Gold: Russia and Ukraine’s decision is waiting for gold directions

Russia temporarily stopped the attack as talks with Ukraine went on, and several Rounds of talks happened last day in Belarus.

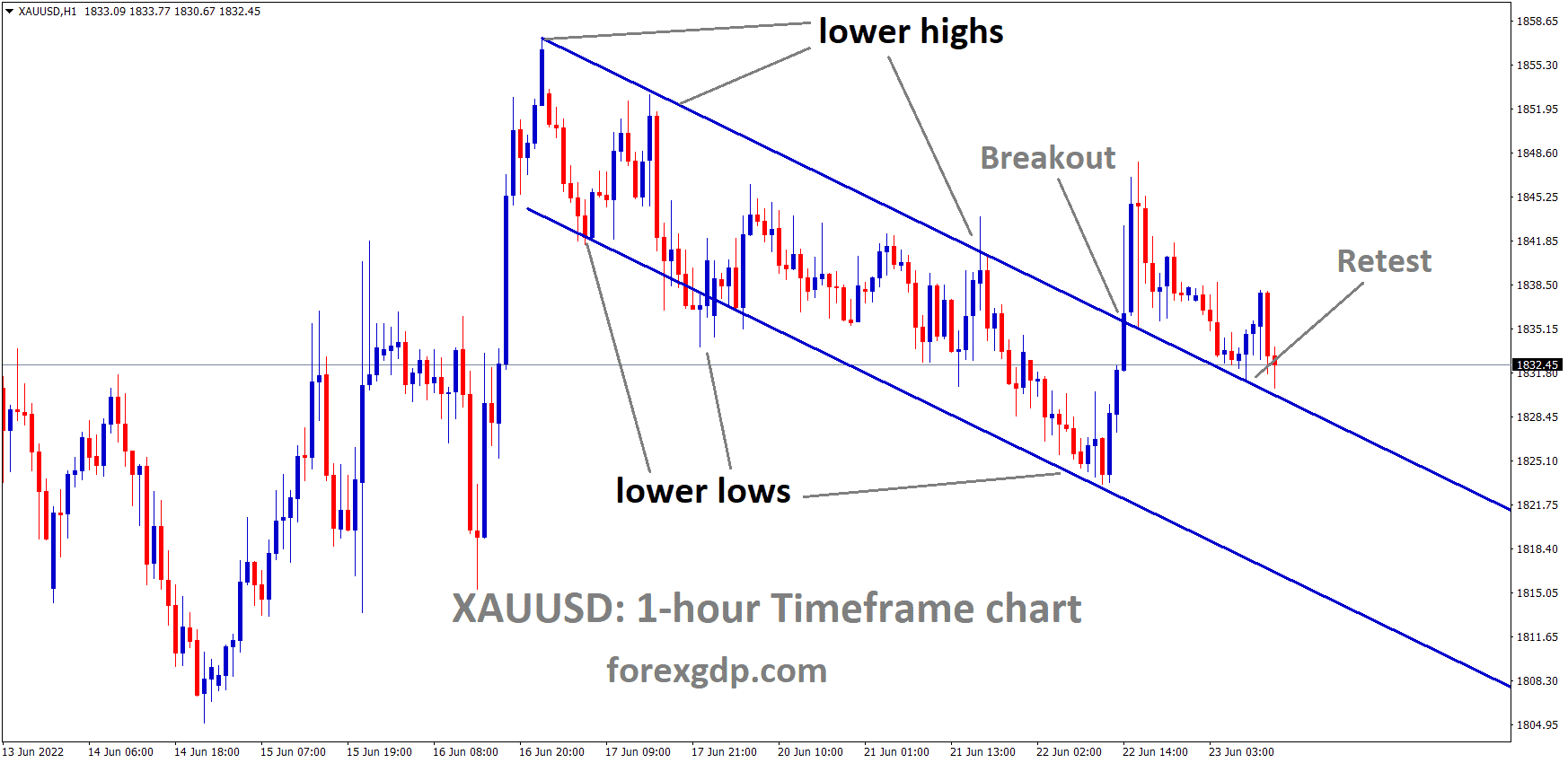

XAUUSD Gold price is moving in an ascending triangle pattern and the market has reached the Horizontal Resistance area of the pattern.

Gold prices are in consolidation around 1936$-1880$ waiting for Breakout or Reversal depends on Ukraine and Russia second round of talks on Poland Border.

Now Next round of Talks happened in Poland, and the UN security council said Russia have to scale Back troops from Ukraine immediately without any delay.

So, Russia and Ukraine War will end or continue the directions of End the Gold rally or continue the gold rally in new highs; all we have to do is wait and See the Final decision today.

US Dollar: Russian Troops march towards Kyiv City to Block routes

USDCHF is moving in an ascending triangle pattern and the market has rebounded from the higher low area of the pattern.

Russia and Ukraine peace talks first round completed and next round set to talk today, Russian Troops are marching towards Kyiv to block the significant routes to Ukraine capital city.

And the US Said Russia had a Double Down on Violence when Russian Troops struggled against Ukraine Troops.

And this week, Germany inflation data and US ISM manufacturing PMI, Non-Farm Payrolls set to release.

Rounds of Talks Between Russia and Ukraine going on

US Dollar index went for minor correction after Russia and Ukraine talk on War stoppage at Belarus for First round of Talks.

Next Round of Talks going to Happen in Poland for Final decision whether war is going to stop or continue with current actions.

And US ISM manufacturing PMI scheduled this week and Domestic data for the US Performed Well in Last month.

This week NFP and ADP data are scheduled, and more upbeat numbers are expected from Analysts.

And Due to War fears US Dollar index went higher as investors parked their funds in Safe Haven Assets.

EURO: Danske Bank Forecast of EURO is 1.0800 in 12 Horizon months

EURUSD is moving in the Symmetrical Triangle pattern and the market has reached the bottom area of the Pattern.

According to Danske Bank forecast for EURUSD is 1.08 in the 12 Horizon months of 2022 from 1.1200 from the Latest price.

The Ukraine Crisis does not impact the Euro side, but sanctions against Russia may be revenge in terms of Gas Supplies to Germany is expected.

And Danske Bank said ECB may not do rate hikes until December month, But FED is eager to do rate hikes in every meeting with Selling Bonds at a higher rate.

10 year and 5-year bonds are rising higher as the Interest rate is set to rise in every meeting are possible.

UK Pound: UK Manufacturing PMI came at higher than expected

GBPUSD is moving in an ascending triangle pattern and the market has reached the higher low area of the Triangle pattern.

The EU has Paused Funding to UK Scientist’s studies due to Brexit, and the UK did not compromise with the Northern Ireland Protocol deal.

Bank of England expected to Increase rate 25bps this month due to FED doubtful of a 50bps rate hike.

And US Dollar strengthens due to War fears higher in Global levels.

UK Manufacturing PMI came at 58.0 versus 57.3 expected, But Pound remains lower as Crisis in Ukraine height up.

Canadian Dollar: Bank of Canada monetary policy meeting Forecast

AUDCAD is moving in the Descending channel and the market has reached the lower high area of the Channel.

Bank of Canada monetary policy meeting going to Happen tomorrow and Expected 25 Basis points hike from Current rate of 0.25%.

And Governor Tiff Macklem and Co discuss Household and Business sectors affected by Covid-19 and how much recovered in the meeting.

Russia and Ukraine Invasion War makes support for Canadian Dollar to increase due to Oil prices made higher every day.

And Hiking Interest rates makes the Canadian Dollar double support to increase against Counter pairs.

Japanese Yen: Leveraged Loan market risks swell

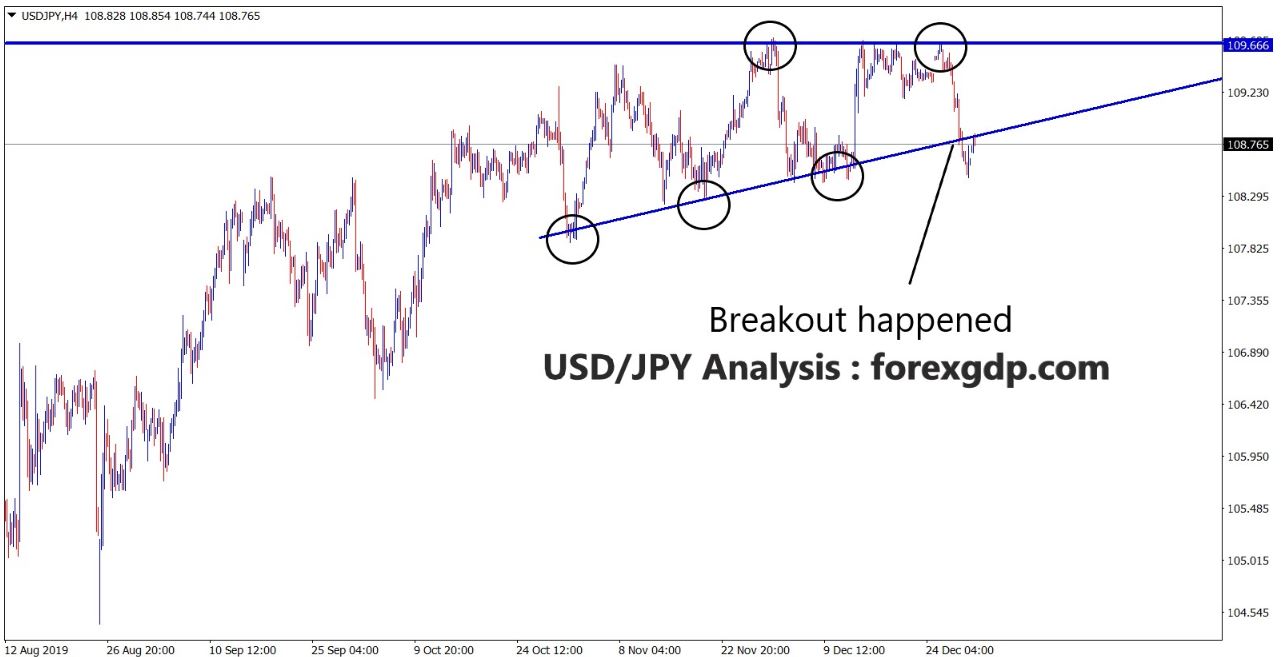

USDJPY is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

$3 Trillion Leveraged Loans were risks for investors and Lower interest rate prevails in Global market, Investors interested in JPY Bonds as Safe Haven Assets investment during War and Crisis Times.

And FED took more assets purchases in 2020 to compensate Economy crisis by Covid-19.

Now Asset purchases may be continued, or a Rate hike is possible from FED; more bond purchases happened and now Selling is more doubtful and May be extended for more months until Ukraine and Russia War stopped.

Australian Dollar: RBA left interest rates unchanged

AUDJPY is moving in the Symmetrical triangle pattern and the market has reached the Top area of the Triangle pattern.

RBA Monetary Policy meeting Happened today and left interest rates unchanged at 0.10%.RBA said There are no changes in cash rate until May month 2022.

And Assets purchases not mentioned in the meeting, FED mandated RBA to maintain CPI levels on average Between 2 and 3% in the medium term.

And Several market participants urge Federal Government to provide additional funding to the Australian Bureau of Statistics to Increase the Frequency of Consumer price inflation.

The Fourth Quarter CPI came above expectations as 1.3% printed as QoQ and 1.0% expected, and the Previous reading was 0.80%.

New Zealand Dollar: Chinese Data came above expectations

NZDUSD is moving in the Descending channel and the market has rebounded from the Lower low area of the channel and the Market reached the lower high area of the minor Descending channel.

Chinese NBS Manufacturing PMI for February Rose to 50.2 versus 49.9 expected and 50.1 previous reading.

Non-Manufacturing PMI crossed 51.1 versus 51.6 previous reading, China’s Caixin Manufacturing PMI rallied to 50.4 versus 49.3 expected.

And New Zealand Dollar gained after Chinese Data was released today.

Ukraine crisis makes it riskier for AUD and NZD Dollars.

And More Borders to reopen and planned by New Zealand Government and Favors for Tourism revenues.

Swiss Franc: Swiss Franc Value increases against Riskier Currencies like EUR, AUD, and NZD

EURCHF is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

Swiss Franc makes 6.5 highs against Euro as Tensions in Russia and Ukraine tempted higher.

Switzerland also joined with the EU to propose sanctions on Russia, which makes investors to more transfer Funds to Switzerland.

US, EU and its allies imposed more sanctions on Russia, and Russia will take revenge on Gas Supplies to Europe; this will trigger Gas prices to Higher and Energy prices to lift higher.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade setups at Premium or Supreme plan here: https://signal.forexgdp.com/buy/