NZDUSD Analysis

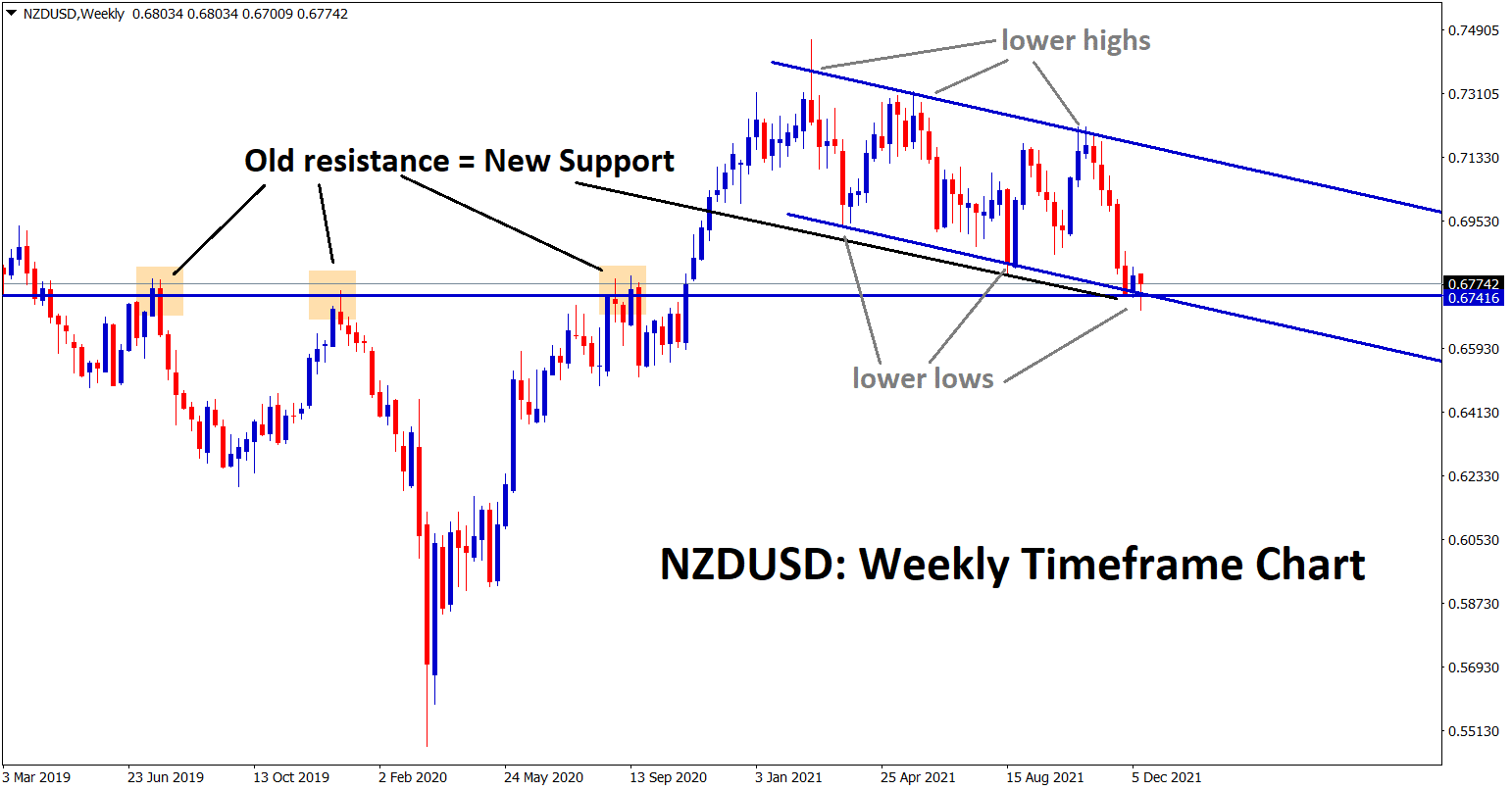

NZDUSD is rebounding from the major support area where the old resistance acting as a new support area in the weekly timeframe chart. And in the descending channel, NZDUSD hits the lower low area.

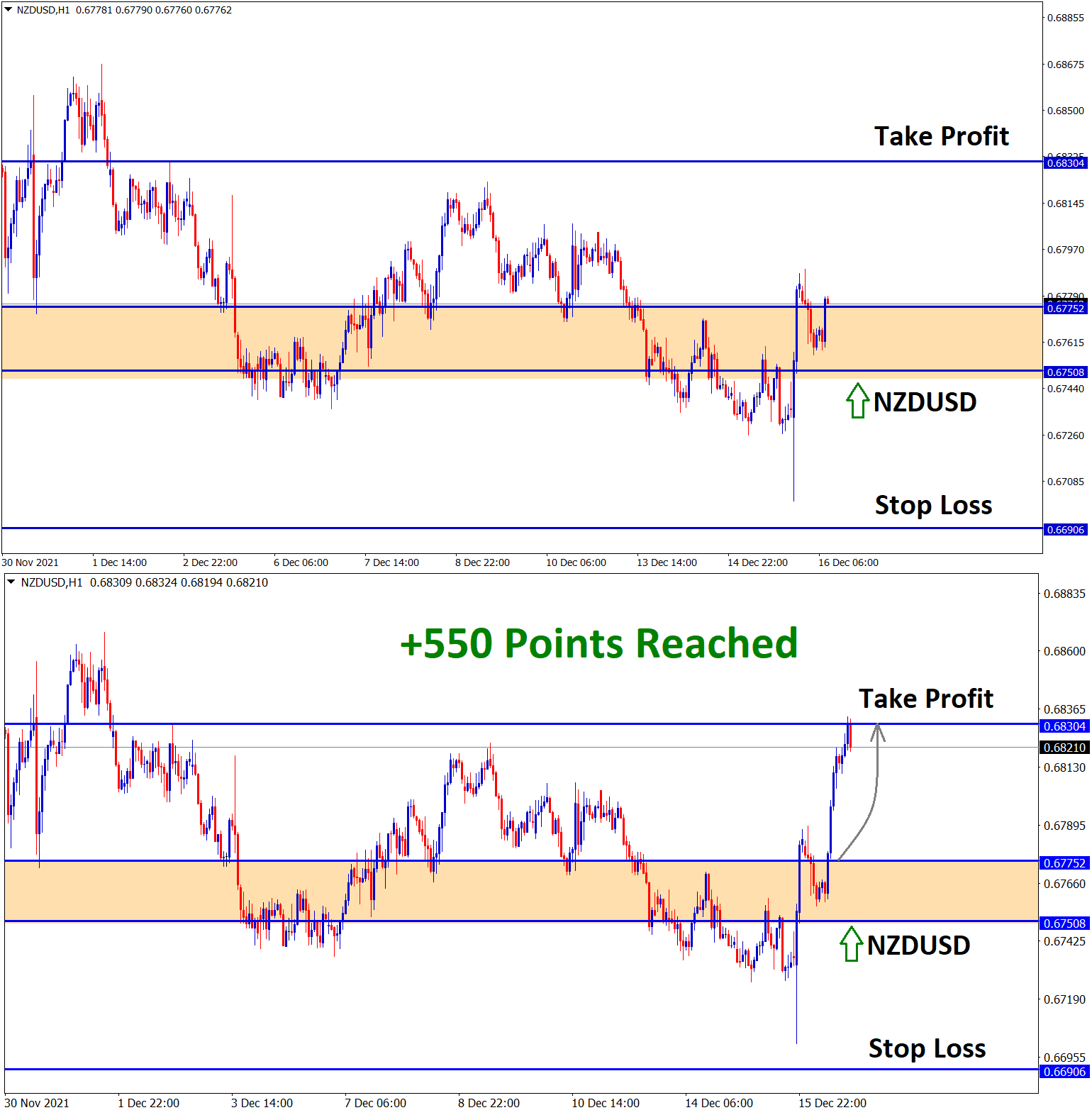

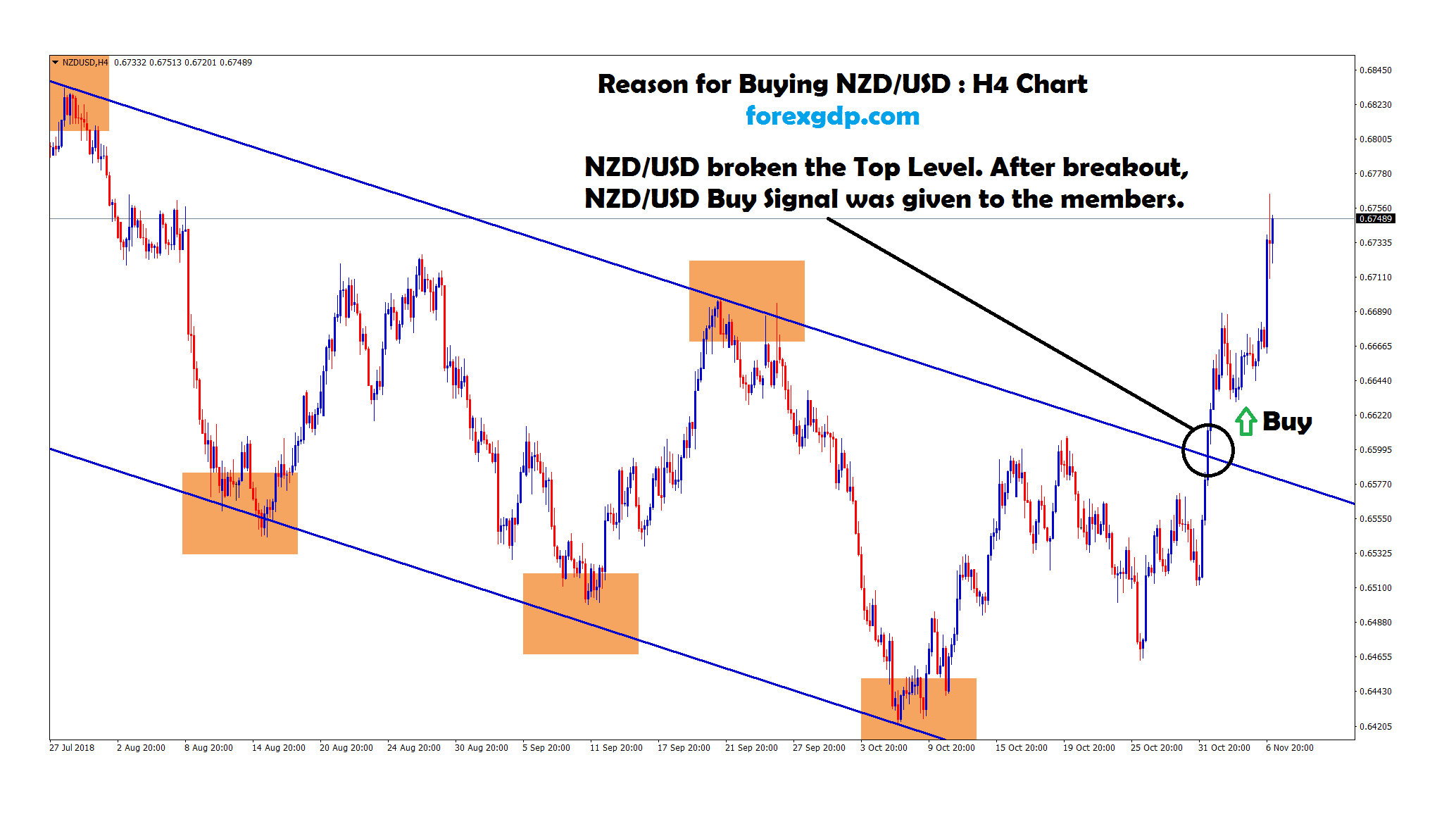

After the confirmation of upward movement, NZDUSD buy signal given.

NZDUSD reached the take profit target successfully.

New Zealand Dollar: New Zealand GDP outlook

New Zealand Q3 GDP came at -3.7% from -4.5%, and the previous reading stood at 2.4%.

And More lockdowns in Q3 time makes retail sales and manufacturing productions lower than expected.

But China retail sales well above expectations this week make more orders for New Zealand, and Exports revenues will increase in next quarter.

And RBNZ will do rate hikes in the February meeting as widely expected.

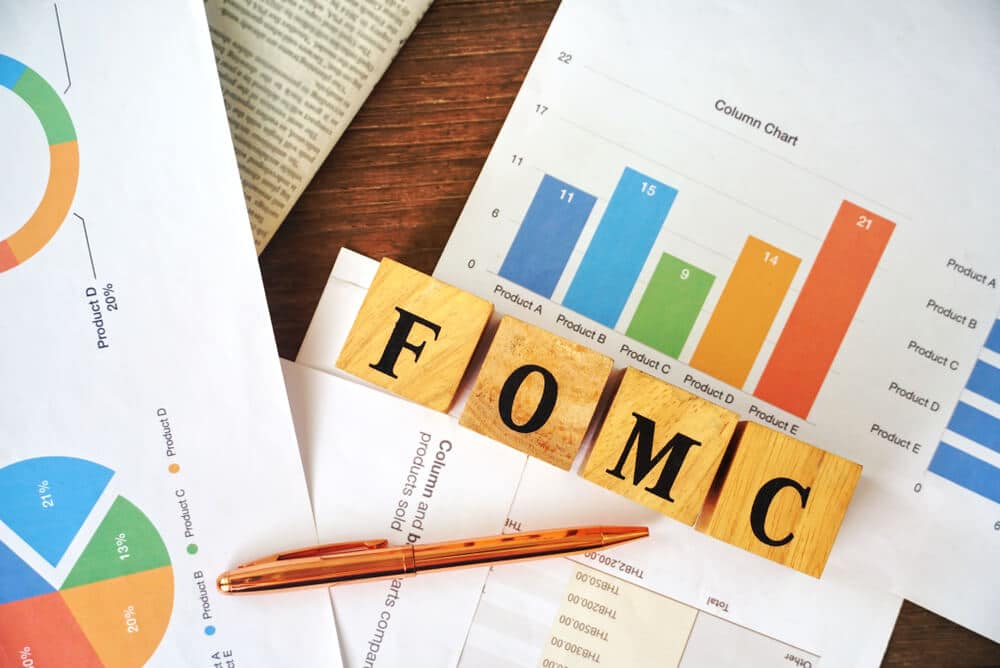

Yesterday FOMC meeting made drags down for New Zealand Dollar and tapering at a level of $30 billion per month from January onwards. So NZDUSD dragged down to 0.50% after News flashed.

US Dollar: FED Press meet outlook

In the FED Press conference meeting, Powell said it is appropriate time to hike interest rates in the Economy to tackle inflation too high.

And the Balance sheet discussions progressed, no decisions were taken on that in today meeting whether the Balance sheet shrink or is well based on the discussion which will be made next week.

Now Tapering the Bond purchases doubled to $30 Billion per month to complete the tapering purchases by March-end.

FED Powell commented shows hawkish made and cheered investors for Holding Dollars for the long run.

US FOMC meeting outlook and speeding Omicron spreads

FED Forecasted PCE inflation rate will be 2.7% in 2022, up from 2.3% last time forecasted, But 2.3% in 2023 and then 2.1% in 2024.

GDP Growth forecast will be 4.0% from 3.8% in 2022 and 2.2% in 2023 and 2.0% in 2024.Long Run expected reading is 1.8% for US Economy.

And Covid-19 New strain of variant Omicron causes more drawback for Economy revival and hunt Job numbers in coming quarters.

Fed did not wait for Full up of Employment numbers gap and will do rising interest rates if inflation numbers are too high.

And Job Gains in the US shows solid, and the Unemployment rate is much better than expected.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/