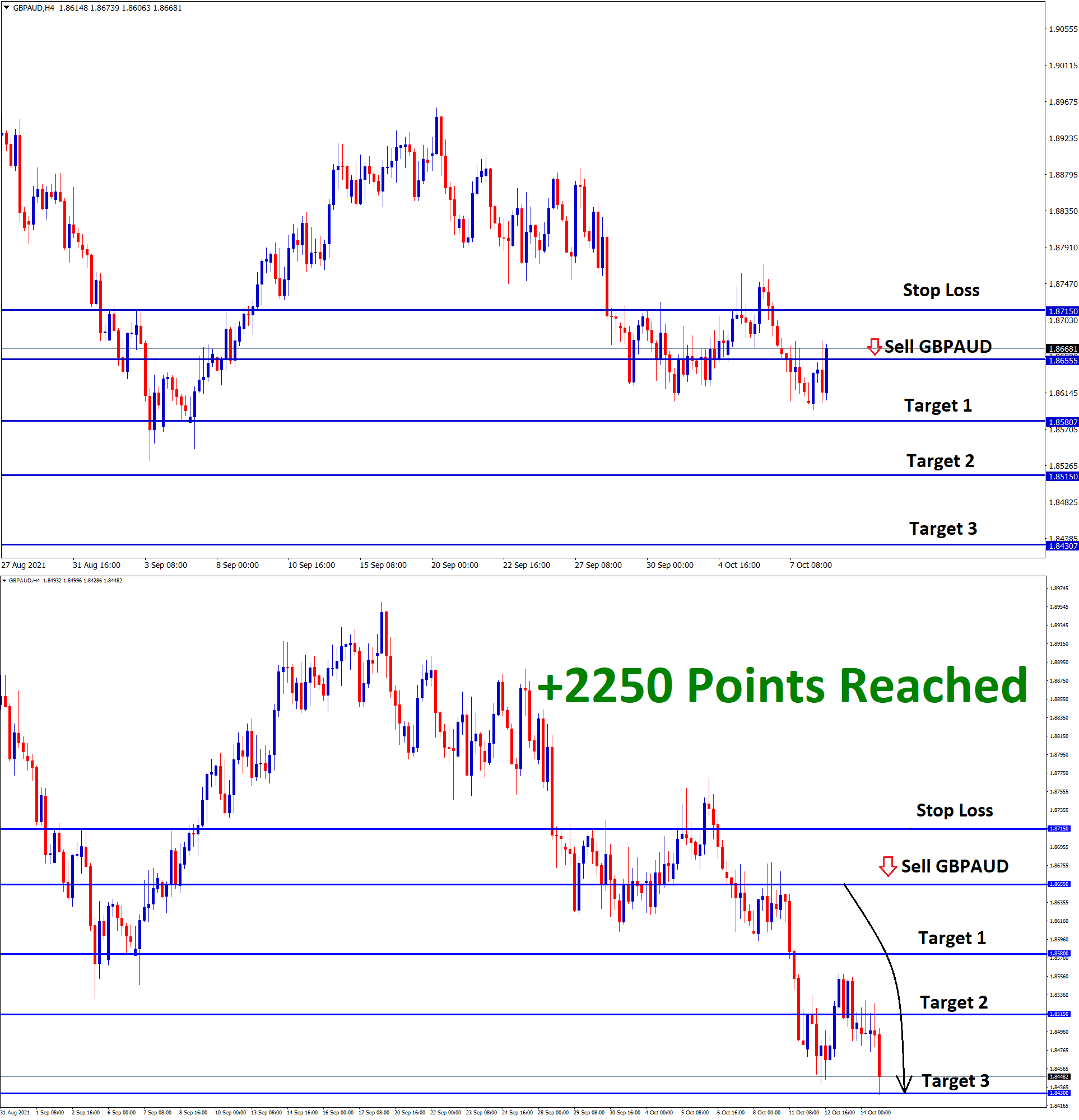

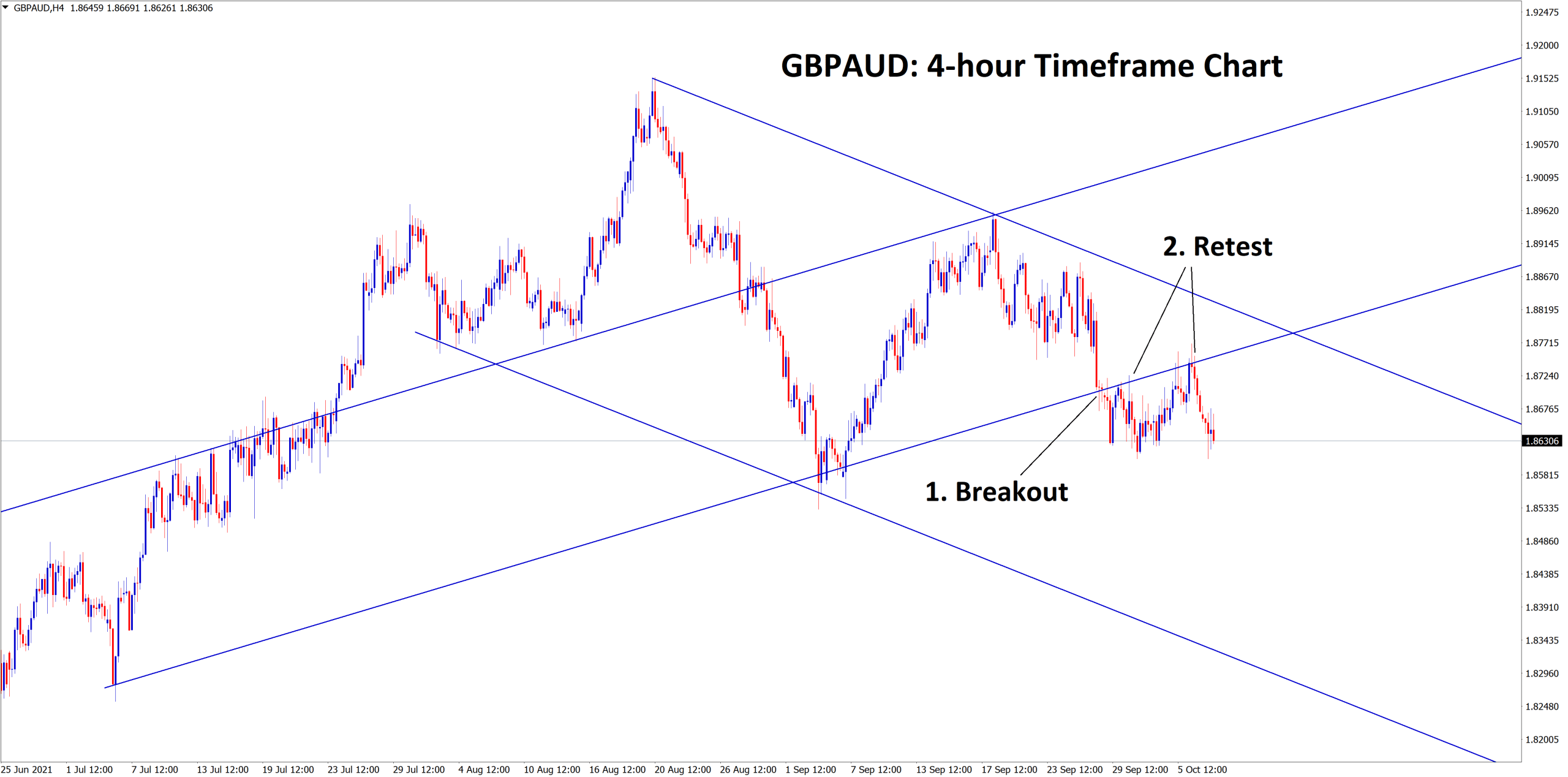

GBPAUD Analysis

GBPAUD has retested the broken uptrend line twice and now the market is moving in a descending channel.

After the confirmation of the downtrend movement, GBPAUD sell signal given.

GBPAUD has reached the take profit target successfully.

UK POUND: Wages growth remain a concern for UK Companies

UK Pound makes higher as GDP rate in the UK was higher number printed at 6.9%, and CPI data came at 3.2% in last month September.

The unemployment rate is at 4.7%, and the Bank of England may be ready to hikes rates of interest by the end of 2021 at least 15 basis points.

And GBP 895 billion Bonds purchases program is likely to end in March 2022, and tapering assets leads to Support for UK Pound.

The Brexit issue on Northern Ireland Protocol weighs on the UK and the Still no-compromise solution from the UK side.

In the UK, 90% of 1st dose vaccination completed in the UK and 80% of second Dose vaccination progressing, So Covid-19 remains less pressure on UK and Energy crisis makes worry for the UK as More European workers left after Brexit deal.

Now British companies want more workers in place of EU workers, but wages are higher to UK Employees when compared to EU Employees.

UK Government Furlough Schemes were Ended and So many Job Vacancies created for UK People.

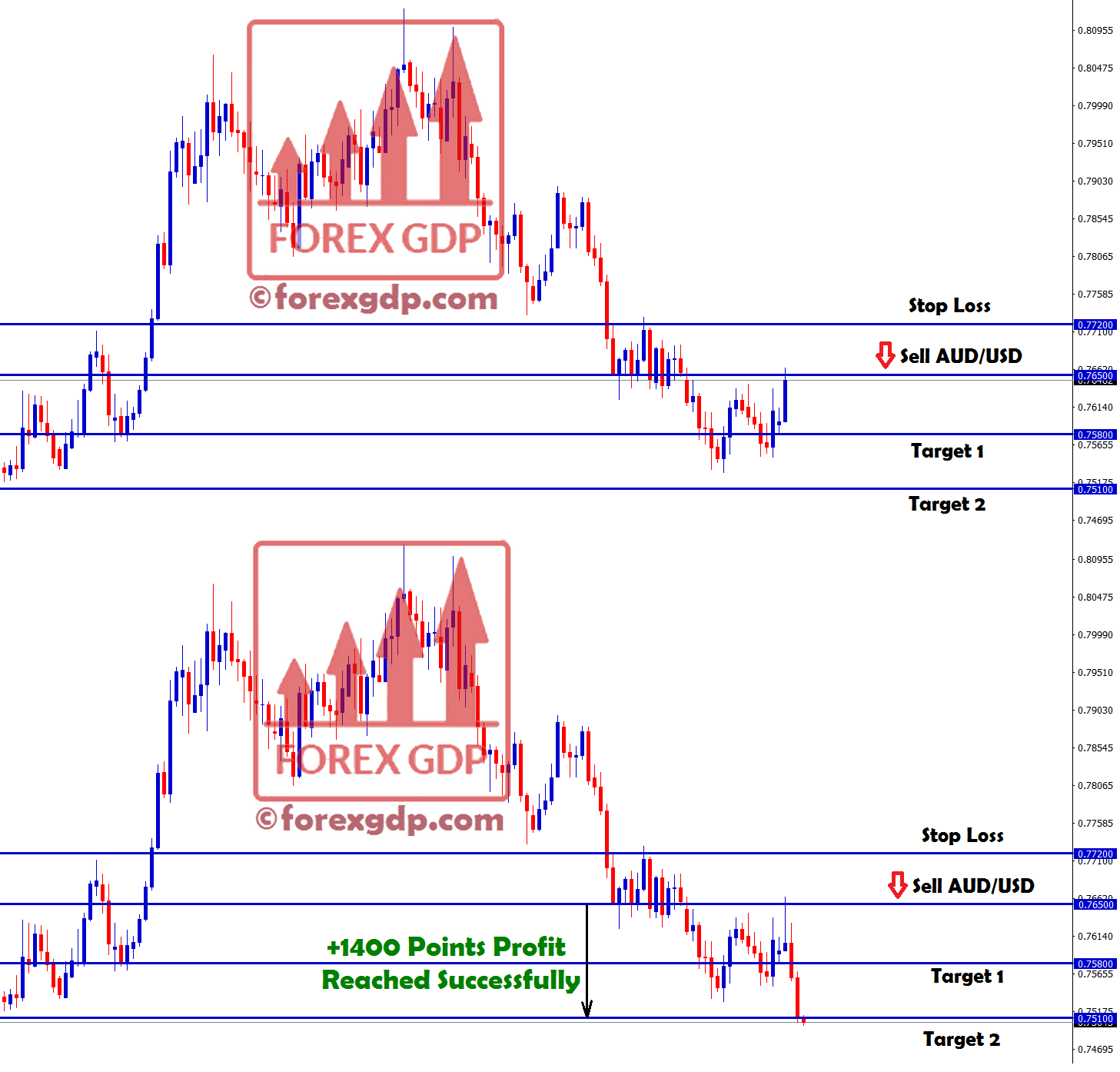

Australian Dollar: Weaker Unemployment data

Australian Jobs data shows loss of 138000 jobs versus -110K expected, and Unemployment rose to 4.6% from 4.5%.

And Sydney announced easing lockdown restrictions after 80% of people were vaccinated, NewSouth Wales completed 80% of Above 16 Vaccinated.

Energy prices soaring makes the Australian Dollar pushed for Higher highs.

And US CPI data came at higher than expected and becomes a backlog for US Dollar.

Whether US FED Do tapering or not in November inflation gauge came at higher numbers.

When Consuming costs becomes higher, Spending will decline if the price of borrowing products is more elevated.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/