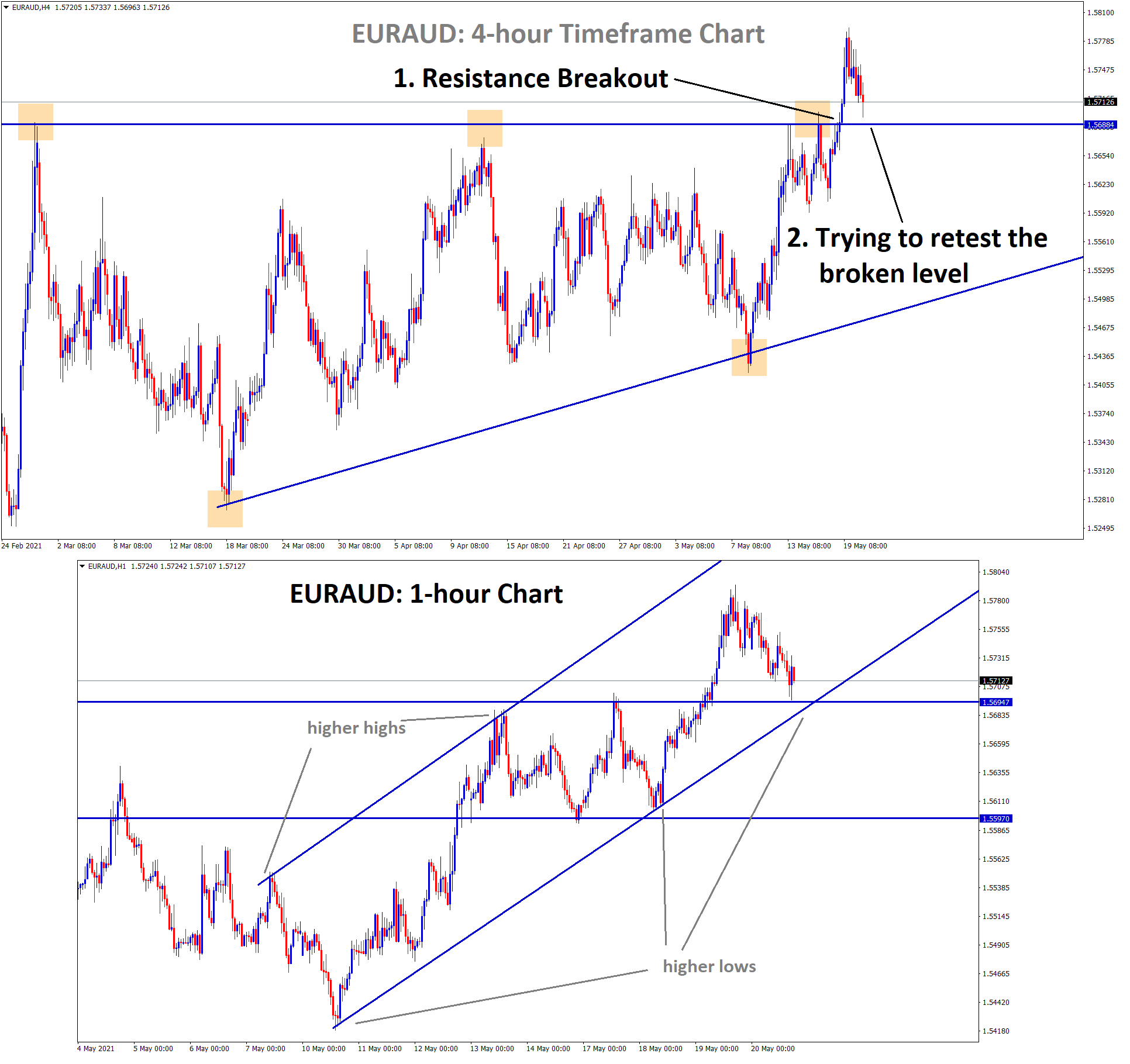

EURAUD Analysis

Recently, EURAUD has broken the long waiting resistance level in an Ascending Triangle pattern.

Now, the market is trying to retest the broken level.

In the 1-hour timeframe chart, EURAUD is near to the higher low zone of an uptrend line.

This gives double confirmation on EURAUD buy signal.

EURAUD has reached the take profit target successfully.

ECB Meeting

ECB corporate faces Solvency risks issues moved elevated, and ECB must support corporate issue in Upcoming Monetary policy settings.

Due to national lockdowns, more businesses get locked, and the Unemployment rate is higher.

Now people consuming spends less as less money as income.

Corporate profits get losses in last 1 years, and many small businesses get affected.

As non-banking assets, loans are gets elevated for credit risks.

And ECB slower PEPP purchases will impact more corporate risks and Yesterday, Crypto markets went down more, and Euro Prices remains higher this month.

Vaccinations moved People to engaged in works but businesses to take pickup at least 1 to 2 years to stable.

Losses that occurred in the last 1 year will take at least 2 years of period to overcome.

And Now, Financial stability remains under pressure in Eurozone, and Fiscal spending rising is the solution for stability in the financial strength of Europe.

AUD

Australian Employment change came in Disappointment numbers on Thursday show -30600 jobs decline from 15000jobs expected in April.

The unemployment rate fell to 5.5%, which was down 0.2% from March month.

RBA mentioned inflation and employment change goals once reached, then only we talk for tapering and hike rates possible.

But Until 2024, there are no hike rates is possible, easing lockdown in more regions makes way for Businesses to started up; Labour force participation decreased from 66.3% to 66.0% in April.

Due to this, RBA going to alter the bond-buying program to fix the issue.

And Wednesday FOMC meeting minutes support US Dollar to the upside, as Tapering talks hinted in speech.

Trade forex market only at the confirmed trade setups.

Get Each trading signal with Chart Analysis and Reason for buying or selling the trade which helps you to Trade with confidence on your trading account.

Want to increase your profits in trading? Get the best trading signals at an accurate time. Try premium or supreme signals now: forexgdp.com/forex-signals/