Gold: US ADP report came at higher

Russia and Ukraine War escalated, and due to this scenario, soaring Energy prices, Commodity prices like Wheat will be flying.

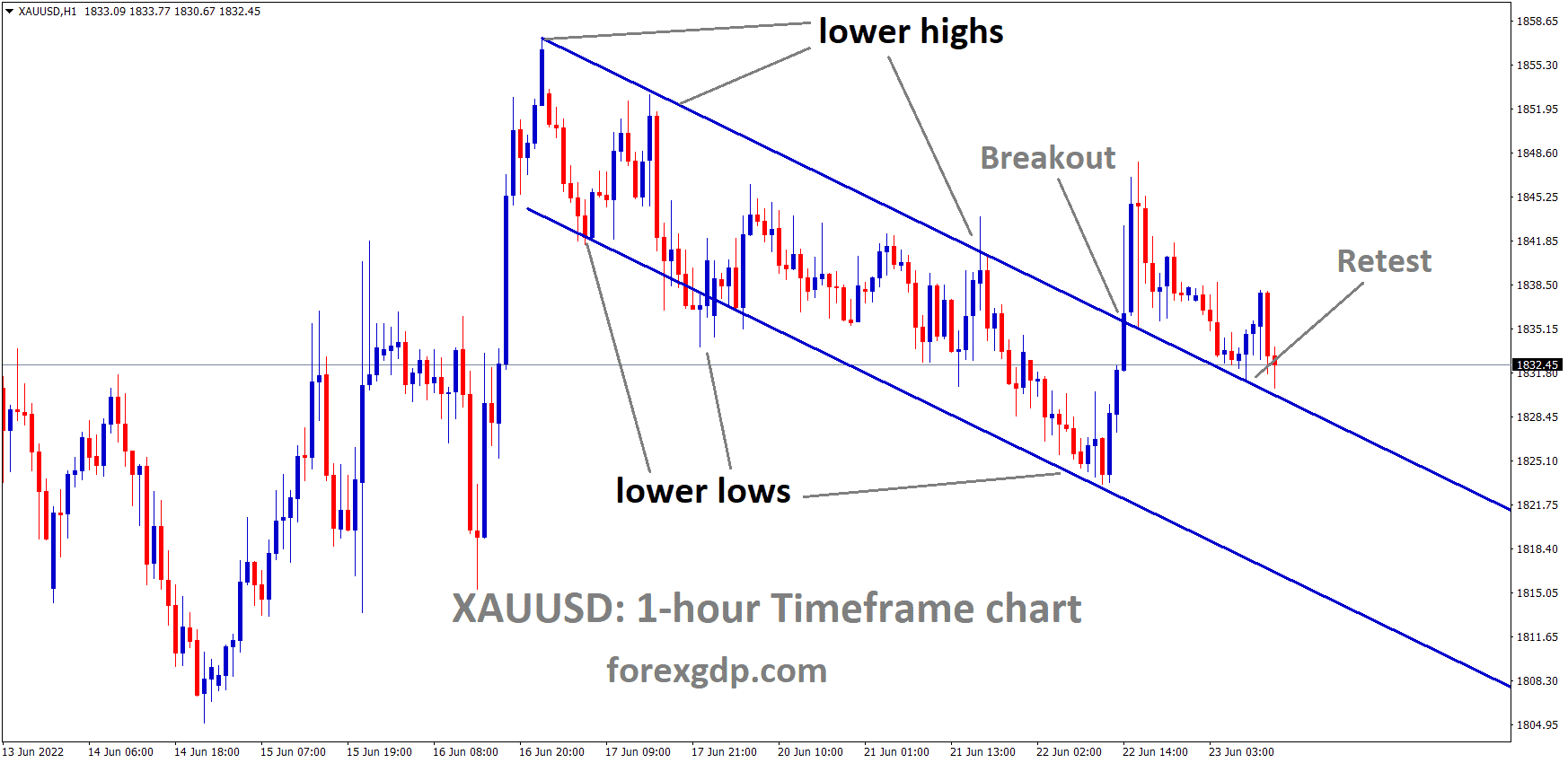

XAUUSD Gold price is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

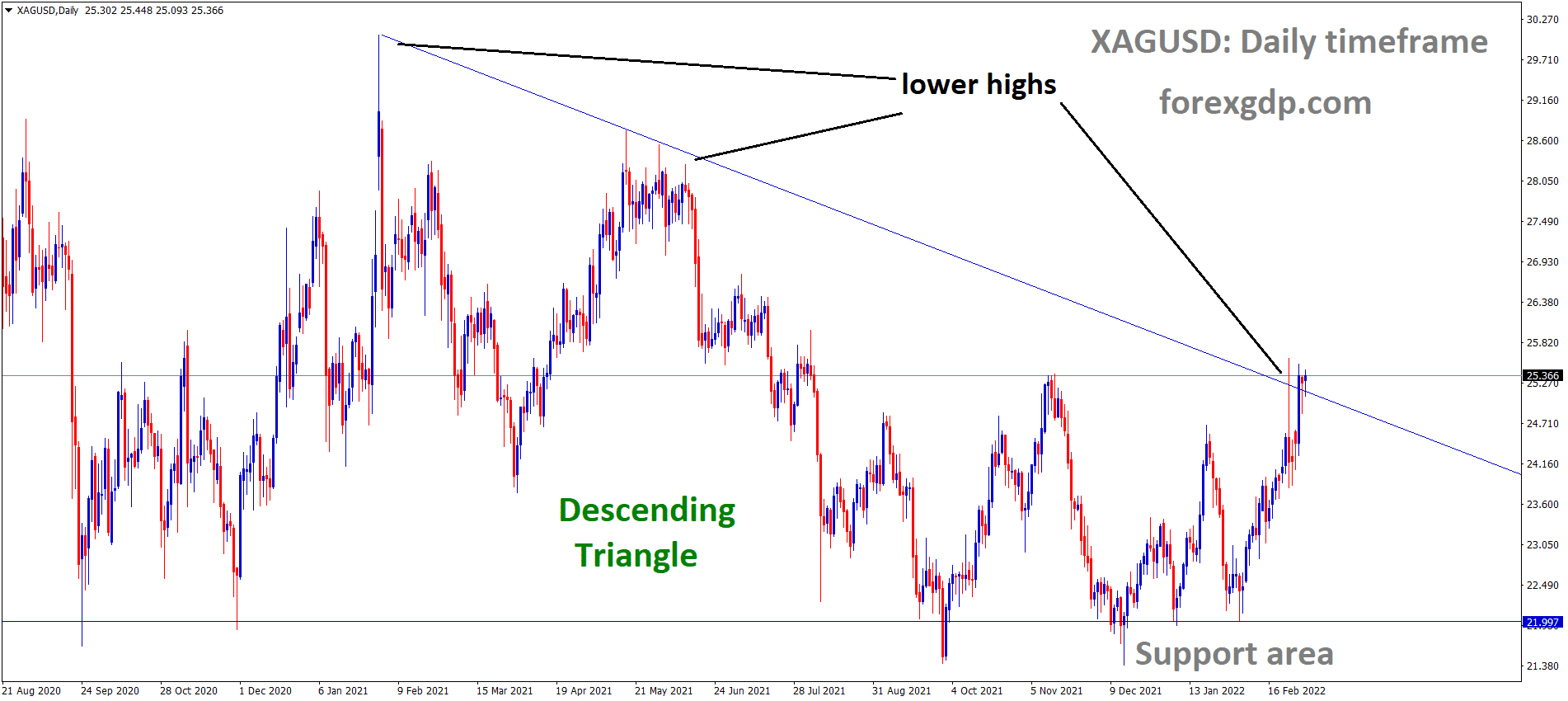

XAGUSD Silver Price is moving in the Descending triangle pattern and the market has reached the lower high area of the Triangle pattern.

USD ADP Non-Farm Employment change came at 475K versus 378k expected.

And FED Chair Powell testifies happened last day, and Assurance of 25bps rate hike on March’16 meeting is given.

But Aggressive rate hikes have not been expected in upcoming meetings.

Gold prices are decreasing due to FED Chair Powell’s testimony, and the Russia and Ukraine War make a demand for Gold prices higher.

And NFP report expected to 400k versus 467k previous reading and more than expected data came then gold prices drive the directions.

US Dollar: Russian Foreign Deputy minister speech

USDCHF is moving in an ascending triangle pattern and the market has rebounded from the higher low area of the pattern.

Russian Deputy Foreign minister said Russia has prospects for Negotiations in Belarus for Talks with Ukraine.

And Russia has the proper communication channels with Western countries.

Ukraine has a stronger presence in Kharkov, Chernihiv and Mariupol.

But Russian Military advances on Kyiv and more tough to battle in 3 days.

Fed Chair Powell’s testimony shows a positive tone

US Dollar index went for correction after hitting the peak of 97.80 area.

And FED Chair Powell intimates 25bps rate hikes is possible in March monthly meeting, now 98% Polls from 67% Polls suggested for 25bps rate hike.

Russia and Ukraine War escalated, and due to this scenario, Energy prices to soar, Commodity prices like Wheat will be flying.

Last day ADP Non-Farm employment shows robust numbers, and US FED Powell testimony gives US Dollars a positive tone.

EURO: Hungarian President Speech

EURCAD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

Hungarian President Viktor Orban said war is an unacceptable Tool for any disputes, So Hungary does not help Russia with EU Sanctions.

And Hungary is driving for World Peace and Europe peace, not for combat against each country.

We have maintained good relations just before the war, but now it seems a different scenario.

And Hungary is ready to help Ukraine in talks with Russia. Provide humanitarian support, and Let in all refugees from Ukraine.

UK Pound: Domestic data came lower than expectations

GBPJPY is moving in an ascending triangle pattern and the market has rebounded from the higher low area of the Triangle pattern.

UK Pound in Consolidation mode due to no clearance for trend.

And today, Composite PMI and Services PMI for February month came lower than expected, 59.9 vs 60.2 and 60.5 Vs 60.8, respectively.

Europe is a more suffering Country than the UK due to Western countries imposing massive sanctions on Russia on Energy sectors.

And Natural Gas accounted for 40-50% of Russia’s Pipeline to Europe before the war; now, it is stopped due to the War crisis.

Europe now Demanded Other counties like the US for Energy supplies.

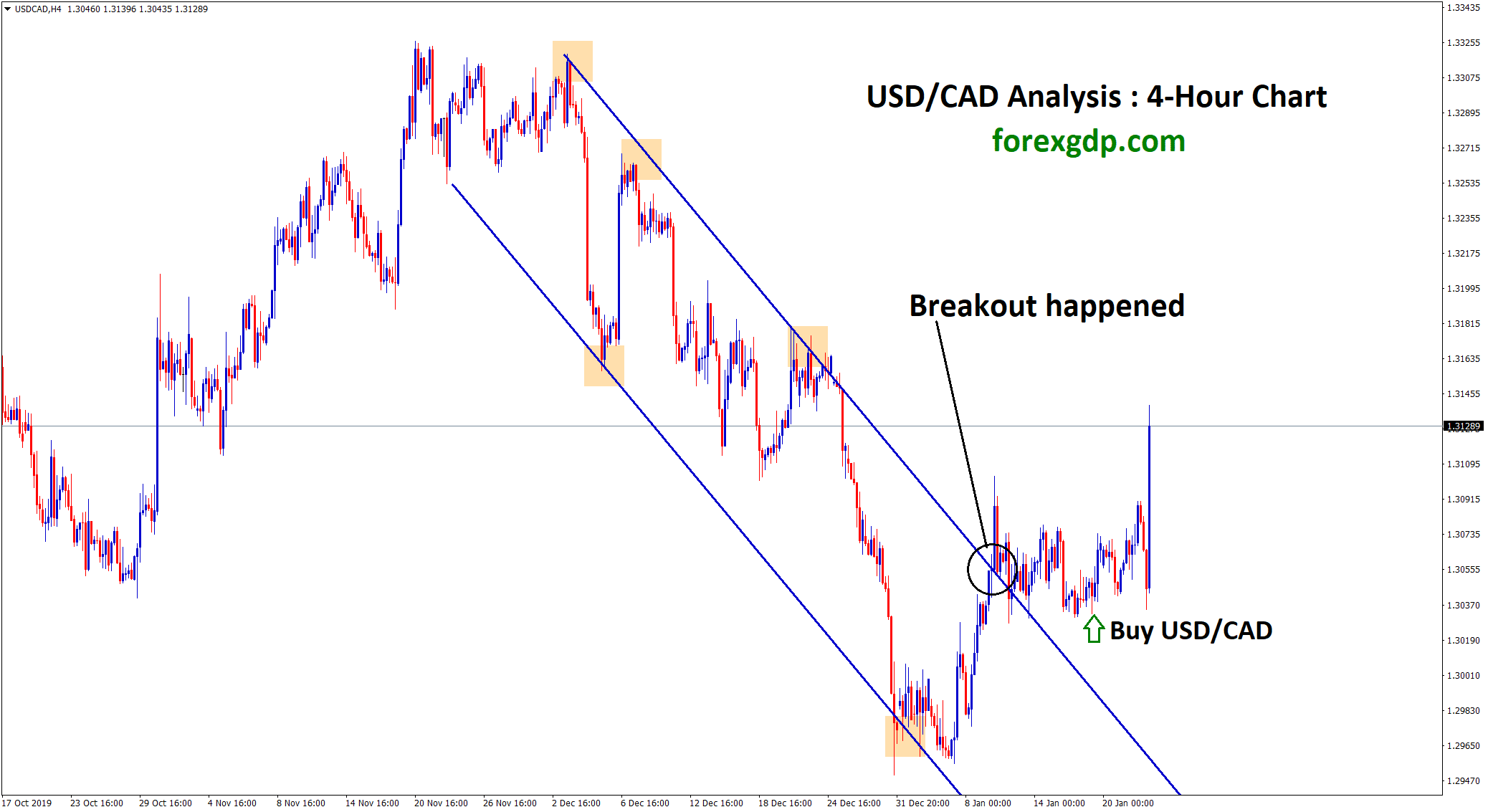

Canadian Dollar: Bank of Canada hiked interest rates

AUDCAD is moving in the Descending channel and the market has reached the lower high area of the channel.

Bank of Canada Hikes interest rate by 25bps to 0.50% from 0.25%.

And Canadian Dollar has Double support from Domestic data and foreign data like Crude Oil prices surges.

Crude oil touched the price of $114 due to More sanctions on Russia, and revenge from the Russian side is possible.

And Alternative sources are OPEC countries increasing output and the US Raising its output shales.

Canadian Dollar soaring against USD due to interest rates rose by Bank of Canada last night.

Japanese Yen: Bank of Japan Board member Nakagawa Speech

CHFJPY is moving in the Symmetrical triangle pattern and has reached the Resistance area of the Box pattern and Symmetrical triangle pattern.

Bank of Japan monetary policy board member Junko Nakagawa said the War between Russia and Ukraine does not directly hurt the Japanese economy.

But European economy was hit by Ukraine and Russian War due to Natural Gas and Oil prices steeped higher in the market.

Due to this, Energy prices and Grains received from Europe makes Japan pay higher prices than Normal.

This, in turn, raised the inflation reading in Japan; inflation in Japan is quite below 2%, Now it seems to achieve the 2% inflation goal quickly.

And Bank of Japan not to aim for 2% inflation goal but to economic recovery in the path and all household and corporate profits to increase.

Australian Dollar: Australian GDP came in Robust numbers

AUDJPY has broken the Symmetrical triangle pattern.

Australian GDP Q4 came at 3.4% versus -2.7% forecast and previous reading -1.9% printed.

And Commodity prices are increasing higher, Australian Trade Surplus increased to A$12 billion.

Crude oil hits 114.83bbl as 2011 highs and Russia Versus Ukraine War continues and Non-Stop progressing, Today Talks Between Ukraine and Russia happening on Poland Border.

Russia’s invasion of Ukraine made Oil prices higher, and More countries are Banning Exports from Russia; energy prices are driving higher due to the demand of buyers increasing more.

New Zealand Dollar: Russia captured the Kherson area in Ukraine

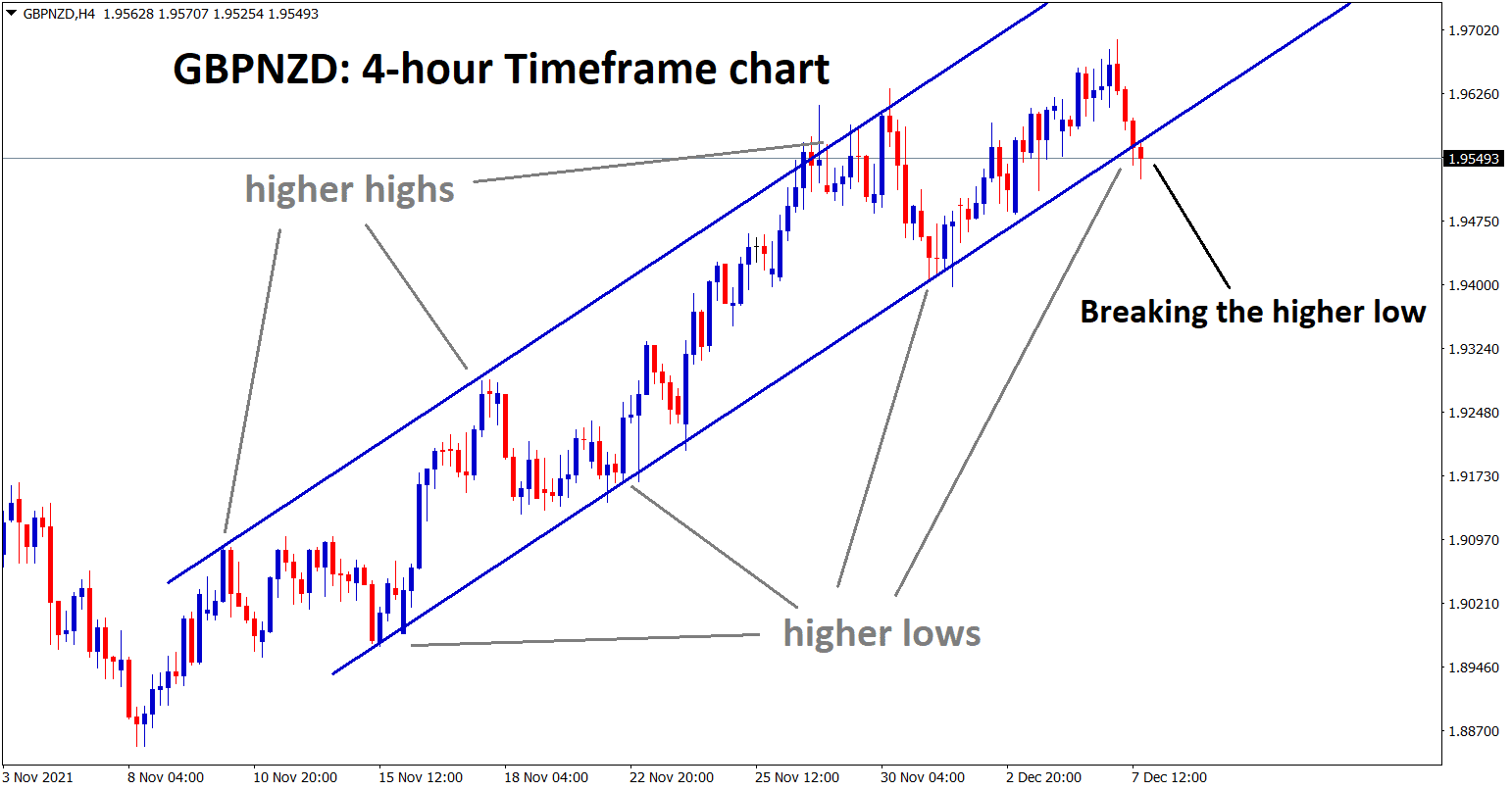

GBPNZD is moving in the Descending channel and the market has reached the lower high area of the channel.

New Zealand Dollar gains are capped amid Ceasefire talks between Russia and Ukraine that were started today.

But Russia has intensified on Bombardments in Ukraine cities captured the Black Sea port of Kherson.

And Russia invading Ukraine progressing in 8th day and New Zealand Dollar rises as commodity prices are soaring higher.

The inflation reading surges at the Global level as Energy prices shoot up aggressively.

Swiss Franc: Swiss CPI beat expectations

AUDCHF is moving in the Descending triangle pattern and the market has reached the lower high area of the Triangle pattern.

Swiss Consumer price index YoY came at 2.2% versus 1.8% and 1.6% previous reading.

And CPI (MoM) came at 0.70% versus 0.30% expected and 0.20% previous reading.

The war between Russia and Ukraine makes Oil prices costs higher, so Energy prices are soaring, reflected in the CPI prices of the Swiss Zone.

FED Chair Powell’s testimony gives Confident in the 25bps rate hike in March instead of the 50bps hike expected.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade setups at Premium or Supreme plan here: https://signal.forexgdp.com/buy/