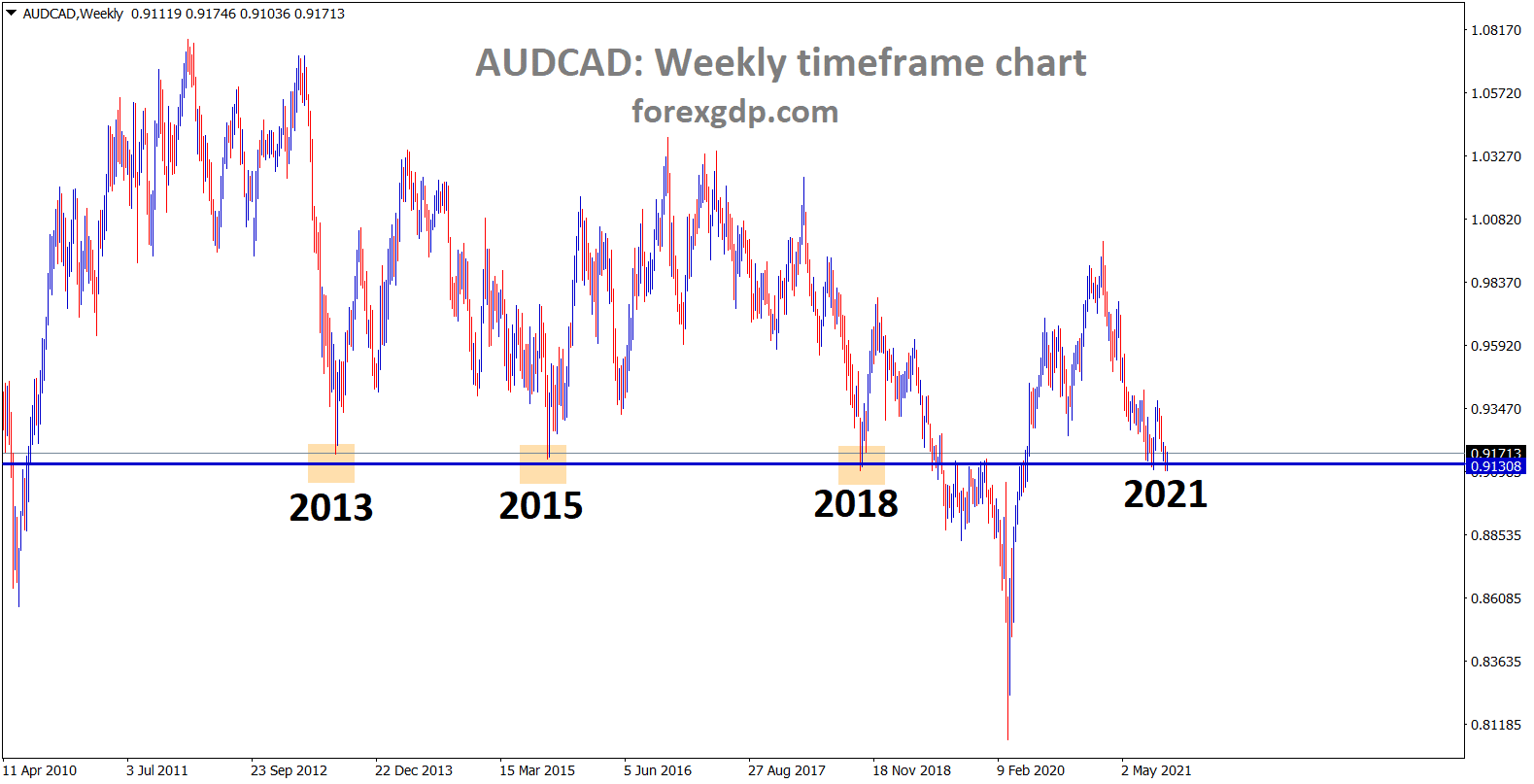

AUDCAD hits the major support area again after 3 years.

Oil prices are kept higher at 80$, and these Oil prices move significantly as 4Q2021 because global demand increased as the Covid-19 crisis came to end, and the Energy crisis started up.

So, Oil prices rose to 2022 full year and will come to consolidation in 2023 as JP Morgan analysts expected.

Canadian Dollar comes out with massive rally against Japanese Yen on Friday and Today due to Oil prices surging and Canadian Employment data.

Canadian Employment rate came at 6.9% versus 7.1% previous level, and Job numbers came at 159K Versus 60K expected.

So Strong employment numbers pushed the Canadian Dollar to higher highs last week.

Australian Dollar: New south Wales removed lockdowns

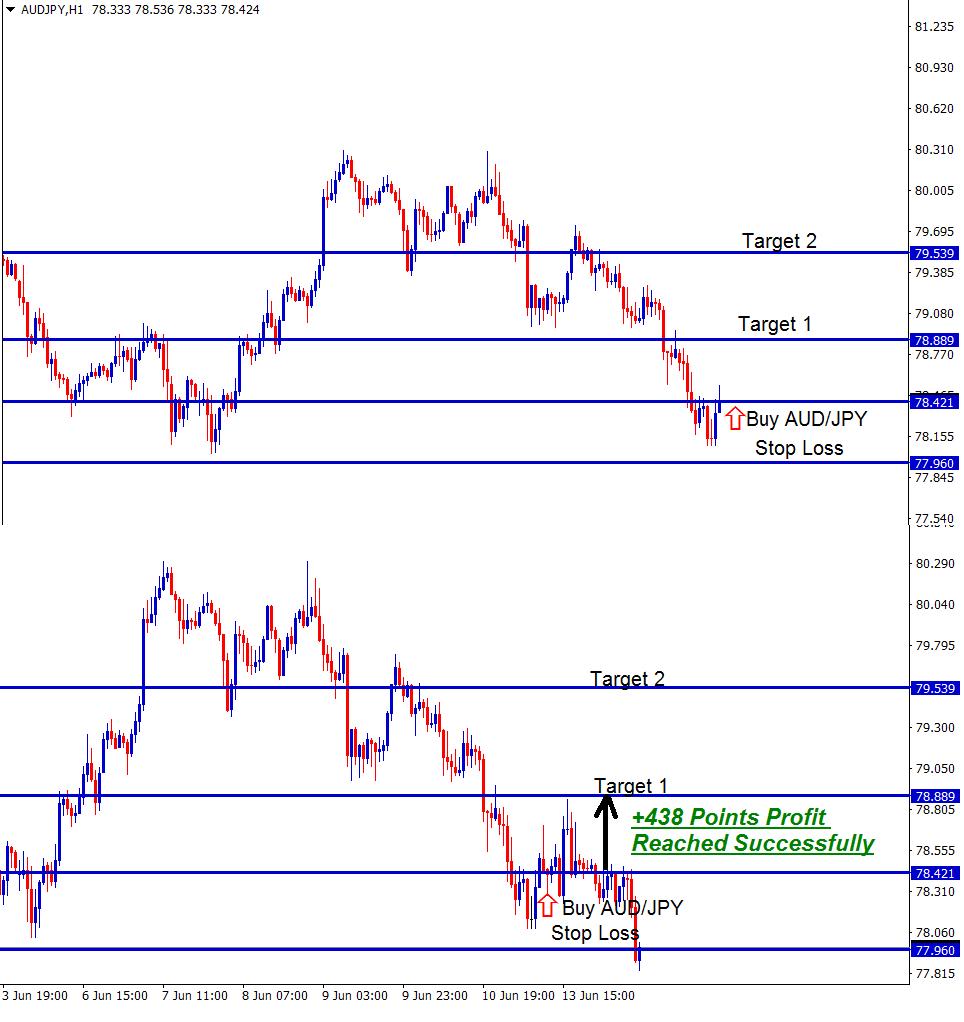

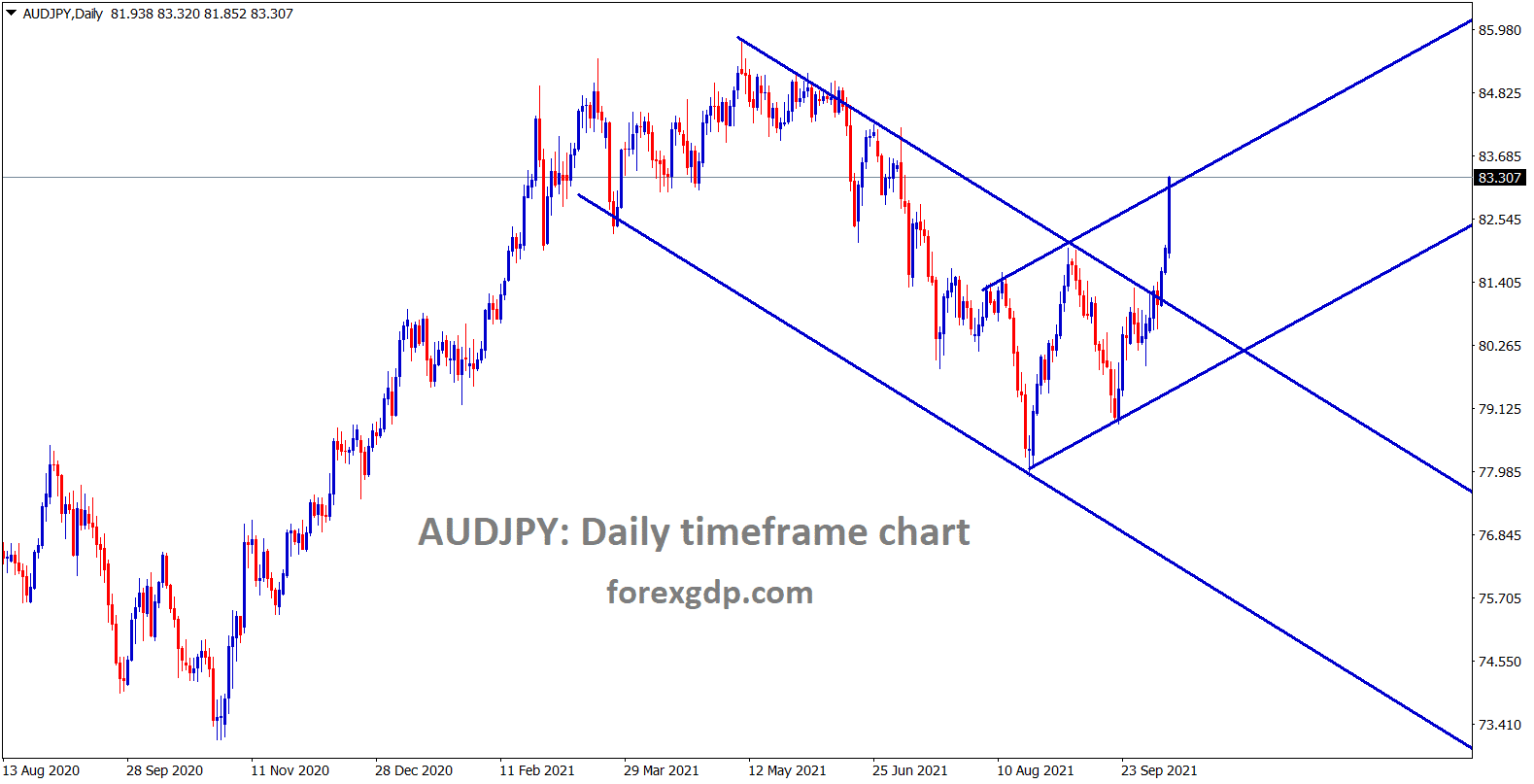

AUDJPY is moving in a strong uptrend.

Australian Dollar moves higher after New South Wales 100-day lockdown came to an end as partially released lockdown from the city.

And the Vaccination rate 70% crossed in New South Wales, so passengers are allowed to travel to other countries who have finished 2 doses of Vaccination.

Now China also admits Coal imports more from Australia, and Revenues in Exports triggered higher.

And any time, AUDUSD will shot up higher if China makes more imports from Australia.

As China facing more Power difficulties and Bitcoin mining companies used more power in past years, Due to the Government ordered to shut down Bitcoin mining areas and No Crypto transactions to use.

New Zealand Dollar: One more rate hike by Year-end

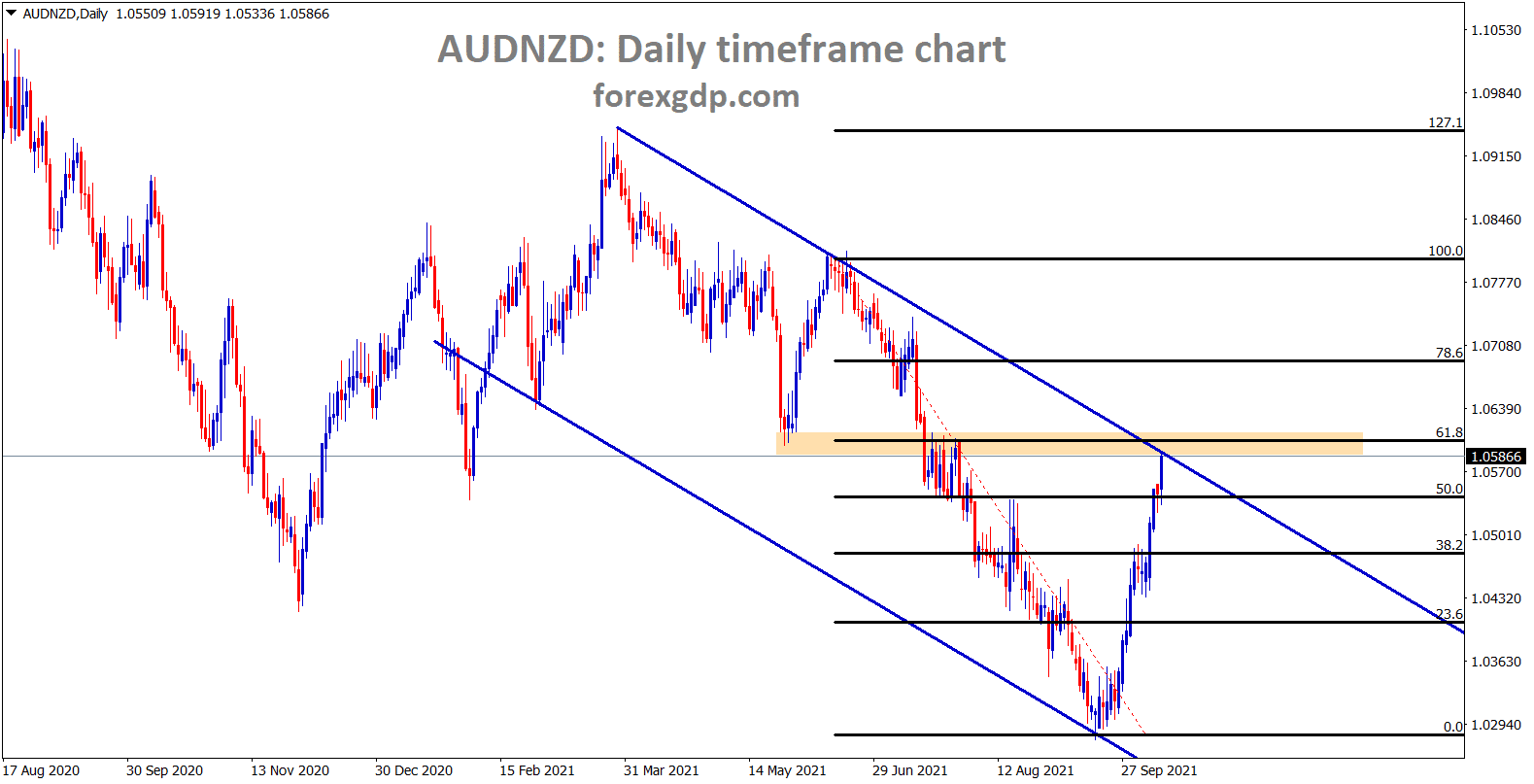

AUDNZD hits the lower high area of the downtrend line and it’s near to 61.8% retracementt level.

New Zealand Dollar keeps higher after RBNZ did Rate hikes last week. And the RBNZ Shows fewer bonds purchases, and Rate hikes show the Government now required no printing of money further.

So, another Rate hike is expected in the November meeting, and by 2022 rate of interest will be 1.50%, as analysts expected.

And US NFP data shows fewer job numbers, and the Unemployment rate crossed 4.8% versus 5.1% expected

New Zealand PM speech

New Zealand PM Jacinda Ardern said the country’s largest city of Auckland remains under Tier 3 lockdown.

And this lockdown remains as 35 cases appeared from 60 cases but fewer cases.

New Zealand Government faces tough issues from Covid-19, and Vaccination are progressing faster.

China is facing electricity issues, and the Demand for Coal is higher.

New Zealand Dollar makes higher after rate hikes from RBNZ in last week.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/