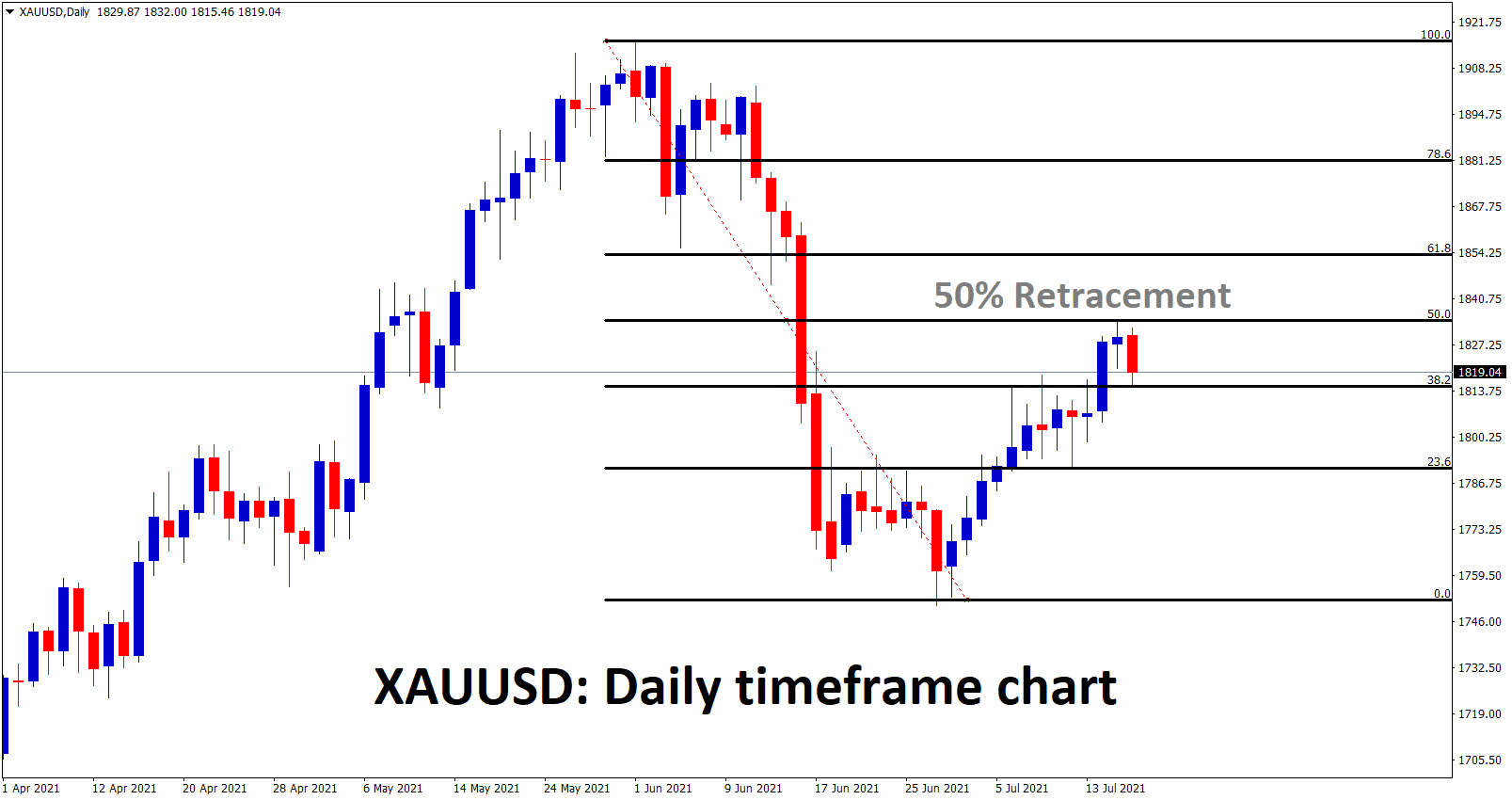

Gold: FED testimony outcome

Gold is making a correction after making 50% retracement.

Gold prices remain Higher as Two days Powell Testimony failed to impress markets.

And US Dollar moves lower as No more tapering assets speech takes place in Testimony.

Delta Variant spread across the US causes recovery of the economy to a full stop. Higher inflation numbers produce pressure on US Dollar, and Gold prices remains higher.

FED Powell commented recent higher inflation prices are transitory and not to panic about inflation numbers; by December end, we started to plan for Tapering assets in committee.

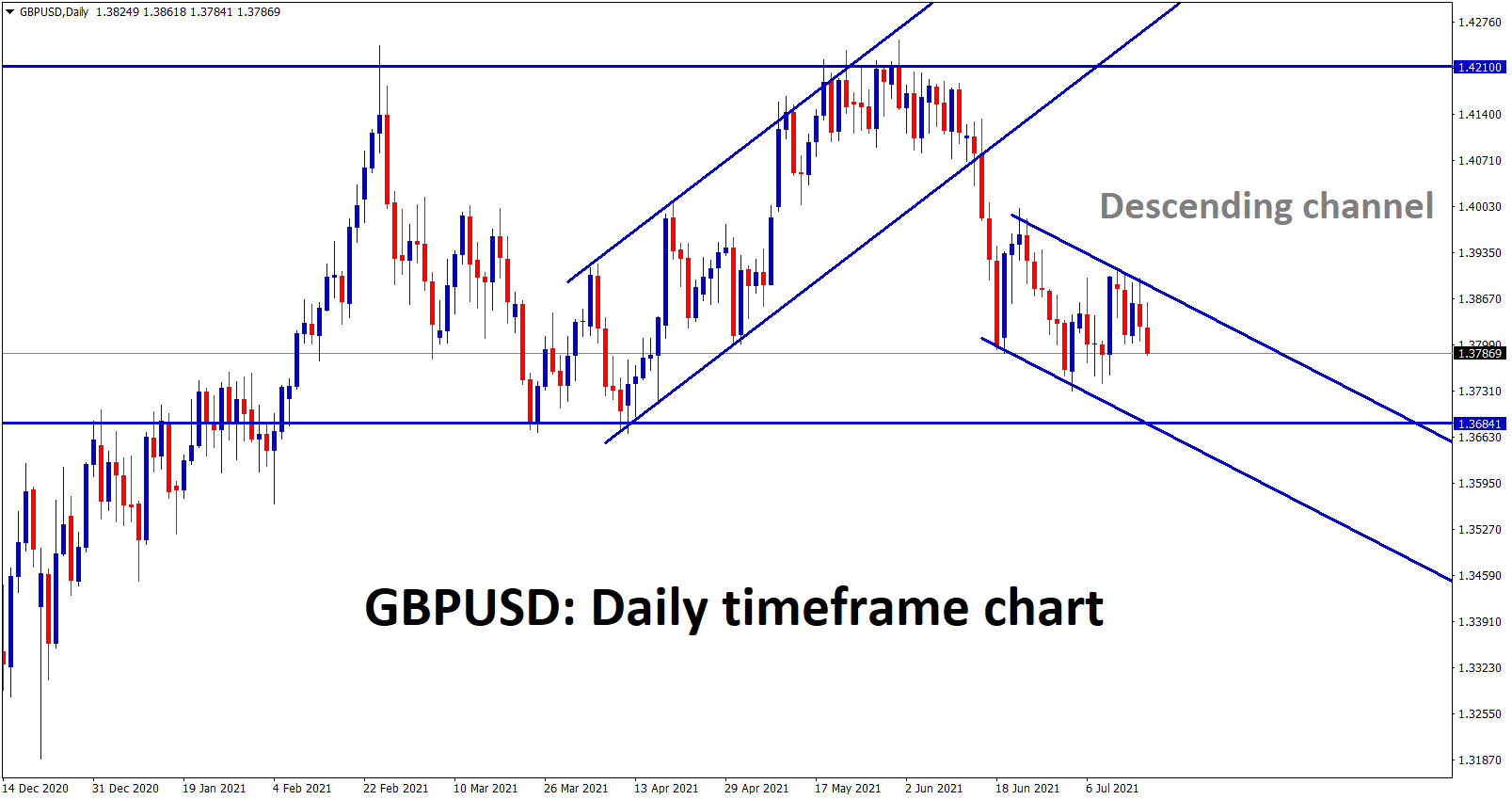

US DOLLAR: Retail sales and Michigan consumer sentiment report

GBPUSD is moving in a descending channel right now which will lead the market to the support zone.

US Dollar makes higher after FED Powell comments less Dovish policy statement.

FED will start to discuss on tapering in December end before a speech will be discussed inside the committee.

Inflation numbers turned higher is showed as Transitory, Retail sales and Michigan Consumer sentiment scheduled on Friday to watch close on markets.

US Jobless claims weekly report came at 360k versus 385.2k expected. It shows Four weeks lowest since the Pandemic started. From September, unemployment insurance benefits rolled off.

Due to this US Labor market may tend to fall if claims benefits are removed. Now FED more focus on employment numbers and the unemployment rate to lower.

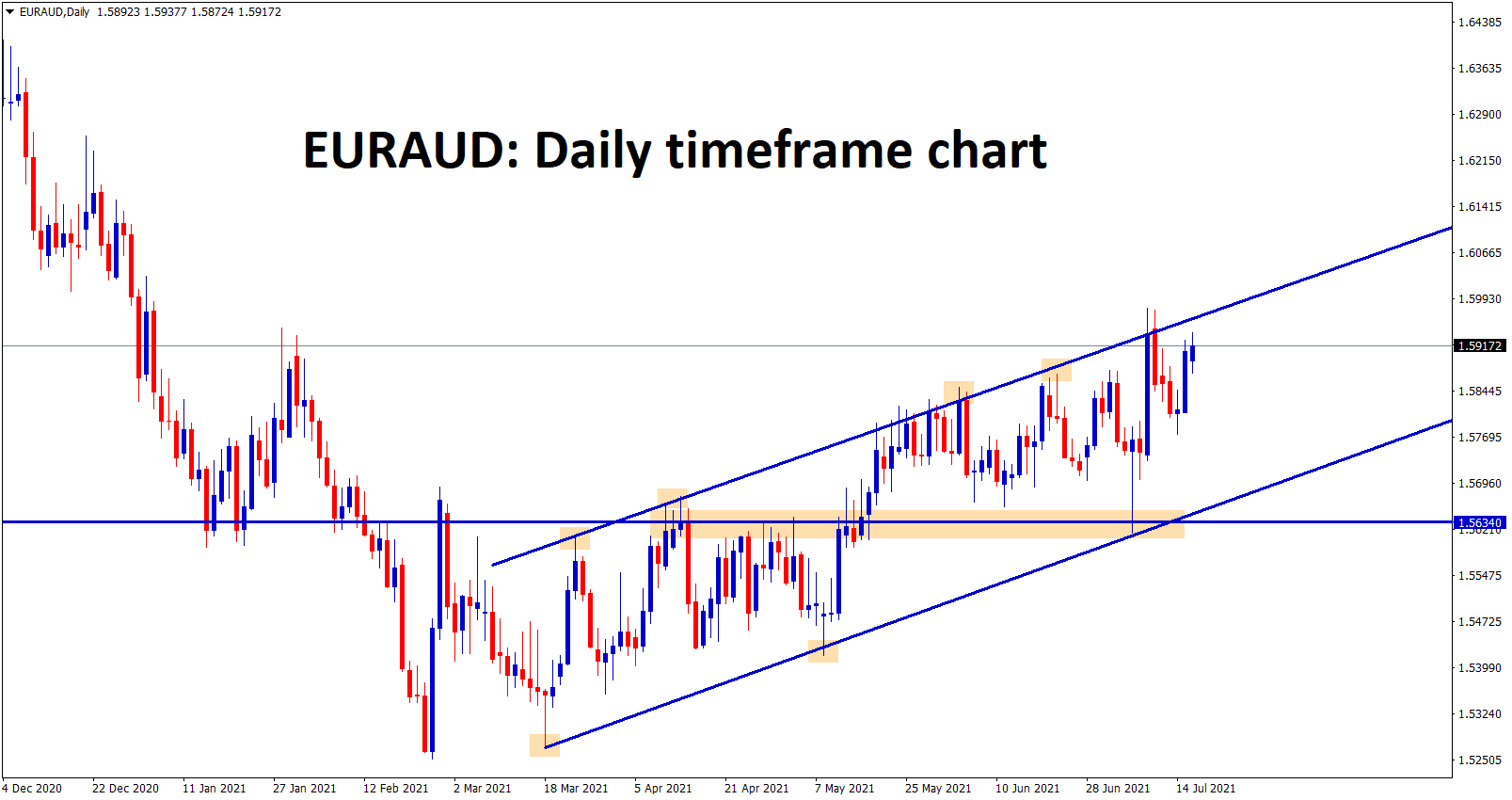

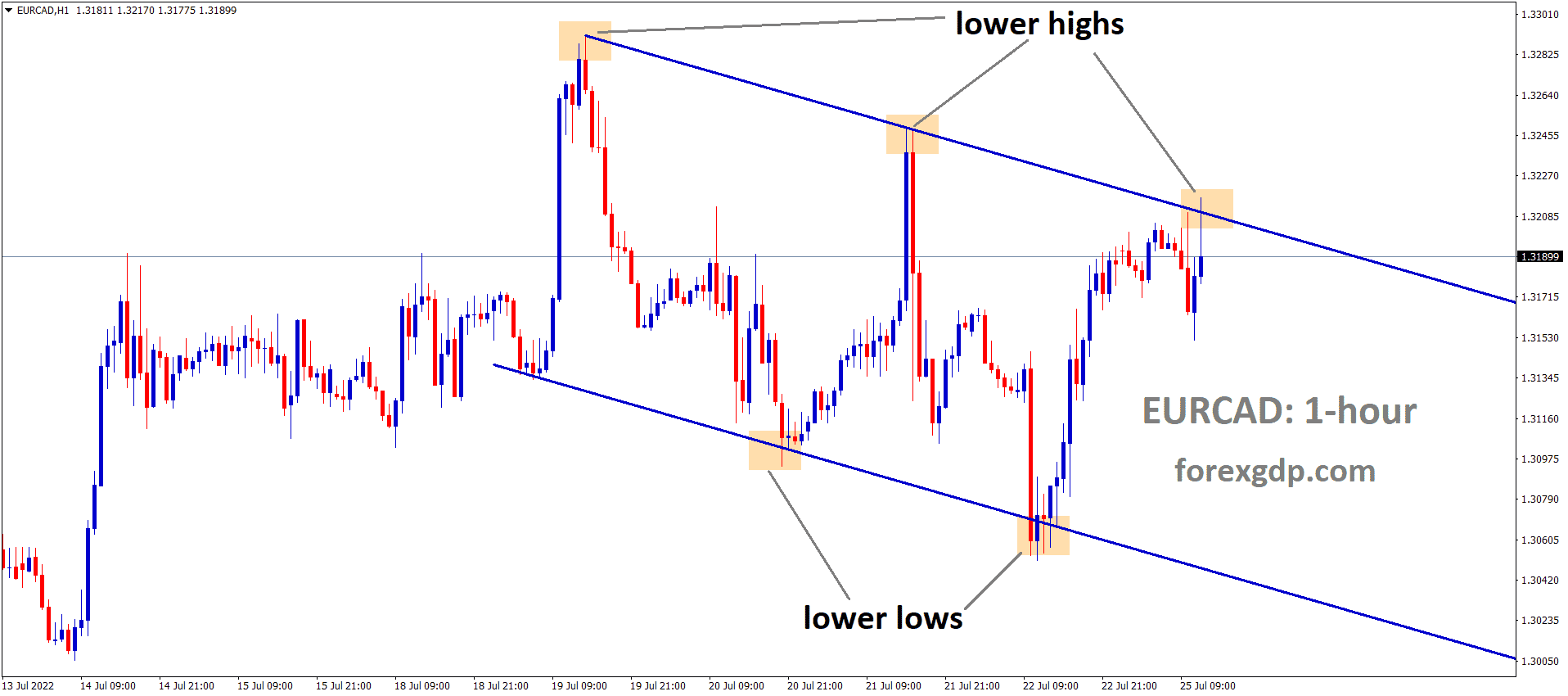

EURO: FED testimony

EURAUD continues to rise up by making 40 to 60% retracement in every swing.

EURUSD moved in the ranging market as 1.17-1.18 level as No more big news impacted market till now.

And this month-end FED policy meeting will happen; more Dovish stance of Policy shows US Dollar less strong in the market.

The higher inflation numbers make US Dollar weak for a certain period. More Printing of money over excess liquidation in the economy shows supply weight increases in the market.

So, FED may take immediate action to counter the inflation risks eats Dollar Valuation.

ECB, on the other side, Follows the same accommodative policy stance since inflation takes 2.3% only in the Eurozone, compared to 5.4% in the US.ECB may wait for tightening policy conditions until the economy growing up.

EURO: ECB meeting next week Forecast

ECB will never alter the bond-buying program in the upcoming meeting on next week monetary policy meeting on Thursday.

As 52% of analysts shows ECB will use the entire 1.85 trillion Euro ($2.2 trillion) pandemic program, this is up from 40% of analysts in June.

Monthly purchases falling by 5 billion euros to 75 billion Euros in August and provide less liquidity on financial markets, buying of bonds more significant slowdown in October expected by economists.

New virus variants bring more slows down to economy and recovery happened in last 6 months will like to slow vanishing by major upcoming lockdown measures.

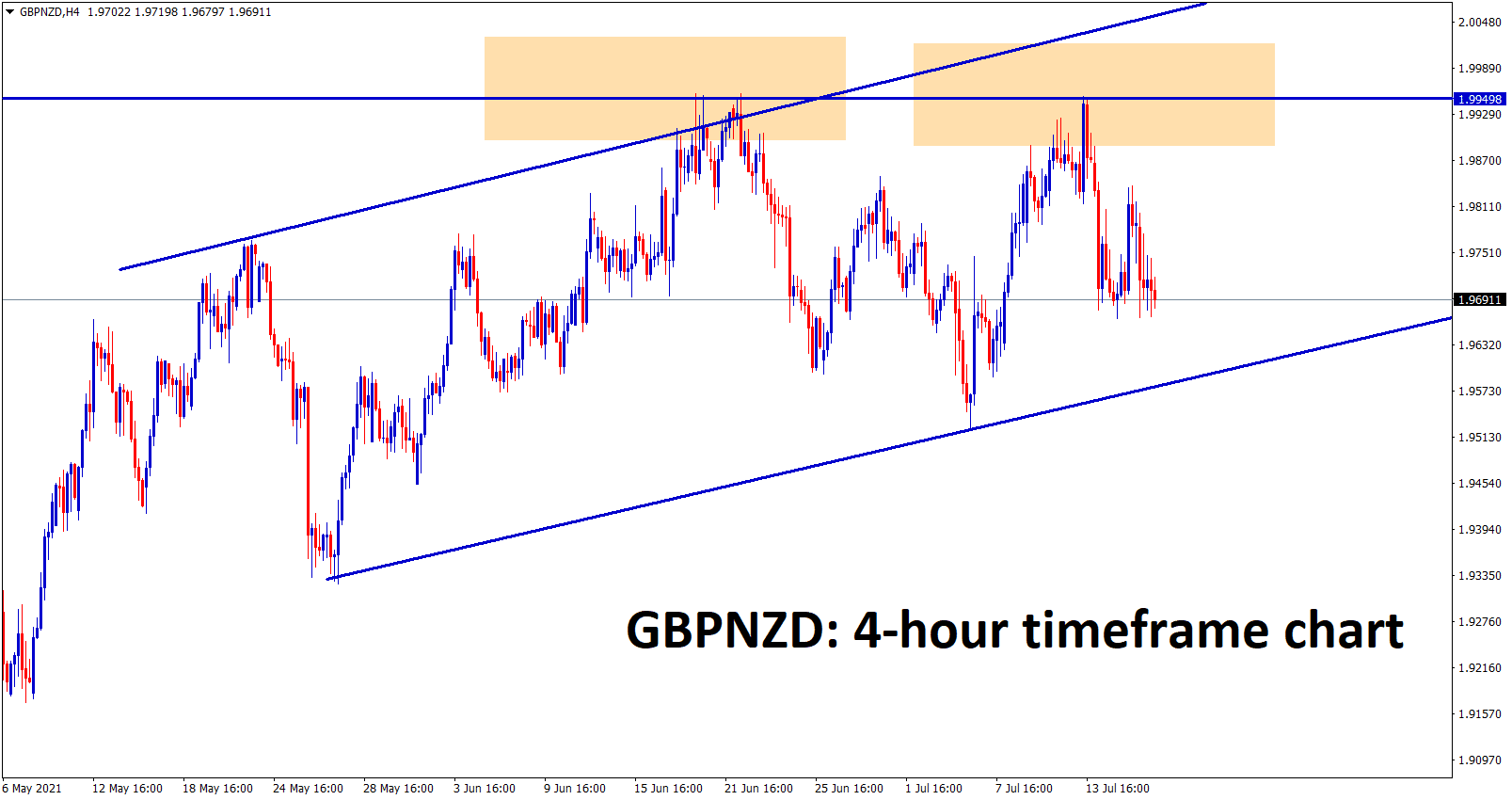

UK POUND: Lockdown relaxed in the UK

GBPNZD is moving in an Ascending channel – the major resistance is highlighted if ti breaks the top, it will surge more.

UK Pound makes ranging market between 1.39-1.37500 level for last one month since Lockdown released today in the UK.

Full Lockdown relaxation in the UK makes worry for Delta variant concerns in economy.

If again starts to Spread more will cause the UK for an economic slowdown from recovery.

And the Bank of England Policymaker Michael Saunders commented the fresh outbreak of delta variant makes more cautious on people from the spread.

US Dollar makes stronger foot as the Global pandemic is not came to an end. Domestic data supports the UK very well, and Vaccination rollouts are successfully progressed.

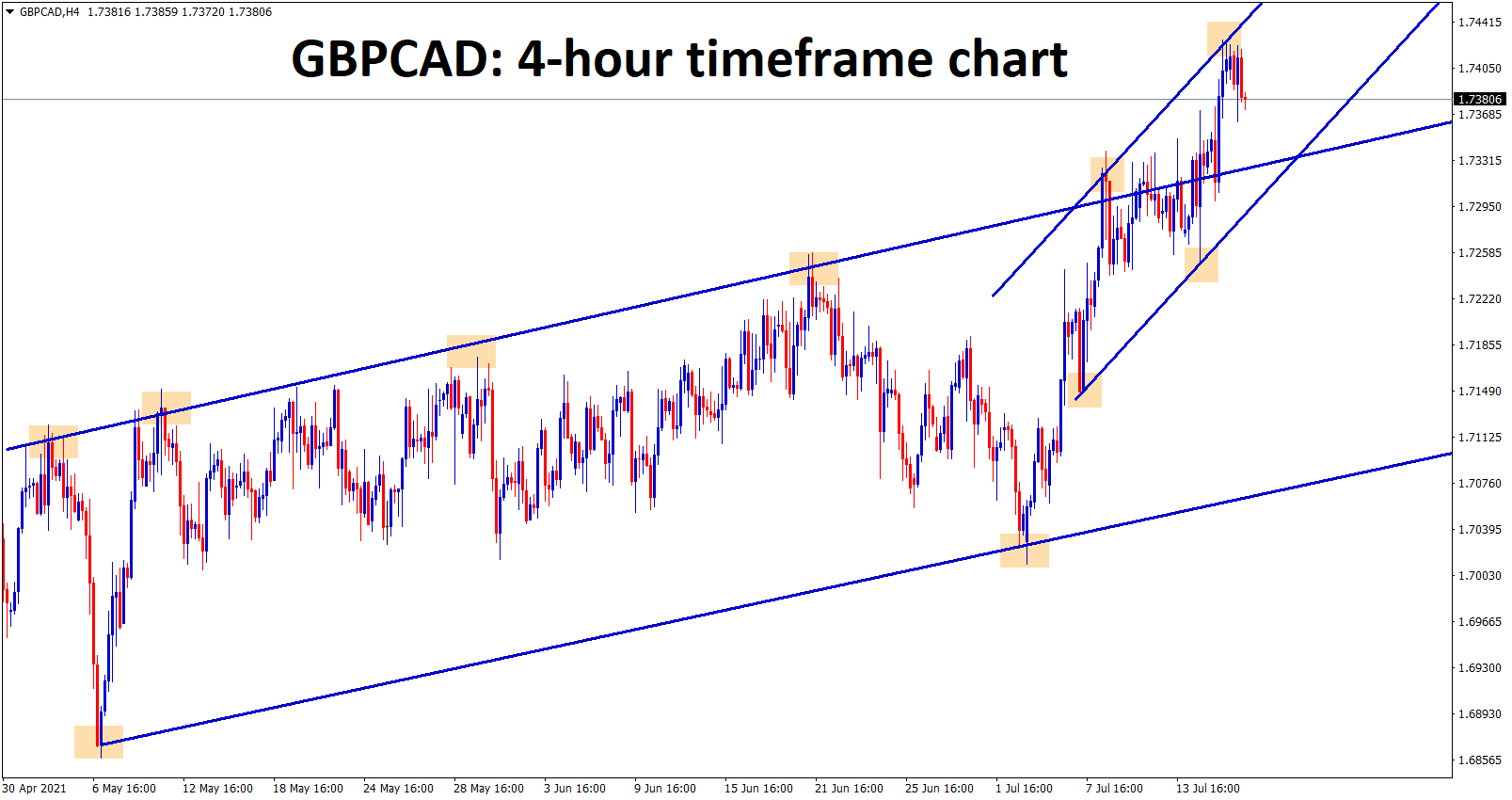

Canadian Dollar: Bank of Canada monetary policy meeting

GBPCAD has broken the top level of the Uptrend line and now starts to move between the minor ascending channel.

Canadian Dollar shows more weakness as Bank of Canada slows asset purchases as Canadian Dollar 2 billion per week from 3 billion in the previous month.

Two days Powell Testimony was failed to impress US Dollar, and USDCAD makes higher after the Canadian Dollar weakness.

OPEC+ Deal was failed to Boost the supply and demand for Oil over the globe higher.

CADJPY still makes lower another 2% in three months. Corrections will be seen in the Canadian Dollar, and counterparties will gain in the next 3 months.

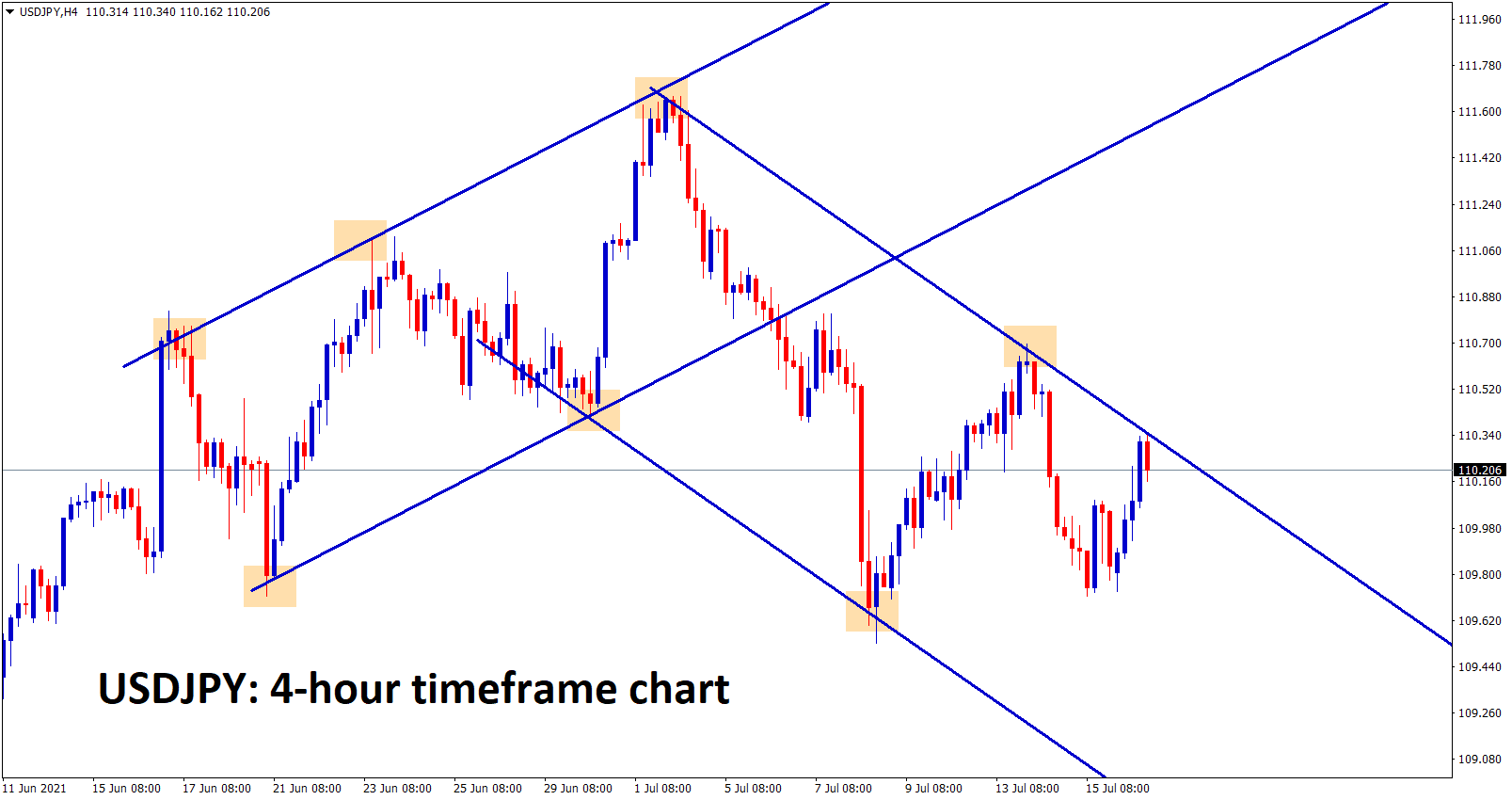

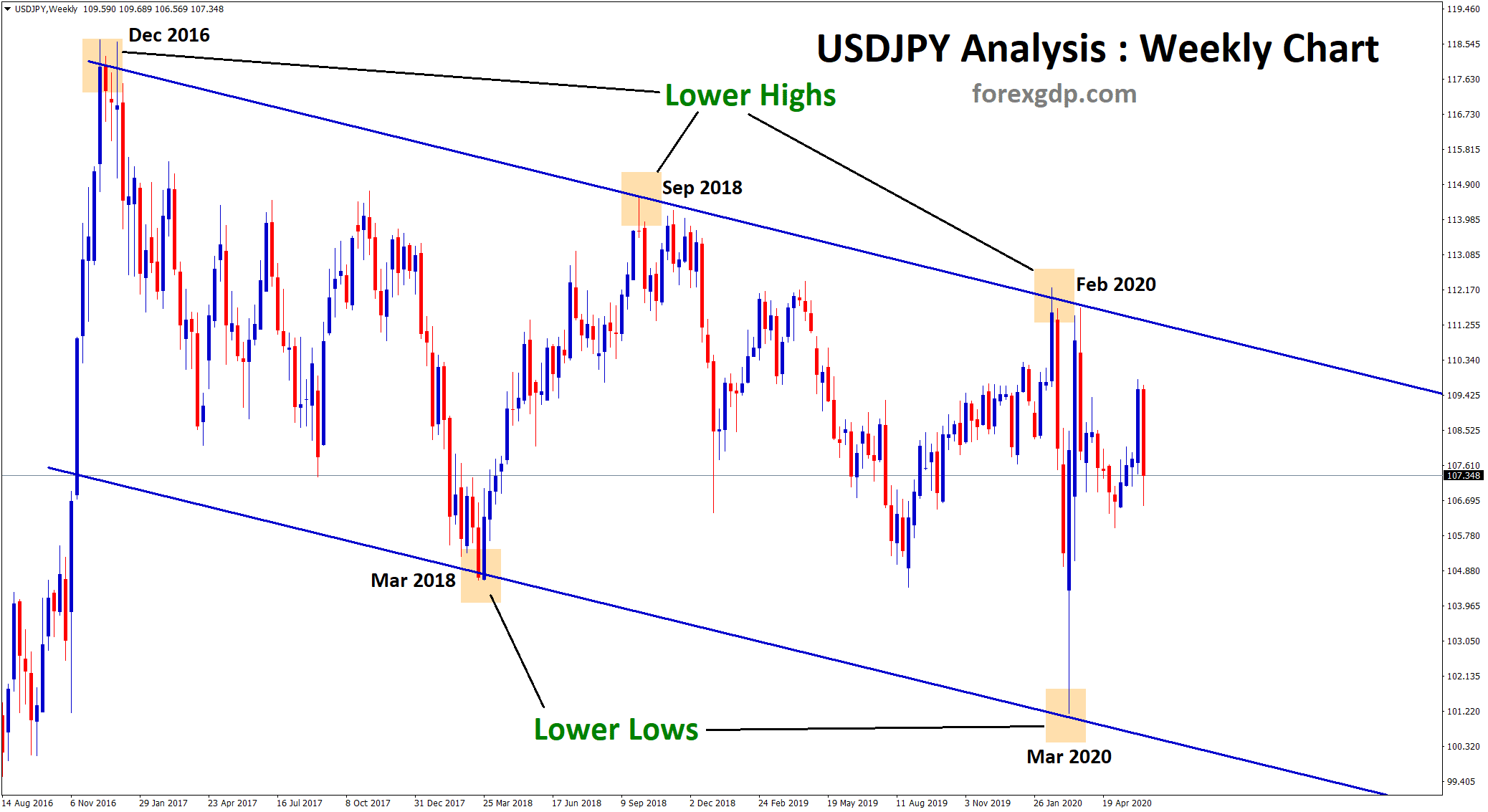

Japanese Yen: BoJ Governor Speech

USDJPY is moving between the minor channel ranges now.

Bank of Japan Governor Haruhiko Kuroda said uncertainty prevailing in the economy shows more Cautious in time as a speech given on Friday.

Consumption stagnating makes weaker services sector. Exports were quite high due to high global demand. Consumer inflation remains 0%, and the Gradual increase was seen after the lockdown was released.

Bank of Japan is ready to give stimulus support to whatever economy is needed.

The vaccination side will focus more and take appropriate action to control the pandemic.

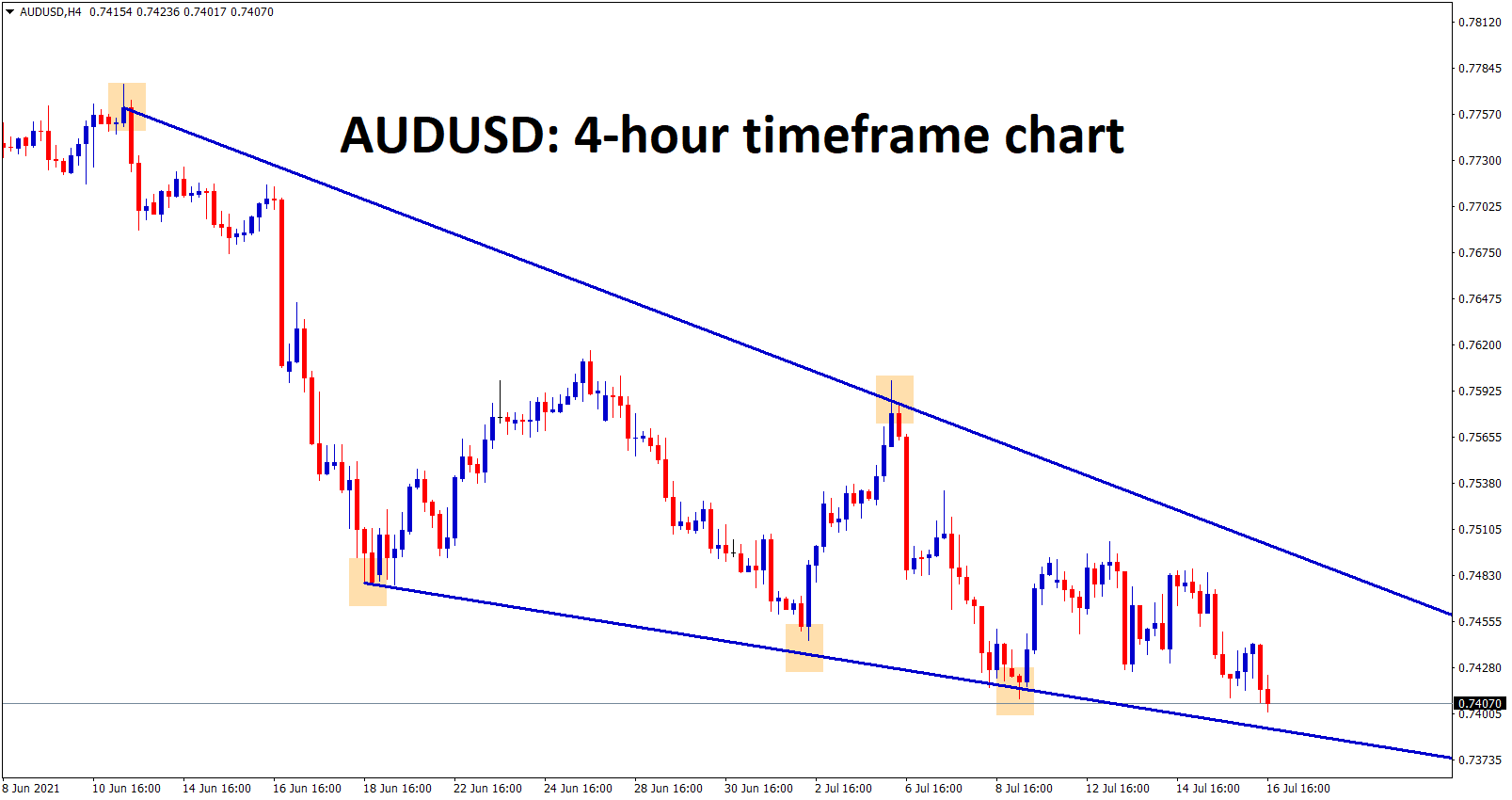

Australian Dollar: China GDP

Falling wedge chart pattern found on AUDUSD – wait for breakout.

Australian Dollar makes lower hint as US Dollar moves in a stronger position after Domestic data printed higher numbers.

China also slashed 0.50% for private lending banks to stimulate the economy to create fears of the Global side.

China is the only country that recovered in 2020 itself after the pandemic attacked.

Once China the economy slowdown perimeter countries like New Zealand and Australia will suffer.

As Iron ore Prices remains more in demand in China side but Prices are controlled by creating lower demand in China.

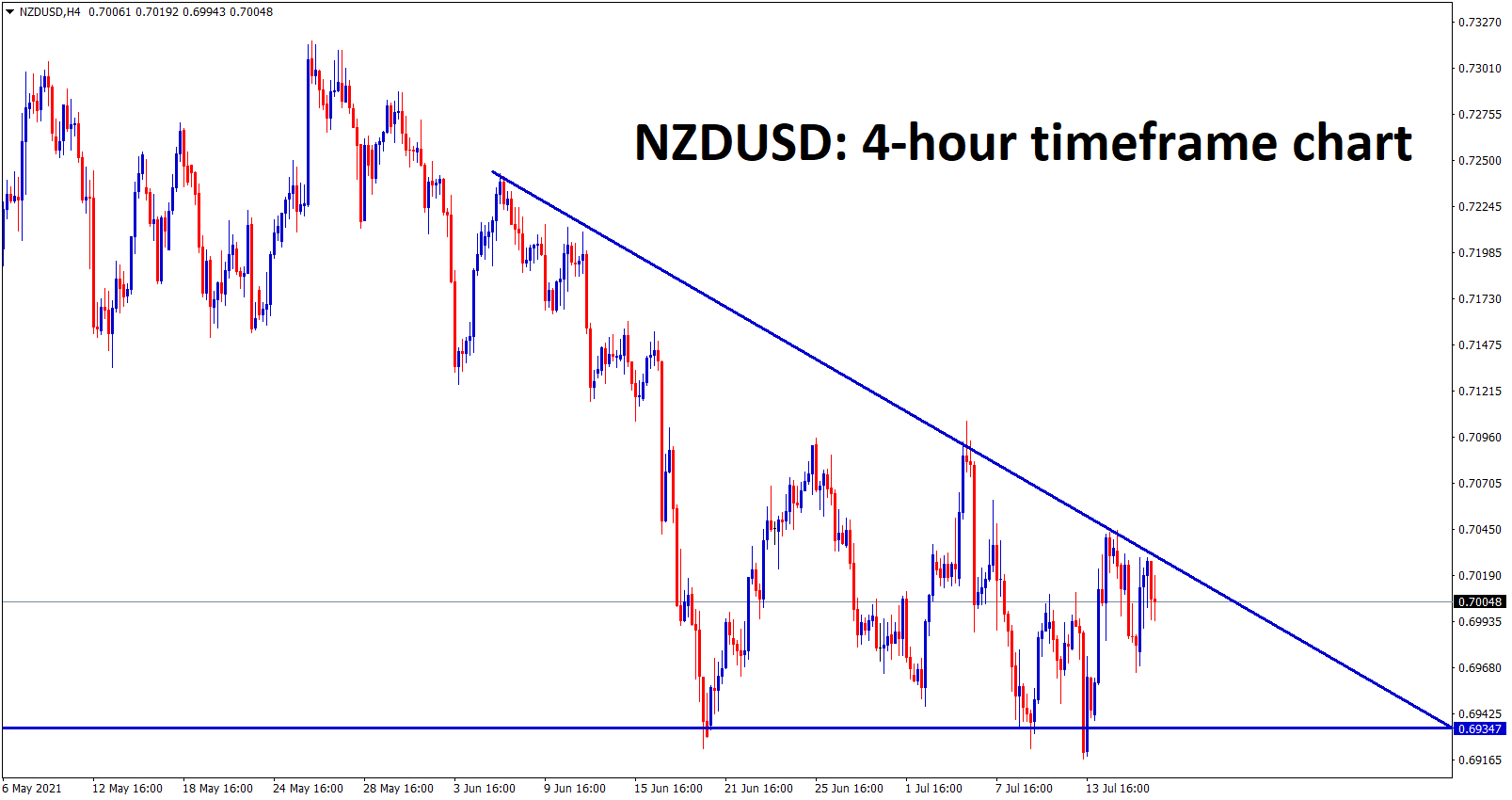

New Zealand Dollar: Inflation report

NZDUSD is moving in a descending triangle pattern for a long time – triangle getting narrower, we can expect a breakout soon from this triangle pattern.

New Zealand Dollar moves higher after RBNZ makes a good decision on tapering large scale assets from July 23.

And Inflation report printed today as 3.3% versus 2.7% forecasted, this reading is 1.5% higher than the first quarter.

The higher Inflation is compensated with tapering assets in New Zealand. So New Zealand Dollar got Positive after the Economy cycle kicked to normal life cycle from the pandemic cycle.

Global countries also followed the same method to control inflation numbers once the economy got a healthy pickup from the Covid-19 cycle.

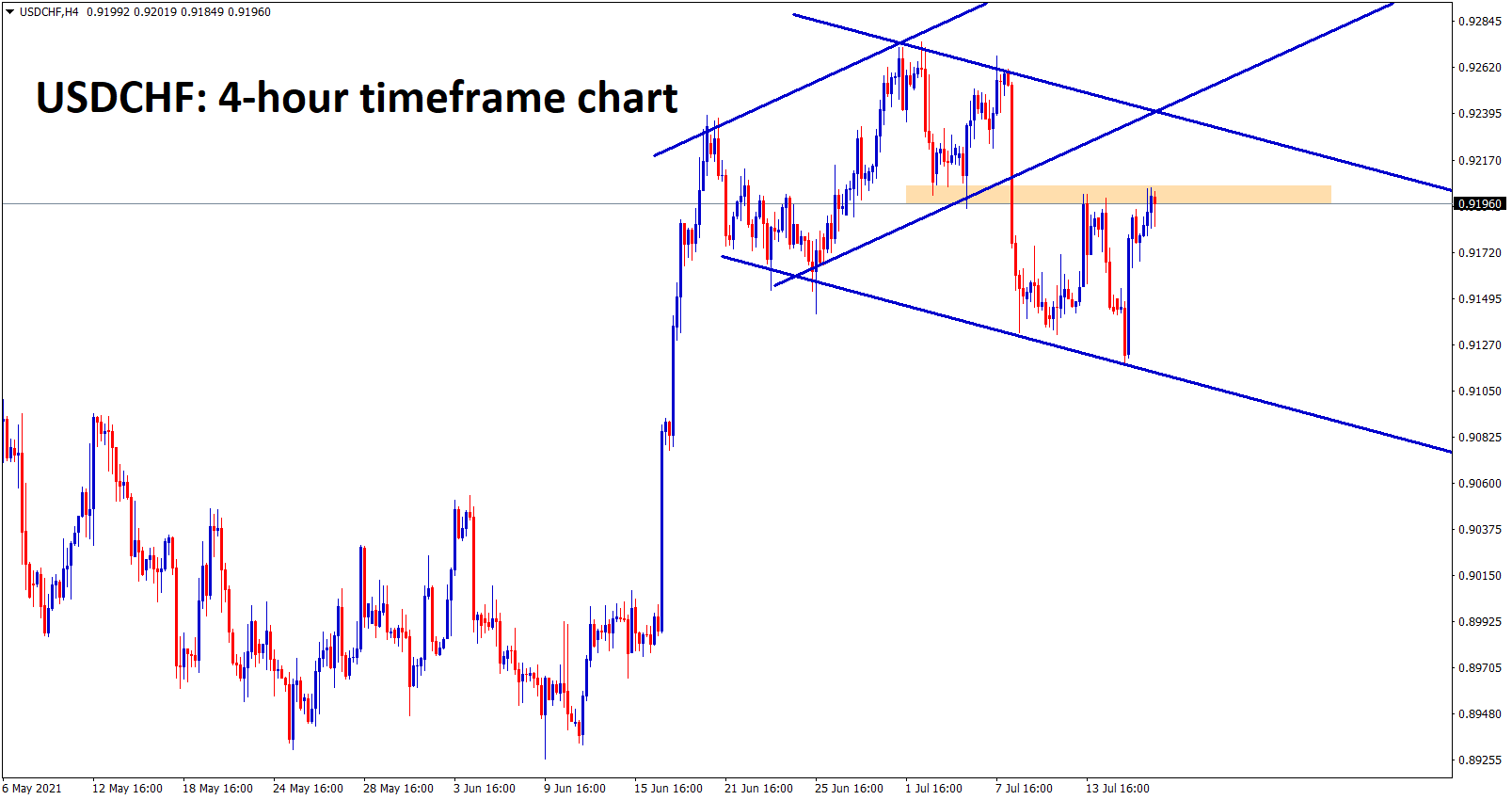

Swiss Franc: Vaccination Slow rollout

USDCHF is moving up and down between the channel and SR levels.

US Dollar continues to climb up higher after FED commented less Dovish policy on two days testimony.

And Swiss Franc continues to lower as Delta Variant spread and slow Vaccination rollouts in Switzerland.

USDCHF continue to move higher 0.50% from the start of the week and now going to down from 0.92 level in next week.

Weekly jobless claims of US Data show lower before pandemic level, By Considering this unemployment benefits will be stopped from September month.

Your channel is very special and your trading is simply nothing but price no indicators making noise confusion just the market price and I’m truly coming on board from the 25th of this month. I can learn a lot if I pay a closer look at your trading simplicity and I can become somebody one day.