After FED increases interest rate from 0.75% to 1.00%, the USD becomes too weaker.

The Result for FED interest rate decision came in positive, But the market simply went into an opposite direction.

The Reason for Opposite movement :

The Federal Reserve on Wednesday, raised interest rates by 0.25% to a target range of 0.75% to 1% but kept its previous forecast of three rate increases this year unchanged, which disappointed investors, who expected four rate hikes in 2017.

The dollar continued its move lower in the mid-afternoon session, after a mixed batch of economic data failed to halt the slide, as the USD slumped to a low level.

Trump government still needs to earn a good name and confidence among the investors to move the US market according to the Fundamental expectations.

NOTE : According to Forex market, Technical Strategy wins 70% of the time, But Fundamental Strategy wins Only 30% of the time. Stick with most winning probability strategies to make Consistent profits in the forex market.

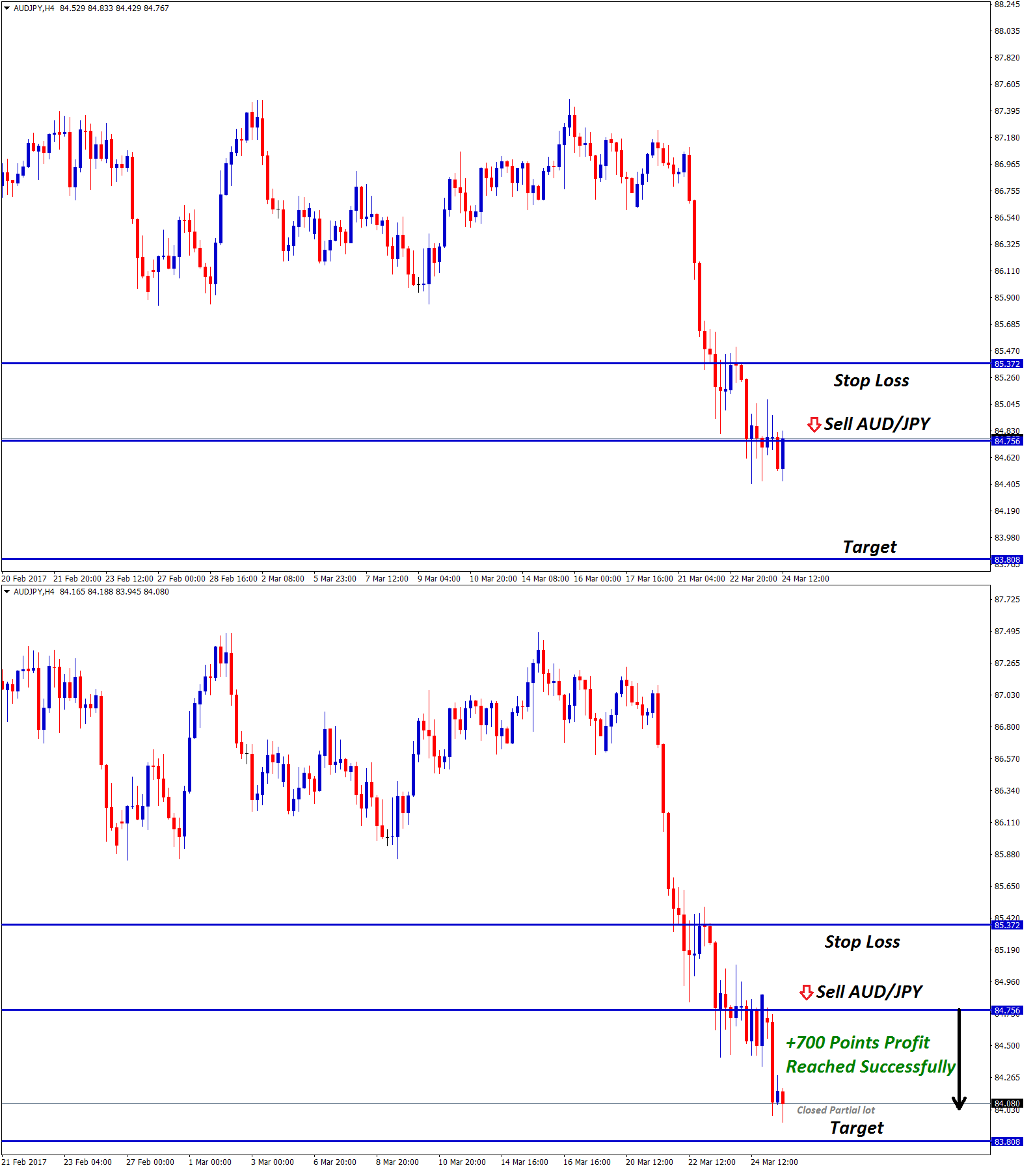

Don’t trade all the time, trade only at Best Setup. Join Free now. Let result speaks on your trading account. Start to receive the forex signals now: forexgdp.com/forex-signals/

Pingback:+703 Points Profit Reached Successfully in USD/CHF Sell Signal – FOREX GDP

Pingback:GBP/AUD Analysis : Wait for Breakout (or) Reversal ? – FOREX GDP

Pingback:+1468 Points Profit Reached Successfully in USD/CHF Sell Signal – FOREX GDP

Hellow my name is Martinvap. very good article! Thx 🙂