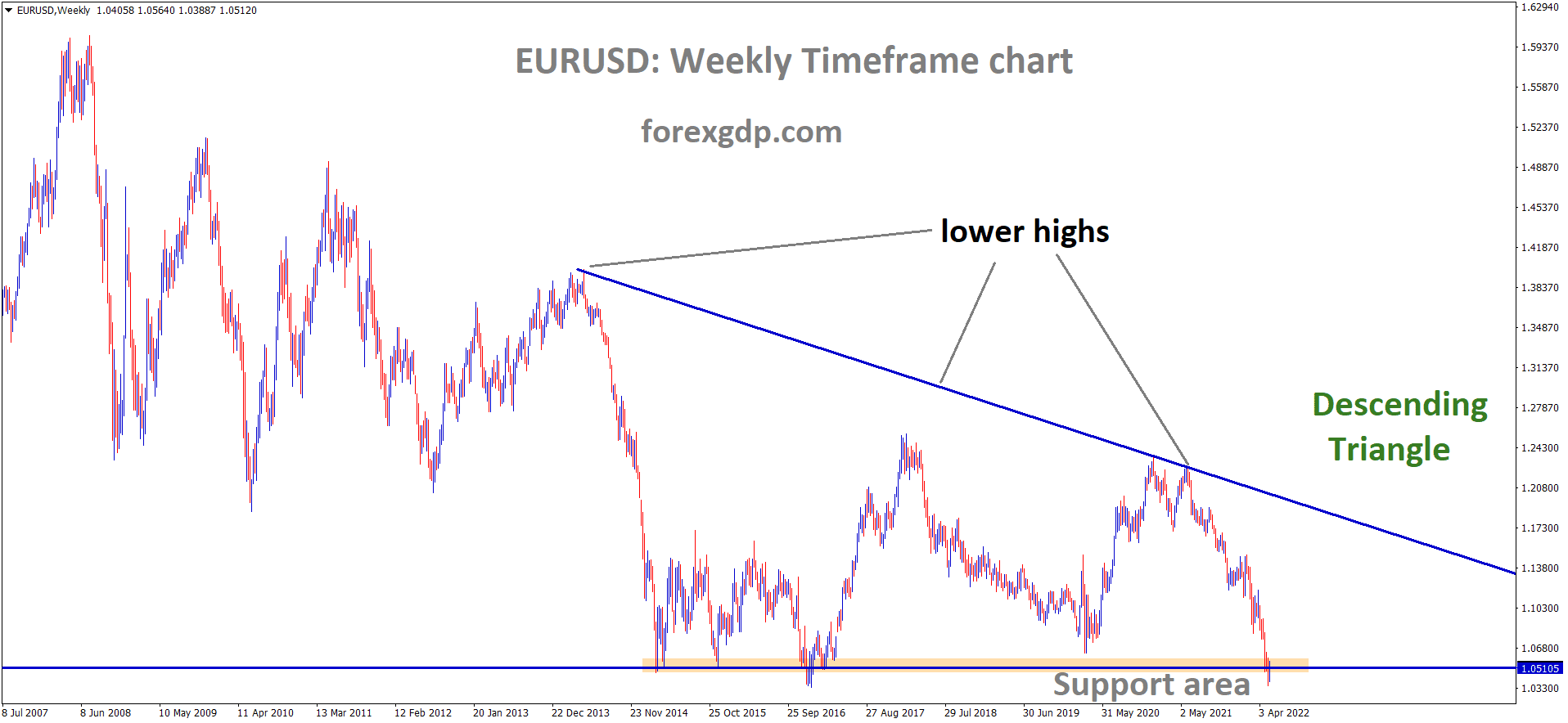

EURUSD is moving in the descending triangle pattern and market has reached the support area of the pattern.

Where Is The EURUSD Today

The EURUSD currency pair is struggling to stay above support levels following the release of the EU’s CPI data report. Looking at each of the time frames, it is evident that this major pair is currently entering bearish market conditions as a result of the worse than expected CPI report.

EURUSD is moving in the ascending channel and market has reached the higher low area of the channel.

We can see that every now and then, the pair seems to recover slightly before falling back under hot waters. Just today, we have seen the EURUSD pair fall as low as 1.04 but has since slightly recovered and is now teasing around the 1.05 region. At the moment, it seems as though this pair may continue to fall or struggle to hold at support. It is very unlikely that this pair will begin an upward trend into bullish markets.

The EU CPI Data Report

The EU released their CPI data early on Wednesday which didn’t look very promising. In fact, it is really bad news for the European Union. The Consumer Price Index measures the change in price of goods and services from the perspective of the consumer. It is a great way of reading the current inflation situation in the economy. If the reading comes back greater than expected, it means the economy is improving and thriving. However, if it comes back lower than expected, it means that the economy is really struggling and inflation is getting out of hand. The EU’s CPI data revealed a rate of 7.4% which is lower than the expected 7.5%. This is bad news for the EU as it reveals that inflation is getting out of hand. Euro markets are expected to witness entering bearish market conditions.

Analysts at FxStreet have broken down the main points from the CPI report and reveal, “The lowest annual rates were registered in France, Malta (both 5.4%) and Finland (5.8%). The highest annual rates were recorded in Estonia (19.1%), Lithuania (16.6%) and Czechia (13.2%). Compared with March, annual inflation fell in three Member States, remained stable in two and rose in twenty-two.

EURUSD is moving in the descending channel and market has reached the lower high area of the channel.

In April, the highest contribution to the annual euro area inflation rate came from energy (+3.70 percentage points, pp), followed by services (+1.38 pp), food, alcohol & tobacco (+1.35 pp) and non-energy industrial goods (+1.02 pp). The bloc’s HICP rose by 0.6% versus 0.6% expected and 2.4% booked in March while the core HICP numbers also came in at 1.0% versus 1.1% expected and 1.1% seen previously.”

Where Is The GBPUSD Today

The GBPUSD currency pair is struggling to stay above support levels following the release of the UK’s CPI data report. Looking at each of the time frames, it is evident that this major pair is currently entering bearish market conditions as a result of the worse than expected CPI report.

GBPUSD is moving in the ascending channel and market has reached the horizontal support and higher low area of the channel.

We can see that every now and then, the pair seems to recover slightly before falling back under hot waters. Just today, we have seen the GBPUSD pair fall as low as 1.23 but has since slightly recovered and is now teasing around the 1.24 region. At the moment, it seems as though this pair may continue to fall or struggle to hold at support. It is very unlikely that this pair will begin an upward trend into bullish markets.

The UK CPI Data Report

While several major countries are slowly coming out with their CPI data, it is becoming quite evident that the UK has taken the brunt of the impact. The UK’s CPI data was revealed earlier today which showed that inflation is now at 9%. This is the highest levels it has seen in over 40 years. The last time the inflation was at this rate in the UK was back in 1992. This is way more than the 7% levels we saw just last term in March. Most people don’t realize how bad this rate is for the UK and its citizens. To put it into perspective, nearly a quarter of the Brits have resorted to skipping meals simply because they can no longer afford it. It is quite horrific how people who were quite well-off prior to inflation are now struggling to put food on the table. The Bank of England seems to not take this crisis as seriously as they should be as the citizens are struggling and there’s nothing that seems to be done about it.

Richard Carter, Head of Fixed Interest Research at Quilter Cheviot has revealed, “Unlike in the U.S., U.K. inflation continues to rise for the time being, stoking further fears around the cost of living. It will also add to the pressure on the Bank of England to increase interest rates and get to grips with soaring prices even if, as they admit themselves, many of the factors driving inflation are beyond their control.

GBPUSD is moving in the ascending channel and market has reached higher low area of the channel.

Further pressure is likely to mount on the British government to pull fiscal levers and look to “alleviate the pain on households come the Autumn.” Ambrose Crofton, Global Market Strategist at JP Morgan also reveals, “For the first time since records began, there are fewer people unemployed than there are job vacancies and the unemployment rate now sits at a nearly 50-year low, and workers are capitalizing on their increased bargaining power to ask employers to raise pay to cope with higher living costs, with wage growth now running at 7%. The risk is that should [the Bank of England] raise interest rates too quickly at a time when consumers are already feeling the pinch, then this could crimp demand and push the economy into recession. Doing too little, however, risks entrenching inflation expectations and driving a more persistent wage-price feedback loop.”

Upcoming Important Events

There are a couple of upcoming important events that we need to keep an eye on. Any second now, we are expecting the release of Canada’s CPI report. As every other country that has released their report so far has revealed to be worse than expected, we expect the same for Canada as well.

Later today, the US will also reveal their crude oil inventory levels in order to find out how bad of a shortage we could be facing as a result of supply chain issues around the world. Tomorrow, the US will also reveal their Initial Jobless Claims report which shows how many people filed for unemployment insurance for the first time. It is a good measure of the health of the job market in the country.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade setups at Premium or Supreme plan here: https://signal.forexgdp.com/buy/