Gold: ADP employment numbers show a positive note

Gold prices are dragged down after FED mentioned a faster pace of tapering taken in the following meeting announcement and by following rate hike also will happen soon.

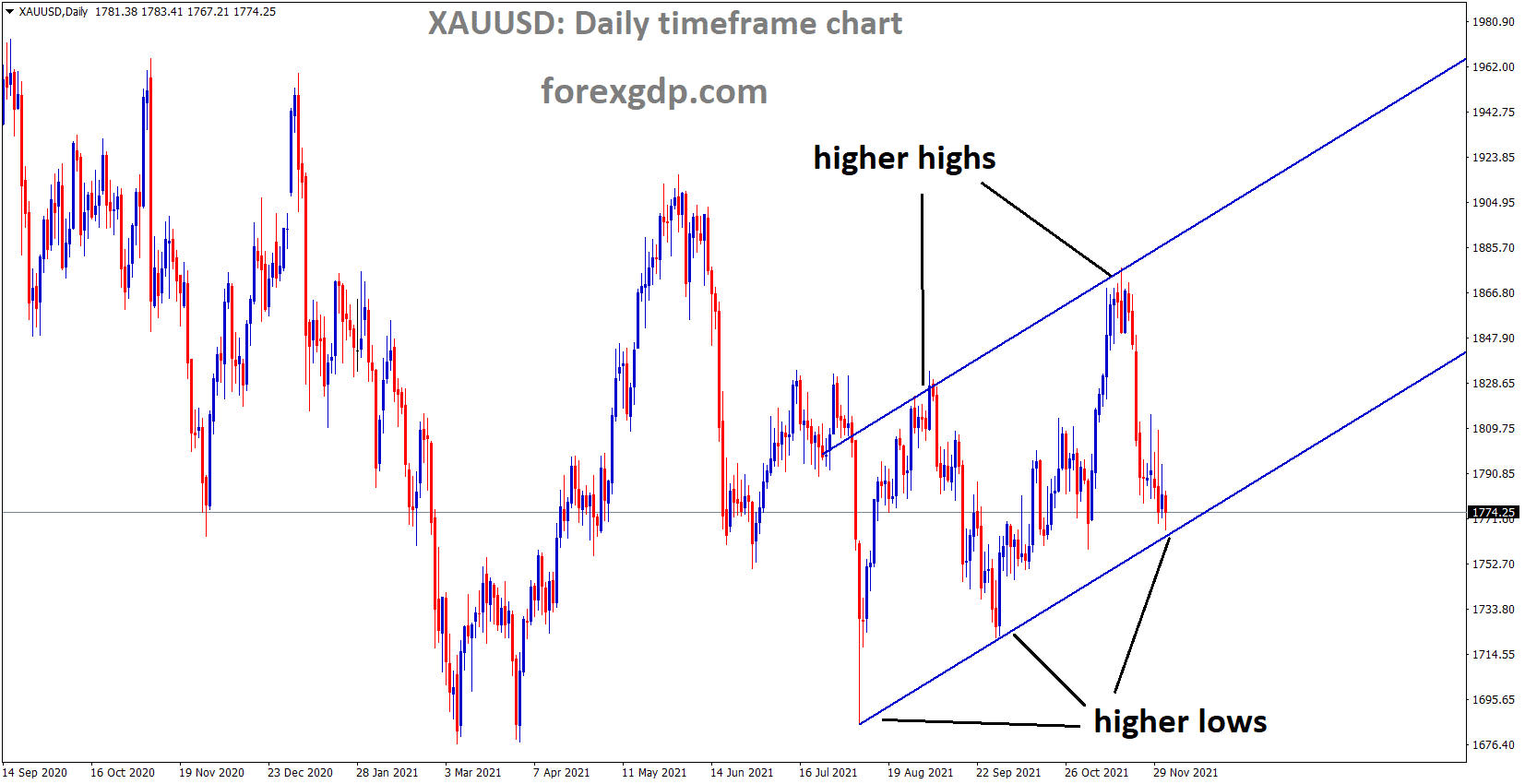

XAUUSD Gold price is moving in an Ascending channel and the market has reached the higher low area of the channel.

XAGUSD Silver price is moving in the Descending channel and market rebounding from the lower low area of the channel.

Gold prices are dragged down after FED mentioned a faster pace of tapering taken in the following meeting announcement and by following rate hike also will happen soon.

Gold prices are dragged down after FED mentioned a faster pace of tapering taken in the following meeting announcement and by following rate hike also will happen soon.

The faster pace of tapering assets makes US Dollar more robust and Yellow metal to drag down.

And now NFP data is expected to be 545K to added in November month, more than expected readings causing US Dollar to increase.

ADP Non-farm employment change brings at 534K versus 525k forecasted. by considering this data, the positive outcome is expected in Friday NFP data.

US Dollar: White house like to extend the mandate mask period

USDJPY is moving in an Ascending channel and the market reached the horizontal support area.

The US would like to extend the mandate mask for travelers and Domestic passengers in All areas till March 18 2022, But the White House and Transportations security administration declined to comment.

As per rule January 18 2022, the mask mandate is progress and no further confirmation. The widespread of Covid-19 new variant mandate mask is much essential for Every US Citizens as of now. So today US President like to extend the period of mandate mask for every people.

US Inflation expectations dwindled from higher and Rate hike will be soon

US inflation expectations came lower to two months low after FED reiterated inflation transitory is retired, and now the faster pace of assets tapering is mandatory on the table.This news dwindled the expectations of inflation makes higher.

In the US FOMC meeting, more tapering of assets than the previous month is expected.

EURO: German Manufacturing PMI came lower than expected

EURAUD has broken the Descending channel and the market reached the Horizontal Resistance area.

German manufacturing PMI came at lower numbers as 57.4 versus the expected 57.6.

And ECB won’t do tapering as New Variant spread; additional purchases can tackle the cautious economy from the spread.

And ECB meeting going to happen on December 16, EU and UK have no compromise on Northern Ireland Protocol.

France condemned the UK on licenses not issued for French Fishermen’s.

Due to the scenarios, Euro shows weaker against the US Dollar and the US Fed Powell state that a faster pace of assets tapering is much needed in this time.

UK POUND: Bank of England less favour for rate hikes

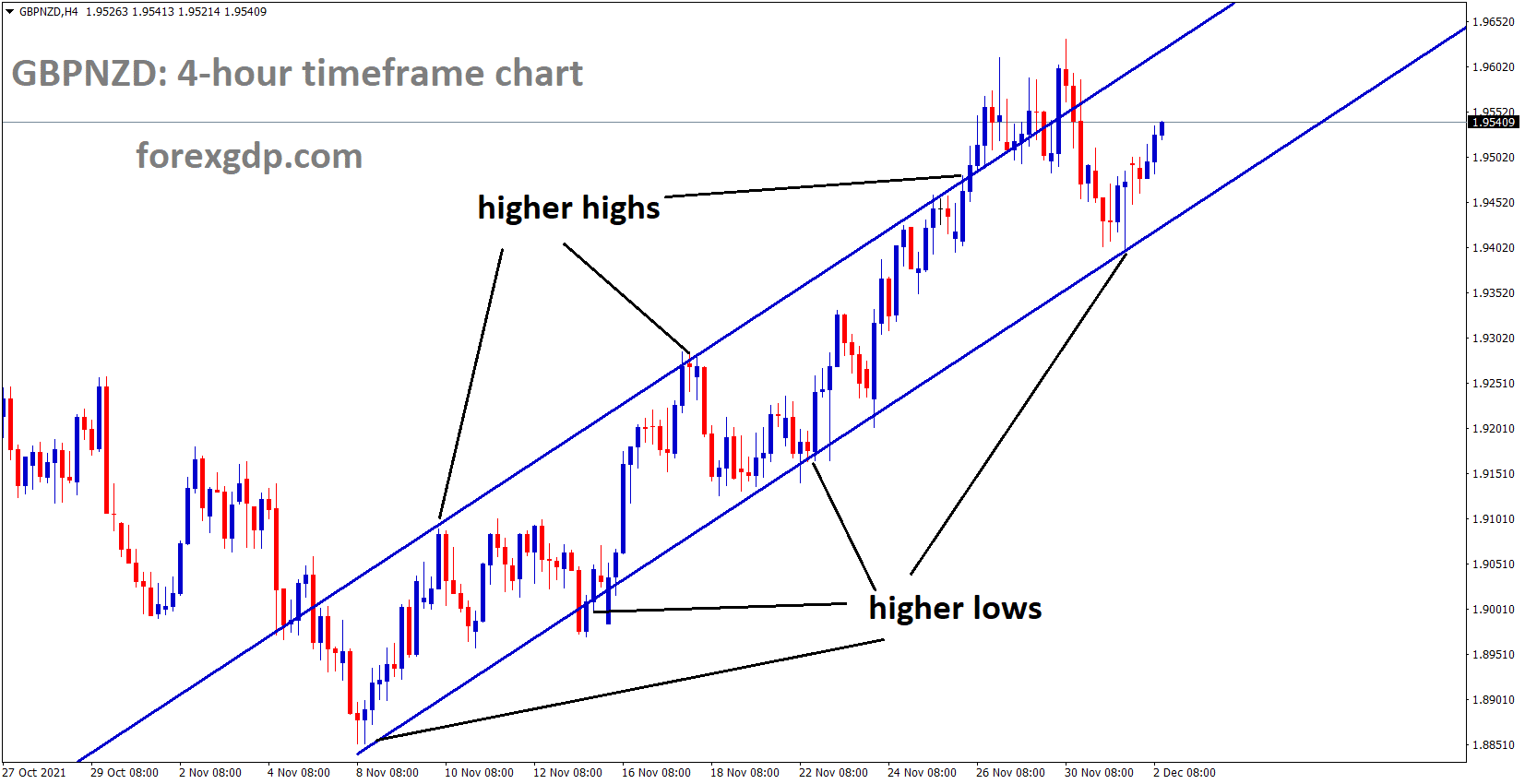

GBPNZD is moving in an Ascending channel and market doing corrections and rebounding from the higher low area of the channel.

Bank of England meeting will do rate hikes or not based on Omicron cases spread in the UK.

EU and UK made combat on Northern Ireland Protocol; other side France stressed the UK to allow fishing licenses in British waters. Due to these, Cables are stressed by Domestic and external factors.

And UK Domestic data is not favourable in the table, and Bank of England rate hike in December month will impact UK Pound in coming days.

Canadian Dollar: OPEC+ meeting forecast and a Rate hike Soon in the US

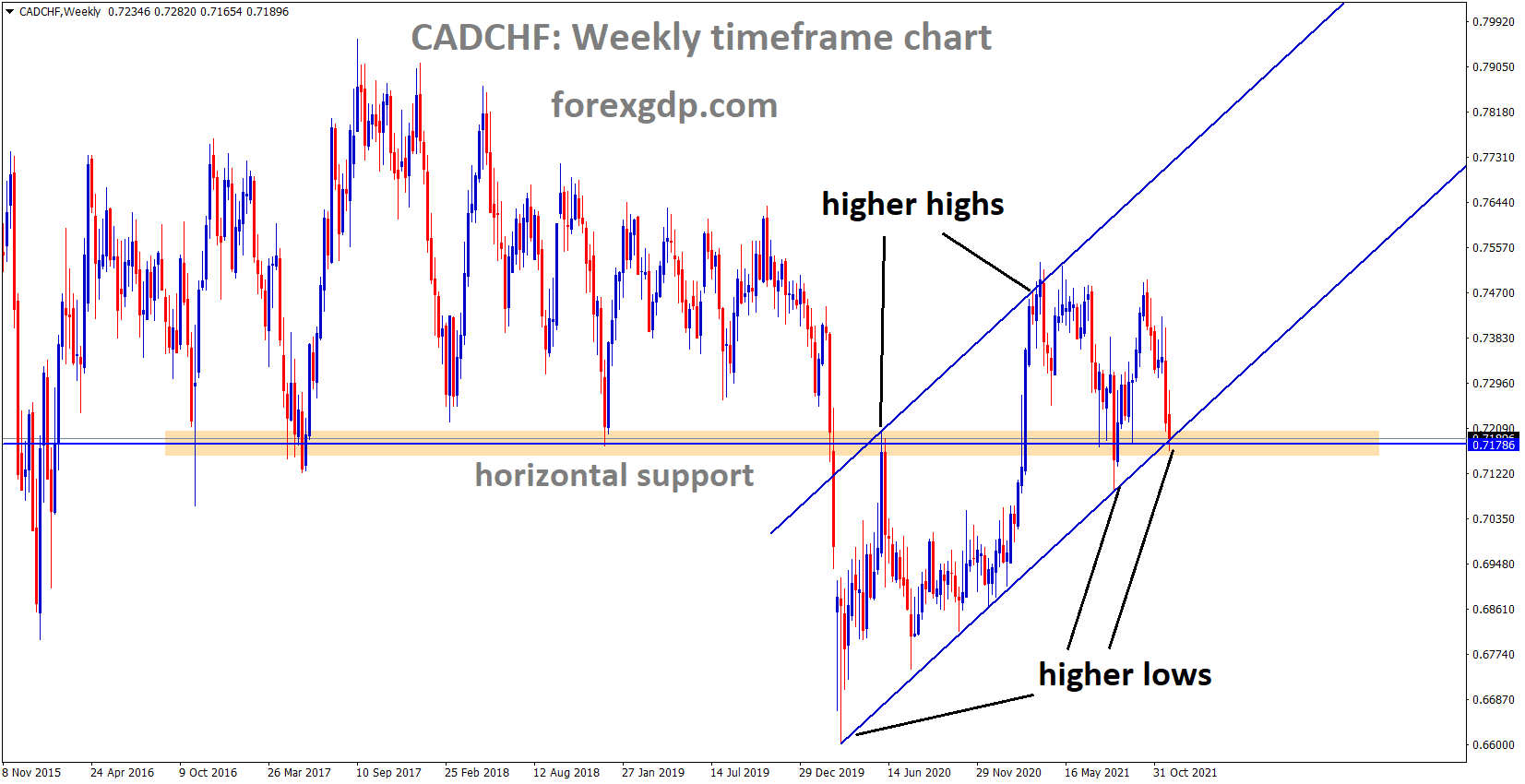

CADCHF is moving in an ascending channel and the market reached the horizontal support area of the channel.

Canadian Dollar makes higher after the OPEC+ meeting happened today and the result will be a reduction on supplies is more expected.

The new variant Omicron Virus has disturbed Supplies, so Demand creating is slower than usual.

And Bank of Canada Governor Tiff Macklem said pushing the rate of interest in the next meeting possible.

Fed members are optimistic about tapering asset purchases, and soon rate hikes will be done after tapering.

Japanese Yen: Some travel restrictions implemented in Japan

GBPJPY is moving in the Descending channel and the market is rebounding from the lower low area of the channel.

Japanese Yen shows more substantial growth, and Lockdown might impose third time as Fresh Omicron wave spread.

And Travel restrictions are implemented in some parts for outside travel passengers.

Some Flights are allowed, and Some are not allowed; the Japanese Government is very cautious about the third wave attacks.

And Fed may soon do a faster pace of tapering and complete in the first half of 2022 and earlier in the Second half of 2022, as Cleveland President Mester said.

Japanese Yen is a crisis time currency to shoot up, and whenever a crisis happens, the Swiss and Japanese yen is favourable for investors sides.

Australian Dollar: Iron ore Prices are hiked

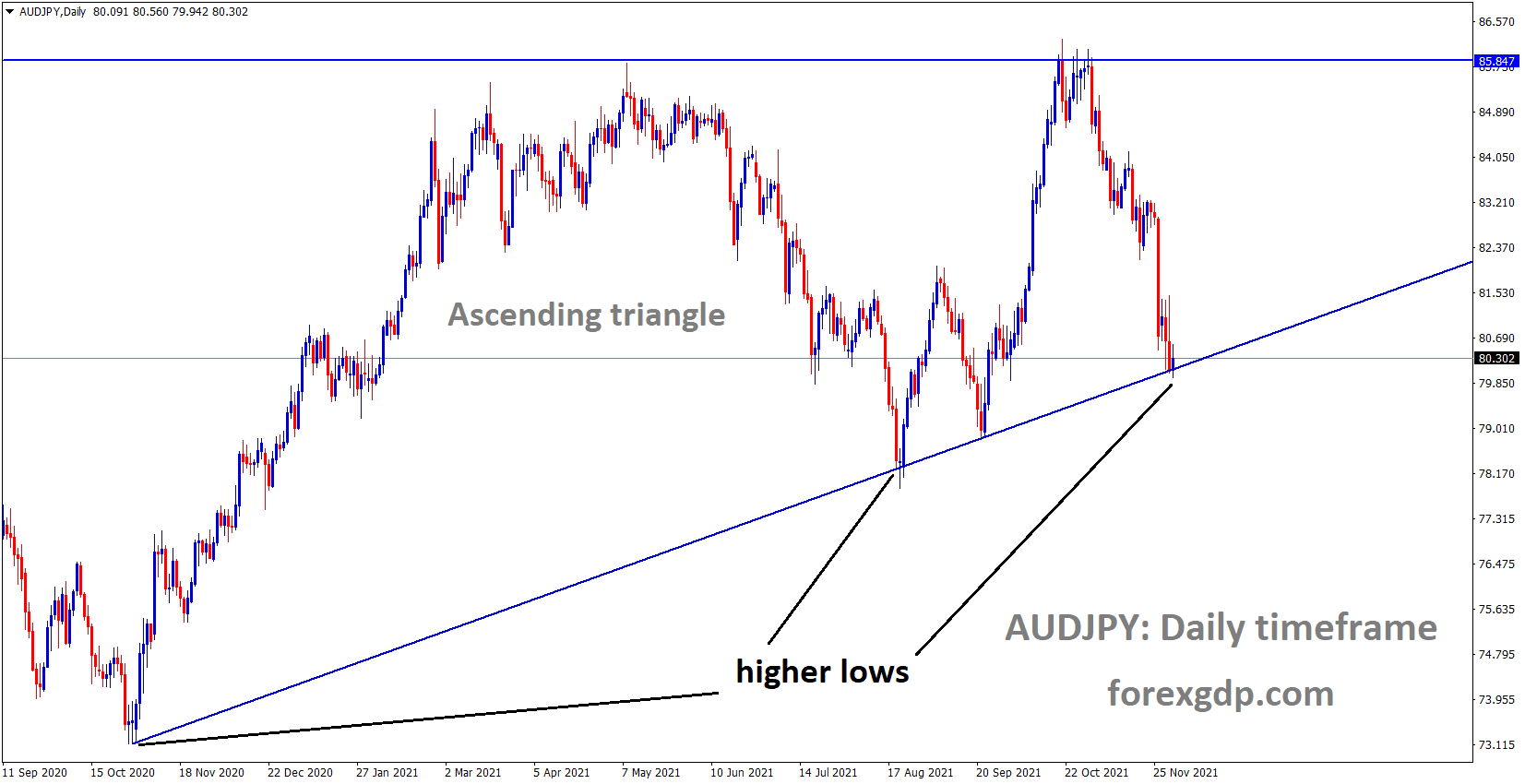

AUDJPY is moving in the Ascending triangle pattern and the market reached the higher low area of the triangle pattern.

The price of Iron ore reached $95 this week from a low of $82.50. And Miners of Iron ore preferred $20 per ton, but marginal players said $80-90 per ton for importers countries. Due to this, China is now seeing various other nations for Iron ore consumption.

But Australia is the largest exporter of Iron ore. And China seems a powerful nation to solve the problems of Iron ore prices hikes.

So, RBA maintains the cash rate at the same level without making any changes until 2024.

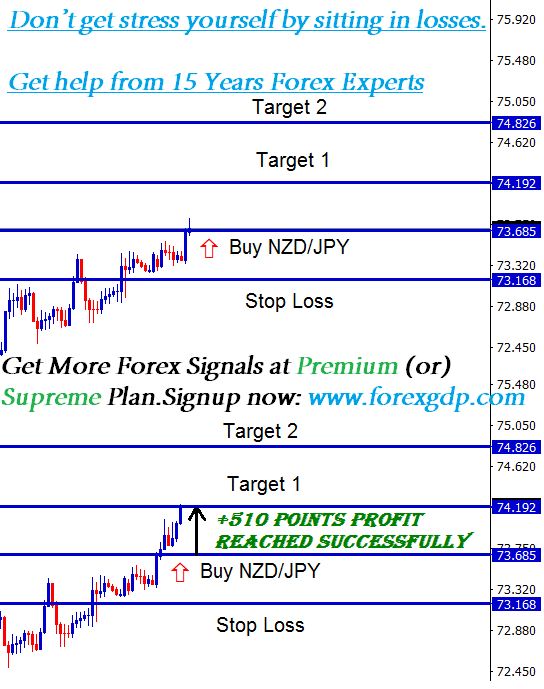

New Zealand Dollar: No rate hikes until February 2022 from RBNZ

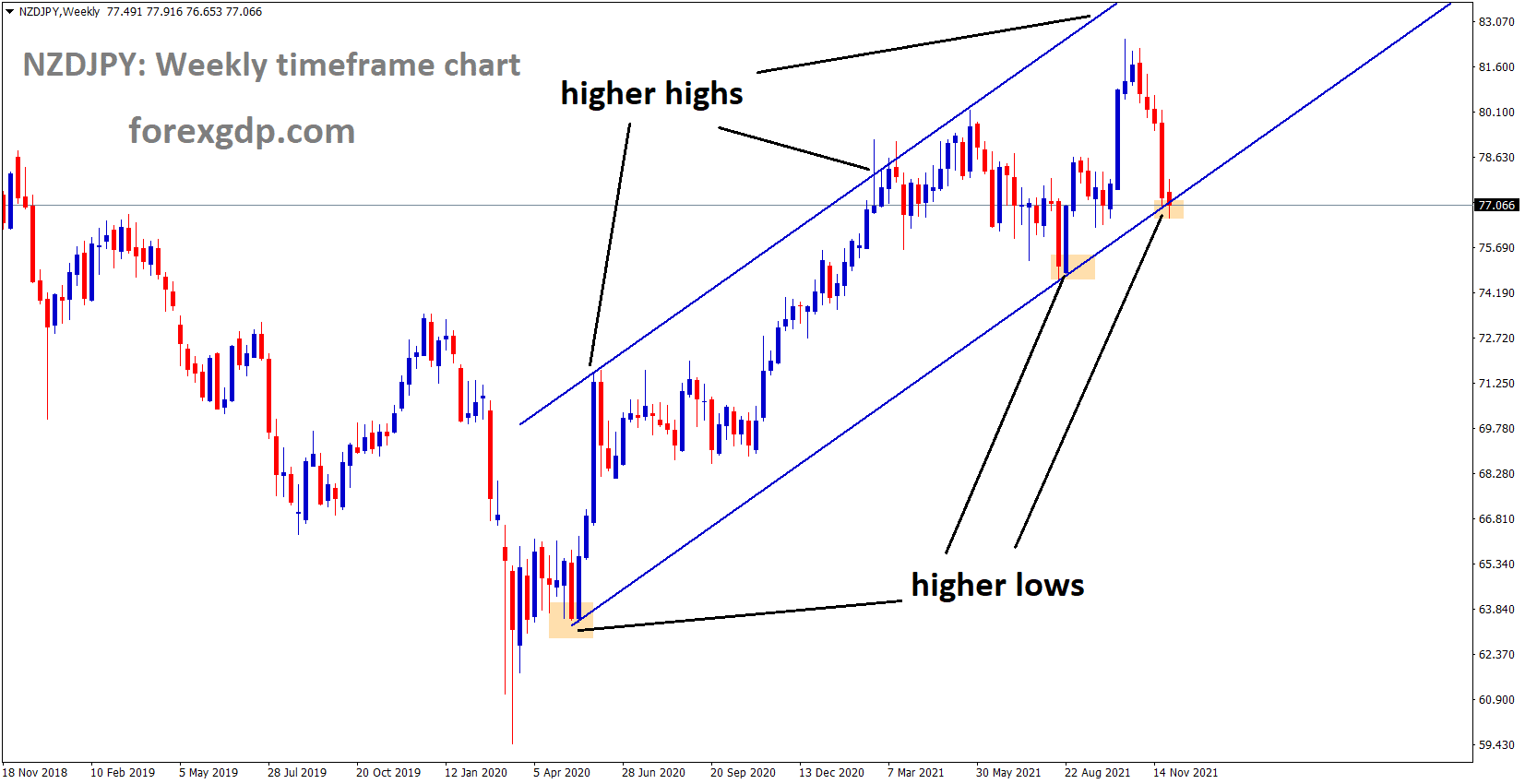

NZDJPY is moving in an Ascending channel and the market reached the higher low areas of the channel.

New Zealand Dollar makes lower as Lower interest rates have to be sustained until next February month 2022.

And US FED taking fast actions against inflation rates make stable pricing for US Dollar and only due to the US Domestic data, New Zealand Dollar made movements this month.

Now China Economy recovery shows moderate progress and makes supports Kiwi exports.

And this week US Non-farm payrolls data is yet to be released; based on the numbers printed, New Zealand Dollar shows the Directions.

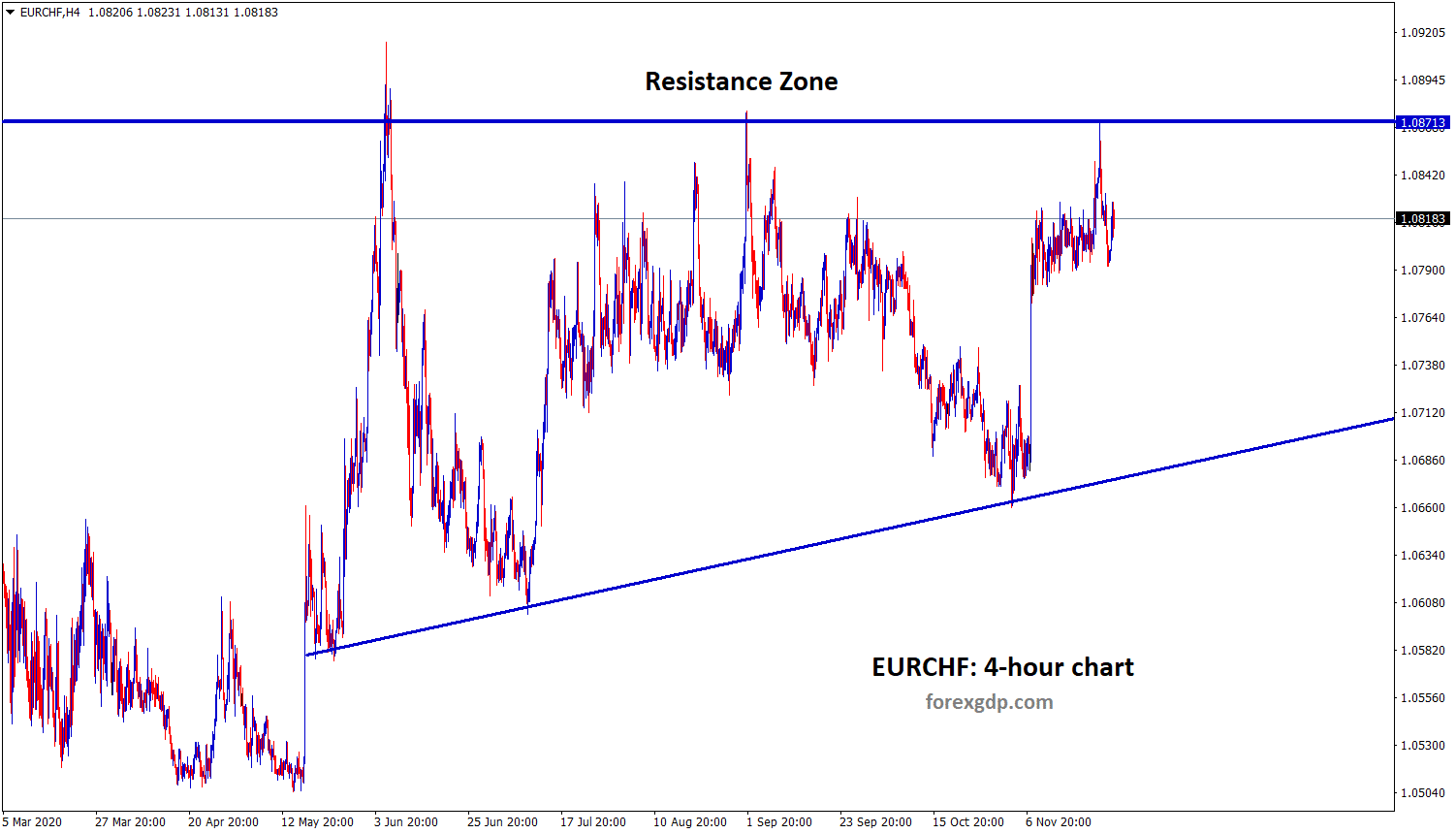

Swiss Franc: Omicron Virus made stable for Swiss Franc

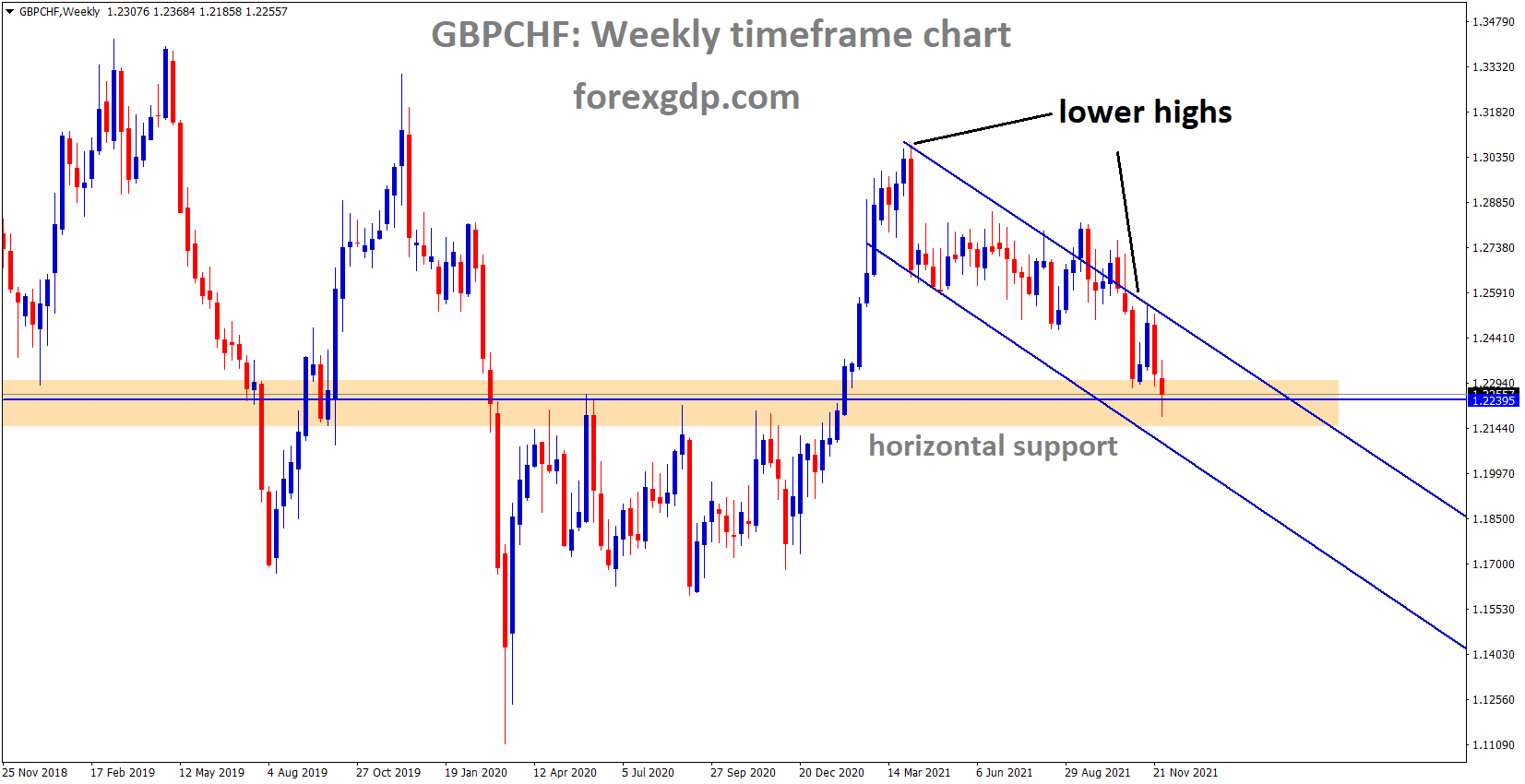

GBPCHF is moving in the Descending channel and the market reached the horizontal support area.

Swiss Franc consolidated against Japanese Yen and made higher against US Dollar.

The Omicron spread makes more fears on Global economic recovery, and The Vaccine foundation is much needed to tackle the new variant.

And US Dollar performed well; Yesterday, ADP data shows a positive note against Expectations.

US Economy shows good recovery as inflation rises gradually; now it is time to taper in faster pace against the inflation gauge.

And the Swiss economy is in moderate recovery, and third-wave fears made unstable factors in the Swiss zone.

Are you trading all the time? or you just trading in your free time? please don’t do that. Trade the market only at the confirmed trade setups.

Get more confirmed trade setups here: https://signal.forexgdp.com/buy/