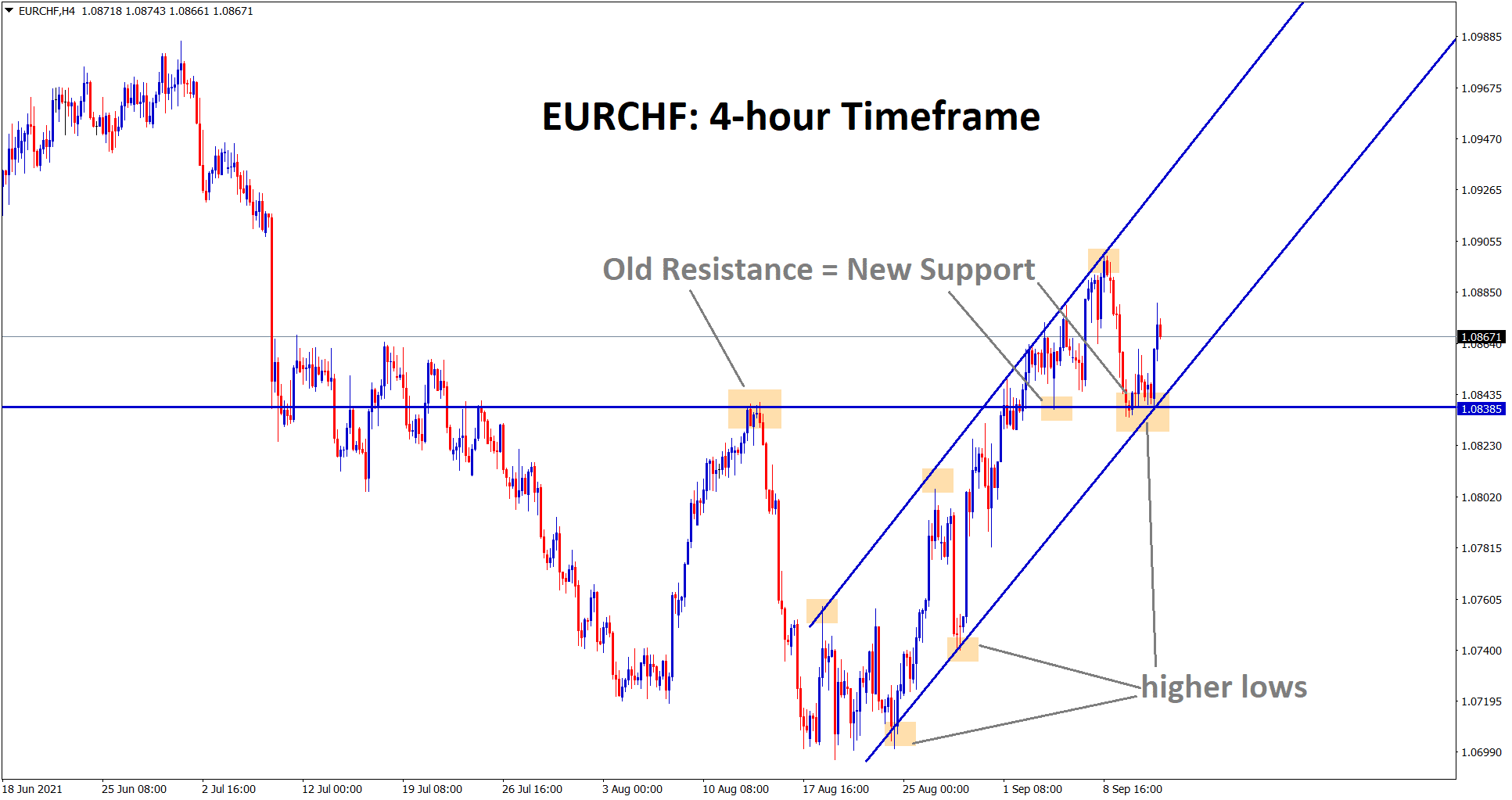

EURCHF Analysis

EURCHF is rebounding from the old broken resistance which act as a new support now and also the price is moving in an Uptrend line in the 4-hour timeframe chart.

After the confirmation of the uptrend movement, EURCHF buy signal was given.

EURCHF has successfully reached the take profit target.

Euro: Inflation data forecast

EURUSD moved lower as Last week ECB meeting failed to impress the Euro currency as ECB President Lagarde thumbs-down for tapering.

And this week Inflation, industrial production data will help for breathing correction in Downtrend; if reveres the data, then pushed lower as Trend continuation.

UK and EU have problems in Post Brexit deal on Northern Ireland protocol.

And EU domestic data shows less expected numbers than other developed nations.

Vaccinations are in Moderate progress, and the Delta variant keeps increasing without controlling by a Single Dosage.

Anyhow By December End, ECB will make adjustments in Purchasing program.

Swiss Franc: US PPI data shows largest numbers since 2010

Swiss Franc made lower as Weaker Domestic data and Weaker vaccination rate progress in Swiss Zone.

And SNB FX intervention is quiet now and compensated for the adjustments done after the 2020 pandemic crisis.

US PPI data shows positive and largest numbers since 2010, And waiting on this week CPI inflation data look for Further move and Friday Retail sales data waiting in the table.

US 10-year yield rose to 1.35% on Friday.

USDCHF pair moved in the range-bound market as 0.91-0.92, if breaks 0.92 level, then the next target is 0.93 level this week.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/