Gold: US CPI Forecast

Gold price headed to 1834.50 resistance area last day and today make or Break level market is standing based on US CPI report. and US President plans for tariffs on china products.

XAUUSD Gold price is moving in an Ascending channel and the market has reached the higher low area of the channel

And US Dollar consolidated waiting for Positive US CPI data to print.

US and Russia war fears on Ukraine make more demand for Gold and sell Gold in markets to buy enough goods before the war.

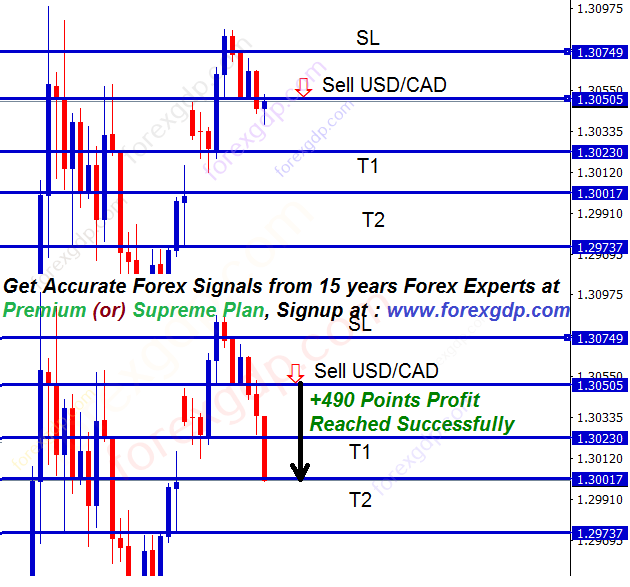

US Dollar: US President and Saudi King had a conversation about Oil markets

USDCAD is moving in the Descending triangle pattern and the market has reached the support area of the pattern.

US President Joe Biden and Saudi King Salman made telephonic conversations about the Oil market.

And Saudi King Salman stressed the importance of oil prices stability and maintaining its OPEC+ and OPEC countries duty.

We are strictly maintaining the agreement on the OPEC deal and the stability of oil prices.

US President Joe Biden plans for tariffs on china imports if China does not accept the deal

US President Joe Biden administration is ready for further China imports additional tariffs if trade talks fail this week for buying US Products like Energy, Foods and Services.

And Reuters reported that cited officials from the largest US Chamber of commerce said from the country’s business lobbying group.

Myron Brilliant, The chamber head of international affairs, said the US is closely watching Euro and its allies for Goods importing and exports to be made higher in front of Beijing to play more on international firms.

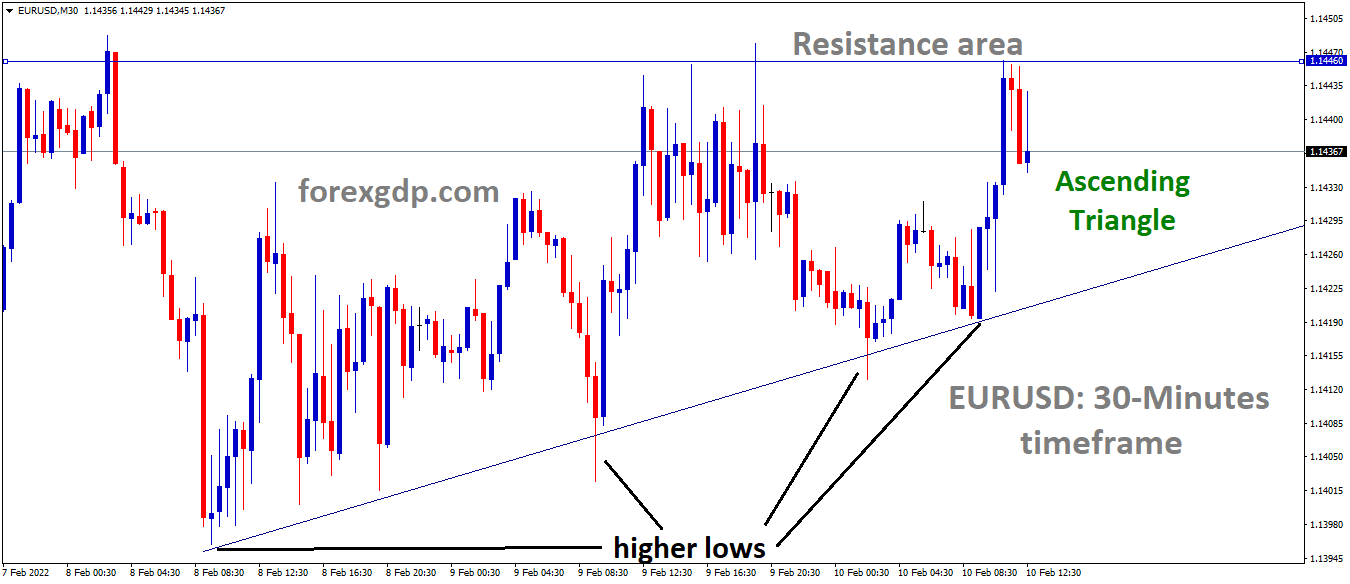

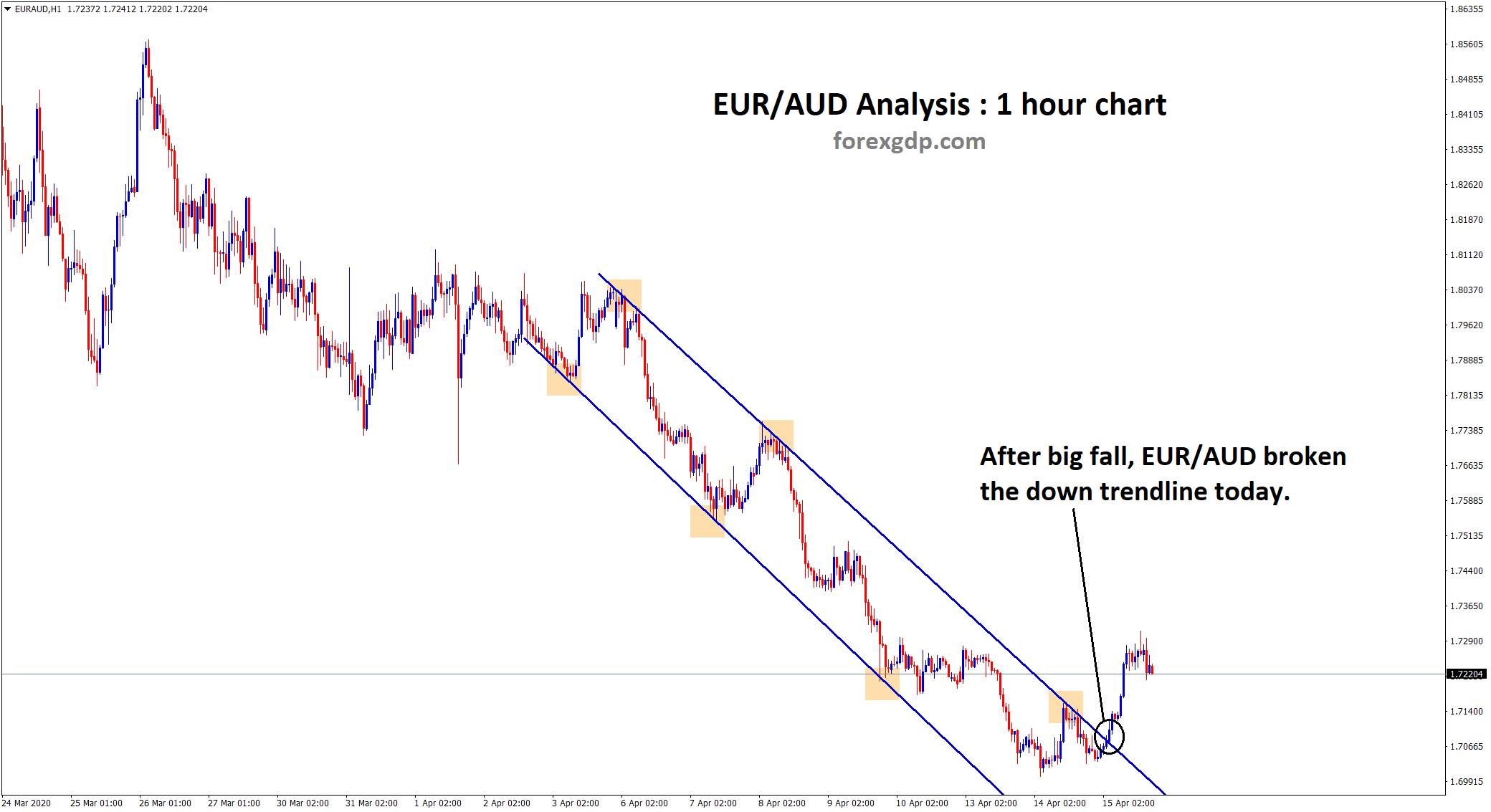

EURO: ECB Inflation forecast for 2022 and 2023

EURUSD is moving in an ascending triangle pattern and the market has fallen from the resistance area of the pattern.

The quarterly release of the European Commission is set to release today.

Euro inflation like to ease in 2023 and GDP like to improve, and Growth Figures are cut in 2022 by 0.30% to 0.40%, while inflation numbers are 3.5% target for the current year.

And the Euro Area inflation for 2023 is below the 2% target, so quick rate hikes are expected in 2023.

And ECB Board member Isabel Schnabel said inflation remains higher than expected, and this ECB Hawkish tone does not change energy prices.

The Bundesbank President and ECB Board member ECB’s Nagel said the first step to end the Bond purchases and then raise rates is better for ECB.

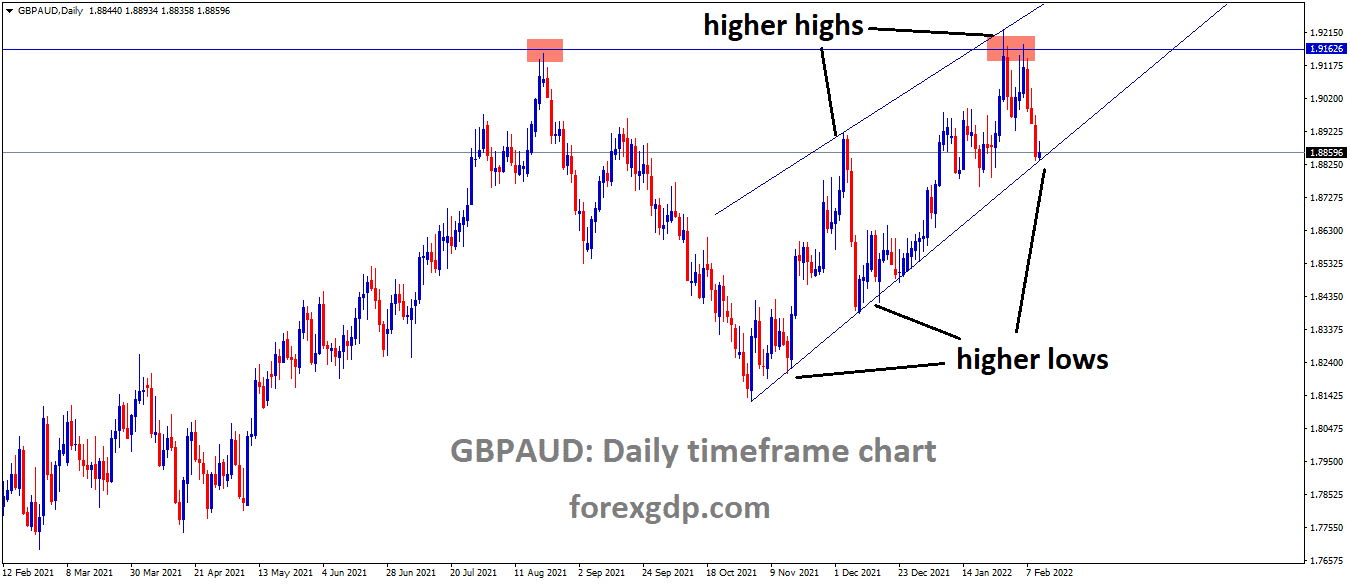

UK Pound: Bank of England Huw Pill speech

GBPAUD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

Bank of England Chief Economist Huw Pill said that the central bank withdrawing bonds is reasonable now.

The Inflation prices are picked up higher in the UK, so public consumption of the Food and Energy is also higher according to wages increases.

And Bank of England expected to hike another 25 bps in March and 125bps by the end of December 2022.

Today US CPI Data is going to publish, and the expected reading is 7.3% more than the expected reading, and there will be a chance for a 50bps rate hike in March month from FED.

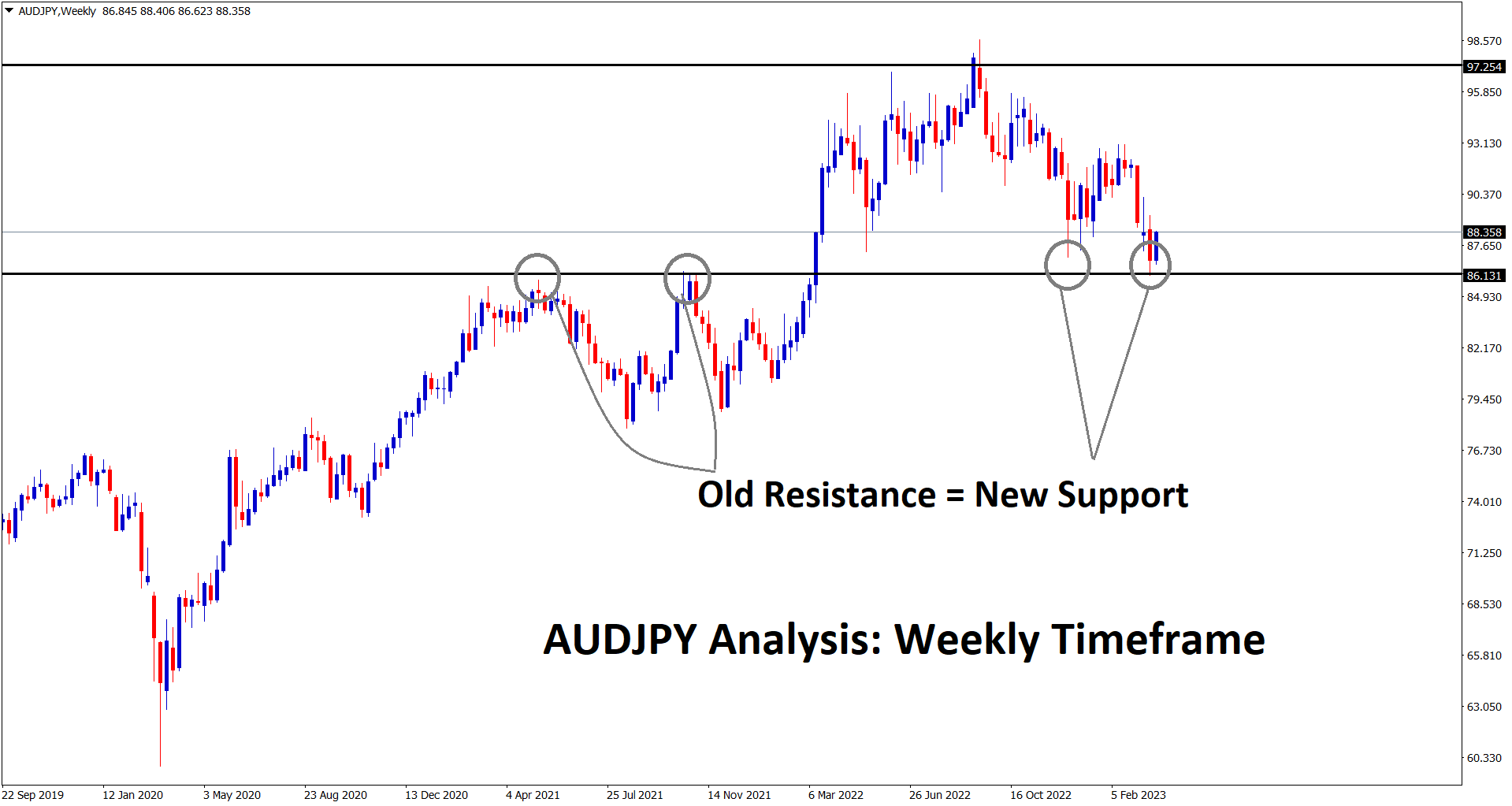

Japanese Yen: Bank of Japan Governor Speech

AUDJPY is moving in an Ascending channel and the market has reached the higher high area of the channel.

Bank of Japan Governor Haruhiko Kuroda said that inflation in Japan wouldn’t accelerate sharply as we expected.

And Wage Growth rises in the medium range, so inflation sustains below 2%.

We cannot expect to widen the US and Japan interest rates gap.

The Monetary policy easing is Better for Corporate profits and Japan’s deflation to end, so it is not Bad for financial institutions.

And consumers worry about paying more prices for household things due to higher inflation numbers.

And the Premature exit from the easy policy is not possible until the Japanese Economy attains its Full height.

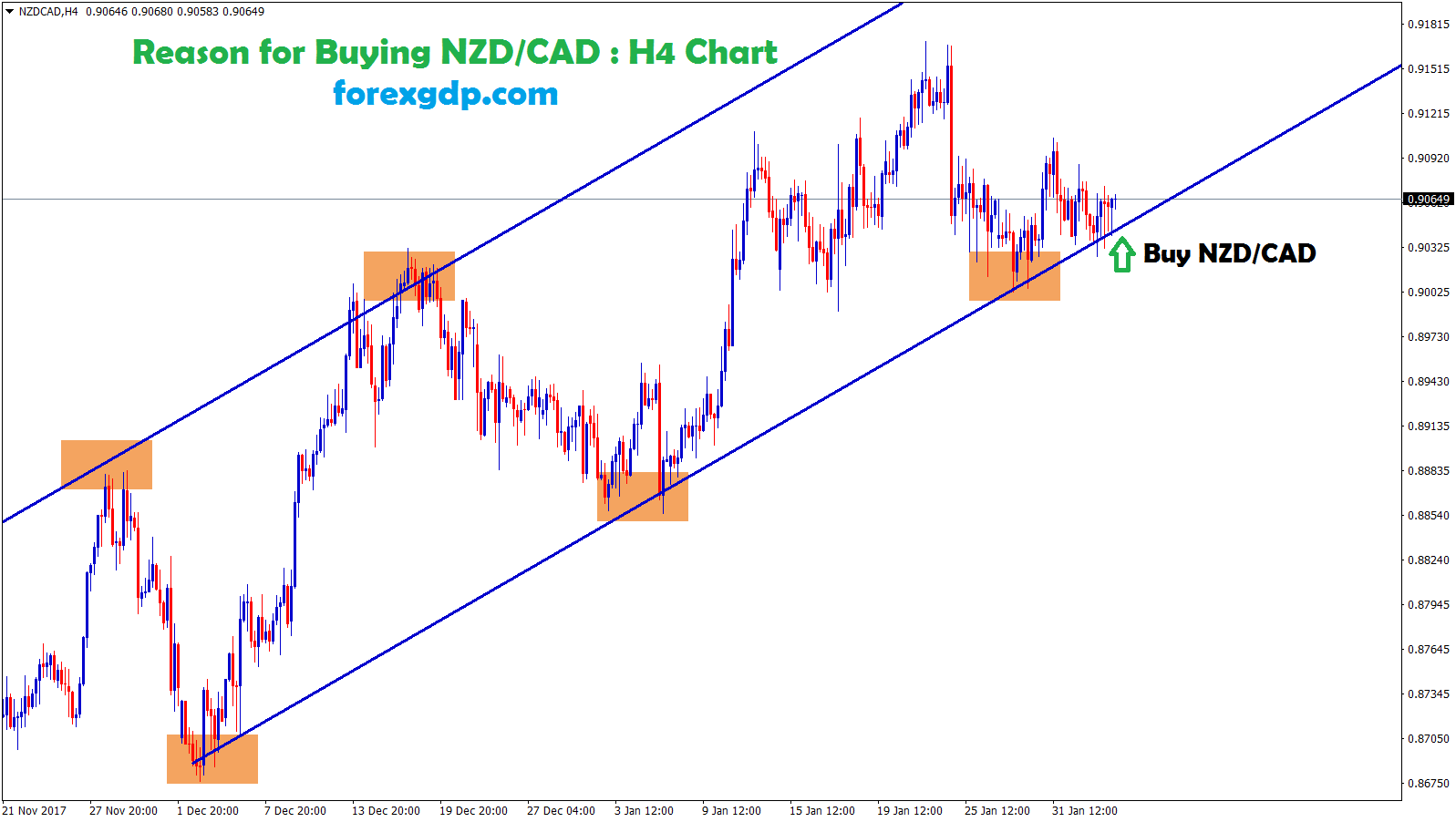

Canadian Dollar: Bank of Canada Governor Speech

NZDCAD is moving in an Ascending channel and the marker has reached the higher high area of the channel.

Today White house expected higher inflation on YoY reading, and WH Economic Advisor Brain Deese said factors affecting inflation to increase would be moderate in coming months.

And the Bank of Canada Governor Tiff Macklem said Global supply chains have peaked. Central Banks blaming Supply chain problems leads the inflation prices to higher.

So, Rate hikes are necessary for curbing inflation rates.

These comments made USDCAD expected to fall below the 1.2700 mark this month.

Australian Dollar: RBA Governor Lowe Speech

AUDNZD is moving in the Symmetrical triangle pattern and the market has reached the lower high area of the triangle pattern.

John Edwards, a former member of the Reserve Bank of Australia, said RBA would do quick rate hikes four times during the Second Half of 2022.

And the RBA Governor Lowe said raising rates is a Good one, but RBA cannot do this until the Economy could take shape to a pre-pandemic level.

Today US CPI data set to publish and expected reading is 7.3% Y/Y which is the highest since 1982.

Australian Dollar set to higher and reach the next resistance zone of 0.72 if inflation rate ticked higher.

New Zealand Dollar: NZ PM Jacinda Ardern speech

EURNZD is moving in the Descending channel and the market has fallen from the lower high area of the channel.

New Zealand PM Jacinda Ardern said Governments Good policies have Doubts about creating protestors in parliament.

And the vaccines and Masks haters must be evicted from parliament is a decision to Police as per NZ Herald.

And There are doubts about US and China phase 1 trade deal to reach this week, and many fears about the US and Russia conflict over Ukraine issues.

New Zealand Dollar is resuming from the Bottom area and now waiting for the RBNZ meeting this month for rate hikes.

Swiss Franc: Swiss union Party asks for pension payout from SNB

GBPCHF is moving in the Descending channel and the market has reached the lower high area of the channel.

Swiss Union party asks for Bailout pension worth 100 billion Francs from Swiss National bank which was safely secure in Bank during Pandemic times.

Now Swiss Union party asks for a Full pension payout from SNB, but SNB has denied the payouts, So Court will pursue further payouts from SNB.

And Swiss Franc likes to act higher due to Ukraine and Russia tensions, haven money guard for investors.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/