Gold: Ukraine President Agreed for Diplomatic solution with Russia

Today US CPI rate is expected at 7.4%, and in 1982 CPI rate was 8.4%, so after 40years, CPI rates are increasing higher month on month.

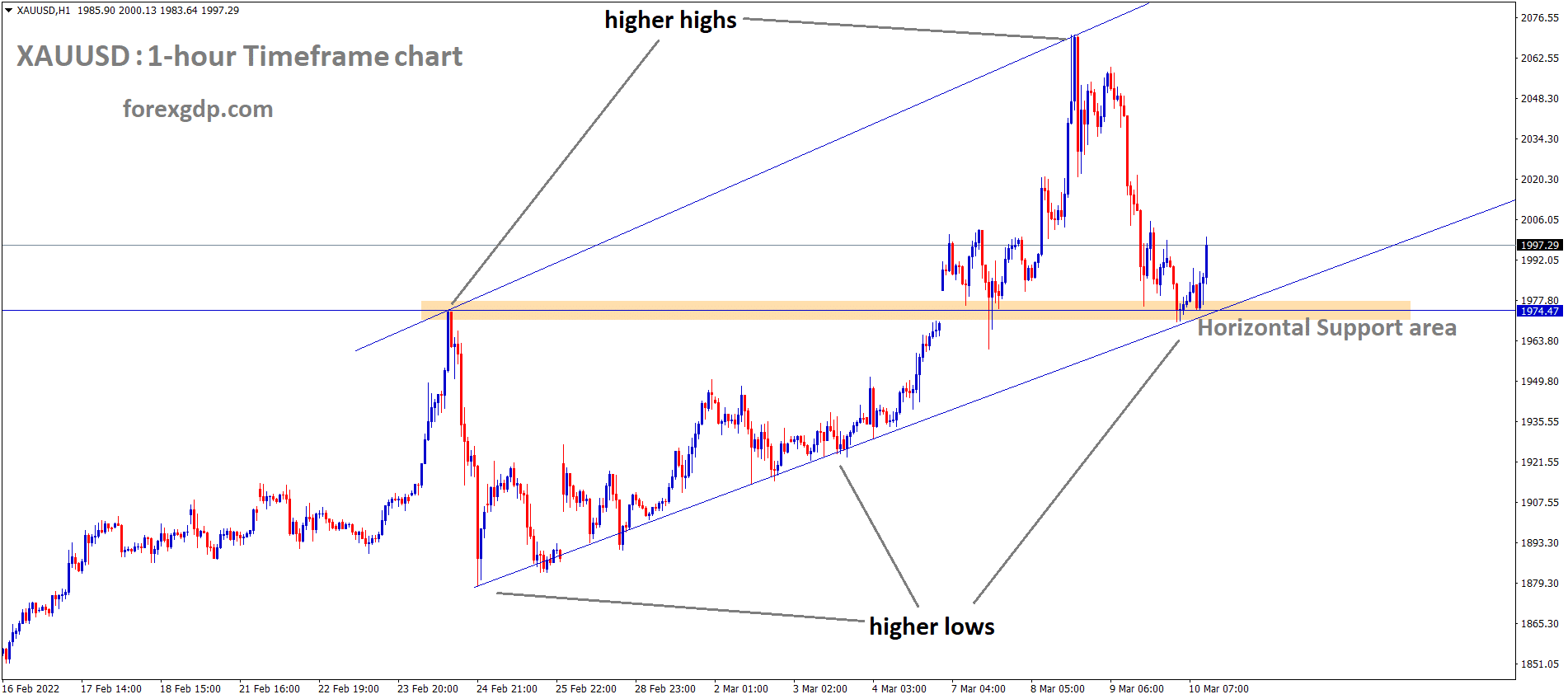

XAUUSD Gold price is moving in an Ascending channel and the market has rebounded from the higher low and Horizontal Support area of the Ascending channel.

Gold prices pull back over 100$ from the August 2020 highs after Ukraine’s President agreed to a diplomatic solution with Russia.

And this news makes optimism felt for investors and Traders in the market, and Riskier currencies moved up, and Safe Haven currencies like Gold USD fell.

In Next week’s FED Meeting, we can expect rate hikes.

If the rate hike is done, the inflation reading will be partially lower; if not, inflation will soar too high.

US Dollar: US CPI Forecast

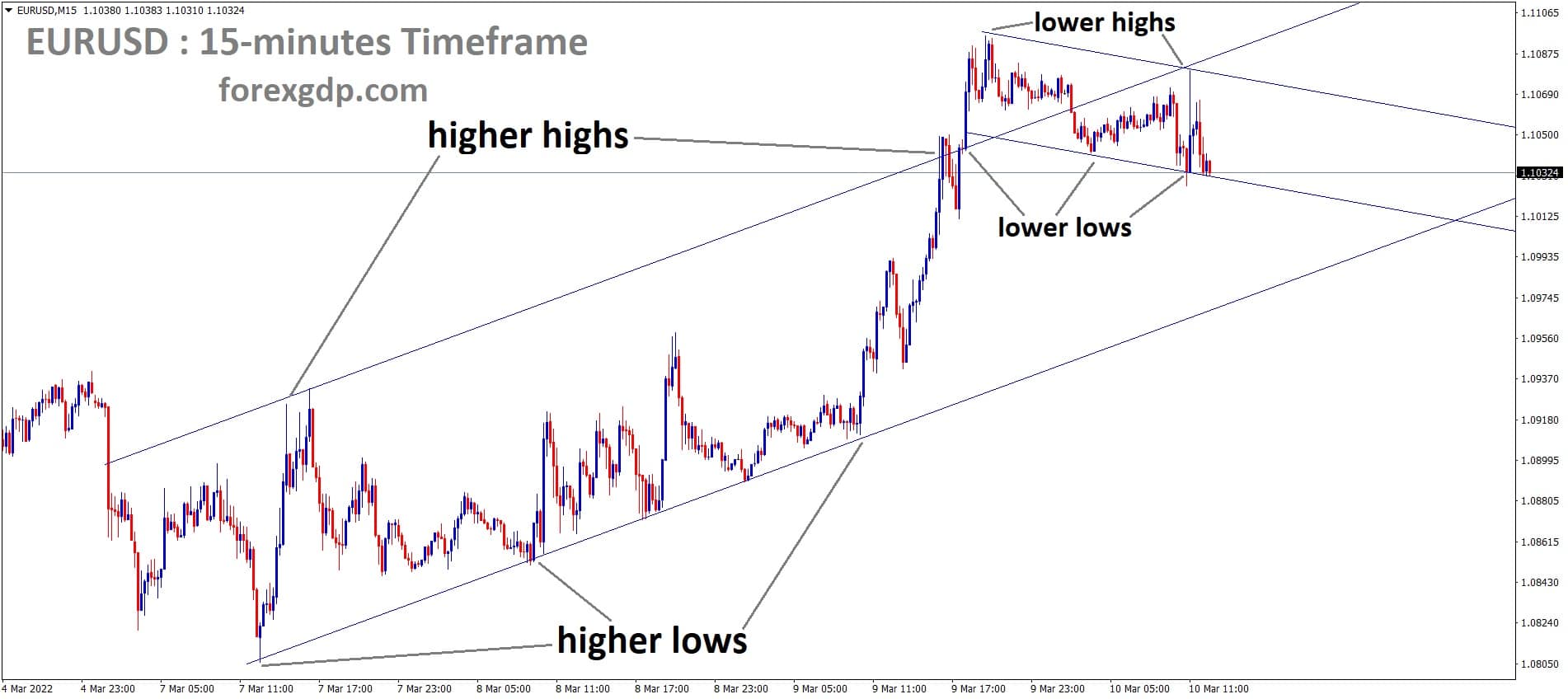

EURUSD is moving in an Ascending channel and the market has fallen from the higher high area of the channel; the market has reached the lower low area of the Minor Descending channel.

US Dollar index fell about 1% pullback as Ukraine President said we could talk for Diplomatic solutions to end the War.

This speech made calm in Commodity markets and Cheered up Riskier currencies.

ECB meeting scheduled today and expected no changes in Interest rates.US CPI data yet to be released now and expected 0.4% above from Last month this time.

Larger than expected CPI makes US Dollar slight weakness this week.

EURO: ECB Monetary Policy meeting Forecast

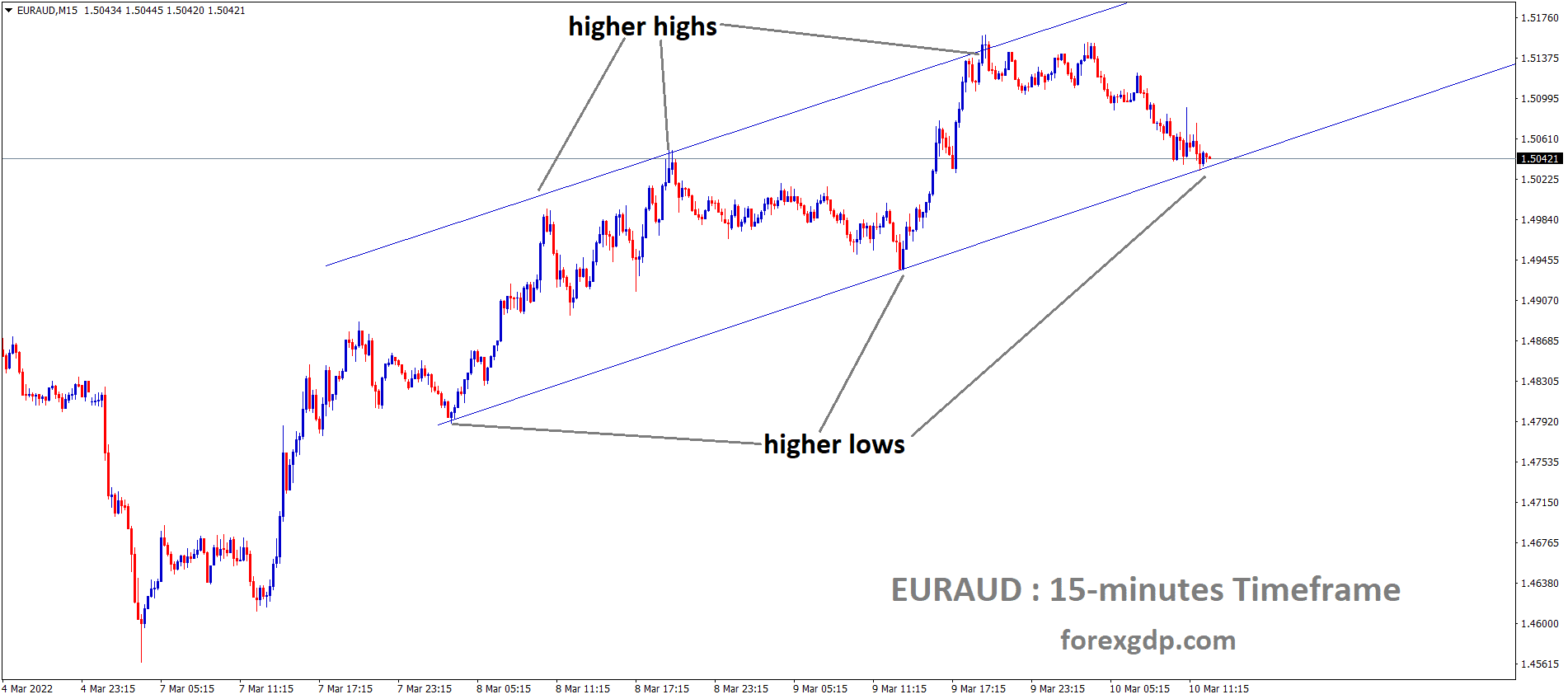

EURAUD is moving in an Ascending channel and the market has reached the higher low area of the Ascending channel.

Ahead of ECB monetary policy meeting, EURGBP marked to 0.8400 area, and No changes in the rate of interest are expected, but any increasing stimulus for the Economy is expected.

And Soaring Oil and Natural Gas prices make Energy inflation in Europe rise day by day.

Public spending Energy expenses more from pockets, and this must be controlled by making more purchases from Russia.

And Germany has to allow Nord 2 stream for better compensation for the current oil and Natural Gas shortage in Europe.

And the US already sanctioned Russian Oil imports, But the EU and UK do not commit to the Sanction of Oil.

UK Pound: Two countries foreign minister arrived in Turkey for Talks

GBPUSD is moving in an Ascending channel and the market has reached the higher low area of the Ascending channel.

Russian Foreign minister Sergey Lavrov and His Ukrainian Counterpart Dmytro Kleba have arrived in Turkey for Talks. This news calms down the riskier currencies like EUR, GBP and AUD, NZD.

And now UK Pound rebounded after the news was released and directed towards the next resistance area of 1.3200.

Brexit Talks are still open, and no compromise deal has not yet been reached.

Now Hot news is Russia and Ukraine War; So UK and EU have postponed the Brexit talks to later next week, Now Oil imports from Russia are planning to avoid a shortage of Supply.

And Ukraine President announced a Diplomatic solution to talk to end the War, and So Two countries minister first-time talks in the Turkey region.

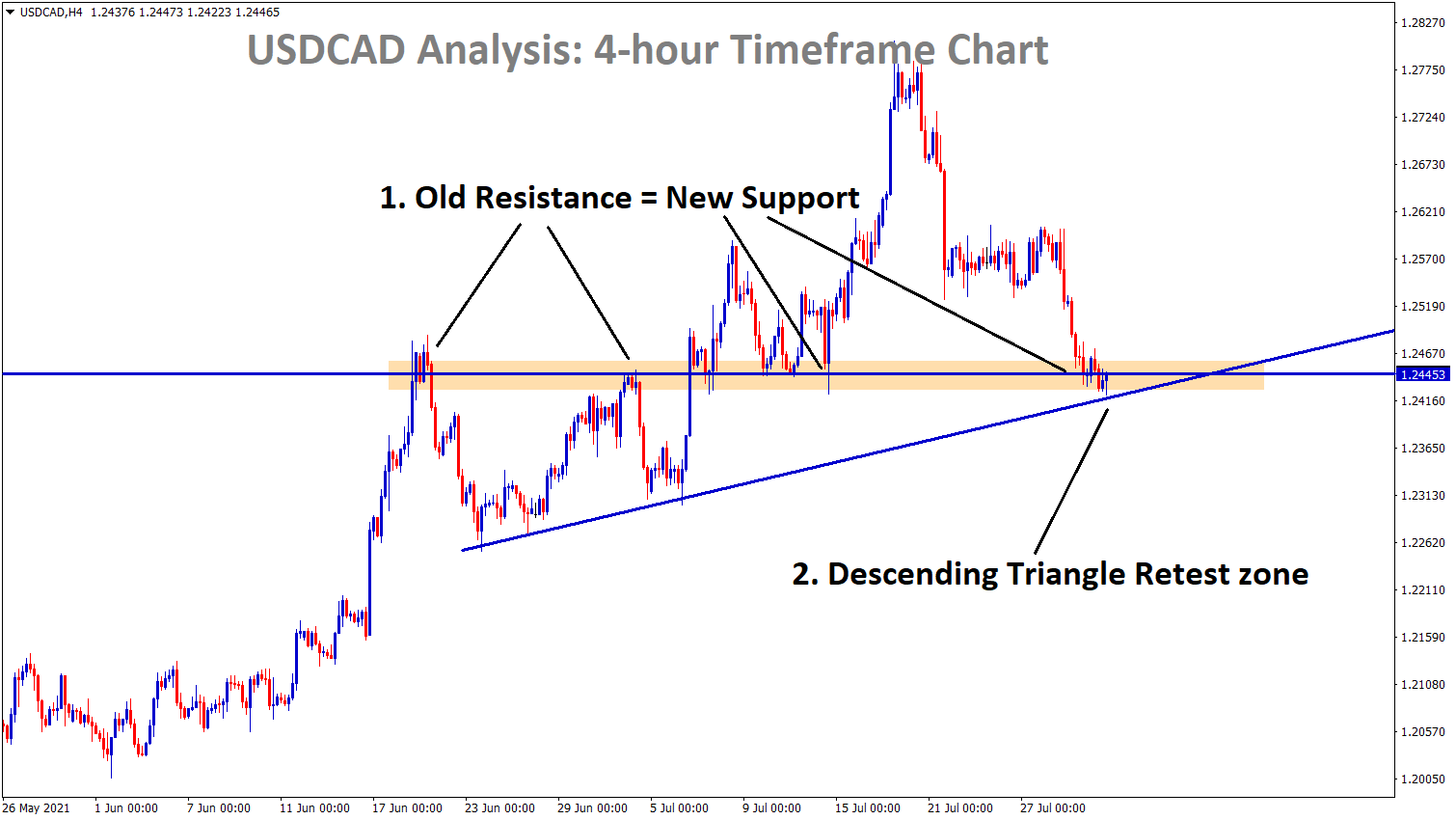

Canadian Dollar: Oil prices declined after Optimism Talks from Ukraine

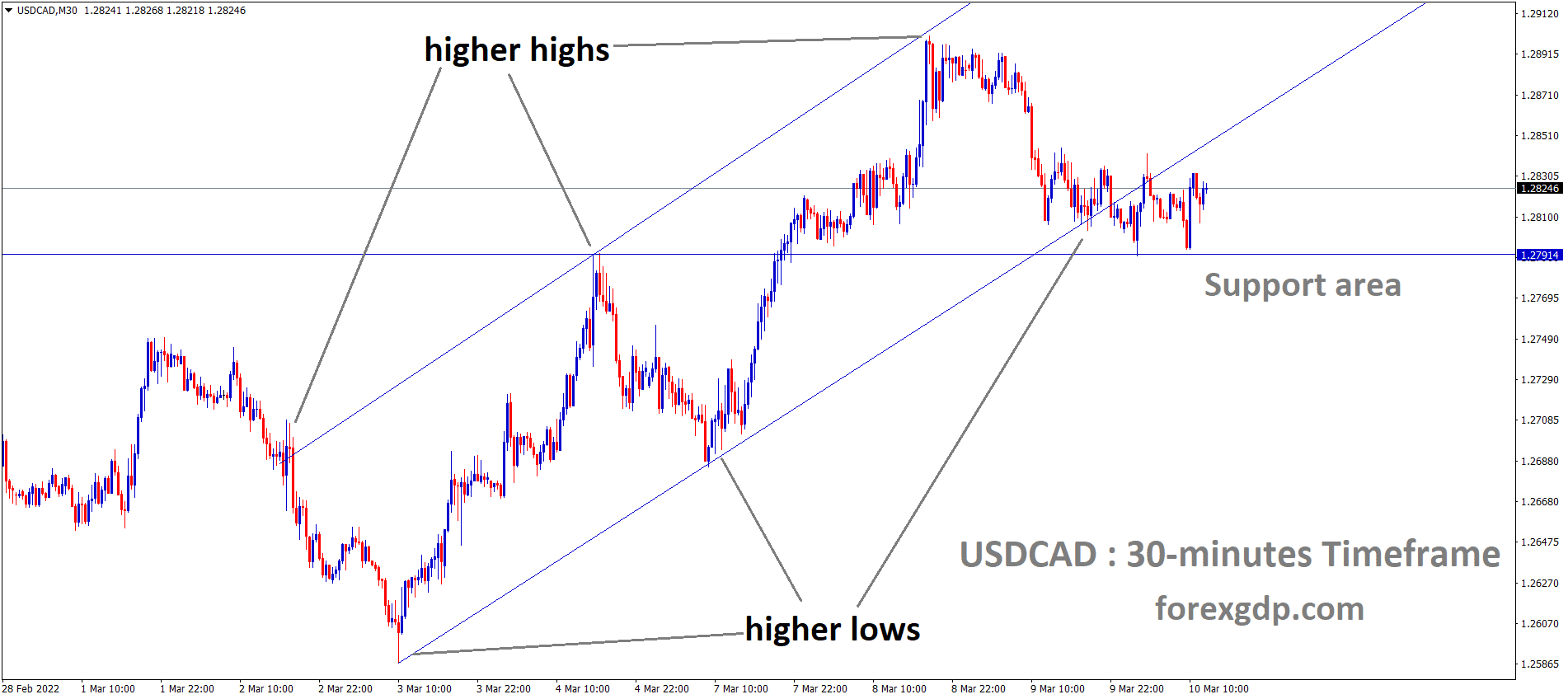

USDCAD is moving in an Ascending channel and the market has rebounded from the Horizontal Support area of the Ascending channel.

Oil prices declined to 103$ from highs of 129$ nearly 26$ fall in a single day after compromising talks expected from Ukraine and Russia.

Ukraine President announced we soon arranged for Diplomatic talks with Russia to end the War.

So Two countries foreign ministers arrived in Turkey for Talks.

Canadian Dollar Declines as Oil prices are decline over Optimism in Ukraine and Russia War.

And US CPI data scheduled this week, expected to be above 0.40% this time.

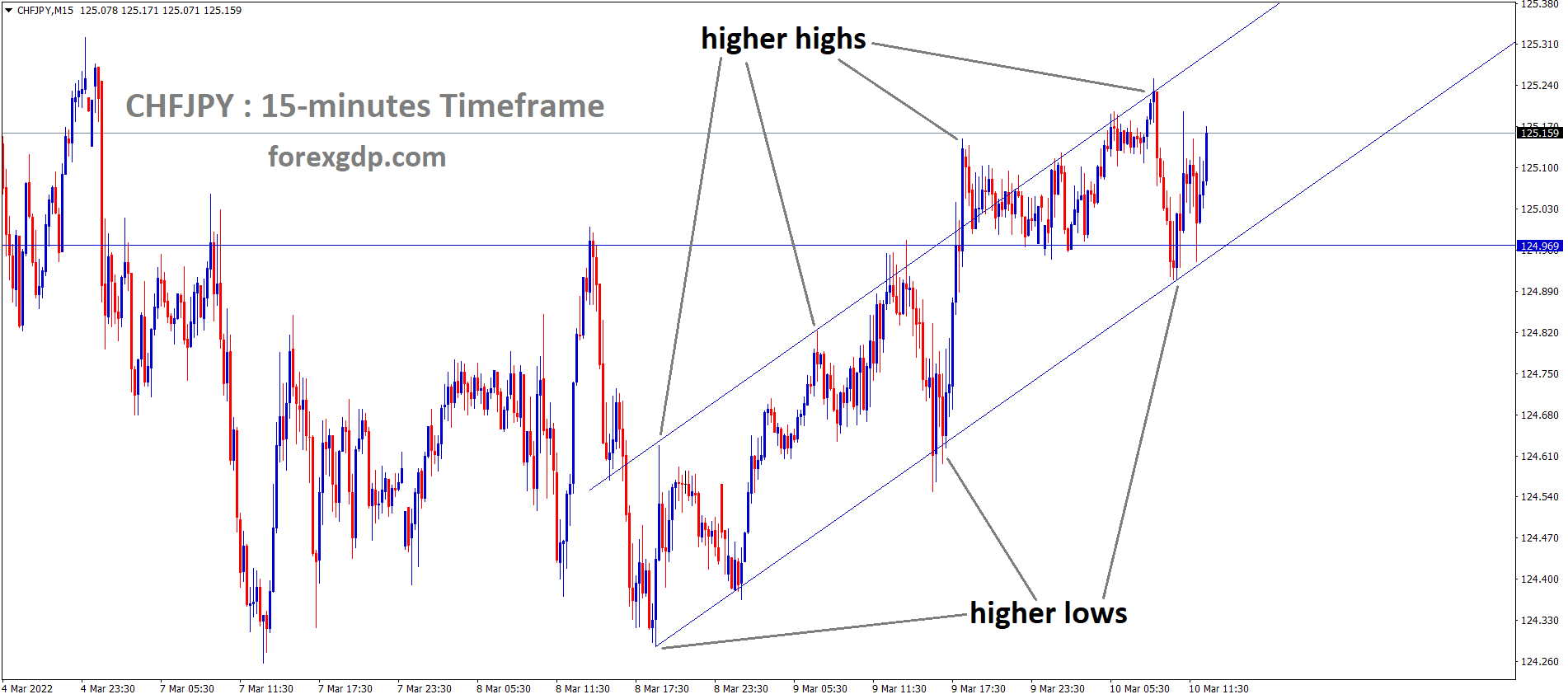

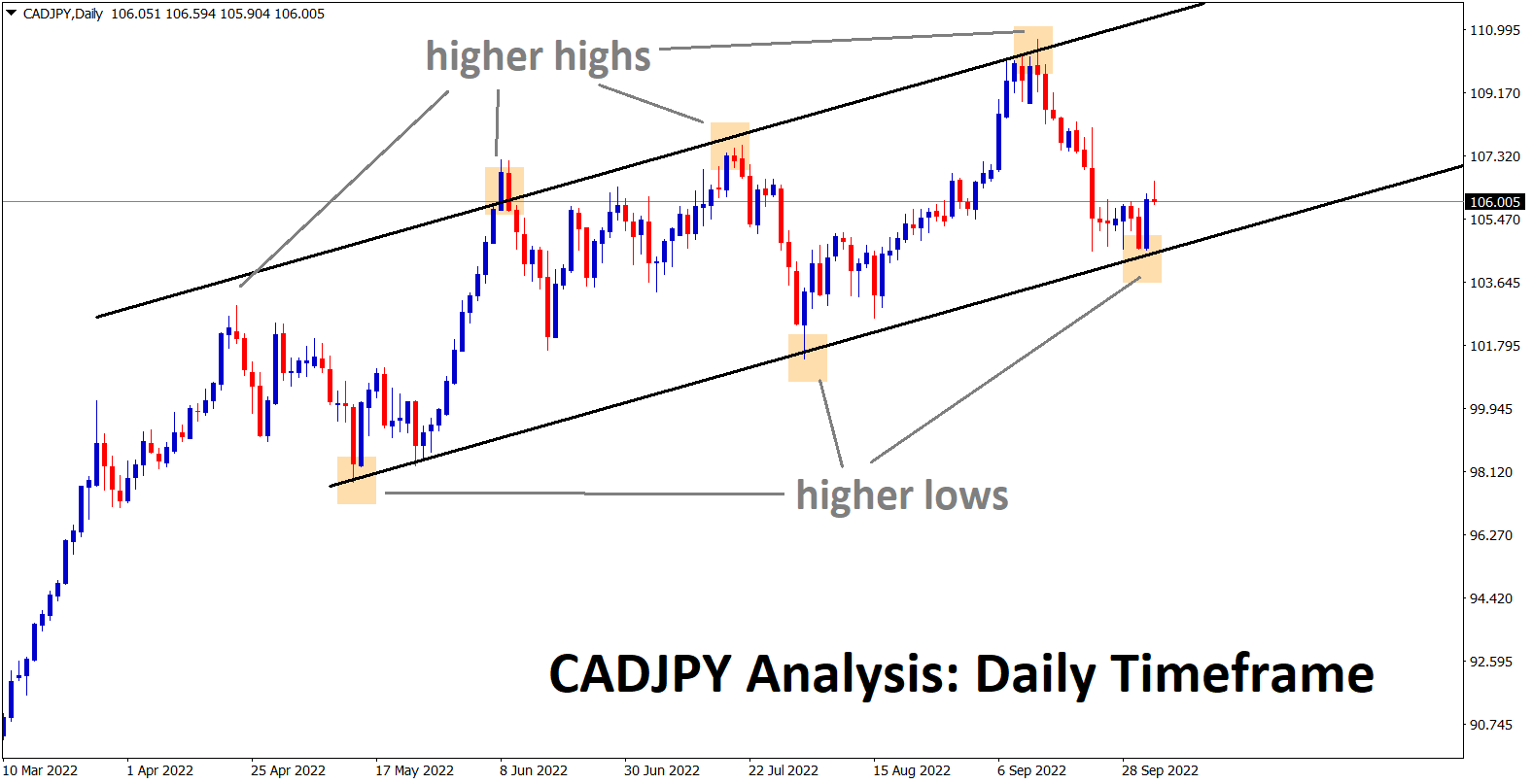

Japanese Yen: Energy prices make inflation higher in Japan

CHFJPY is moving in an Ascending channel and the market has rebounded from the higher low area of the Ascending channel.

Japanese Yen declines as optimism grow over Russia and Ukraine agreed for Diplomatic talks in Turkey.

So Japanese Economy will face more inflation due to energy prices soaring, and Wage hikes are not expected.

And Japanese Economy inflation target of 2% was achieved only by average business Growth and Wage hikes consequences by growth.

But now, the situation is different from the goal of the target.

If inflation is achieved 2% by energy prices soaring, more stimulus has to inject and compromise the Energy prices.

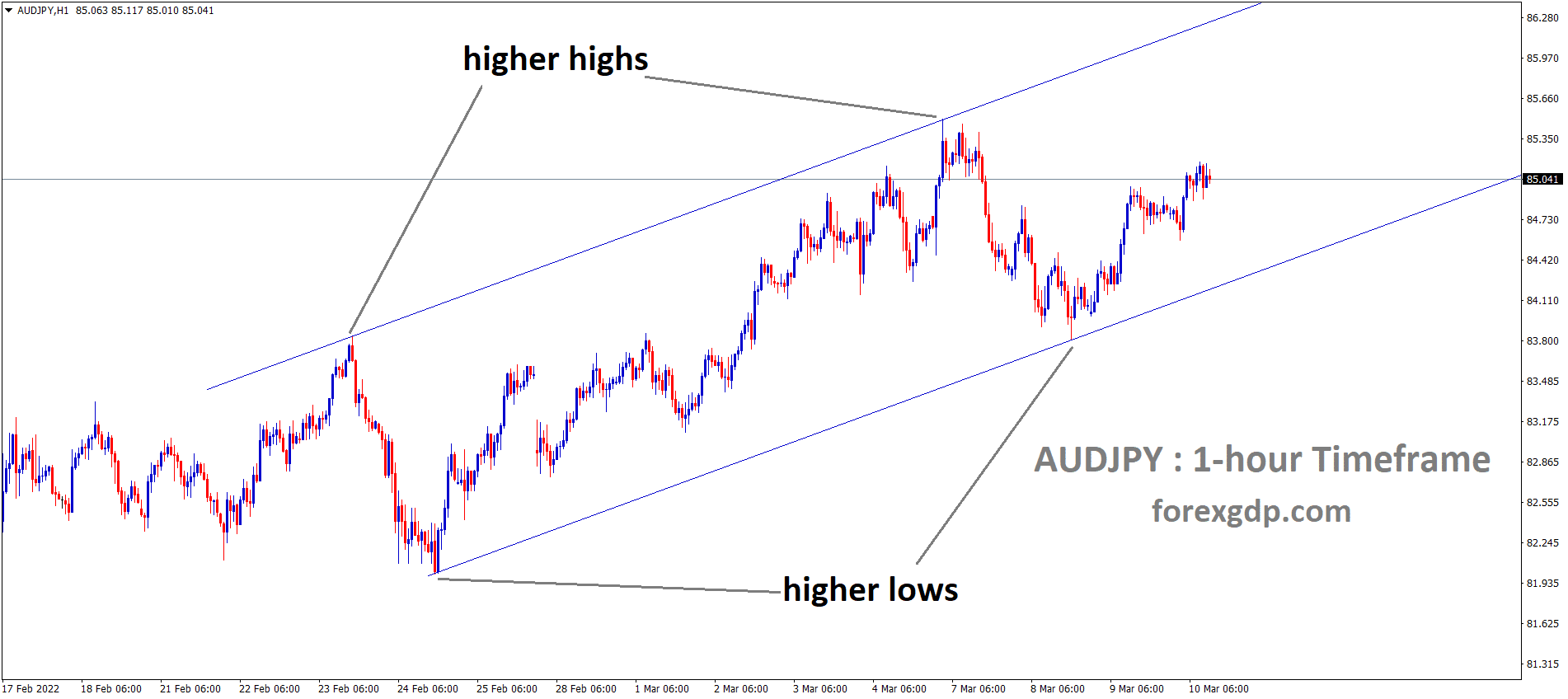

Australian Dollar: RBA expected to 2time rate hikes in 2022 as per Goldman Sachs’s expected

AUDJPY is moving in an Ascending channel and the market has rebounded from the higher low area of the Ascending channel.

According to Goldman Sachs, analysts expected RBA to deliver Two consecutive rate hikes in August and September.

The main reason is inflation soaring higher due to the Russian invasion of Ukraine, oil prices soaring, and Major floods across Australia’s Eastern Coastline; this suggested that the annual Growth of CPI will be 5.3% by June 2022.

And the trimmed mean shows 3.9%, but the RBA target is 2-3% until early 2023 and 2.6% at the end of December.

The third-rate rise may be in November month, and RBA tightening cycle ends in the third quarter of 2024, and the Cash rate is 2.5% at the time completing the Tightening process in 2024.

Moody’s investor services predicted Australian mortgages are safe.

Moody’s investor services said Australian Mortgage delinquencies are normal not to panic.

And Mortgage delinquencies will hold in 2022 as Economy conditions stabilize.

Australian Economy shows Robust recovery from Covid-19 Crisis and Now just in consolidation mode.

And the GDP will grow to 3.5% in 2022 and support steady Mortgage performance.

New Zealand Dollar: RBNZ expected to do Consecutive rate hikes on the rise of Energy prices

NZDUSD is moving in an Ascending channel and the market has rebounded from the higher low area of the Ascending channel.

New Zealand Dollar rise as Ukraine’s president agreed to compromise with Russia via a Diplomatic solution.

New Zealand Exports were improved, and China’s manufacturing activity was higher as Iron ore prices soared.

US CPI data is yet to release today, and the expected data is a Four-decade year high reading of 7.4%.

US Initial Jobless claims are set to release, and more positive data will be a Favour for New Zealand Dollar.

RBNZ will do consecutive rate hikes in the next meeting because Oil prices are soaring, making Inflation rise in the New Zealand economy

Swiss Franc: Optimism favours riskier currencies and Drags the Safe Haven Swiss Franc

USDCHF is moving in the Descending triangle pattern and the market has reached the lower high area of the pattern.

Swiss Franc drives higher against USD after optimism grew over Ukraine and Russia.

And Swiss Franc is the Safe Haven currency, and due to crisis time, Prices are soaring and will fall if the crisis goes down.

US CPI data and initial Jobless claims data are yet to release.

And US Dollar shows pull back from high and Next week FED meeting 98% of Polls suggested 25bps rate will be happening in next week.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade setups at Premium or Supreme plan here: https://signal.forexgdp.com/buy/