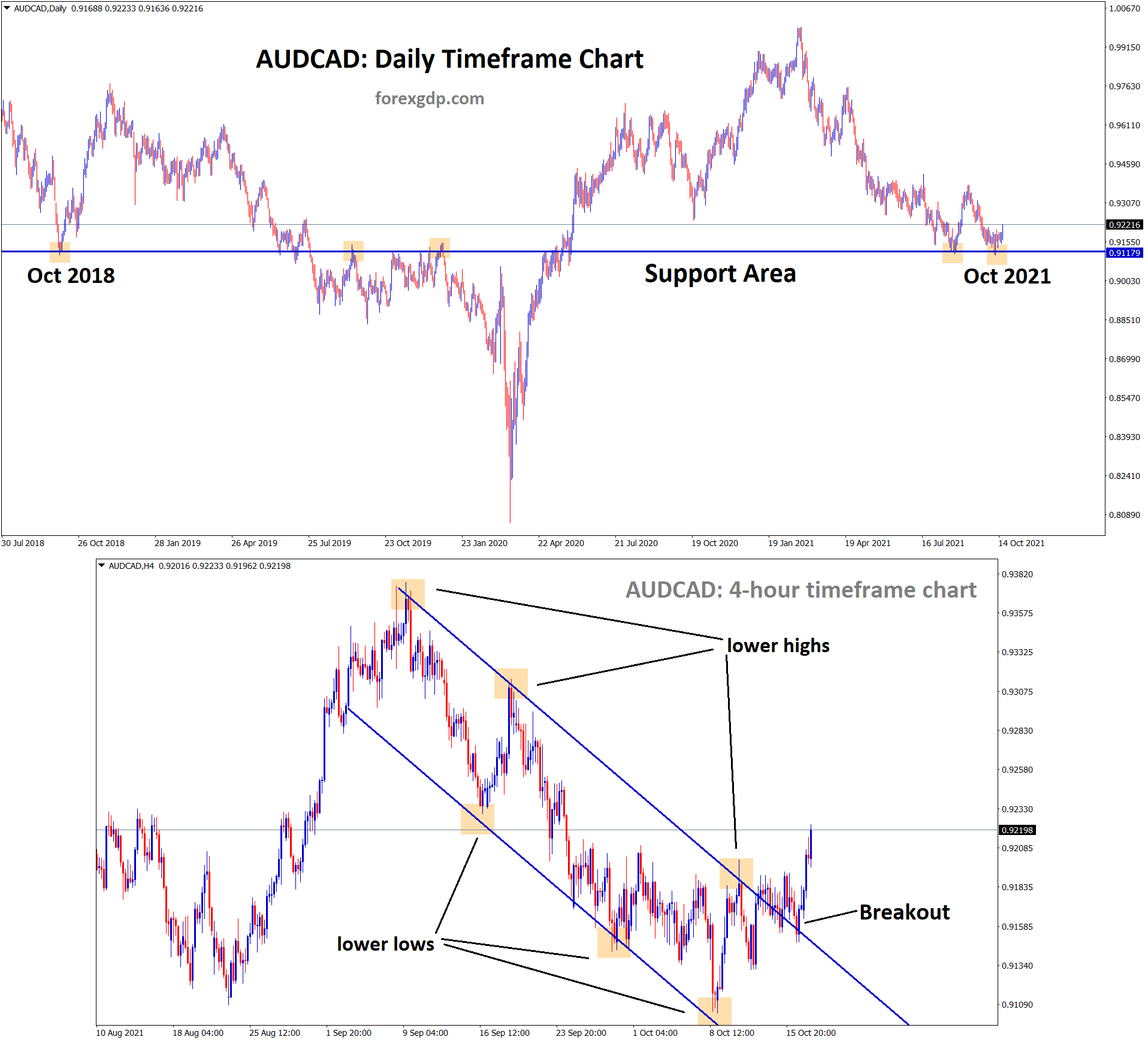

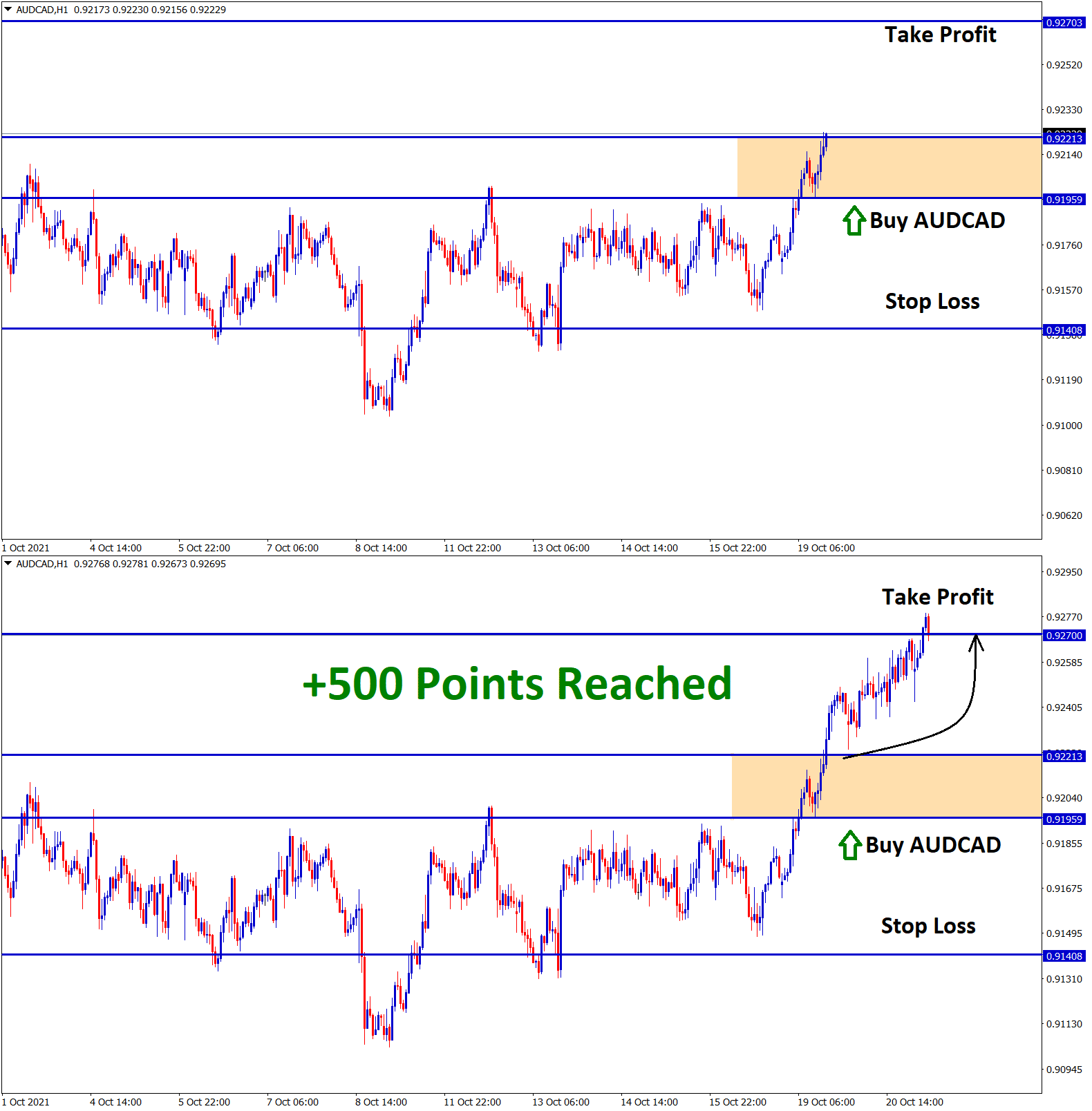

AUDCAD Analysis

AUDCAD is rebounding from the multi-year support area in higher timeframe, In lower timeframe it has broken the top of the descending channel.

After the confirmation of uptrend movement, AUDCAD buy signal given.

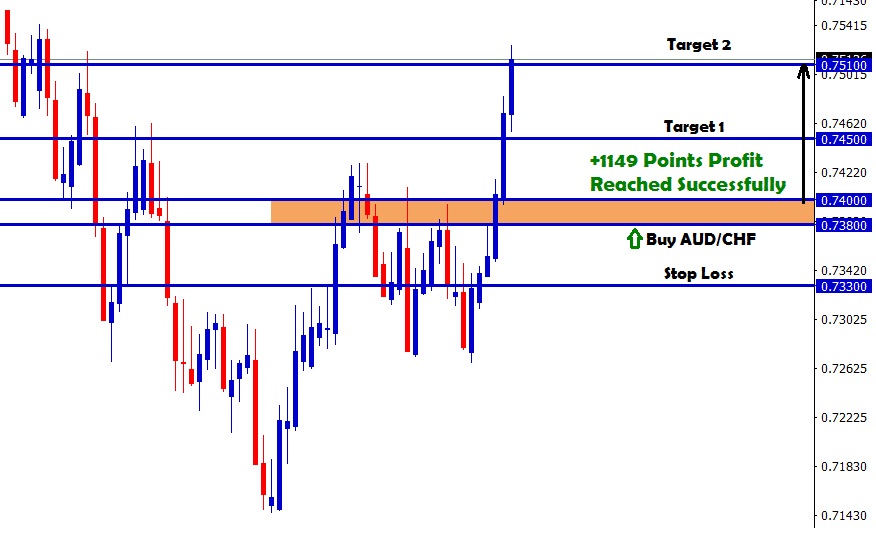

AUDACD reached the take profit target successfull.

Australian Dollar: Energy prices support for Australian Dollar

Australian Dollar keeps higher after US Dollar keeps lower as US Domestic data underperforming in recent days.

And Lockdown in Australia is released in more cities as Vaccinations cover 80% of people.

China Evergrande crisis makes worry for creditors; still, no money was settled by the Evergrande company.

And FED Governor Christopher Waller said FED will do balance sheet tapering after FOMC Announcement in the next meeting.

Australian Dollar main revenues Supporting tools are Coal, Iron ore. And Coal is not imported more in China as they have imposed restrictions on Australian Coal imports.

Canadian Dollar: Canadian CPI forecast

Canadian Dollar keeps higher as Oil prices grow higher in the market.

And US Dollar keeps lower after weak Domestic data this week, USDCAD may retest to 1.22 level once again as previous support.

US FED expected to raise interest rates in 2022, and tapering soon than expected will encourage US Dollar.

And Canadian CPI data scheduled today, if came higher then Bank of Canada keeps tapering in next meeting. If come lower than the Canadian Dollar moves higher as lower printing of the Canadian Dollar by the Bank of Canada.

Oil exports revenues keep CAD stronger against JPY and USD.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/