New traders typically go into the market full of confidence and optimism. If their first few trades go well, they start to believe trading is easy, that they are cut out for this and they are well on their proverbial road to riches. They forget that trading is a demanding occupation, one which should be treated as a professional endeavour, and thus become complacent and begin taking excessive risk.

There is nothing wrong with enjoying some beginner’s luck, but if you want to avoid your beginner’s luck turning into rookie mistakes, and rather turn it into constant and consistent profits, take into consideration the newbie trader’s most common mistakes and try to avoid them.

1. Do not get overconfident.

Don’t think that because you made a few good trades when you got started, you were born with a gift. Good traders recognize that forex trading is not easy. It requires discipline and learning and it goes well beyond buying low and selling high. Celebrate your profits, there is nothing wrong with being happy about making some money, but don’t have high expectations during your first year.

Take the time to learn, be realistic and learn both from your winnings as well as your losses. Analyzing your trading session each day can determine your success as a trader, so get in the habit of doing a post-trading analysis.

2. Avoid overtrades and make better trades

By following the 2 rules you will take only the best trades in the market and it will become a good discipline for you.

- Set a limit to your trading – a target. You decide what you want to achieve – X pips a week (it should not be more than 100 when starting out

and probably even less). Now, as soon as you hit your target, that’s it. You stop trading for the week. - If at the end of the week you’re negative, you can carry over the loss to add to next week’s target. But you can never carry it over more than one week.(eg : if lost 300 points this week, carry this 300 points loss as your target for next week, so your next week target = your regular weekly target + 300 points target….IMPORTANT NOTE: Don’t carry your 300 points loss of 1st week to your 3rd week if 2nd week also ends in loss. Carry only the previous week losses as your target for next week)

Remember that if you take more trades with small pips & reduce your target, you will get more pressure.

By Practicing & following these 2 rules strictly, you will become more focused on only doing what is required to hit that target. Now, your PRESSURE is OFF.

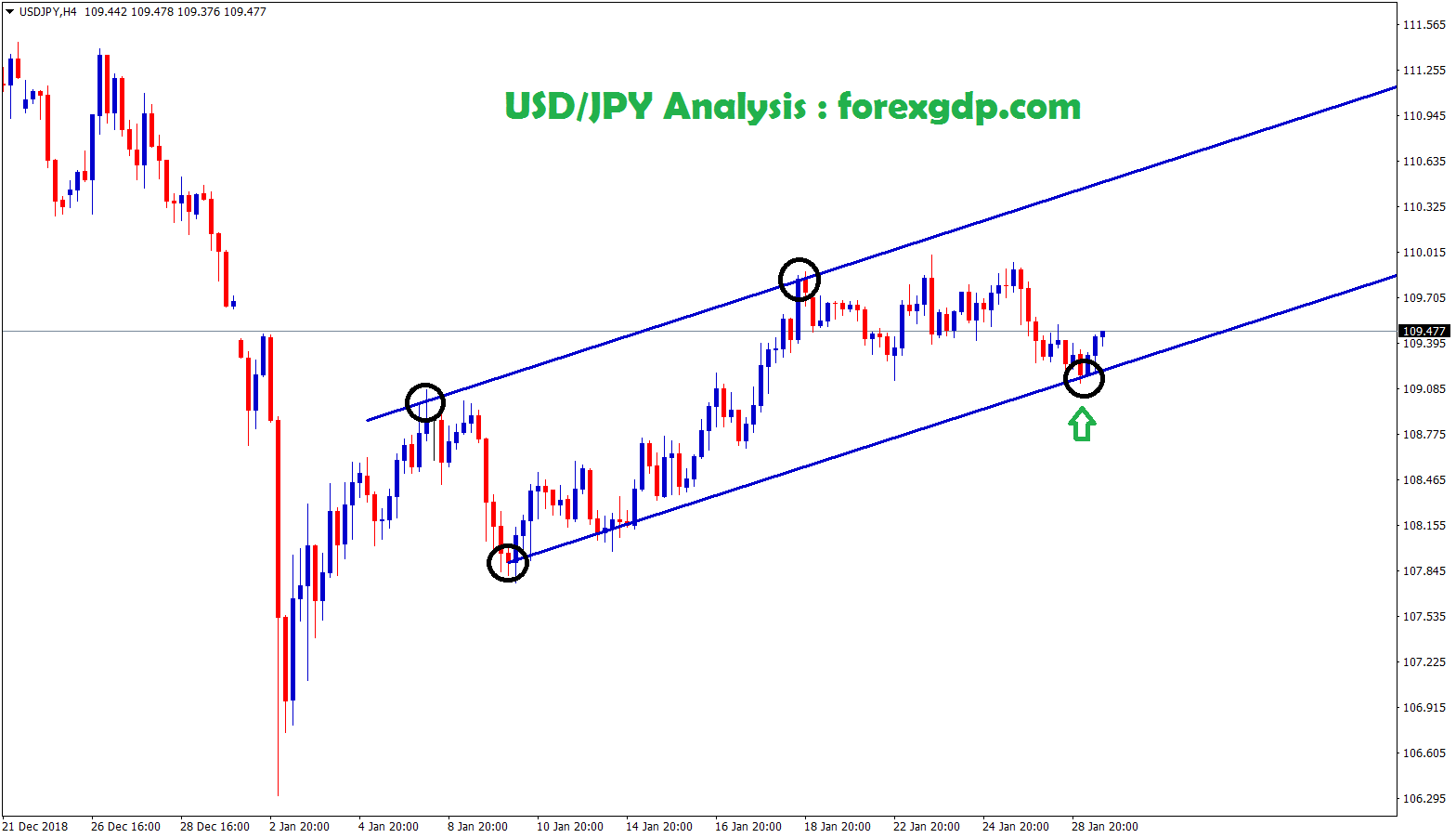

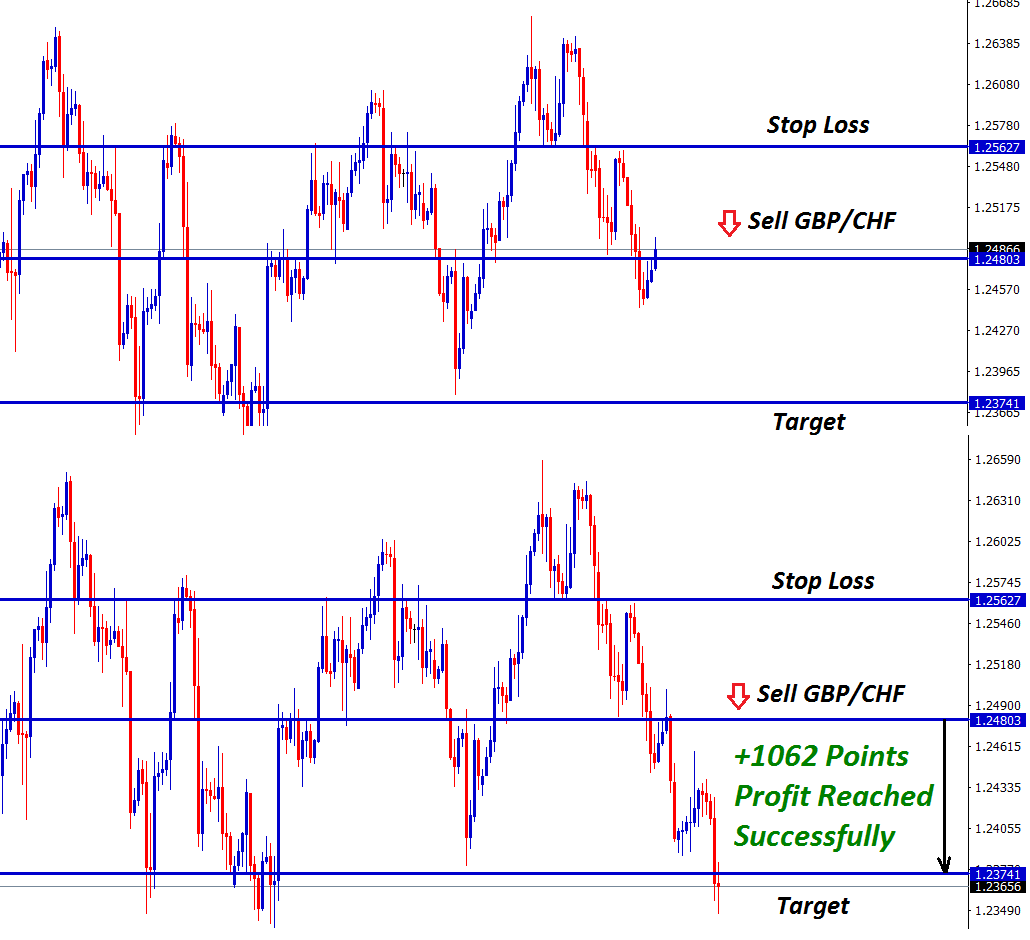

3. Set and forget

The skill of placing a trade and walking away is often referred to as ‘set and forget’. And it’s beautiful if you can do it.

You place your orders, your stops and your risk/reward profit targets. Then walk away. Check back later, see how you did.

And if you’ve got the risk/reward and money management right – and you only take the best set-ups that meet your criteria, then you should come out on top.

And remember, stop over-trading. Overtrading can kill your performance.

4. Don’t be too emotional

There are several ways in which you can spot a trader who is feeling the trade, rather than thinking it. You can tell a new trader is being emotional because they will talk about “hoping the trade goes well”, or “having a feeling about this one”.

They may feel so sure about a certain trade that they will go “all in” and forget about taking proper risk control. Emotional traders think of money as their safety-and-power-provider, and when they lose money, that safety and power are taken away and the decisions they make are often rash and erroneous.

A newbie trader is often paralyzed by losses and instead of capping their losses and getting out of a losing trade quickly and moving on to the next one, they’ll wait in hopes that the trend will change for the better, and see mounting losses. In order to emotionally detach yourself when trading, begin trading small amounts of money. Something you wouldn’t mind losing.

With time, you can raise the amount of money you trade but always remain within your comfort zone. Losing small amounts of money is less distressing both on your pocket and on your emotions.

Another tip to desensitize yourself is to evaluate your winnings and losses at the end of each month, rather than at the end of each day. Do analyze your trades, but keep a long-term outlook on your P&L.

5. Don’t be dazzled by the amount of leverage available

New Forex traders are often dazzled by the amount of leverage available in this industry. 50:1 is not at all uncommon in Forex trading and to a new trader the chance of boosting their returns to such great extents seems marvelous, but remember that leverage is a double-edged sword.

Just as leverage can boost your returns when a trade is profitable, it can also amplify losses on losing trades and if you leverage 50:1, a mere 2% decrease can wipe out your entire capital.

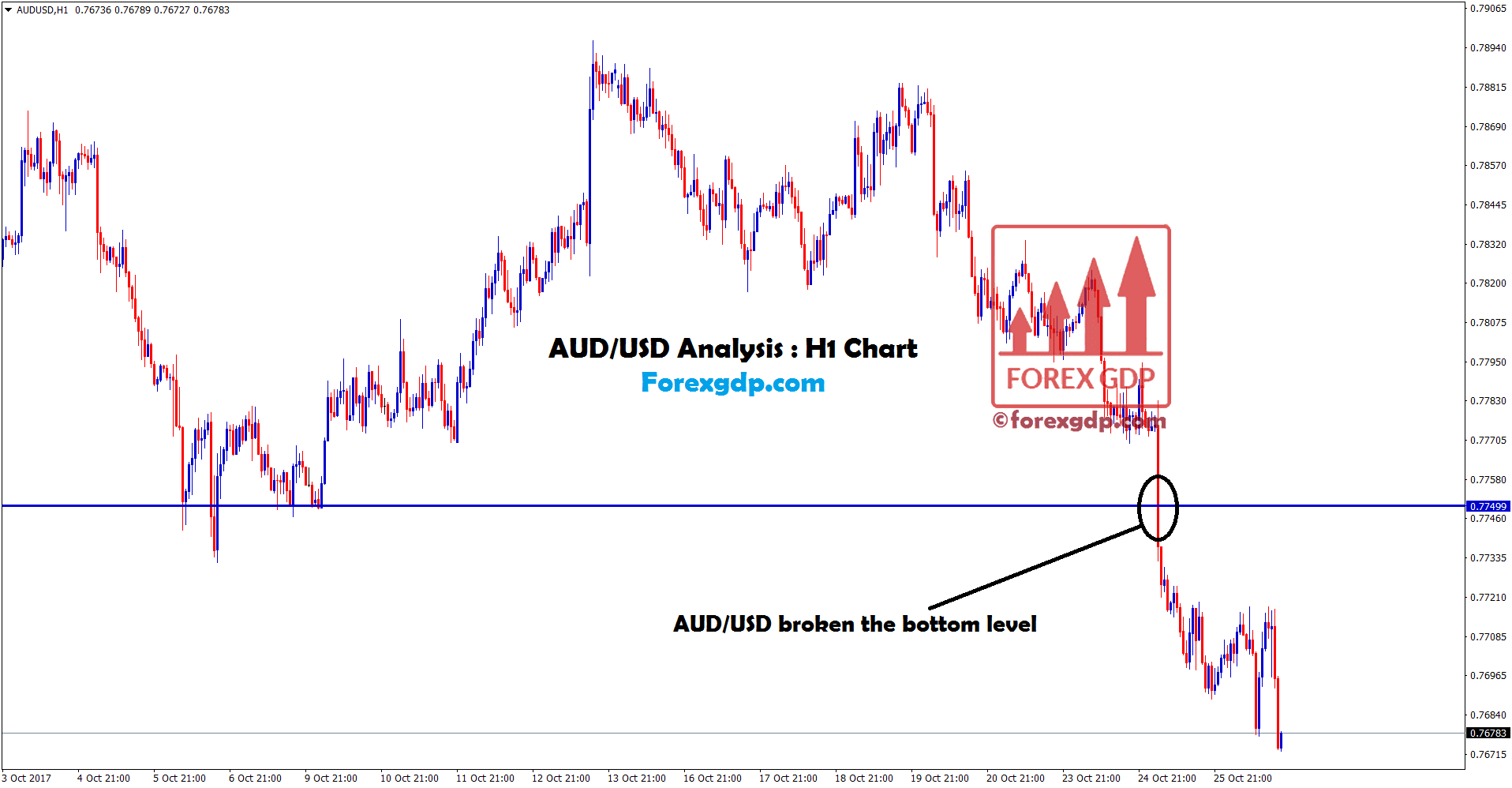

6. Always have a well-defined trading strategy

When a new trader begins trading Forex, every trade should be a learning experience, and one that will help them develop a trading plan. Go into every trade following a well-defined strategy, including entry and exit points, amounts of capital to be invested and the highest acceptable loss. Once you have a plan in place, stick to it.

7. Escape Plan

Last but not least, always have an escape plan and just follow these 2 simple rules:

- stop trading if the market is acting too unpredictably.

- set your maximum loss or drawdown for your a/c. If the max loss hits, just get

out of your PC.

Bottom Line

Trading is simple, but not easy. Because following that simple rules are not easy.

As a new trader, my advice is, enjoy every ounce of beginner’s luck you get, but take your first year in trading as a learning course, act cautiously and look to grow slowly but steadily.

Are you interested in Learn Forex Trading, Binary Options trading, Commodity, Stocks or CFDs trading in Easy understandable way. Learn Forex Trading in Tamil and Binary Options in Tamil.

Please Don’t trade all the time, trade forex only at best trade setup.

It is better to do nothing, instead of taking wrong trades.

We are here to help you for taking the trades only at best trade setup.

Start to receive the forex signals now: forexgdp.com/forex-signals/

Thanks for the wonderful information

Thanks, it is very informative

I like the article

I enjoy the article

Thanks for the wonderful post