All Peoples says that we must work for income. That is perfectly correct. What is wrong is the meaning of “work” for traders. Traders tend to think that work means taking trades. That is wrong, and that is what leads to over trading.

We are working when we are waiting for the best trade.

We are working when we are following our trading rules and executing the trades.

We are working even when we are not taking trades. And if we do our work correctly, we will get paid.

One) Escape Plan

1) stop trading if the market is acting too unpredictably.

2) Set your maximum loss or drawdown for your a/c. If the max loss hits, just get

out of your PC.

Two) Two Tricks (rules) to avoid over trades and make better trades

1) The first is to set a limit to your trading – a target. You decide what you want to achieve – X pips a week (it should not be more than 100 when starting out

and probably even less).

Now, as soon as you hit your target, that’s it. You stop trading for the week.

2) And the next rule. If at the end of the week you’re negative, you can carry over the loss to add to next week’s target. But you can never carry it over more than one week.(eg : if lossed 300 points this week, carry this 300 points loss as your target for next week, so your next week target = your regular weekly target + 300 points target….IMPORTANT NOTE : Don’t carry your 300 points loss of 1st week to your 3rd week if 2nd week also ends in loss. Carry only the previous week losses as your target for next week)

By following the 2 rules you will take only best trades in market and it will become a good discipline for you.

If you take more trades with small pips & reduce your target, you will get more pressure.

By Practicing & following this 2 rules strictly, you will become more focused on Only doing what is required to hit that target. Now, your PRESSURE is OFF.

Three) Another trick to Control the urge to over trade :

The skill of placing a trade and walking away is often referred to as ‘set and forget’. And it’s beautiful if you can do it.

You place your orders, your stops and your risk/reward profit targets. Then walk away. Check back later, see how you did.

And if you’ve got the risk/reward and money management right – and you only take the best set-ups that meet your criteria, then you should come out on top.

And remember, stop over trading. Over trading can kill your performance.

Trading is simple, but not easy. Because following that simple rules are not easy.

We want you to get consistently profitable in this Forex business and survive for a long time.

Please Don’t trade all the time, trade forex only at best trade setup.

It is better to do nothing, instead of taking wrong trades.

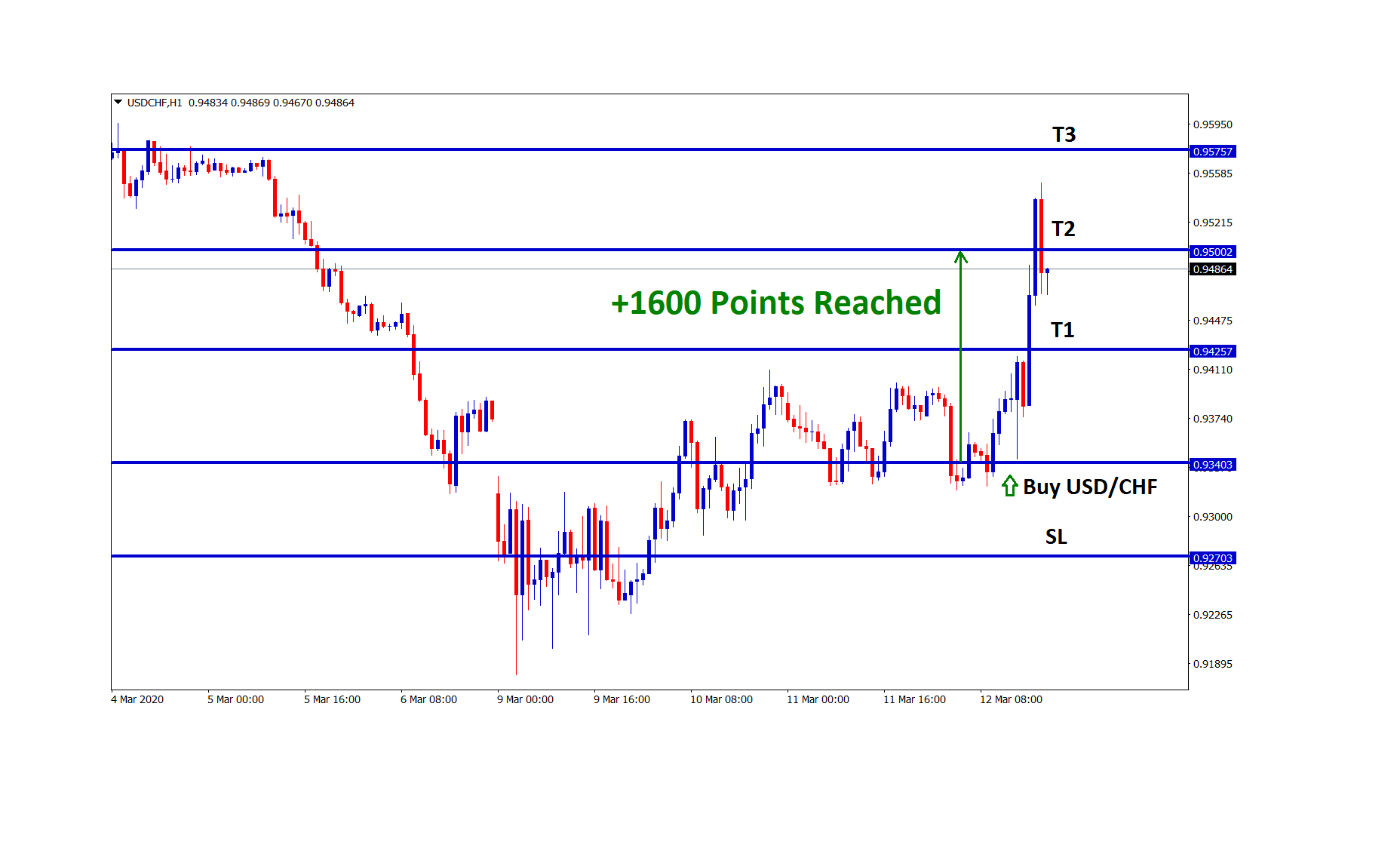

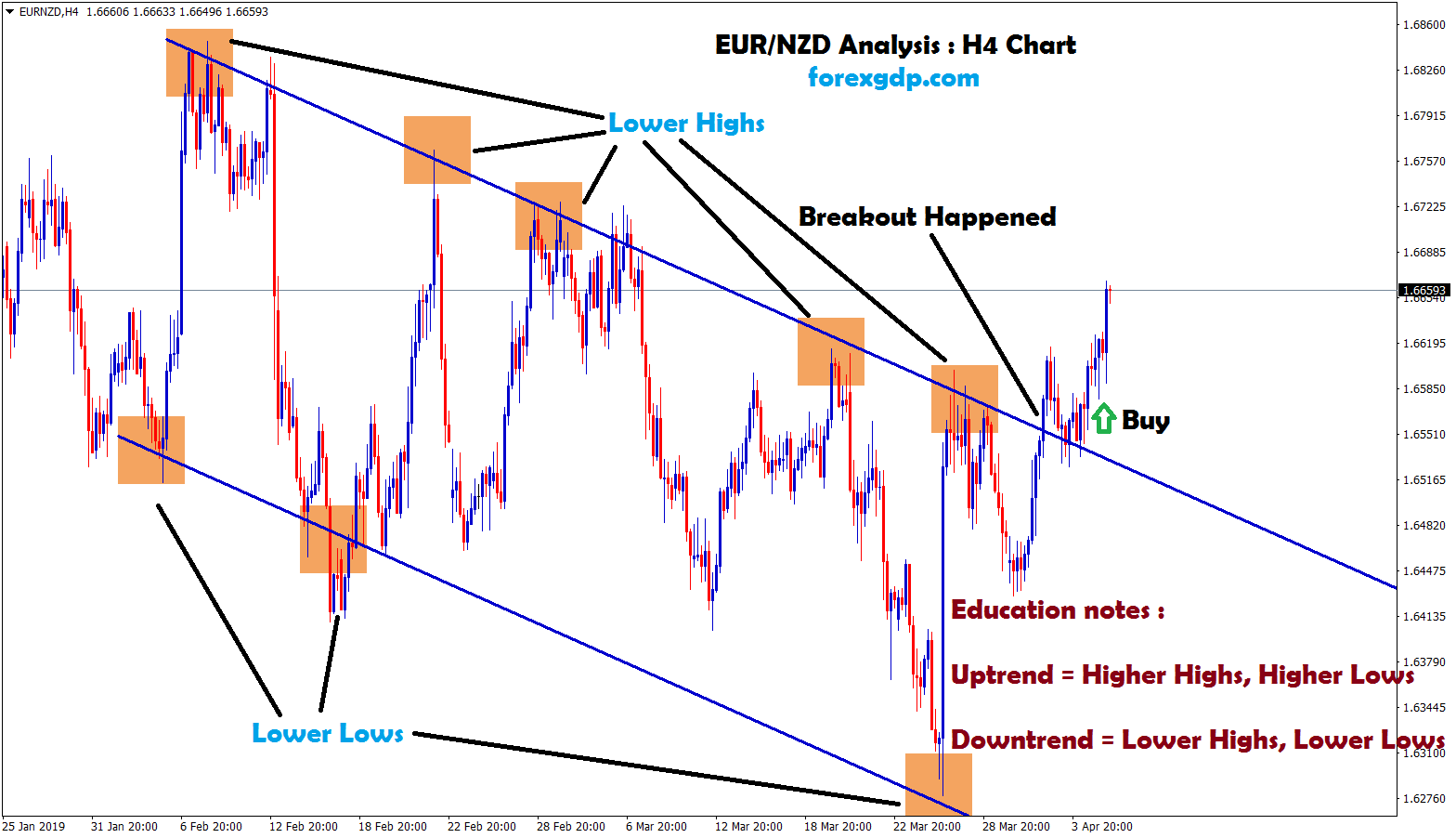

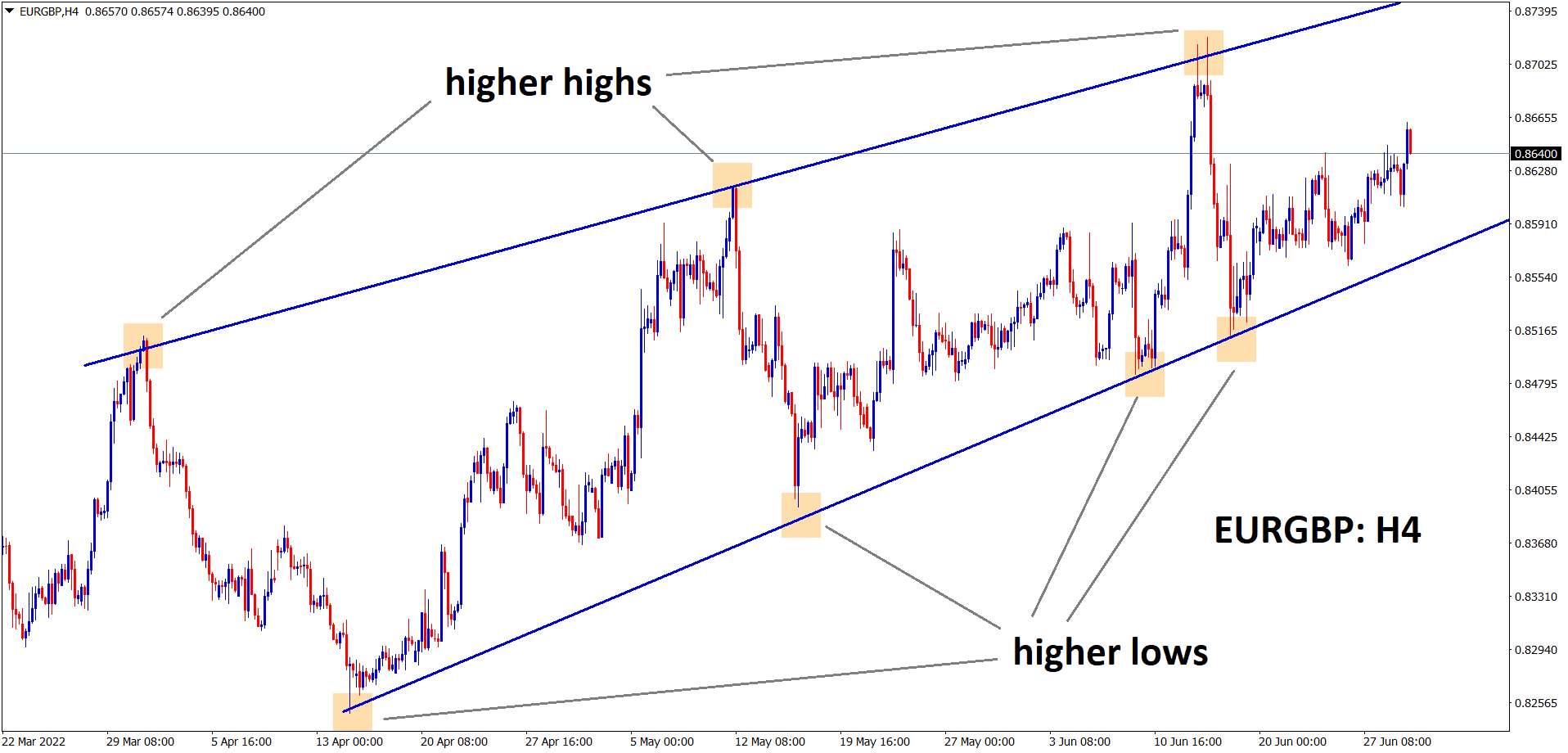

We are here to help you for taking the trades only at best trade setup.

Start to receive the forex signals now: forexgdp.com/forex-signals/