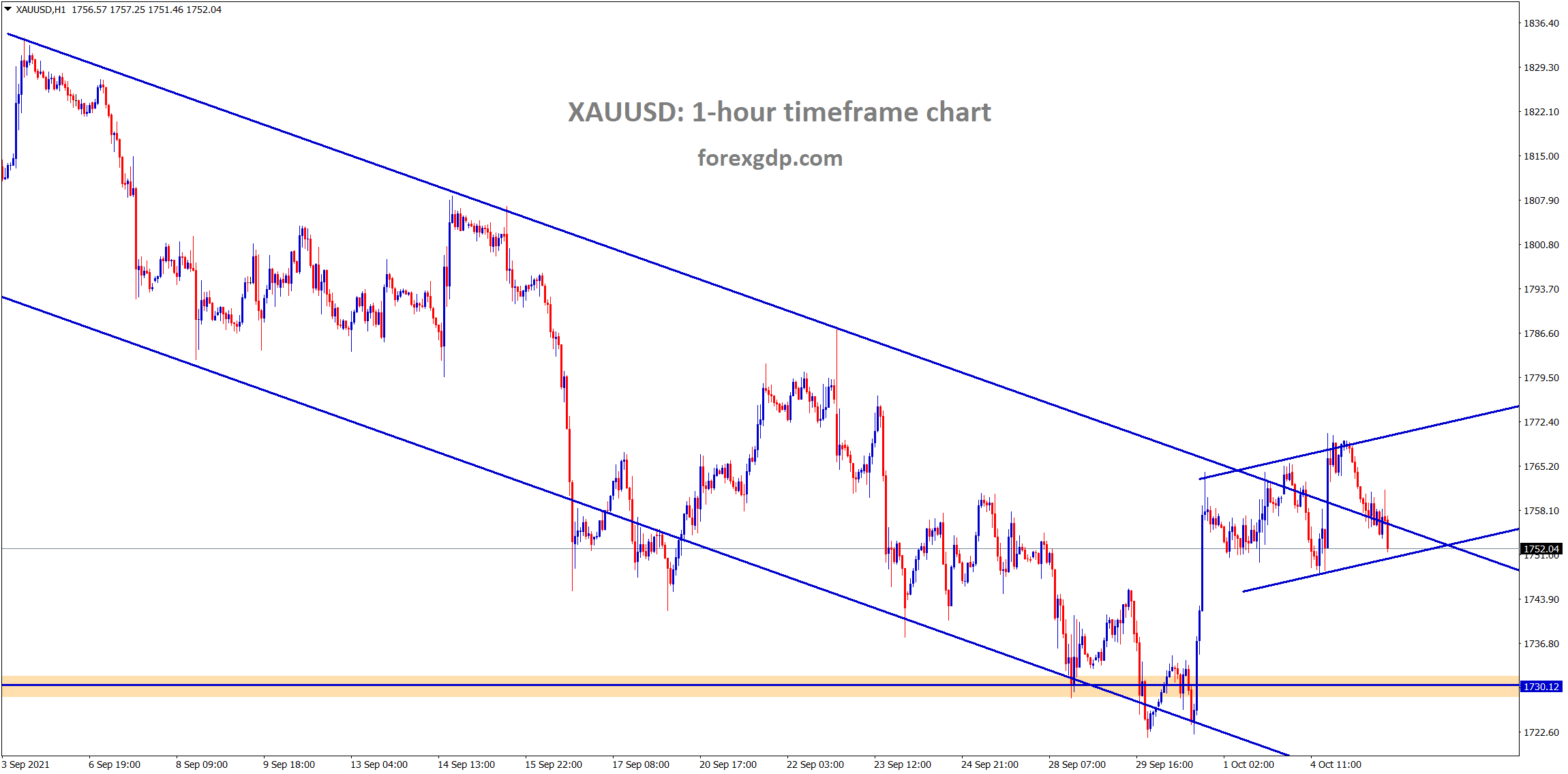

Gold: US factory orders jumped

Gold is consolidating at the lower high area of the descending channel range – wait for the breakout.

Gold prices are slightly higher as profit booking from sellers, and last week dropped to support level.

US Factory orders are rose to 1.2% in August from a 1% jump expected.

Now all eyes waiting for Fed tapering in November and rate hikes in the middle of 2022.

The covid-19 crisis now shows more improvement in the US as Vaccination higher rates. Now the situation is tilted to the US Debt ceiling issue, US Joe Biden plan of $2.2 Trillion package issue and Global oil demand concerns.

Gold seems an inflation hedge currency Globally, but here US Dollar shows a dominant role in the US Economy recovery in a resilient manner.

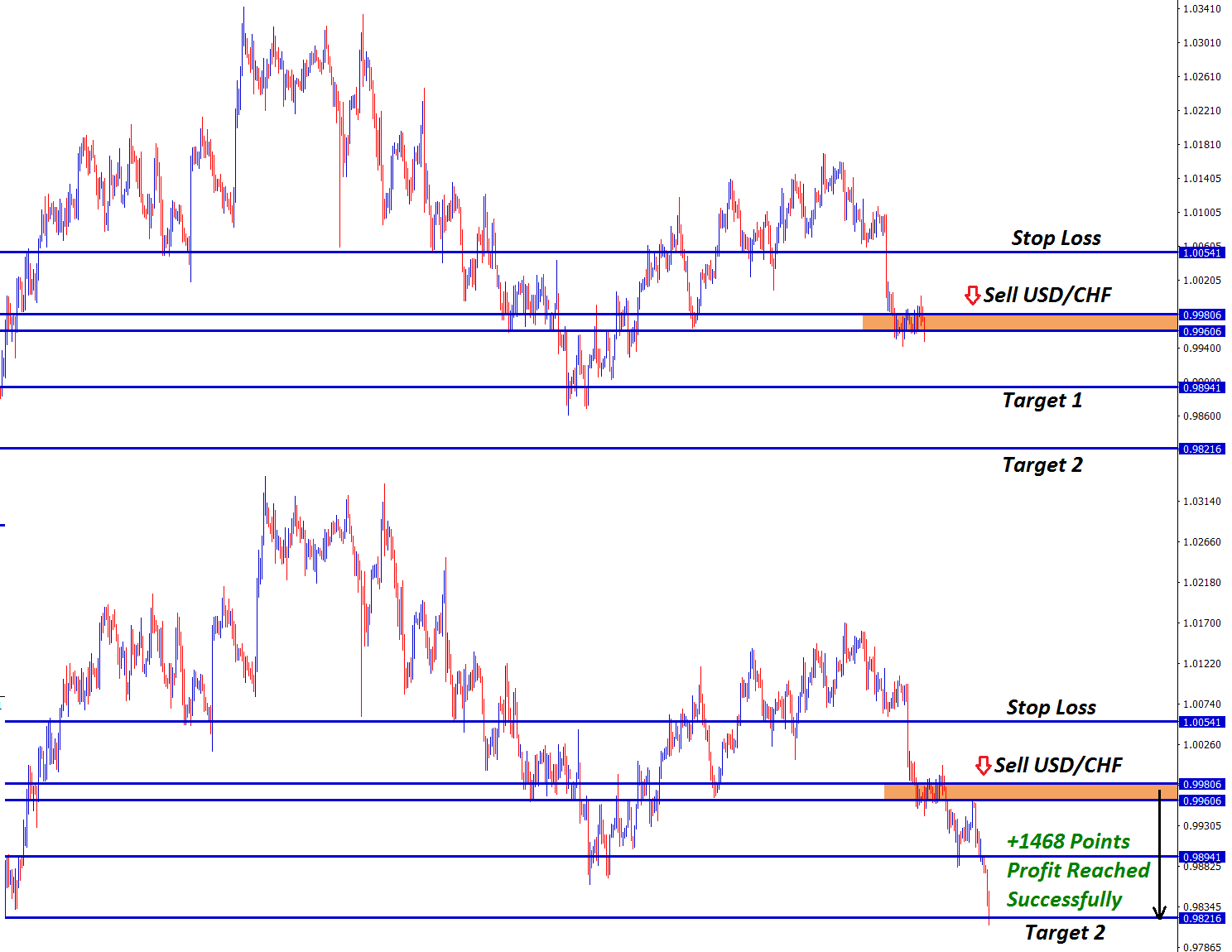

US Dollar: Demand for US Dollar higher

USDJPY is trying to move up again after doing a minimum correction.

US Dollar shows continued strength in the market as Weaker Oil Supplies and US Debt ceiling issues in US Senate.

China Evergrande crisis makes US Dollar demand higher, and Oil prices daily keep higher as US Dollar prices demand higher.

And US Joe Biden plan of a $2.2 Trillion spending package is held by the Republican party to reduce spending plans and not raise US Debt ceiling limits for overspending of US Dollar.

The overspending makes US Dollar worthless and wake up the economy in step-by-step stimulus injections is a requirement by the Republican party.

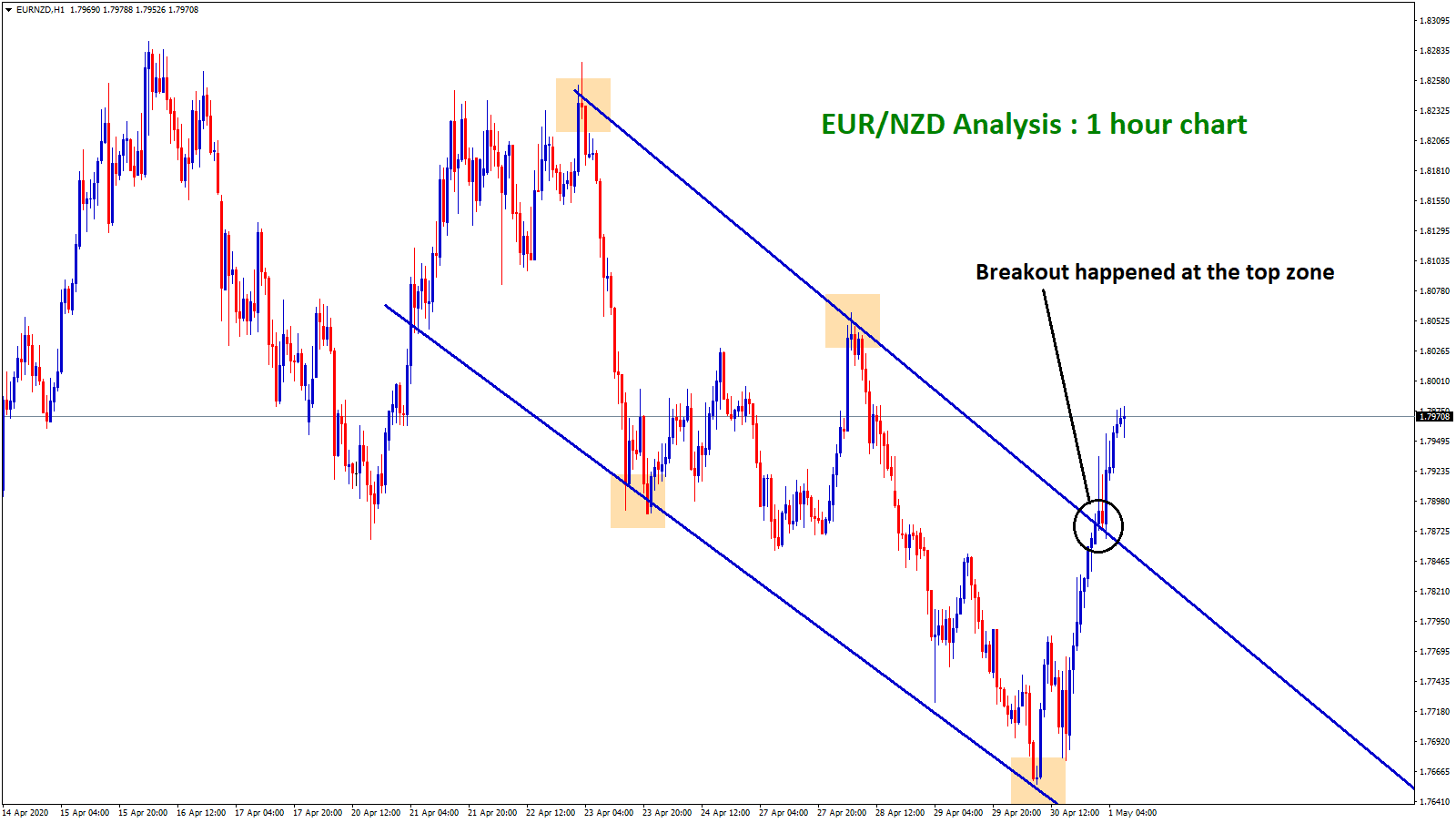

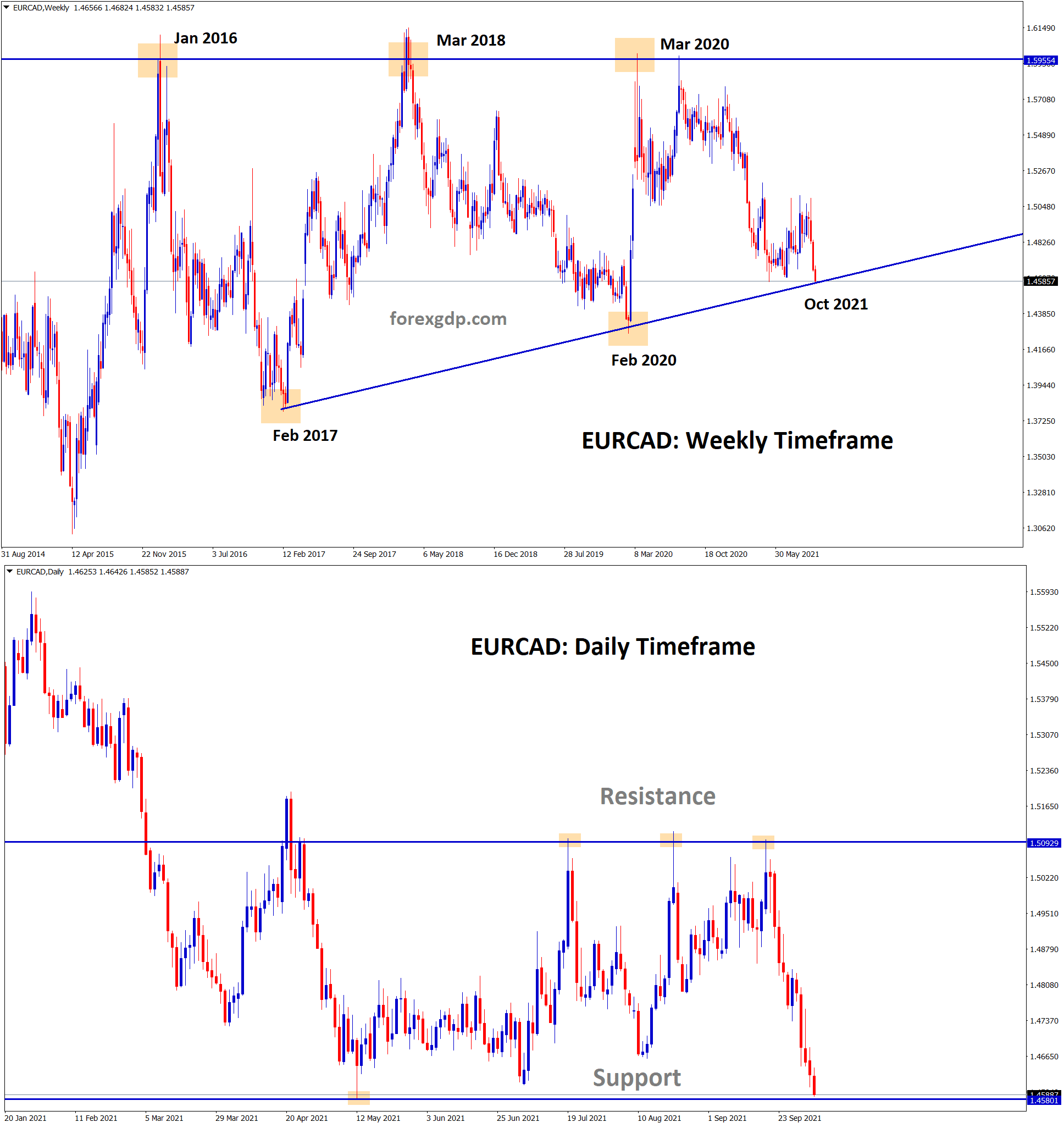

EURO: Weak Eurozone Domestic data

EURCAD is standing exactly at the important support area – wait for reversal or breakout.

EURUSD keeps support level as 1.15500 to 1.16 level as Eurozone Domestic data performed moderately.

As German industrial production shows fewer numbers in last month and Eurozone keeps weak in all sectors of Domestic data.

The unemployment rate rose in Eurozone, and Consumer spending became lower as tight lockdown issues.

And US FED Powell going to taper in November, and ECB will not do soon tapering as inflation below 2% target in Eurozone.

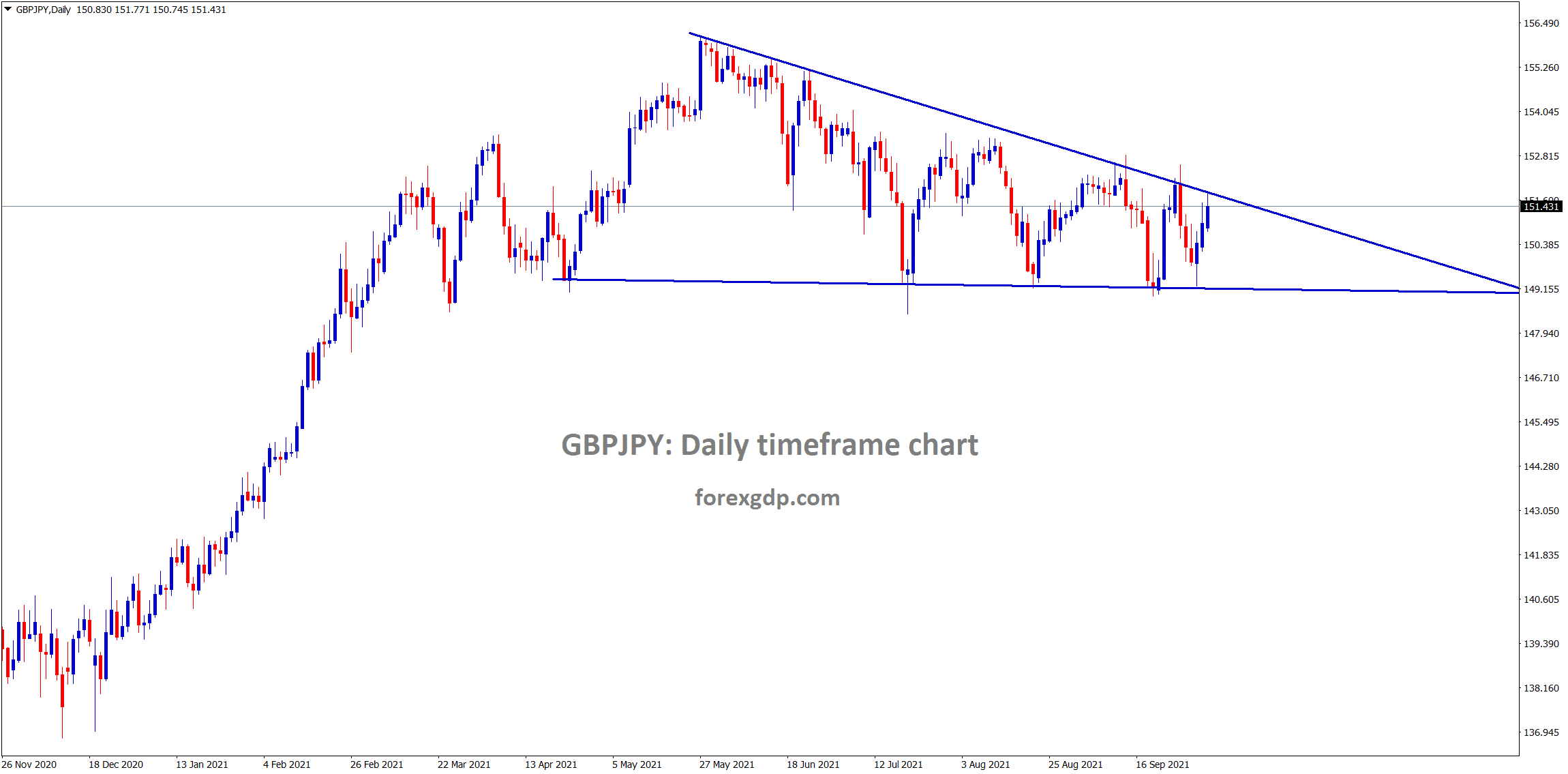

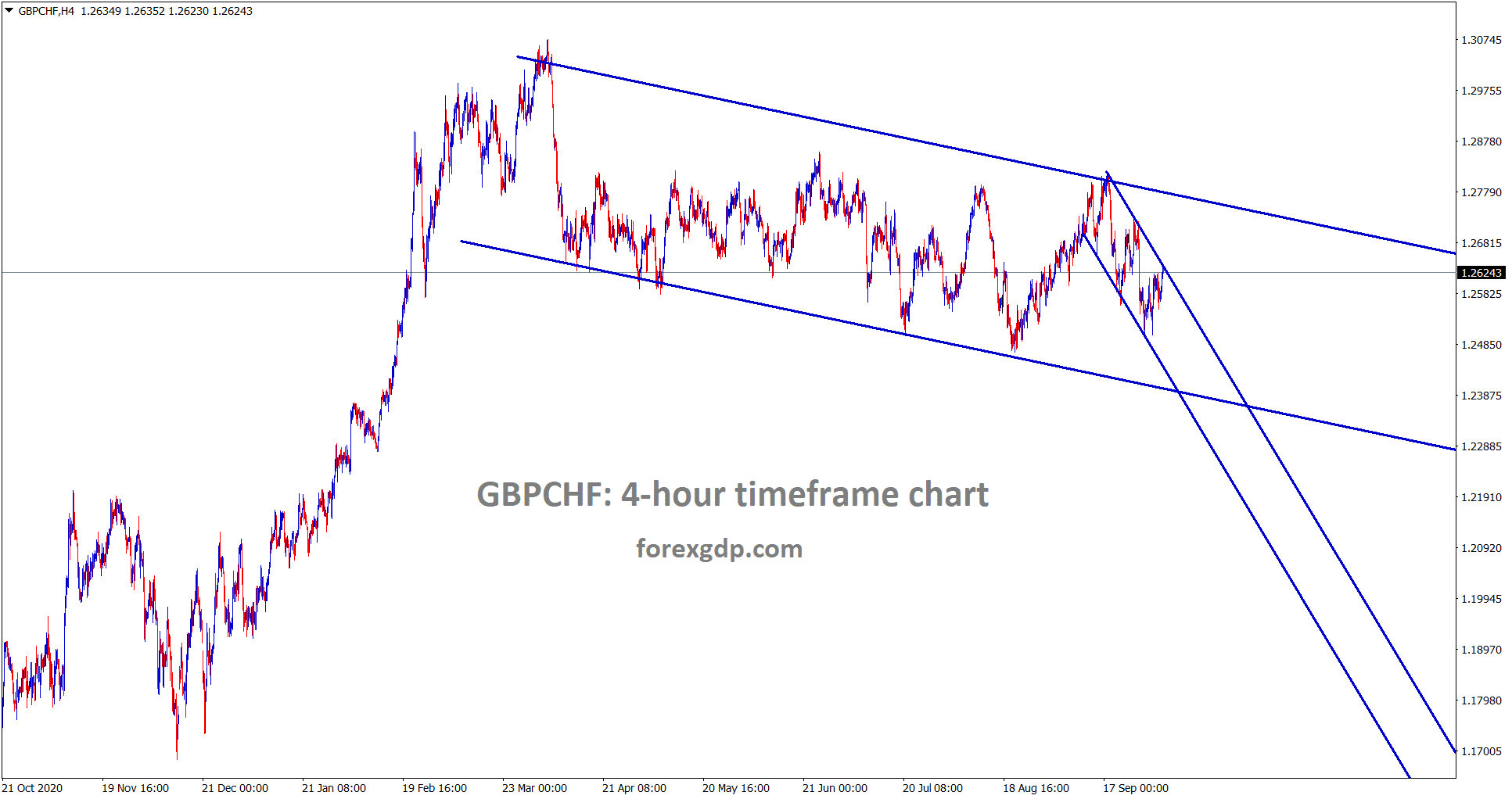

UK Pound: Weak car sales in the UK

GBPJPY is trying to break the descending triangle – wait for the strong breakout confirmation.

GBPCHF is standing at the lower high of the minor descending channel – wait for breakout from this minor descending channel.

British car manufacturers sales down by 35% year/ year and it is the weakest sales for 23 years.

The Reason Behind this was SMMT as semiconductors shortage in industry and Automobiles failed to produce without IC’s and Chipsets to cars.

![]()

One side Stagflation causes weak growth and strong inflation in the UK, and this scenario continues as Fuel prices demand increases in the UK.

The UK feels very hot in Petrol and Gas demand as the Winter season comes.

Wage inflation increases

The United Kingdom faces two types of risk Covid-19 crisis and Brexit issues.

Due to the Brexit deal, EU workers are returned to the EU, now labour shortages in the UK for Truck drivers and all sectors for labour shortages.

Now the UK facing Wage inflation costs as UK Labor to admit in the same seat of EU labour. So the cost of labour is different from Domestic and import labour.

So now increasing wage inflation of labour and unemployment rate creates overheating in the UK.

Due to truck drivers’ shortages, Transport movements are mostly suffered.

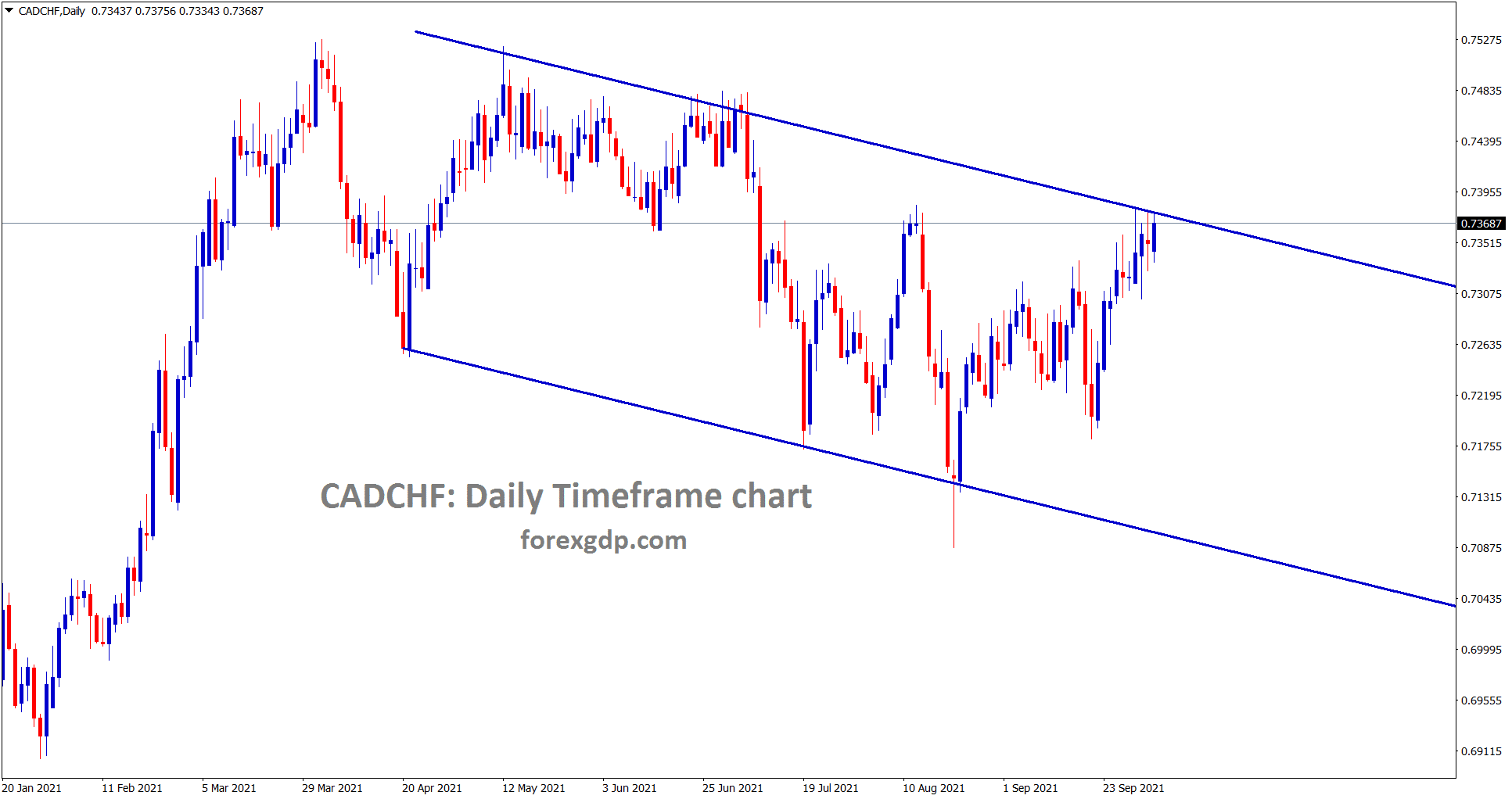

Canadian Dollar: Canadian Building permit data

CADCHF is standing at the lower high level of the descending channel.

Canadian Building permits came at 1.2% declines in August and CAD Dollar Strongly outperformed as Oil prices continue soaring in market.

And US Joe Biden stated US Government will default to $28.4Trillion debt if the Debt ceiling is not rose in two weeks by the Republican parties.

USDCAD shows declines in the market as the Canadian Dollar dominant performer in the market.

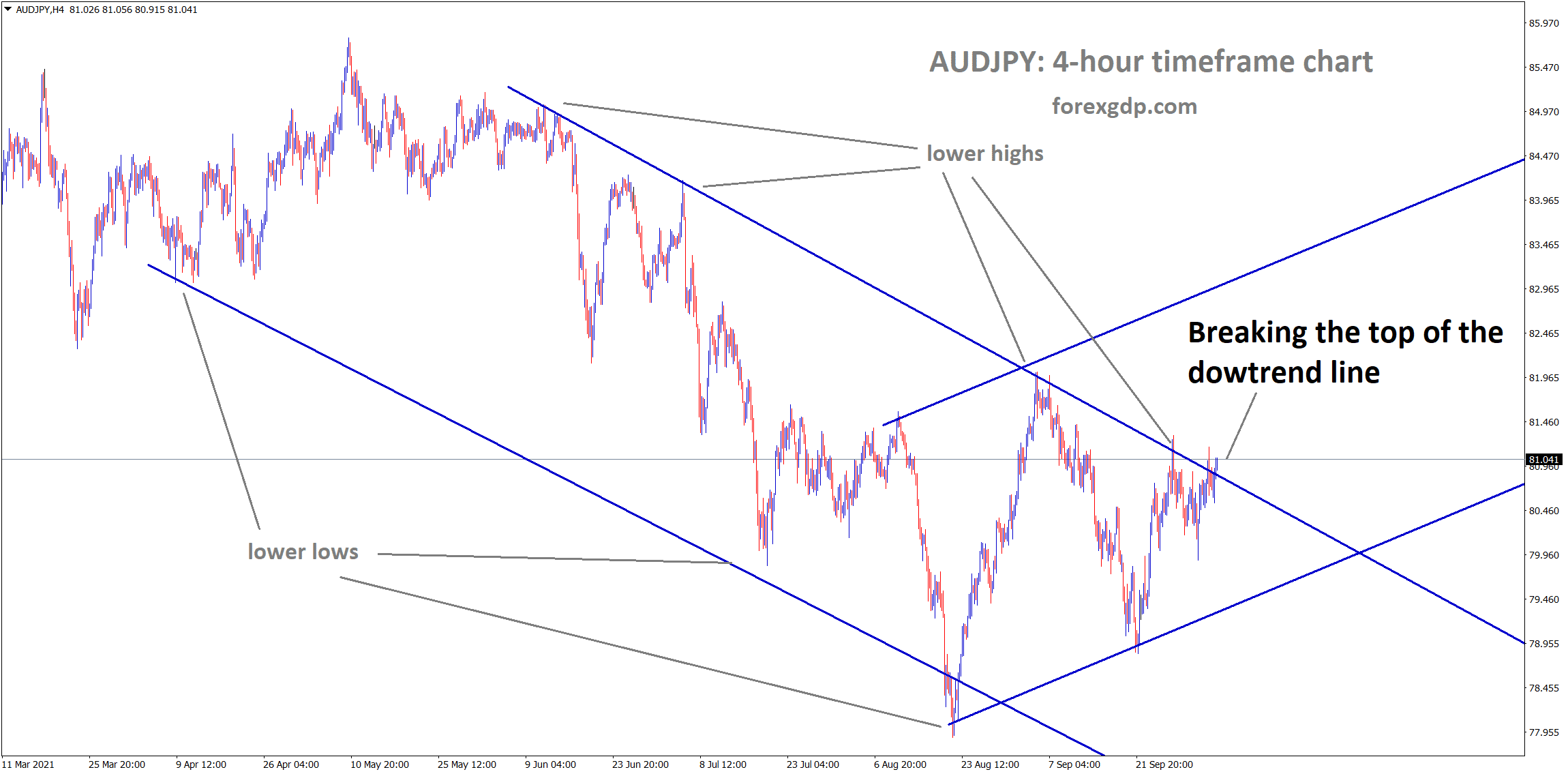

Japanese Yen: Japanese New PM Kishida speech

AUDJPY is breaking the top of the downtrend line in the 4-hour timeframe chart.

Japanese finance minister Suzuki stated Prime minister Fumio Kishida told him to stick to strong stimulus until the Japanese economy recovers.

His goal is to cover the Deflation to inflation category for increasing Consumer growth and sales.

And he told us to use a low-interest-rate environment for utilizing FLIP Programmed.

This statement gives hope for the Bank of Japan to achieve a 2% inflation target by 2022 end.

More stimulus is required for Japanese vaccination and proper business to run without any lockdown purposes.

Australian Dollar: RBA meeting outcome

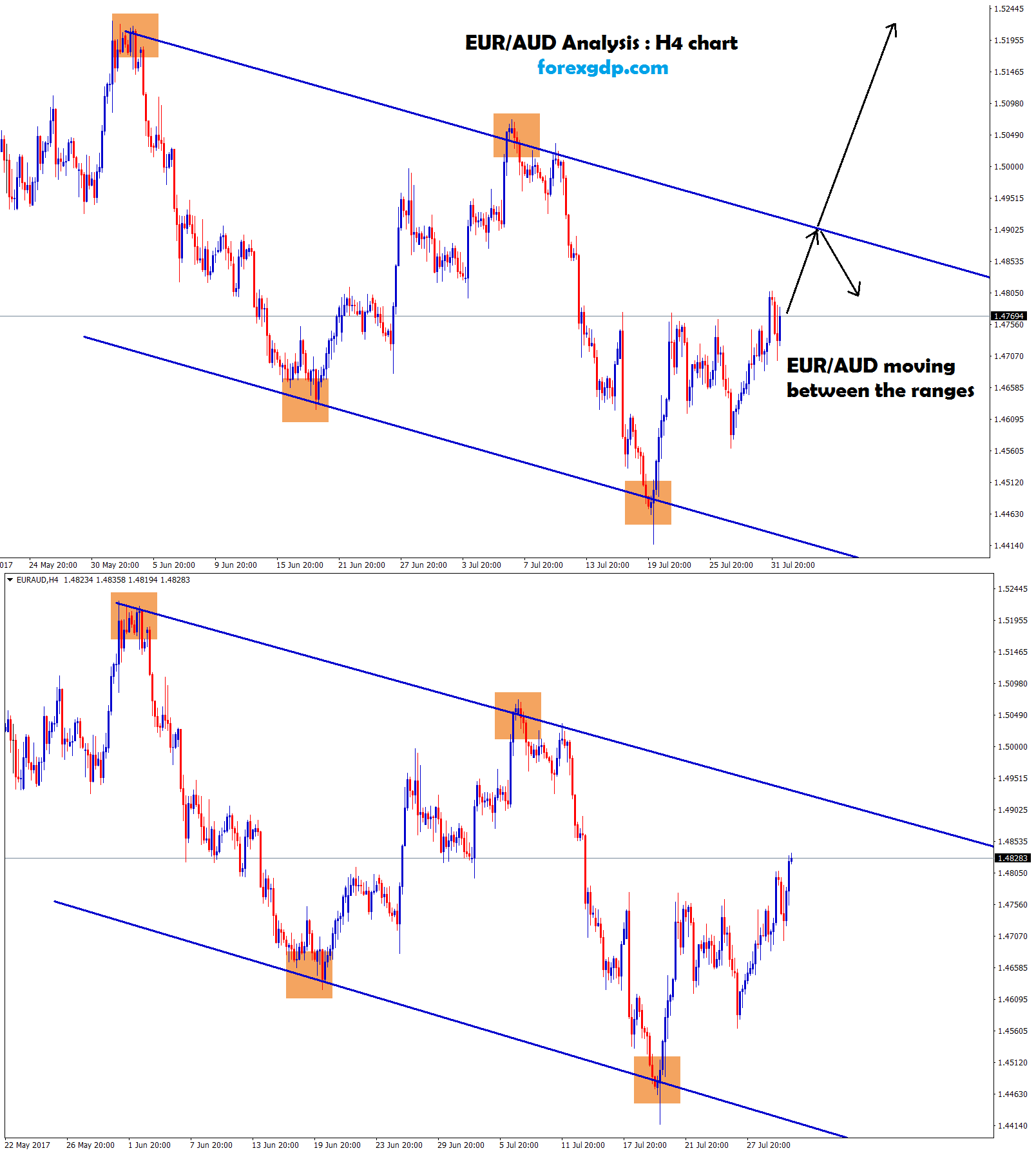

EURAUD is standing at the horizontal support area.

RBA meeting happened today in the morning session and left rates unchanged at 0.10% and AUD 4 billion purchases per week continue until Feb 2022.

Australia’s trade surplus came at AUD15.8 billion against AUD 10 billion expected.

Cases in New south Wales were decreasing and the 4th quarter of the Australian economy shows recovery mood in a good manner as RBA Governor Lowe expected.

Vaccination progressing faster in Australia, and the economy will be shaped in mid of 2022 as RBA expected.

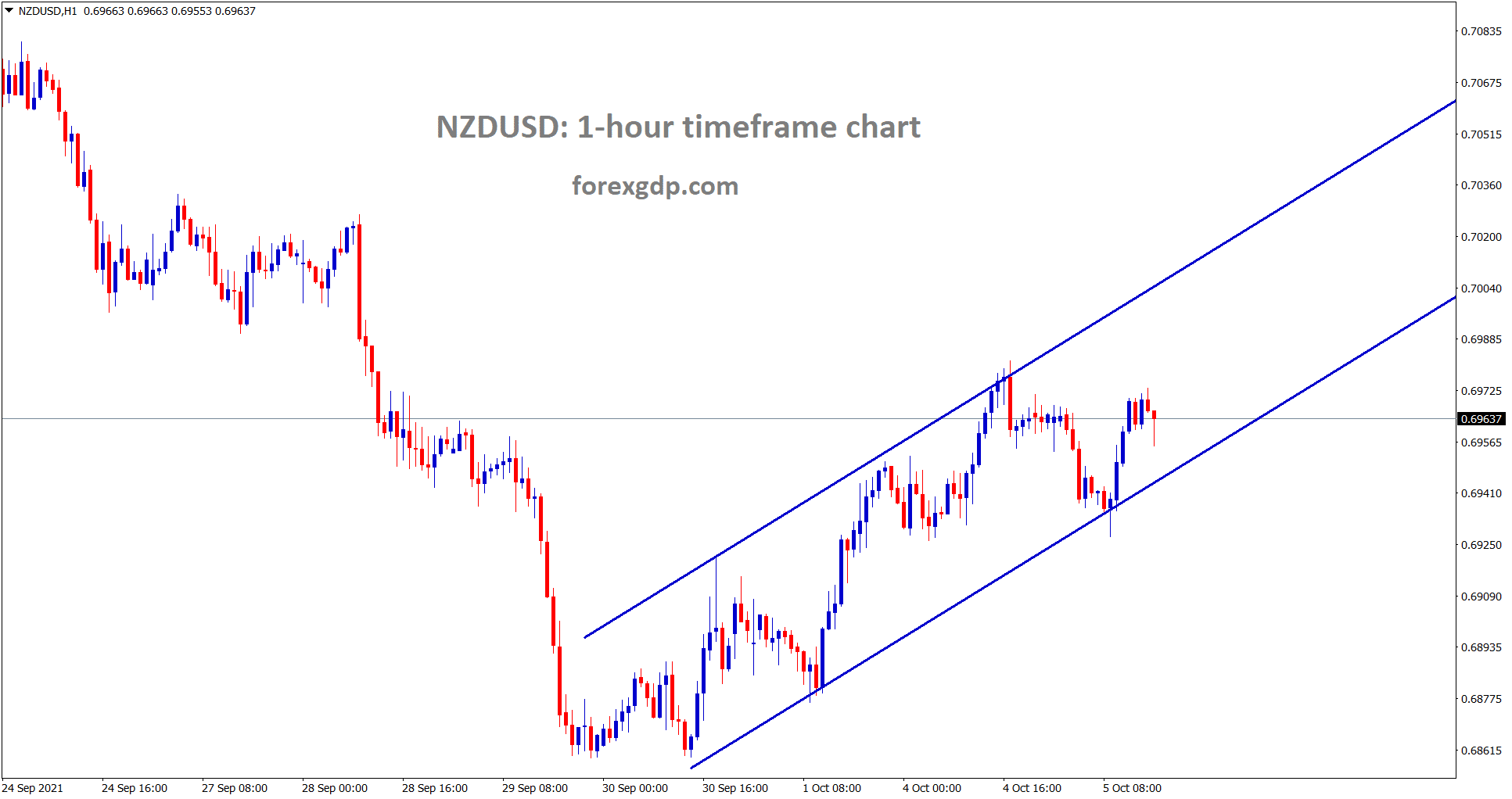

New Zealand Dollar: Vaccination higher in NZ

NZDUSD is moving in an ascending channel – tomorrow we have NZD interest rate news – Expecting positive news for NZD.

New Zealand Dollar shows bearish momentum in the market ahead of the Reserve bank of New Zealand meeting, which will conduct tomorrow.

There is a 90% chance of 25bps rate hikes in this meeting; if done New Zealand Dollar rally started again in the market.

And New cases of Delta variant is rallies in New Zealand continuing, and New Zealand Government imposed 4 tier lockdowns in more cities to avoid spread.

And Government hopes that vaccination above 16 ages will be completed by December end as planned.

Once all 90-95% of vaccination is completed, lockdown will be released.

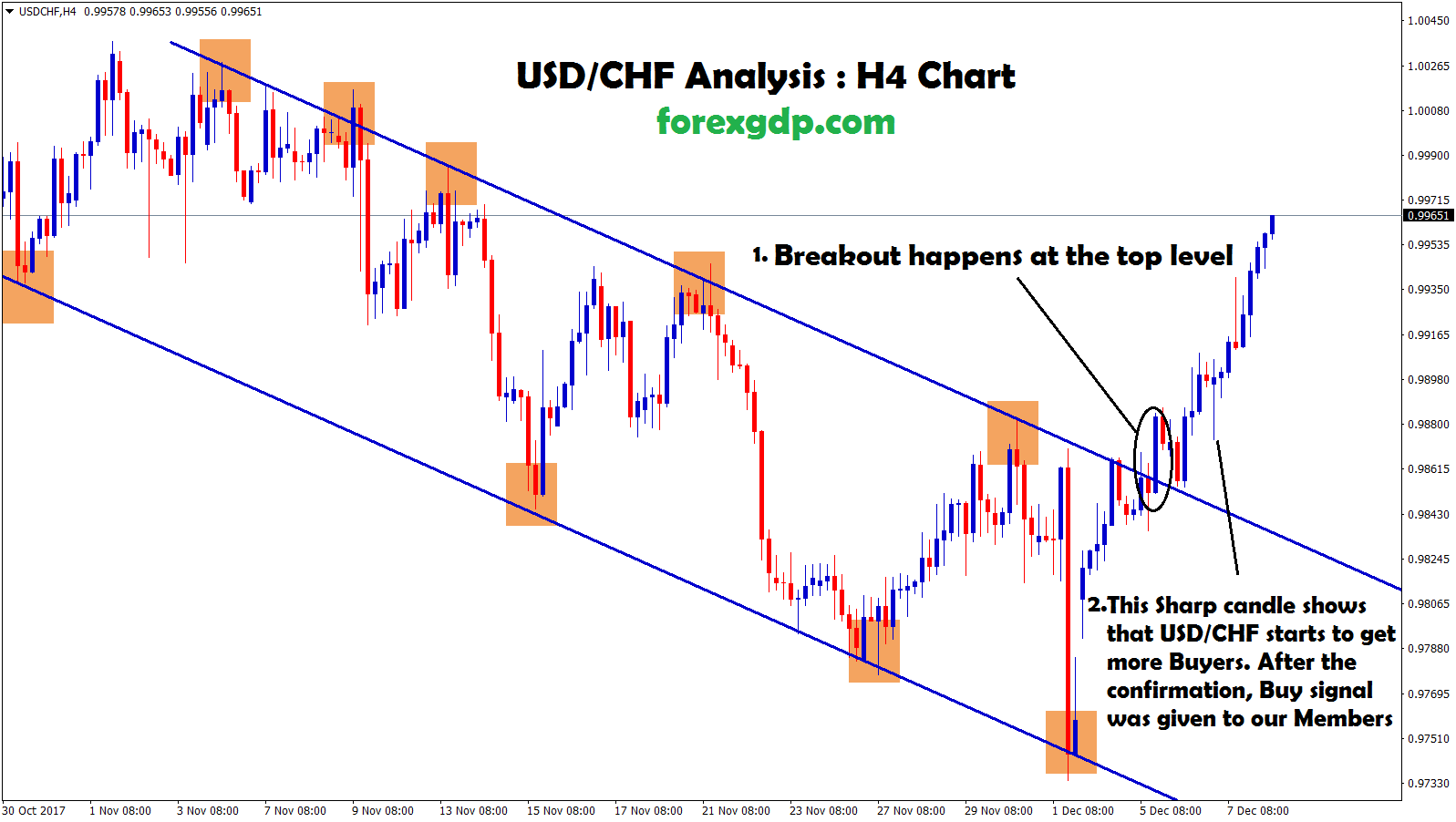

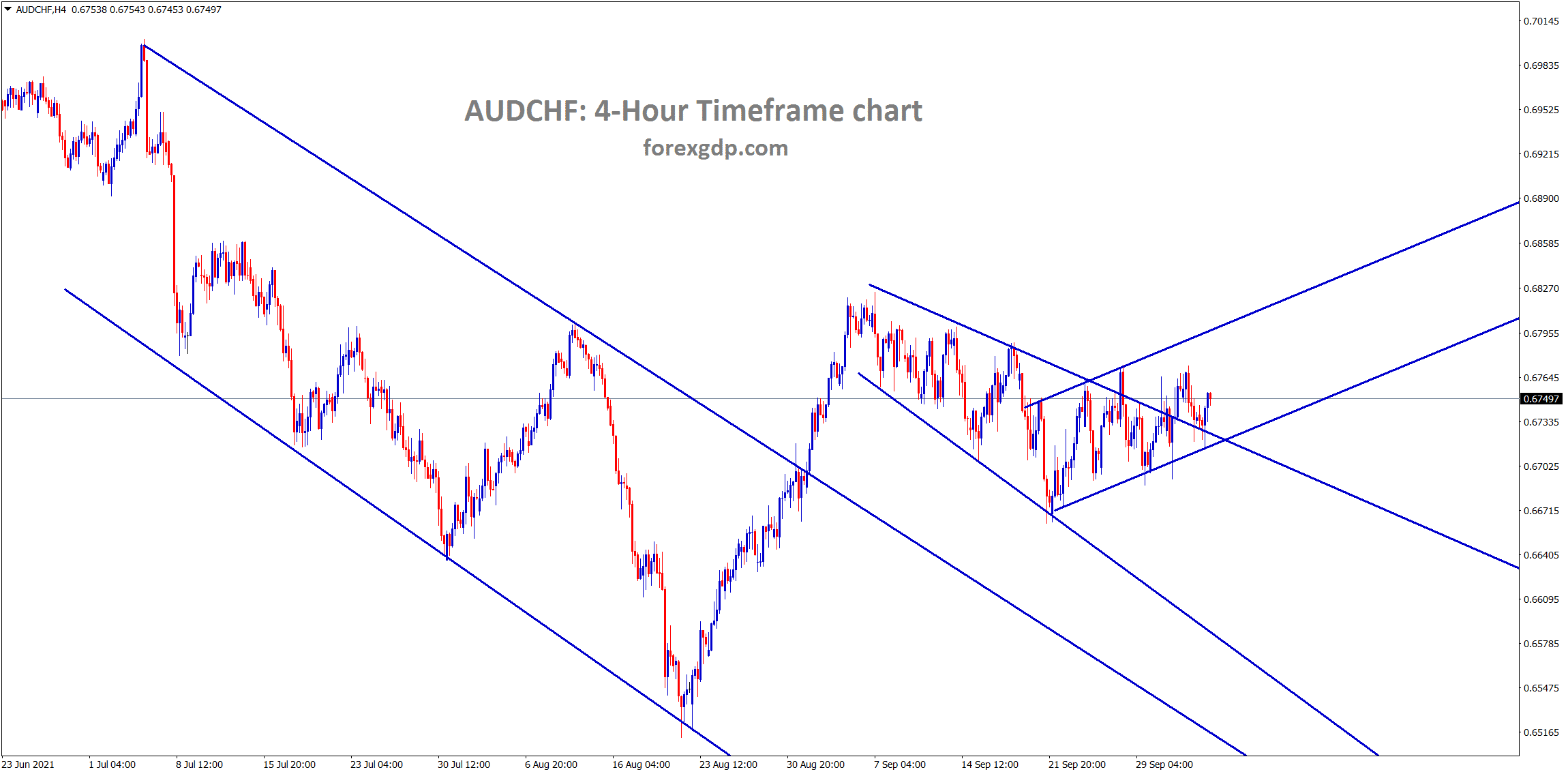

Swiss Franc: US Jobs data forecast

AUDCHF is moving in a small ascending channel line.

This week US both Government Jobs and Private job numbers to listed, So Swiss Franc made more volatile as Job numbers of US.

FED Powell makes the decision of tapering next week based on Unemployment numbers in the US.

Swiss currency now fair value as China Evergrande crisis happened and more money floating to Swiss bank as a Safer mode of investors.

Swiss Zone shows lower Domestic data performance and SNB will start to FX intervention if currency value keeps higher.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/