CADCHF Buy Signal Analysis

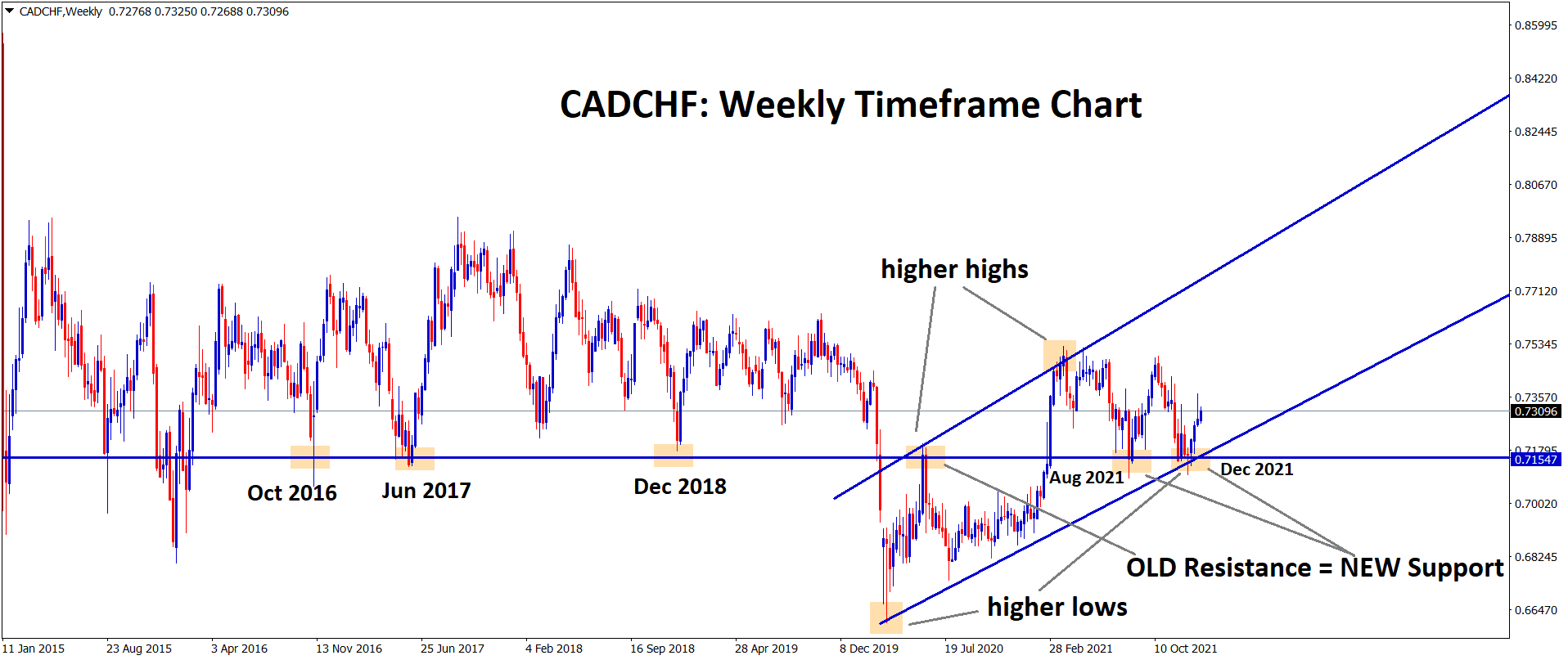

CADCHF is rebounding harder from the higher low area of the Ascending channel and the strong horizontal support zone in the weekly timeframe chart. Due to increase in crude oil prices, CAD Currency is getting stronger continuously.

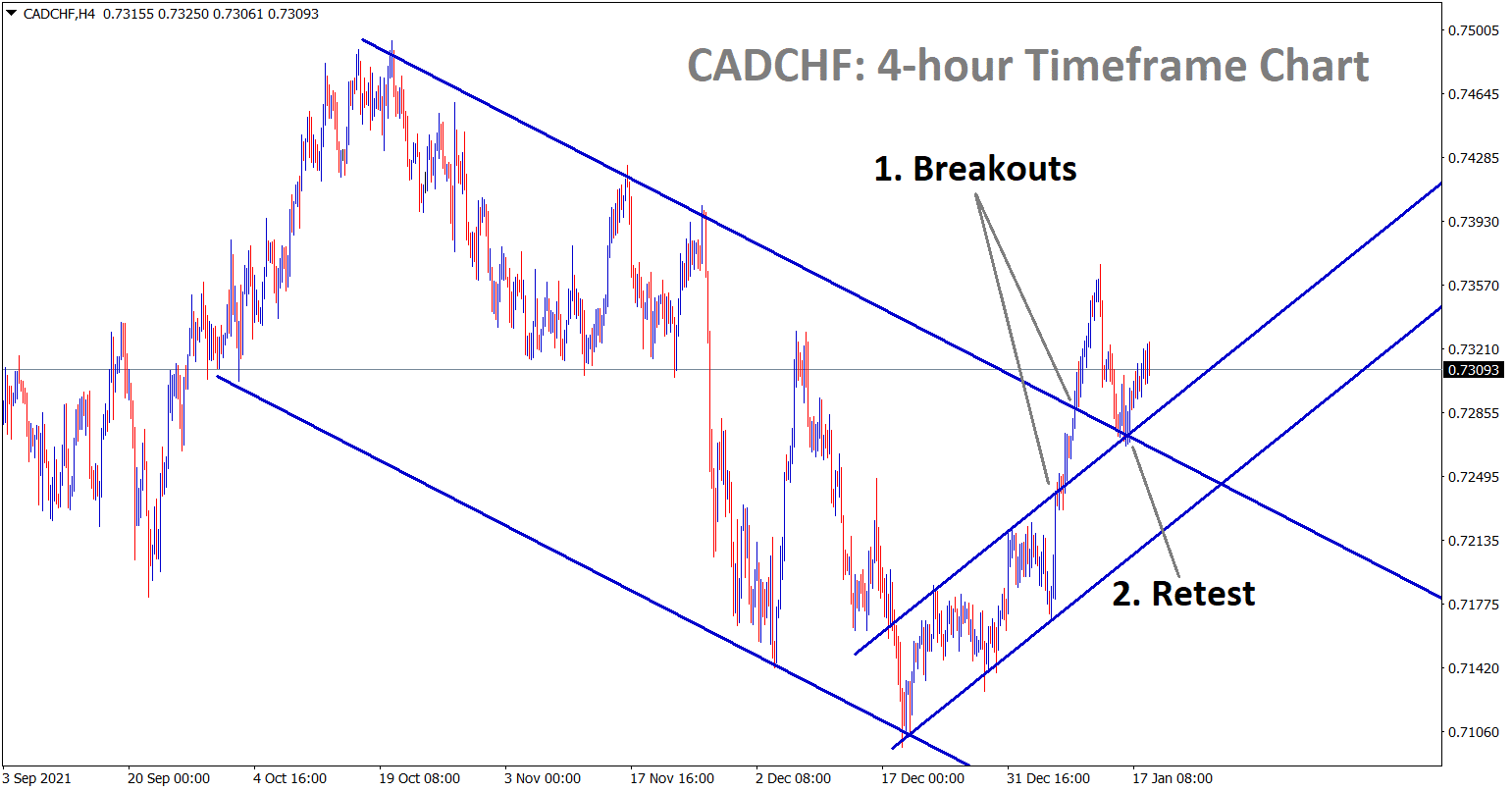

In the 4-hour timeframe chart, CADCHF has broken the top level of the major descending channel line and the top level of the minor ascending channel line. Market is rebounding now from the retest area.

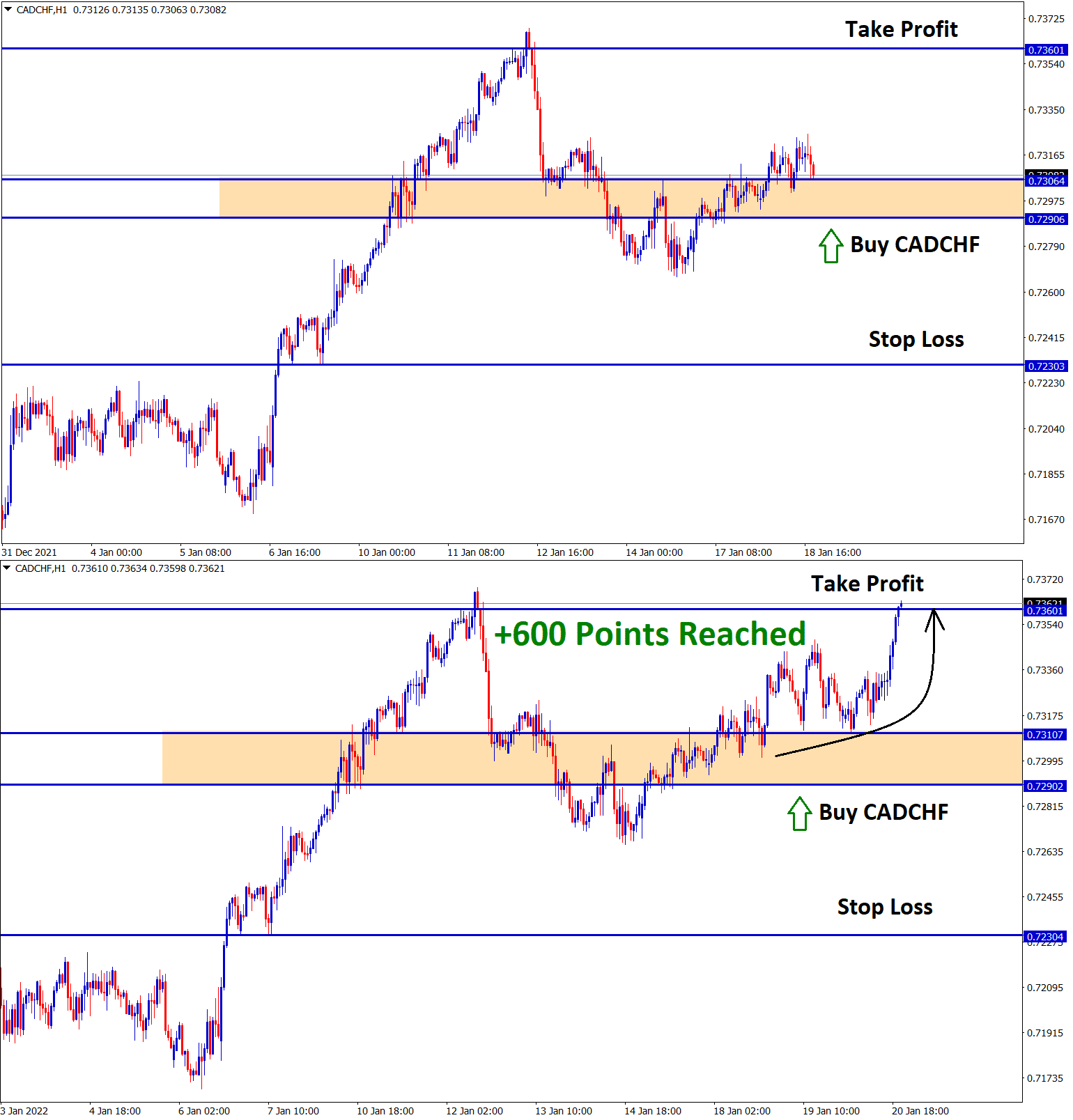

After the confirmation of upward movement, CADCHF Buy signal is given.

CADCHF has reached the take profit target successfully.

Swiss Franc: Swiss Chocolate maker expected fewer sales growth in 2022

Swiss Chocolate maker Lindt and Spruengli expected sales growth to be less in 2022 compared to 2021.

And the main reason behind this is labour and Supply of raw material issues as Email statements by Lindt company.

During pandemic time 2020, growth slowed, and it was picked up in the 2021 second half.

But this year, more labour and supply chain bottlenecks Chocolate production will be less when compared to last year.

As Lindt said, the margin is expected to reach 15% next year and rise by 20-40 basis points per year from 2023.

And Full-year sales rose to 4.59 billion Swiss Francs, $5.01 billion ahead of the 4.55 billion Franc estimate in a Refinitiv poll.

Canadian Dollar: Credit Suisse predicted Bank of Canada would hike 25bps this month

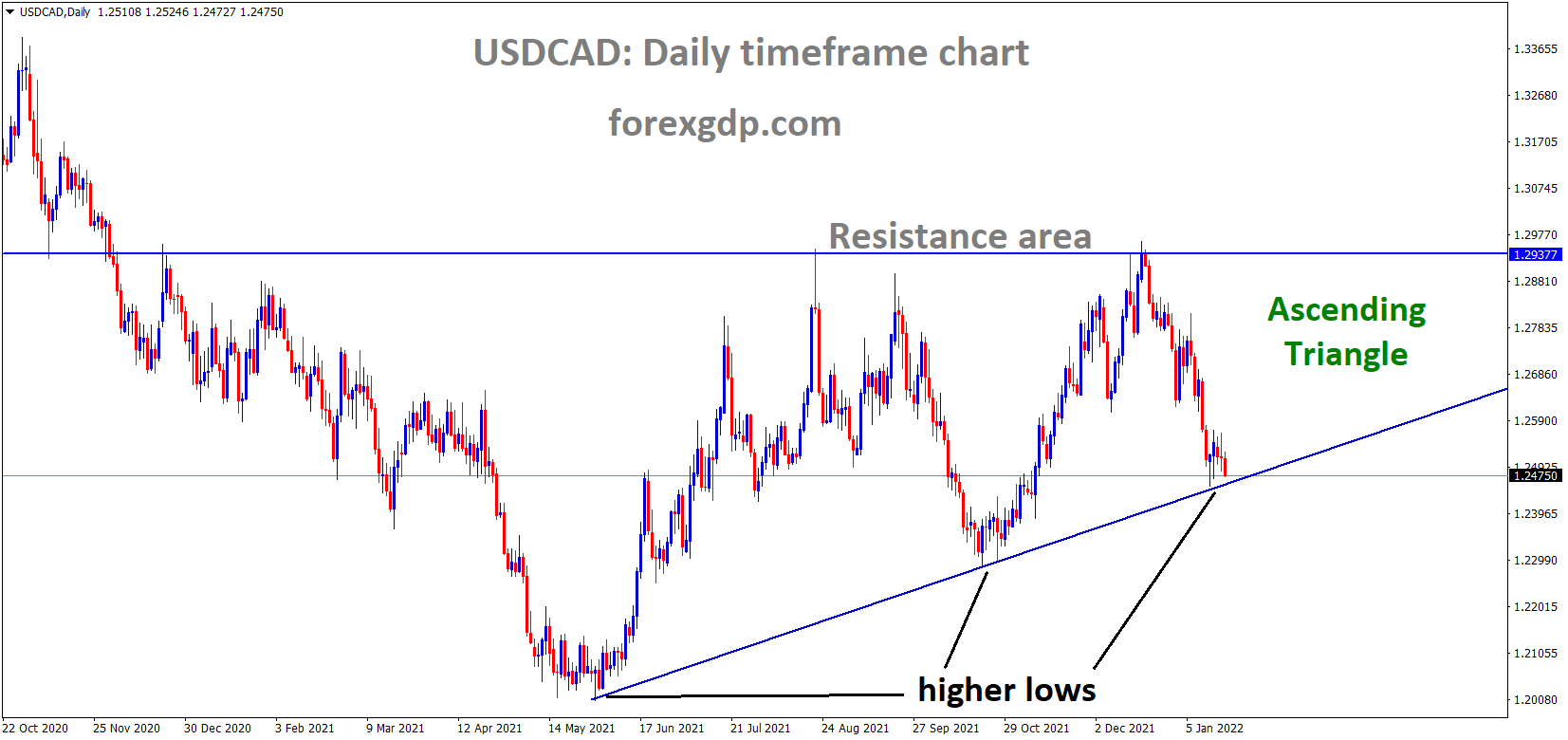

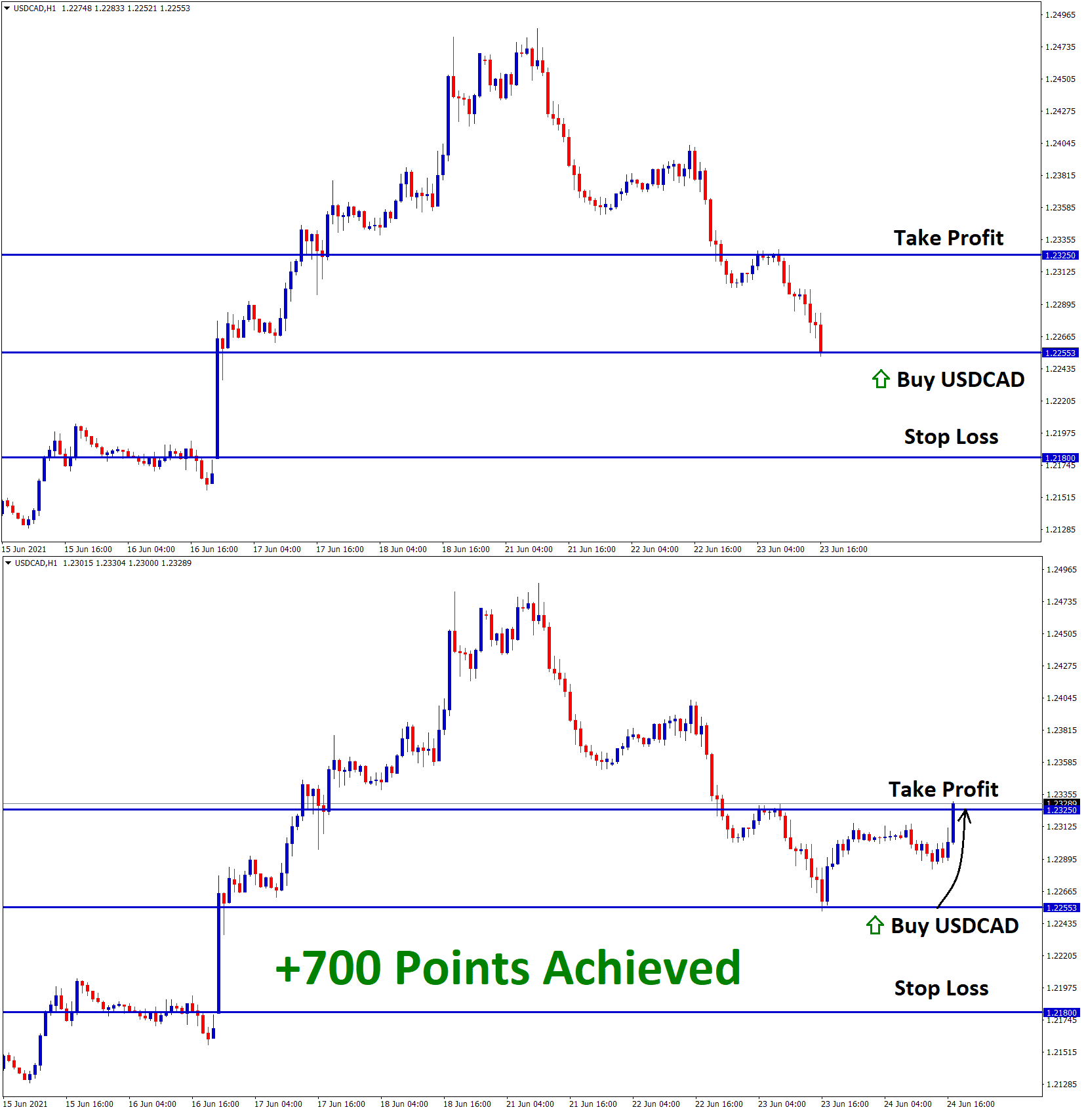

USDCAD is moving in an ascending triangle pattern and the market has reached the higher low area of the triangle pattern.

Analysts at Credit Suisse predicted the Bank of Canada monetary policy would do 25bps rate hikes next week.

And Oil prices created more inflation numbers in US and Canada, So Policy rates are a divergence from FED and BoC at this time.

In March, the FED 50 bps rate hike will be adjusted to BoC rate hike by 25bps this month.

So USDCAD will stay on the price level of 1.2500 area, and rate hikes from the Bank of Canada will undershoot the USDCAD to 1.2300, which formed the next support area.

And also the oil pipeline has exploded in between Iraq and Turkey Port makes Supply fears of 450kBarrels per day to a shortage; that’s why Oil prices are surging day by day.

Canadian Dollar prices are higher as Oil revenues rose compared to last month; the Bank of Canada may be rate hikes to calm down the Canadian Dollar prices to support exports revenues.