Have you ever had someone tell you that he trades online but couldn’t make head or tail about what he was talking about? Well, Online trading means trading that is carried out on the internet.

Investors and traders sell and buy financial instruments through an internet-based platform offered by a bank or a broker to profit from price variations.

Decision relevant to trading is made on your trading platform and immediately sent to the brokers, which is why a very stable internet connection is required.

Since the 1990s, online trading has grown exponentially due to easily affordable internet connection and computers.

Online Trades You Can Participate in

|

Trading Style |

Timeframe |

Trading Period |

|

Day Trading |

Short-term |

Maximum of one day- never hold any position throughout the night |

|

Scalping |

Short- term |

Few seconds or minutes |

|

Position trading |

Long term |

Years, months, weeks |

|

Swing trading |

Medium- short- term |

Many days or even weeks |

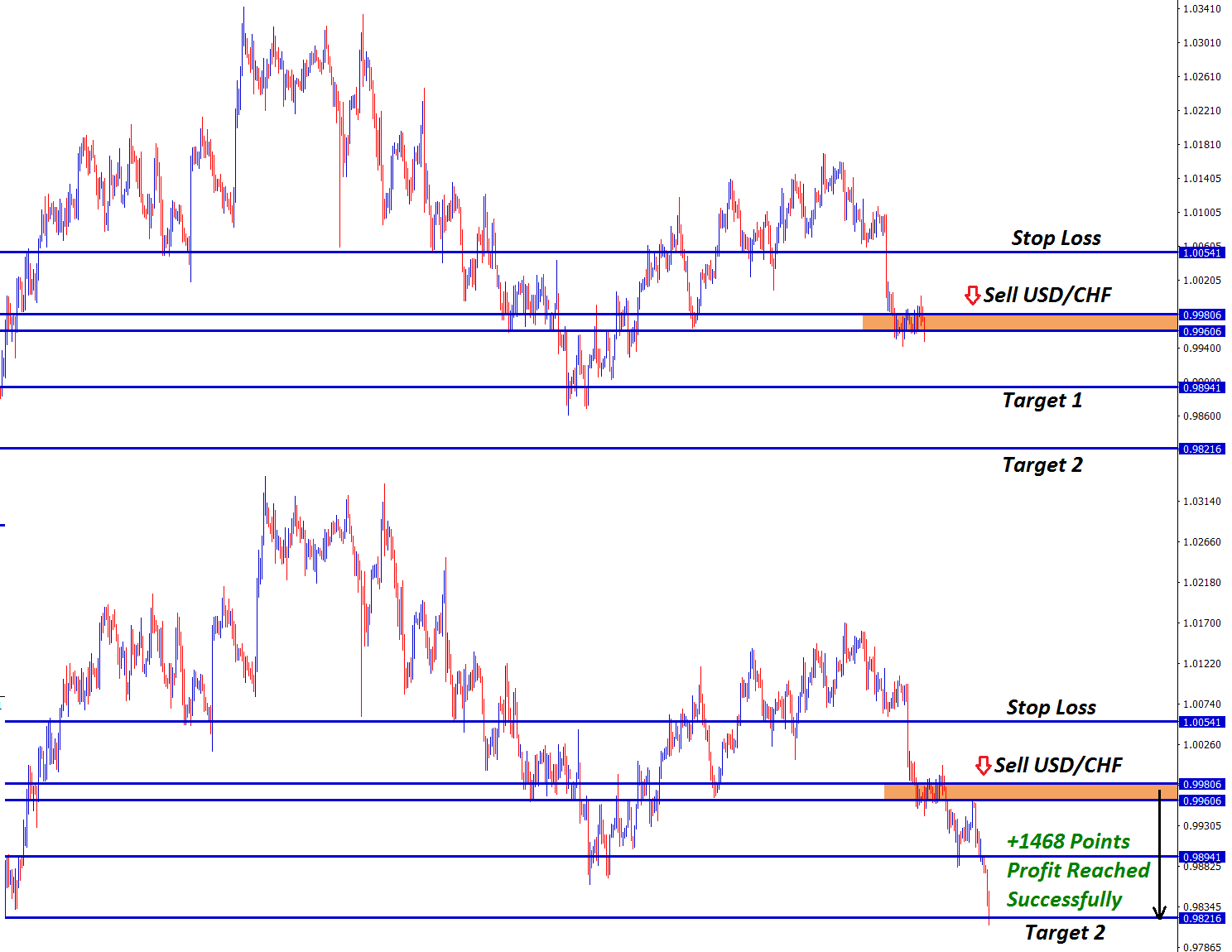

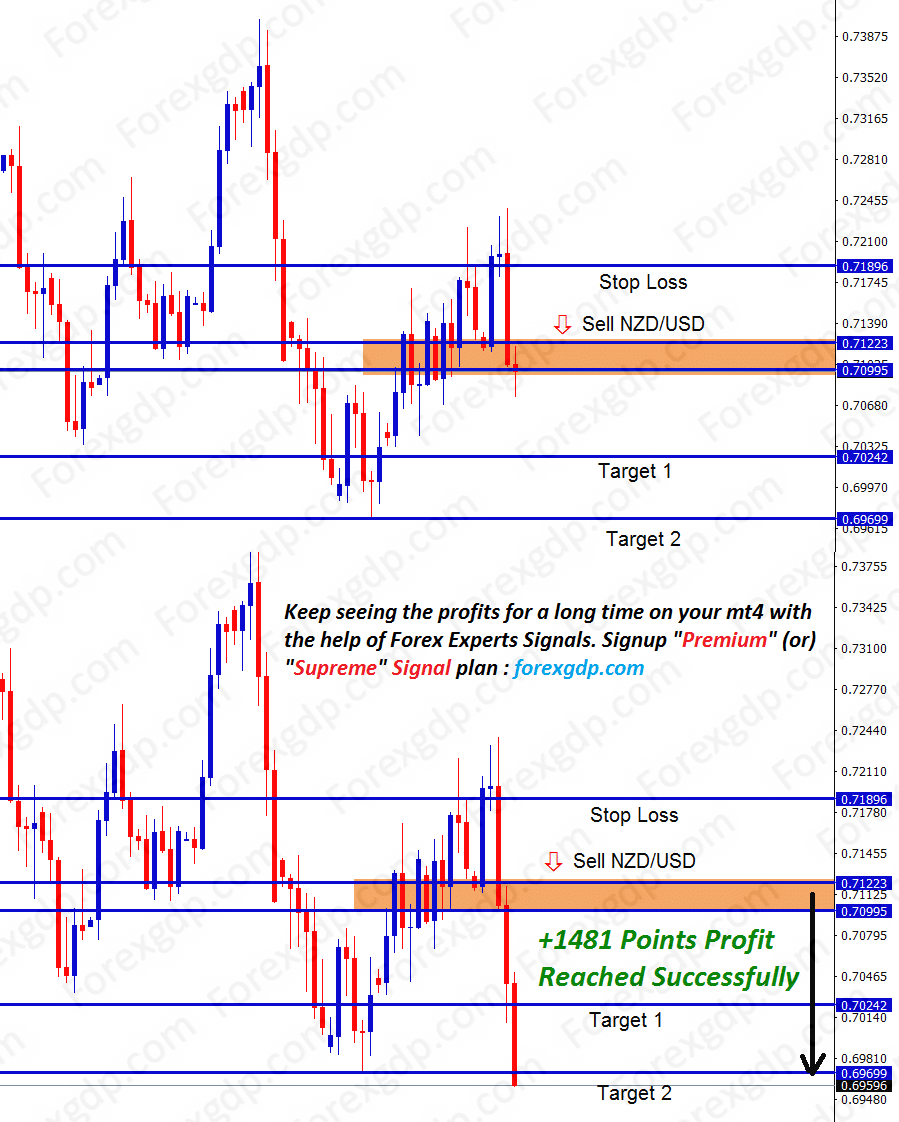

Trading instruments, sometimes referred to as financial markets is a market place where you trade financial securities nationally or internationally.

Traders sell and buy these securities to obtain possible profits while attempting to limit their risks.

Numerous traders focus more on just one financial market, for instance, CFDs or trading stocks. Still, it is critical to analyze all the available financial markets to trade since they can impact each other.

Different Types of Financial Markets You Can Trade

- Derivatives markets – such as CFDs (Contracts for Difference).

- Forex – referred to as the Foreign Exchange market or FX.

- Money markets – such as short-term debt.

- Capital markets – such as bond markets and stocks.

- Derivatives markets – such as CFDs (Contracts for Difference).

- Commodity markets – such as oil, gold, and silver

- Cryptocurrency markets – which involves Bitcoin and altcoins.

- Insurance market – which moves risk for a premium.

You Need The Following Things to Start Online Trading:

- high-speed internet connection

- A reliable computer,

- Trading account

- A trading platform

- A broker

What is A Trading Platform?

A trading platform is a simple software that allows traders and investors to place orders and keep an eye on accounts via financial intermediaries. A trading platform comes loaded with some other features such as charting tools, real-time quotes, and premium research.

Who is A Broker?

A broker is an independent company or a person that organizes and implements trades on another party’s behalf. Nevertheless, brokers must be licensed to give counsel and execute the sales. Brokers will only follow your wishes. They can only trade when you allow them.

What to Look out for in a Trading Platform

Your success in online trading can depend on the trading platform you are using since it determines the types of markets you can access and its features to facilitate your trading. Here is what to look out for in a trading platform. It should enable the things outlined hereinbelow.

- Exiting and Entering Setups

- Fundamental analysis

- Availability to support discussion communities and forums

- Switching to several accounts swiftly

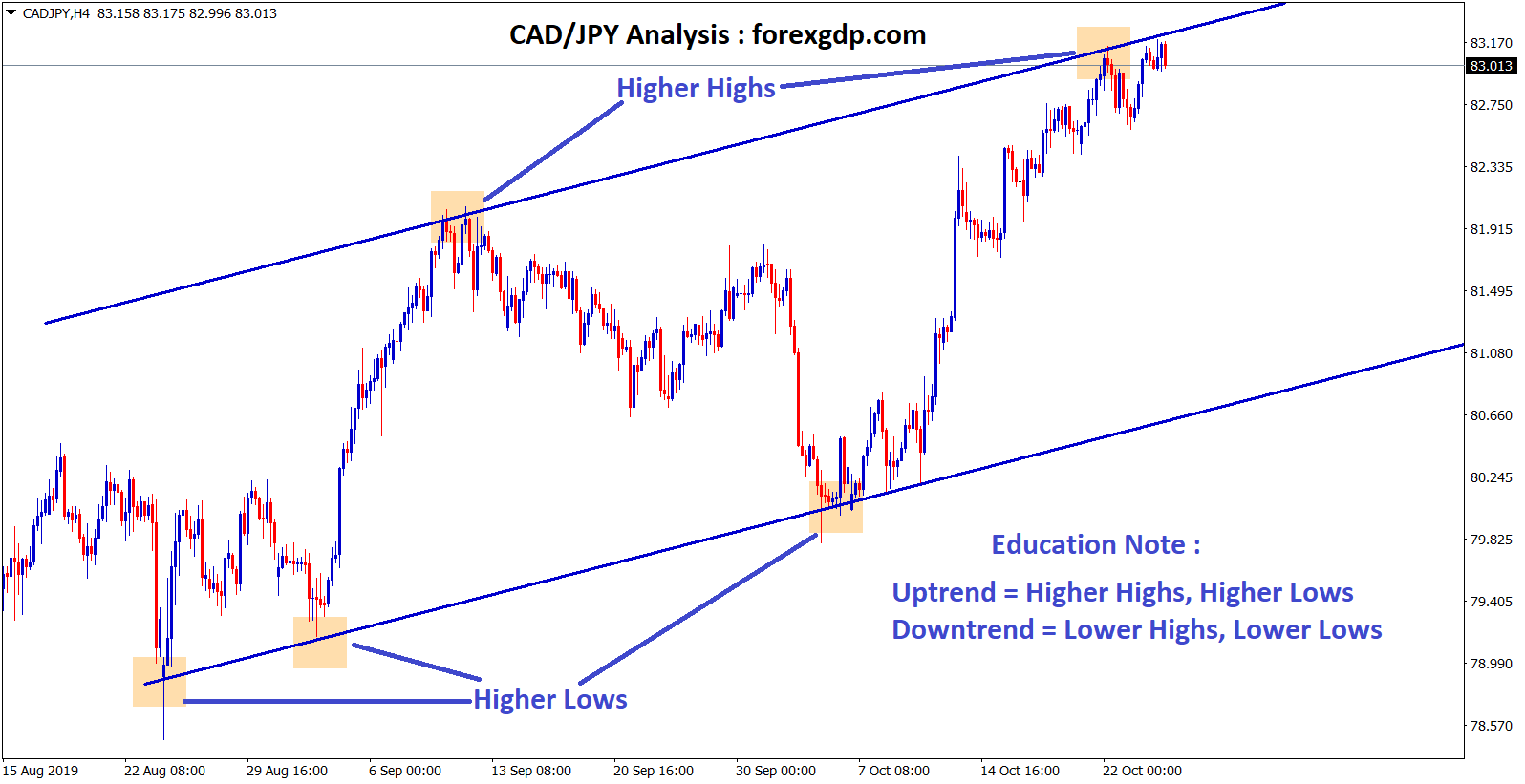

- Performing chart analysis

- Using indicators

- Managing setups

- Adding or changing instruments for analysis

- Operating Expert Advisors, and downloading new and custom ones online

- Using a strategy tester

- Stability and Reliability of the platform. Is it going to crash during high-frequency trades?

- Keeping track of close and open trades

- Using several profiles for different types of analysis

- Equity trading possibilities

Using MetaTrader to Trade Forex

MetaTrader is a trading platform that is popular among millions of traders and brokers.

The platform is particularly great for CFD and forex trading. Its charting platform is easy to use and navigate. Auto trade broker allows you to follow price fluctuations and help you implement complicated trade strategies. It also helps you make informed trading decisions.

Chart types supported by the platform are:

- Line

- Renko

- Heikin Ashi

- Candle Stick

Why MetaTrader is Popular Among Brokers

- It is free

- It has incredible features, such as:

- the Pepperstone market terminal

- more than 80 pre-installed indicators

- automated trading

- the market watch window

- the several charts setup with combined and easy to use charts

- the navigator window

- the indicators window

- Ease of programming language MQL4

- It is convenient

- Easy to customize

- It is very secure

Disadvantages of Using MetaTrader

- Comprehensive historical data for backtesting is not available.

- Execution speed is not that exceptional and is not very appropriate for high-frequency trading.

- Its upcoming web platform does not support automated trading.

- Charting packages don’t enable a standard timeframe

Final Thoughts

As a new online trader, avoid taking risks right from the beginning. Test and try out all types of online ideas, strategies, methods, and analysis via many brokers’ free Demo account. The account enables you to experience several financial markets and trade without any risk on your end.