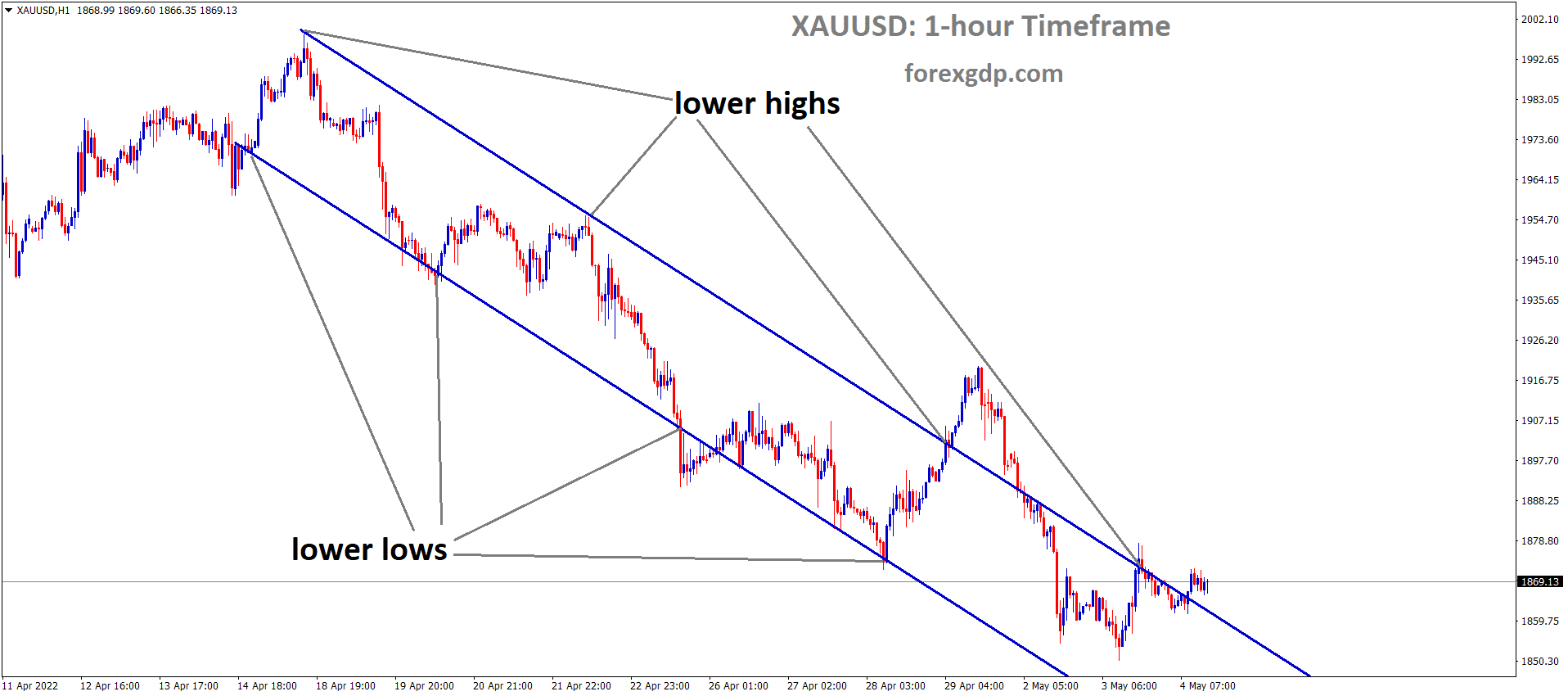

XAUUSD H1 Time Frame Analysis Market is moving in the Descending channel and the Market has reached the lower high area of the Channel.

Where is XAUUSD Today

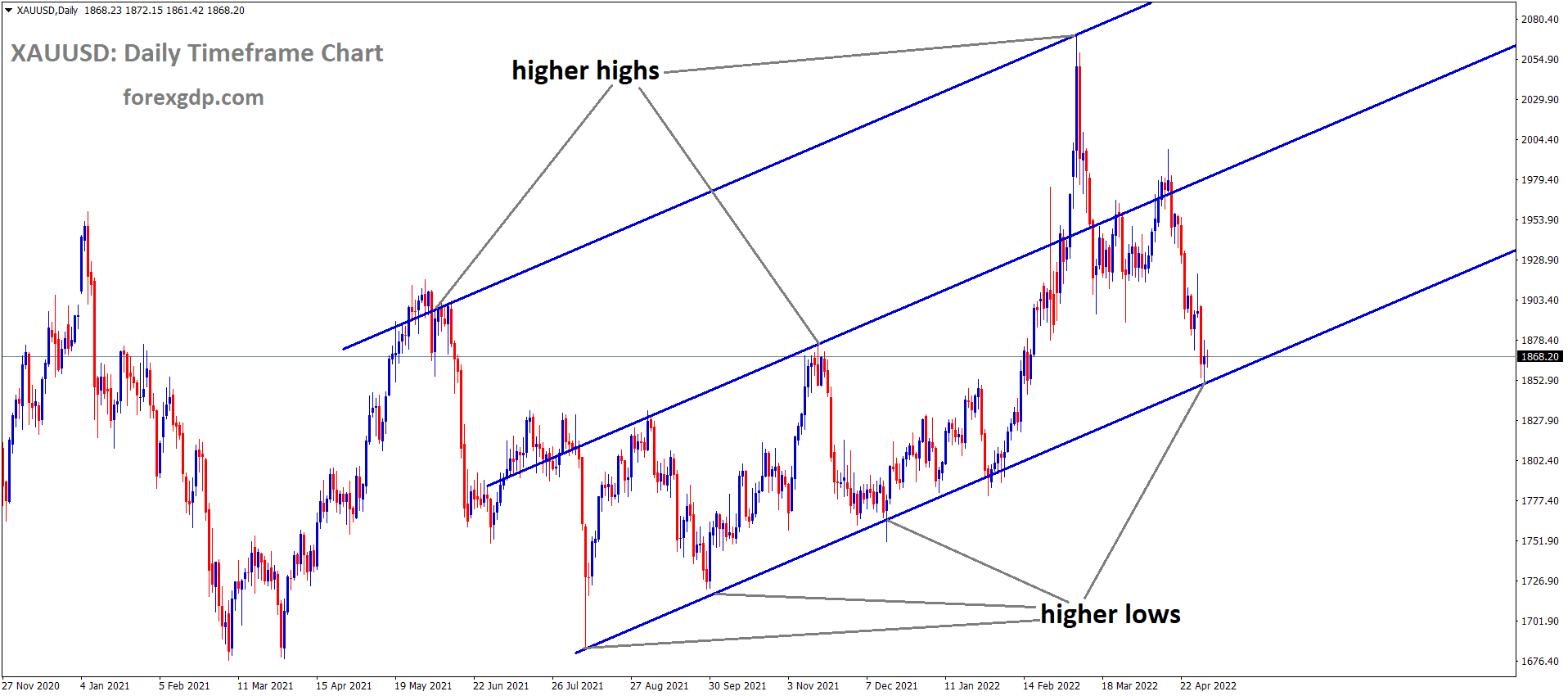

XAUUSD has had two different moods this past week. We started off the week pretty bearish with XAUUSD following a downward trend. It went from highs in the early 1920s to lows reaching the 1860s. This was the lowest point this valuable commodity had seen in quite some time.

XAUUSD Daily Time Frame analysis Market is moving in an Ascending channel and the market has reached the higher low area of the Channel.

We really thought that it would break into the 1850s and continue further into a downward spiral. However, midway through the week, XAUUSD stood back up and started an upward trend in bullish market conditions. This valuable commodity now teases traders around the 1860s region but it is expected that it will continue in an uptrend due to some events we will go through below.

Feds Rate Hike

The Federal Reserve is expected to raise interest rates once again in June in order to combat the ongoing inflation crisis in the country. They have been consistently raising the interest rates these past couple of months and will continue to do so until the issue has subsided. They started off by increasing the interest rates by 25 basis points. However, soon they realized this wasn’t enough and inflation was still winning the race. In order to better get a grip on this issue, the Feds decided to start increasing the interest rates by 50 basis points. This significantly helped the situation and if they continue to increase it by 50 basis points each session, the inflation may actually be subsided. However, analysts and economists have been predicting that these increases are very likely to cause a recession in the long run.

Peter Boockvar, Chief Investment Officer at Bleakley Advisory Group, had revealed his thoughts on this current situation. He states, “I don’t think markets appreciate that (quantitative tightening) is very aggressive, and this double-barreled tightening will be disruptive. A lot of rate hikes have, of course, been priced in, but we’ve also not yet priced in the economic impact of the most aggressive monetary tightening cycle in the post-Volcker world.” Robert Fry, Chief Economist at Robert Fry Economics LLC, has also revealed his thoughts on this ordeal. He states, “I still expect that a recession will be needed to get inflation back down to the Fed’s 2% target, but the recent increase in market interest rates, in anticipation of expected tightening by the Fed, has reduced the likely severity of that recession and has slightly increased the slim chance that the Fed can pull off a soft landing.” Richard Bernstein, CEO of Richard Bernstein Advisors, also reveals. Inflation is the highest in 40 years, yet the real fed-funds rate is historically negative. You can’t fight inflation with a negative real fed funds rate.”

Belarus Prepares For War

In a surprising turn of events, it was revealed that Belarus, the common country between Russia and Ukraine, is actually in support of Russia. They have secretly been preparing their military to support Russia in its war crimes in Ukraine. Belarus is denying all allegations that it is helping Russia in the war against Ukraine. Russia still calls this war a “special military operation”. Early on Wednesday, Belarus’ army had begun military training in order to prepare itself for the war. Belarus had even cut out the entire country’s internet connection in order to secretly bring in military equipment from Russia without word getting out or spreading like wildfire. It is important to note that, unlike the Belarusian government, the people of Belarus are in support of Ukraine just like the people of Russia. It is just political tensions between the governments of these individual countries who are to blame for their downfall.

The Defense Ministry of Belarus has come out in a statement explaining this entire situation. They state, “It is planned that the (combat readiness) test will involve the movement of significant numbers of military vehicles, which can slow down traffic on public roads.” The Main Intelligence Directorate in Ukraine has also revealed the real secrets being hidden by Belarus. They state, “To conceal information about the movement of Russian occupying troops through the territory of Belarus, Belarusians’ access to the internet is being disabled. For the entire month, access to the Internet was restricted for entire regions of Belarus south and southeast of Minsk, where the movement of military equipment of the Russian invading forces was most frequently recorded. This way, the KGB of Belarus and the FSB of Russia are trying to limit the communication of patriotic citizens and prevent the dissemination of information on social networks about the movement of Russian military equipment through the territory of the republic.”

Beijing COVID Crisis

The Chinese capital, Beijing is still facing a surge in COVID cases every day despite already being a week into lockdown and containing the cases before they could spread to other cities. The Chinese government has now decided to enforce a shutdown on all public transportation. This would demotivate people from leaving the house and it would also prevent the spread of cases from overcrowding with strangers in public spaces. Anyone who urgently needs to go somewhere may use their own transport for safe passage. Due to these lockdowns, businesses had to be shut down and productions had to be halted. Due to this China is facing a shortage in oil production and supply. This has caused the oil prices to surge as there isn’t enough supply to meet the growing demands of the people.

Analysts at Fitch Ratings have been following the COVID situation in China and have revealed their thoughts on the ordeal. They state, “Recent mobility trends suggest that China’s growth momentum deteriorated significantly in April, with traffic congestion, subway passenger volume, and other high-frequency indicators at their weakest since the initial outbreak. Numerous factories were shut after Shanghai went into lockdown in March. While some have started reopening, getting workers back, while dealing with snarled supply chains, has proven difficult. At Shanghai’s port, 344 ships were awaiting berth, a 34% increase over the past month. Shipping something from a warehouse in China to one in the United States takes 74 days longer than usual.”