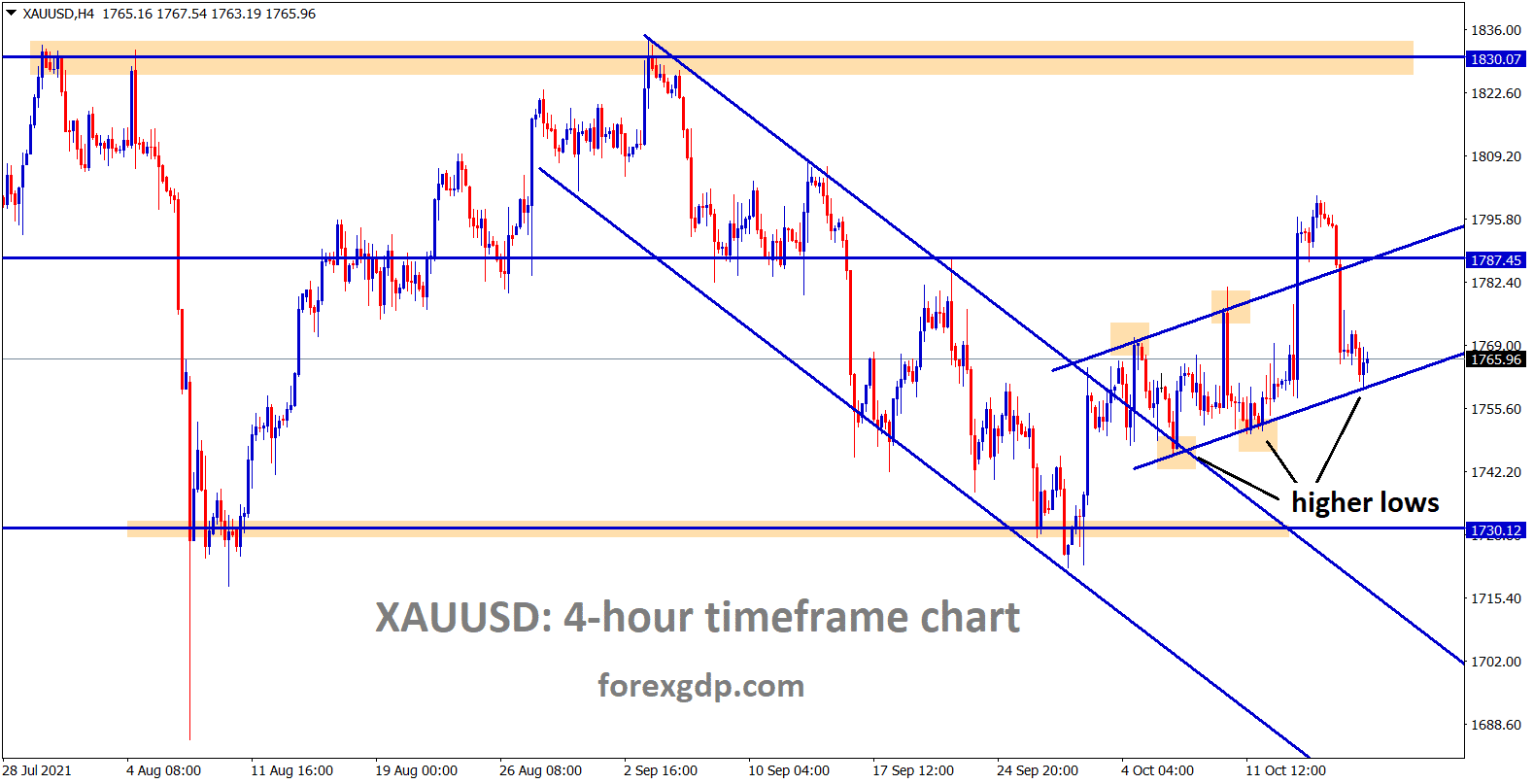

Gold: SPDR Gold trust shows decreased Holdings from last week

Gold XAUUSD is standing now at the higher low level of the small ascending channel range.

Gold prices fell from 1800-1765$ after US Retail sales data printed at 0.70% versus 0.20% expected.

And Michigan consumer sentiment came at 71.4 versus 73.1 Forecast and 72.8 previous reading.

A mixed bag of US Data makes Gold tumbled to lower.

And SPDR Gold trust outstanding gold tons decreased to 980 tons from 982 tons last week.

Gold is a hedging currency for currency inflation or no values or values depreciations.

Now overall Global economy makes little bit hope for currency purchasing than gold purchasing.

Chinese GDP came at lower after Fuel deficiency and Power Generation problems in China.

US Dollar: a mixed bag of US Domestic data

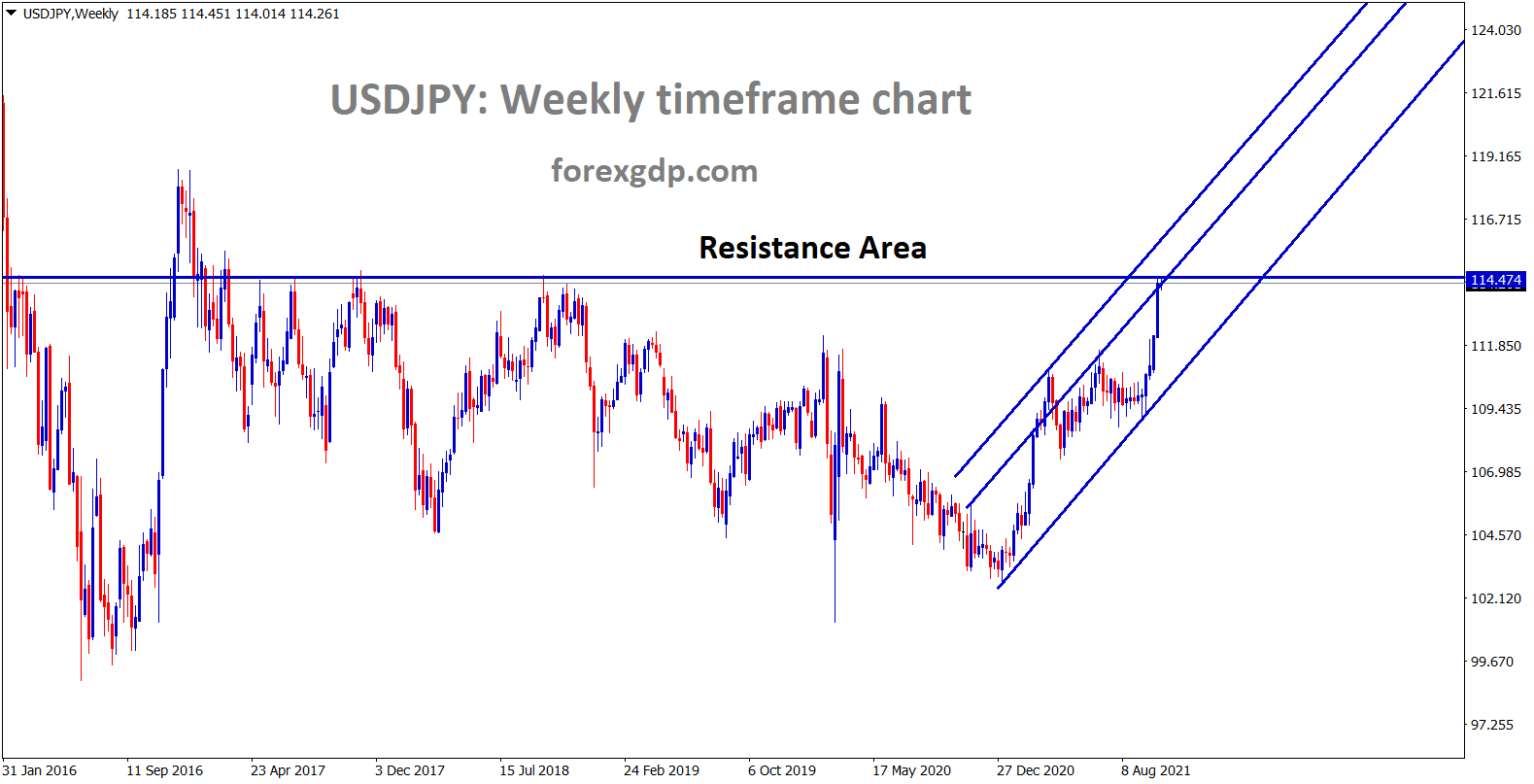

USDJPY is moving in a strong uptrend – now standing at the horizontal resistance.

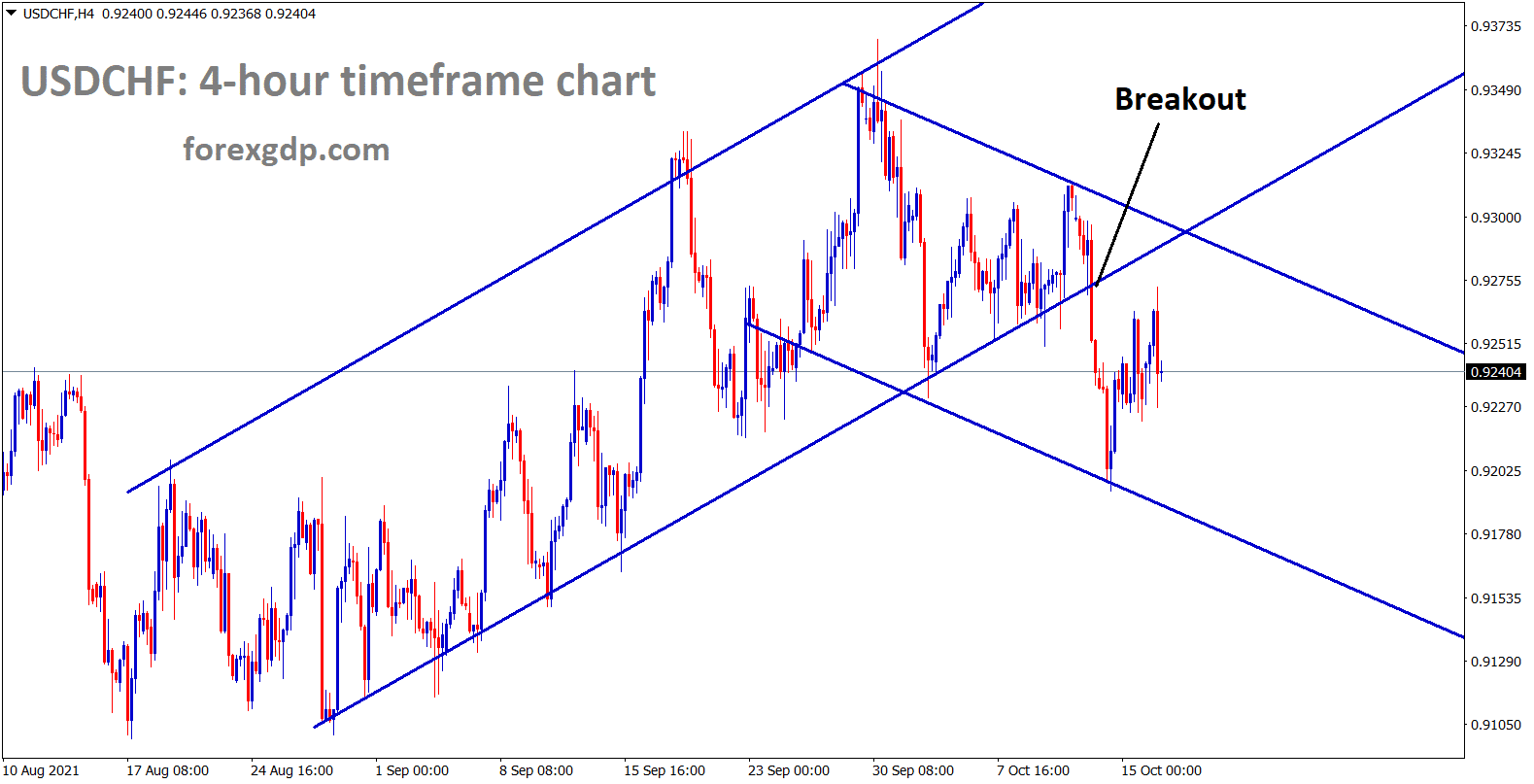

USDCHF is consolidating and trying to retest the previous broken uptrend channel line.

US Dollar keeps rallying after US 10-year bonds rally up to 1.60% in last two weeks.

And also, US Retail sales data came at a 0.70% jumps from 0.20% expected, and Michigan consumer sentiment came at missed expectations makes more rally for US Dollar.

USDJPY soared to 6% from last 3-4 months, and USDCHF keeps 4% from the bottom, USDCAD makes lower 6% from highs in the past one month after CAD determination for a significant bull run.

And FED stated that tapering is on the table and hikes in 2022 is possible on last week FOMC meeting minutes.

Eurozone: ECB may take changes in Monetary policy decisions

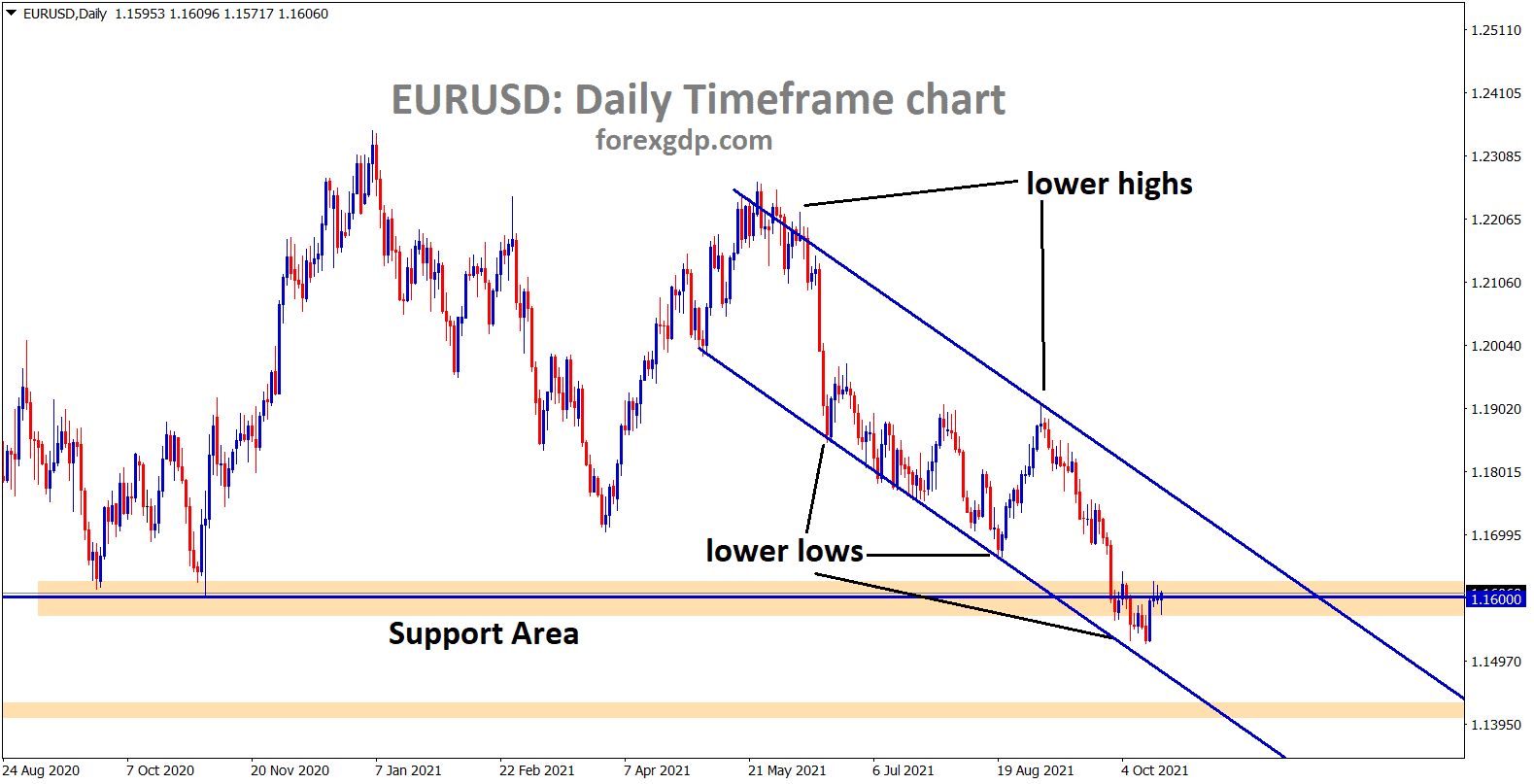

EURUSD is rebounding from the lower low level of the descending channel and the support area.

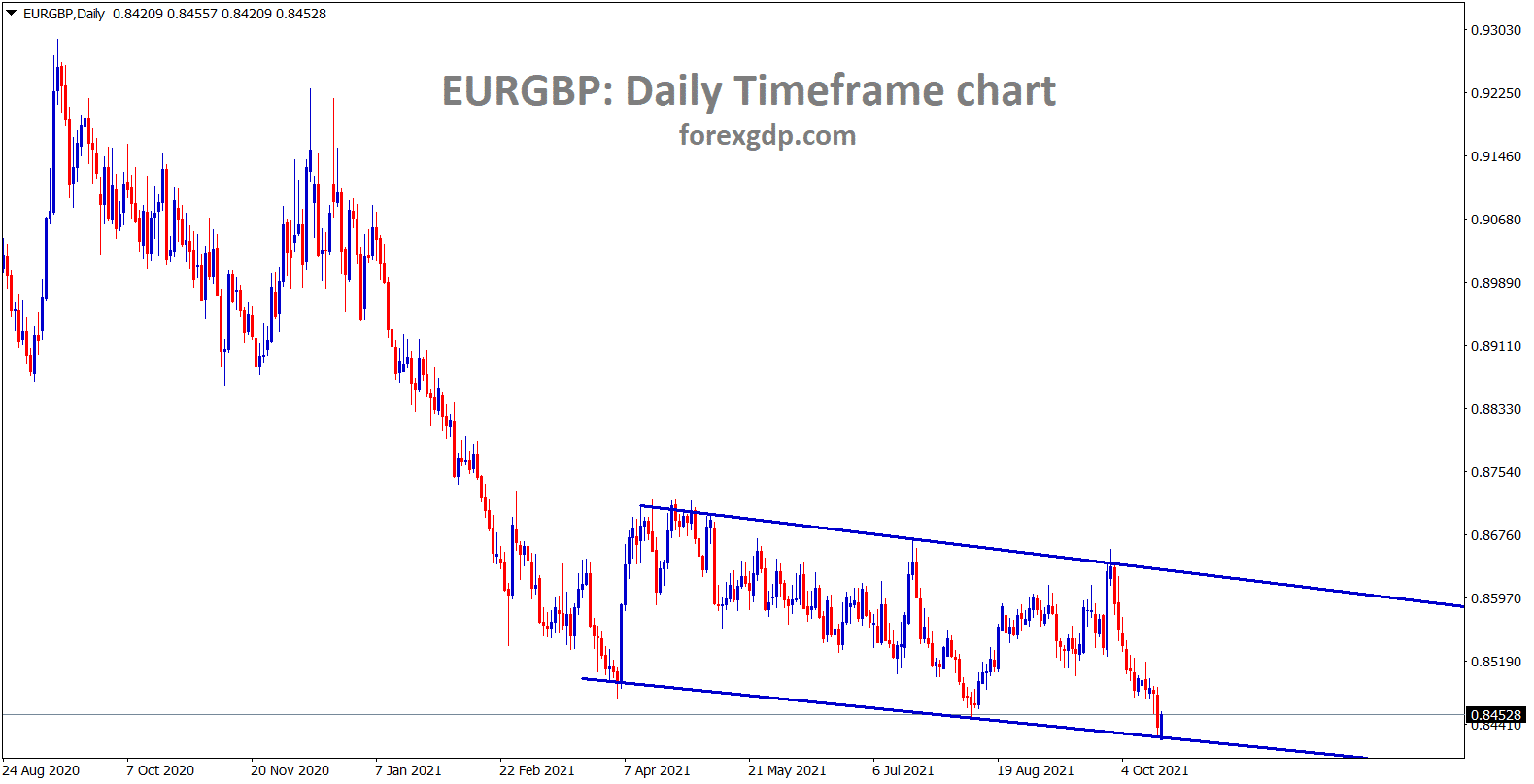

EURGBP is moving between the specific price ranges.

Q3 Quarter ending for Eurozone but no changes in ECB monetary policy settings as of now.

ECB forecasts for inflation are transitory, not permanent, so 2.2% in 2021 will step down to 1.7% in 2022 and 1.5% in 2023.

And Rising consumer prices in Fuel and other commodities makes less consumer spending on the economy.

This makes Government spend more stimulus and reduce the inflation cost too normal.

Only after the inflation cools, People will start Spending back to the pre-pandemic level.

And Employment changes are significantly lower in the Eurozone, this, ECB must reduce the stimulus and rate hikes plan as soon as possible.

UK POUND: Bank of England planning for rate hikes

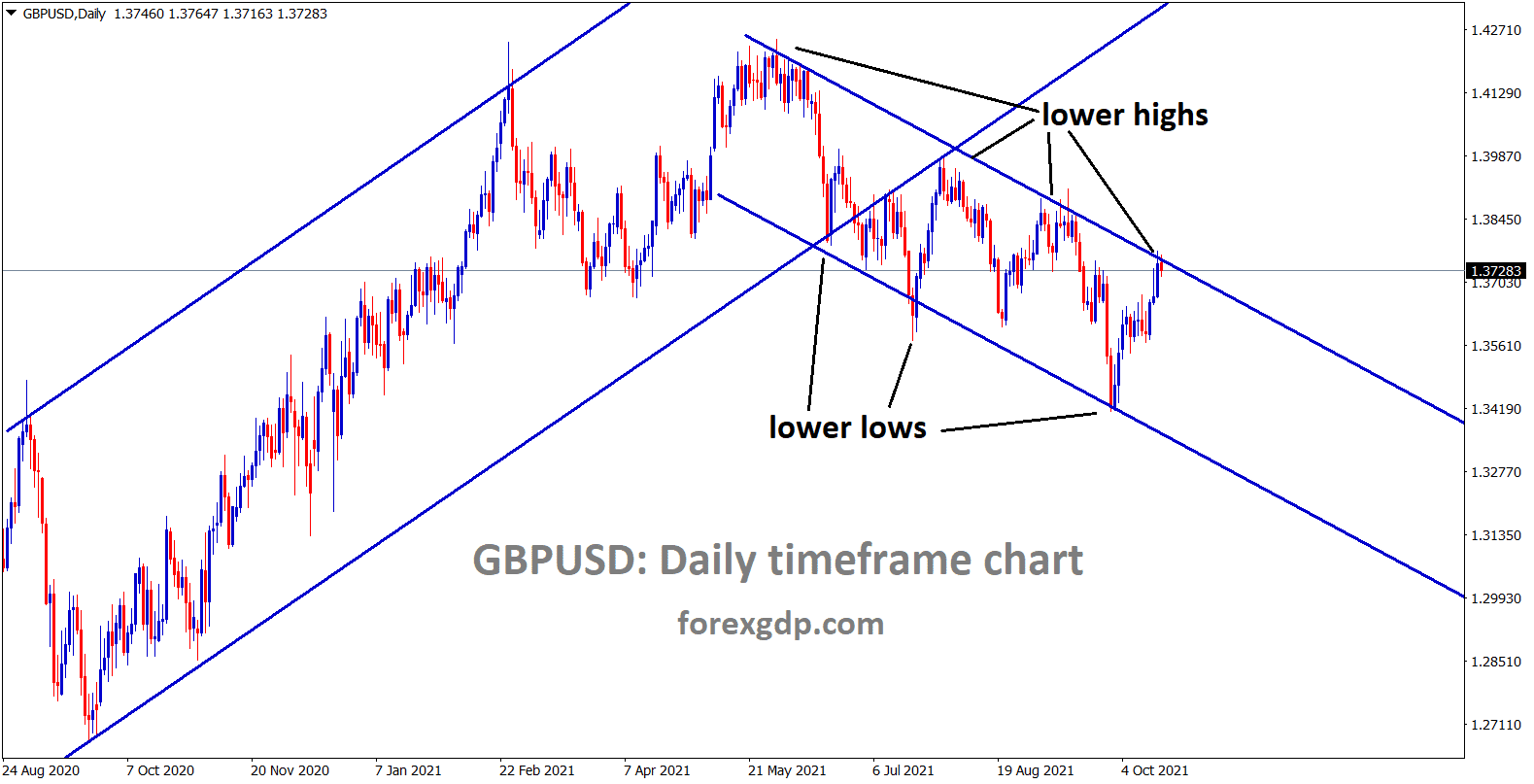

GBPUSD standing at the lower high of the descending channel now – wait for breakout or reversal.

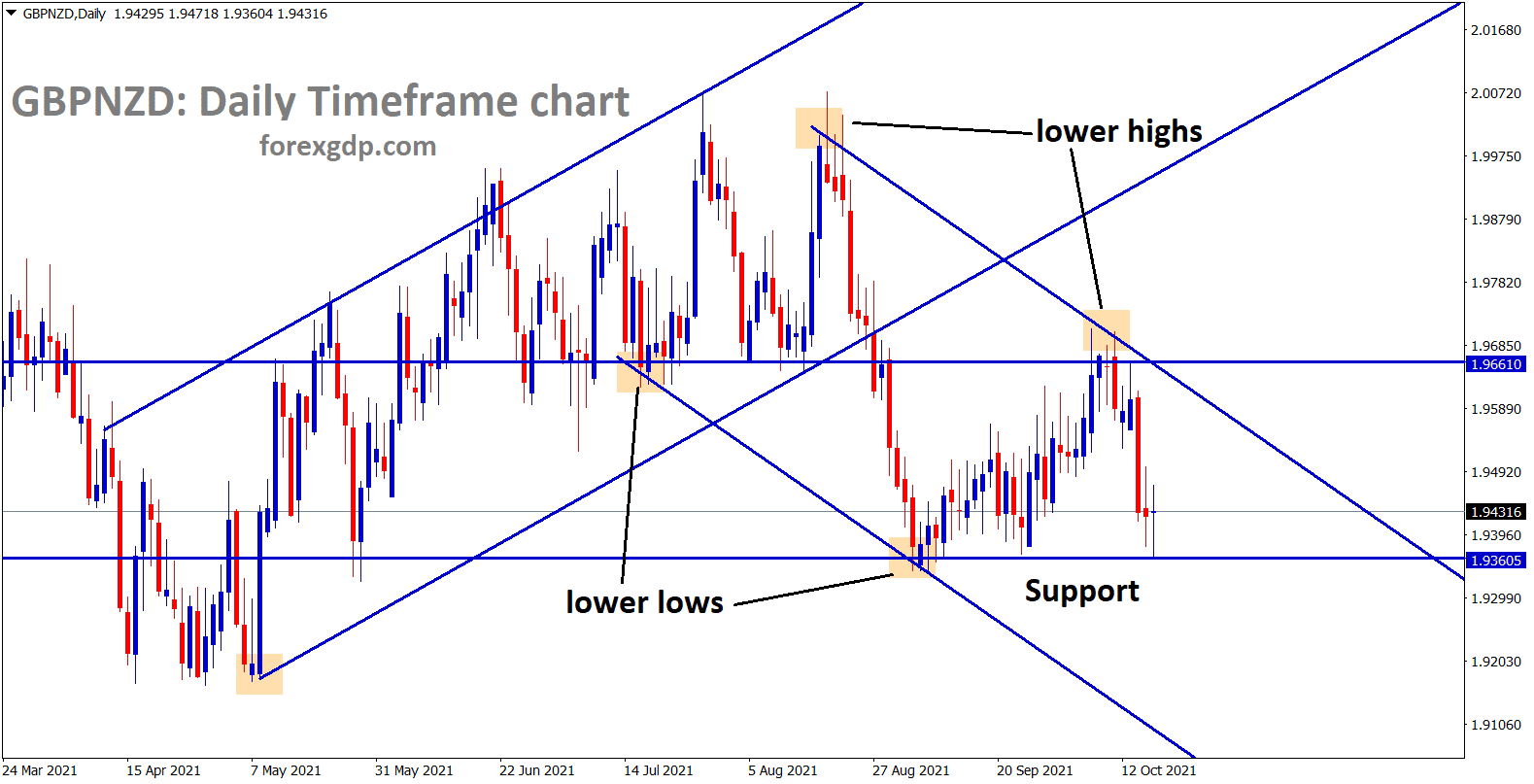

GBPNZD has tested the horizontal support area recently and making some correction – wait for the breakout at the current support to fall in a descending channel.

UK Pound is soaring higher as Bank of England Governor Bailey adds more pressure on Rate hikes.

And Policy measures cannot solve supply chain problems; the only solution to cool the inflation rates is a rate hike.

Bank of England tightening measures makes UK Pound stronger more.

And Employment data makes it comfortable to look for UK Economy, and inflation stood above 2% target.

Coming November meeting 60-40% Call for Rate hike bets on Bank of England monetary policy meeting.

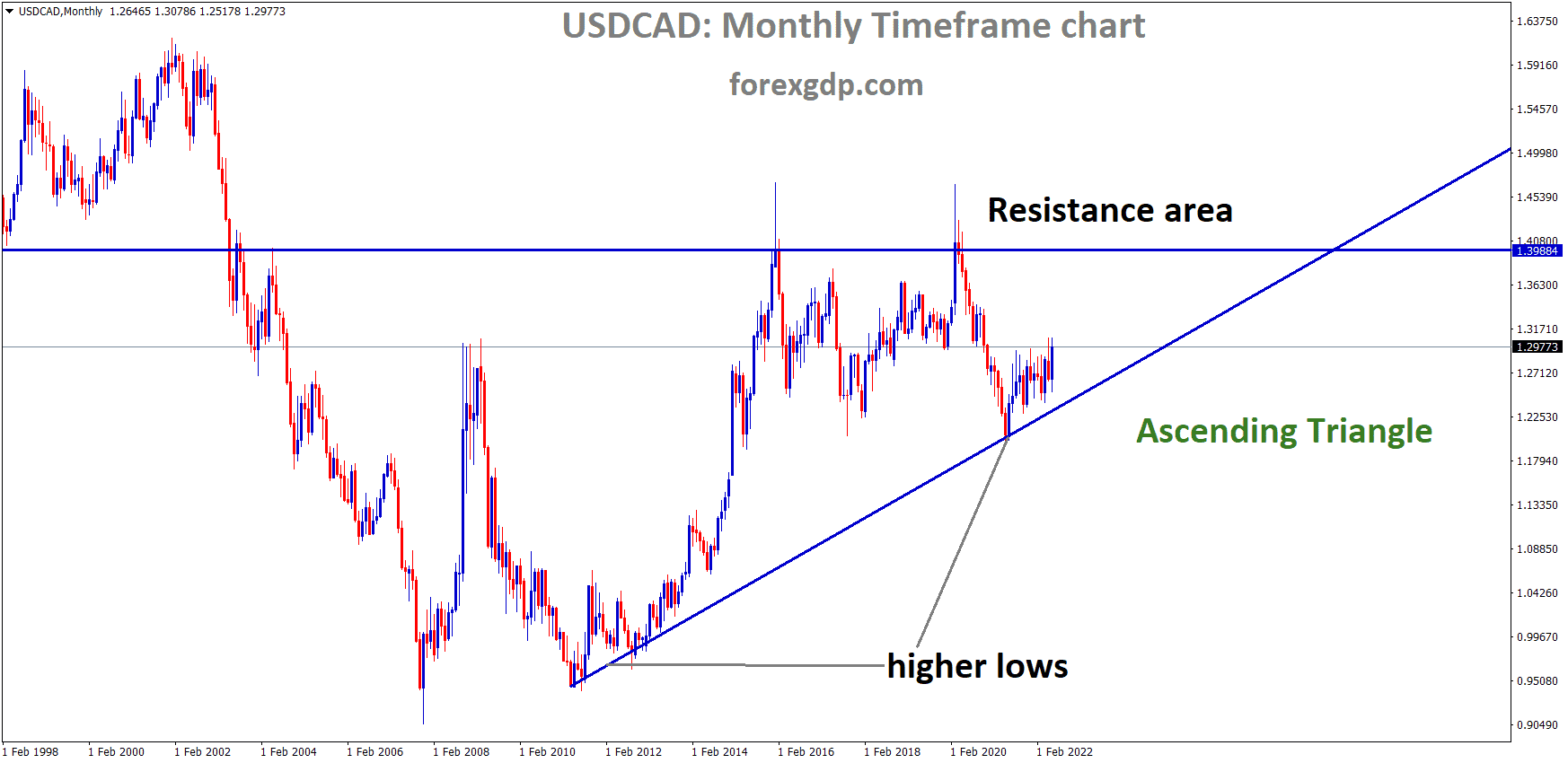

Canadian Dollar: Oil prices soaring supports for CAD

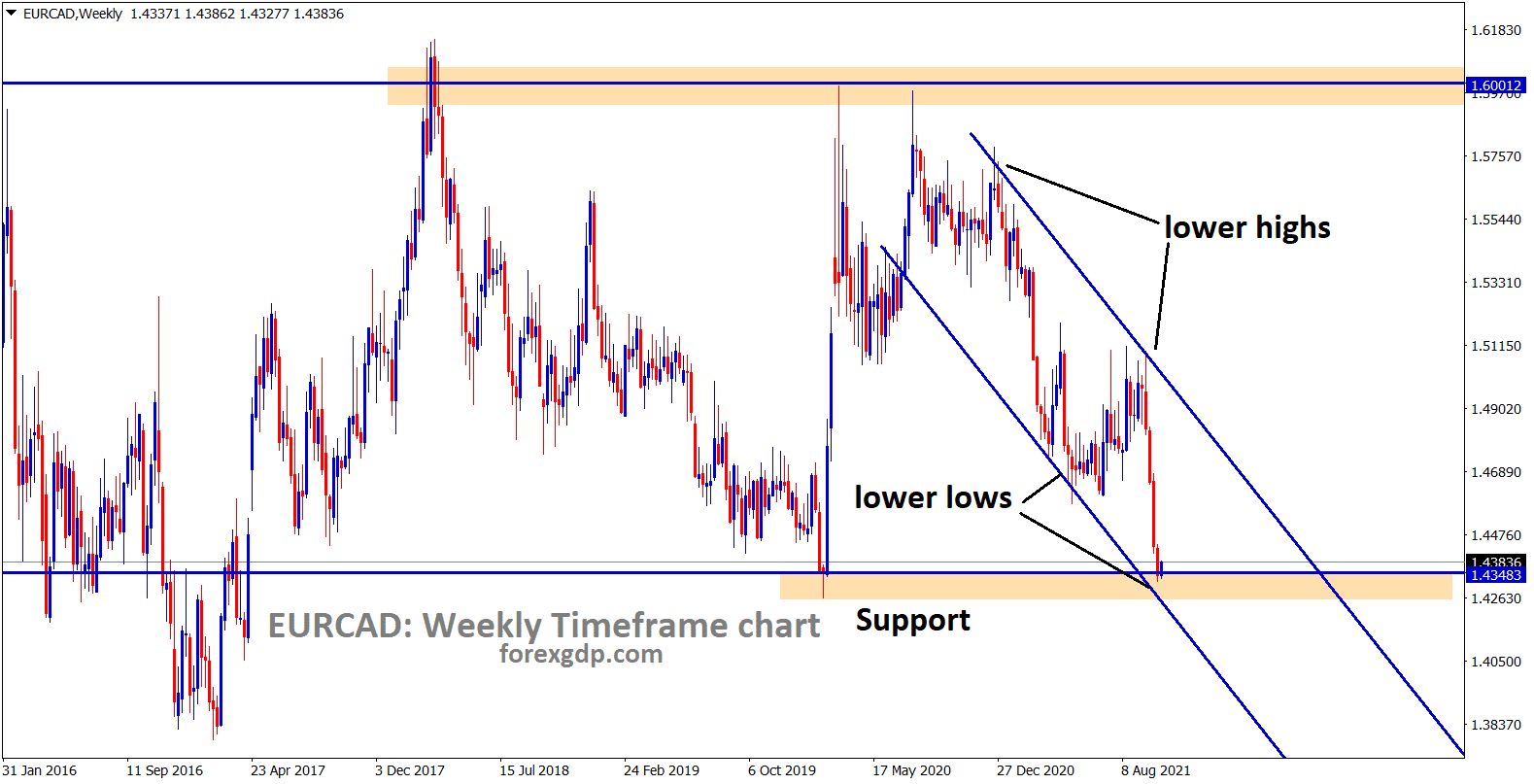

EURCAD is rebounding from the support and the lower low level of the descending channel.

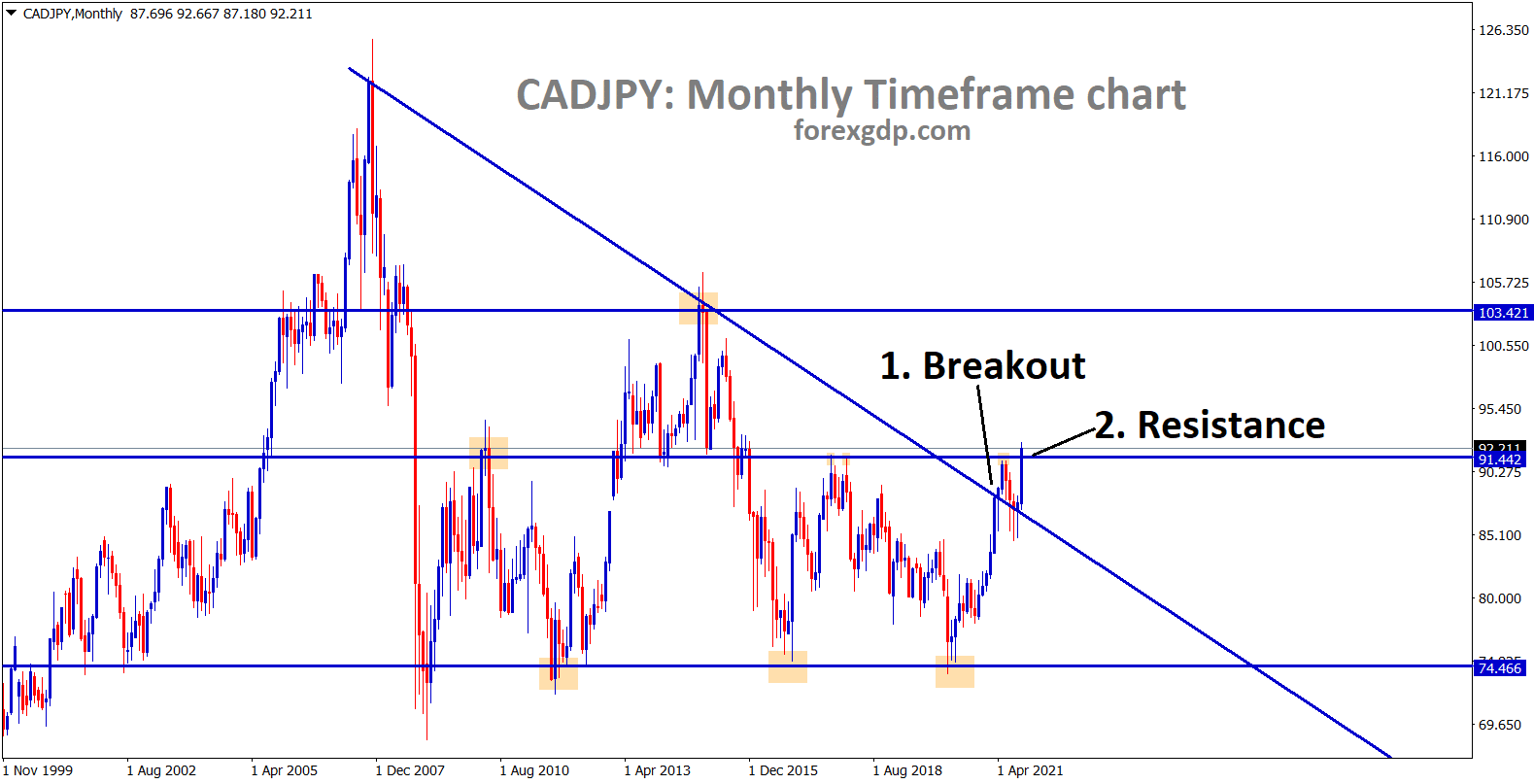

Canadian Dollar kept rallying at least 8% from lows and broke out the previous resistance level of 91.

As Oil prices soaring above 81 is more supportive for the CAD against all other pairs.

USDCAD slumped over 7-8% from a higher level of 1.29 as the Canadian Dollar performed well.

And Canadian Government makes use of the Energy crisis and will implement rate hikes or tapering soon in the next meeting.

Fuels demand makes more revenues on Exports of Canada, then automatically credits to Canadian Dollar revenue.

Japanese Yen: Japanese Trade balance numbers Widens

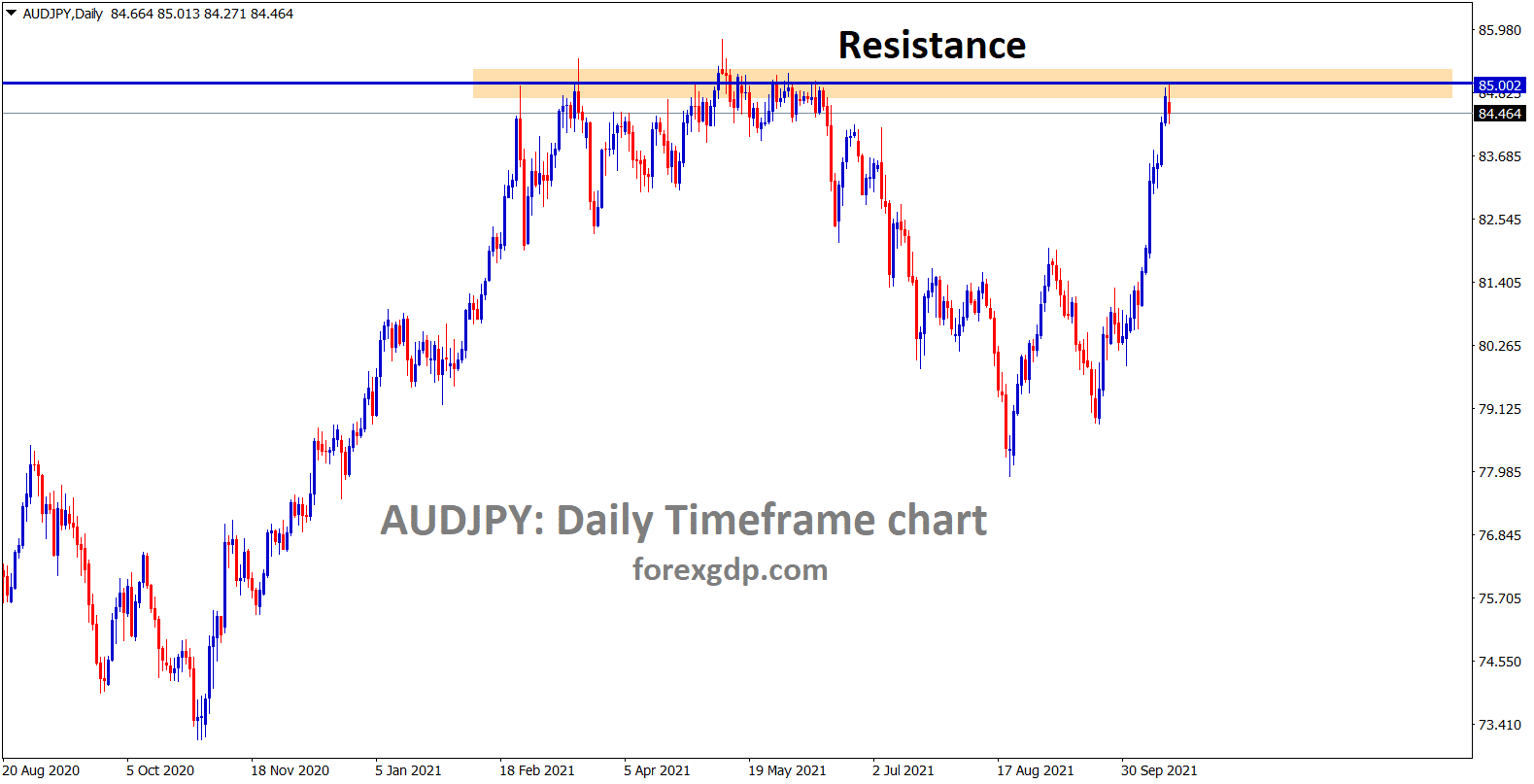

AUDJPY is standing at the resistance area.

CADJPY has broken the top of the descending triangle and trying to break the horizontal resistance now.

Japanese Monthly trade balance widens towards the JPY500B area. So USDJPY makes more rally towards 115 mark this week.

And Japanese PM Kishida shows the economy will be recovered by more stimulus measures injection after the election.

And more Vaccination progress for every people to cover 80-90%.

The energy crisis made the Japanese economy fell more, but financial stability is high and no need to worry about financial situations.

Australian Dollar: Chinese GDP Gloomy data printed

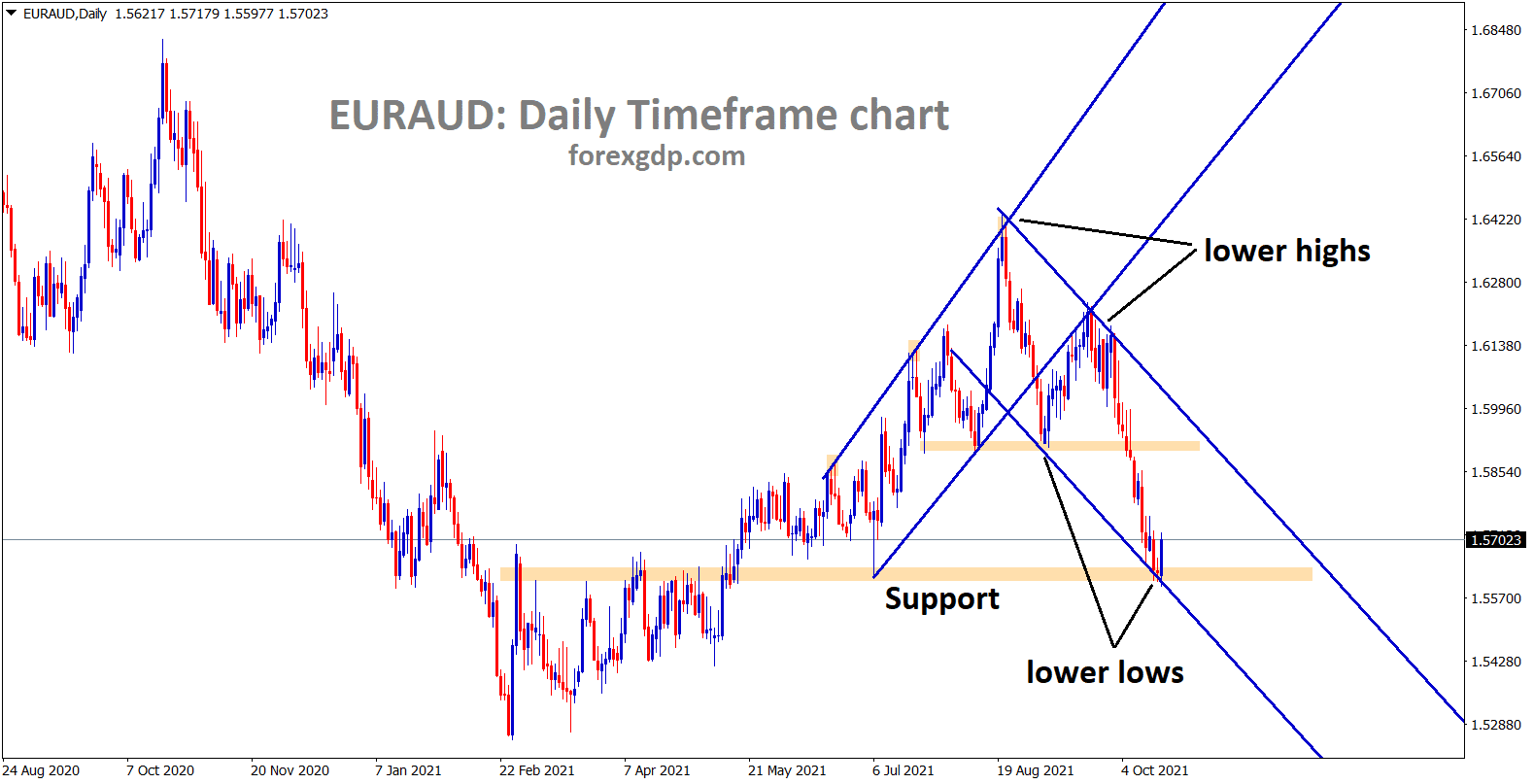

EURAUD is rebounding from the support area and the lower low level of the descending channel.

Chinese GDP came at 4.9% Y/Y against 5.0% expected, and

Industrial production came at 3.1% Y/Y, missed expectations of 3.8%.

Retail sales were released at higher as 4.4% Y/Y versus 3.5% expected.

And Chinese GDP was lower after the impact of energy prices and the Real estate sector collapse.

The PBOC Governor Yi Gang said more loosen monetary policy will be implemented based on a request for easing real estate sector problems by major real estate companies.

Now Typhoon hits major in China, and coal mining is closed as Heavy Typhoon occurred.

And the Winter season consume more energy like Natural Gas, Coal and Petrol for heating purposes.

Australia is the major exporter to China, and the slowdown in the Chinese economy makes Australian Export revenue slow down.

New Zealand Dollar: NZ CPI came at higher than expected

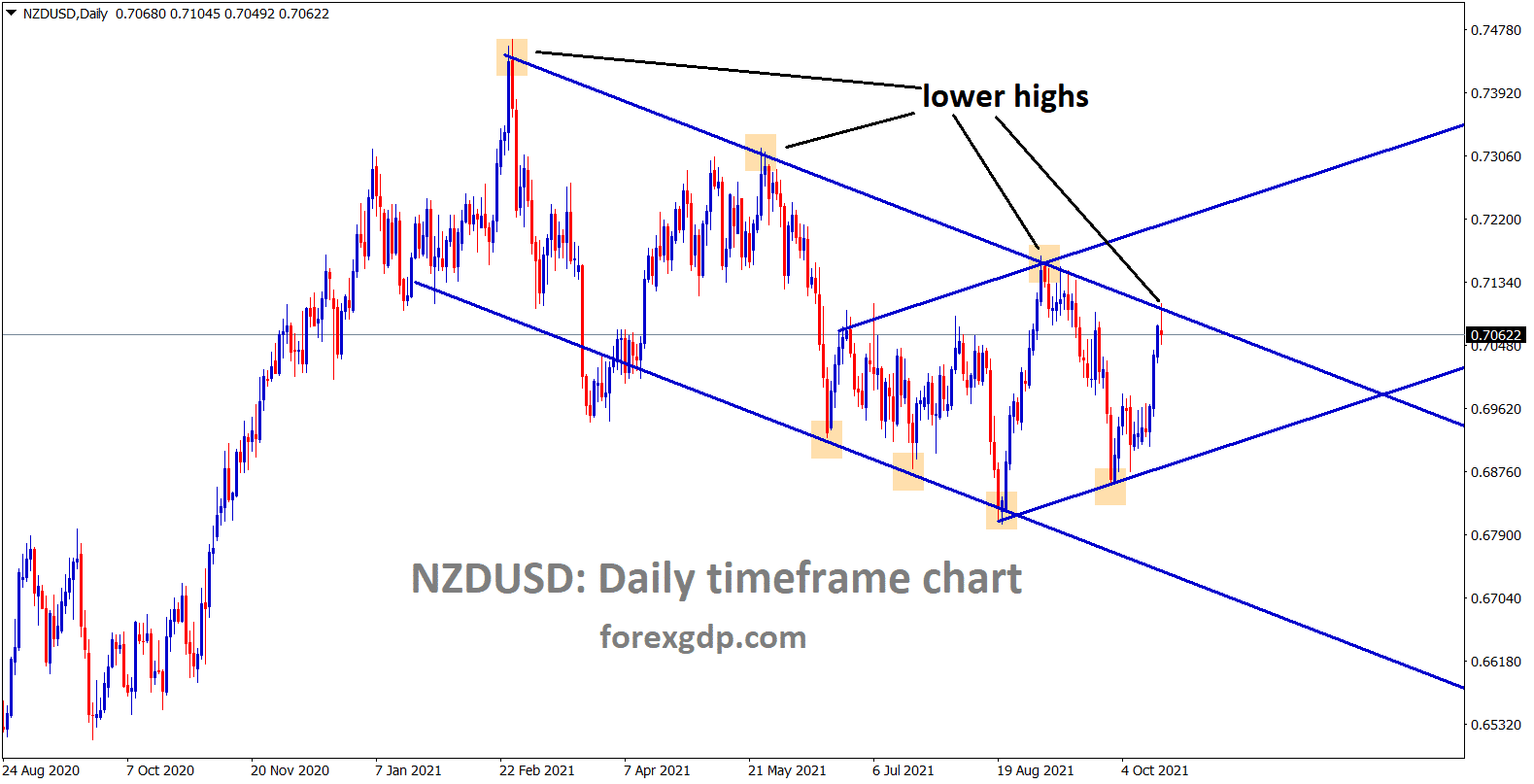

NZDUSD hits the lower high area of the downtrend line again – wait for the reversal or breakout.

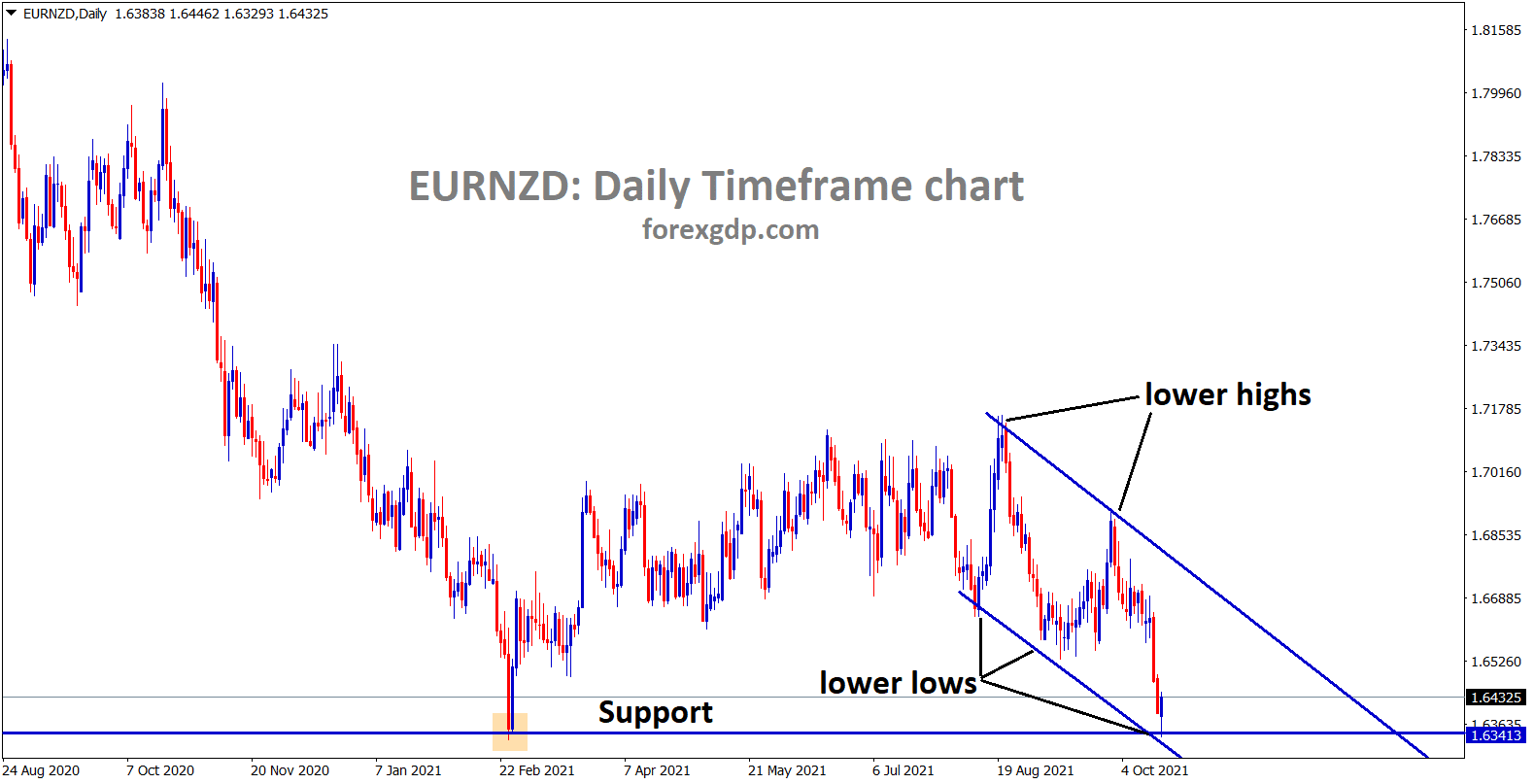

EURNZD is rebounding from the lower low and the horizontal support area.

New Zealand CPI data printed at 4.9% versus 4.1% expected, and Services index performance also increased to 46.9 from 35.6.

Overall economy shows improvement in Services and Retail sales.

And RBNZ rate hikes are incremented in Upcoming monetary policy meetings as inflation rising higher.

But Chinese GDP came at lower numbers; due to this, New Zealand Export revenue will be affected as the Chinese Domestic economy slow down.

NZ PM Speech

New Zealand PM Jacinda Ardern announced an extra 2-week extended lockdown for the Largest city population in Auckland nation.

And this comes after rising in Covid-19 cases and 2.5% of the population managing to vaccinate in a Single day.

New Zealand CPI rate was reported higher and Services index PMI said higher this week.

RBNZ may do another rate hike next month as all expected.

Swiss Franc: US Dollar keeps stronger after Friday sales data

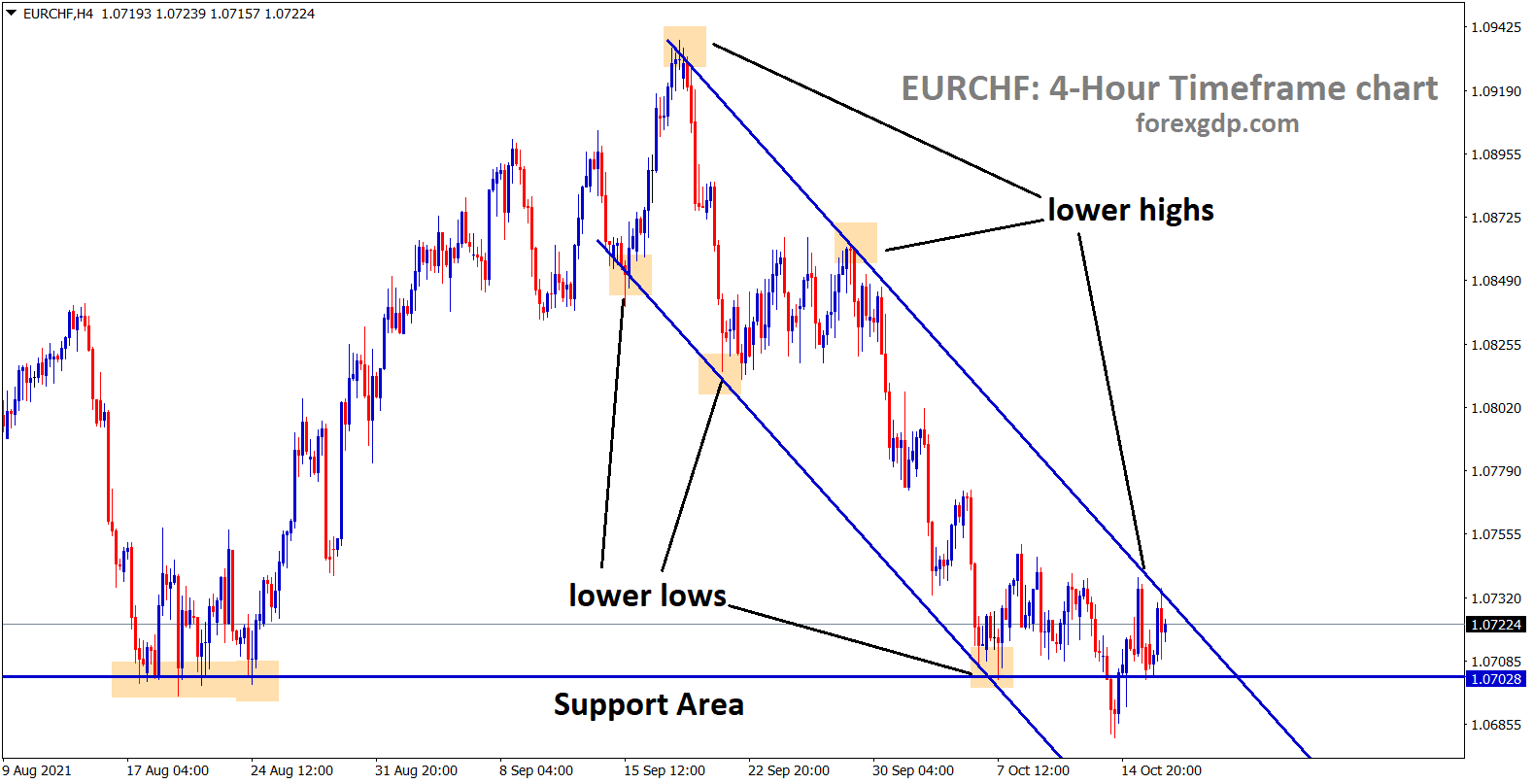

EURCHF is still moving in a descending channel range – wait for the breakout.

Swiss Franc remains higher as more deposits from foreign institutions and individuals park as safe investments.

SNB may do Forex intervention any time to cool off the CHF currency rate.

And domestic economy shows slower growth, but outstation funds inflows make CHF currency stronger.

US Dollar keeps increasing as FOMC meeting minutes last week stated that FED will be on the track of tightening stimulus spending and rate hikes in 2022.

And US 10-year yields reached 1.60% higher after US Domestic data performed well on Friday.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/