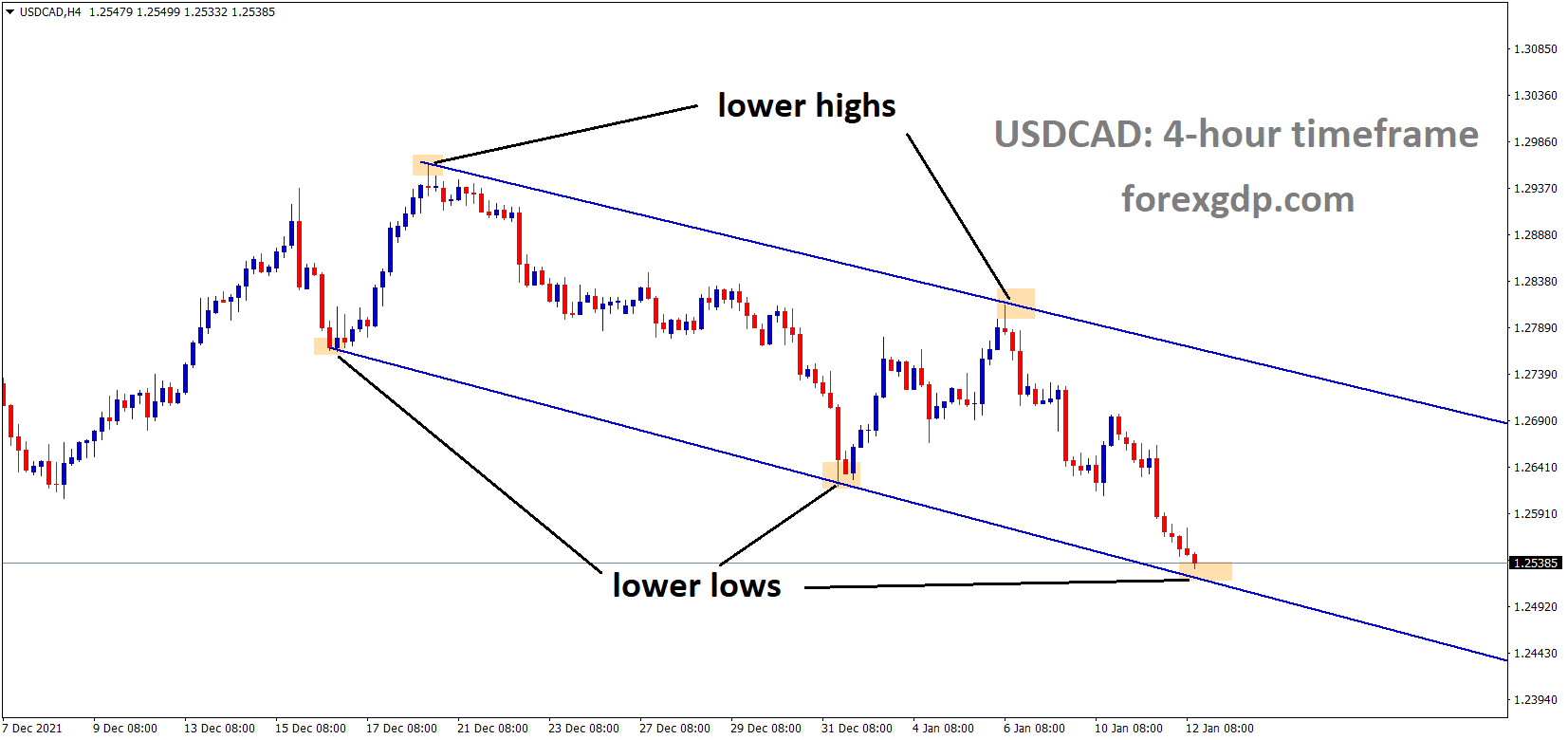

USDCAD CLOSES NEAR 1.2500 AS OIL RATES INCREASE AND INTEREST RATES ARE PREDICTED. USDCAD is moving in the Descending channel and the market has reached the lower low area of the channel line.

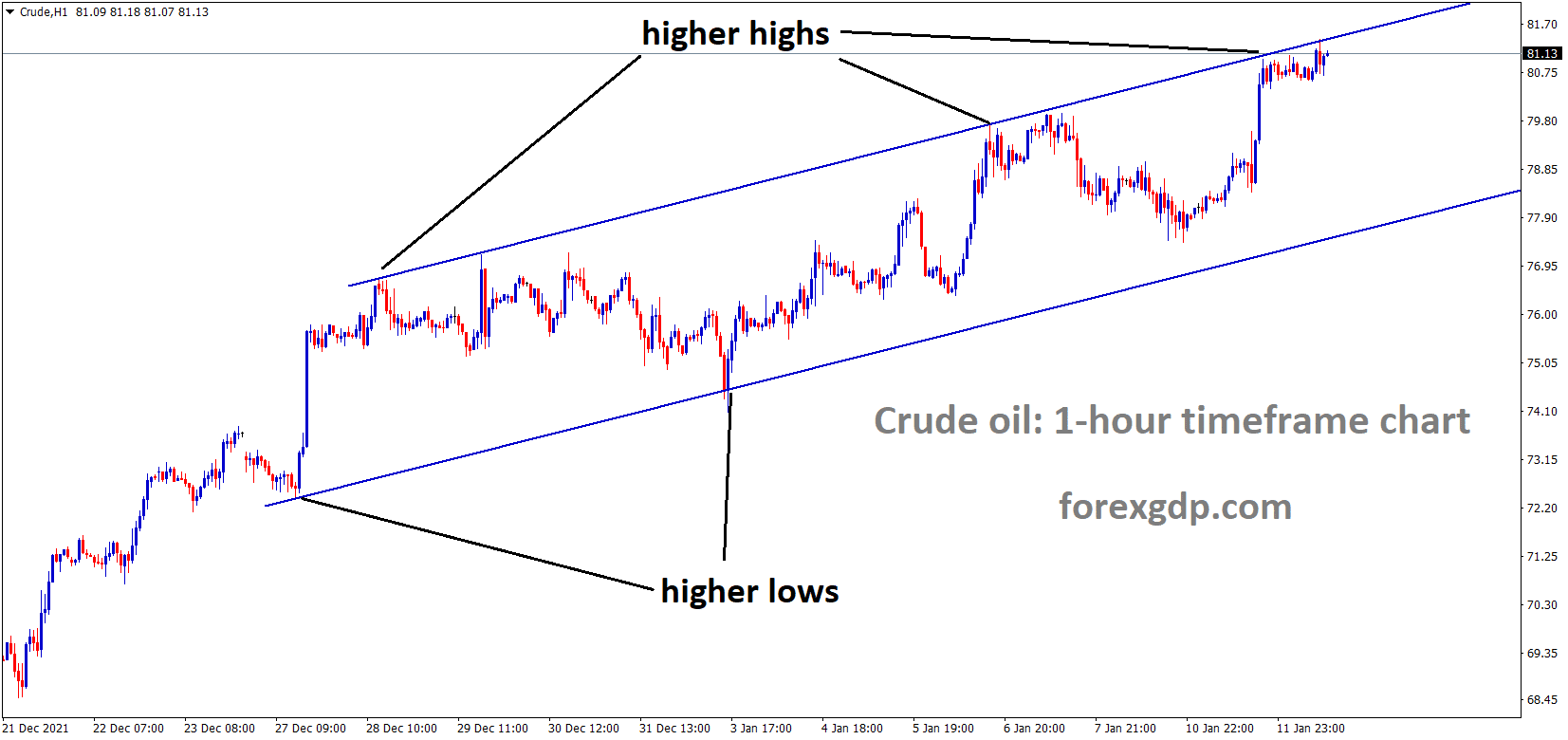

Crudeoil is moving in an Ascending channel and the oil price has reached the higher high area of the channel line, it is just opposite to USDCAD channel pattern. If crude oil gets strong, CAD gets strong. So both Crude oil and USDCAD are standing at the important price areas.

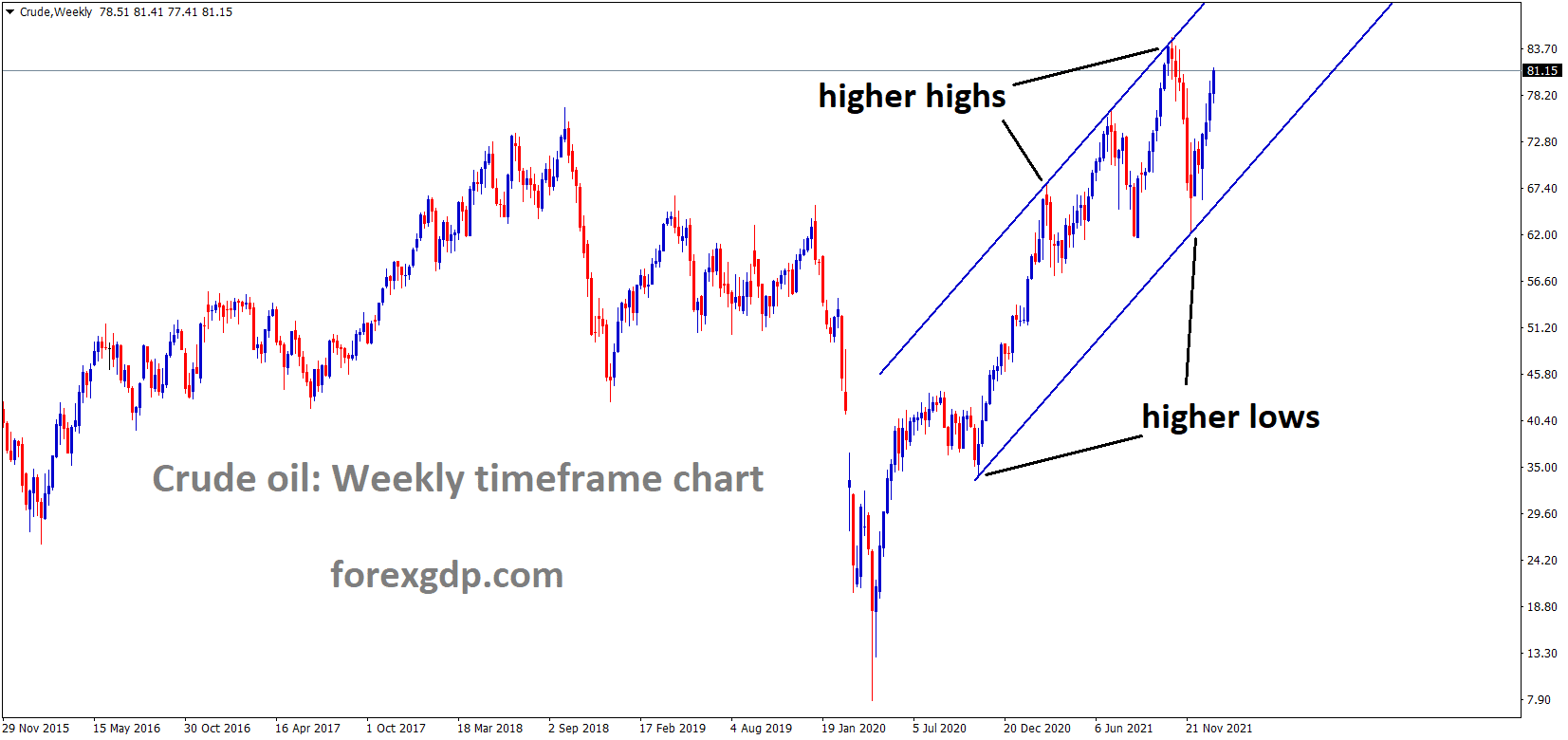

In the higher timeframe weekly chart, Crudeoil is moving in an Ascending channel and the market is rebounding harder from the higher low area of the channel line. now it’s near to the recent high.

Where is USDCAD today

This past week, the dollar index has been at record highs. This comes as no surprise considering that traders and investors were waiting in anticipation of any hints that the Feds would raise the interest rates earlier than expected. Inflation has played a huge role in this decision. The Feds believe that in order to combat this inflation crisis, the interest rates need to be raised earlier than expected. Analysts predict that these raise in interest rates can happen as early as March. It is due to these predictions that the dollar index was on the rise and therefore caused USD/CAD to rise as well. It is also why other currency pairs like EUR/USD and GBP/USD were only seen struggling at support levels.

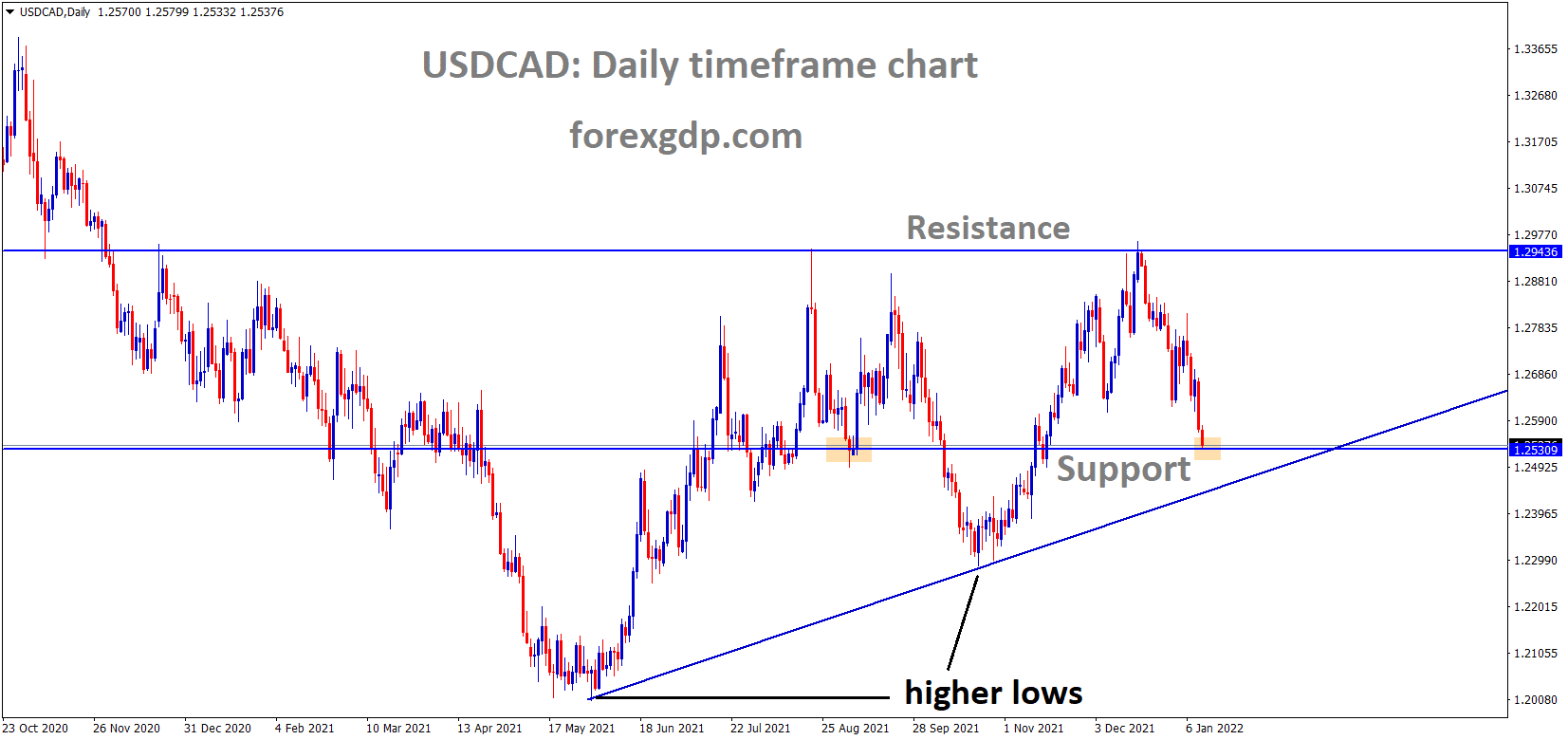

In the daily timeframe, USDCAD is near to the horizontal support area and it looks like an Ascending triangle pattern in the long view.

This all changed as of yesterday as the unemployment report was released which showed that the unemployment rate dropped from 6.3% to 6.2%. This comes as a surprise as most analysts predicted that the unemployment rate would be on the rise due to the ongoing COVID-19 crisis. Due to this, the dollar index had been consistently dropping and USD/CAD had been struggling as well. USD/CAD was last seen around the 1.2570 point after reaching rates as low as 1.2567. The Feds speech which was released yesterday also plays a major role in the direction the market is heading these days. Continue reading to learn more about what Powell has said.

The FED’S Speech

For quite some time now, investors faced some major inflation crisis which led to stocks rebounding overnight and dropping with no hints. This has caused investors to always be on the edge as they’ve been consistently reaching new lows and losing a ton of profit. Due to these concerns, the Feds have been giving hints that they’re going to raise the interest rates in order to combat the inflation crisis.

This raise is predicted to occur as early as March of this year considering that this issue needs to be solved as soon as possible. Analysts have also predicted that the Feds may even raise the interest rates twice this year in order to fully have the inflation finally under control and stocks returning to ordinary levels.

Yesterday, Feds Chairman, Jerome Powell, had announced in his prepared remarks about their monetary plans for the U.S. economy. Powell gave hints to tightening their policies as early as possible as their primary goal as of right now is to bring back stability to market prices. Powell narrated that if inflation continues to persist at the rate is it going right now, they will have no choice but to raise the interest rates as quickly as possible in order to control this ongoing inflation problem.

MORGAN STANLEY RELEASE

Recently, Morgan Stanley released their expectations for the month of January in terms of monetary policies for the Bank of Canada.

They also were giving their predictions for a possible interest rate boost for the Canadian dollar. Morgan Stanley believes that the strong employment rate is the main reason behind these predictions. They also believe that if the Feds tighten their monetary policies, this will play in the favor of the Canadian dollar to see new record highs.