Today the US markets made some retracements of the yesterday movements. check various forex market analysis now.

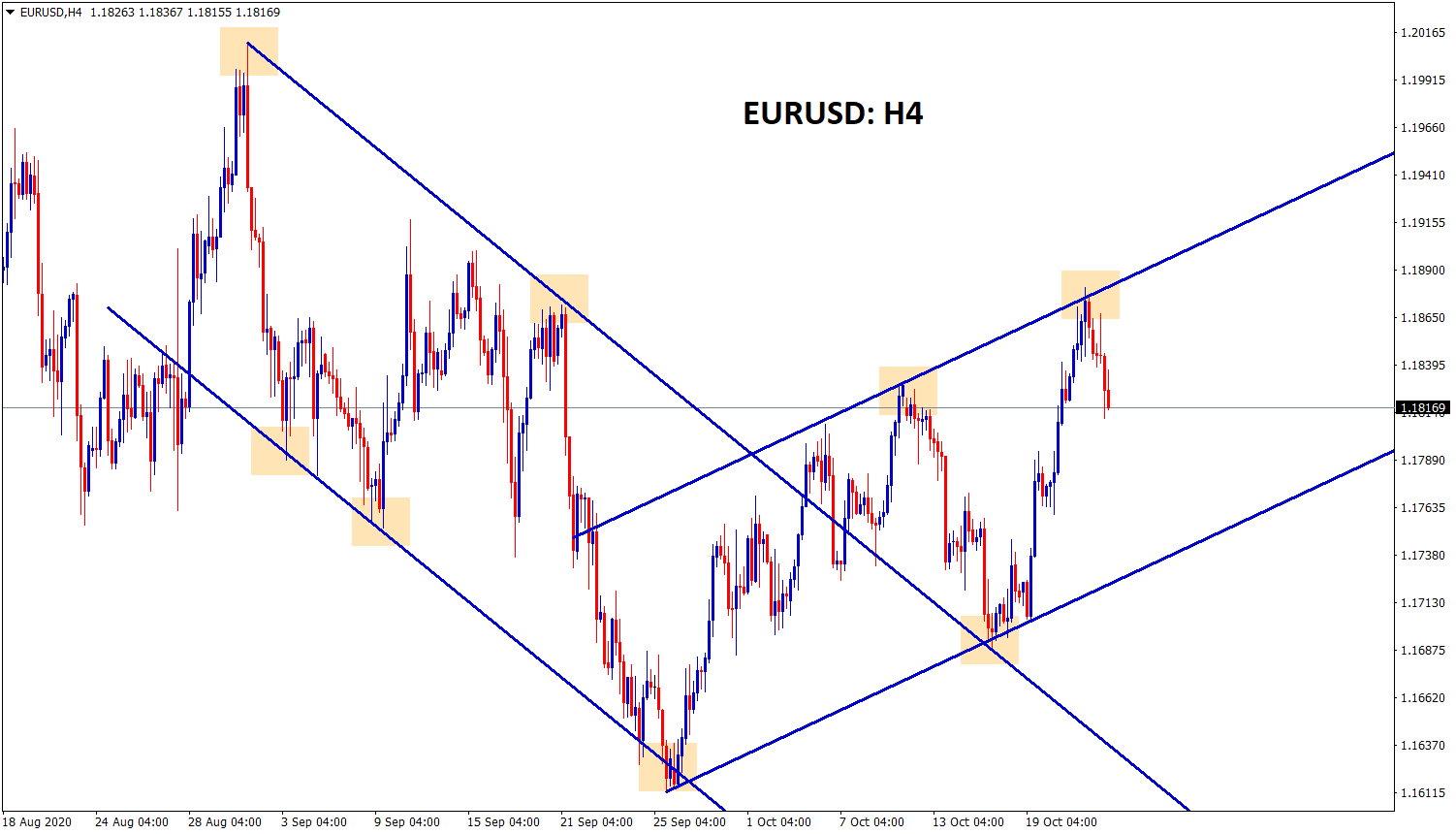

EURUSD

EURUSD has broken the descending channel and now starts to make retracement in an Ascending channel.

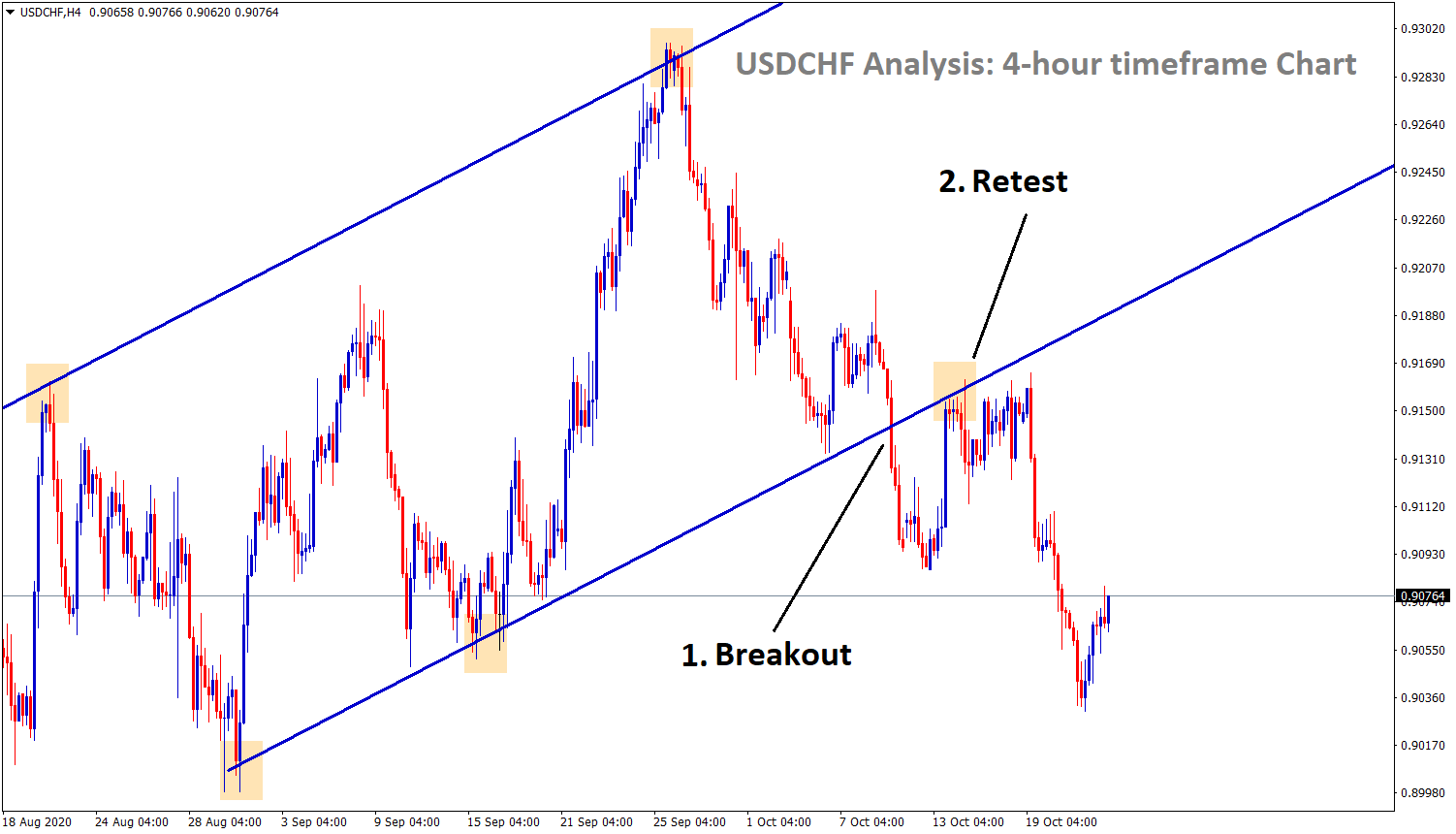

USDCHF

USDCHF broken the Ascending channel bottom zone, retested it and fallen down.

Today USDCHF trying to make some retracement.

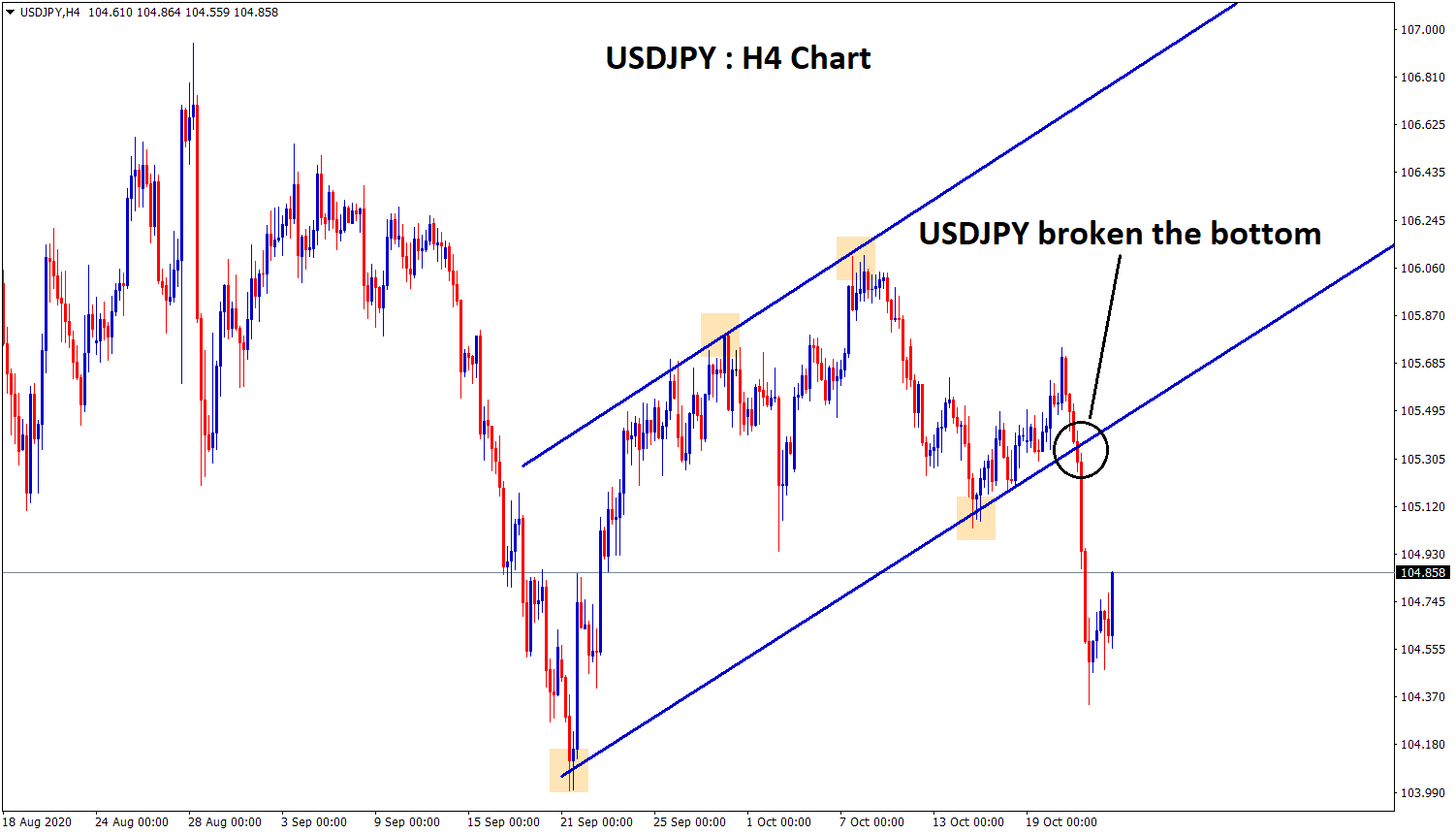

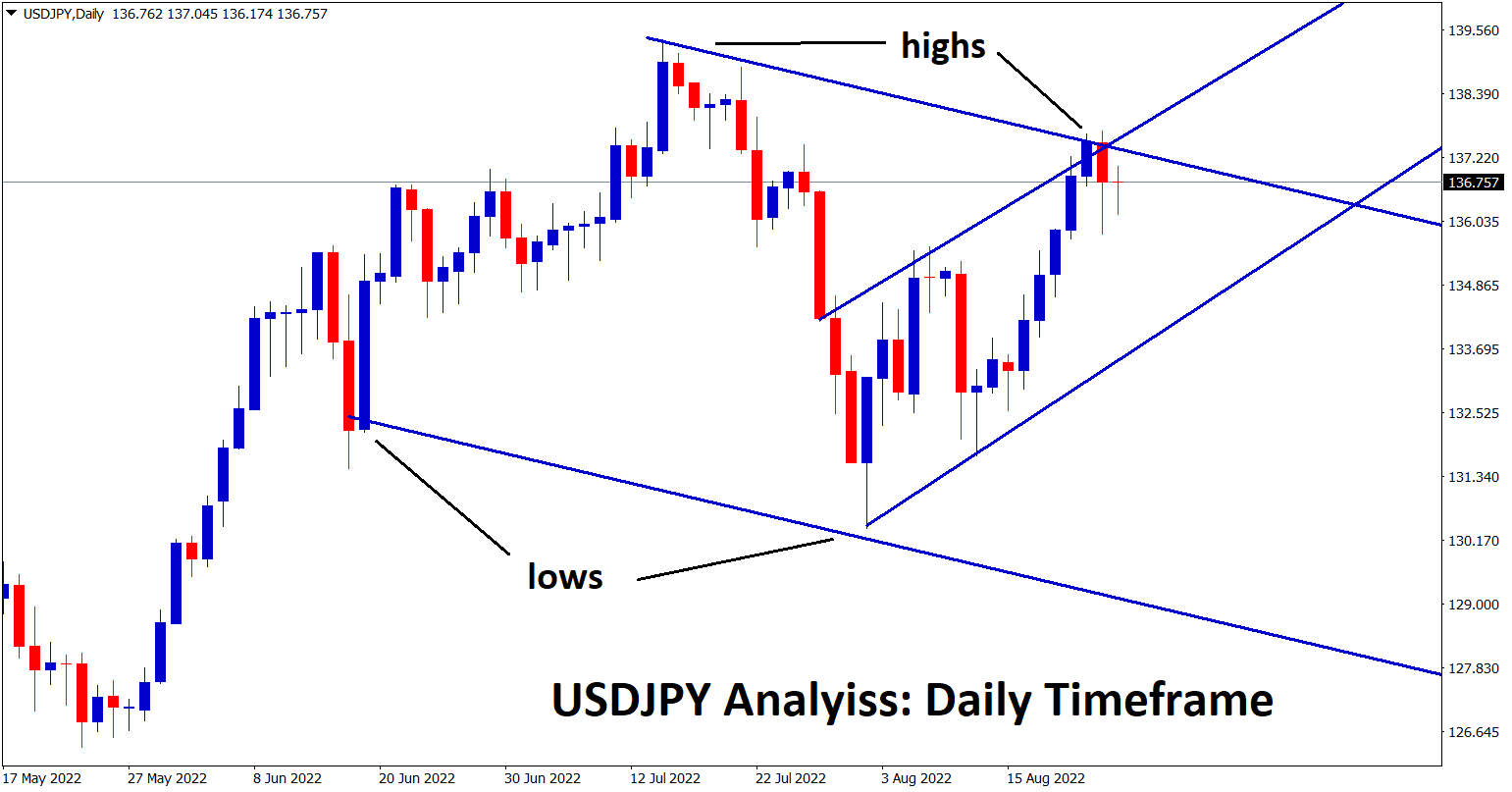

USDJPY

USDJPY has broken the bottom zone of the Ascending channel range in the 4-hour time frame chart.

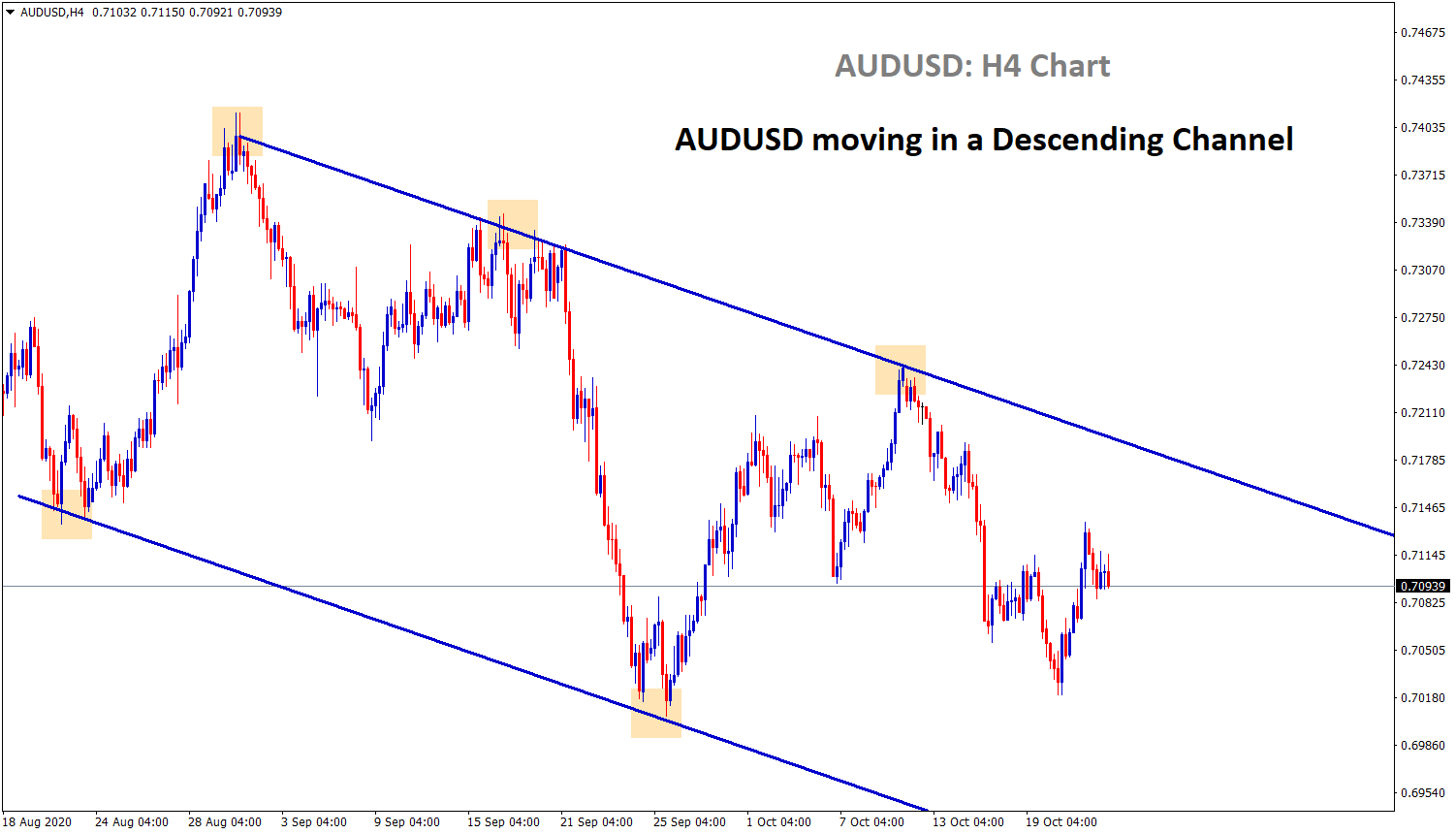

AUDUSD

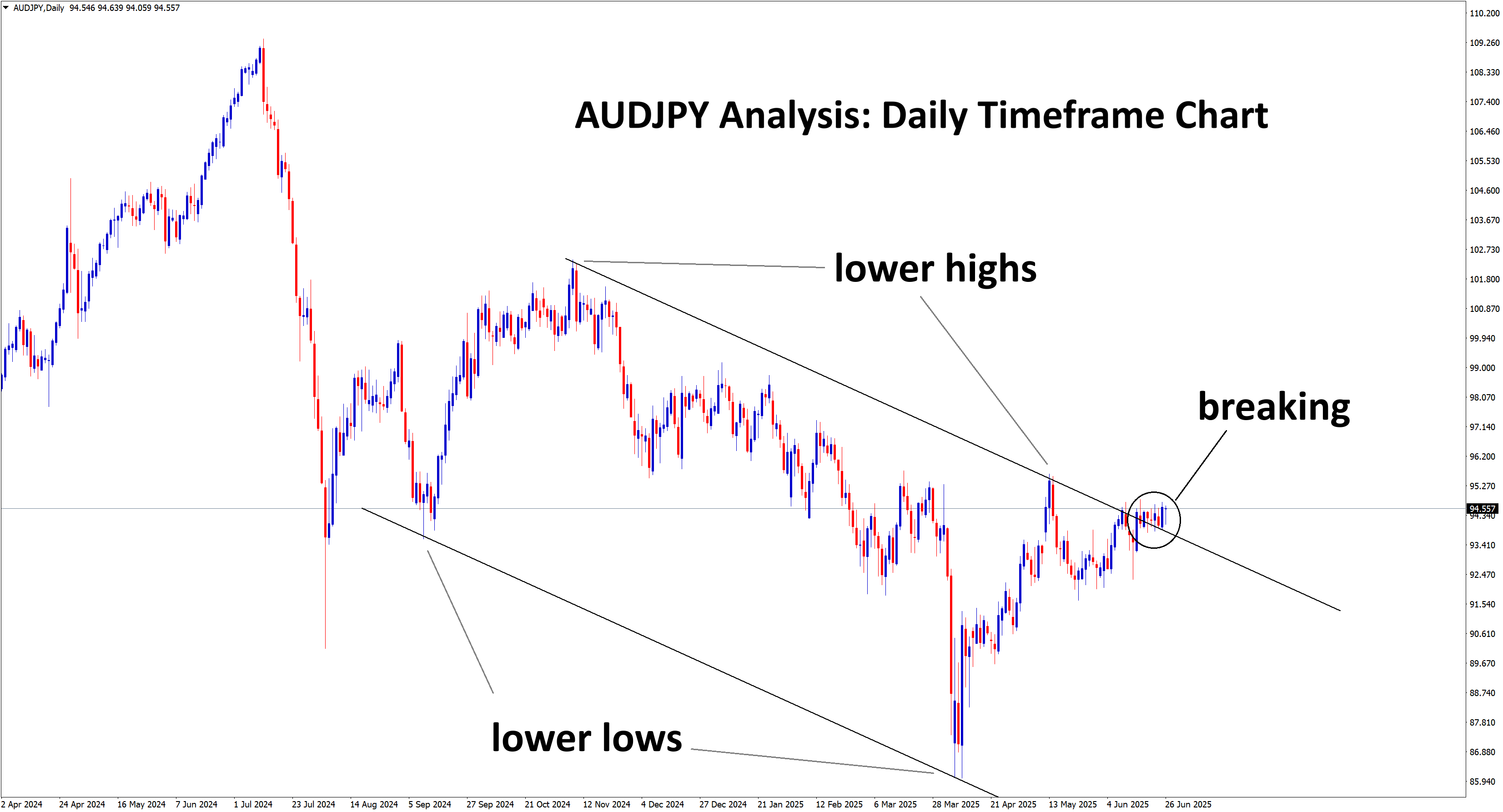

AUDUSD is still moving in a descending channel by forming lower highs and lower lows.

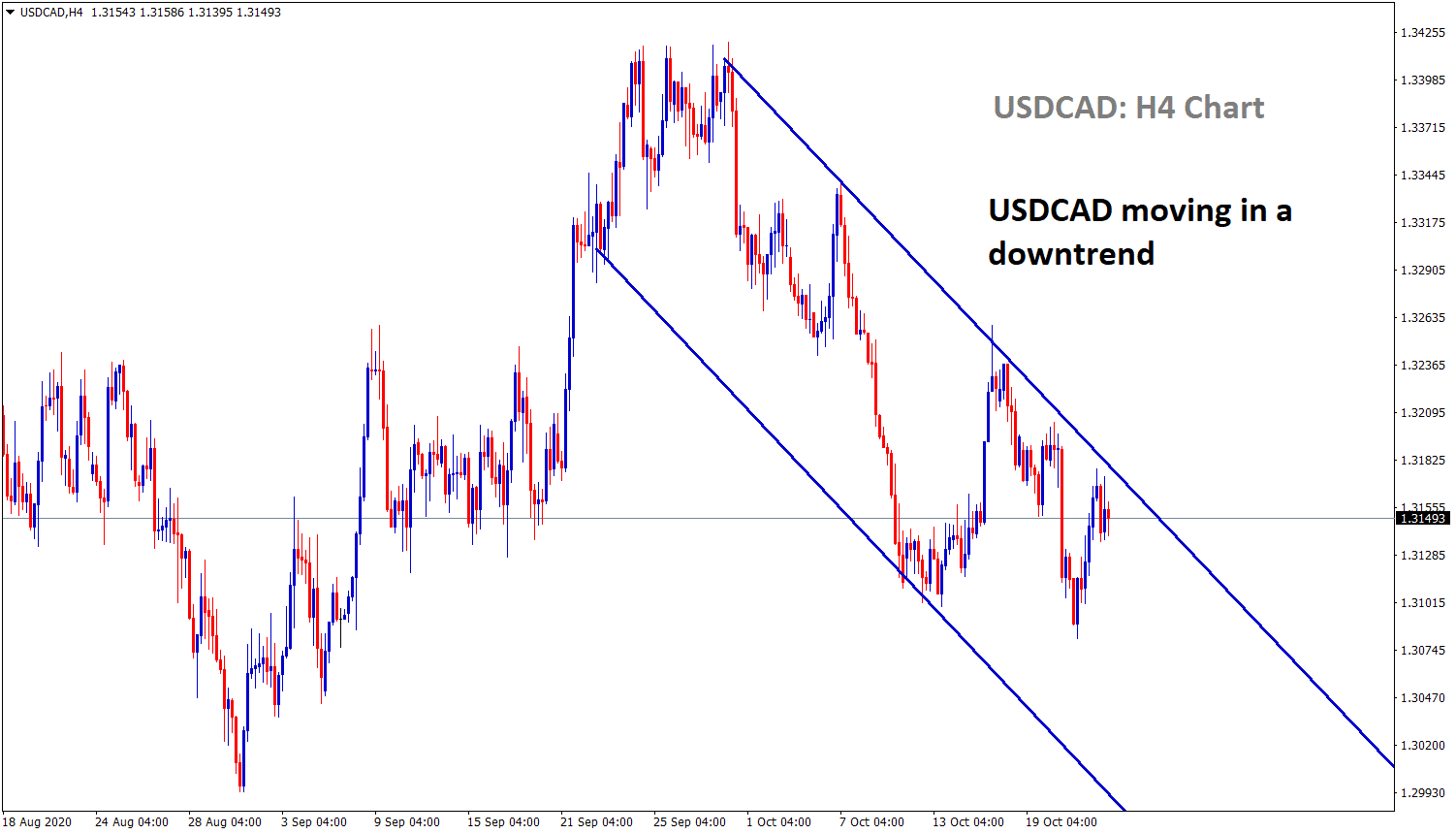

USDCAD

USDCAD is moving in a downtrend range now.

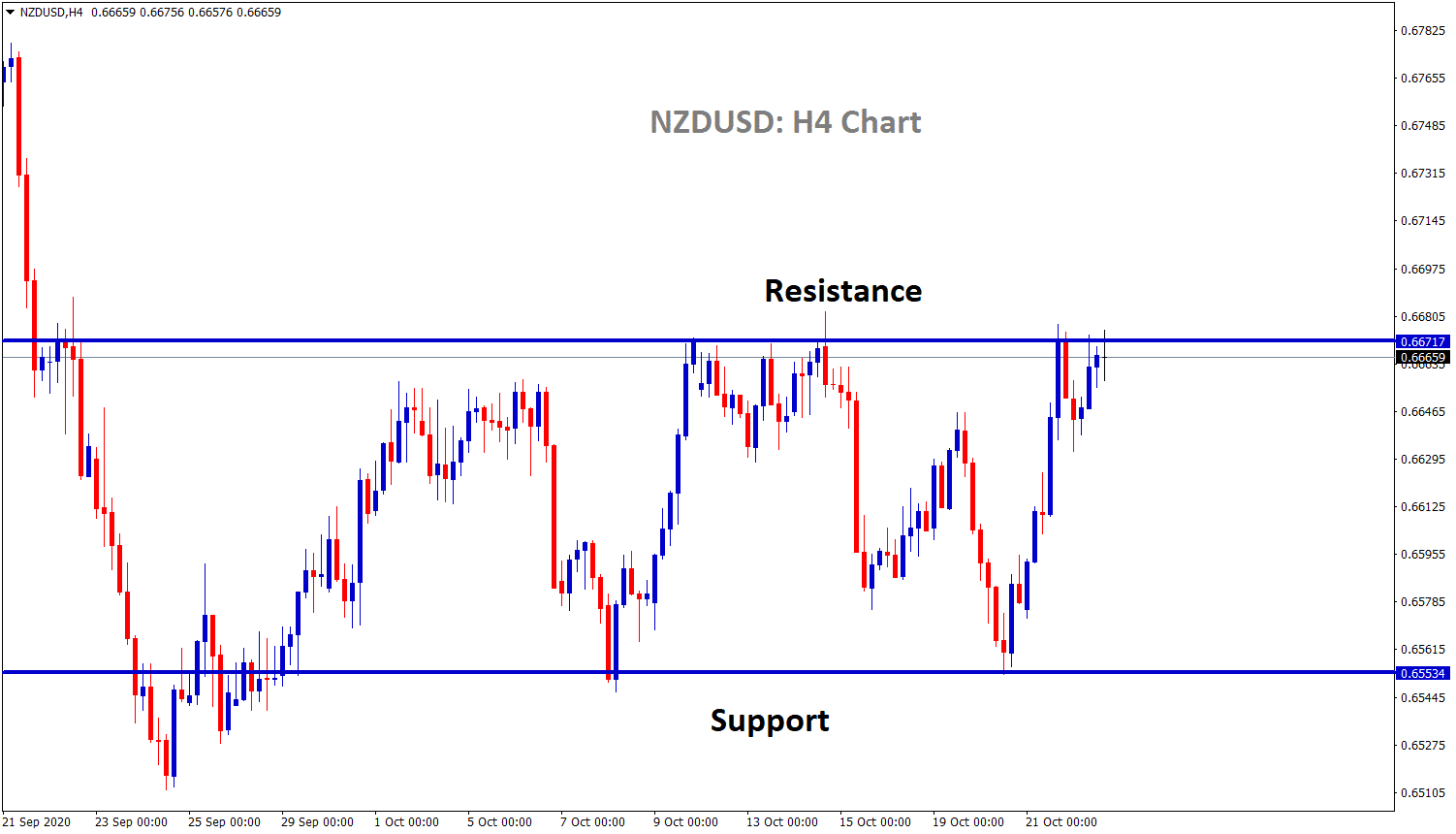

NZDUSD

NZDUSD is moving up and down between the resistance and support level.

Now, NZDUSD is standing at the resistance level.

Let’s wait for the confirmation of breakout or reversal.

US Market starts to fall

US stocks took a tumble and fell on Wednesday as the Democratic and Republican Party in the US edged closer to agreeing on a second major fiscal stimulus for the world’s largest economy.

The popular S&P Index finished 0.2% lower, due to volatility causing it to fluctuate between gains and losses in the earlier session. On the other hand, the NASDAQ closed down 0.3%. The varied session on Wall Street came after Nancy Pelosi, the Democratic speaker of the House of Representatives, and Treasury Secretary Steven Mnuchin started talking about a major relief package, which will inevitably help US businesses and households throughout the current pandemic we are all experiencing.

Tuesday evening saw both sides reporting that they had made enough progress to keep the potentially enormous $2 trillion bailouts alive, although as you might expect nothing was expected to be signed before next month’s presidential election.

In other news, the dollar index saw a drop of half of a percent to its lowest level since early September. The dollar index is the measure of the greenback against six other currencies. So this fall in the dollar meant that it helped the pound, which has been extremely volatile due to post-Brexit trade talks nearing the end. Other major currencies such as the euro and the Japanese yen, joined the pound and started their descent in anticipation of a US relief package.

Right now the bias for the dollar is weakening, due to so many factors both internal and external influencing the greenback and pushing it down to uncomfortable levels for investors. Jim Leaviss, head of fixed income investing at fund manager M&G, said “investors were eyeing the dollar warily ahead of the US election. This is because the currency could be sold off heavily if President Donald Trump lost but did not immediately concede defeat, as he had signalled he might do”

The hopes for a mass spending spree to inject fuel into the economy to battle the effects of COVID-19 spilled over into the US government debt market. The yields on benchmark 10-year Treasury notes, which coincidentally move inversely to prices, added 0.02% causing them to trade at their highest levels since early June.

US Dollar Declining since March 2020

Since the end of March, the US dollar has been in a decline against a number of major currencies, mostly due to the pandemic and other factors throughout the year like the election. What can we expect for the future of the dollar? Our initial view is a bearish one, given the scenario we are in right now with viruses and elections. We don’t expect the dollar to return to its former glory any time soon, as the economy is trying to avoid falling into economic disaster, meaning investors will be taking a long hard look at the future of their US-based investments.

Right now, the smart thing investors can do is pull their money out of the US economy into safer instruments until the time is right.

Want to boost your profits? Get more trading signals at Premium or Supreme signal plan here: forexgdp.com/forex-signals/

Please don’t trade all the time, Trade forex only at best setup. Thank you.

Hello,

I’m looking to know how to trade effectively & positively.