Gold: FOMC meeting disappointed gold prices

Gold Dropped to 30$ from highs last night due to FOMC firm decision on rate hikes forecast and US GDP data scheduled today.

XAUUSD Gold price has fallen from the lower high area of the Descending triangle pattern.

And FED Powell said inflation picked higher is more worry for US Economy, once rate hikes and tapering is done, inflation will automatically come down.

And FED Powell said inflation picked higher is more worry for US Economy, once rate hikes and tapering is done, inflation will automatically come down.

Supply and Demand mismatch from Covid-19 will be resolved for clear track between Supply and Demand chain will result in Lower inflation numbers.

Gold prices are directly proportional to inflation numbers in the economy; once inflation lowers, gold prices come down.

US Dollar: FED Powell Speech

USDJPY is moving in an Ascending channel and the market has rebounded from the higher low area of the Channel.

FOMC meeting Fed Powell Speech Shows US Economy outlook in stable mode.

Powell said Very Tight Labor market conditions and inflation are very high and will be picked up in the second half of 2022.

And inflation is well above the target of 2% sustaining now, and the Unemployment rate was also well done in Previous months.

And the significant increase in inflation reading controls the wage increasing method.

So Monetary Policy adjustments will control inflation numbers to small and increase the Wages for Employments.

And After completion of Tapering, Rate hikes will be done in consecutive months but not Sure based Upon the Economy data.

Omicron Variant is now Largely caused for the Supply Chain issue, and it will impact the Economy until Full Vaccination does.

And the impact in the Second Half of 2022 and Supply Chain mismatch should be Solved by the end of 2022, and we Hope Supply Chain constraints will solve, and Inflation numbers will get down at the end of 2022.

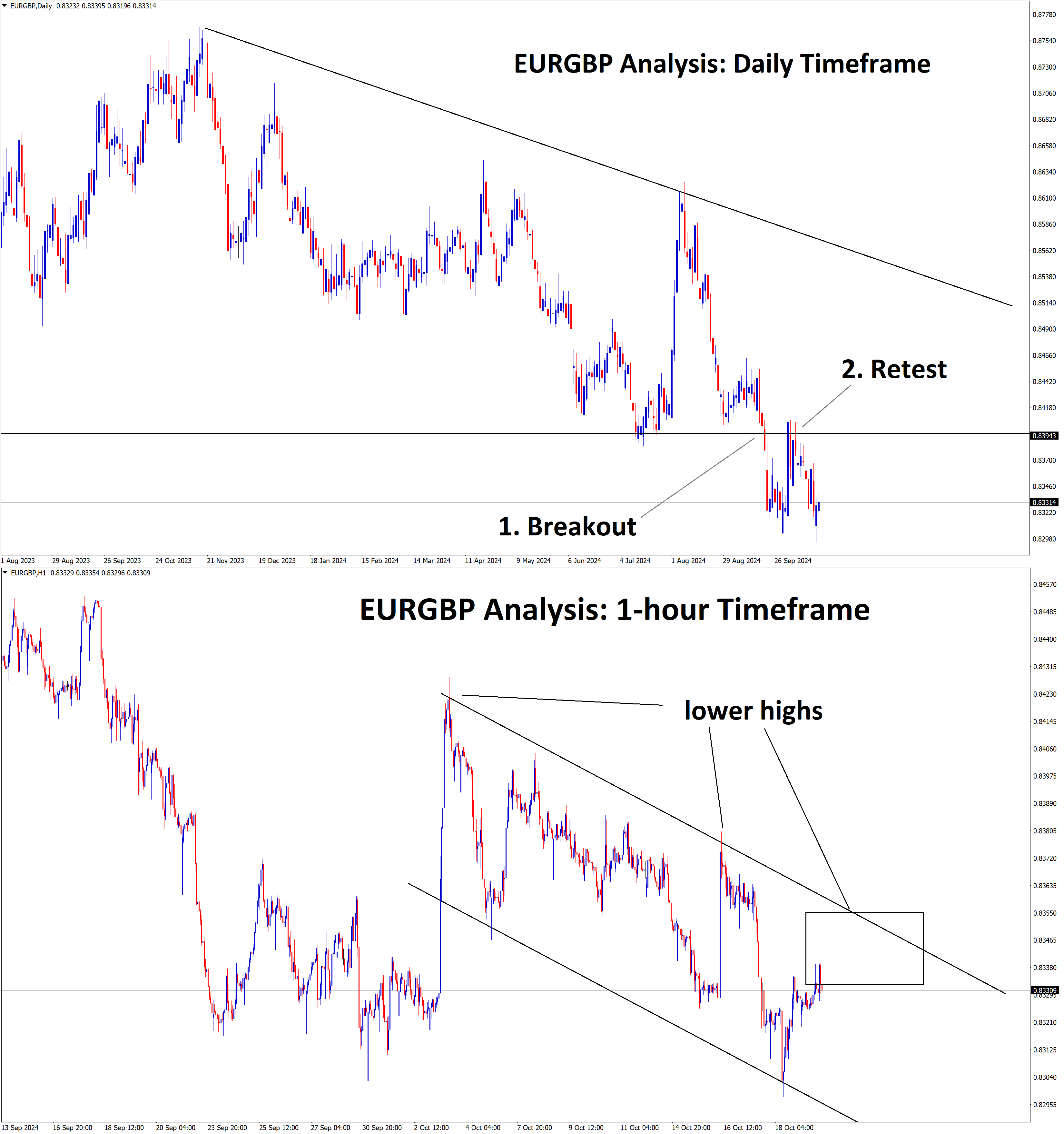

Euro: Russia and Ukraine tensions made Oil demand problem in the EU

Russia and Ukraine tensions show Europe have more burdens on Oil demand and supply disruptions.

Ukraine transit Russia has supplied 11.9 million metric tons to Europe in 2021.

So Any clash between Russia and Ukraine made a heavy impact on Oil Supply in Europe.

The US reported Three straight weeks; Crude oil inventories dropped to a low level.

Next week OPEC+ meeting will decide on the 400K Output increasing idea already discussed in the last meeting.

And If this hike of 400K barrels will compensate Global Supply levels to medium level.

Divergence Polices between US and EU

FOMC meeting concluded and March month set for rate hikes once tapering has been completed,

And ECB may be decided to tapering its net asset purchased from Euro 80 billion per month to Euro 20 billion Per month is possible to control Euro weakness against US Dollar.

The Divergence in Policy settings between US and EU shows more variations in EURUSD price movements.

UK pound: UK PM Johnson anytime resignation is possible

GBPJPY is moving in the Descending channel and the market has reached the lower high area of the channel.

The Position of UK PM Boris Johnson is questionable anytime resignation is feared surrounding UK Pound.

And also FOMC meeting dragged down the UK Pound to 1% lower after the meeting was released.

US 2-year rate jumped to 13 basis points at 1.17%, and 10-year rates ten basis points higher makes Higher selling in Bonds buyers shown.

Today US GDP data will further drive the GBPUSD, and UK Pound moves lower as Political uncertainties happen in the UK.

Canadian Dollar: Bank of Canada Monetary policy decision

USDCAD has broken the Descending channel.

The Bank of Canada Monetary Policy meeting left rates unchanged last night.

And BoC Governor Tiff Macklem said inflation is driving higher, and Omicron weighs on the Canadian economy more.

We proposed Tightening monetary policy settings, but inflation and Supply Chain problems increased more.

And We Think Supply Chain soon be Solved by the end of 2022, and the Way of Solving is in progress.

We Should not make rate hikes or stable based on the Situation; we have to discuss in each meeting based on All Economies issues and then conclude for a rate hike or stable decision.

And this Time, keep rates unchanged and Upcoming meeting in March, we See Any rate hikes as per Bank of Canada Governor Said.

Japanese Yen: Japan reported 70K cases Surpassed till the month

CHFJPY is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

Japan reported 70K cases until this week, and the US warned Russia to scrap the Nordstrom 2 Oil pipeline if Russia invades Ukraine.

And Japan has now shrunk in economic shows, and foreign investments were selling pressure on JGB Bonds and Foreign investment in Stocks reversed with the Previous contraction of the Yen 10.2 billion level.

Due to these, USDJPY increased by 0.50% from the Lower area, and USD shows stronger upside storms as FED is more robust in the path of rate hikes.

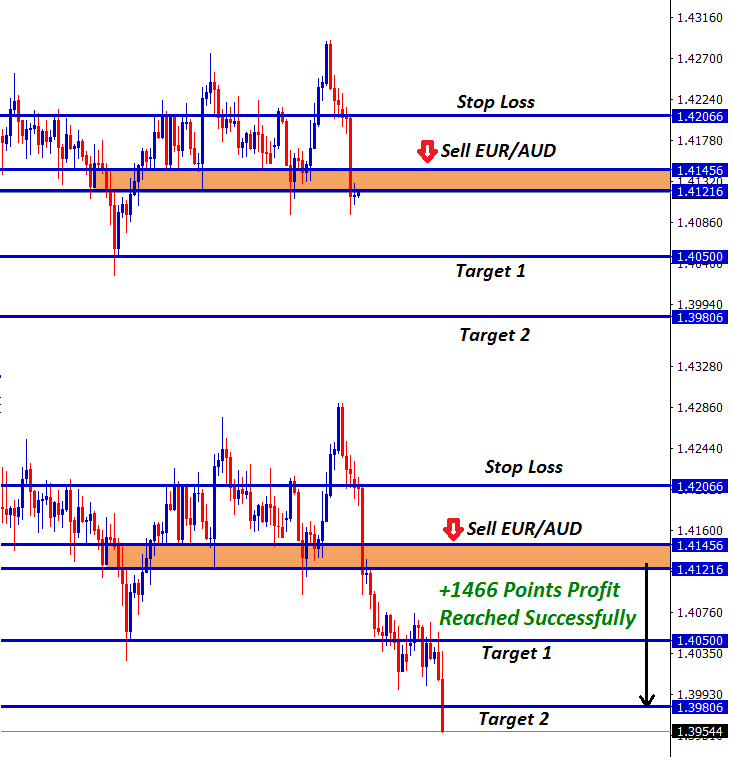

Australian Dollar: China appointed New Ambassador to Australia

GBPAUD is moving in the Box Pattern and the Market has fallen from the Resistance area.

China’s New Ambassador to Australia is Xiao Qian, and he urges Both countries to compensate by talks due to Four years of Difficulties faced in relationships between the two countries.

We are looking forward to Good Relationships to bring up between two countries, China and Australia.

Australian Trade minister Dan Tehan said China Economic coercion against Australian policies were not successful and till now, no new sanctions have been applied this year.

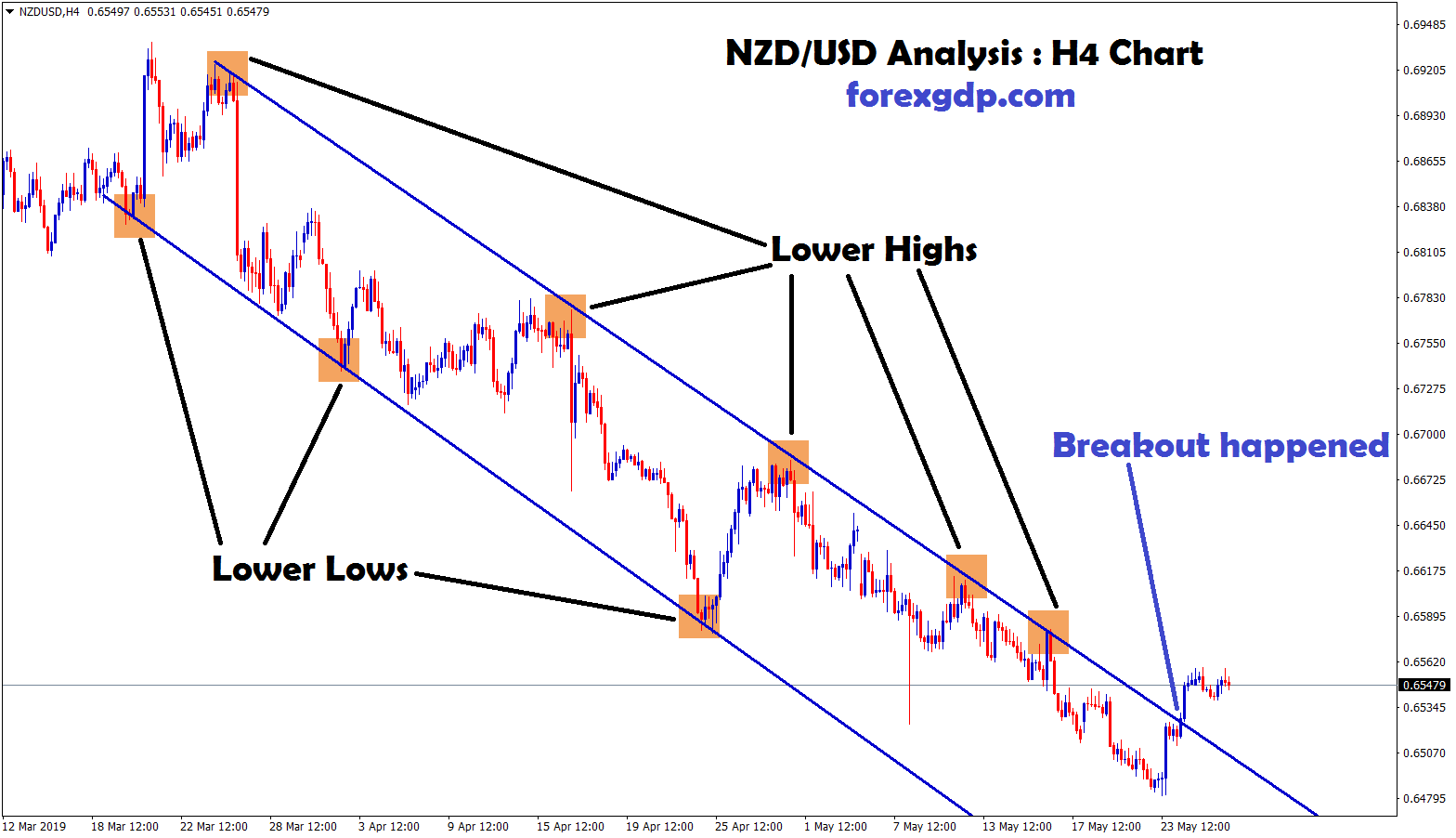

New Zealand Dollar: NZ CPI beat expectations

EURNZD is moving in the Descending channel and the market has reached the lower high area of the channel.

New Zealand CPI (Q0Q) 4Q came at 1.4% versus 1.3% expected, and New Zealand Dollar unfazed by data published.

And FOMC meeting Today made more impact on NZDUSD to tumbled to 0.50% down as FED Powell stated Comment on rate hikes started in March Month onwards.

We See the inflation picked up higher in the Second Half of 2022 due to the Supply chain mismatch issue; once Supply and Demand are compensated, inflation data brings down.

Omicron Variant paces the economy very high in the First Half of 2022, and Vaccinations is the only tool to control Spread.

Swiss Franc: US GDP Forecast

USDCHF Has broken the Descending channel.

Swiss Franc declined to 0.50% against US Dollar, and USDCHF gained to 0.50% and reached 0.9250 area.

The mainstream News that lifted USD is the US FOMC meeting interest rate decision, and FED Powell said five more rate hikes in 2022, which is different from the 2008 approach.

Today US GDP and Core Durable Goods scheduled and better number appreciations will drive US Dollar higher and Swiss Franc to get lower.

And also, SNB interventions in foreign investments made the Swiss Franc lower against the USD

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/