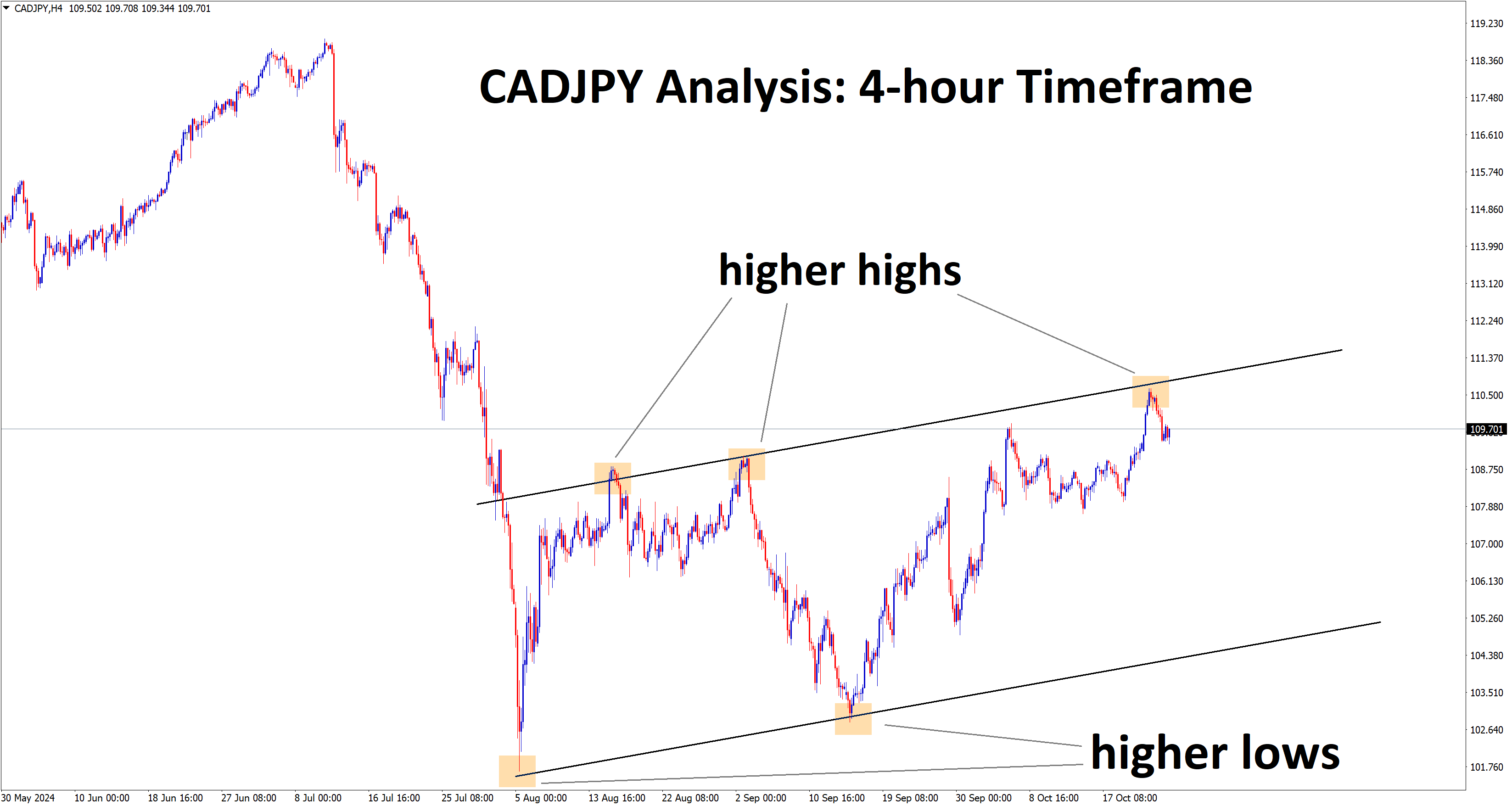

CADJPY Analysis

CADJPY is falling from the higher high area of the Ascending channel in the 4-hour timeframe.

CADJPY Update:

The upcoming US election likely increased market expectations of a stable or more favourable economic outcome, leading to a stronger USD. The weaker JPY suggests that investors may be anticipating a more robust US economic outlook or potential policy stability, which tends to drive money away from safe-haven assets like the Yen. This leads to the SL price in CADJPY with a gap up on Monday.

This could also imply that traders are positioning themselves ahead of the election, causing volatility and impacting currency pairs like CADJPY. A stronger USD often influences market sentiment, leading to a sell-off in JPY as traders adjust for potential interest rate expectations or shifts in economic policy.

Divergence in Monetary Policy

- The Bank of Japan (BOJ) has maintained a very loose monetary policy with extremely low or negative interest rates. In contrast, the Federal Reserve and other central banks like the European Central Bank have either kept higher rates or hinted at rate hikes, making those currencies more attractive for investors.

- The interest rate differential makes borrowing in JPY (which is cheap) and investing in higher-yielding currencies (like USD) profitable, contributing to Yen weakness. This is known as the carry trade, where investors borrow in a low-yielding currency (JPY) to invest in a higher-yielding one (like USD).

US Economic Outlook and Election Impact

- With the US elections approaching and recent signs of a stable US economic outlook, the USD has gained strength. A strong USD typically leads to a weaker JPY due to their inverse correlation.

- The US dollar tends to be seen as a safe-haven currency during political events like elections, causing a shift away from the Yen, traditionally seen as a safe-haven currency in times of global uncertainty.

In the Forex market, Fundamental wins 20% of the time, and technical wins 80% of the time. On this trade, fundamental wins at this time.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade signals at premium or supreme plan here: forexgdp.com/buy/

💹 +2200% + 800% +400% +150% Growth in Live Real Trading account of our users, check here: https://www.forexgdp.com/realaccounts/