Gold: US Domestic data performance Well

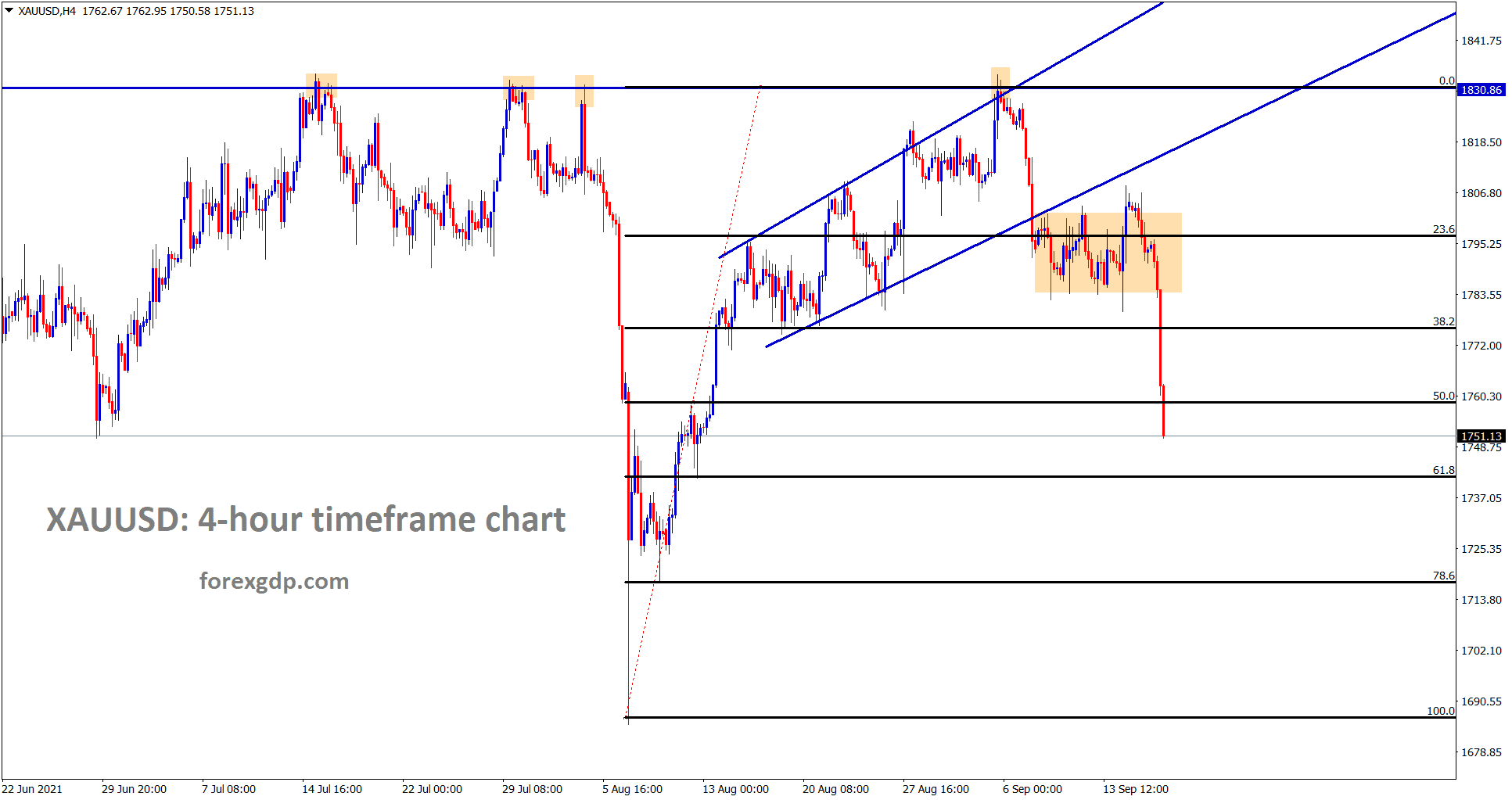

Gold price fell today to 50% retracement level after breaking the consolidation range.

Gold prices are declined down as Range bound market performed in the market. US CPI lower numbers show US Economy strengthened more.

And US Dollar performed higher, causes gold prices to move lower, and retail sales data is expected to be in lower numbers; if came lower, then gold prices move higher today. Otherwise, Gold prices moved further declines is expected.

Global cues like the Delta variant in China and the US makes sluggish recovery in Economy, Industrial production and retail sales data in China made lower.

And Gold prices once again retested to previous support of 1780$ and then bounced back, or further decline is possible.

US DOLLAR: US Domestic data came lower

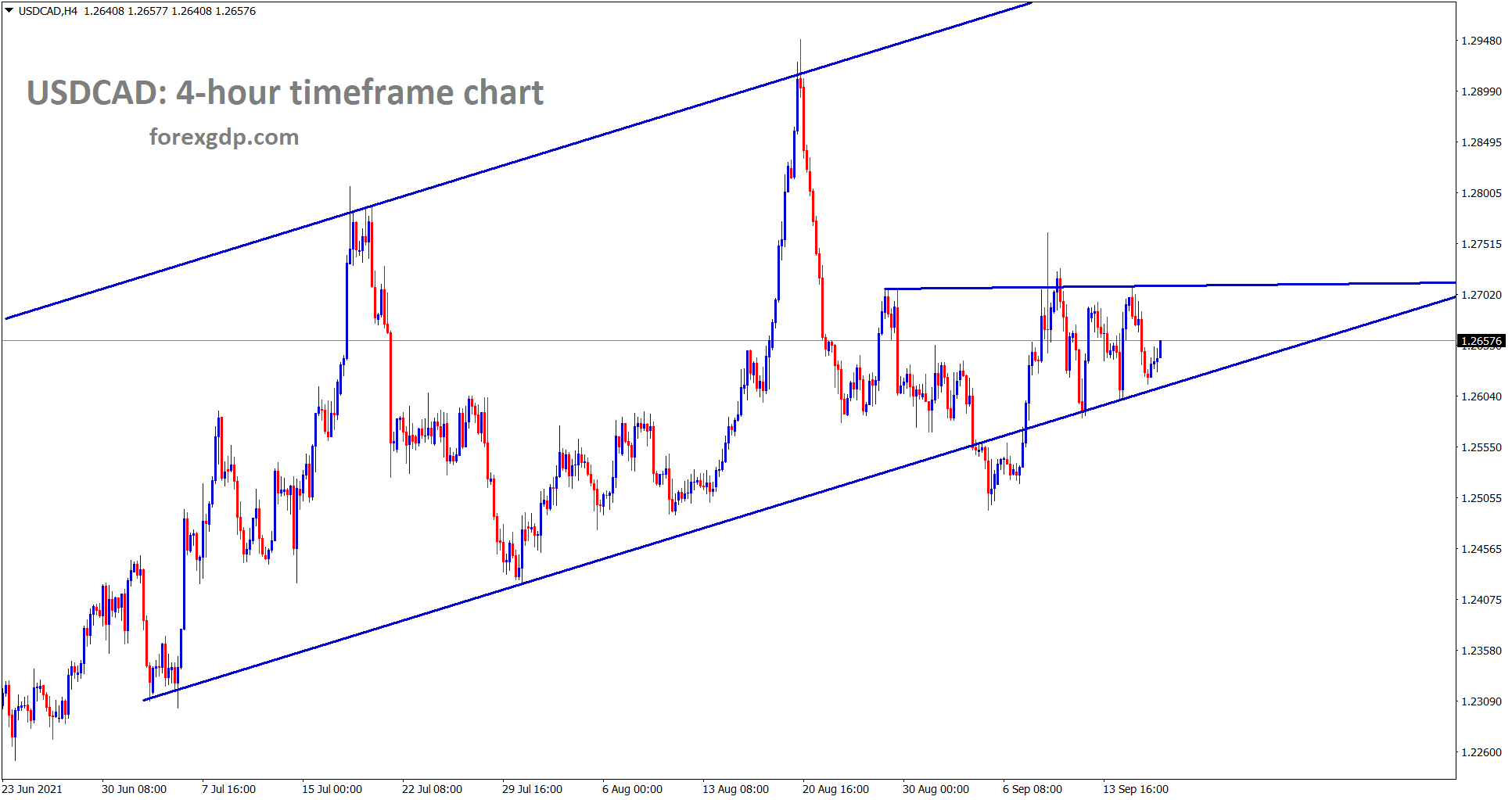

USDCAD is rising from the higher low area of the uptrend line.

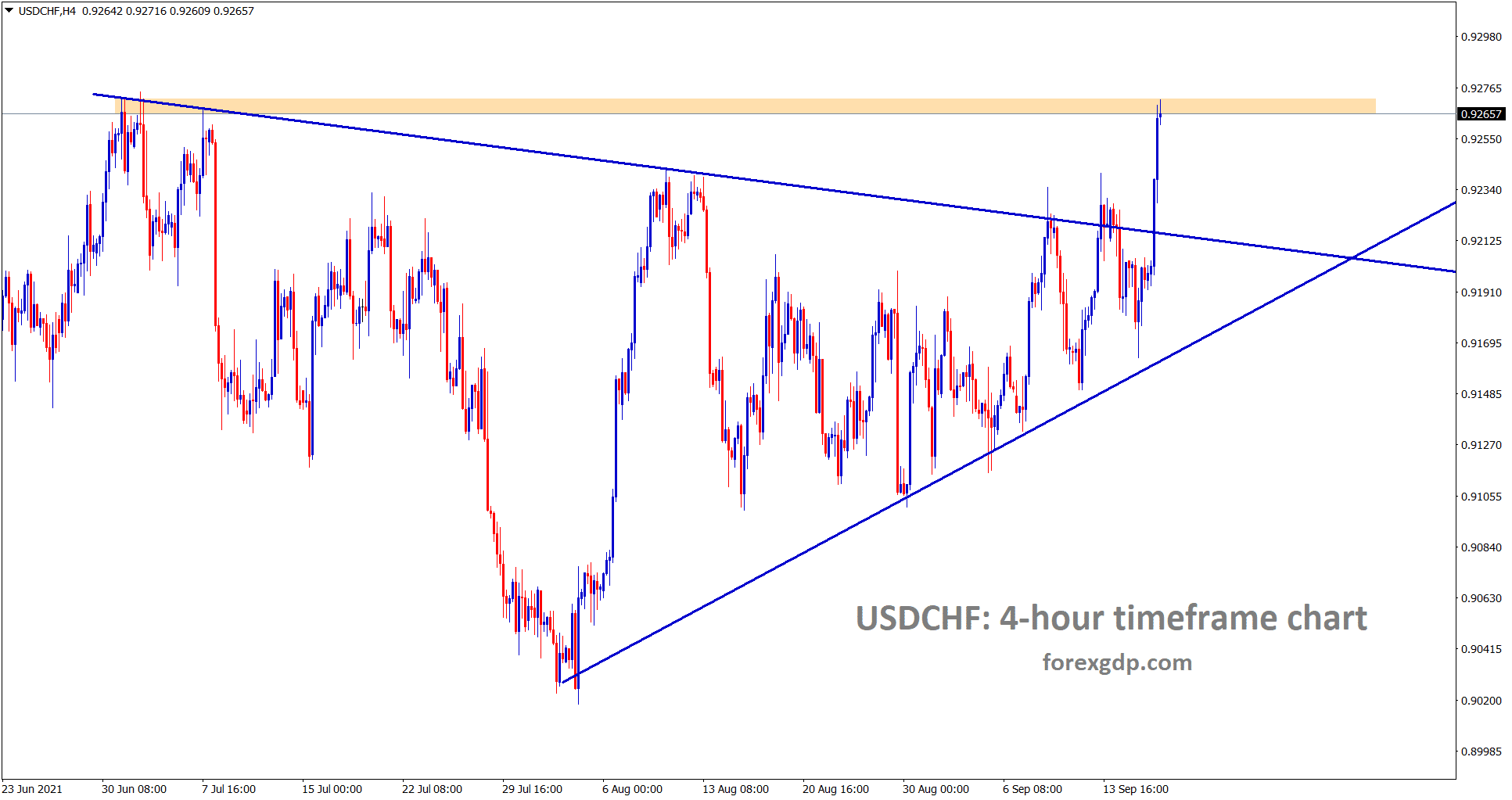

USDCHF has broken the top level of the symmetrical triangle and it hits the horizontal resistance area.

US Dollar showed little higher Yesterday as Industrial production shows lower numbers and import and export data came at lower numbers.

And FED may soon taper assets as expected, and once Done US Dollar will move up.

President Joe Biden plan of $2 Trillion stimuli for infrastructure soon will be passed by Senate as expected.

New Zealand Dollar made stronger as Q2 GDP data came at a higher point and the only pair made stronger than others.

Euro: ECB President Speech Forecast

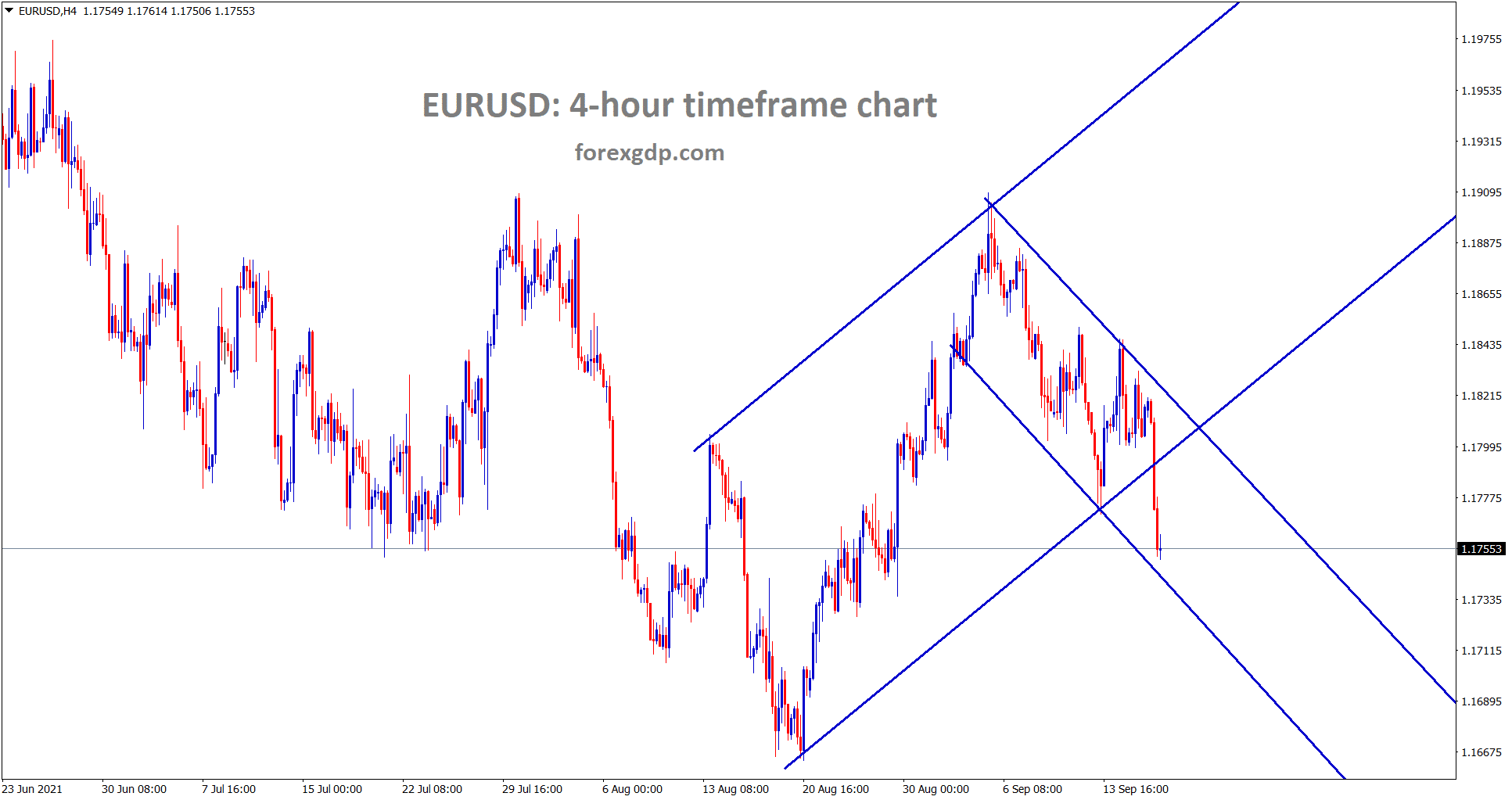

EURUSD is moving between the channel ranges.

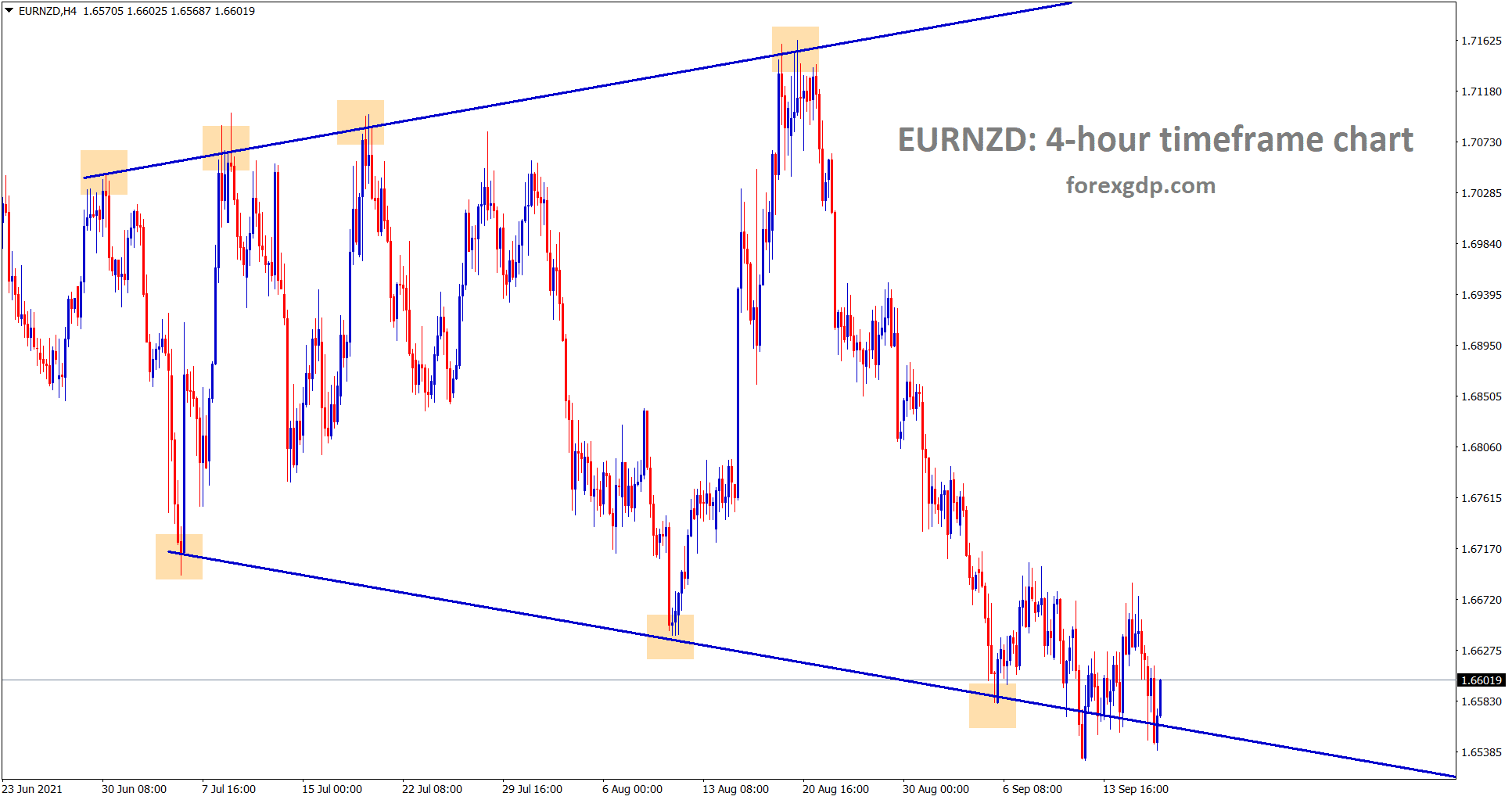

EURNZD is still struggling to rise or break from the low level of the expanding triangle.

Trade Balance Figures in Broader for Eurozone as ahead of ECB President Lagarde speech.

Trade Balance Figures in Broader for Eurozone as ahead of ECB President Lagarde speech.

And Upcoming Philadelphia index numbers in US Data lookout to watch for further move in EURUSD.

But Eurozone shows higher industrial productions than other developed countries.

Eurozone comes back from a pandemic, but ECB President will do tapering at a slower pace if situations come to Favour for the economy.

And EURUSD traded lower to 1.17800 as the weaker tone for the Eurozone as No rate hikes hopes and no tapering hopes.

UK POUND: Domestic data supportive for UK Pound

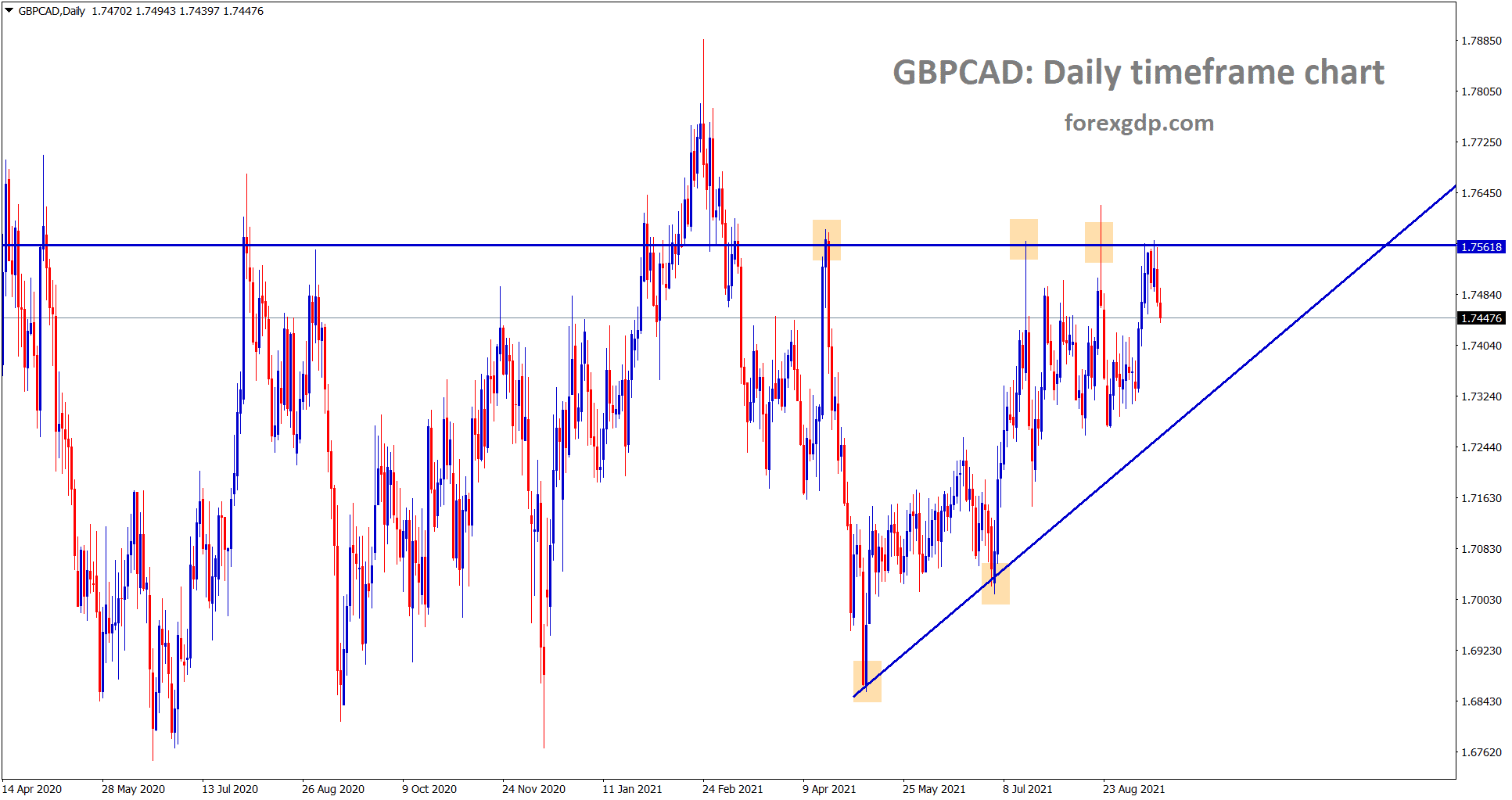

GBPCAD is making a correction from the resistance area.

This week UK employment change came in higher numbers, and also Domestic data shows the recovery of the economy.

And Bank of England may hike rates or taper by year-end if the same range of Job data continues and Delta variant slower in the UK.

EU and UK will do renegotiations on Northern Ireland Protocol are expected by next week.

UK faces Delta variant and Political pressure on the nation for tax hikes by UK PM.

Canadian Dollar: Canadian CPI data

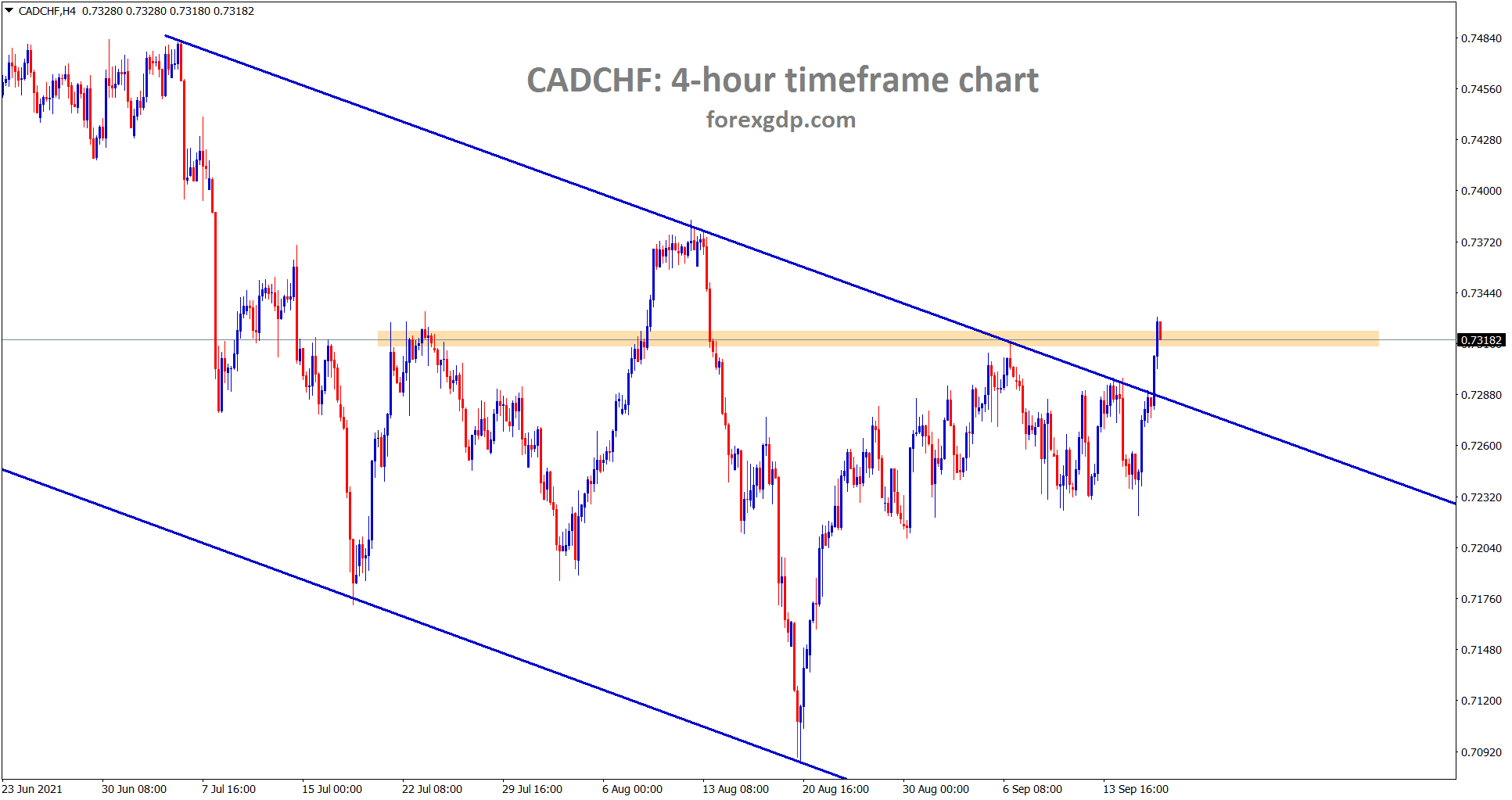

CADCHF is trying to break the lower high area of the downtrend line and reached the horizontal resistance.

Canadian CPI shows Eighteen years high at 4.1% in August and soon expected to taper by the Bank of Canada in the next meeting.

Base effects are easing in the coming months, and inflation rates are seen higher in upcoming quarters.

And Bank of Canada keeps normalizing policy by slowing QE purchases in the next October 27 meeting.

But we continue to expect a rise in the Canadian dollar price if Tapering is done next month.

Japanese Yen: Bank of Japan Governor Speech

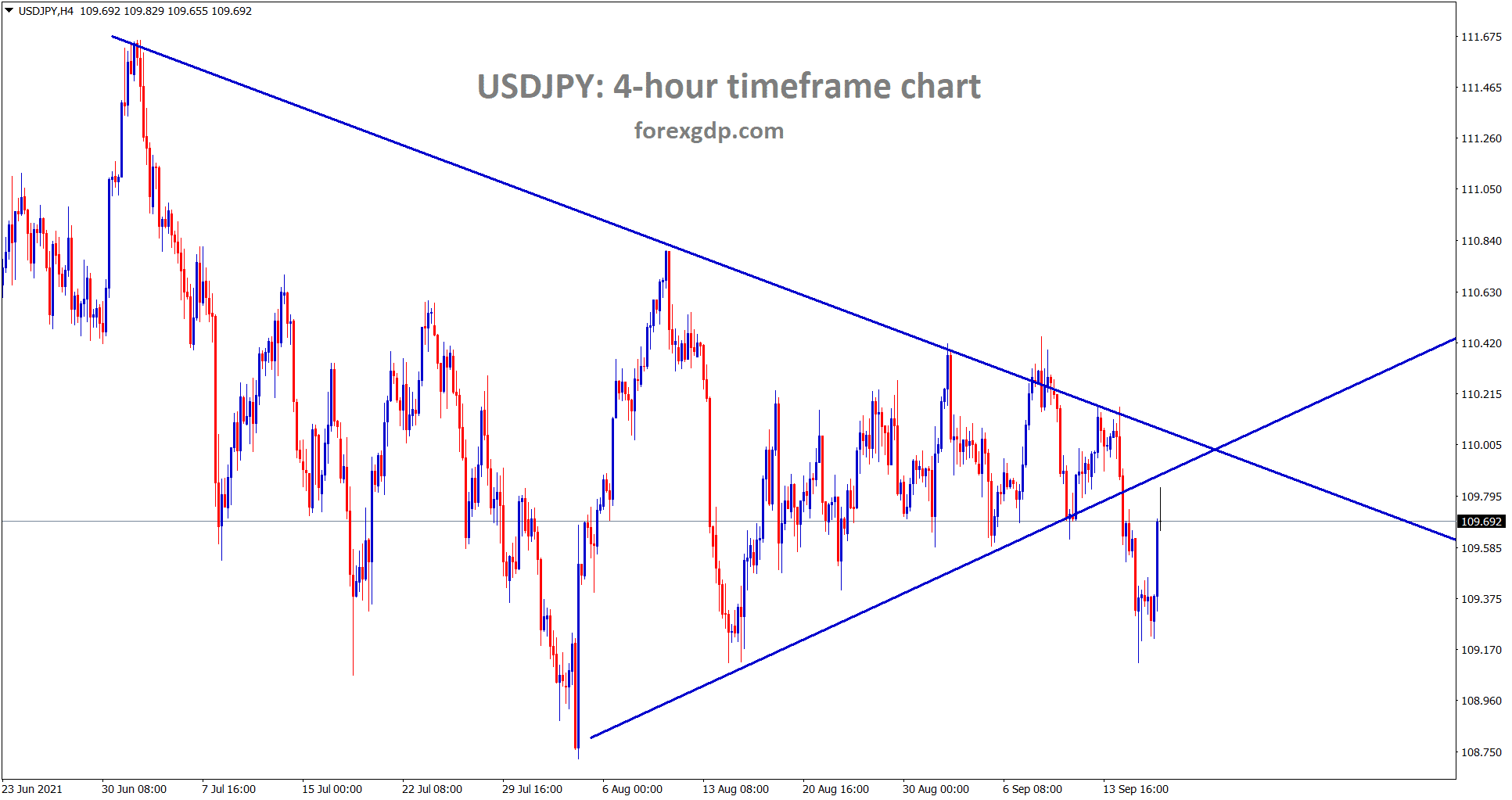

USDJPY is retesting the broken level of the symmetrical triangle pattern.

Japanese Yen pulled stronger as Japanese Trade balance data came at -635.4 Billion Yen as Worse than expected.

And Bank of Japan Governor Kuroda commented that current inflation would increase, and then only we compensate the starved economy to a stable level.

We are not expecting Deflation in Japan, As a Partial increase in Inflation is a must for economic growth.

And New Zealand Q2 GDP numbers came at 2.8%q/q against 1.1% and the previous print of 1.6%.

Australian job numbers show a loss of 146300 as 68000 for Full time and 78200 for part-time.

Japan Government lower Forecast it’s Economy

Japanese Government cuts its economic view for the first time in Four months as Monthly assessment approved by Cabinet.

A surge in covid-19 cases makes lower global supply chains and dimmed consumer confidence, as the Japanese government said in September month.

And Production view was also downgraded by Government Authorities the first time in 17 months, and Private consumption was downgraded for the first time in four months.

All major parts of the economy show dimmed the outlook for Japanese Recovery.

Due to this Scenario, Q2 and Q3 of Japan will be lower as All Domestic data shows weaker than expected.

And Japanese Government itself forecasted weaker economic progress in Q2 as the Delta virus revival.

Australian Dollar: Australian Job data

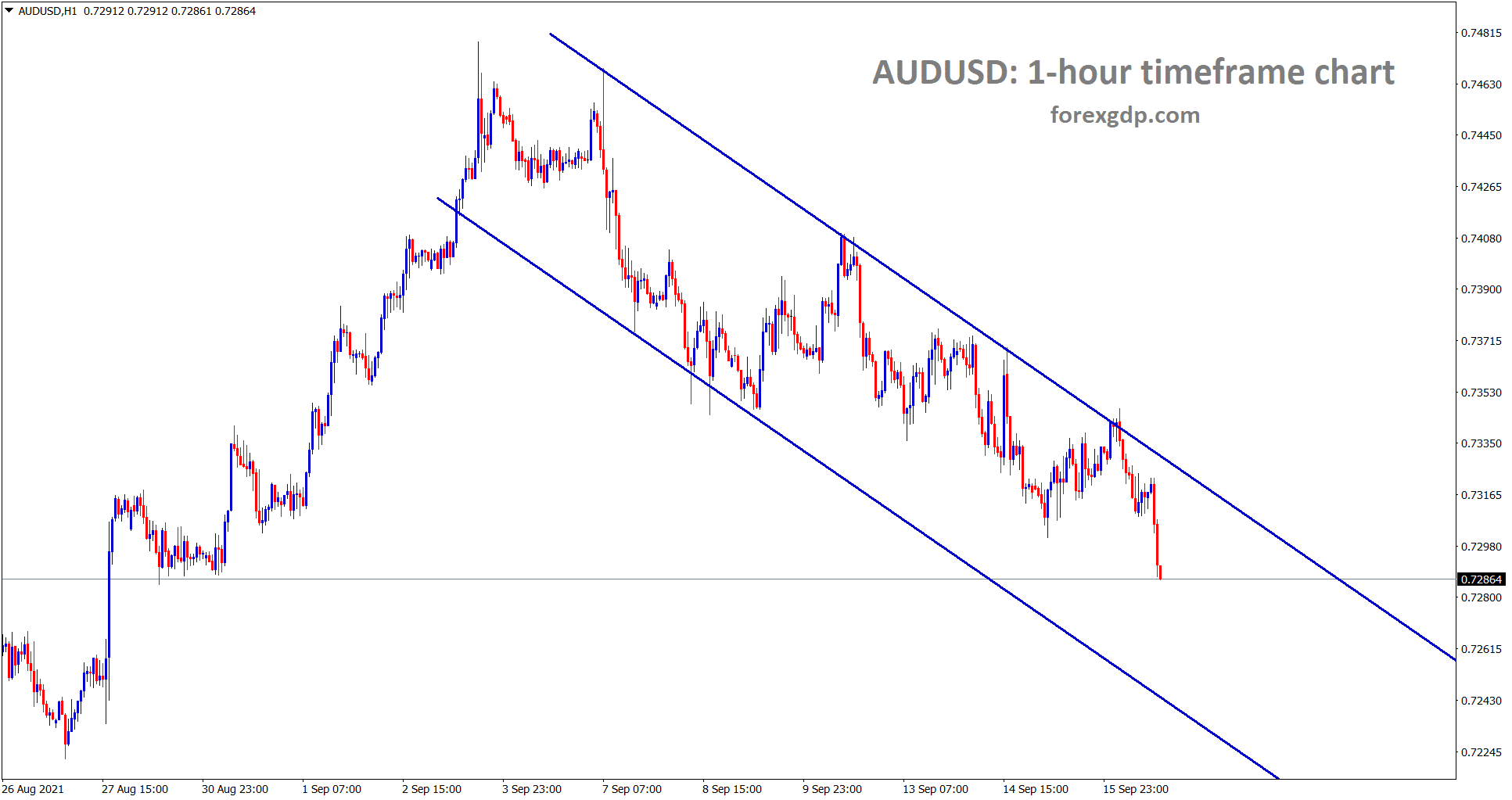

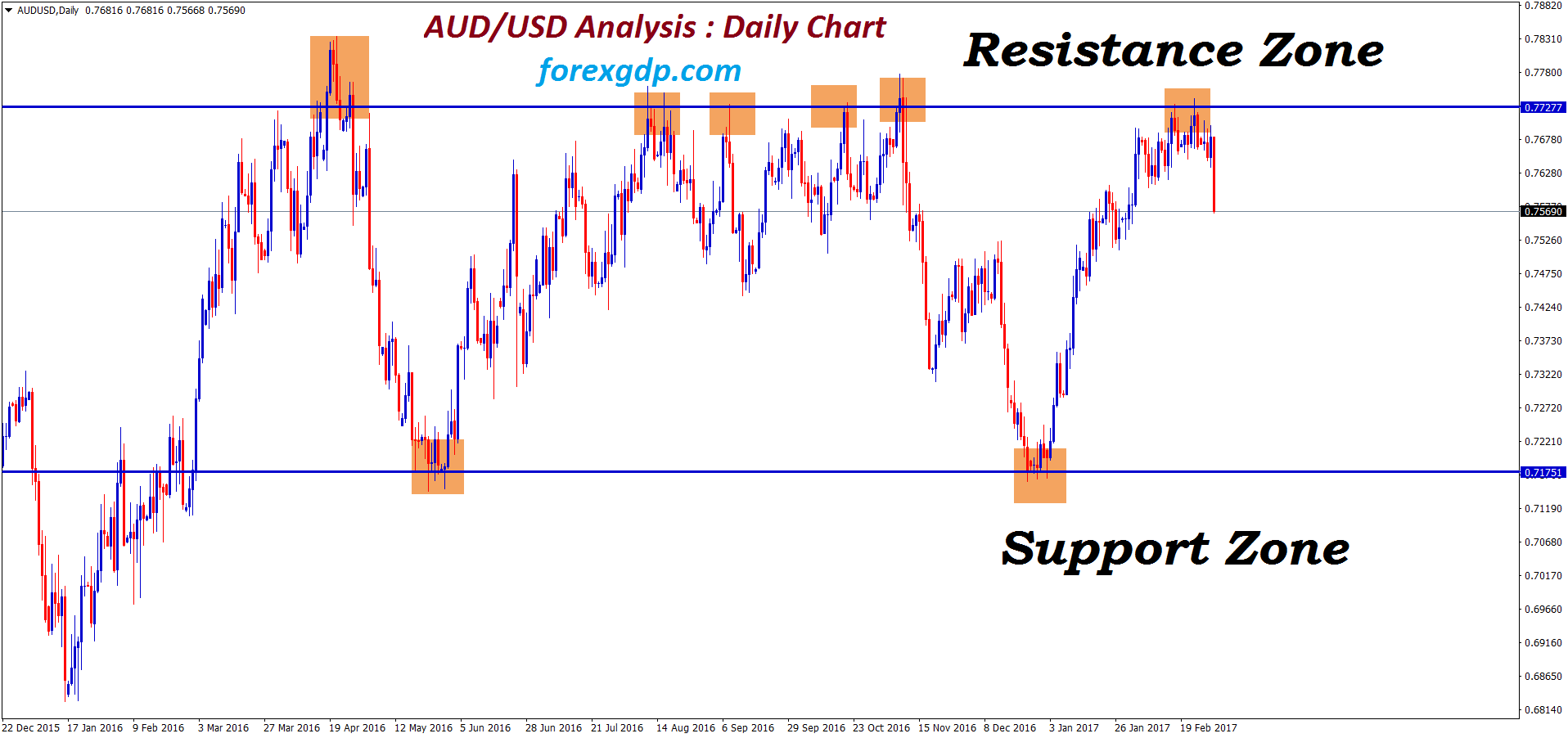

AUDUSD is moving in a descending channel.

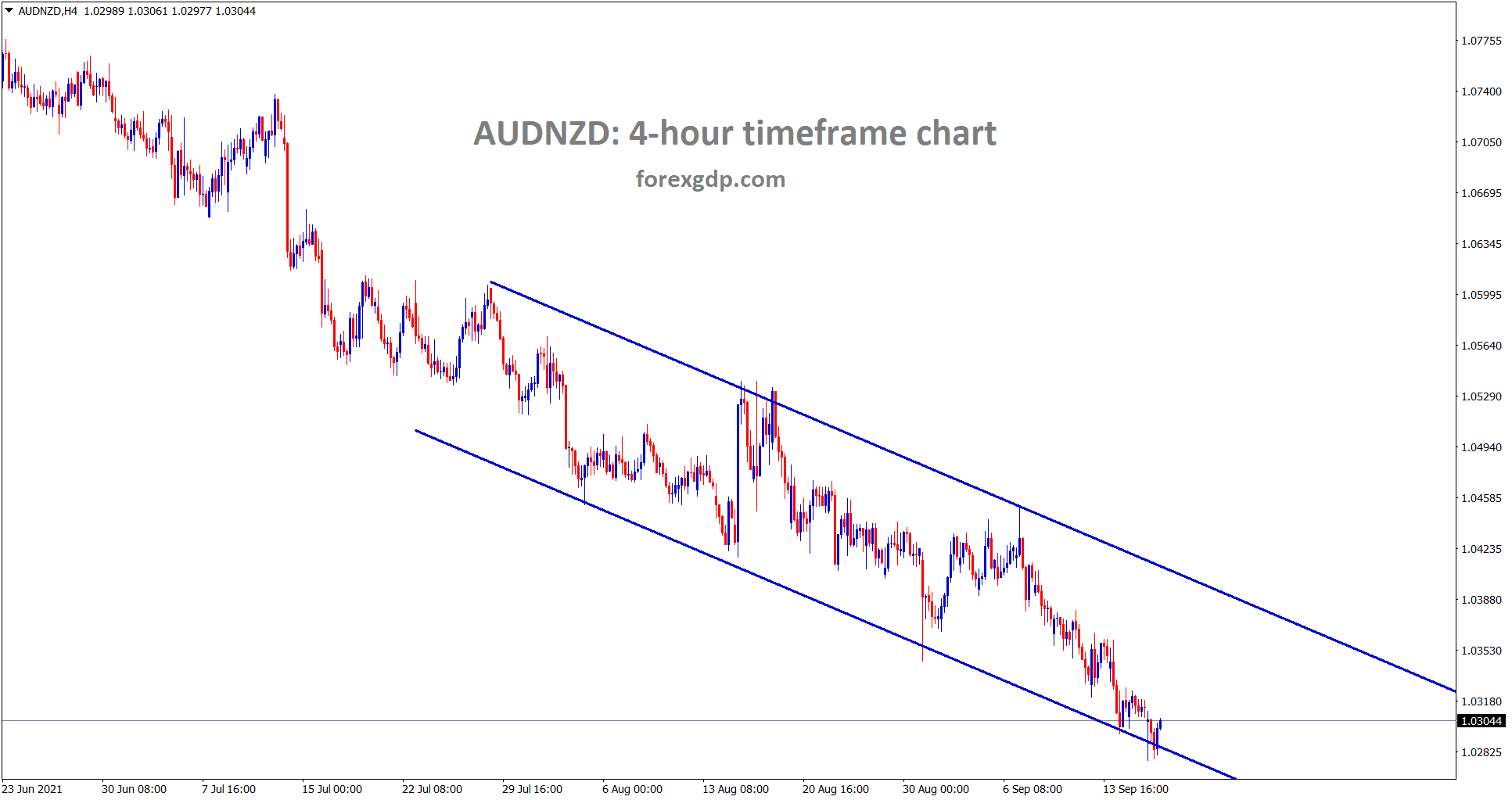

AUDNZD is moving in a descending channel range.

Australian Job Report shows 146.3K losses versus 80K loss expected. The unemployment rate fell to 4.5% versus 5.0% expected.

More Job losses are due to Covid-19 lockdown in areas like Victoria and New South Wales.

But Australian Governor Phillip Lowe said a 2% contraction would be expected in the Third quarter and expanded in the fourth quarter.

Vaccination will be covered for 80% of above 16 aged people, and proper lockdown restrictions are removed from a nation in December.

And From the Fourth quarter Australian economy shows a good recovery path as expected by RBA Governor Lowe.

New Zealand Dollar: Q2 GDP Data

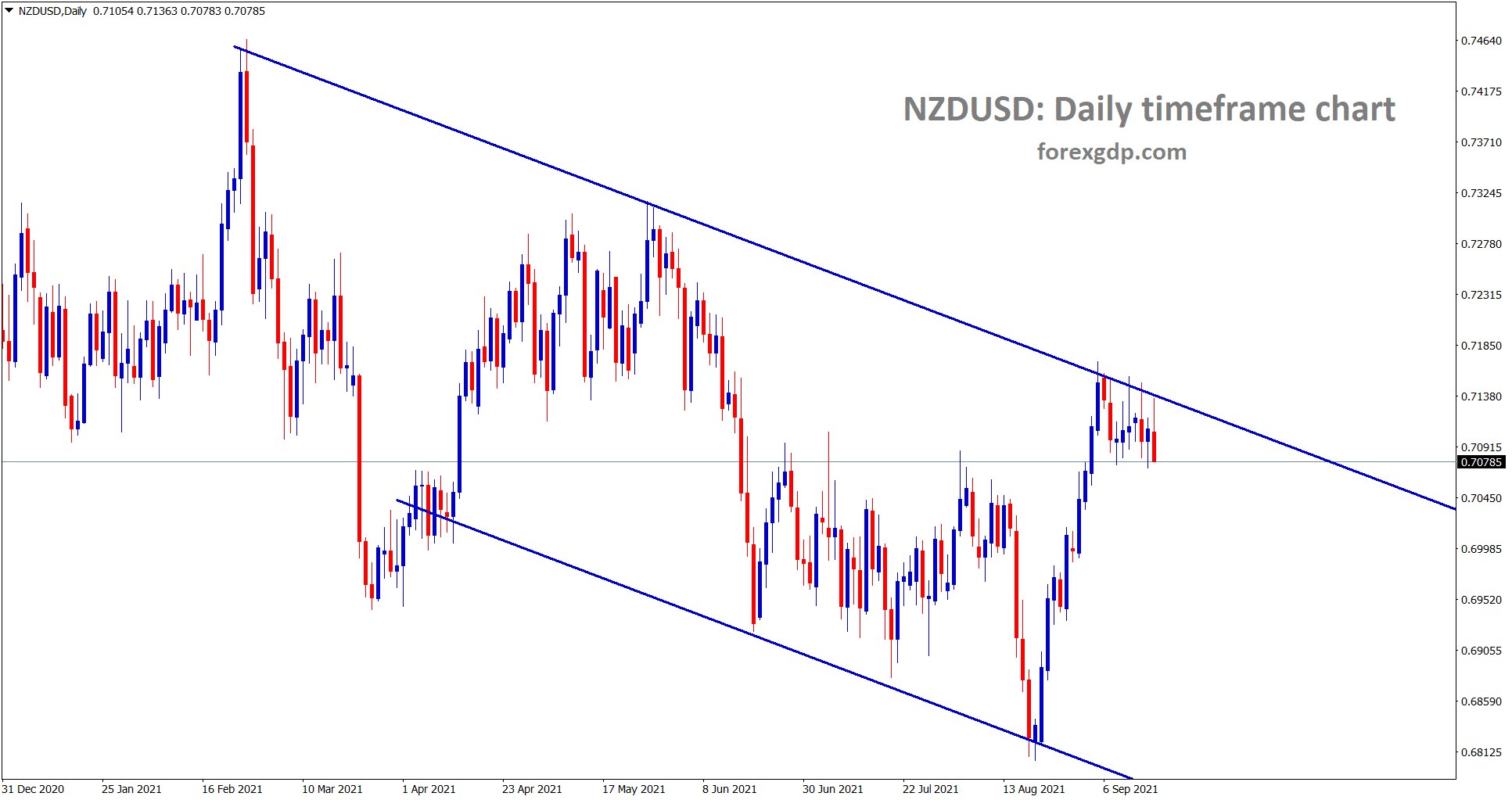

NZDUSD is falling from the lower high area of the downtrend line.

New Zealand Q2 GDP printed at 17.4% versus 16.4% expected and Previous at 2.8% QoQ.

Auckland remains in lockdown as tighter level 4 to avoid Spread.

And Weaker retail sales and Industrial productions from China made New Zealand Dollar move lower.

But RBNZ made rate hikes in next month is expected if all lockdowns are released.

Swiss Franc: Global cues benefitted Swiss Franc

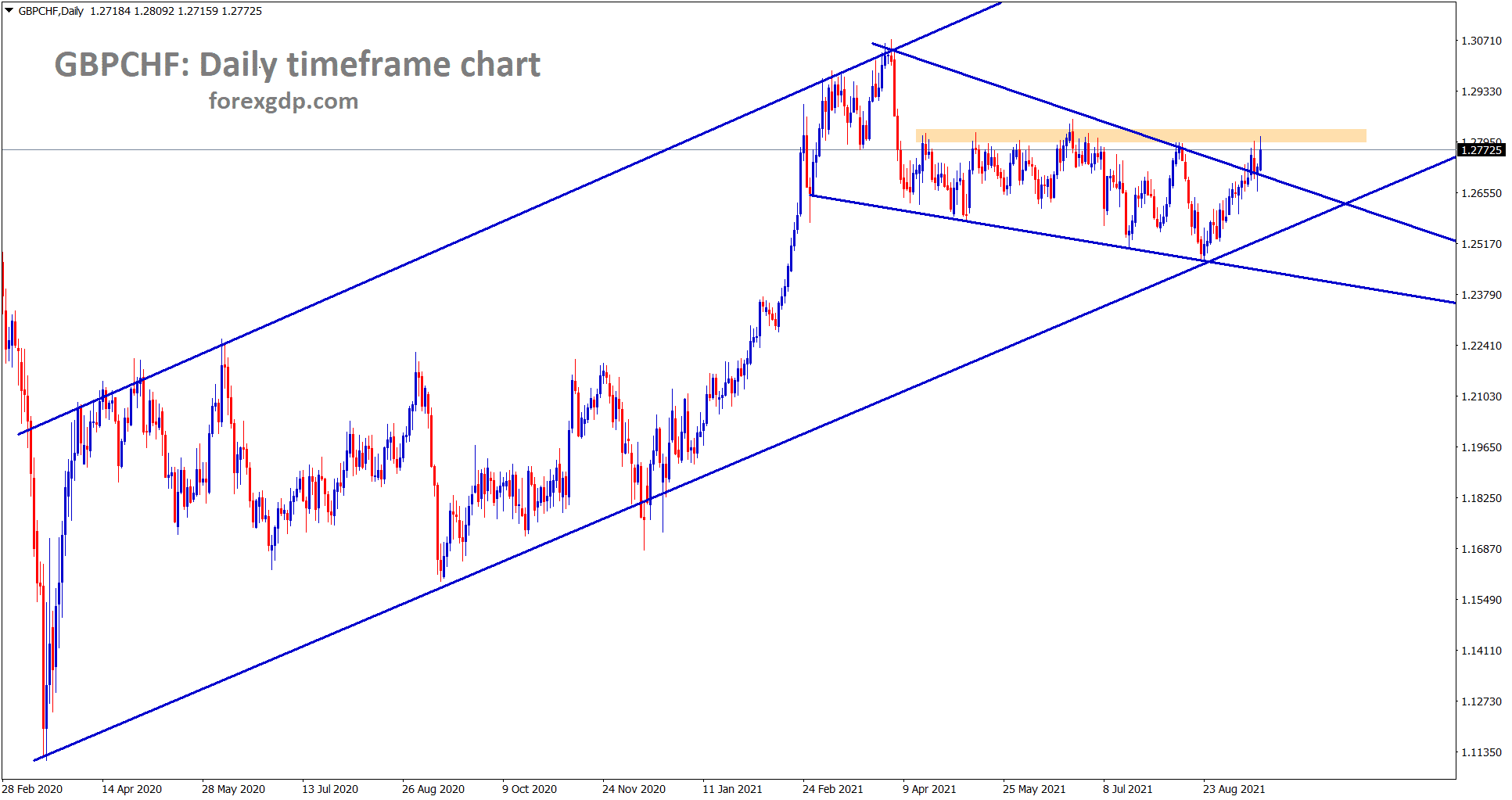

GBPCHF again hits the horizontal resistance after retesting the broken falling wedge.

Swiss Franc is benefitted from the Delta variant spread across the global level more.

And Vaccinations are slower in the Swiss Zone, and employment data is not up to the mark.

US Dollar shows continuous stronger momentum as Domestic data performed well.

USDCHF rising higher to near resistance of 0.92300 level; if it breaks, it will move up to the next resistance level of 0.92700.

And FED will do tapering if strong Employment data and Lower inflation numbers come.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/

Thanks a lot for send me chart